A brief analysis of the Pyth Network white paper: participant interaction methods, HUMAN protocol and participant incentives

Original Author: Python Chinese

Original source: Medium

January 18, 2022officially releasedofficially released. Along with the release of the white paper, we will provide Pythians with a summary of the white paper.

The rapid growth of DeFi projects needs to rely on high-fidelity, time-sensitive, real-world data obtained directly from the data source, and make this data available on any L1 blockchain. However, data on financial markets is often only accessible to a limited number of institutions and users. Traditional markets usually maintain strict control and access to real-time and historical price information data. Therefore, only selected users can obtain the most timely, accurate and valuable information.

The Pyth Network is a next-generation oracle solution designed to bring valuable financial market data to the masses. The Pyth Network incentivizes market participants—trading institutions, market makers, and exchanges—to share existing price data collected in daily operations. Python aggregates first-party price data and puts the data on-chain, making it available for on-chain or off-chain applications.

End-users of Python data can choose to pay data fees to protect them from possible oracle failures. Delegators earn data usage fees by choosing which product (price data) and specific data publishers to support (if the data is inaccurate due to the error of the data provider, the delegator will lose the pledged pass).

This incentive system operates through Pyth Network participants pledge PYTH tokens and voluntarily pay data publishers for data usage. The purpose of this design is to enable Pyth Network to complete continuous closed-loop and decentralization by itself.

network participant

In the Python network, 3 different types of stakeholders will interact:

Data Publishers (Publishers):Publish price data to earn part of the data usage fee. Data publishers are usually market participants with access to accurate and timely price information. The Python protocol rewards data publishers for the number of new price feeds they provide.

Data users (Consumers):Read price data, incorporate data into smart contracts or decentralized applications, and choose to voluntarily pay for data usage. Data users can be either on-chain protocols or off-chain applications.

Delegators:Stake tokens on specific price products and data publishers to obtain part of the data usage fee. If the oracle publishes inaccurate data, delegators may lose their pledged tokens.

Any participant can have multiple roles in the network. For example, a data publisher (or user) may decide to also become a delegator, staking tokens to earn additional data usage fees.

How do actors interact in Python?

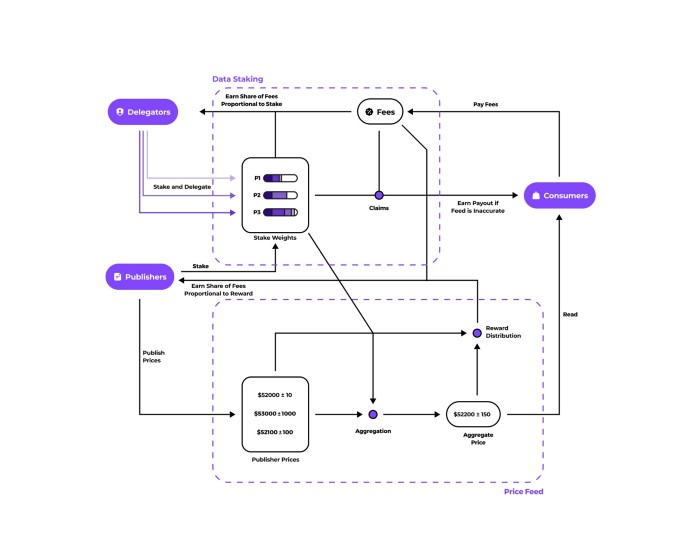

The Pyth protocol includes 4 core on-chain mechanisms:

Price aggregation mechanism (Price aggregation):Combining prices and confidence intervals reported by individual data publishers into a single price data and confidence interval data for a specific product (eg BTC/USD price data). This mechanism is designed to output robust price data — prices that are not significantly influenced by a small number of price publishers.

Data pledge mechanism (Data staking):Allows delegators to stake tokens to earn data usage fees. In general, delegators also determine the level of influence each publisher has on the aggregated price through the weight of its tokens pledged to specific data publishers. In addition, this mechanism also determines whether the tokens pledged by the client will be punished and reduced. Finally, this mechanism collects data usage fees from data consumers and distributes a portion to delegators (initially set at 80%). The remaining 20% will enter the reward pool and be distributed to data publishers.

Reward distribution mechanism (Reward distribution):Determines the share of rewards each data publisher receives. Each price product has a reward pool where delegators can stake tokens. The reward distribution mechanism preferentially provides rewards to publishers who provide high-quality price data, thereby reducing the possibility of rewards for data publishers with imperfect information.

Governance mechanism (Governance):image description

Overview of the Python protocol describing actors (purple ovals) and their interactions with various mechanisms (purple circles)

CLAIMS PROCESS: HUMAN AGREEMENT

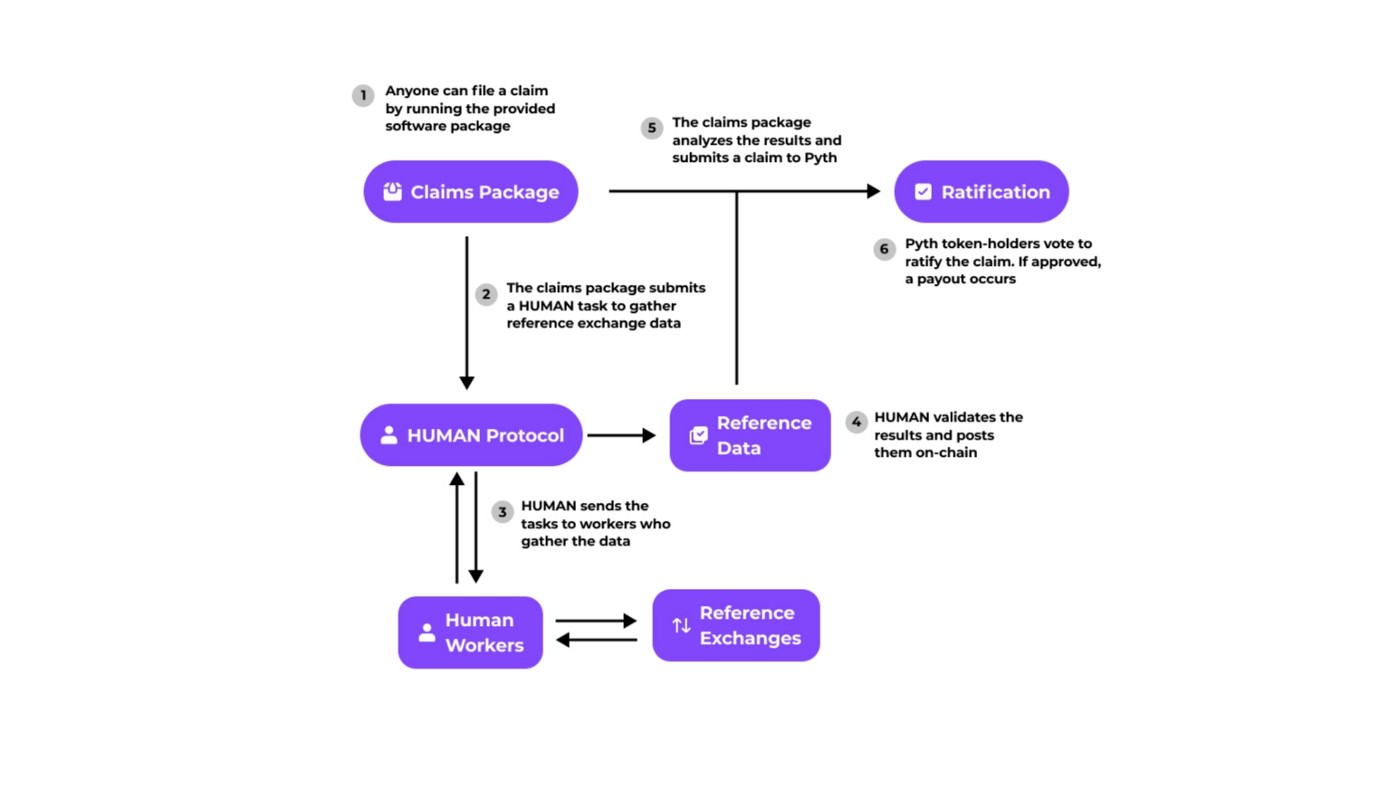

One should be able to expect that at times the Pyth Network will have to verify and resolve apparent inconsistencies between on-chain aggregated market prices and real-world reference prices, which may be deemed wrong when compared to real-world reference prices.

A seemingly obvious but subtle problem: when a data publisher (or series of data publishers) gives an outlier value and then generates an aggregated price that the data consumer considers to be wrong, the Python network must determine Whether compensation will be paid to end-user agreements that stake tokens to hedge risks. If the aggregated price is deemed to be wrong, the wrong issuers are identified and their staked tokens are slashed and paid out to end users.

In general, the process of claiming will determine whether compensation occurs. The purpose of this process is to verify that a product's aggregated price and confidence interval are incorrect compared to some real off-chain data. This process will useHUMAN protocol— an open-source package provided by Pyth — collects the necessary off-chain information from an impartial judge, which is then fed into a predetermined algorithm that determines the outcome of the claim. Finally, PYTH token holders will vote to approve the output of the algorithm, and if the claim is confirmed, the payment process will be triggered.

image description

Flowchart of the claims process

participant motivation

This module summarizes the incentives that Pyth Network gives to stakeholders:

data publisherIncentivized to pledge PYTH tokens to participate in the agreement and get some rewards. Data publishers earn a share of data usage fees from the products they price. Data usage charges for Products may increase as Price Consumers use Price Data. Publishing incorrect data (whether intentional or not) onto the network could result in a slash of the data publisher's staked tokens.

data userWillingness to pay for data usage is based on two reasons. First, paying for data usage enables applications to reduce the risk of using Pyth's price data, as they will receive a compensation payment should the data go wrong. Second, paying for data usage will attract more data publishers to provide price data, which improves the stability of price data.

Principals are incentivized to participate in the protocol to earn data fees (from data usage fees paid by data consumers). Principals will initially receive an attractive reward, but as the market becomes more efficient, competition among principals will gradually reduce their reward.

The future of DeFi is bright. For this field to thrive, we need a truly decentralized oracle solution that brings real-world data on-chain on a sub-second time scale (previously not possible with either on-chain or off-chain data ). The Pyth Network sends data directly from the data source without the need for middlemen or intermediaries.This is what a data publisher network is compared to a reporter network.

An oracle built on the chain can provide more complete, faster, and more confident data to the world. This is the reason for choosing to build programs with Python data.

documentwebsiteordocumentorDiscordorTwitterJoin us on and give us feedback.