The DeFi3.0 sector is heating up? One article explains its concept, characteristics and ecological situation

and968% and744%, driving the entire DeFi 3.0 sector to heat up, and other DeFi 3.0 concept tokens have gained more than 40% in the past half month.

first level title

Concept and Features

DeFi 2.0 (protocol controls liquidity) represented by Olympus (OHM) mainly solves the capital efficiency problem of DeFi 1.0, while DeFi 3.0 professionalizes the business of Yield Farming (liquidity mining), and the protocol formulates corresponding Farming strategies to obtain income , and return profits to token holders, that is, "Farming as a service", which aims to lower the participation threshold for ordinary investors and increase Farming income.

DeFi has a relatively high threshold and is not friendly to ordinary users. Farming in DeFi requires setting slippage coefficients, forming LPs, staking, understanding free losses, etc., and in order to obtain high APY returns, it takes a lot of time to research and find new liquidity pools, and at the same time faces many potential risks, such as large investors The resulting "mine disaster", the project party's running away and other problems, as well as the high risk factor of operation on the chain.

The DeFi 3.0 protocol uses Farming as a service to formulate specialized and cross-chain diversified farming strategies. Compared with ordinary investors operating on their own, the DeFi 3.0 protocol helps investors obtain higher returns. Investors do not need to spend time researching and selecting safe and high APY mining pools, nor do they need to transfer assets in different liquidity pools, and at the same time avoid the risk of operations on the chain. They only need to hold the Token of the agreement to share The profit earned by protocol Farming. DeFi 3.0 lowers the threshold for users to enter DeFi and increases their returns, especially for ordinary users.

The DeFi 3.0 protocol sets a certain percentage of transaction fees (buy/sell), part of the fees flow into the protocol’s treasury, and the protocol farms the funds according to the established strategy. The profits obtained are used to repurchase tokens, reduce the supply to maintain the currency price, or reward part of the repurchased tokens to token holders in the form of airdrops. In addition, currency holders can also obtain a certain percentage of handling fee rewards from each transaction.

image description

image description

USDC yield rate in Yearn Finance on Fantom

In order to obtain higher returns, users have to transfer funds in Yearn Finance from Ethereum to Fantom. The protocol cannot automatically transfer funds to higher APY liquidity pools on other chains, and requires users to operate by themselves, which will cause users to miss out on pools with higher yields on other chains.

Different from Yearn Finance, the DeFi 3.0 protocol implements cross-chain diversified Farming, and optimizes the Farming scheme according to the APY conditions provided by protocols on different public chains.

The APY on different public chains is often very different, especially in order to attract developers and users, new public chains will launch incentive programs and generate higher APY. For example, after Avalanch and Fantom launched hundreds of millions of dollars in incentive programs, their TVL and The ecology is ushering in rapid growth, and the APY of the two ecological agreements is generally higher than that of other public chains.

image description

Multi-Chain Capital Fund Distribution

first level title

representative project

text

Etherum

Multi-Chain Capital($MCC):In the past half month, the token has increased by about 52%. The number of currency holding addresses is 21125, and the number of Twitter fans is 29.4k. It is the pioneer of the concept of DeFi 3.0 and has passed the audit of Certik and Solidity Finance.

Currently, the public chains involved in Farming include Fantom, Avalanch, BSC, Polygon and Ethereum, and its main investment strategies are:

Stablecoin Farming.In order to ensure the safety of funds, stable coins account for a large proportion. The protocol chooses stablecoins with high liquidity and sufficient collateral behind them, mainly USDC, USDT and DAI, and the obtained APY is about 7% ~ 24%.

Farming with as little gratuitous loss as possible.In order to reduce unpaid losses, the agreement will select highly relevant tokens to form LPs, and conduct Farming with the lowest possible unpaid losses. According to the official 21-year annual report, the representative LP is FTM-TOMB. The price of TOMB is linked to FTM. The relative price of the two remains relatively stable. The LP has a small uncompensated loss, and the APY is about 155%.

Farming that focuses on compound interest.When there is an opportunity to compound interest or stake earned tokens for additional rewards, the protocol will increase the Farming position in that direction. For example, when earning BOO on the SpookySwap protocol, the BOO will be used to earn additional $FTM reinvestment, obtaining a reinvestment income of about 49.5% APY.

The protocol uses investment income to repurchase tokens for two purposes:

Direct destruction reduces supply;

Added to the fund pool of MCC/BNB or MCC/ETH to provide liquidity.

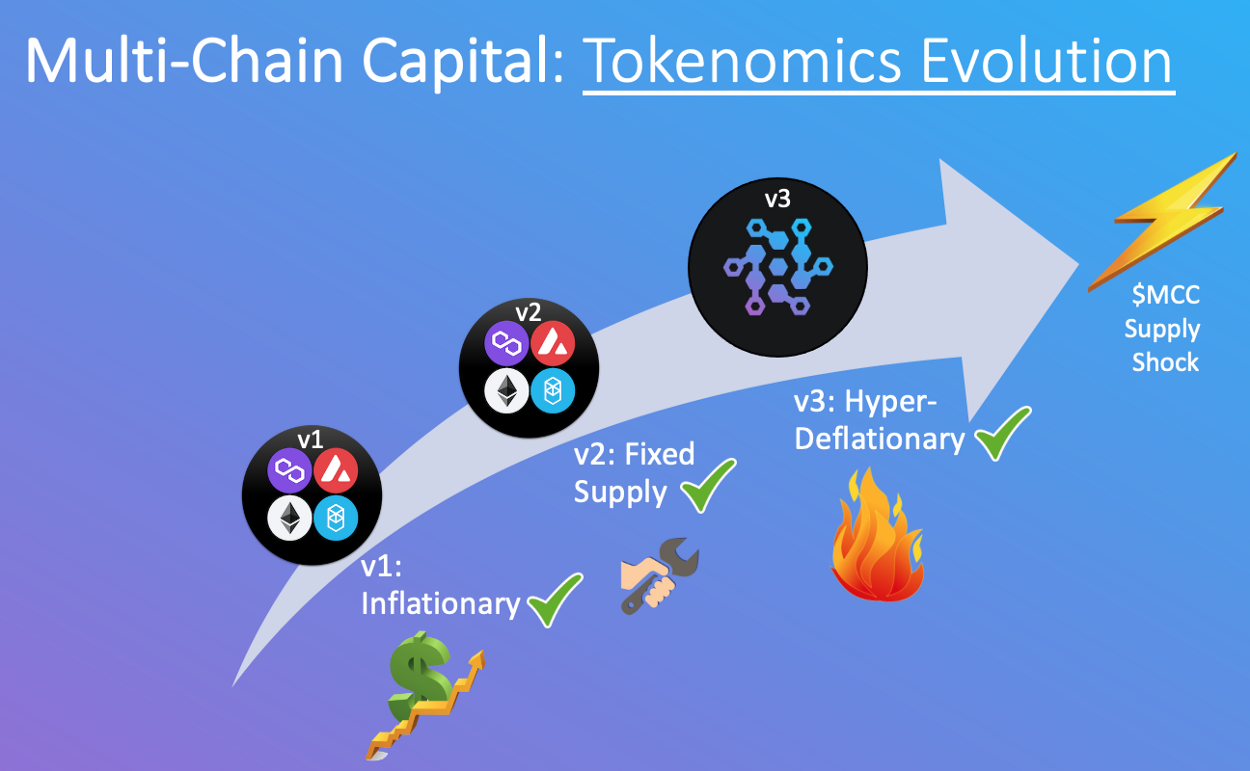

In the process of the agreement using the proceeds to buy back its tokens, the tokens will gradually transition from an inflationary mode to a deflationary mode.

Reimagined Finance($REFI):In the past half month, the increase is about 968%. The number of currency holding addresses is 2832, and the number of Twitter fans is 10.8k. It has passed the Certik audit. The Farming strategy of the DeFi 3.0 protocol is similar to that of Multi-Chain Capital, and will not be repeated here.

The profits obtained by the agreement will be given back to holders with more than 10,000 REFI in the form of airdrop ETH or REFI. The agreement will charge a 12% handling fee for each transaction. The specific purposes are as follows:

6% will flow into the treasury of the agreement for Farming;

5% flow to token holders, rewarded in ETH;

1% is used to buy back tokens to provide LP liquidity.

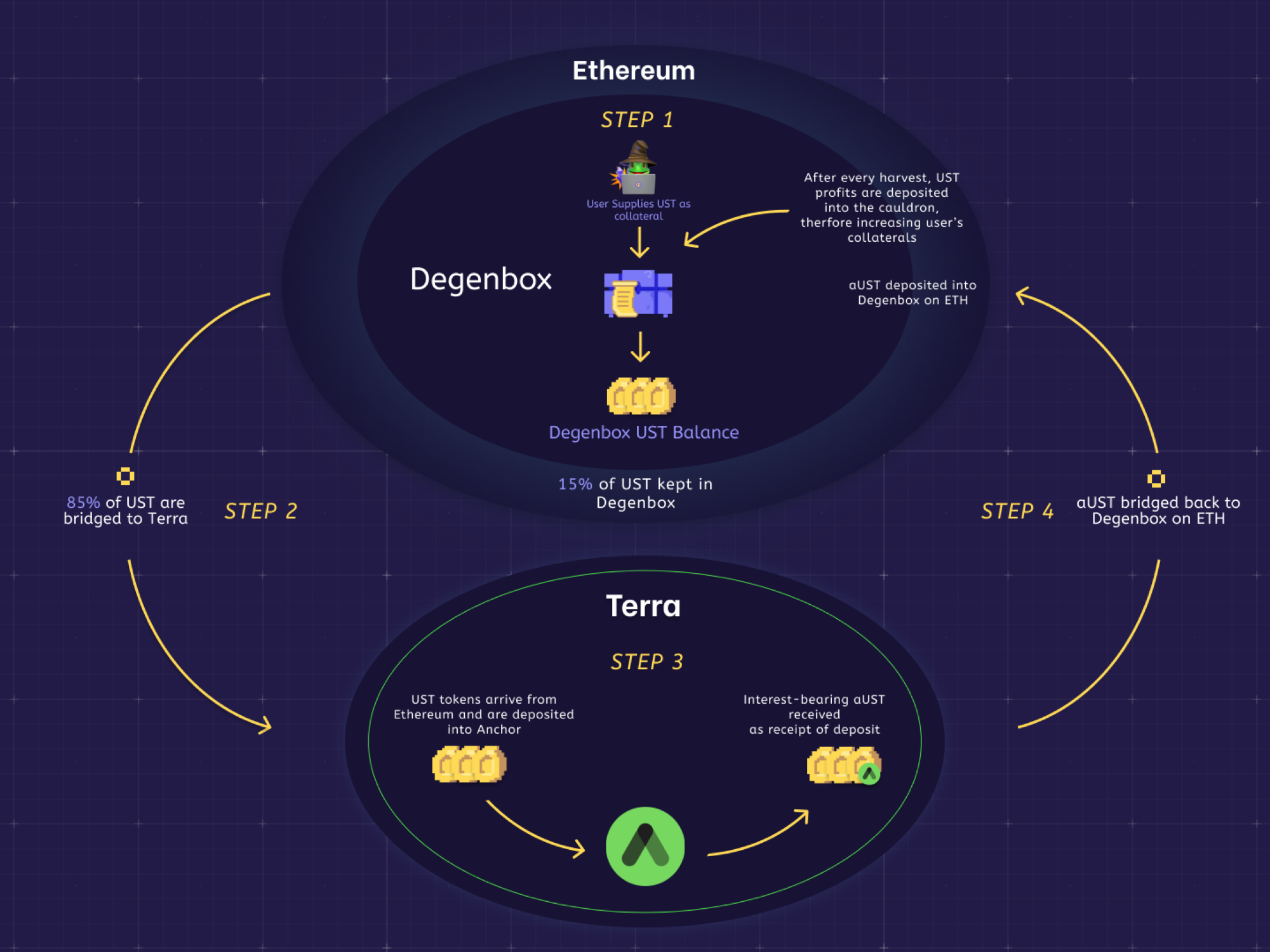

A strategy of the agreement in a weak market is as follows:

BSC

Cross Chain Farming($CCF):The increase in the past half month is about 54%, the number of currency holding addresses is 5784, and the number of Twitter fans is 16.2K, which has passed the Hashex audit. The Farming strategy of the DeFi 3.0 protocol is similar to that of Multi-Chain Capital, and will not be repeated here.

In addition to Yield Farming, which is the same as the above-mentioned DeFi 3.0 protocol, Cross Chain Farming will build a portfolio, and the benefits obtained will be airdropped to token holders in the form of BNB. In addition, the agreement will establish its own Launchpad to analyze and audit online projects to ensure user safety, and token holders will have the opportunity to participate.

The specific usage of the transaction fee collected by the agreement is as follows:

3% is used to buy back tokens, 2% is used for burning, and 1% is used to replenish the liquidity pool;

3% are automatically rewarded to token holders;

3% will be donated to DAO for Farming or investment, where Farming proceeds are used to repurchase tokens, and investment proceeds are rewarded to token holders in the form of BNB;

3% will flow into the marketing wallet of the protocol, which will be used to build Launchpad.

Empire Capital Token($ECC):The increase in the past half month is about 744%, the number of currency holding addresses is 2493, the number of Twitter followers is 1.8k, and has passed the Certik audit. The Farming strategy of the DeFi 3.0 protocol is similar to that of Multi-Chain Capital, and will not be repeated here.

The protocol charges a 10% fee for each transaction, and the specific purposes are as follows:

9% of Buy is rewarded to token holders;

1% of buyback tokens will be burned and destroyed;

2% of Sell provides BNB-ECC liquidity;

8% of Sell will flow into the protocol treasury or repurchase tokens.

text

Avalanch

Cross Chain Capital($CCC):The increase in the past half month is about 141%. The number of currency holding addresses is 4341, and the number of Twitter fans is 8.7k. It has not yet passed the security audit. The Farming strategy of the DeFi 3.0 protocol is similar to that of Multi-Chain Capital, and will not be repeated here.

Cross Chain Capital charges a 10% handling fee on each transaction for the following purposes:

10% of Buy is rewarded to token holders;

10% of Sell is donated to the protocol treasury.

secondary title

Fantom

Scary Chain Capital($SCC):The increase in the past 7 days is about 44%. The number of currency holding addresses is 1814, and the number of Twitter fans is 2.9k. It has passed the audit of Solidity Finance. The Farming strategy of the DeFi 3.0 protocol is similar to that of Multi-Chain Capital, and will not be repeated here.

Scary Chain Capital charges a 10% handling fee on each transaction for the following purposes:

5% is used to reward token holders;

5% will flow into the agreement treasury;

Summarize

Summarize

DeFi 3.0 increases the income of ordinary investors' Farming, which has certain value.DeFi has a high threshold, especially if you want to obtain income through Farming, which is relatively unfriendly to ordinary users. The DeFi 3.0 protocol launched "Farming as a service", which uses the protocol to formulate diversified cross-chain Farming strategies and returns profits to token holders. DeFi 3.0 has lowered the threshold for ordinary investors to enter the DeFi ecosystem to make profits to a certain extent, which has practical significance.

At the same time, it should be noted that DeFi 3.0 has already accumulated relatively large risks.DeFi 3.0 is in a very early stage, and the project launch time of the entire sector is relatively short, less than two months, and has not been verified by the market for a long time. Secondly, the market does not pay much attention to DeFi 3.0. Except for the concept pioneer Multi-Chain Capital, the number of currency holding addresses and the number of Twitter fans of other projects are relatively low. Finally, many tokens ushered in a large increase in a short period of time. For example, REFI and ECC have increased by about 968% and 744% in the past half month, respectively, and there is a certain bubble.

Projects that have passed security audits so far include Multi-Chain Capital, Reimagined Finance, Cross Chain Farming, Empire Capital Token, and Scary Chain Capital, while Cross Chain Capital has failed.