Europe's Third Way in Web3: Why the EU Should Embrace the Crypto World

Author: Patrick Hansen

In this article, guest author Patrick Hansen from Unstoppable Finance discusses the EU's struggles in the cyber age.

Between what Harvard professor Shoshana Zuboff calls a model of surveillance capitalism, in which private tech giants accumulate and use personal data for profit, the European Union (EU) has struggled for years with an "Article 3" approach to technology and economic policy. road (third way)". Despite the many policy proposals and political speeches, the quest for greater digital sovereignty remains somewhat ambiguous. Also, judging by the results of recent policies (such as GDPR) and the current state of European tech companies, it can be argued that whatever the current “third way” model is, this strategy is a failure. Instead of catching up economically, Europe has fallen further behind.

In this post, I want to outline why cryptocurrencies and Web3 provide the "third way" that the EU has been looking for for a long time. Not only are the values of Web3 fully aligned with the sought-after concept of digital sovereignty, cryptocurrencies will make the EU more fiscally independent of the US and provide a unique economic opportunity to recover from its Web2-era economic woes. Also, I think for several geopolitical reasons, Europe actually has the greatest potential upside from mass adoption and support for Web3 compared to the major global superpower, the US.

My main argument is threefold. For those interested in learning about Europe’s upcoming rules for cryptoasset companies (EU Markets in Cryptoassets Regulation – MiCA), please see my article from earlier this year.

Web3 is the EU's most promising route to digital sovereignty

The topic of digital sovereignty underpins every EU digital policy proposal. It is a common theme of the GDPR, the Digital Markets Act, the Digital Services Act, and many more political initiatives. According to Angela Merkel, "digital sovereignty" describes the ability of individuals and societies to shape digital transformation. She emphasized that the commitment to a shared, free, open and secure global Internet is in fact a manifestation of digital sovereignty, and people must participate in and control their data. The core concept of digital sovereignty is self-determined control by individuals, against the concentration of power, whether that power is a government or a corporation.

Web3 is the perfect vehicle to make this happen. In Web3, ownership and control of data can be decentralized. Users and builders (e.g., social networks) can own fragments of Internet services by owning tokens, both non-fungible (NFTs) and fungible. This solves the main problem of centralized networks, which is that value is accumulated by one company, and incentives are not aligned among network participants (such as users, content creators, builders).

While content creators are currently only rewarded with hearts and likes on Twitter and elsewhere, they will be financially rewarded through tokens in Web3. Finally, users and creators will always be able to opt out of centralized services. Unlike Twitter handles and hearts, tokens (such as NFTs) are linked to public blockchain addresses rather than locked to a single platform. This will enable builders and creators of Web3 services to gain more digital sovereignty.

So far, the EU has struggled to achieve the goal of digital sovereignty by exercising its regulatory powers. It has proposed several legislative proposals to force Internet companies to comply with regulatory requirements on data privacy or content management. Regulations like GDPR have had at least some success. Citizens are more aware of their rights, such as rights of access, rectification, erasure or data portability. They feel these rights empower them and are more willing to share data online.

But this strategy has its obvious limitations. While in theory users are now fully exposed to the ubiquitous cookie pop-ups, privacy policy consent, terms and conditions, in practice very few actually read these documents. People spend (on average) less than a minute on any given website, and hardly anyone is prepared to read a popup for it. This is exacerbated by the poor and confusing design of these cookie banners.

As a result of these regulations, the Internet in the EU has become increasingly user-unfriendly. Users who are theoretically authorized are fed up with it, and companies are spending millions of dollars to come up with new workarounds to get user consent.

GDPR and related legislation have undoubtedly had some benefits in terms of digital sovereignty, but the overall results have been rather dismal and limited. Users will continue to use internet services more and more and share their private data - and no cookie pop-ups will stop them from doing so.

Just like copyright infringement and piracy have not been greatly reduced by regulation, but by the emergence of technological alternatives (streaming giants like Netflix or Spotify), I believe that the most effective strategy for achieving digital sovereignty is the active adoption of alternatives. The architecture of the Internet has these values built (by design) into its core.

Cryptocurrencies will make the EU financially independent from the US

The adoption of cryptocurrencies will not only help the EU achieve its digital sovereignty ambitions, but also free it from the dominance of the US dollar and the hegemony of the US over the global financial system.

Let's face it - America is dominating the global financial system. Nearly half of all cross-border activity is denominated in dollars, as are most securities and derivatives settlements and foreign exchange transactions. It has by far the deepest and most liquid capital markets. It is home to the largest global payment giants - Paypal, VISA and Mastercard - in terms of international reach and acceptance, and has a major influence on SWIFT, the global messaging network used for international payments.

This was clear to all when the EU's efforts to bypass former President Trump's Iran sanctions completely failed. Iranian banks and financial institutions have been cut off from the dollar-based payment system, and despite the strong political resolve of Europe's politicians, the EU has no way around U.S. sanctions. Alternative payment instruments like INSTEX have seen little adoption. The risk of being cut off from the dollar and dollar-denominated payment systems is proving too high for European banks and companies.

Cryptocurrencies could reduce U.S. dominance of the global financial system. By definition, it is immune to national interests and political manipulation. It is an open, transparent, decentralized and censorship-free financial infrastructure on which payments, money and capital markets can be built by anyone and used by everyone. The greater the adoption of cryptocurrencies, the more independent global finance will be from political interference.

There is no doubt that the US will be reluctant to give up its leverage over the current financial system. Cryptocurrencies and Web3 represent one of the greatest financial, economic and geopolitical opportunities in Europe to step in and lead the way in building and pioneering the future of global finance on cryptocurrency tracks. A "third way" for Europe would be against the current politicized and dollar-dominated system. Instead, promoting a decentralized, depoliticized, free and open payment system based on cryptocurrencies is not only financially and politically beneficial, but also attracts talent, capital and companies from around the world.

This article focuses on the “why” Europe should embrace cryptocurrencies, not the “how” (this will be discussed in a future article). However, one thing is worth emphasizing here: stablecoins will play an important role in the future of payments. The current proposed EU regulations on cryptocurrencies (MiCA) will effectively suppress euro-denominated stablecoins even before this market emerges.

Killing a euro-backed stablecoin would simply be counterproductive if the EU wants the euro to play an important role in future global payments. The current stablecoin market has been heavily dominated by USD stablecoins (over 99%). Not only does this create foreign exchange risk for European consumers (e.g. using DeFi), but more importantly, it again leads to significant political influence from the US government, and an equally large amount of economic value creation is denominated in USD.

If cryptocurrencies "eat the world," the power of governments and central banks (e.g., the effectiveness of their monetary policies) will depend largely on the relative importance and adoption of stablecoins denominated in their currencies. For example, if in a future European crypto-economy all activity (financial and economic) is denominated in USD stablecoins (meaning that people and businesses borrow and pay in USD stablecoins), the effectiveness of ECB monetary policy - Such as raising the euro interest rate - it will be close to zero.

Given this, perhaps the EU, and especially the ECB, should aim to support euro-based stablecoins rather than hinder them.

Web3 is Europe's biggest chance for economic and technological recovery

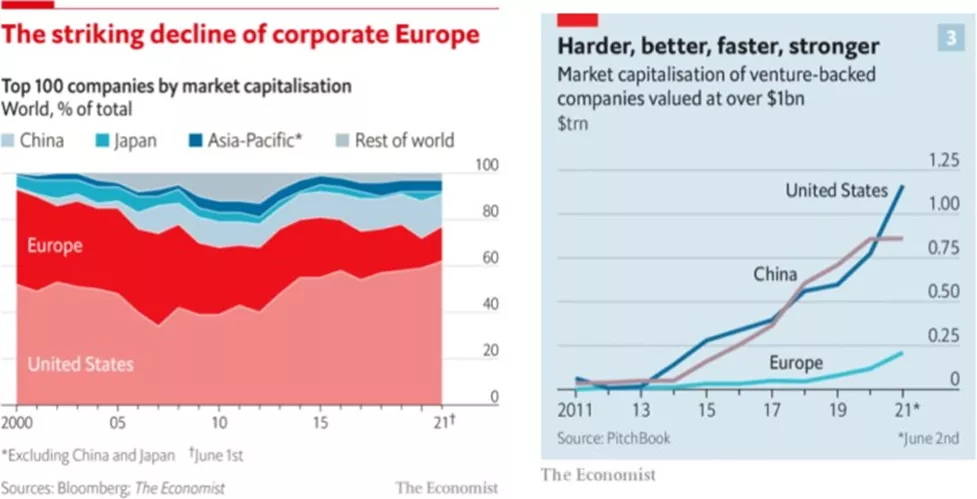

image description

Figure 1 Europe lags behind in international comparisons

Clearly, Europe has fallen behind economically in the Web2 era. The reasons (such as the size of the domestic market, capital market, universities, research and development, mentality, language) are multifaceted and not the center of this article. Suffice it to say that the associated value creation and brain drain (brain drain) is very painful for the European economy. There are two ways to deal with the current state of European tech.

The first seems to be favored by government officials and business leaders at the moment. It includes regulatory action (such as the Digital Market Act), protectionist measures (such as the Chip Law) or large-scale tech projects initiated by governments (such as GAIA-X) aimed at strengthening the competitiveness of established European players.

The second way requires large-scale investment and the promotion of new technologies and start-ups that have the potential to upend the current landscape and become major economic forces.

Likely, the latter model has a higher chance of success. Also, I think Europe may have some competitive advantage in cryptocurrencies and should put Web3 at the center of its economic comeback strategy. Why?

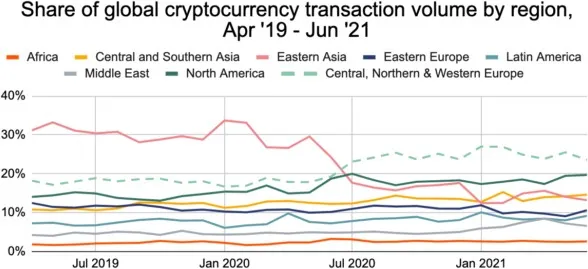

Europe is now the largest cryptocurrency economy with more than $100 million in trading volume

image description

Figure 2 Share of global cryptocurrency trading volume by region

It is undeniable that there is still a long way to go, and most of the innovations in cryptocurrency and Web3 are currently created by US companies. Nonetheless, having the most cryptocurrency-aware population is a good prerequisite for future growth and adoption in this industry.

The EU has the most advanced and harmonized regulations around this issue

The next stage in the mass adoption of cryptocurrencies will be institutional. And institutions need legal certainty and regulatory clarity.

The Markets in Cryptoassets Regulation (MiCA), scheduled to be passed next year (at the latest), will create a fully harmonized, binding regulatory framework across Europe. Agreed, it has its own flaws (see here), but at least provides transparent guidelines for issuers and service providers, with clear regulatory responsibilities and regimes.

Meanwhile, financial regulation in the U.S. — especially cryptocurrency regulation — is a mess. Regulation varies from state to state, lacks a clear oversight regime, and presents enormous potential for conflicting requirements of different regulatory agencies or conflicting laws at the state and federal level. For example, Coinbase has money transmission licenses from 50 different state regulators and lending licenses from 50 different state regulators, in addition to federal regulators FINCEN, SEC, CFTC, IRS, Treasury, and OFAC.

U.S. regulators, such as the new chairman of the Securities and Exchange Commission, Gary Gensler, have stepped up their tough tone on cryptocurrencies and signaled tougher regulation and supervisory action. As such, a lack of regulatory clarity may soon be accompanied by heavy enforcement action.

If the EU can do MiCA well, Europe has the opportunity to attract talent, companies and capital from around the world and lead the next phase of institutional cryptocurrency adoption.

Europe has the biggest upside and lowest cost of destruction by far

This is probably the most important strategic and geopolitical advantage in adopting Web3 compared to the US. Web3 heralds a huge financial, economic, political and social revolution. It won't come without a price. Financial institutions, Web2 technology companies, and political institutions will all face massive disruption.

The US has Wall Street, Silicon Valley and the global reserve currency. The cost of undermining these institutions is enormous, which is why I expect the resistance against cryptocurrencies to be violent. The more cryptocurrencies grow, the greater this resistance will be. Web3 challenges the current American economic, financial, and political power structures and foundations.

Undoubtedly, for European companies, the evolution to Web3 will also come with its costs. But let's be frank, European banks have been struggling to survive since 2008, Europe hasn't created a single tech giant in the Web2 era (except maybe Spotify), and the Euro as currency/Eurozone as currency union Under attack from continental Europe. In the long run, the unique euro architecture, ie a common monetary policy but no fiscal union (national deficits, debts, budgets, etc.), stands on shaky ground.

Compared with the US, Europe has by far the lowest cost of destruction and the greatest potential upside. The cost-benefit analysis on Web3 seems clear. The stated benefits (digital sovereignty, financial independence, economic opportunity) would greatly outweigh the costs.

in conclusion

in conclusion

In this article, I outline several financial, economic and geopolitical reasons why Europe should embrace Web3. Not only could Web3 potentially allow the EU to finally achieve digital sovereignty and financial independence, but it is also the biggest chance to revive its struggling economy since the days of Web2.

Furthermore, the EU has several geopolitical advantages (crypto-savvy population, regulation, lower cost of disruption) compared to the US, allowing it to benefit the most from a positive Web3 strategy. This is why I think the EU has a real chance to play a significant global role in Web3, and why we should do everything we can to make it one of the key political and economic priorities for the next decade.

Mark

This article was originally published on the Stanford Law School website (source: https://stanford.io/3pQhJMp)

Patrick Hansen is Head of Strategy and Growth at Unstoppable Finance, a Berlin-based startup with a mission to enable people around the world to access, interact and unlock financial opportunities in the decentralized economy. Before that, he was Head of Blockchain at Bitkom, the largest technology association in Europe with over 2000 member companies, where he led blockchain and cryptocurrency related regulatory work, research, collaboration and communication. Patrick holds a master's degree in business and political science. You can reach Patrick on Twitter and connect with him on Linkedin.