CoinGecko 4D Report: A comprehensive review of the development of the digital asset industry in 2021

Table of contents

first level title

first level title

Table of contents

first level title

foreword

2021 Spot Market Overview

The performance of the top five currencies in 2021

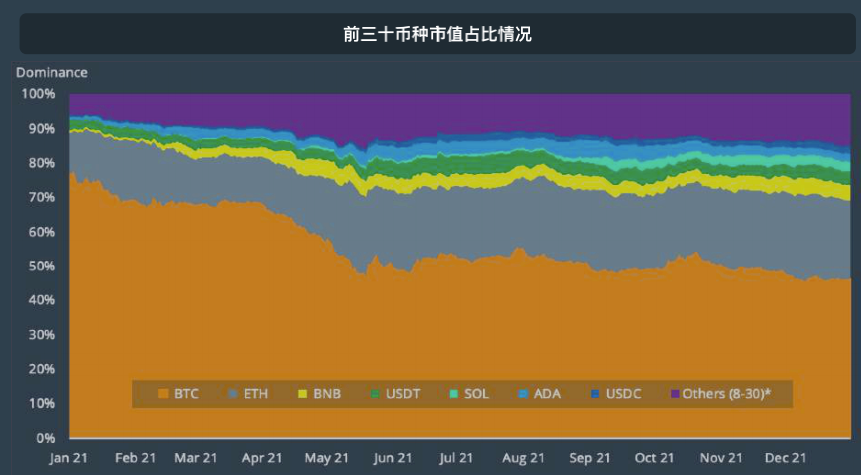

2021 Top 30 Currency Market Value Proportions

Data performance of the top five stablecoins in 2021

text

Bitcoin Analysis

Bitcoin computing power

Ethereum Analysis

Distribution of Bitcoin computing power by country/region

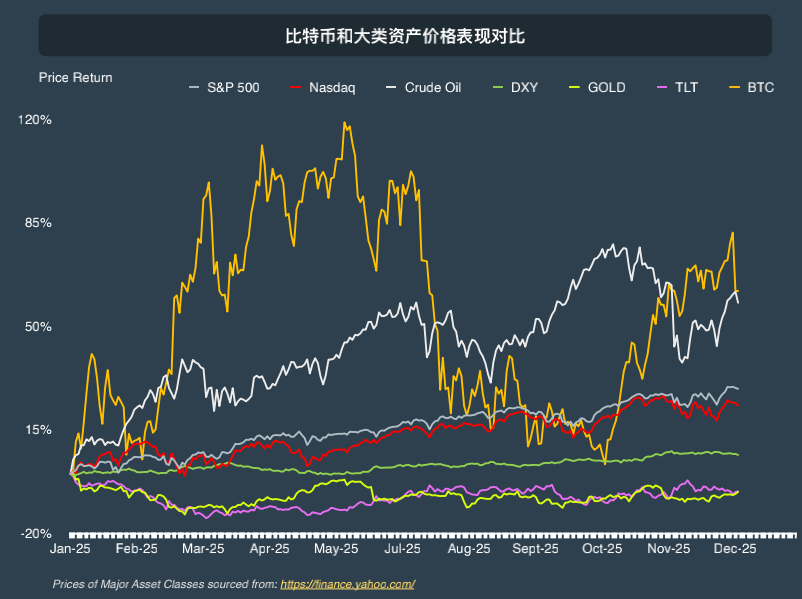

Bitcoin Price Performance: Compared to Major Assets

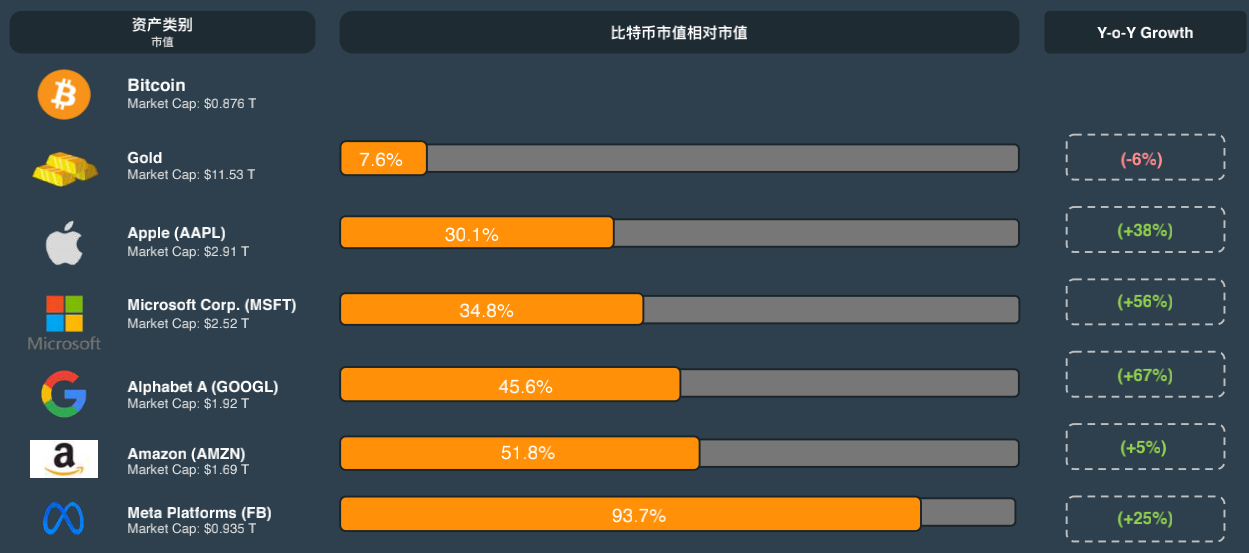

Market value comparison: Bitcoin, gold and top S&P 500 stocks

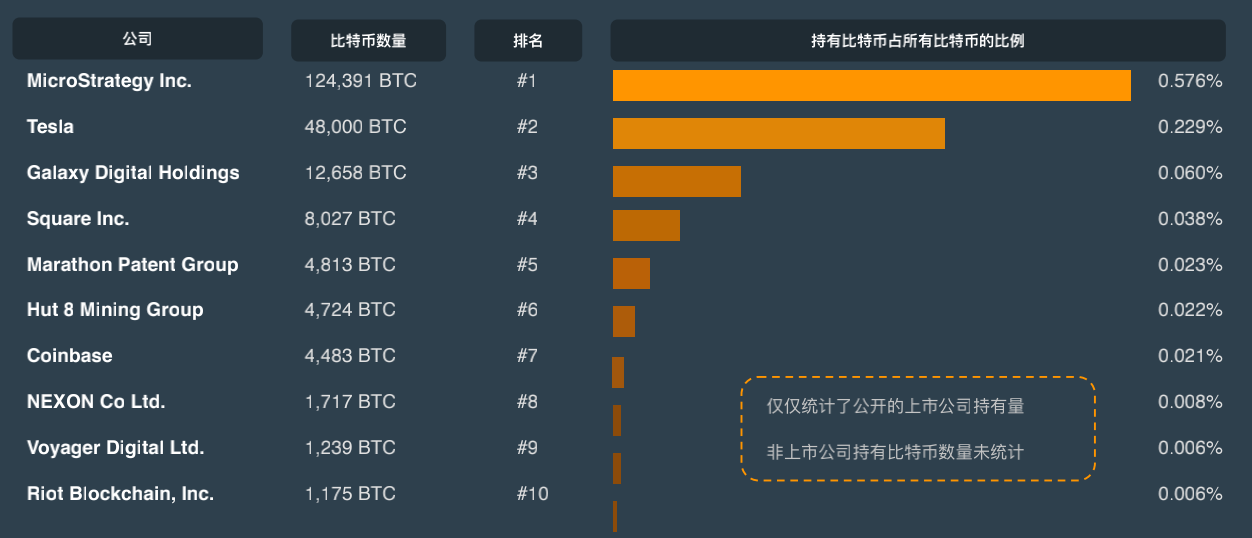

Number of Bitcoins held by listed companies

Ethereum Analysis

Ethereum price and volume

ETH2.0 Roadmap

Destruction after EIP-1559 upgrade

The average daily GasFee of Ethereum

ETH2.0 pledge

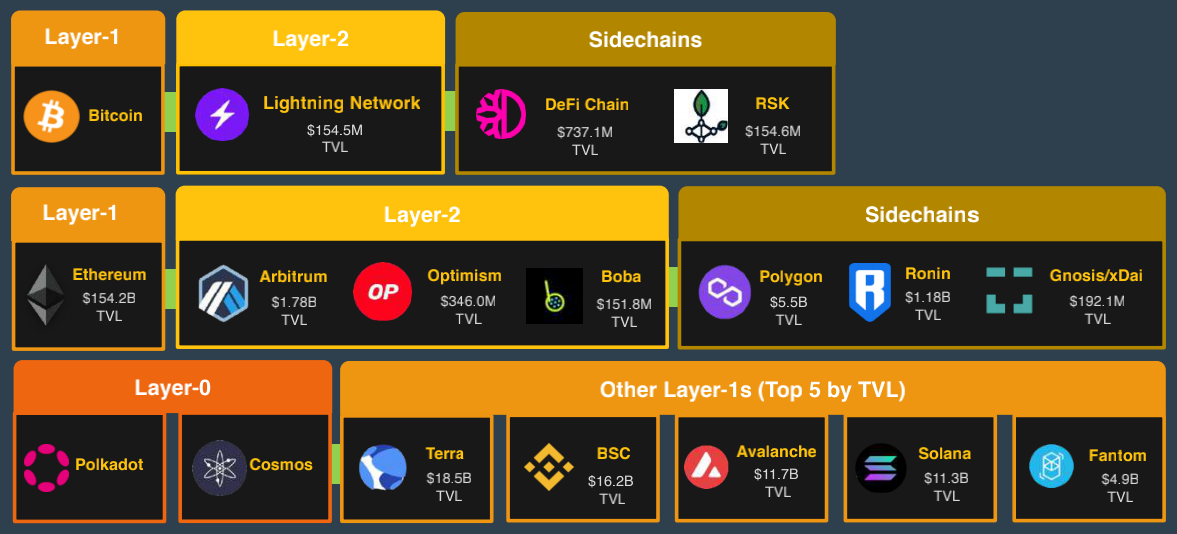

Other L1&L2 Analysis

The rise of other L1 & L2

The data structure of the chain and the price performance of different chains

Star projects on different chains

High-quality airdrops in 2021 and "airdrop rumors" in 2022

DeFi analysis

Non-FungibleTokens(NFTs)

2021 DeFi Overview

Q32021 DeFi public chain market share 2021 DeFi ecology

NFTLeaderboards

Solana ecology

exchange

Avalanche ecology

Trading volume of NFT trading platform

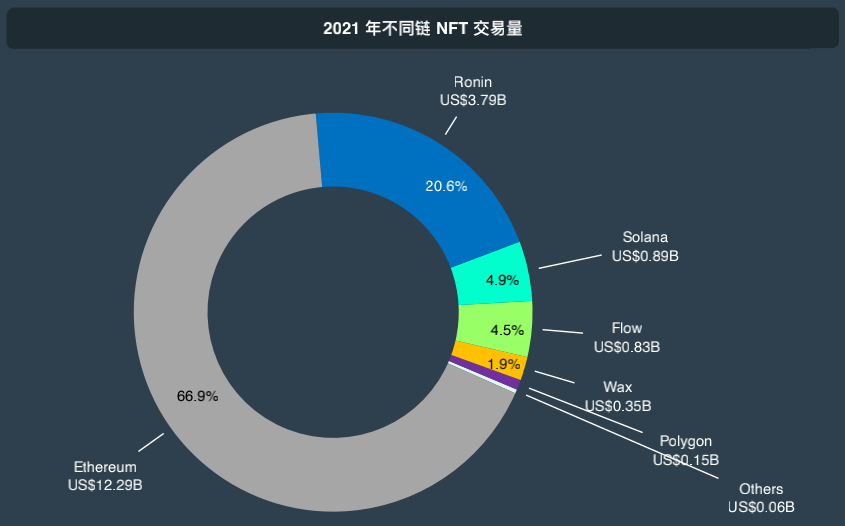

NFT platform transaction volume of different chains

2021 Big Events

exchange

Top 10 Centralized Exchanges (CEX) in 2021

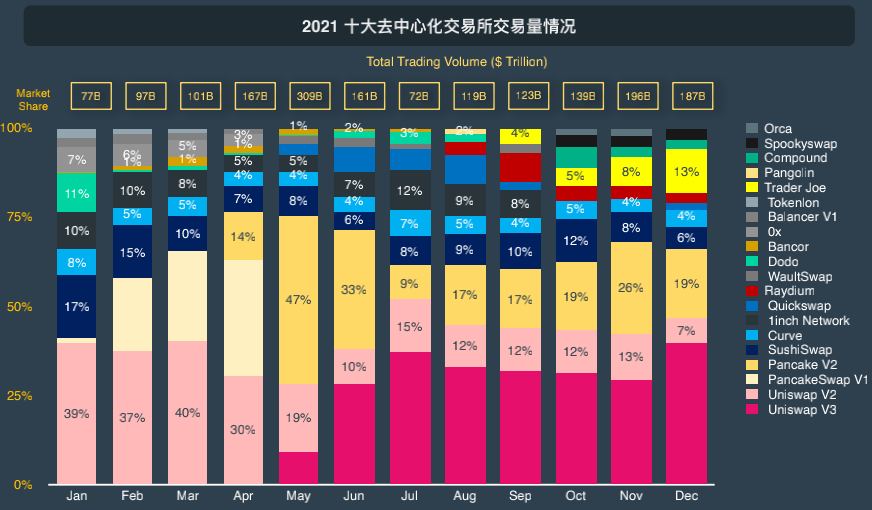

Top 10 Decentralized Exchanges (DEX) in 2021

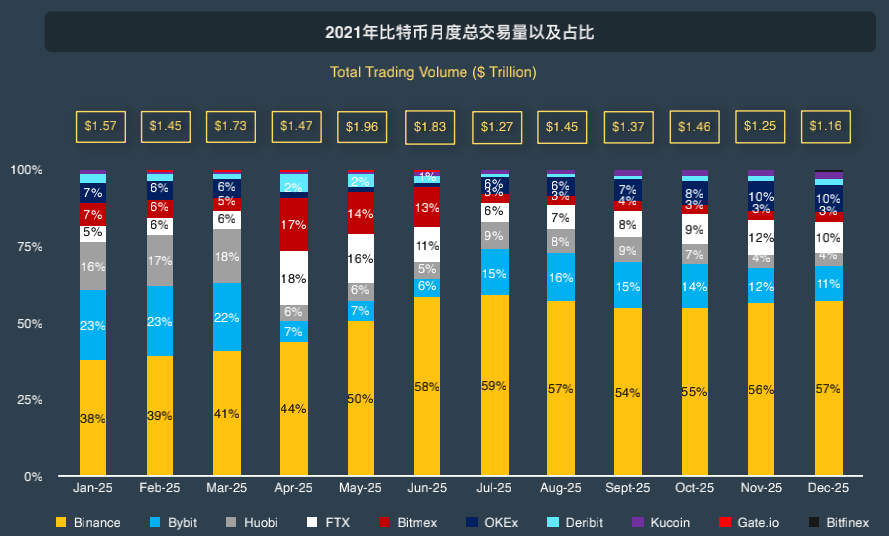

Q42021 Derivatives Exchange – Bitcoin Perpetual Contract Trading Volume

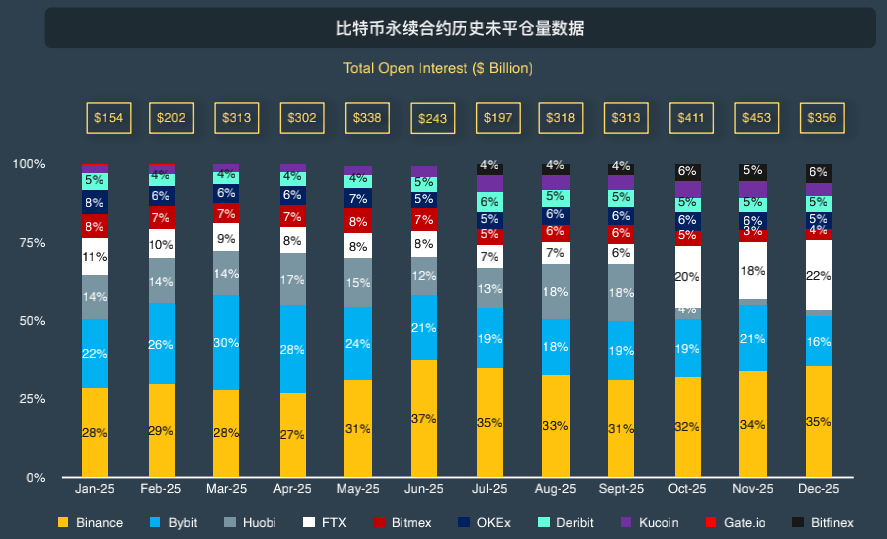

Q42021 Derivatives Exchange – Bitcoin Perpetual Contract Open Interest

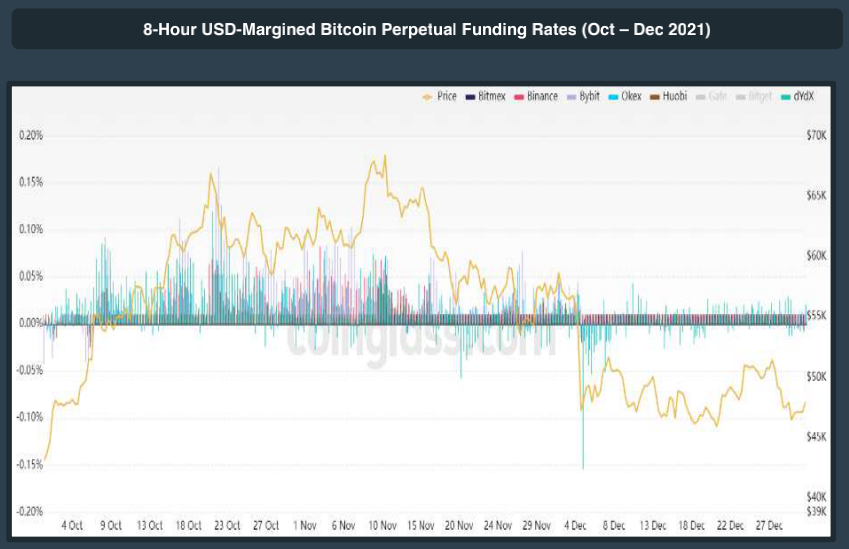

Q42021 Derivatives Exchange – Performance of Bitcoin Perpetual Contract Funding Rate GBTC and BITO"first level title

foreword

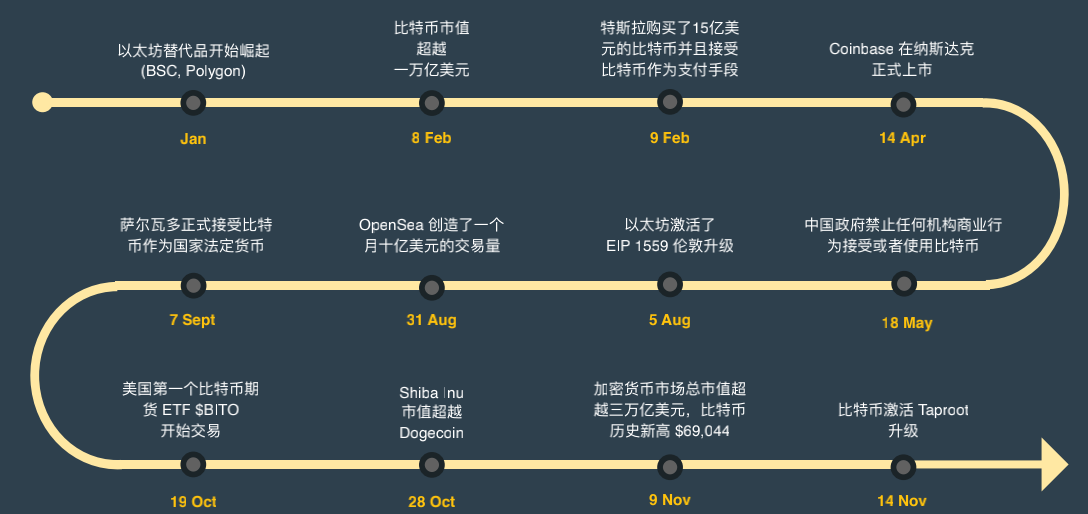

In 2021, the cryptocurrency industry continues to climb new heights, continuing the momentum of 2020. Although the retracement at the end of the year may dampen some people's sentiments, the market value of the entire industry has more than tripled in 2021, closing at approximately $2.4 trillion, and briefly reached $2.4 trillion in the middle of the year. up to $3 trillion.

The price of Bitcoin at the end of the year was about 48,000 US dollars, which was lower than its highest price, but also doubled compared to the beginning of the year. However, its market dominance has weakened, falling below 40% by the end of 2021. Much of the market's attention has shifted to Ethereum, its competitors, and Layer 2. These alternatives to Ethereum all claim to solve its scalability problems, such as Solana and Terra. The same goes for MEME tokens, which seem to have figured out how to grab the attention of the market.

When talking about NFTs, the metaverse must be mentioned. Facebook's rebranding to Meta grabbed headlines and sparked countless thoughts about what's next for the internet, the elusive Web 3.0, while also attracting more talent and investment into the field than ever before. With the popularity of Metaverse and Web3.0, the two concepts of NFTs and blockchain will inevitably continue to grow as people's cognition expands.

market Overview

In addition to the blockchain industry, related developments outside the industry are also crucial. Gary Gensler was appointed as the chairman of the SEC, and the market was once worried about its regulatory impact on the cryptocurrency industry; the US SEC approved the application for a Bitcoin futures ETF. Coinbase successfully listed on Nasdaq, MicroStrategy continued to invest in Bitcoin, and Tesla also (shortly) paid attention to supporting cryptocurrencies. El Salvador officially recognizes Bitcoin as legal national currency. In China, the government continues to expand CBDC research trials, with wider rollout expected soon; while cracking down on cryptocurrencies and cryptocurrency mining, triggering a massive migration of miners.

There is no rest time for cryptocurrencies, and 2021 has truly verified this sentence! We are now tracking more than 12,000 Tokens, more than 500 exchanges, and we have also launched an exploration of NFT, launched a new application, held our first GeckoCon, and launched many of the website Other new features and updates. As the cryptocurrency industry expands into a wider field, we will continue to expand our team and products to serve the community and realize a decentralized future for everyone. Looking forward to more developments in 2022!

Data source: CoinGecko

first level title

market Overview

secondary title

2021 Spot Market Overview

Total cryptocurrency market cap closes at $2 trillion in 2021, growing strongly despite year-end decline

The total market capitalization of the top thirty cryptocurrencies hit an all-time high of $2.53 trillion in November before declining at the end of the year

Ethereum's competing public chains, Layer 2 and MEME tokens are growing the most rapidly, and Bitcoin's market capitalization share has also reached a record low. At the same time, Ethereum continues to grow, and Gas fees are still increasing.

Stablecoins also continue to grow, and UST has grown rapidly in the second half of the year, officially entering the top 30 rankings.

Data source: CoinGecko

Spot trading volumes surged at the beginning of the year, matching the growth in market capitalization, but tapered off after May's decline.

The growth in the second half of the year was mainly driven by NFTs. Liquidity continues to diversify from centralized exchanges to decentralized exchanges and derivatives exchanges.

secondary title

2021 top five currency performance

The top five cryptocurrencies are up 2,913% on average

Compared with 2020, the return rate of the five major cryptocurrencies in 2021 has a qualitative leap (+242%), and SOL has pulled everyone a lot!

XRP (+281%), DOGE (+3545%), DOT (+194%) still produced good returns for investors by the end of the year.

Data source: CoinGecko

secondary title

Ethereum Competitors Layer 1, Ethereum Layer 2 & Sidechains, MEME Coins, Stablecoins Quickly Grab Bitcoin's Market Share

New alternative L1 chains, as well as Ethereum L2 and sidechains around solving the scalability challenges of Ethereum, entered the top thirty list with the fermentation of market sentiment.

BNB,Memecoins have also found a frenzy, with Elon Musk breathing new life into Dogecoin and spawning a flurry of new memecoin projects.

Is the old project still going strong? Older projects like ADA, XRP, LTC, BCH are still in the top 30 despite lack of enough market voice (or sometimes negative press).

CRO and OKB are still holding their ground for centralized exchanges.

text

The popularity of the Axie Infinity game brought AXS into the top 30 rankings.

Data source: CoinGecko

text

In addition to the top 30, there is also a long tail asset consisting of about 90 projects, whose market capitalization has exceeded 1 billion US dollars.

secondary title

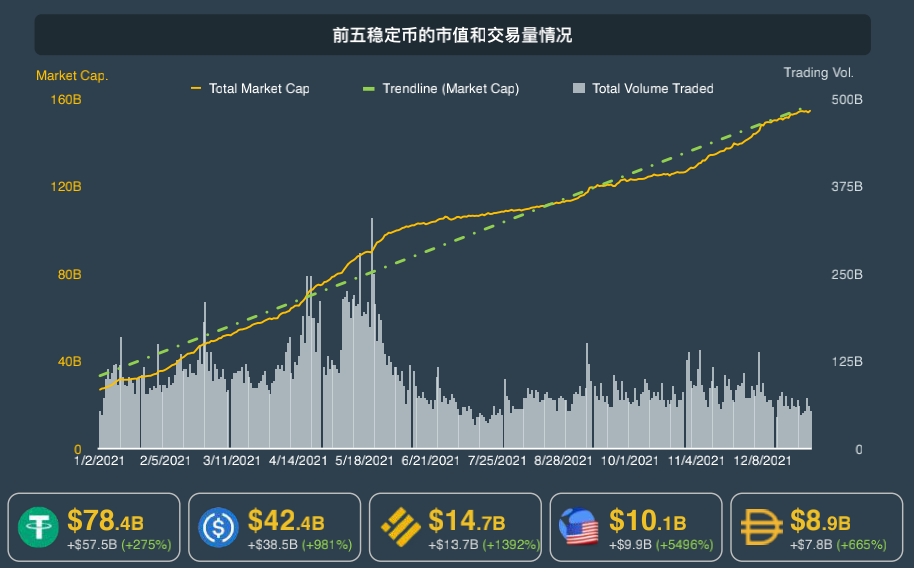

Top five stablecoins in 2021

Top 5 Stablecoins Gain $127 Billion in Market Cap

The market value of the top five stablecoins has increased by 469%, and the top five have all entered the top 30 rankings in the market.

The growth of UST squeezes DAI down, and its rapid growth momentum mainly comes from the overall growth of Terra ecology.

Data source: CoinGecko

Except for the top five, MIM and FRAX will develop rapidly in 2021, with a market capitalization exceeding US$100 million. This also reflects the increasing market acceptance of algorithmic stablecoins.

Data source: RektHQ

secondary title

2021 Major events worthy of attention

Big events filled with changes throughout the year

secondary title

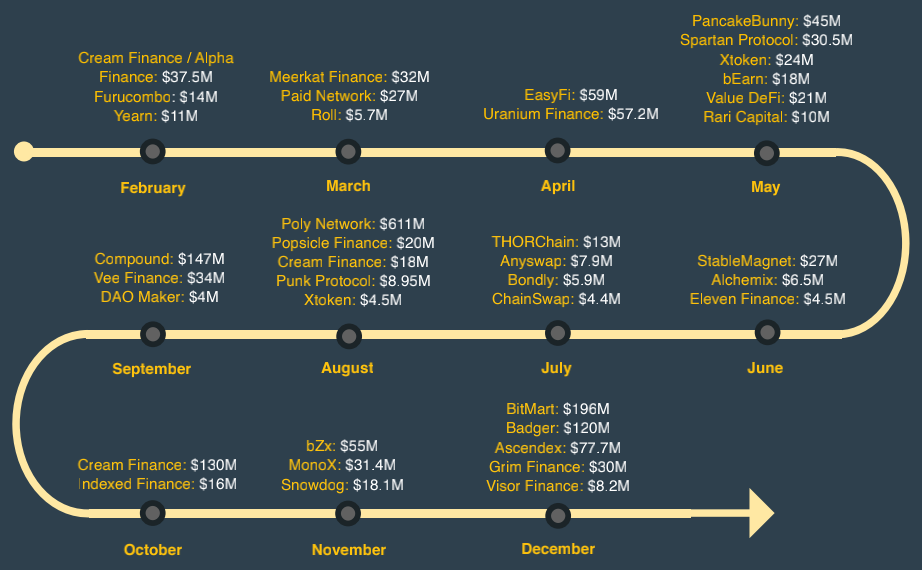

Notable security incidents in 2021

Cream Finance2021 is a year of frequent security incidents, and the annual loss due to vulnerabilities and hacker attacks is estimated to be 14 billion US dollars.

THORChainCompound’s vault bounty bug was the biggest of the year, draining $147 million worth of COMP before the bug was patched.

Protocols that have been attacked many times:

In 2021, it was stolen three times and lost a total of 185 million US dollars.

It was attacked twice in July, and the total affected funds were 13 million US dollars.

first level title

Bitcoin Analysis

secondary title

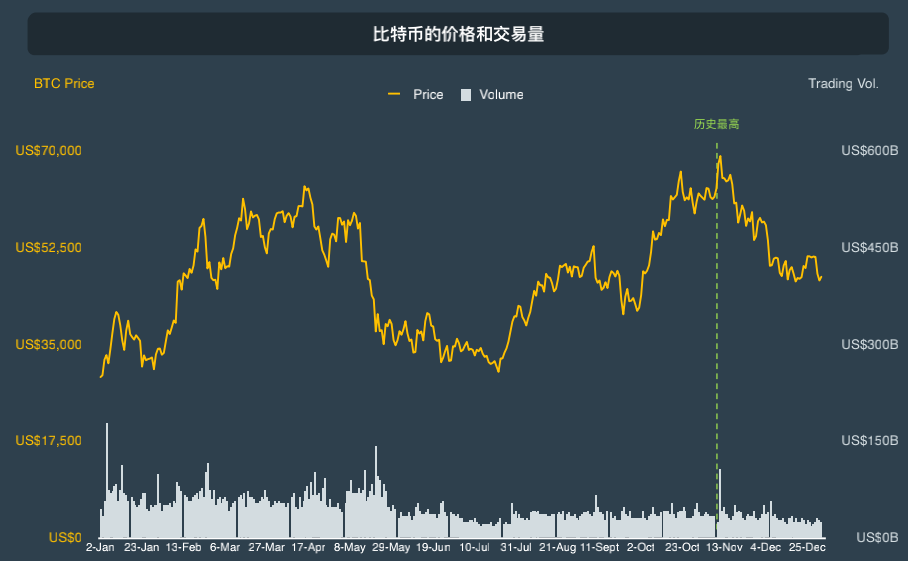

Bitcoin price and volume

A turbulent year for Bitcoin, but the price volatility was relatively less dramatic compared to what was happening around Bitcoin

Bitcoin Annual Price Return +62.6%

Compared with 2020, the price trend of BTC in 2021 is quite sluggish. However, Bitcoin still ended the year on a positive note, reaching $47,191, up 62.6% year-over-year.Bitcoin also hit a new all-time high, hitting $69,045 on Nov. 10 before falling back.

Listed companies add bitcoin to their balance sheets

El Salvador accepts Bitcoin as legal tender

Chinese government

Data source: https://www.blockchain.com/charts/hash-rate

Ban on Bitcoin officially enacted, leading to mass migration of Chinese miners

The Taproot upgrade is officially deployed, providing greater privacy for Bitcoin and enabling the deployment of smart contracts

secondary title

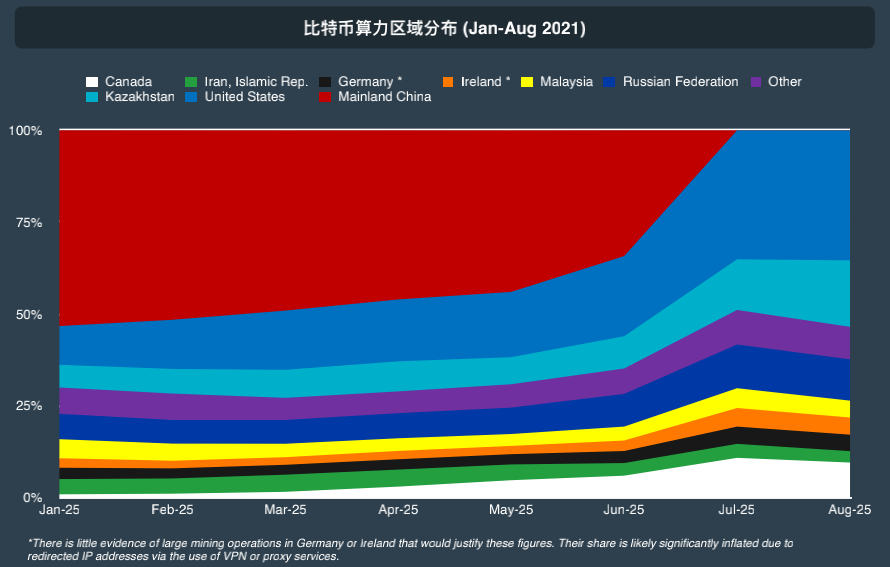

Bitcoin computing power analysis

2021 Bitcoin computing power will increase by 18%

After the Chinese government announced a mining ban on May 21, 2021, Bitcoin’s total hash rate collapsed, bringing the Bitcoin hash rate down to a multi-year low of 85M TH/s.

Some bitcoin miners reaped record profits in the second quarter as hashrate fell during the same period due to less competition from Chinese miners.

*There is little evidence of large mining operations in Germany or Ireland that would justify these figures. Their share is likely significantly inflated due to redirected IP addresses via the use of VPN or proxy services.Data source: Cambridge Centre for Alternative Finance

secondary title

The United States and Kazakhstan are the main destinations for the second half of computing power

After China's cryptocurrency ban in September 2021, BTC miners flocked to the U.S. and other countries like Kazakhstan to get more favorable electricity rates and avoid regulatory crackdowns.

As of Aug. 21, the U.S. leads with about 35 percent of the total hash rate share, followed by Kazakhstan at about 18 percent, a country known for its cheap and plentiful coal power.

text

However, recent reports claim that Kazakhstan has experienced frequent power outages at its bitcoin mining farms since a power shortage in October. Correspondingly, its total share of the global hash rate has decreased significantly compared to the August figure.

Prices of Major Asset Classes sourced from: https://finance.yahoo.com/

text

In any case, any such decline will be temporary, as the global hash rate keeps climbing steadily in late 2021, and miners may have migrated to other countries.

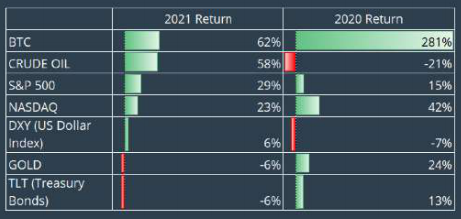

Comparison of the price performance of Bitcoin and major assets

Bitcoin is again the best performing large asset class

Markets are largely in risk-on mode as interest turns to stocks and commodities, leaving gold and Treasuries behind.

Data snapshot taken on 1 Jan 2022; Price of Assets (other than Bitcoin) sourced from: https://finance.yahoo.com/

Bitcoin sees a downward trend in its correlation with major asset classes in 2021. This is not always the case for digital assets. It used to be strongly positively correlated with assets such as gold and stocks in 2020.

secondary title

Data source: https://bitcointreasuries.net/

Ethereum Analysis

Bitcoin holdings of listed companies

Listed companies now hold about 1.14% of Bitcoin supply

Data source: CoinGecko

first level title

Ethereum Analysis"secondary title

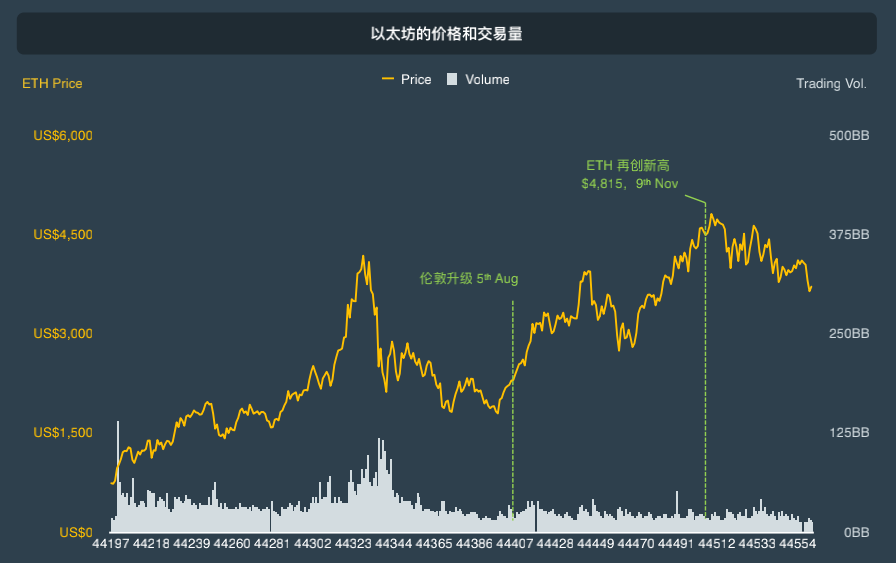

Ethereum Price and Volume

ETH hits its highest price twice, ending 2021 at $3,715 with a 403% gain

Ethereum is up 403% in 2021In full Layer1 competition and

AltairIn 2021, ETH hit record highs twice. The first time, on May 11, it broke the $4,000 mark and closed at $4,183. After a pullback, it rallied again to $4,815 on Nov. 9, setting a new ATH.

This year saw a number of notable upgrades to the network in anticipation of the arrival of ETH 2.0 in 2022:

london upgrade"- Ethereum's much-watched network upgrade, including five improved protocols, among which EIP-1559 has received the most attention because it has completely changed the entire transaction structure.

secondary title

Data source: Ethereum Org

Eth2.0 Roadmap

Ethereum looks ready to finally become a "proof-of-stake" blockchain in early 2022

Data source: Etherchain via TheBlock, Dune Analytics (@k06a)

(PoS) chain.

Eth2.0 is a series of upgrades that will transition the Ethereum network to the PoS consensus algorithm and introduce shard chains at the same time. This will increase the speed, efficiency, scalability and sustainability of the network, allowing it to increase transaction throughput to alleviate bottlenecks.

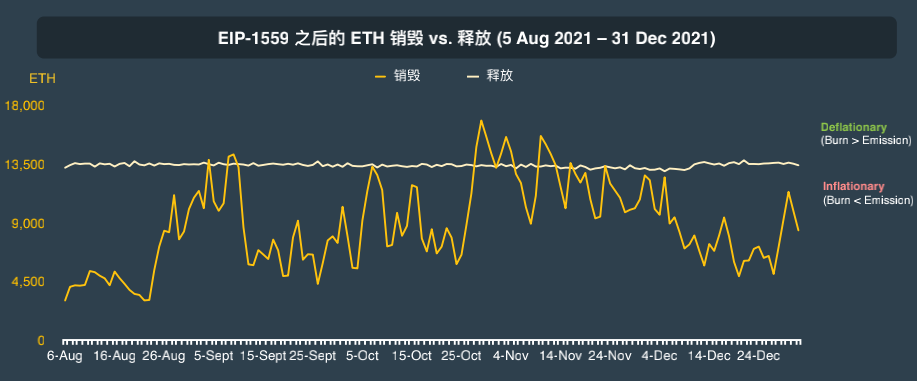

Ethereum burn after EIP-1559 London upgrade

exist"The average amount of Ethereum burned per minute after EIP-1559 is 6.16 ETH

EIP-1559 introduces ETH burning in each transaction is a prelude to Eth2.0, which will further reduce ETH issuance and may make ETH more deflationary.

The issuance of ETH still largely exceeds the amount burned after EIP-1559, which means that ETH remains an inflationary asset most of the time. Its first deflation day was 1 month after EIP-1559 on September 3rd.

Data source: Etherscan via Ycharts

exist

In the "Summer of NFT" wave, OpenSea becomes the main reason for ETH burning in 2021, and ahead of Uniswap V2/V3 and stablecoins (ie USDC and USDT).

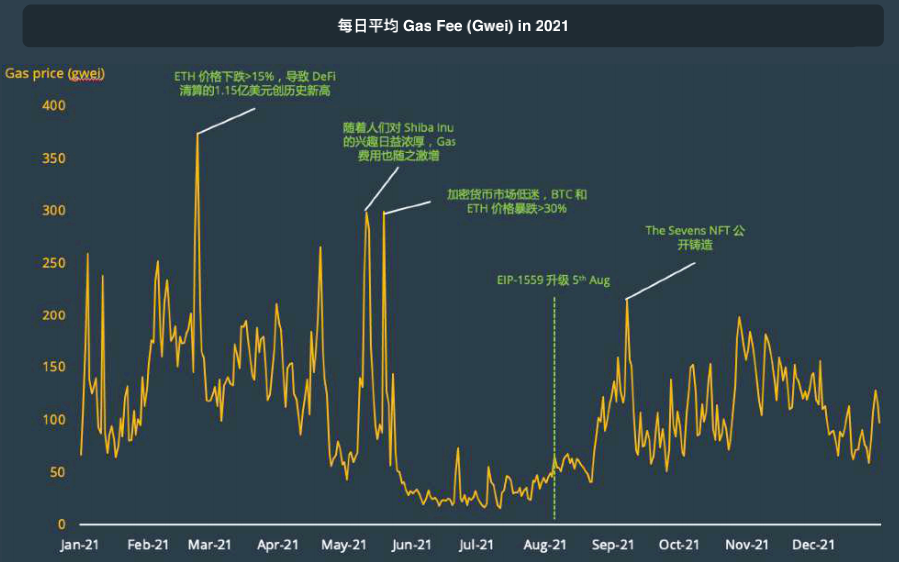

secondary title"Average daily gas cost of Ethereum

Affected by NFT activities, the average daily Gas Fee price remains above 100 Gwei on most days."The average Gas Fee in 2021 is 105.2gwei

Historically, as users rushed to salvage their leverage or "buy the dip"

Eth2.0 Staking

, Gas spikes occur during downturns in the cryptocurrency market.

Data source: Dune Analytics (@hagaetc)

Many users expect the changes brought about by EIP-1559 to reduce gas fees, but gas continues to climb, possibly due to

The increased network activity of "Summer of NFTs".

As users scrambled to mint the latest NFT assets, driving up the Gas Fee, the minting price of "The Sevens" once soared to >5,000 gwei, and the transaction fee alone reached an eye-popping ~1 ETH."secondary title

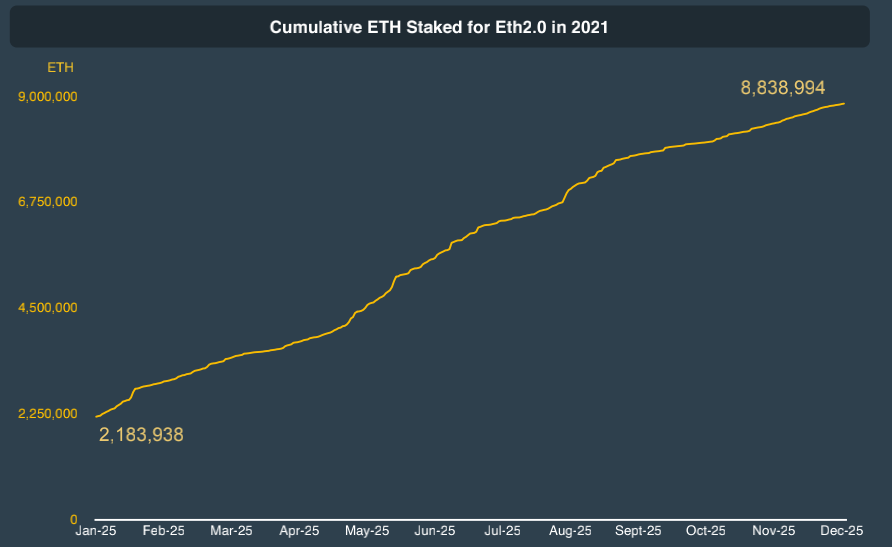

4x increase in Eth2.0 staking volume in 2021, Lido and Kraken's leading Eth2.0 staking service provider

Back in November 2020, staking on Eth2.0 was initially slow at launch, but quickly entered a steady upward trend throughout 2021, with total stakes increasing by more than 305% in 2021.

After that, deliveries are not expected until the second quarter of 2022.

With the increasing interest in Eth2.0, Lido, the Eth2.0 staking protocol, has gained a lot of attention.

first level title

Data source: DeFiLlama

Analysis of other public chains

Overview of Smart Contract Platforms

Image source: CoinGecko

We have entered a multi-chain era

The Rise and Boom of Smart Contract Platforms

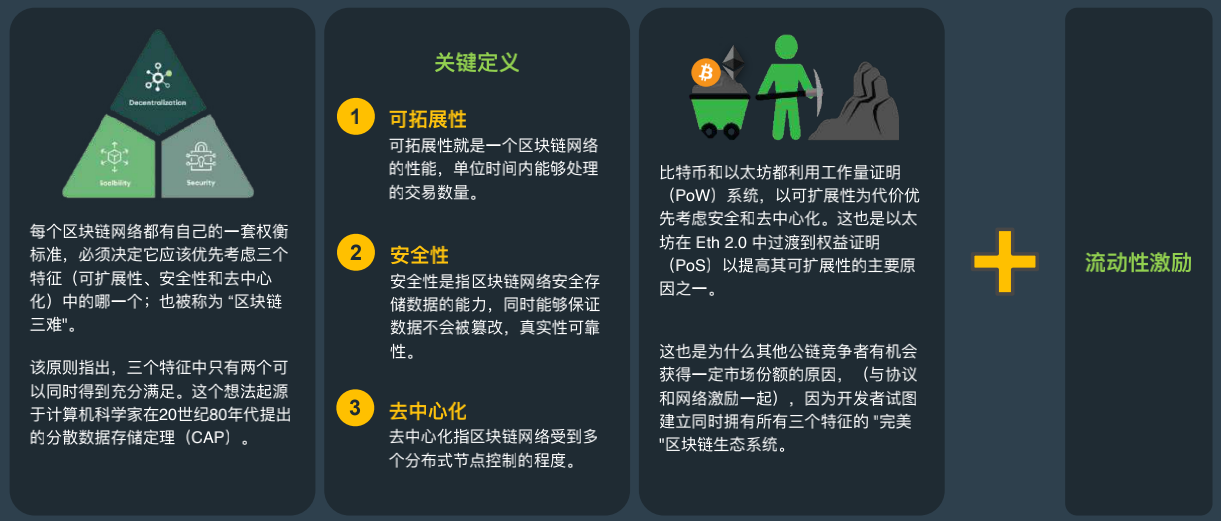

Other public chains are also trying to solve the trade-off problem among blockchain performance, security and decentralization

secondary title

Data source: CoinGecko

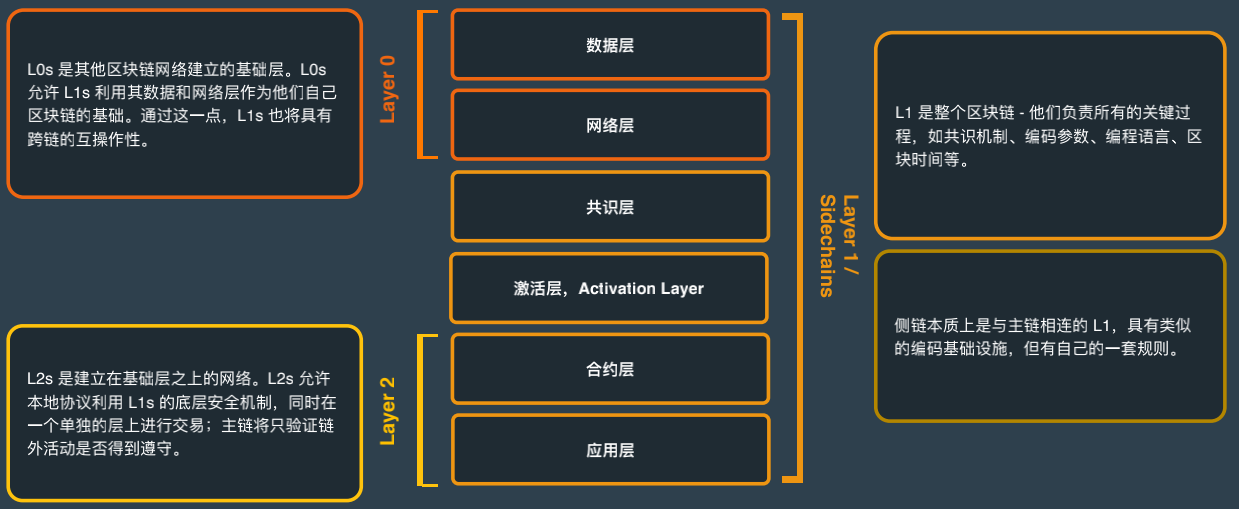

Blockchain Structure

Blockchain is made up of different layers

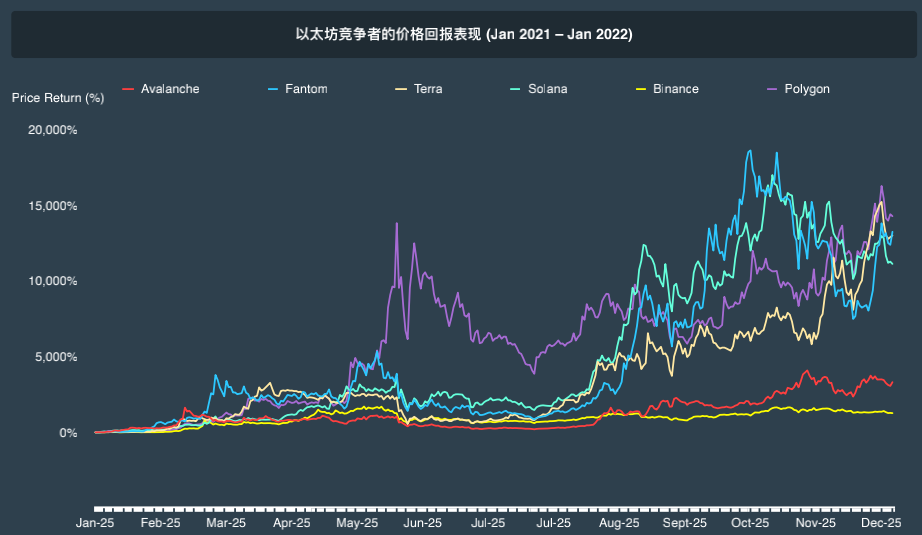

The performance of the top six non-Ethereum public chains in 2021

Fantom leads the performance of many Ethereum competitors

There are four tokens whose price growth exceeded 10,000% in 1 year; namely Fantom, Terra, Solana, and Polygon. Fantom marked the highest YTD increase of 14,279%.

Other public chains also saw positive price returns, but nowhere near the top 6, all of which were below 1000%.

secondary title

Star projects on different chains"secondary title

text

CowSwap

Hop Exchange

Element Finance

MetaMask

BAYC

Optimism

Arbitrum

zkSync

text

text

text

Data source: https://www.coingecko.com/en/defi

first level title

DeFi Analysis

secondary title"2021 DeFi overview

The total market value of the DeFi market will increase by 650% in 2021

In 2021, the market value of DeFi increased from 20 billion US dollars to 150 billion US dollars, an increase of 7.5 times, and its dominance increased from 2.8% to 6.5%, the highest level in history, more than doubling.

DeFi 2.0”. These products seek to improve upon the design of the original DeFi protocols. In addition to this, the rise of incentives for new alternative EVM networks such as Cronos, Aurora, and Boba is driving demand for DeFi tokens on these blockchains .

Data Source: DefiLlama. Monthly TVL is calculated by taking the average TVL on daily basis for each month

secondary title

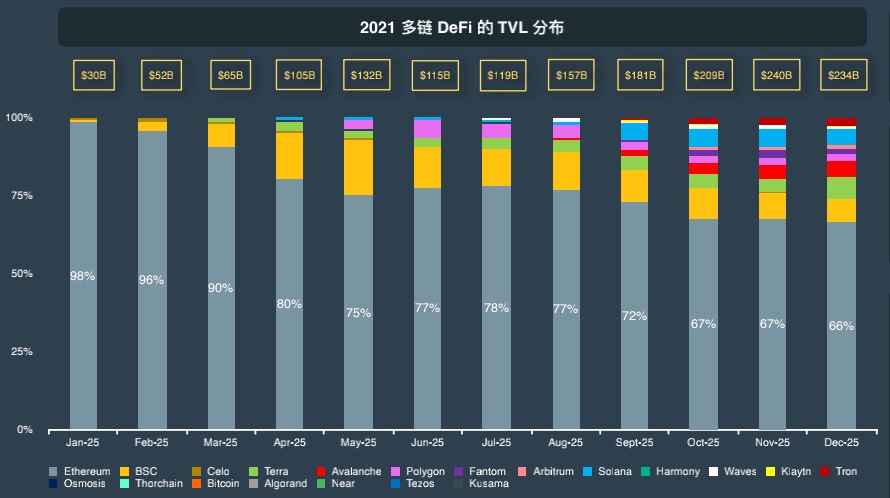

2021 is the first year of DeFi blooming in multi-chain

In the first quarter of 2021, Ethereum and Binance Smart Chain occupied most of the market and gained most of the TVL. However, that quickly changed as the year progressed.

EVM-based networks such as Polygon and Fantom began to develop in the second quarter of this year. These chains are viable alternatives due to their similarity to Ethereum, but with faster transactions and lower fees.

secondary title

Data snapshot taken on 1 January 2022 * Categorical market cap includes only governance and utility tokens (excluding stablecoins and wrapped tokens)

DeFi Ecosystem Overview

text

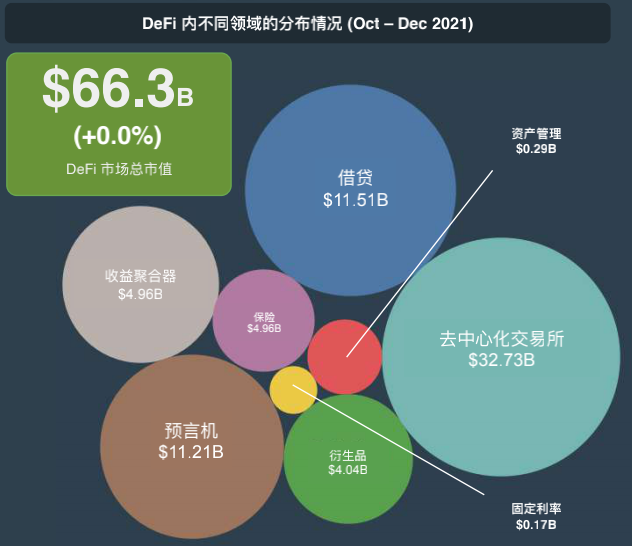

Despite swings in most segments, DeFi’s market capitalization remains relatively unchanged

text

In the last few months of 2021, the overall market value of the DeFi ecosystem has not changed much. However, compared to the third quarter of 2021, the market share of its ingredients has clearly shifted. Larger subdivisions, such as decentralized exchanges, oracle machines, and lending platforms experienced a decline of up to 9%. Cumulatively, these three sectors have removed roughly $1.5 billion from DeFi’s market capitalization.

While the market capitalization of most DeFi industries has decreased, the yield aggregator and insurance industries are the biggest winners in the fourth quarter of 2021.

Data source: CoinGecko

The total market capitalization of the yield aggregators themselves increased by about $2 billion, largely due to Convex Finance and inSure. Convex's market capitalization itself has increased nearly 10-fold over the past quarter.

Smaller parts of the DeFi ecosystem have seen more dramatic volatility. Even though the market value of asset management and fixed interest rates has plummeted by nearly 37%, it has little impact on the overall situation.

2021 DeFi Project Price Changes

While DeFi tokens performed relatively poorly throughout the year, LUNA was an exception, achieving a return of 123% in Q4 and a staggering 12,894% year-to-date. This is mainly due to the Columbus-5 upgrade on the Terra blockchain, as well as the explosive growth of the Terra ecosystem, with new protocols such as Astroport and ApolloDAO bringing more usage scenarios to LUNA.

Solana has had a stellar 2021, cementing its place as one of the top 10 cryptocurrencies of the year. From less than $2 in January 2021 to early 2022, SOL has a return of more than 112 times.

While both CEX and DEX tokens had incredible returns towards the end of the year, the latter clearly had the upper hand. PancakeSwap is one of the leading DEXs on Binance Smart Chain, achieving 1846% growth during the year.

Datasource:DappRadar

first level title

Non-Fungible Tokens (NFTs)

secondary title

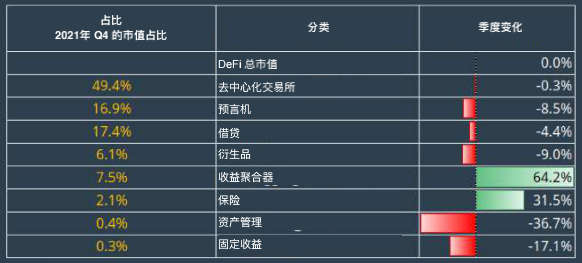

NFT platform trading volume"The trading volume of NFT has risen sharply since the summer, mainly dominated by OpenSea.

Compared with December and January 2021, the transaction volume has skyrocketed by +5,438%.

88% of the annual trading volume is contributed by just 3 marketplace platforms - OpenSea (61%), AxieInfinity (17%) and CryptoPunks (10%). The rest of the top ten platforms each account for 1-3% of the market share.

NFT trading volume increased significantly in July/August, marking the "Summer of NFTs"

Datasource:CryptoSlam *Adifferentdatasourceisusedforthisslidecomparedtothepreviousslide

Start.

As the market slowly weakened, AxieInfinity lost the most volume, while smaller marketplaces Mobox and MagicEden started to grow and gain market share.

secondary title

Ethereum and Ronin are the clear leaders in NFT trading

NFT Leaderboards

Although the NFT summer mainly started on Ethereum, other L1 chains and sidechains (such as Ronin, Solana, Polygon) quickly caught up and established their own NFT communities.

Datasource:CoinGecko,NFTGO,NiftyPrice,CryptoSlam,@maxbrand99 *TotalsalesonlyavailableinETH

Similar to DeFi, these other on-chain NFTs benefit from faster transactions and lower GasFee. Recently, OpenSea also started to support Polygon.

Datasource:CoinGecko,NFTGO,NiftyPrice,CryptoSlam,@maxbrand99 *TotalsalesonlyavailableinETH

'Others' include Panini ($21m), Tezos ($16m), ThetaNetwork ($15m), and BSC ($5m).

CryptoPunks became a top collectible, while First5000Days remains the most valuable piece

text

By the end of 2021, CryptoPunks retained its status as the collectible with the highest reserve price, despite being briefly surpassed by BAYC a few days ago. Although the floor price of AxieInfinity is very low, the transaction volume is very high.

Beeple and XCOPY tied for the artist with the most works in the top 10 best-selling NFTs, taking 4 positions each. Two other works, Stay Free (Edward Snowden, 2021) and Ross.

The UlbrichtGenesisCollection is primarily a fundraiser for causes with a common theme - "Freedom".

secondary title

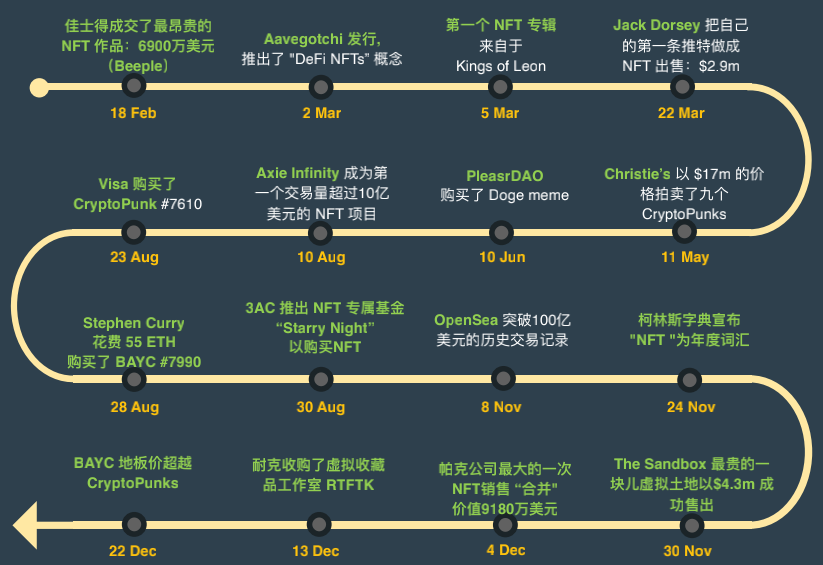

Noteworthy NFT Events in 2021

In 2021, NFT will hit the headlines many times

Big brands from sporting goods, fashion, tech, and even F&B are jumping on the NFT bandwagon—brands launching NFT collections include: Nike, Adidas, Dolce & Gabbana, Phillips, Budweiser, and even It's Pringles.

exchange

In 2021, there will be no shortage of celebrity endorsements for NFTs. Big names like SnoopDogg, Grimes, Deadmau5, and PostMalone have all added fuel to the NFT hype train.

2021 is also the year that several notable collectibles drop, for example, Loot, PudgyPenguins, CoolCats, Fidenzas, Meebits, and of course BAYC.

first level title

exchange

secondary title

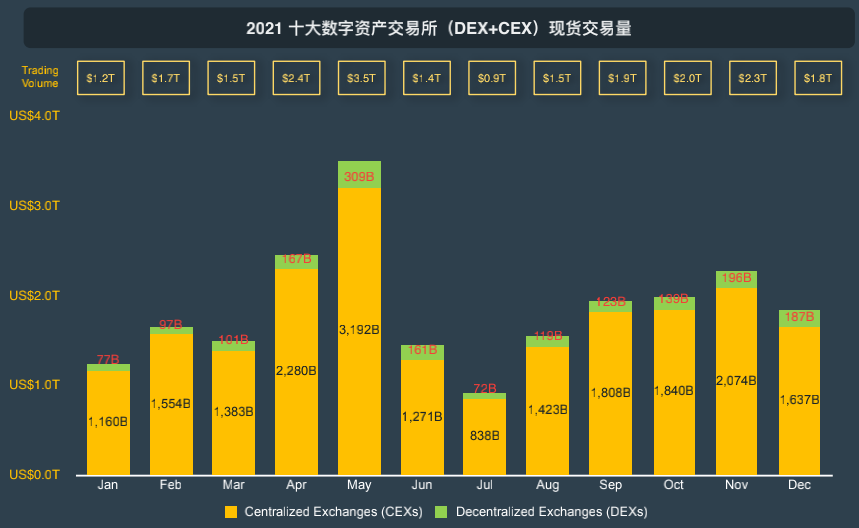

2021 Top Ten Digital Asset Exchanges

From the third quarter to the fourth quarter of 2021, the total transaction volume of the top 10 (DEX+CEX) will increase by 39%

Overall, the Q4 spot trading volume of the top 10 CEXs and DEXs increased from $4.38 trillion to $6.1 trillion (+38.57%).

Apart from the increase in November, the monthly transaction volume in the fourth quarter remained basically at the level of September.

Datasource:CoinGecko Top-10CEXasof1July2021–Binance,Huobi,Coinbase,Crypto.com,FTX,OKEx,Kraken,Bitfinex,Bitmart,Gemini Top-10CEXasof1January2022–Binance,Huobi,Coinbase,Crypto.com,FTX,OKEx,KuCoin,Kraken,Bitfinex,Gate.io

Monthly transaction volume in the fourth quarter was the highest since the rise and subsequent decline in the second quarter.

It is worth noting that the DEX:CEX ratio has risen steadily from 6% at the beginning of the year to 10%.

secondary title

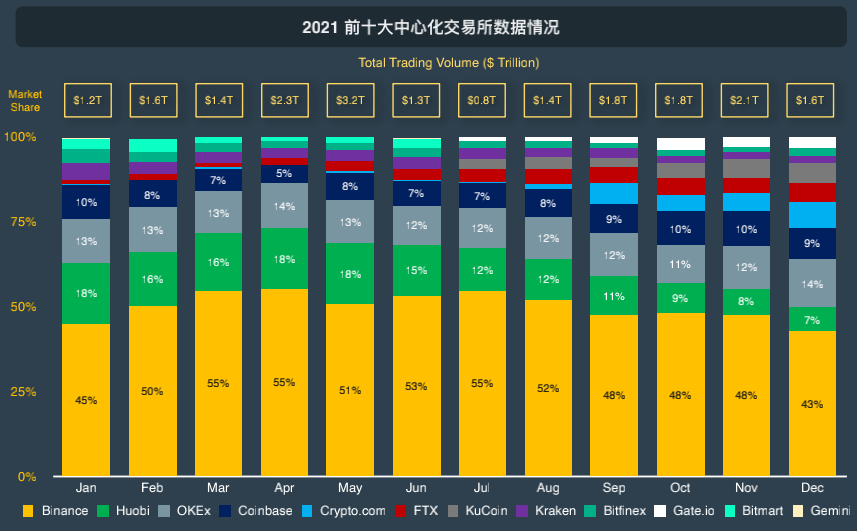

2021 Top Ten Centralized Exchanges (CEX)

Compared with Q3 in Q4 in 2021, the total transaction volume of the top 10 CEXs will increase by 36%

The total spot trading volume of TOP10CEX in 2021Q4 is 5.55 trillion US dollars. Q4 peaked at $2.07 trillion in November and fell to $1.64 trillion in December (-21%).

2021 Top Ten Decentralized Exchanges

Datasource:CoinGecko

RefertoCoinGeckoQuarterlyReportQ22021andQuaterlyReportQ32021forTop-10decentralizedexchangesrebalancesfromJanuarytoSeptember

Top-10DEXasof1November2021–Uniswap(v3),Uniswap(v2),PancakeSwap(v2),SushiSwap,TraderJoe,Raydium,Curve,SpookySwap,Orca,Compound Finance

Top-10DEXasof1December2021–Uniswap(v3),Uniswap(v2),PancakeSwap(v2),SushiSwap,TraderJoe,Raydium,Curve,SpookySwap,CompoundFinance,QuickSwap

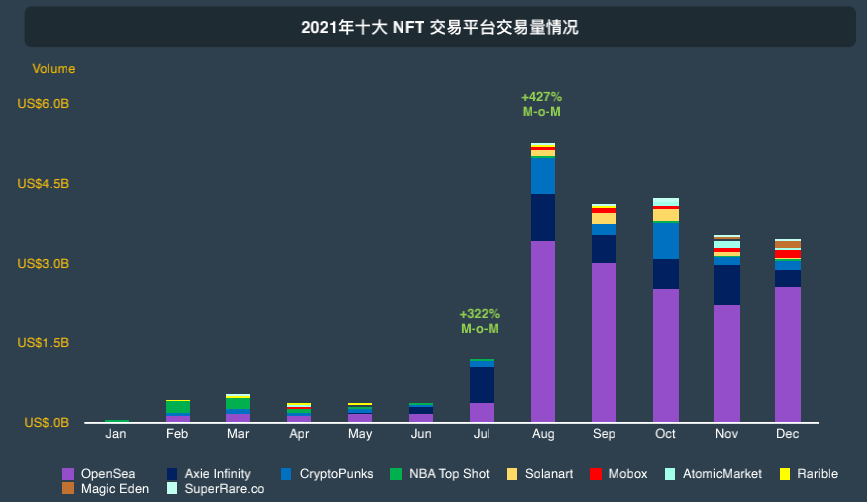

The trading volume of the top ten decentralized exchanges in 2021 will surge at the end of the year

image description

image description

image description

image description

In Q4 of 2021, the spot trading volume of the top ten DEXes will reach a total of US$522 billion.

Trading volume on DEXes rose sharply in November and December, jumping from $123 billion in September to $196 billion and

secondary title

Datasource:CoinGecko

Top-9DerivativeExchangesforBitcoinPerpetualSwapsasof1July2021–Binance,FTX,Bybit,OKEx,, Gate.io,Kucoin,Deribit,BitMEX,Huobi

Top-9DerivativeExchangesforBitcoinPerpetualSwapsasof1January2022–Binance,FTX,Bybit,OKEx,, Bitfinex,Kucoin,Deribit,BitMEX,Huobi

2021Q4 Derivatives Exchange—Bitcoin Perpetual Contract Trading Volume

BTC perpetual contracts see lackluster volume in final months of 2021

image description

image description

Bitcoin's perpetual contract trading volume on the nine major exchanges will drop by 26% in 2021

secondary title

Datasource:CoinGecko

Top-9DerivativeExchangesforBitcoinPerpetualSwapsasof1July2021–Binance,FTX,Bybit,OKEx,, Gate.io,Kucoin,Deribit,BitMEX,Huobi

Top-9DerivativeExchangesforBitcoinPerpetualSwapsasof1January2022–Binance,FTX,Bybit,OKEx,, Bitfinex,Kucoin,Deribit,BitMEX,Huobi

2021Q4 Bitcoin Perpetual Contract Open Interest Data

FTX is growing rapidly, and its market share has tripled

image description

image description

The 2021 Bitcoin perpetual contract of the nine major derivatives exchanges increased by 131% in liquidation

Binance maintained its number one market share with the highest open interest ($125 billion) among exchanges, however FTX also increased its share of open interest by more than 3x.

Datasource:coinglass.com.Consistsof8-hourfundingratesfromBinance,Huobi,OKEx,andBybitfrom1Julyto1October2021

In a similar trend to trading volume, Huobi’s open interest fell by nearly half, while its market share fell by nearly 90%. From being one of the top three exchanges at the beginning, to the current top nine exchanges, it has the lowest open interest.

secondary title

2021Q4 Bitcoin Perpetual Contract Funding Rate

image description

As of January 1, 2022, the average funding fee is 0.008% (+1.2 bp)

Under the higher leverage option, Bybit's funding rate is still at the highest level from October to November.

Data Source:Ycharts

Funding rates were fairly stable until Bitcoin plummeted to $47,000 on December 4. The 16% drop resulted in an extremely negative funding rate on dYdX, breaking through -0.15%.

secondary title

Performance of GBTC and $BITO

image description