A Brief History of the Curve Empire Chronicles: A Leading Player in Improving Capital Efficiency

foreword

Original source: Mirror

foreword

Curve.fi — the king of TVL in the Defi world. Curve.fi is not a complex DeFi product in terms of function, but the ecosystem derived from Curve.fi is intricate and is affecting the entire Defi world with tremendous energy. This article will review some history, explain Curve.fi's economic model and provide some personal anatomy. In the foreseeable future, Curve.fi, like Uniswap, Maker, and AAVE, will become the cornerstone of Defi, and it is a project that every Defi player should understand deeply.

Fundamental value of Curve.fi

white paperwhite paper。

Stablecoin trading is the most suitable scenario for liquidity mining in the AMM field. The biggest problem of the traditional AMM mechanism for liquidity providers is the impermanent loss. Simply put, the prices of the two currencies in AMM are relatively stable, and there is a large-scale transaction volume, which is the most suitable situation for AMM liquidity mining.

A truly decentralized central bank that issues a payable stablecoin with sufficient consensus strength has always been the LAUGH TALE of decentralized idealistic Crypto heroes. Here I do not intend to expand on the progress related to calculation stability, but the conclusion is that Curve.fi provides an incubator for the development of stablecoins. In the long transitional stage, various innovative stablecoins can use Curve to anchor their initial value. Buy time for the scene development of the project. As a bridge between these stablecoins, Curve will become a long-term DeFi infrastructure. The transaction volume of these stablecoins is the value foundation of Curve.fi.

The merits and demerits of veCRV mechanism

Introduction to veCRV Mechanism

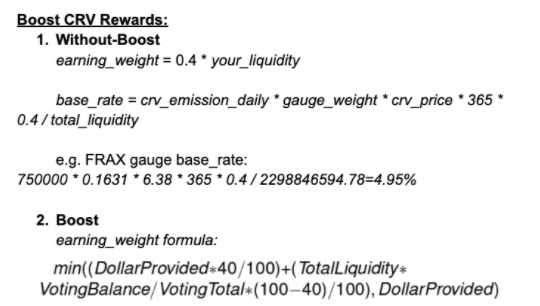

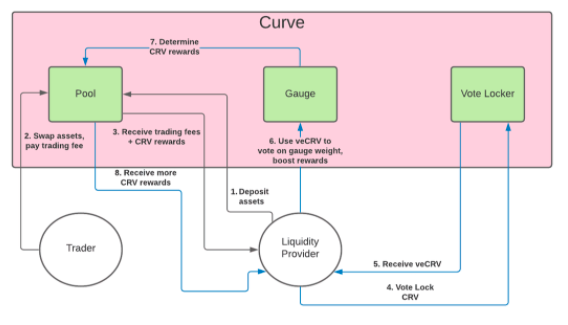

50% of the transaction fee of the Curve protocol is charged, and the proportion of the fee charged is divided equally according to the proportion of veCRV.

Vote Power. The voting rights mechanism of veCRV is very simple. The voting rights are proportional to the lock-up time. veCRV will decay with time, so in order to maintain enough voting rights, it means that the lock-up time must be refreshed all the time.

image description

image description

Curve Basic Mechanism

Why veCRV changed everything

Time -> Consensus -> Value

The veCRV mechanism was finally discovered after the tempering of time. All consensus needs the accumulation of time, how to accumulate value through time, and Curve.fi’s simplest method: lock the position, and quantify the value of the locked position—voting power. In fact, locking positions to increase voting rights is nothing new, but why did veCRV succeed? Mainly because of the cooperation with the boost mechanism, users have a very direct reason to compete for CRV: more votes represent more revenue, which is the game basis of veCRV. This function allows the project party to lock a part of CRV almost forever to maintain its own power on Curve. At the same time, this veCRV also resisted the situation of directly buying in large quantities for the purpose of voting, and then selling in large quantities after the voting ended, maintaining the stability of the currency price.

Defects of veCRV

The voting mechanism + Boost mechanism is the basis of the game, but veCRV itself cannot be transferred, which means that the voting right only belongs to the address itself that has pledged CRV, and the boost mechanism only exists in this address. An address provides liquidity while also providing liquidity. It is necessary to have a sufficient level of CRV corresponding to the liquidity in order to maximize the profit. So far, this mechanism is not a big problem. Curve hopes that all liquidity providers are also competitors of the CRV token, so that the lp provider understands the basis of the game After that, they competed with each other to buy CRV locks and exercise their voting rights to their own pools.

However, there are still problems in reality. Due to the project pre-excavation and the inflation in the early stage are too fast, if users think of the maximum boost in the later period, the number of CRV is too large. A large number of whales with CRV and liquidity provider retail investors will eventually fork into two. The intersection collective, the veCRV mechanism officially became a defect, which also led to the beginning of the war on the optimization platform introduced next.

Multidimensional War in the Curve Universe

The war around Curve has never stopped since its inception. With the increase of participants, the war is expected to be magnificent and begin to extend to every corner of Defi. Next, we will introduce wars in several latitudes.

The War of Curve.fi Earning Platforms

As discussed above, due to the unreasonable design of the veCRV non-transferable system and the operational problems in the early stage, the stratification of CRV holders and liquidity providers has led to the identification of opportunities.StakeDAO, the competition officially started, and then through the vote of Curve DAO, StakeDAO became the second company after Yearn to obtain the Curve governance whitelist (SmartWalletWhitelist) of the CRV Depository Agreement.

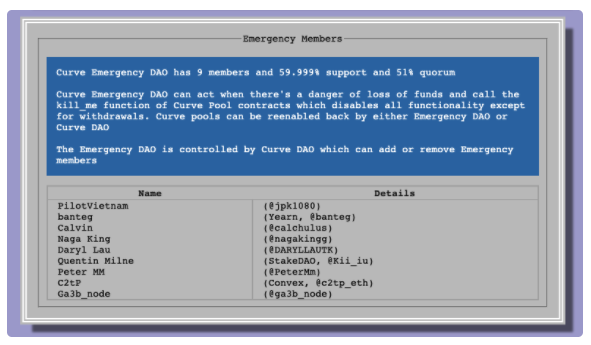

Here is an extension to mention Curve'sSmartWalletWhitelistimage description

The Elders in the Curve Empire, the 9 most powerful

Then came the current king:Convex, the mechanism of Convex is the focus of our attention. Convex uses the cvxCRV solution to tokenize and bond the voting rights of non-transferable veCRV. By permanently converting crv into cvxCRV and permanently locking it on the convex platform, the newly issued CVX token is used to exercise these crv Voting rights, and the establishment of cvxCRV to CRV close to 1:1 liquidity pool, which gives a certain exit path, which makes CRV holders have a great motivation to put CRV into Convex.

StakeDAO finally chose to support Convex in this war, and transferred its CRV to Convex to help Convex complete its original accumulation. At the same time, Convex finally attracted the vast majority of CRV users to settle in, and won the final battle of the optimization platform by occupying more than 50% of vecrv.

The mechanics of Convex complete the fix for the Curve.fi economic model. Although it is not perfect from the author's point of view, it is already a very good solution. The author believes that CRV and CVX should have a better integrated solution in essence, but this point of view can only be proved by history. In the following liquidity war chapters, the far-reaching impact of Convex will be described

Curve.fi vs Uniswap’s Stablecoin Volume Battle

Uniswap V3 has also recently launched a 0.01% handling fee plan. The purpose is very obvious. It refers to Curve.fi’s stablecoin foundation and large-scale stablecoin exchange. However, due to the relatively low income from handling fees, although the overall tvl is still not as good as 3CRV pool , but the transaction volume below one million dollars has already played a big threat.

The essence of the battle for DEX supremacy is still the transaction share of super-large currencies: BTC, ETH, and the direct transaction volume of the three major stablecoins in 3CRV. In the reality of fighting against uniswap, we chose the most reasonable strategy: mainstream currency low-slippage AMM solution, and launched the Tricrypto Pool of ETH/BTC/USDT with its own algorithm. Is Tricrypto Pool a better AMM solution? It is still unknown, but as a defensive strategy, the current TVL and daily transaction volume of Tricrypto V2 can be said to exceed expectations, and it is expected that Tricrypto will perform better.

Liquidity leasing war among the stable

After discussing the battle of optimized platforms and the battle of stablecoin transaction volume, we have come to a more magnificent battlefield, the liquidity leasing war of stablecoin projects. The previous two wars were like a battle for the right to build the Colosseum, but now it is a war between fighters

During the Defi frenzy period in 2020, various projects completed the deployment of liquidity in the form of the second pool, and the second pool model became a deadlock in the late Defi summer. In order to compete for liquidity, projects had to increase the rate of return to staggering This makes it difficult to control the inflation rate of Token, and it collapses rapidly under the mining and selling of giant whales, which leads to a key problem: the project party does not have enough time to build a real value consensus of the project Token, and cannot distribute Token in a balanced manner.

After the basic value of CRV's transaction fee has reached a consensus, the Suan project has discovered that veCRV itself can share the entire platform's handling fee, and at the same time, enough voting rights can give the project itself more valuable liquidity lock-in encouragement ; At the same time, the characteristics of lock-up time + voting rights decay over time further guarantee the rise of currency prices. These characteristics are the basis for competing for value among projects.

Convex, the real promoter of the Curve liquidity war, has completely heated up the Curve war, so we will make some inventory of Convex's product mechanism:

Convex separates the voting rights and income rights of veCRV by permanently converting CRV into cvxCRV. The crv becomes a transferable perpetual bond through cvxCRV. Compared with before, you can earn most of the original veCRV income (Convex deducts 10% of the CRV income) without locking up the position, and also earn CVX; and the voting rights of veCRV are transferred to vlCVX — locked CVX .

CVX voting rights proxy, CVX long-term position users can vote through locked CVX for 16 weeks, and can also transfer voting rights to specific addresses, making the bribery vote mechanism easier to implement.

image description

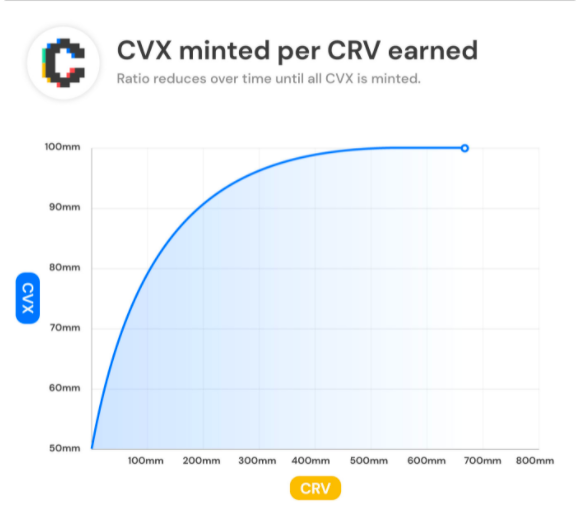

CVX mint algorithm

Many people describe Convex as a kind of nesting doll for Curve, but the author prefers a kind of repair and improvement. Although the existence of Convex absorbs a large part of Curve's market value, it greatly liberates Curve's energy and completes the construction of the Colosseum . Especially after cvxCRV and CVX separate Crv's income rights, warlord projects can focus on the competition for ticket rights on Convex and strive for greater benefits for their users, while ordinary users who only care about income only need to choose to provide liquidity, or You will buy CRV and convert it into cvxCRV bonds with higher yields and sell your voting rights at the same time.

Calculate how the warlords won the war

Vote, vote, vote! !

From veCRV at the beginning, to CVX later, to bribery votes later. In fact, warlords have more and more means of fighting for voting rights. At present, the main means are as follows:

Purchase CRV and obtain ticket rights through unlimited lock-up

Buy CVX and obtain ticket rights through unlimited lock-up

Bribe votes, buy retail votes through their own tokens

In the end, the cost of ticket rights is what these warlords are most concerned about. In the above methods, the value of each veCRV can actually be calculated, and holding CVX can pass the total of Crv held by vlCVX and Convex. The ratio of the amount can be used to get how many veCRV votes are currently supported by one CVX. Therefore, the project can use the cost of means to capture votes. In the long run, as long as competition exists, the prices of CRV and CVX will continue to be raised to a balanced state.

as well asbribe.crv.financeas well asVotium**. The former is for veCRV holders and the latter for CVX holders. Their existence is very simple, becoming a separate voting agent, collecting users' idle voting rights, and centrally issuing bribe tokens for the project party.

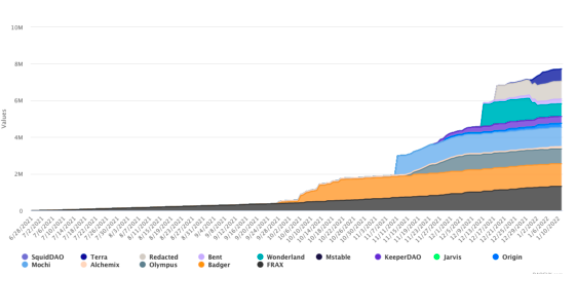

Who is vying for governance control of Curve?

image descriptionCVX。

Data from https://daocvx.com/

Frax/Fxs

As an old Defi project, Frax has finally blossomed after years of deep cultivation, and it is also the first batch of stable projects that hold continuous CVX. Frax can be said to be the most influential representative in the stable echelon at present. They are very close to Convex, and Convex has specially opened up a Frax zone. At the same time, FXS has also launched its own veFXS mode. FXS has shown a very strong style no matter in the stable field or in the role of the Curve participant.

Spell/Mim

Abracadabra,An interest-bearing asset stablecoin project that threatens to completely defeat Maker. Its stablecoin is MIM. Under the strong attack of his Frog Nation led by the leader Daniele, and taking advantage of the extremely high APY income of Convex, the largest liquidity pool since the establishment of Convex - MIM/3CRV pool has been created. It can almost be said that MIM is a typical representative of the successful use of Curve in this war.

UST

Terra, as a dazzling supernova in the Cosmos system, brings its unique stable Native Token — UST to try to conquer the world. UST is relatively unique. It can be seen that Do Kwon has huge ambitions, and he and Daniele hit it off to bind two non-traditional collateralized stablecoins together. With Terra's ecological prosperity and rising rankings, it has given UST great financial strength to compete for the throne of stablecoins. According to recent data, they have begun to accelerate the deployment of Convex, and they have purchased more than 60w CVX at the beginning of 2022.

Ohm/Redacted

As a non-traditional algorithmic stablecoin, Ohm cannot provide liquidity by establishing a pegged pool on Curve for the time being, but the close relationship between Ohm and Frax is well known. The Ohm community has long realized the role of Curve and Convex, inOIP-43China has already proposed to increase the creditor's rights of CVX and put the increased holdings of CVX into the treasury to prepare for future competition.

The Redacted (BTRFLY) protocol with Ohm blessing has entered the war as an optimization strategy on top of Convex. Using the Ohm mechanism to issue bonds has attracted a large number of CRV and CVX, helping users to better utilize their CRV and CVX benefits . Their Curve is called L1, Convex is called L2, and they call themselves L3. They have successfully attracted a large number of CRV and CVX, which is equivalent to occupying a place in the voting competition. It is still unknown how many surprises BTRFLY will bring after that.

The participants in the war include **Tokemak, Fei/Tribe, Originprotocol, Dopex, ** and many other key players. Due to the limited space, the participants in the liquidity war will not be described too much in this article. There will be opportunities to participate in the war Fang carried out a detailed explanation of the forces one by one.

Where will this war lead Defi to in the future?

Various wars around Curve have gone through several rounds of battles, and the war has just finished warming up. Next, share the possible development directions:

1. The territory of the Curve empire will continue to expand, and the war will become more intense.

Curve V2, It is very likely that this war will be the key to the entire Defi world. Curve v2 is an AMM trading solution for non-stable coins. Once the permission to freely establish a Factory Pool is opened, it is likely to become a major event that changes the history of DeFi. Because it is not just algorithmic stablecoin projects that will participate in the CRV war, all large Crypto projects will eventually be involved in the competition. From the point of view of the game, if the project party does not enter the battle ahead of the competitors and have enough voting rights, it is possible that the competitors will use Curve to obtain more liquidity and win the war, so the foreseeable battle will be It will be completely white-hot.

And will Uniswap V3 give its own liquidity mining plan in the future? Will it become a situation where Curve is attacking and Uniswap is defending? At present, the liquidity mining proposal of Uniswap V3 is also under construction. When this happens, what new impact will it have on the Defi world? We will wait and see.

2. The vigorous development of the ve model

The ve model is profoundly affecting the entire Defi governance form. Compared with the weak governance form of other projects, veCRV manages the most critical affairs of the Defii project-financial allocation in a relatively reasonable way. Many related projects and new projects are trying to ve the governance authority, including FXS. The veFXS they launched has also begun to promote the integration of Frax and other Defi projects. At the same time, ve(3,3) recently proposed by AC is also an attempt to make more attempts and innovations on ve. In the dark forest of the blockchain, the power struggle is always evolutionary and cruel. The whales at the top of the Crypto world will definitely have new struggles at the level of governance rules. The evolution of ve mode is worth looking forward to.

3. Scenario Wars for Stablecoins

Stablecoins are ultimately created to become anchors for other transaction scenarios. The liquidity war is just to gain time for scenario expansion. Frax, represented by Frax, aggressively expands its trading pairs in various fields, including cross-chain and various new Into the union of popular projects, TempleDAO, Ohm. Moreover, there is also a phenomenon of reporting to the group between the calculations. In the end, whoever wins the scene battle can fundamentally challenge the current stablecoin giants.

4. A new battlefield for derivatives?

epilogue

epilogue

The eternal theme in DeFi is the evolution of capital efficiency. The members of the Curve ecosystem, including itself, are all leading players in the field of improving capital efficiency. It is destined that no matter how important this ecology is, it cannot be overemphasized. I hope this article can maximize the help of Defi players to understand the shape of Curverse more deeply. If you want to discuss the possibility of Curve more, you can private message the author via TwitterFlynnGaohave a discussion.