Messari: A brief analysis of the market status and major players of DeFi structured options

Original title: "Overview of Options Vaults"

Compilation of the original text: Gu Yu, Chain Catcher

Compilation of the original text: Gu Yu, Chain Catcher

2022 is off to a hot start. In the first week of the year, the entire cryptocurrency market cap fell by -11%. DeFi’s top 100 tokens saw an even steeper drop of -12%. However, there is one sub-sector in DeFi that will do exceptionally well in 2022 — options. Instead of falling, the option agreement has outperformed the market by a large margin. At the beginning of this year, the market value rose by 66%.

What a way to ring in the new year.

Part of the reason options protocols have been able to significantly outperform the crypto market so far this year has to do with starting points. Compared with other DeFi agreements, the price of options agreement is relatively low. For example, Ribbon Finance ended the quarter with a float market cap of less than $100 million and a price-to-sales ratio of 2x. Uniswap, Yearn, and others have ~4x float-to-sales ratios. Much of the price difference has to do with the relatively slow adoption of on-chain options compared to the rest of the DeFi industry.

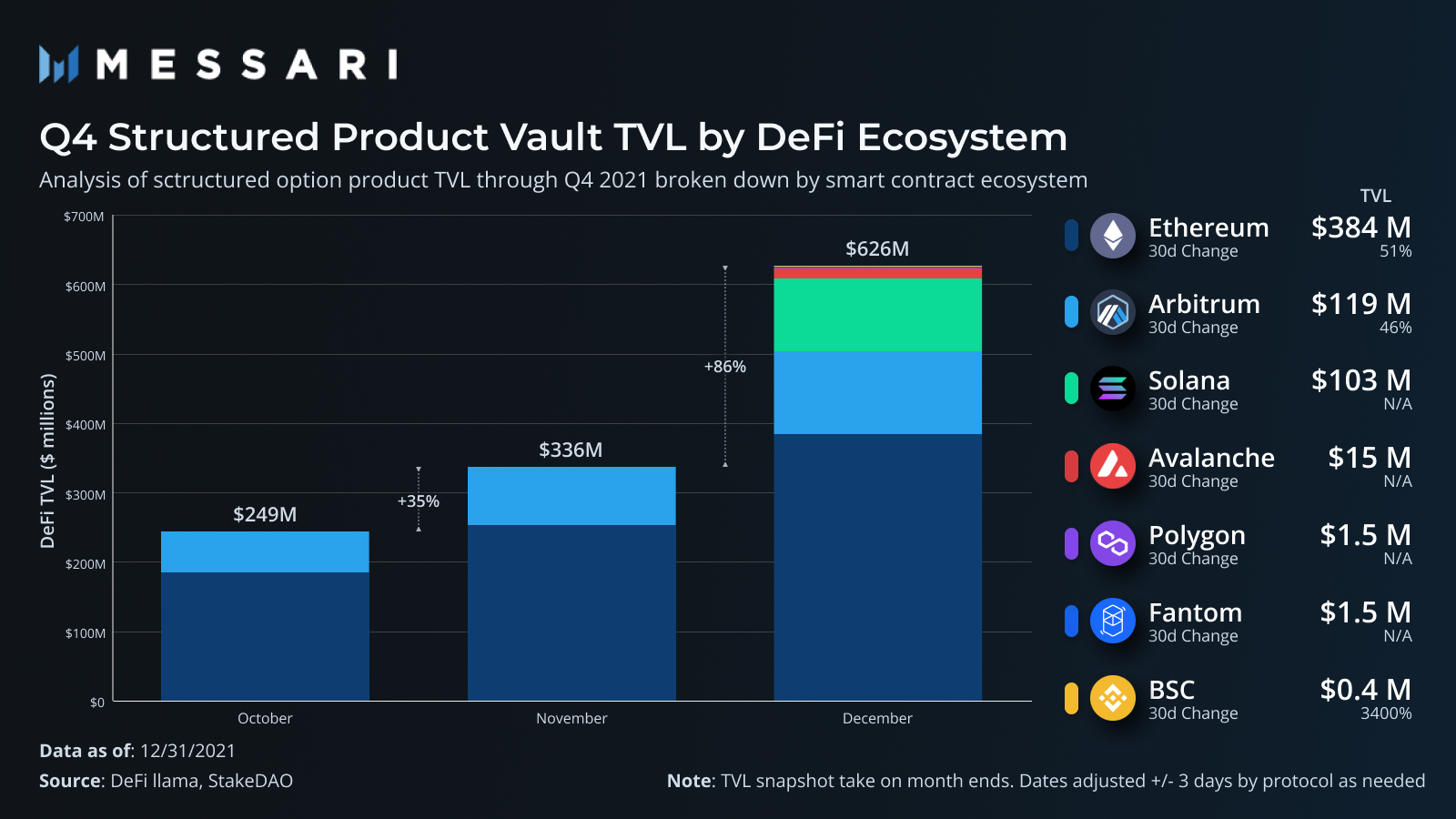

However, initial slow adoption has given way to strong growth. By Q4, the TVL growth rate of options protocols significantly outpaced that of DeFi more broadly.

In December, the TVL of options agreements increased by 86%, while the overall DeFi TVL actually contracted by -1.5%. Over the course of the quarter, options protocols expanded TVL by 412%, while DeFi TVL increased by 278%.

Relatively strong growth in options protocols, but still far from adoption levels compared to traditional finance. To say options are a huge market in traditional finance is an understatement. Options play an important role in modern finance and are used by market makers, hedge funds all the way to retail traders. Zooming out on the retail options trading market, Robinhood generated 45% of its revenue in the third quarter from options trading on its platform.

Options have proven popular and lucrative for Robinhood, whose user base most resembles the average crypto user. Robinhood's roughly 19 million monthly active users generate $656 million in annual revenue for the platform.

With such huge profit potential and product alignment with retail traders, which protocols and ecosystems are leading the way in capturing this market?

Let's first break down the different types of agreements in the options world.

Options Ecosystem Overview

On-chain options agreements are mainly composed of two types of agreements. Options markets and structured products. Marketplaces are protocols that create actual options contracts and facilitate the buying and selling of options. Liquidity for underwriting each option can traditionally come from individual users writing options with deposited funds or from passive liquidity pools. Protocols like Opyn, PsyOptions, and Zeta Markets all operate under a traditional order book style, while most other options market protocols like Dopex, Lyra, Premia, and Hegic use a liquidity pool approach.

The structured product agreement sits on top of the options market and provides users with a vault to deposit their funds. Each vault executes a defined option-based yield strategy, abstracting complex pricing and risk management out of the user's hands. Similar to how Yearn executes yield farming strategies for money markets and exchanges under its coffers.

Selling covered calls or cash-margined puts is the industry's most prominent library of structured products. Covered calls generate income for tokens by selling call options with strike prices above the current token price (out-of-the-money calls). Option buyers pay a premium for the options contract, which is channeled back into the vaults, increasing yields for savers. Cash margin puts are similar, but in the opposite direction. Stablecoins are deposited into the vault and are used to underwrite put options on tokens with strike prices below their current value.

Structured product vaults have driven the majority of on-chain options adoption so far. Raw buy and sell options at various strike prices have not attracted crypto users. Structured products remove all the complexities of underwriting options, pricing options, strike prices and replace them with simple deposit and earn vaults.

It's not just retail users who use these structured options libraries. Many protocols are working with structured options protocols to manage funds and create vaults for their token holders. Utilizing an option vault instead of a typical collateral vault to earn yields eliminates the need for token releases, effectively reducing overall inflation and selling pressure on protocol tokens.

Since structured product vaults drive much of the adoption of on-chain options, let’s zoom in on these protocols to understand which smart contract ecosystems are used by users and which specific protocols are attracting the most usage.

Ecosystem TVL

Of course, Ethereum has the largest TVL among structured products. It is home to Ribbon Finance, the first widely used structured product protocol. Ribbon popularized structured products in the crypto space and then dominated the space until other protocols started rolling out in the fourth quarter.

Arbitrum is the second largest ecosystem of structured products, led by the fast-rising Dopex. Arbitrum's overall TVL ($1.7 billion) is significantly lower compared to L1 ($5-143 billion), so having the second-highest TVL option indicates the protocol has strong relative user alignment in the ecosystem. Dopex is by far the largest options protocol on the platform and is responsible for most of the growth. Rising prices for its tokens have also fueled the options industry's stellar performance this year (market cap up 85% from Jan. 1 to Jan. 9).

Solana launched two new protocols in December, both attracting significant funding within weeks of their launch. Friktion and Katana offer similarly structured product libraries with extensive supporting assets. Both protocols offer 14 different vaults, compared to the 7 offered by Ribbon, 4 offered by Dopex, and 3 offered by StakeDAO.

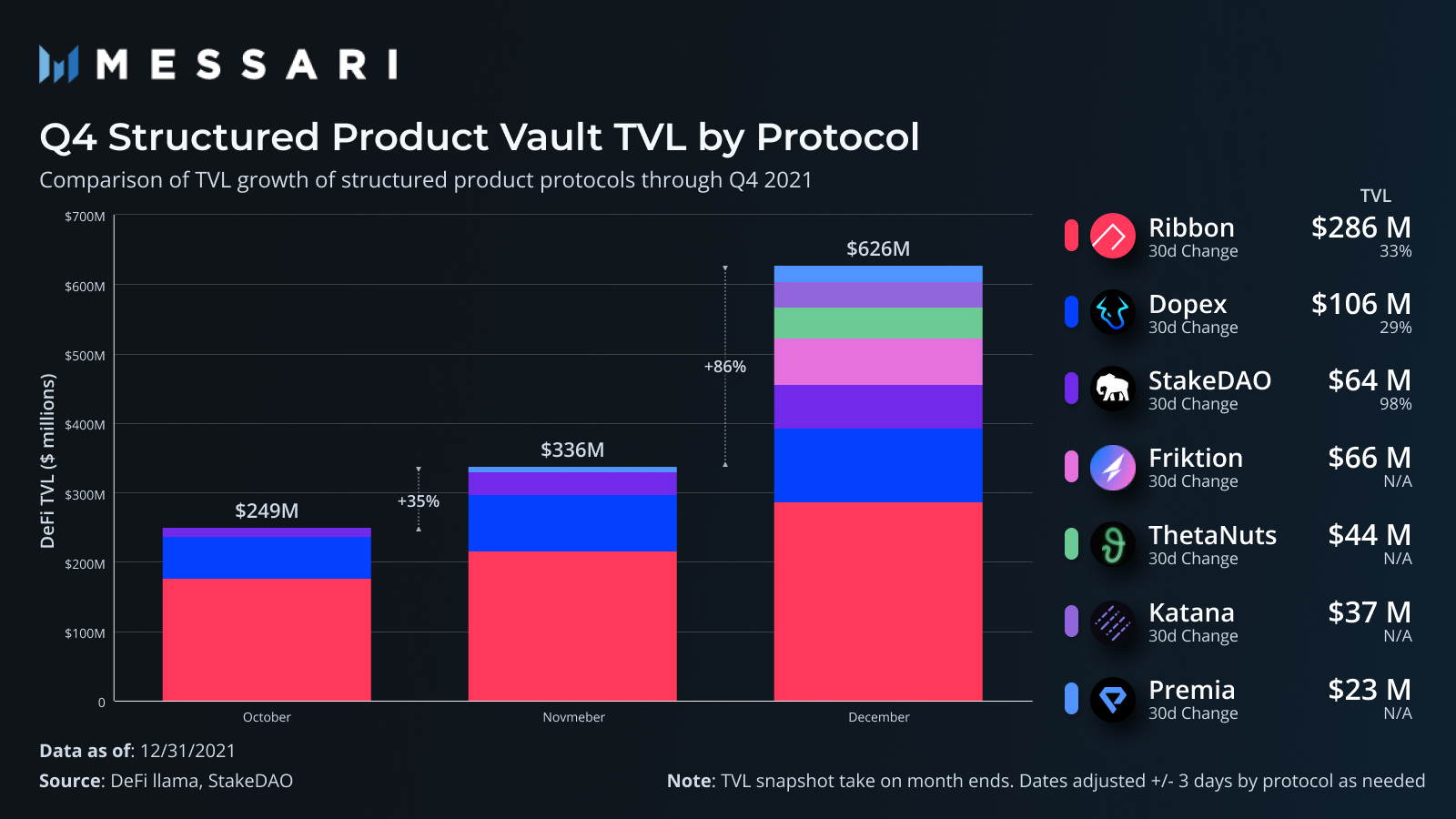

Ribbon continues to dominate structured options with more than half the TVL. After starting the quarter with almost all the TVL in the industry, its market dominance is declining. This isn’t an impact on Ribbon’s growth profile, which is impressive in itself, but more to highlight the meteoric rise of other protocols in the industry during the quarter. Let's dig into each and compare the nuances of each.

Ribbon

Ribbon Finance is a traditional structured product protocol that runs on top of Opyn's marketplace. Each week, each of Ribbon's 7 vaults uses deposited funds to underwrite options on Opyn, which are then sold or auctioned off, with the premium collected returned to the vault as proceeds. During the fourth quarter, Ribbon generated more than $11 million in underwriting fees for its coffers.

In September, the protocol released V2 of its treasury and recently fully migrated all funds to V2. Like V1, the V2 vault executes the option sales strategy on a weekly basis. Changes in V2 are vesting options for decentralized vaults, changing the fee structure, and enabling meta-vaults (fee-sharing for protocols that build strategies on top of Ribbon vaults). Changing the fee structure from a withdrawal fee to a model of management and performance fees (2% and 20%) more closely aligns the goals of the protocol with users and enables more composable strategies on top of Ribbon.

Ribbon has been an innovative team in the space and was the first to launch a yield product in combination with Yearn's yvUSDC. Instead of selling put options against ordinary USDC, the user's USDC collateral is converted into profitable yvUSDC, which improves the excess return status of the treasury by obtaining income from the borrowing demand in the ecosystem and option premium income. In addition to innovating on the types of products offered, Ribbon is pushing an expansion strategy to other public chains that launched in Avalanche in December, and has laid out plans to implement Solana.

Dopex

Dopex may have the most ambitious and innovative roadmap of all the projects here, and while not currently the most used, its valuation has skyrocketed to the highest floated market capitalization of any options protocol. The way the protocol works is also rather unique. Instead of using deposits to underwrite options on another protocol, Dopex sources liquidity and underwrites all options on the same protocol.

Its main product is SSOV (Single Staking Options Vaults), which is a structured option. Each month, users can deposit funds into the vault and choose the strike price at which they want to provide liquidity. After the deposit period ends, the funds are used to underwrite options at various strike prices, which can be purchased by other users during that period. This is a more granular approach to overlaying calls, giving users more control (at the cost of complexity) than the "set and forget" vaults used by Ribbon. Currently, only calls to four assets are supported: DPX, rDPX, ETH, and gOHM.

Dopex fees are not charged to vault depositors, but to option buyers, marking a stark difference from other protocols. 20 basis points are charged when options are purchased, and an additional 10 basis points will be charged for exercising in-the-money options at the end of the epoch.

The creativity of Dopex has to do with its dual token model (DPX and rDPX) and how it utilizes its reward emissions. SSOV vaults receive DPX rewards as well as a premium, effectively combining a typical second-pool mortgage vault and option vault. On the roadmap, Dopex plans to implement the popular veDPX model, directing rewards to vaults based on the voting weight of locked DPX tokens. This model will become increasingly important as Protocol continues to partner with Dopex to create SSOV vaults (OHM being the first), and as Protocol acquires DPX to incentivize liquidity in its pool. In theory, option vaults for rewards could become more popular as protocols look to move away from the yields created by token reward releases (which would lead to dilution and selling pressure) towards a more evergreen model of selling options on assets .

rDPX is the Dopex discount token issued as compensation to option underwriters who lost capital at a rate of 30% of losses during the period, offsetting the risk of providing capital. However, the planned utility of rDPX is much greater than that of a pure rebate token. Dopex plans to add synthetic assets to the platform and utilize rDPX as backing collateral to mint the stablecoin dpxUSD to be used throughout the protocol. rDPX is undergoing an official re-architecture and details of the token design will be released later this month.

Outside of protocol design, Dopex has some interesting ideas on its roadmap on how to leverage options in DeFi. One point to note in particular is the application of options to curve gauge emissions. Instead of using options to speculate on token prices at expiration, options are used to see changes in the Curve metering weights of CRV reward emissions. The so-called Curve wars all revolve around the idea of controlling significant CRV to award rewards directly to voter-chosen AMM pools (which incentivizes liquidity in those pools). By offering CRV reward rate options per pool, users or protocols can indirectly earn from CRV emissions rather than competing for veCRV votes.

StakeDAO

StakedDAO started out as a Yearn-like yield aggregator, but recently added a structured product library to its product set. While traditional yield aggregation vaults continue to account for a significant portion of the protocol's TVL, its structured options vault's strong growth in Q4 made it one of the largest in the industry.

StakeDAO currently offers three vaults, all of which are similar in nature to Ribbon vaults. Under both agreements, Opyn is used as an options market to secure its options. StakeDAO differs mainly by combining the returns from its Yield Aggregator Vault and Option Vault. Assets deposited in the StakeDAO option vault are then automatically deposited into the corresponding passive income vault on the platform to generate additional income.

StakeDAO is also unique in that it leverages Frax as a stablecoin to underwrite its short-sale vaults. In addition to option premiums and yields generated by StakeDAO’s passive Frax vault, users can also stake their LP tokens on Frax for additional yield.

StakeDAO's fee model is also different from Ribbon. Ribbon moved to a management and performance fee model, and StakeDAO currently charges no platform fees on assets or profits, but instead charges vaults a 50 bps withdrawal fee.

Friktion

Launched in mid-December, Friktion is Solana's largest structured product agreement with over $90 million in TVL. TVL started the year up nearly 50%, up from $66 million at the end of the year. This is roughly a growth profile of $30 million in new TVL every 15 days. It runs a traditional structured product architecture similar to Ribbon. Options are underwritten on various platforms and sold on a weekly or fortnightly basis.

Driving its growth rate is its impressive ability to add new markets. Friktion has 14 real-time options vaults and supports a wider variety of assets than EVM-based protocols that typically focus on ETH and BTC products. Friktion has vaults of assets such as Luna, FTT, SOL derivatives, and various Solana DeFi ecosystem tokens. Its ability to expand available options is driven by its ability to sell options to off-chain market makers via channel RFQ (it is not limited to the collateral types of supported on-chain options markets like psyOptions).

ThetaNuts

ThetaNuts may be the most aggressive cross-chain strategy of all structured options protocols. ThetaNuts has been deployed on Ethereum, BSC, Avalanche, Polygon, Fantom, Boba, Aurora, etc. While it does not have a dominant position in any market, it has the benefit of launching first to chains that no other options protocol is currently launching on. Its cross-chain strategy has helped it achieve a year-end TVL of over $44 million, most of it from its Ethereum deployment.

ThetaNuts also currently does not charge fees for its vaults. It appears to employ a similar off-chain options auction, enabling it to offer its options assets as it is not limited to on-chain backing collateral in options market protocols.

Katana

After winning the Solana Ignition Hackathon earlier in 2021, Katana launched in mid-December and has grown to become the second largest structured options protocol on Solana with year-end TVL of over $37 million. It offers a set of products very similar to Friktion, all supporting a total of 14 different vault strategies for similar assets such as Luna, FTT, Solana derivatives, and Solana DeFi tokens.

Katana is also actively pursuing treasury management partnerships with various DAOs. Injective and Katana recently announced a fund management partnership whereby Katana will provide INJ with an option vault and back funds through option premiums to generate income. In addition to Injective, Katana has announced various other partnerships with Solana-based protocols to improve its ability to deploy capital.

Premia

Premia is fairly small in terms of TVL, but has implemented an interesting approach to DeFi-native options. Similar to Dopex, liquidity underwriting options come from liquidity pools on the protocol. Users can deposit funds into liquidity pools and earn yield as the funds are purchased against. Therefore, the premium does not rely on the on-chain options market, nor on off-chain buyers, but on the options demand on its protocol.

Summarize

Summarize

As DeFi matures and the high yields generated by leveraged lending demand decline, options protocols have good reason to step up to offer outsized premiums with minimal risk.Especially when the protocol starts to find revenue streams for token holders outside of token offerings, this can dilute and drive continued sell pressure on project tokens.

Options protocols have fairly modest valuations compared to DeFi more broadly, with many of the top options protocols under $100 million in market cap. Adoption of options-based protocols is starting to shift rapidly as options protocols attract higher TVL growth rates in Q4 compared to the broader DeFi ecosystem.

What needs to be watched closely is the level of on-chain options buying. Robinhood’s success with stock options has been driven by retail traders buying and selling options on its platform, while much of DeFi’s adoption has been simply depositing into option strategy pools. This means that DeFi protocols are forced to find buyers (usually market makers) off-chain to obtain premium returns. Protocols like Dopex, Lyra, Premia, etc. are all built on users buying and selling options directly on the protocol, so a shift in user behavior is critical if these platforms are to scale to significant valuations.