Exploring "Progressive Decentralization": How a Three-Phase Analysis Creates a Successful DAO

Compilation of the original text: The Way of the Metaverse

Compilation of the original text: The Way of the Metaverse

Original source: BanklessDAO

DAO to the future

Quite frankly, DAOs are the future of organizations. The elements of a DAO (Decentralized Autonomous Organization) have been around for a long time, but it's finally time for these elements to come together and form something larger than the whole.

COVID has prompted us to discover what many technologists already know - that distributed teams can work effectively. Compound, Gitcoin, and others have shown us that it is also possible to merge these teams with the community and let them make decisions.

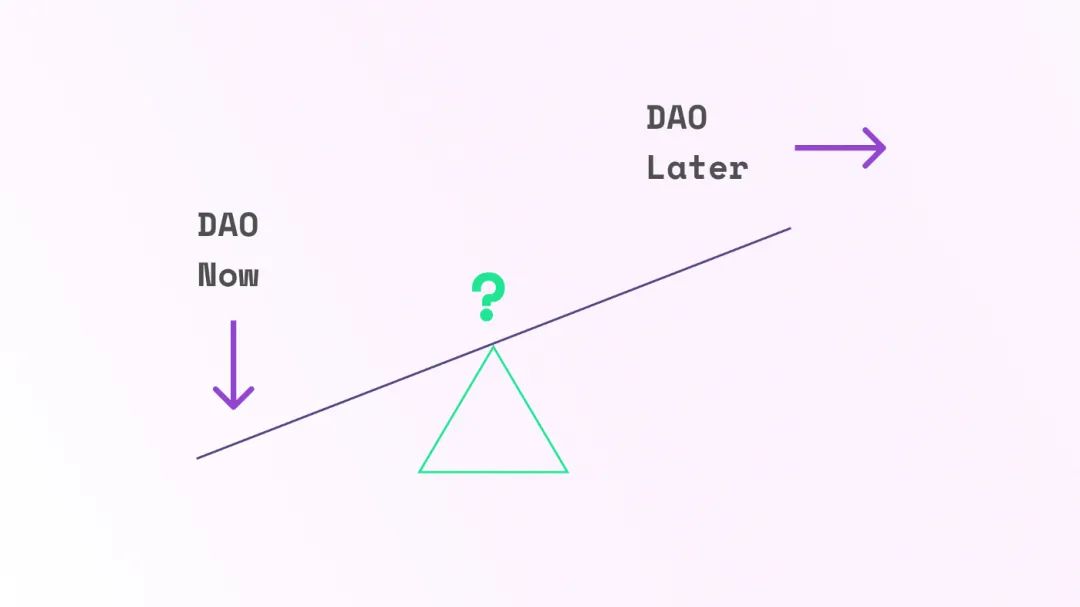

So, does this mean every startup should create a DAO?

not completely.

First, not every business is a good fit for a DAO (for example, your sock store on Shopify). Even if it is suitable, there is quite a bit of work to be done before the first on-chain vote.

DAOs are communities. The community forms a shared vision and develops a mission on how to make that vision a reality. Hector Espinal built We Run Uptown around a shared mission, "to build a network to uplift and inspire New York City's runners to be the best they can be, and have fun in the process."

But that's not why he's letting his Washington Heights neighbors run with him. Instead, he just posted on Facebook: "Meet you at 168th Street and Broadway. We're going to run across the bridge."

People who join Hector's team know exactly what they're going to do (running) and with whom (neighbors). As for why, everyone has their own personal reasons, but the common vision must be fitness.

The same is true for DAOs. You can't start until you understand the what, how and why of a project, and whether other people care about those ideas too.

In addition to a sense of community, DAOs require governance and incentives. While the community will build these, you'll need to build scaffolding. The governance and incentive structure will carry your blueprint vision, outline the overall direction of the DAO, and ultimately be the main reason people join.

Progressive decentralization

Progressive decentralization

Walden believes that cryptocurrency startups should be gradually decentralized:

“… much of what it takes to build a successful product from day one—product leadership, rapid iteration, managed go-to-market—complicates the path to community ownership and regulatory compliance, but ensures long-term healthy."

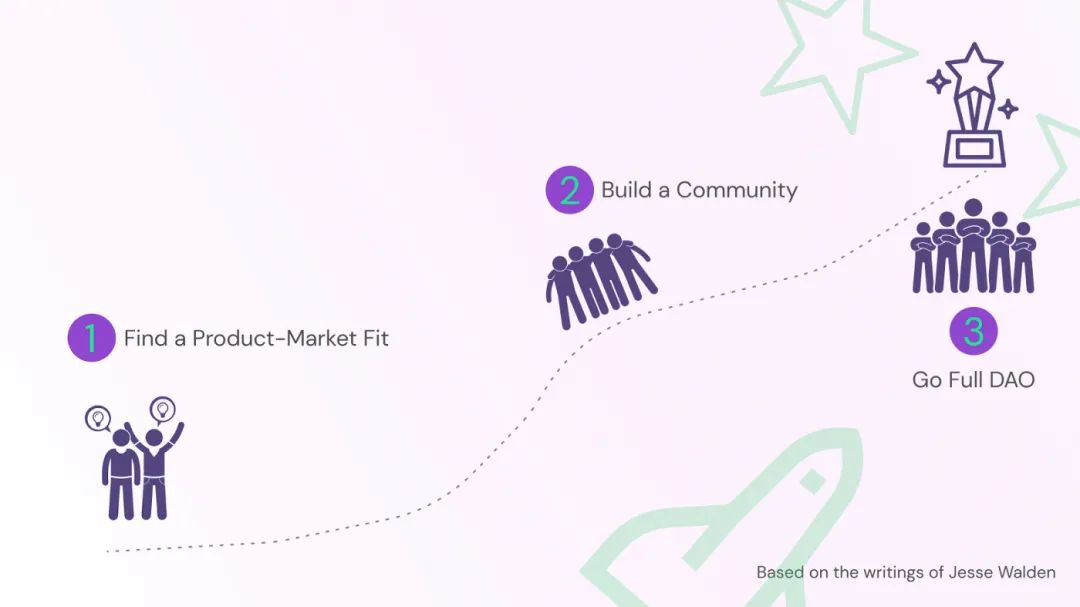

Building a community around an untested idea distracts people from the most critical task: testing the idea. To avoid this misguided approach, Walden recommends going through three stages:

Discover product-market fit

build an active community

image description

secondary title

Discover product-market fit

Things moved quickly and directions changed quickly. You work in sprint mode: define the problem, draft a solution, and test it. A core team can tweak and iterate until your product fits the market.

Community Involvement

Community Involvement

At this point, you've found your market and are solving a real problem for a large group of people. Your product is still in rough draft, but customers keep asking for it. Some will even make unsolicited feature requests. This is when you start building a community.

Even if a DAO is not in your plans, a community is a great idea. There are two main reasons:

Gain customer insights to help you fine-tune your product.

Increase customer stickiness. It's an easier choice for consumers to stop using a product they haven't developed an affection for through the community.

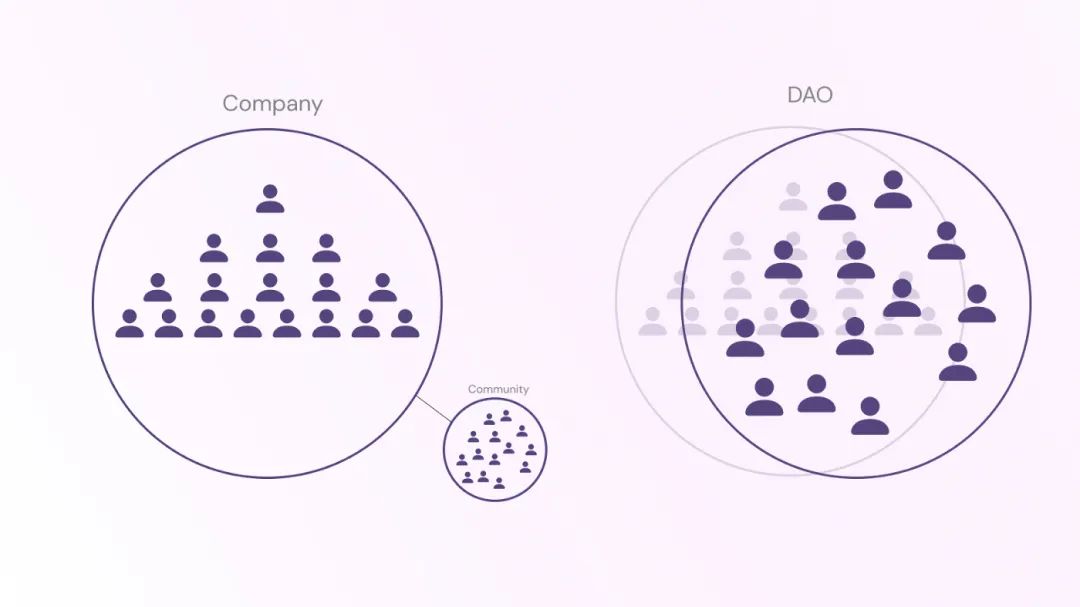

In Web2, businesses build communities in order to derive value from them. For example, Coda—the documentation app I'm using to write this article—has a vibrant online workspace where people share templates, develop workflows, and exchange experiences. While members benefit from these interactions, the greatest portion of value goes to Coda. It mines the forum for use cases, feedback, and ideas. In return, users get paid for products they help develop.

If this seems like exploitation, it is—even if the community is voluntary. But it doesn't have to be this way.

In Web 2, companies and communities are two separate groups. In Web 3, they can become one.

If Coda decides to go the DAO route, it can:

Enable community members to make suggestions for the development of the product.

Build governance and incentive structures at the community level.

Give back value by paying members for their contributions (e.g. template creation, workflow development).

community ownership

community ownership

All the efforts of the previous two phases culminate in this phase. The founding team hands over full control to the community. Token holders will now make all decisions about the future of the organization.

Governance and incentives are the biggest challenges in the leap from a supportive but hands-off community to an operational DAO. Regardless of how much work you have done in the previous phase, it will be up to the community to strengthen the governance structure and develop processes and procedures that will allow the DAO to manage all aspects of the business.

In addition to day-to-day operations, there are challenges in managing existing shareholders, employees, taxation and company formation. Most states and countries do not recognize DAOs as legal entities. Will you register the DAO as a limited liability company (LLC) or incorporate it in Wyoming? Based on the options you decide on, how will you handle payroll deductions and employment law compliance?

I don't have all the answers. Frankly, I don't think anyone knows. As we'll see in the examples below, designing a proper structure can take years, often more than three years.

How Others Are Fully DAO

Gitcoin

In 2017, Scott Moore and Kevin Owocki launched Gitcoin, a platform to fund the development of public goods for Web3. Earlier this year, Owocki explained that many exciting projects never got built for a simple reason: lack of funding in the initial stages. To address this, Moore and Owocki launched a grant program to support developers building open-source software for Web3.

Gitcoin will not become a DAO until May 2021, when it launches its governance token (GTC). For the previous four years, Owocki and Moore were busy defining problems, designing solutions, and growing a community of builders and sponsors. After figuring out all of the above issues, the team had to formulate a framework for community governance and how to hand over responsibility to the DAO. The launch of the GTC is the culmination of all these efforts.

AAVE

Stani Kulechov founded ETHLend in 2017 as a decentralized peer-to-peer lending platform.

A year later, Kulechov and his team transformed their business model into a liquidity pool platform. They also changed the name to AAVE - the Finnish word for "ghost".

AAVE did not start operating as a DAO until 2020.

What have Kulechov and his team been doing during those three years? They refined their business model, rebranded, and validated their product-market fit. Once AAVE had some traction, they decided to become a DAO.

MakerDAO

MakerDAO was established in 2015 as the Maker Foundation. Rune Christensen came up with the vision of building a stable token (e-Dollar) to support the exchange of value on the Ethereum network. The problem Christensen wants to solve is one we still face today: Major cryptocurrencies are too volatile to be practical tools for day-to-day transactions. Cryptocurrencies need a stable coin.

Over the next few years, Christensen abolished the Maker Foundation, released a limited-edition stablecoin, launched DAI, and paved the way for the formation of The DAO. You can read the full Maker's journey here.

MakerDAO, like many others, has successfully exploited progressive decentralization to grow into a DAO. However, this approach doesn't always make sense.

When Progressive Decentralization Doesn't Make Sense

Progressive decentralization works best for Layer 2 applications. Typically, these are built on Ethereum and use smart contracts. Most DeFi and Web3 applications fall into this group. However, some business models require decentralization from the start.

layer 1 protocol

By design, projects like Ethereum, Solana, and Polkadot require a community of participants from the beginning. The real reason they exist is to provide specific solutions utilizing decentralized blockchain technology. They are networks that operate without a central authority.

Ethereum would never have succeeded if its founders had all the decision-making power. It won’t be trustless and permissionless, it will probably just be another Amazon or AirBnB, a place where people operate within the parameters set by a centralized decision maker.

The value of a blockchain network lies in its decentralization. Therefore, it must be optimized from the beginning.

Social Clubs and Investment Funds

If it weren't for Web3, The LAO would be a traditional venture capital (VC) fund. PleasrDAO will never exist.

The LAO's success lies in community participants investing in cryptocurrency projects together. In the traditional venture capital world, the LAO would have a general partner (GP) pooling the money of the limited partners (LP) into a fund. The GP will be responsible for investing the money and providing a return.

This model works in a world where limited partners have no interest in the day-to-day running of the fund. Many LPs take this approach and as long as the fund delivers the promised returns and maintains the same risk profile, there is no need to participate.

However, an active LP should look elsewhere if it doesn't want to be limited to being a bank account. Decentralized organizations like LAO and Meta Cartel are built for them.

You cannot achieve The LAO without DAO. By design, it relies on a network of people who play different roles — investors, scouts, mentors and founders. Together they work to build projects that shape the future.

The same is true for PleasrDAO. Its premise is collective ownership of digital art. It brings together a group of people with a common goal. Collectors clubs do exist in the offline world. However, they tend to rely heavily on centralized control and often have small memberships. Thanks to a single tweet, PleasrDAO's decentralized and mostly anonymous members have united around a cause and now hold some of the most prominent NFT artwork in the world, without ever forming a centralized entity.

While projects like The LAO and Ethereum wouldn’t benefit from a phased approach to decentralization, they weren’t fully decentralized to begin with either. They need a small team of committed founders to move things forward.

In The Infinite Machine, Camila Russo describes how Vitalik Buterin worked with Gavin Wood, Charles Hoskinson, and Anthony Di Iorio to drive the project. Each plays a different role, but they all collectively make key decisions about company formation, legal registration, token issuance, and more.

According to Russo, the first days of Ethereum were by no means smooth sailing. Quarrels and power struggles are typical. Most of the original founders left the project in conflict. The first days of any company are tough, even if the founders get along well. Trying to start a DAO will only make things more challenging.

Many in the crypto space are familiar with the story of The DAO. In the weeks following Ethereum’s launch, hackers were able to withdraw millions of dollars’ worth of ETH tokens due to a flaw in its smart contracts. Researcher Quinn DuPont provided an in-depth assessment of The DAO's early challenges, noting that at the time of the attack, "we saw visions of future governance structures being broken and degraded into traditional social models — leveraging existing powerful Negotiate and influence relationships, argue and oppose — all without seeing a single line of code.”

That’s why it’s important to clearly define the process and timeline for handing over to community-driven governance, understand what the shared vision is, and execute in a way that engages your community with you.