A glance at the performance of projects invested by leading venture capital institutions in the industry in 2021

foreword

foreword

In 2021, the growth momentum of DeFi will continue to be maintained, the locked-up value will continue to hit new highs, and micro-innovations will continue to emerge; GameFi, Metaverse, and NFT will continue to be popular, and many brands, companies, and investment institutions will enter the market one after another; Solana, Fantom, Avalanche, etc. The representative new public chain will perform well in 2021, greatly changing the ecological pattern of the public chain.

After experiencing the downturn in 2020, the blockchain industry investment and financing market finally ushered in a rebound in 2021. The number of investment and financing in the first half of the year alone has exceeded the whole year of 2020. In order to analyze in detail the performance of projects invested by leading venture capital institutions in the industry in 2021, 98KDAO conducted a comparative analysis of 14 investment institutions from different dimensions such as project growth rate, track distribution, and multiple distribution.

overview

overview

first level title

List of investment performance of various institutions

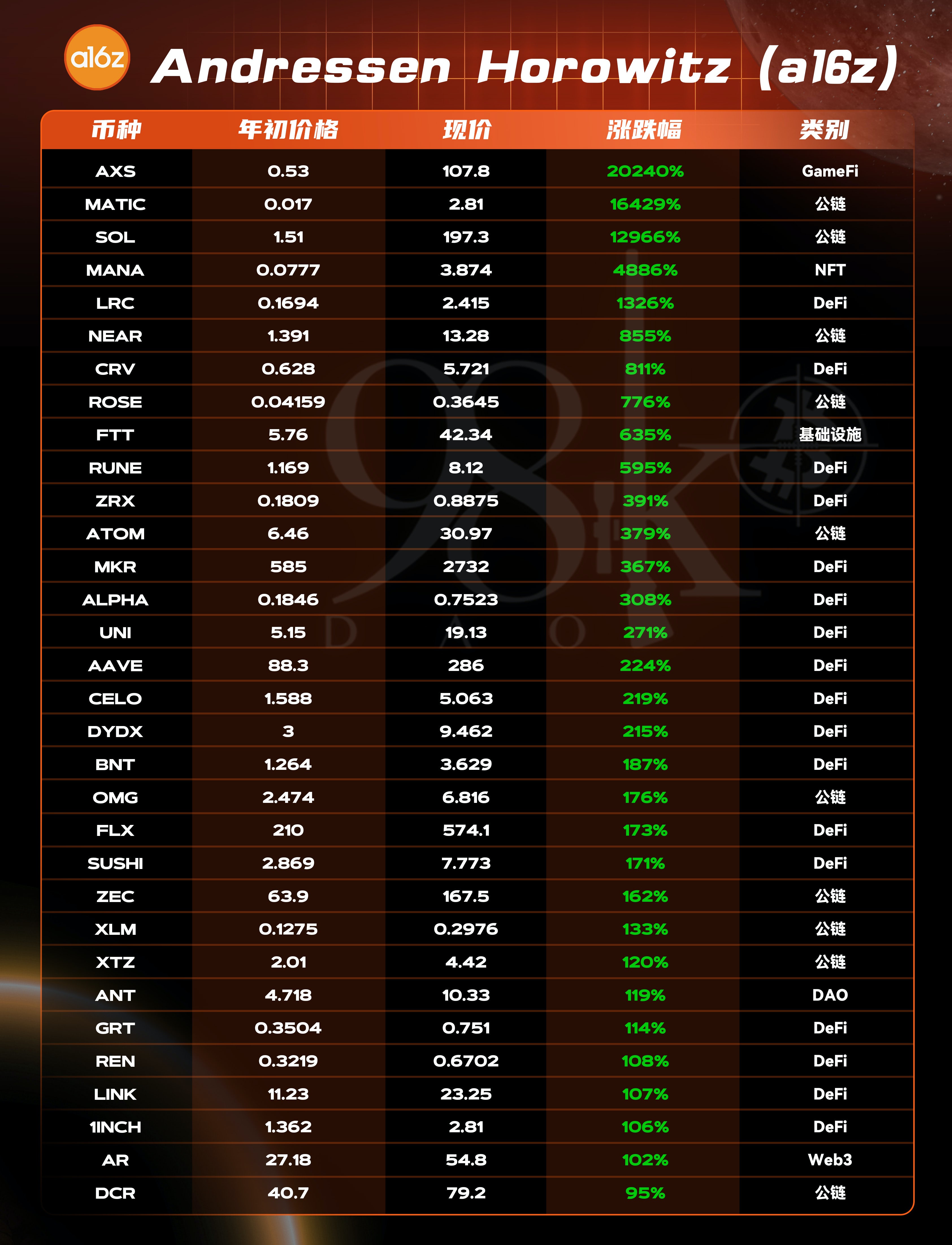

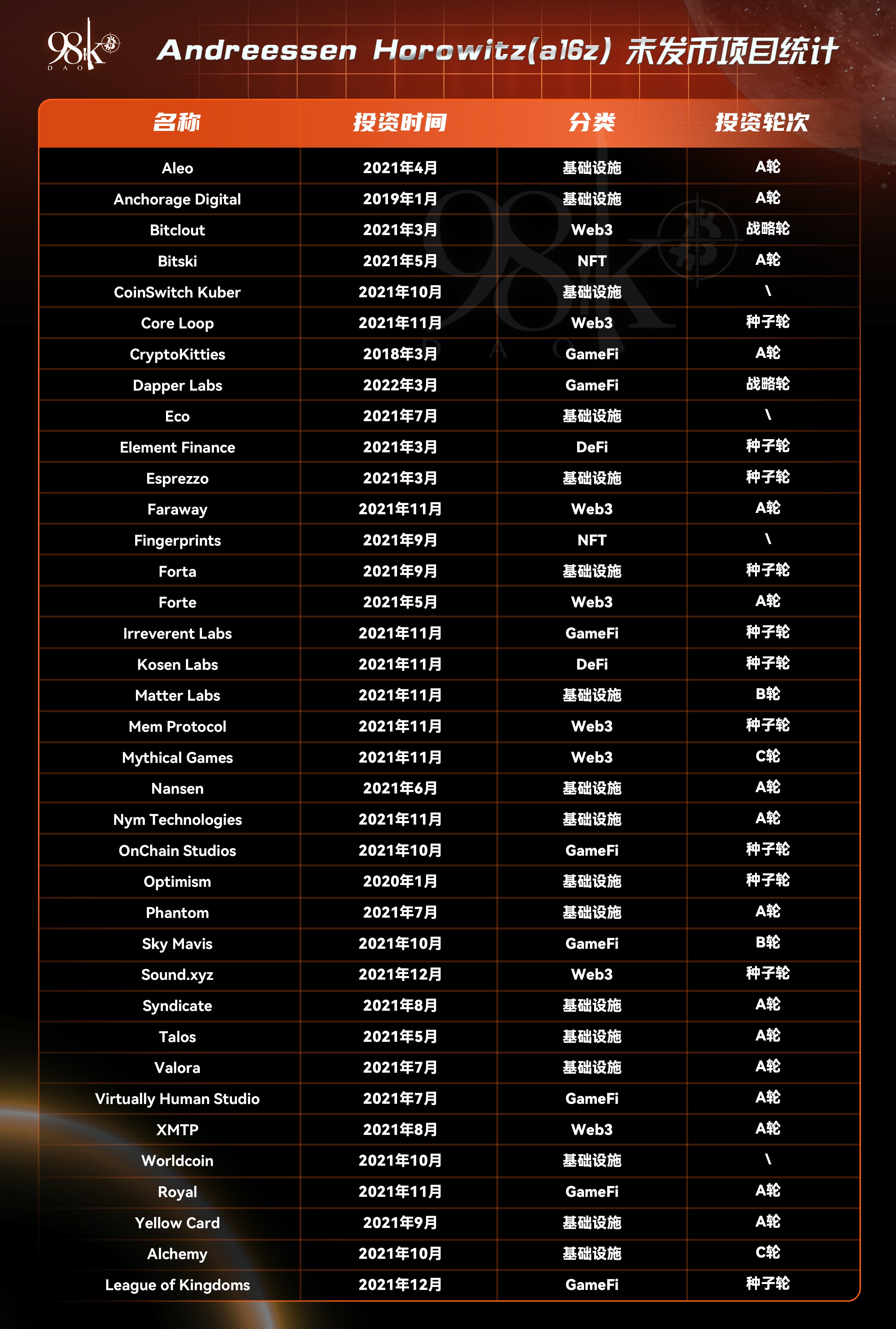

Andreessen Horowitz(a16z)

Institution introduction: a16z is one of the most dazzling stars in the entire Internet investment circle, and has successively invested in well-known projects such as Facebook and Twitter. It has invested in several blockchain star projects and has become the vane of cryptocurrency investment. After Coinbase went public, a16z became its second largest shareholder with a 14.8% stake, becoming the biggest external winner.

In addition, a16z has also invested in Uniswap, MakerDAO, Compound, Dapper Labs, Arweave, Optimism, Solana, etc., almost all of which have become leading blockchain projects. Today's a16z has an encryption fund size of more than 3 billion US dollars. It is like a capital lighthouse in the encrypted world, with high attention and strong appeal.

The following data is the currency price performance of a16z invested and issued currency projects in 2021:

From the statistical data, a16z has invested in and launched 63 currencies, which is far ahead of other institutions in terms of quantity. At the same time, the positive growth rate of its portfolio this year has exceeded 75%, and the highest growth rate is 20240% AXS, and there are three 100-fold coins (AXS, MATIC, SOL).

From the perspective of project classification, there are 36 DeFi projects, accounting for 57.1%; 14 public chain projects, accounting for 22.2%; and 7 Web3 projects, accounting for 11.1%. It can be seen from this that a16z's investment focuses on the DeFi and public chain fields, while the layout of NFT and GameFi projects is less.

The following statistics are for projects that a16z has invested in but has not issued coins:

The total number of unissued currency projects is 37, of which infrastructure (17) accounts for 46%, followed by GameFi and Web3, each with 8.

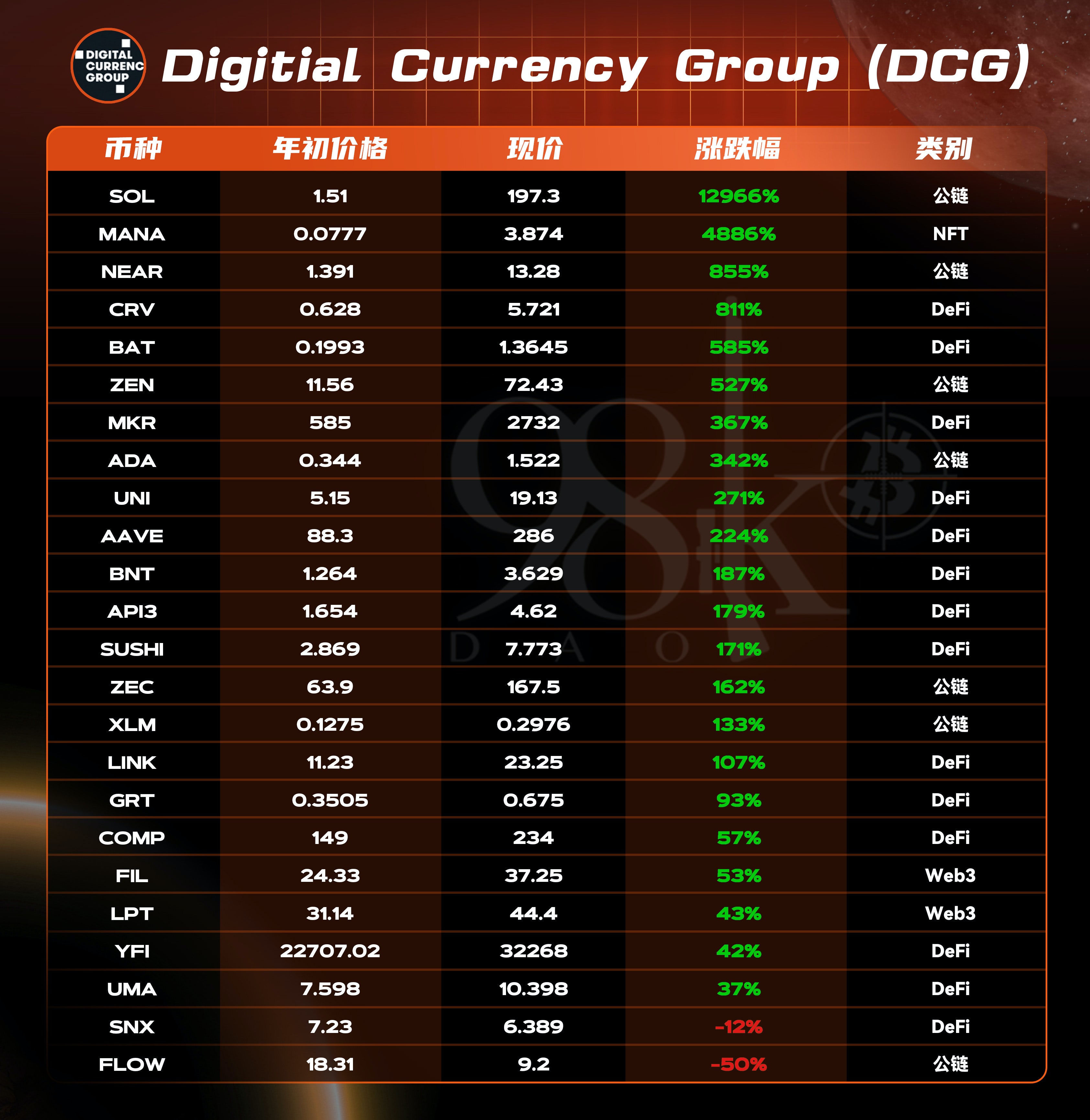

DCG(Digitial Currency Group)

Institution introduction: Blockchain startup incubator, Coindesk, the parent company of Grayscale, is an investment company focusing on the encryption and blockchain industry, with a portfolio of more than 100 companies.

The following data is the currency price performance of DCG-invested and issued currency projects in 2021:

From the perspective of data, DCG, as the leading encryption investment institution, has performed very well in its investment portfolio this year, with a positive growth rate of more than 90%. There are nearly 30 listed currencies in the portfolio, second only to a16z. Among them, SOL with the highest increase of 12966% accounted for more than 85% of the increase within 10 times, and most of them were concentrated in 1-10 times, accounting for 55%.

From the perspective of project classification, there are 14 DeFi projects, accounting for 56%; there are 7 public chain projects, accounting for 28%, and the total of DeFi and public chain accounts for 84%. The investment preferences of a16z are basically the same, with more emphasis on DeFi and public chains, and less investment in tracks such as NFT, GameFi, and Web3.

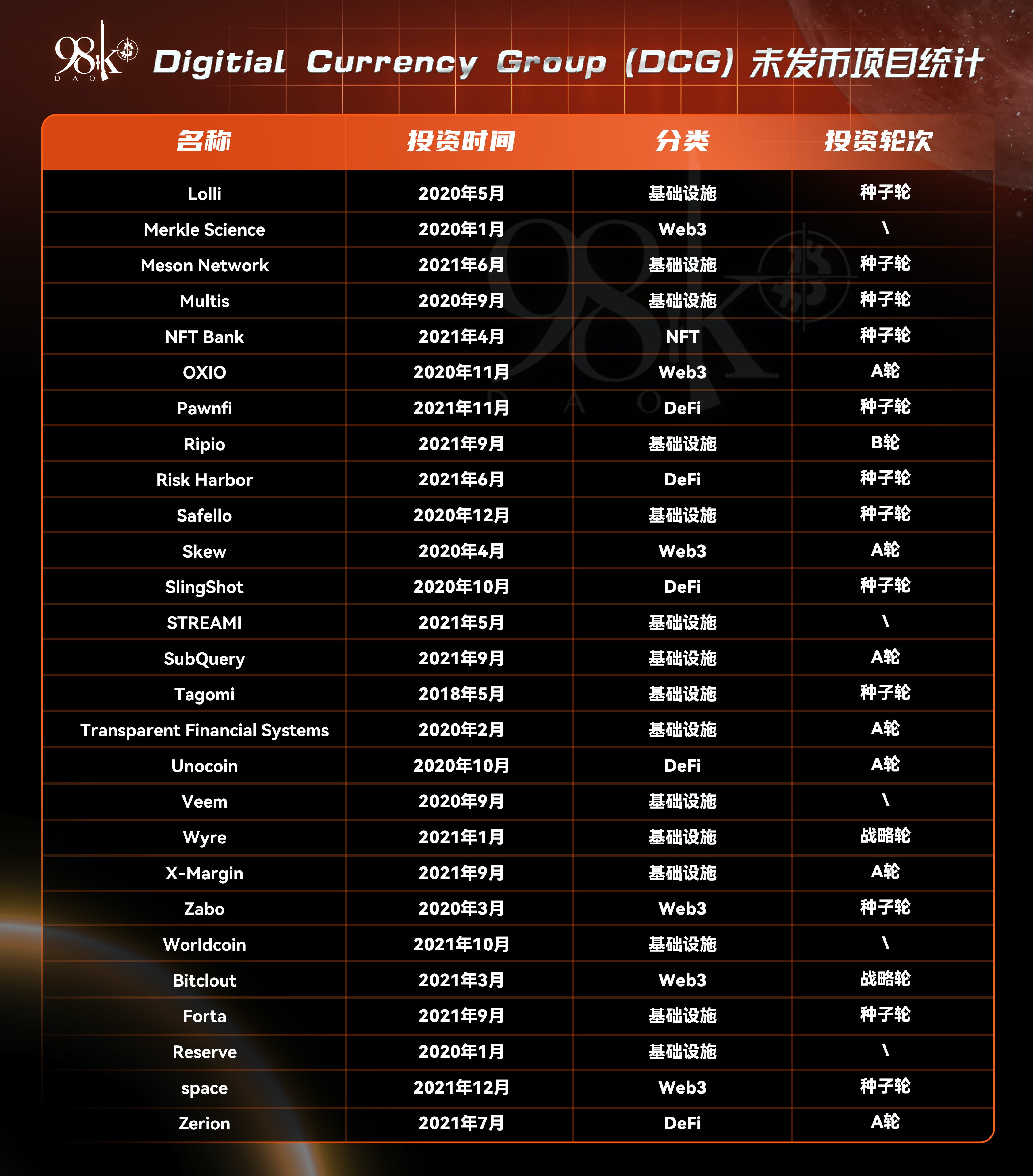

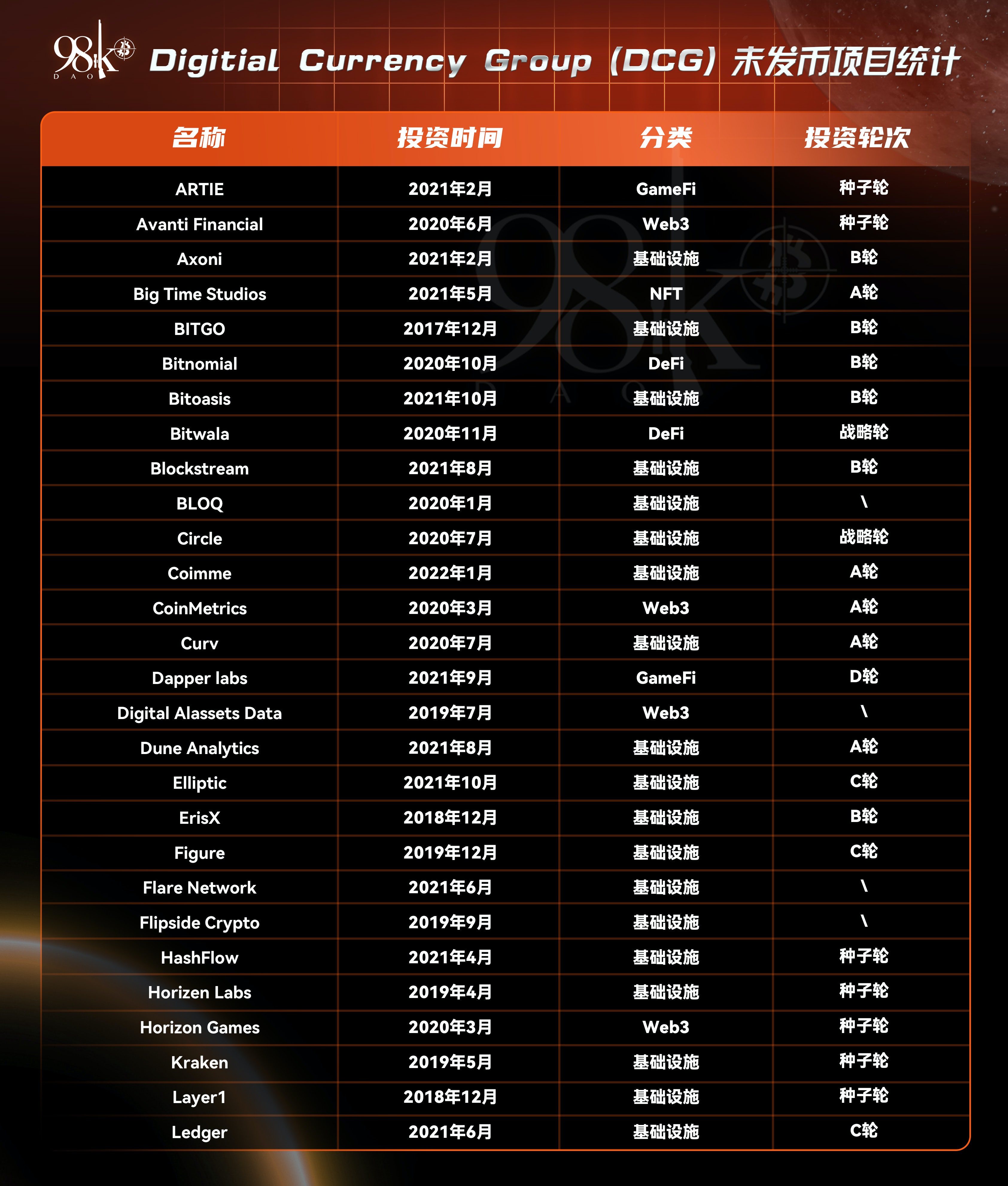

The following statistics are projects that DCG has invested but not issued:

The total number of unissued currency projects is 55, of which 34 are infrastructure projects, accounting for 61.8%, followed by Web3 and DeFi.

Paradigm

Organization introduction: Paradigm was co-founded by the co-founder of Coinbase, the former partner of Sequoia and the former employees of Pan-tera Capital. It is reported that this fund has received capital injection from Sequoia Capital and Yale University. The background of the two founders is worth mentioning: Fred Ehrsam was one of the co-founders of Coinbase.

Matt Huang started a business in Silicon Valley after graduating from MIT, and the company was acquired by Twitter. Since 2011, he has made some early investments successively, and has a very luxurious investment resume. The most successful one is undoubtedly Toutiao.

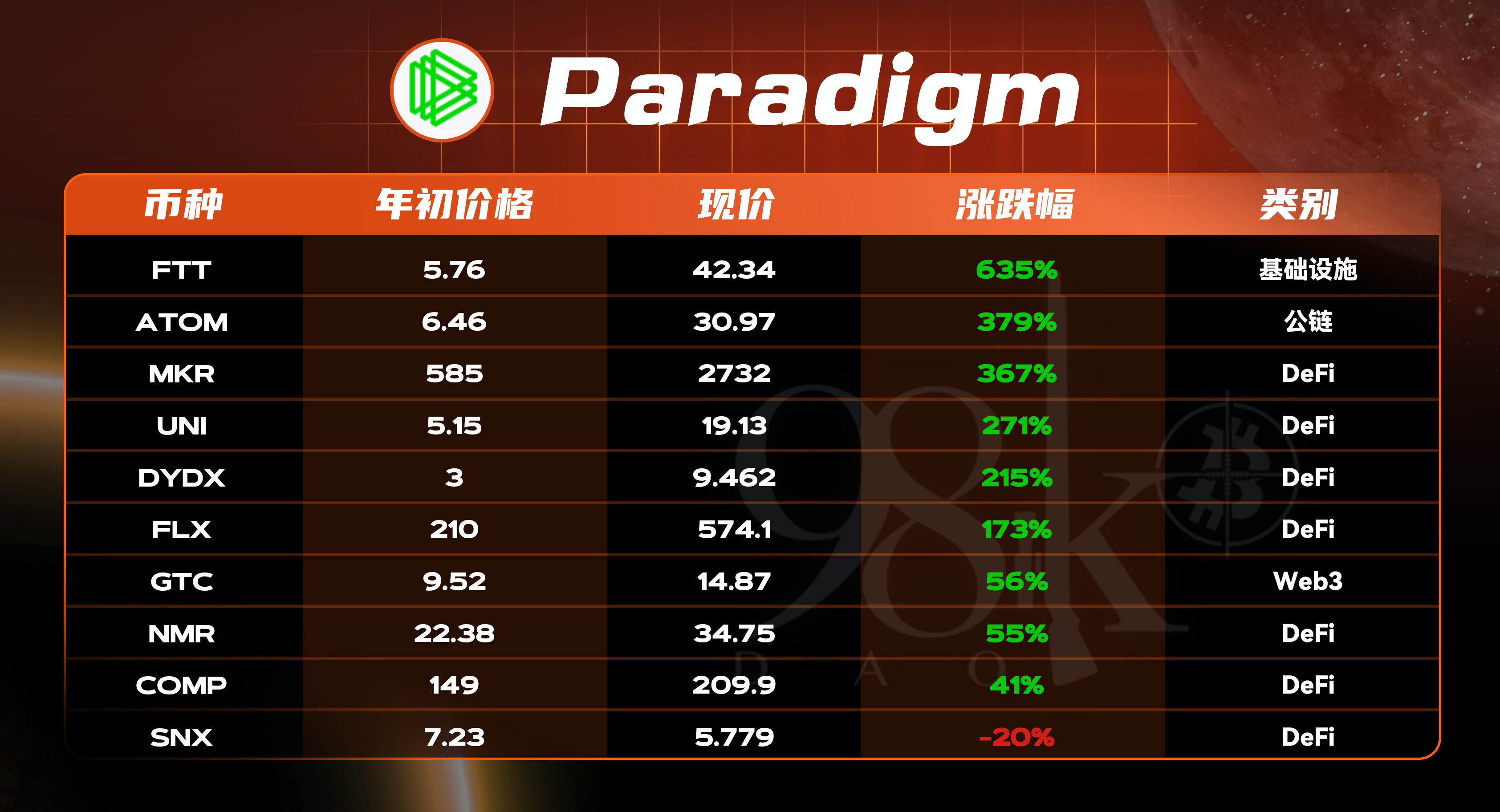

The following data is the currency price performance of Paradigm invested and issued currency projects in 2021:

Paradigm has invested in more than 30 projects. According to statistics, 10 projects have been listed this year. The performance of its investment portfolio is very good, with a positive growth rate of up to 90%. The highest increase is 635% FTT, 60% of the increase is concentrated in 1-10 times, and the decline of the currency with negative increase is the smallest among all institutions, which is -20%.

From the perspective of project classification, there are 7 DeFi projects, accounting for 63.6%, and infrastructure, public chain and Web3 are also involved.

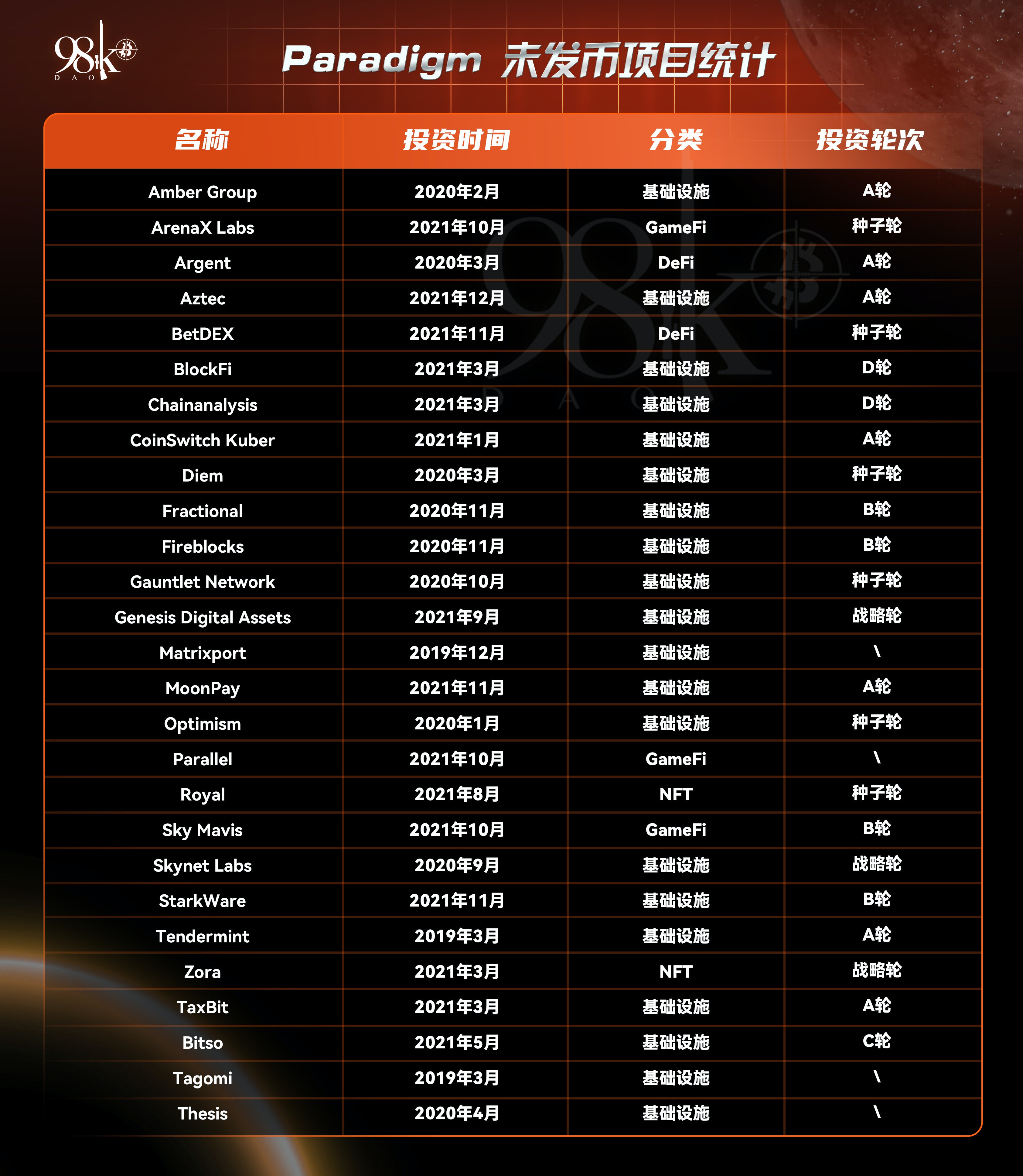

The following statistics are the projects that Paradigm has invested but not issued:

The total number of unissued currency projects is 27, of which 20 are infrastructure projects, accounting for 74%

Multicoin Capital

Institution introduction: An investment fund focusing on cryptocurrencies not only received investment from Binance, but also received support from a number of organizations and well-known venture capital institutions in Silicon Valley.

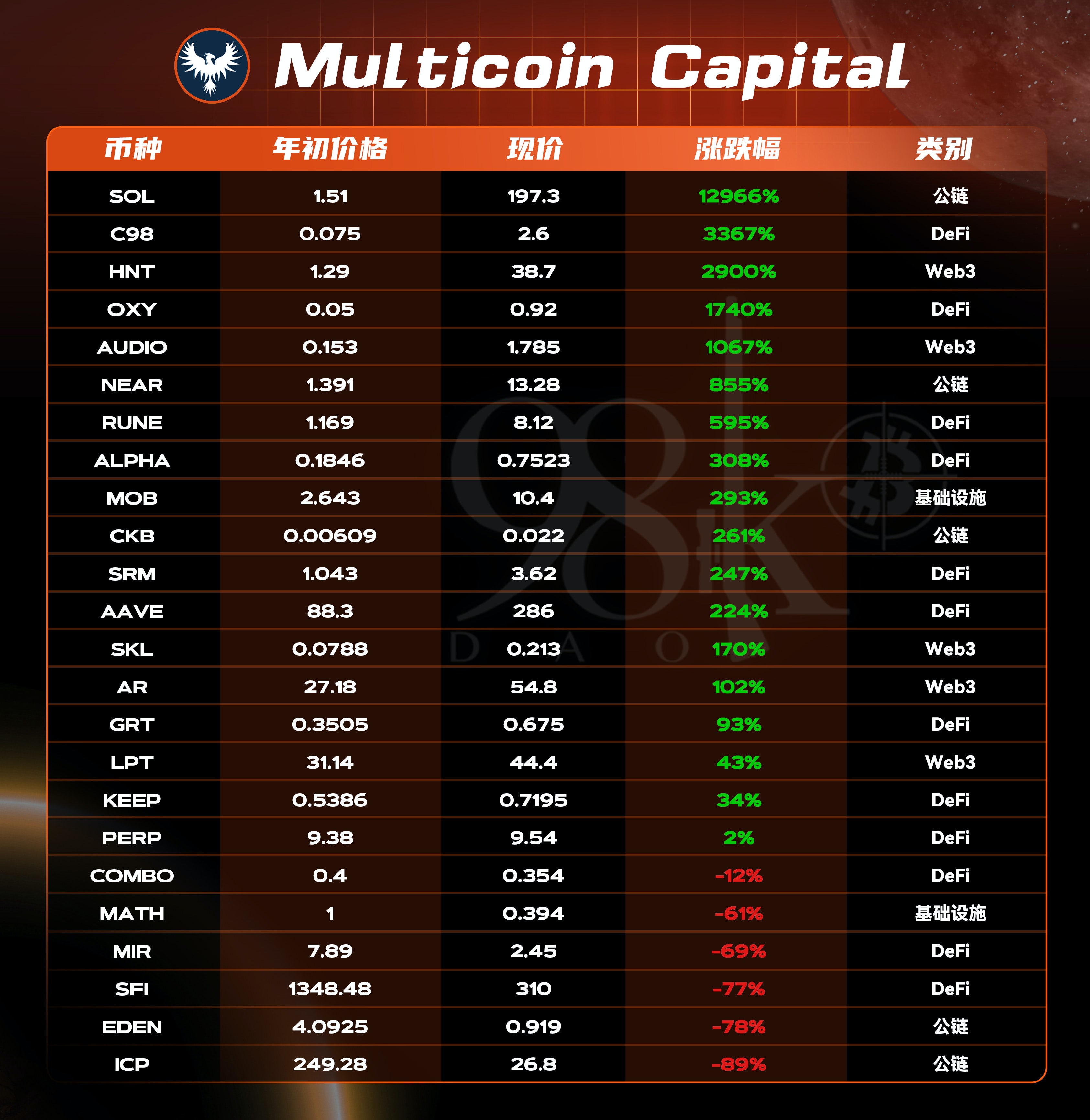

The following data is the currency price performance of Multicoin Capital invested and issued currency projects in 2021:

A total of 24 projects have been invested by Multicoin Capital and have been launched, with a positive investment growth rate of 75%, and 54% of which have a growth rate of less than 10 times. The highest increase is 12966% SOL, and the largest decrease is ICP, which drops by 89%.

From the perspective of project classification, there are 12 DeFi projects, accounting for 48%; Web3 and public chains are both 5, each accounting for 20%. The investment style of Multicoin Capital is very similar to that of a16z, focusing on DeFi and public chain projects.

The following statistics are for the projects that Multicoin Capital has invested but not issued:

The number of unissued currency projects is 24, of which there are 8 DeFi projects, accounting for 33.3%, followed by Web3 and infrastructure, with 6 each.

NGC Ventures

Institution introduction: Established at the end of 2017, it is a blockchain technology venture capital fund composed of members from technology entrepreneurship, traditional capital markets, management consulting and other fields. There are two funds under it, NGC Fund I focuses on investment in the field of blockchain technology, and the other NEO Eco Fund is dedicated to the ecological layout of NEO blockchain. The overall size of the two funds is about 500 million US dollars.

The following data is the currency price performance of NGC Ventures invested and issued currency projects in 2021:

NGC Ventures has invested in a total of 19 projects that have been launched, with a positive investment growth rate of 73%, and 68% of which have a growth rate of less than 50 times. The highest increase is 12966% SOL, and the largest decrease is WSOTE, which has a drop of 99%, close to zero.

From the perspective of project classification, there are 8 public chain projects, accounting for 42%; 4 DeFi projects, accounting for 21%; the others are GameFi, Web3 and infrastructure.

The following statistics are for projects that NGC Ventures has invested but not issued:

The total number of unissued projects is 6, including 5 infrastructure projects and 1 GameFi project.

Three Arrows Capital

Institution introduction: A hedge fund registered in Singapore, focusing on providing excellent risk-adjusted returns. One of its founders, Su zhu, is very active on Twitter and has a certain influence.

The following data is the currency price performance of Three Arrows Capital invested and issued currency projects in 2021:

Three Arrows Capital's investment portfolio is second only to a16z, but its positive growth rate is far lower than DCG's 93%, only 69%. The proportion of 100 times coins in its investment portfolio is double that of DCG, and the number of projects in the range of 10-50 times is also three times that of DCG.

Although the overall performance data of Three Arrows Capital is not particularly outstanding, its performance in individual projects is still very impressive. The project with the highest increase was 20240% AXS, and the project with the largest decline was ROOK, which fell 76%.

From the perspective of project classification, DeFi projects accounted for 82% of the total, with a total of 24. It can be seen that Three Arrows Capital attaches great importance to the DeFi track.

The following statistics are the projects that Three Arrows Capital has invested but not yet issued:

The total number of unissued currency projects is 8, with infrastructure and DeFi each accounting for half.

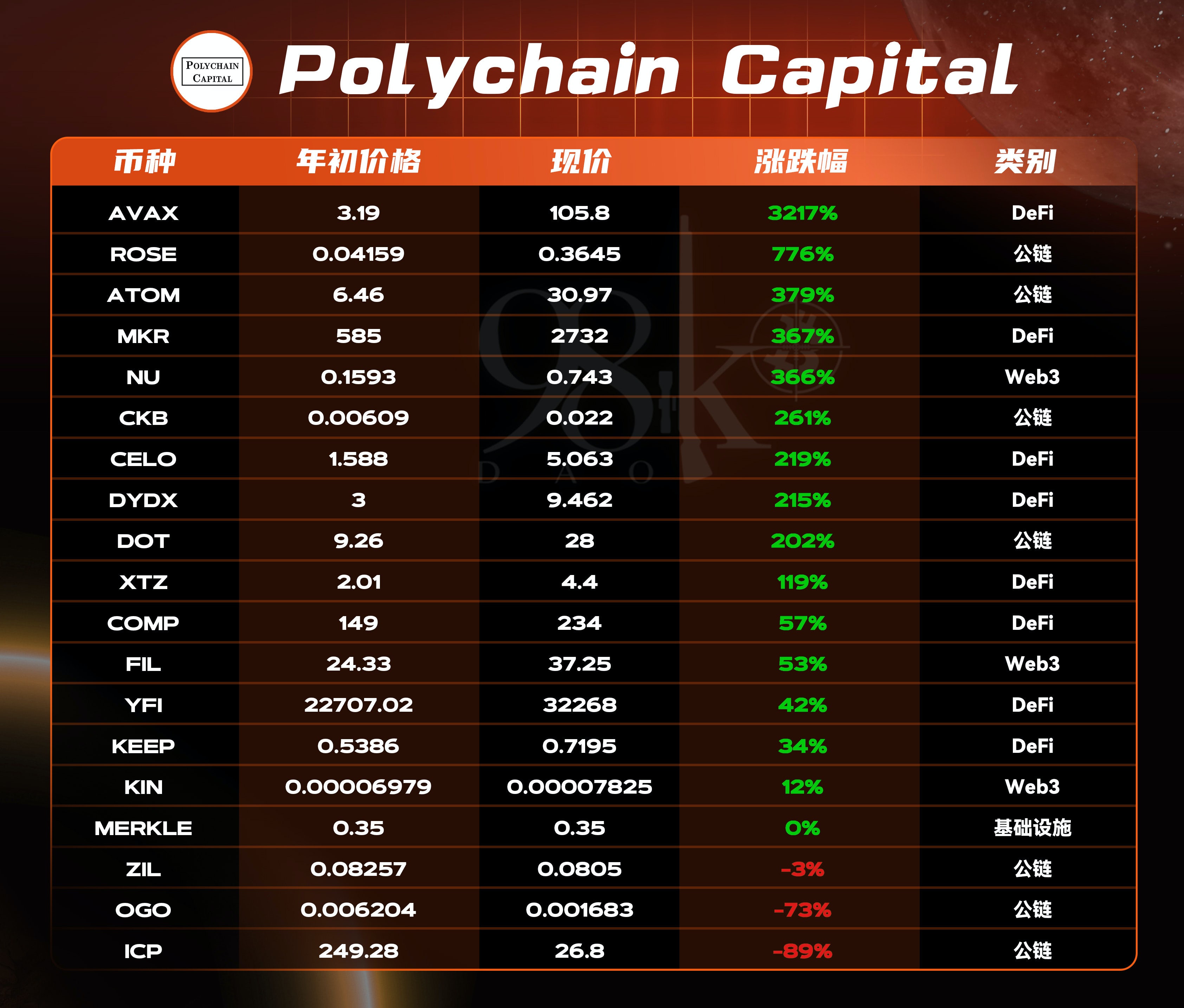

Polychain Capital

Institution introduction: Founded in 2016, a16z, Danhua Capital and other investments focus on blockchain assets. It is the earliest native encryption hedge fund and has invested in many blockchain star projects.

The following data is the currency price performance of Polychain Capital invested and issued currency projects in 2021:

Polychain Capital's investment portfolio has a positive growth rate of nearly 85%, and the currencies below 10 times account for nearly 80%, and it is also concentrated in 1-10 times, accounting for 47%, and there is no 100 times currency. The largest increase is 3217% AVAX, the largest decrease is -89% ICP.

From the perspective of project classification, there are 8 DeFi projects, accounting for 42.1%; there are 7 public chain projects, accounting for 36.8%, and the combined proportion of DeFi and public chains is 78.9%.

The following statistics are the projects that Polychain Capital has invested but has not issued coins:

The total number of unissued currency projects is 45, of which 23 are infrastructure projects, accounting for 51%; there are 15 DeFi projects, accounting for 33%.

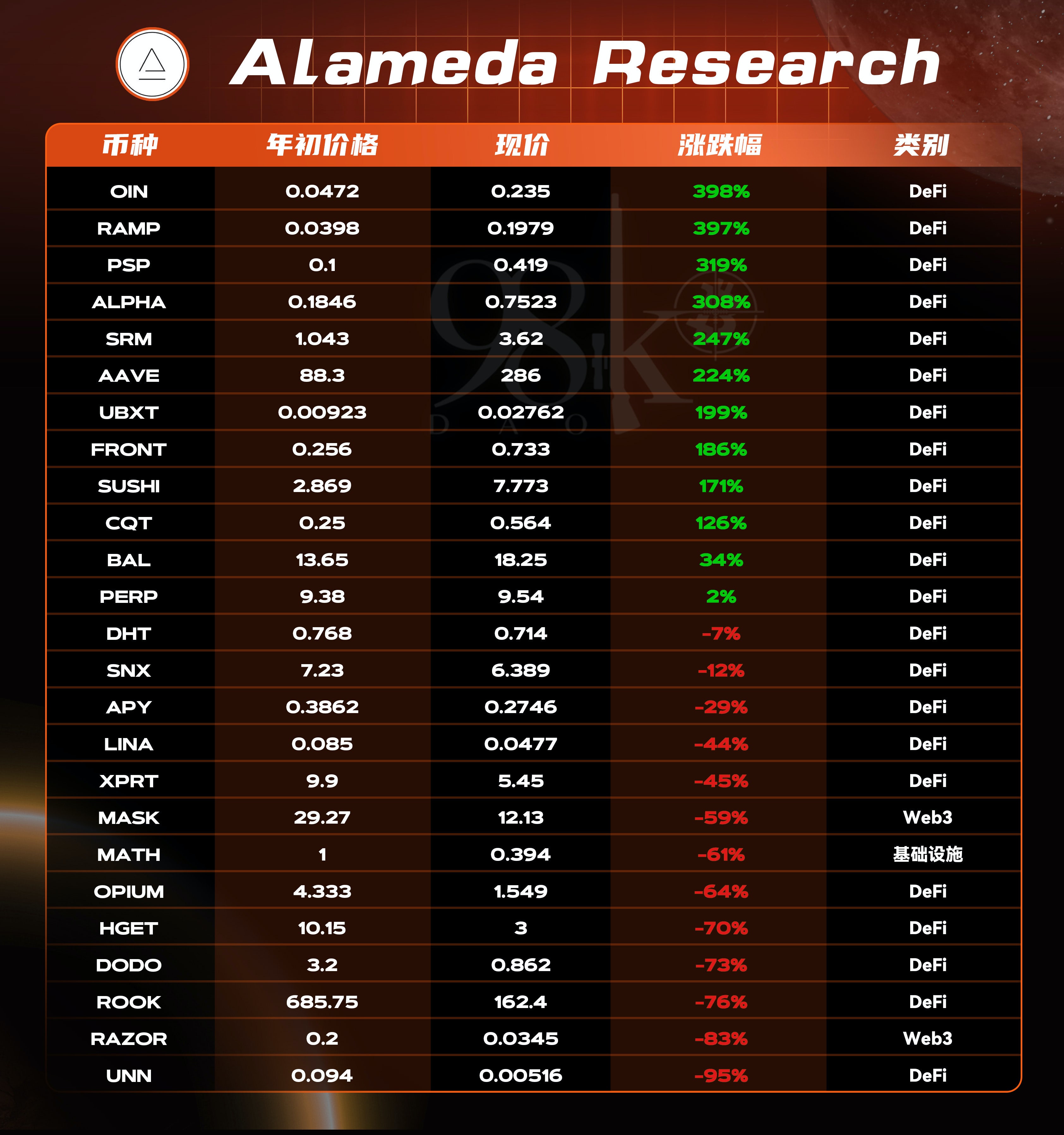

Alameda Research

Institution introduction: Alameda Research was founded by FTX founder and CEO Sam Bankman-Fried. It has invested in several blockchain star projects and performed better than financial companies in traditional markets and long-term encryption funds.

The following data is the currency price performance of Polychain Capital invested and issued currency projects in 2021:

Alameda Research has the lowest positive rate of increase among all institutional portfolios, only 48%, and the largest increase in the currency is also the lowest among all institutions, only 398%. The increase in the portfolio is concentrated in 1-3 times, accounting for 40% of the total, less than 1 times accounted for 8%.

From the perspective of project classification, there are 22 DeFi projects, accounting for 88%, and the remaining 12% are Web3 and infrastructure.

The following statistics are for projects that Alameda Research has invested in but have not issued coins:

The total number of unissued currency projects is 19, of which 8 are infrastructure projects, accounting for 42%, followed by DeFi and GameFi projects.

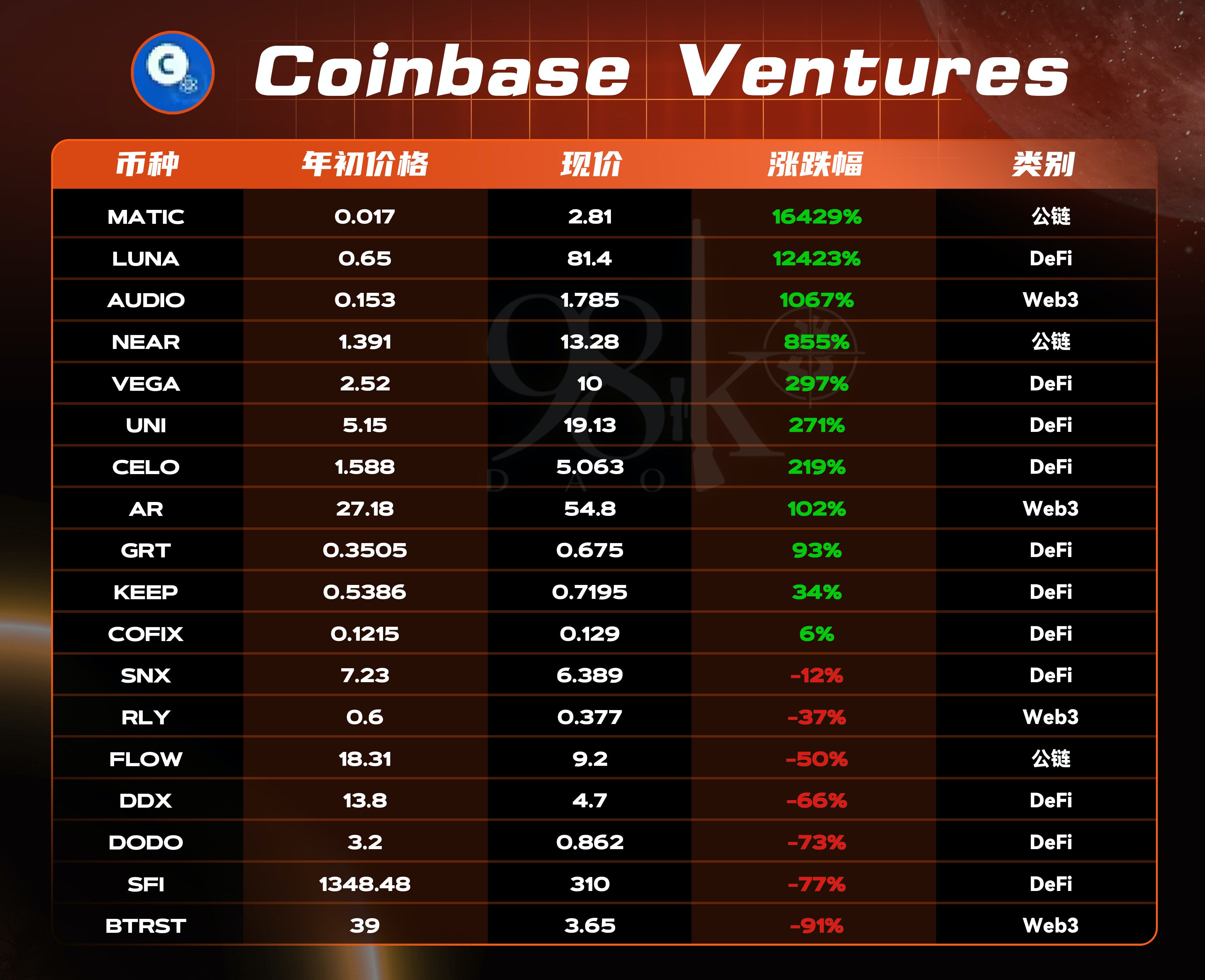

Coinbase Ventures

Institution introduction: A venture capital fund affiliated to Coinbase, headquartered in San Francisco, mainly invests in early-stage cryptocurrency and blockchain startups, and its investment tendency is open financial solutions.

The following data is the currency price performance of Polychain Capital invested and issued currency projects in 2021:

The positive growth rate of Coinbase Ventures’ investment portfolio is only 61%. There are two 100-fold currencies (LUNA 124 times, MATIC 164 times), 10 times one (AUDIO), 1-10 times accounted for 28%, and less than 1 times accounted for 28%. 17%. The highest increase is 16429% MATIC, and the largest decrease is -91% BTRST.

From the perspective of project classification, there are 11 DeFi projects, accounting for 61.1%, 4 Web3 projects, and 3 public chain projects. DeFi still accounts for the highest proportion.

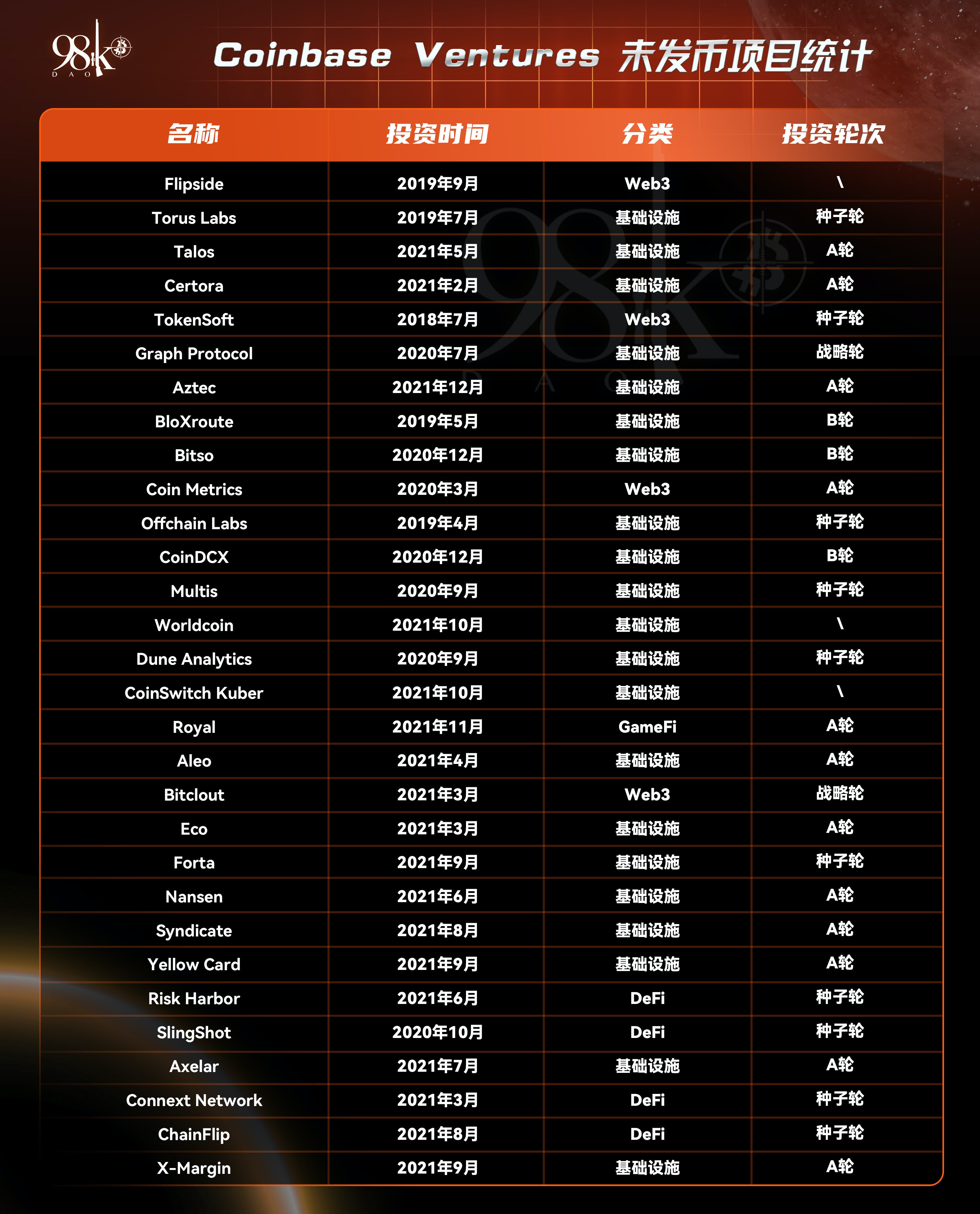

The following statistics are for projects that Coinbase Ventures has invested in but not yet issued:

The total number of unissued projects is 60, of which 43 are infrastructure projects, accounting for 71%, followed by DeFi and Web3, and NFT projects account for the least.

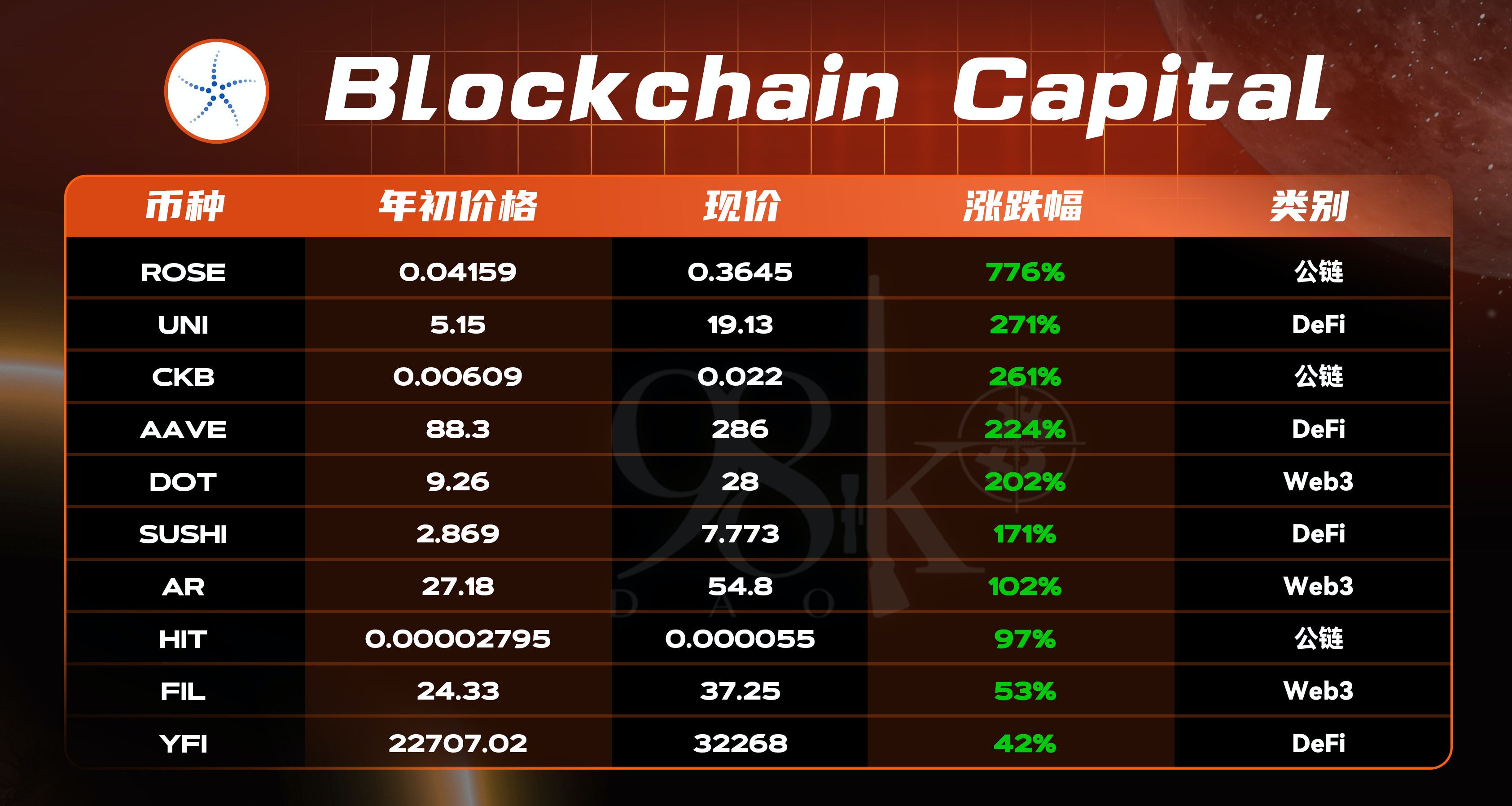

Blockchain Capital

Institution introduction: The first venture capital fund dedicated to the Bitcoin and blockchain ecosystem. Invested in financial technology companies such as Coinbase and Ripple, and is one of the top investment institutions in the blockchain industry.

The following data is the currency price performance of blockchain capital invested and issued currency projects in 2021:

The positive growth rate of Blockchain Capital's investment portfolio is 100%. There is no 100 times currency, 78% of which are 1-10 times, and 33% are less than 1 times. The highest increase is 776% ROSE, and the lowest increase is 42% YFI.

From the perspective of project classification, the number of DeFi, public chain, and Web3 is basically the same, and the distribution is relatively even, but there are no GameFi, DAO, and NFT projects.

The following statistics are for projects that Blockchain Capital has invested in but have not issued coins:

The total number of unissued currency projects is 20, and there are 12 infrastructure projects, accounting for 60%, followed by DeFi accounting for 30%.

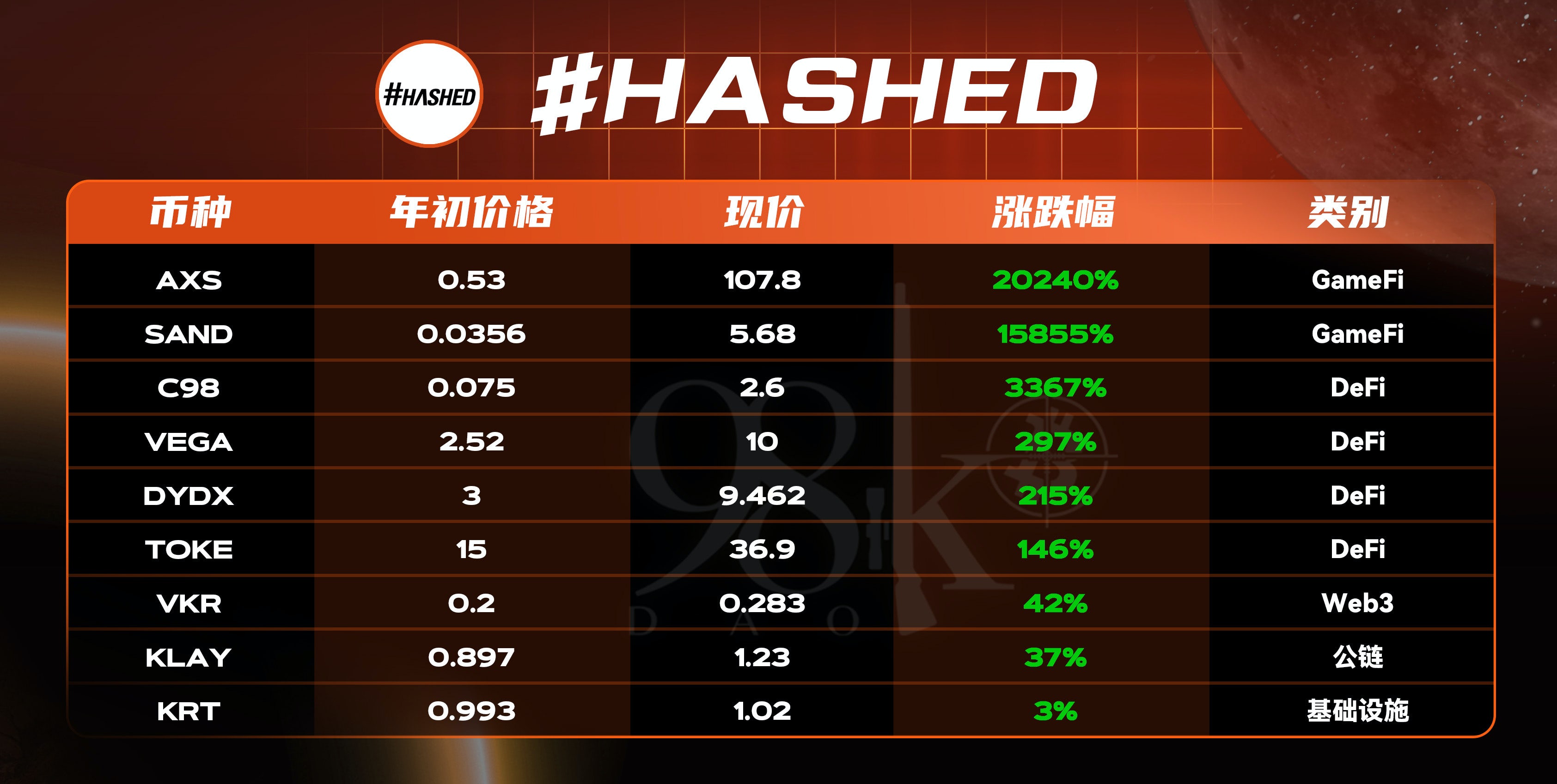

#HASHED

Institution introduction: South Korea's largest digital currency and blockchain investment fund is also one of the largest investors in many well-known blockchain projects. It mainly covers South Korea and Asia, and its influence radiates to Silicon Valley.

The following data is the currency price performance of #HASHED invested and issued currency projects in 2021:

The positive growth rate of #HASHED investment portfolio is 100%. There are two hundred times coins SAND (158 times) and AXS (202 times). Those with 10-50 times accounted for 11%, and those with less than 10 times accounted for more than 60%. The largest increase is 20240% AXS, and the smallest increase is 3% KRT.

From the perspective of project classification, there are 4 DeFi projects, accounting for 44.4%, 2 GameFi projects, and 1 each for Web3, public chain, and infrastructure.

The following statistics are #HASHED projects that have invested but have not issued coins:

The total number of unissued projects is 20, and the tracks of investment projects are relatively distributed. The highest proportion is infrastructure, accounting for 30%.

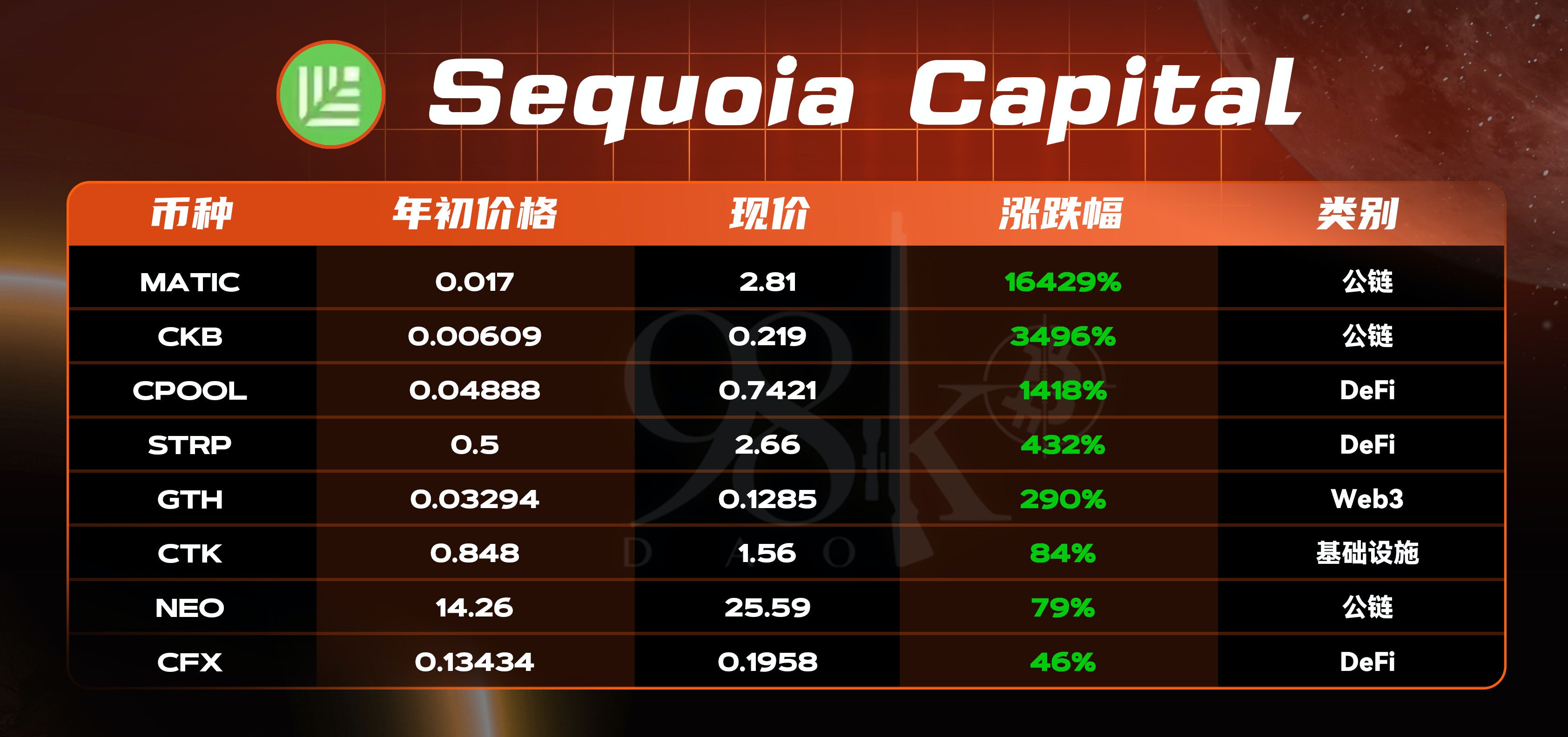

Sequoia Capital (Sequoia Capital)

Institution introduction: The top venture investor of the global Internet, and the top-level VC who put China's Internet industry on the altar. It has invested in several blockchain star projects. It is said that Sequoia China is preparing to All in Crypto.

The following data is the currency price performance of Sequoia Capital invested and issued currency projects in 2021:

Sequoia Capital’s investment portfolio also has a positive growth rate of 100%. There is only one hundred-fold coin MATIC (164 times), 10-50 times accounts for 25%, 1-10 times accounts for 25%, and less than 1 times accounts for 38%. The highest increase is 16429% MATIC, and the lowest increase is 46% CFX.

From the perspective of project classification, there are 3 each for DeFi and public chains, and 1 each for Web3 and infrastructure projects.

The following statistics are for projects that Sequoia Capital has invested in but have not issued coins:

The total number of unissued projects is 9, of which 5 are infrastructure projects, accounting for 55.5%.

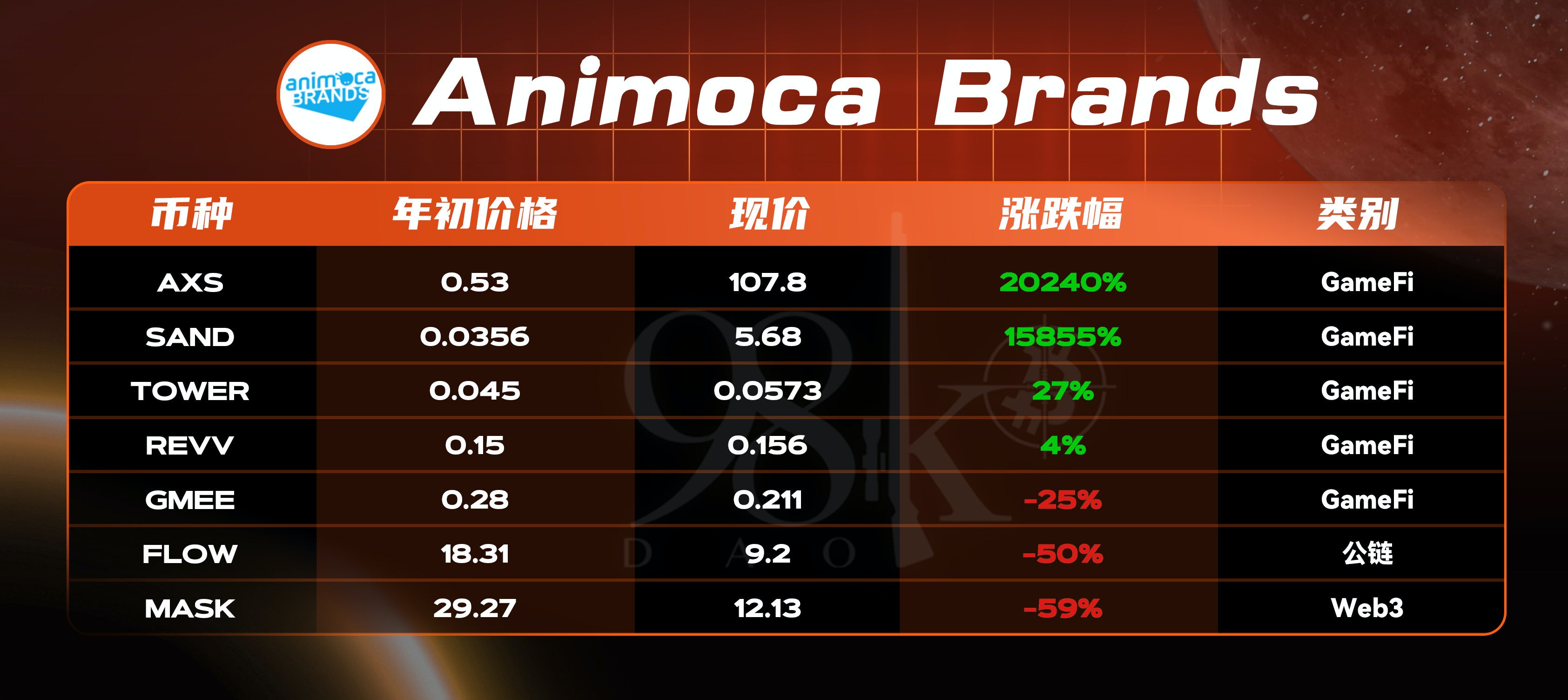

Animoca Brands

Organization introduction: A Hong Kong mobile game development company, a technology unicorn, listed on the Australian Stock Exchange, focusing on Metaverse and GameFi projects, and has invested in a number of star-level blockchain games.

The following data is the currency price performance of Animoca Brands invested and issued currency projects in 2021:

Animoca Brands has the least number of portfolio currencies among all institutions, and it only has 57% positive investment growth rate, which is only higher than Alameda Research's 48%. Those with more investment preferences have a winning rate of more than 80% in the game, and there are two hundred-fold currencies, and the rate of return of others is less than 1 times. The highest increase is 20240% of AXS, and the largest decrease is -59% of MASK.

From the perspective of project classification, there are 5 GameFi projects, accounting for 71.4%, one for public chain and one for Web3, and none for DeFi projects.

The following statistics are projects that Animoca Brands has invested in but has not issued coins:

The total number of unissued currency projects is 5, of which Web3 projects account for 80%.

Binance Labs

Institution introduction: The social impact fund of Binance, the world's largest cryptocurrency exchange, aims to provide incubation and investment for blockchain and cryptocurrency entrepreneurs; projects and communities.

The following data is the currency price performance of Binance Labs invested and issued projects in 2021:

Binance Labs’ investment portfolio has a positive growth rate close to 90%. Among the 28 listed currencies, there are four hundred-fold coins, ALICE, LUNA, MATIC, and AXS, which are the most among all institutions; 4, the proportion of 1-10 times is more than 50%, and there are only two currencies that are less than 1 times, which is the least among all institutions.

From the perspective of project classification, Binance Labs has a relatively diversified investment style. The number of infrastructure, public chain, DeFi, and GameFi is very close, and there is no excessive emphasis on a single track.

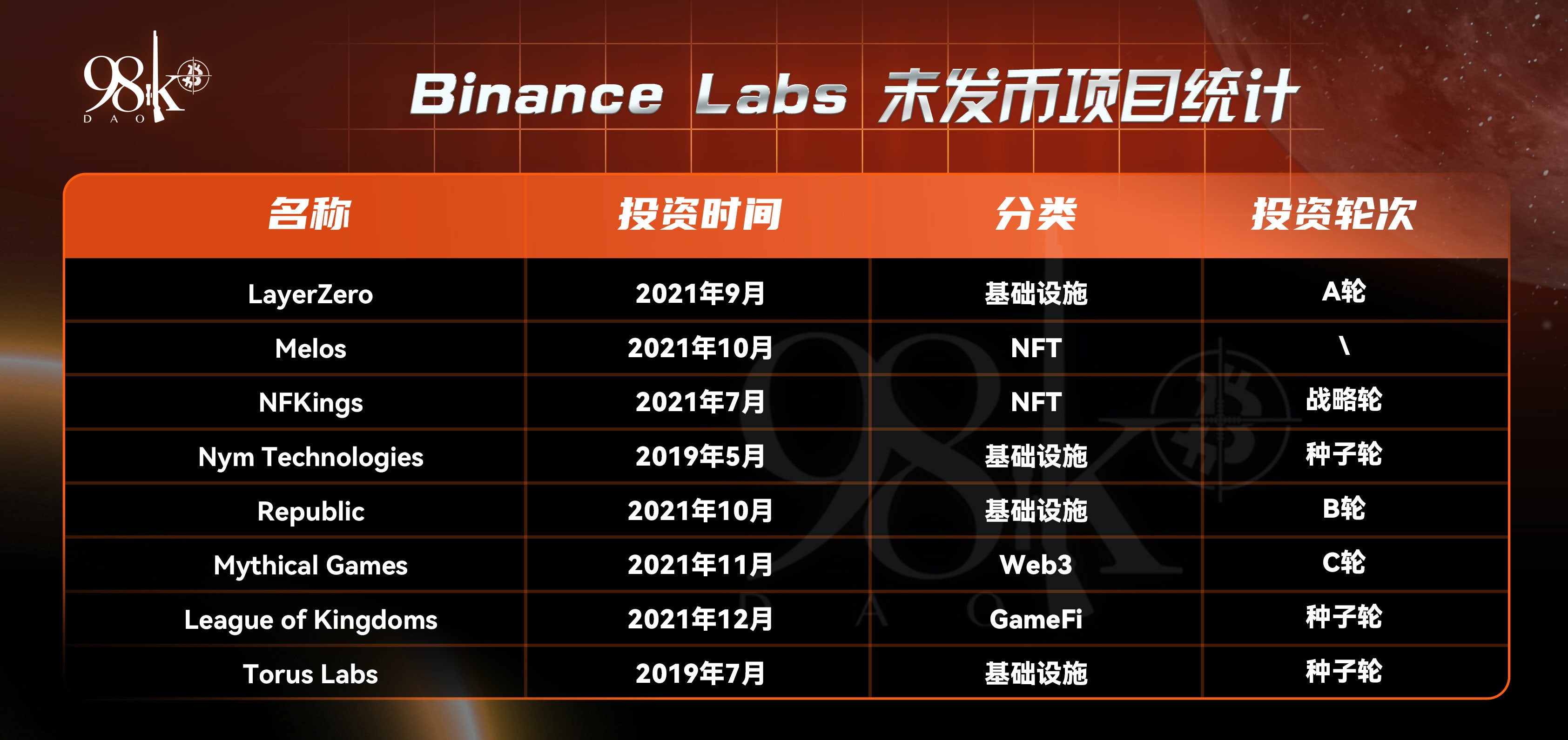

The following statistics refer to projects that Binance Labs has invested in but has not issued tokens:

first level title

comprehensive comparison

Judging from the overall data, all institutional investment portfolios performed well this year.There are three institutions whose investment portfolios have a positive growth rate of 100%, ten institutions with a positive growth rate of more than 70%, and only one with a positive growth rate of less than 50%, and the positive currency ratio is nearly 80%.

We divide by 1 times, 10 times, and 100 times. The increase of less than double accounts for 25%, and the increase of 40% of the total currency is concentrated in the 1-10 times, and the 10-100 times only accounts for 10%, and more than 70% of the institutions have 1-3 100 times coins.

Among the currencies with the largest gainsAXS ranked first with 202 times, and also the project with the largest number of investment institutions, followed by MATIC (164 times) and SOL (129 times). There are 6 100 times coins, namely AXS 202 times, MATIC 164 times, SOL 129 times, LUNA 124 times, SAND 158 times, ALICE 123 times,a16z hit 3 hundred times coins,The biggest amount.

DeFi trackDeFi track, followed by the public chain and Web3. The institution with the highest proportion of DeFi is Three Arrows Capital, accounting for 83%. On the GameFi track, the most bet is Animoca Brands, which is far ahead of other institutions with 71%, and #HASHED, which ranks second, only accounts for 22%.

What I have to say is that in 2021, GameFi and Metaverse are on fire, and investment institutions have also invested in many GameFi projects. However, due to the long development cycle of game projects, many projects have not yet reached the stage of issuing coins, so the proportion of GameFi is generally small.