A comprehensive analysis of the cross-chain final battle: multi-chain game, compatibility and coexistence

first level title

first level title

01

first level title

The origin of this research report was published in the synthetix community in July and December this year.sip156andsip165。

and

At present, these two proposals are still in the Feasibility stage, which means that although they have not been actually implemented, their feasibility has been recognized to a certain extent. The main reason for these two proposals is to solve the problem of data compatibility between Synthetix's layer2 and Layer1. Users who have read the synthetic asset research report I did in October should know it all. As the most complex DeFi project in the Ethereum community, Synthetix was officially deployed on Optimism, a layer2 solution, this year. However, the pattern of multi-chain competition has gradually formed. Although layer2 and layer1 can complete cross-chain communication to a certain extent, this communication cannot be extended to other sidechains or even heterogeneous chains such as Solana for the time being. The global debt adopted by Synthetix cannot be synchronized. This has resulted in a great "fluidity waste".

This kind of "liquidity waste" is one of the biggest problems faced by various DAPPs in the current era of public chains and the Warring States Period. Especially global debt projects like Synthetix (projects that use shared risk like pool 2 users will encounter the same problem). When adopting multi-chain deployment, the liquidity of multiple chains has to be separated from each other. And re-incentivize the generation of liquidity from scratch.

Take the "DeFi For All" fund that is often whipped by us as an example. Polygon introduced Aave, Curve, Sushi, and recently Uniswap through this plan. However, these leading projects still need to re-motivate liquidity and deposit funds on Polygon.

You might say that for miners, the more new economic incentives the better, but for users with actual needs, it will cause great trouble, such as the collateral and deposits supported on other chain versions of Aave The types of products are much lower than ETH, and Sushiswap’s assets with better liquidity on other chains are still far lower than Ethereum.

From the perspective of the project side, if I want to deploy my original mortgage lending protocol on a heterogeneous chain with better experience or an EVM side chain such as Polygon. Then I will face a big problem, that is, the types of collaterals that can be adopted are insufficient, because there are not many assets on the chain that have sufficient liquidity to support large-scale liquidation.

In addition, there are currently some mainstream token trading pairs AMM pools on multiple chains, taking ETH as an example. At the time of writing, the total TVL of the asset on Uniswap V3 is 1.41B, and the TVL on Pancake V2 is about 0.3B. When trading the same ETH, the slippage pressure on Pancake is nearly 5 times that of the Uniswap V3 Ethereum version. The larger the amount, the larger the slippage gap. This is why the adoption rate of transaction aggregators is getting higher and higher, and even the adoption rate of cross-chain transaction aggregators is getting higher and higher.

To give another example, users bear different interest rates when they use Aave of different chains for mortgage loans. This is because the data on each chain cannot communicate with each other, and the contract only adopts the original data of the chain when calculating the interest rate. It may seem that there is not much difference in use, but to put it another way, it is like, when you use a bank deposit in this city, the interest rate is 4%, but you go to other big cities and find that the deposit interest rate is actually 6%. The same bank, the same currency, this situation is impossible in the traditional financial market. However, due to the data island problem of the blockchain, similar situations are not uncommon.

Therefore, it triggered our thinking:

Now that a multi-chain game and a compatible and coexisting ecology are a foregone conclusion, the future war may even become more chaotic. So is the information communication between chains the next track that is about to explode?

first level title

02

Some existing cross-chain communication infrastructure

(1) Lightweight plug-in communication protocol - LayerZero

text

LayerZero is a cross-chain communication infrastructure that SeerLabs came into contact with in August this year. It caught my attention at the time, but I missed the investment in it because of some other things (sorry). Later, I saw that this agreement has received investment from Binance, Mulitcoin, and Delphi Digital, so if I look for it again, I will ignore me.

1. Brief description of the plan

LayerZero focuses on a lightweight communication layer-based solution. It is mainly aimed at DAPP on each chain. Help them solve the intercommunication problem of information between chains.

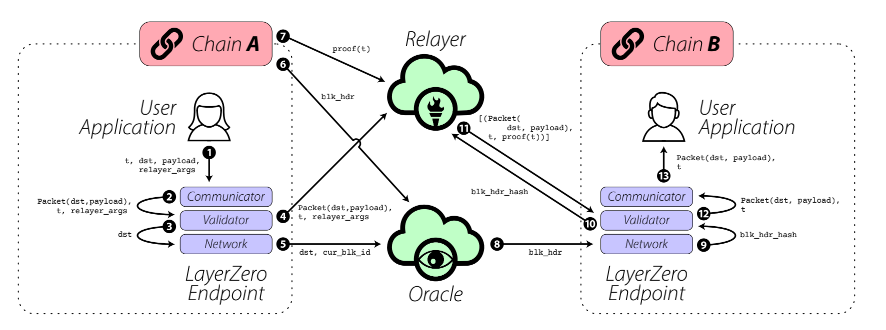

The figure above illustrates the steps involved in effectively delivering a single LayerZero message, with each number in black representing a step.

step 1:step 1:

A user application on chain A (AppA) performs a sequence of actions as part of transaction t. We uniquely identify a transaction T by a transaction identifier t, whose format may vary depending on the type of chain A. One of the steps included in transaction T is efficient delivery via LayerZero transport. For illustration purposes, and without loss of generality, let's assume that Appa uses our template repeater in this scenario. AppA sends a request to the LayerZero communicator with the following information:

t: represents a unique event identifier

dst: represents the global identifier pointing to the smart contract on the chain

relayer_arge: represents some parameters of the payment information submitted when the chain A application wants to adopt the template relayer shown in the figure (a customizable relayer provided by layerZero)

Step 2:The Communicator constructs a LayerZero packet containing dst and payload, called packet (dst, payload), and sends it to the Validator along with t and relayer_args.

Step 3:The Validator sends t and dst to the network. This step informs the network that the block header of the current block on chain A needs to be sent to chain B.

Step 4:Step 4:

The validator (Validator) forwards the package (dst, payload), t and relayer_args to the relayer (Relayer), and notifies the relayer (Relayer) that it needs to prefetch the transaction proof of T and finally send it to chain B. This happens at the same time as step 3.The network sends the block ID of the current transaction (cur_blk_id) to the Oracle. This will tell the oracle to fetch the block header of the current block on chain A and send it to chain B. If multiple LayerZero transactions occur within the same block, step 5 is performed only once.

Step 6:The oracle reads the block header (blk_hdr) from chain A.

Step 7:Step 7:

The relayer (Relayer) reads the transaction proof (proof (t)) associated with the transaction T from the chain A, and stores it outside the chain. Step 6 and Step 7 happen asynchronously to each other.Step 8:

Oracle confirms that the block corresponding to blk_hdr is submitted stably on chain A, and then sends blk_hdr to the network on chain B. The mechanism for determining when this happens is different for each chain, but usually involves waiting for a certain number of block confirmations.Step 9:

The network sends the block hash specified as blkJhdrJhash to the Validator.Step 10:

The Validator forwards blkJhdrJhash to the Relayer.Step 11:

After receiving the blk_hdr_hash, the relayer (Relayer) sends a list of all packet (dst, payload), t, proof (t) tuples that match the current block. If multiple users are simultaneously sending messages between the same endpoint, there may be multiple data packets and associated transaction proofs within the same block.Step 12:

The Validator uses the received transaction proof together with the block header stored in the network to verify whether the associated transaction T is valid and committed. If the block header and transaction proof do not match, the message will be discarded. If they match, the packet (dst, payload) is sent to the communicator.Step 13:

The communicator (Communicator) sends a data packet (dst, payload) to AppB. If you are not a developer but still understand this solution, please DM my Twitter: @0xOar

2. The main advantages of this program are:

(1) Lightweight and low cost

Its solution does not require a node based on the upper layer of chain A and B to provide protocol communication like other solutions. Instead, it can be freely deployed by the project party, using templates provided by LayerZero and even repeaters can also be designed by users themselves. Moreover, the white paper mentions a ULN ultra-light node, which is lighter than a light node, and I have not found a particularly detailed implementation. However, from the description, this is also a manifestation of ultra-lightweight deployment.

(2) Solutions based on the communication layer

This is one of the main selling points of the project party. LayerZero believes that its solution is a new communication protocol based on Layer0. We do not agree with this point. Its level is not a communication protocol like TCP, but just an inter-chain data transmission protocol. In the layer setting, I prefer to place it at the application layer, between layer2 and layer3 between.

(3) Do not rely on third-party credit

The white paper mentions cross-chain protocols such as Anyswap and THORChain. LayerZero believes that the aforementioned two partial notary mechanisms (mentioned in the next example) are actually relying on an intermediate consensus layer, and users need to trust this intermediate consensus layer the services provided. However, LayerZero is a peer-to-peer communication primitive that does not need to rely on this intermediate consensus layer.

(4) Summary

It sounds like the cross-chain mechanism described by LayerZero is quite interesting, and it can indeed solve many practical problems, and it is lightweight enough. But looking at the essence through the phenomenon, we can also find some inducing problems caused by this very "technical" solution.

3. Problem

(1) We do not agree that this is a solution based on the communication layer

This project is not a communication protocol at layer0. The main tools it provides include the endpoint and the relayer. The endpoint is responsible for communication verification, and the relayer is responsible for delivering messages. This is just an inter-chain data transmission protocol. In the layer setting, I prefer to place it at the application layer, between layer2 and layer3.

(2) LayerZero also relies on an intermediate consensus layer

LayerZero adopts the method of mutual verification between the relayer and the Oracle oracle in the design of the scheme to ensure security. However, the white paper also mentions the so-called extreme situation - the situation where the repeater and the oracle machine jointly do evil. LayerZero believes that maintaining relative independence can reduce this risk, but repeaters are generally deployed by the project side. And LayerZero believes that the oracle machine can choose a service like Chainlink. Not to mention the cost of using Chainlink to communicate, in essence, this is to trust that Chainlink will not cooperate with the project party to do evil, and Chainlink is also an intermediate consensus layer.

4. Subjective outlook judgment

(1) Most users cannot know the differences in technical details

Therefore, the subtle induction of stories in publicity is often harmless. There are also "technical" projects that are more ruthless. For us, we have seen too many "writer" founders.

(2) Lightweight deployment is conducive to promotion and application

Compared with Anyswap, THORChain, Polkadot, Cosmos, and another project to be discussed, Axelar, the LayerZero solution has relatively less technical and ecological investment and operating costs. There is no need to build a node and absorb other validators. The cost of organizing an intermediate consensus layer is definitely much greater than just providing tools.

Under the premise of equal resources, I am more optimistic that LayerZero will have a better application in the cross-chain ecology.

(3) Low narrative and ecological potential

Similar to auxiliary products such as Anyswap and Chainlink, although LayerZero can play a big role, it is not strong enough because of its product's feature storytelling ability and ecological expansion ability.

For example, Chainlink's own intermediate consensus layer ecology is actually complete enough, but because its oracle image is too deep-rooted, the overall story is not as good as layer 1 such as solana. In fact, Chainlink's ability is fully qualified to be all layer3 of the chain.

That's about as much as defining yourself on the same narrative level as one of the universe's components.

(2) Heterogeneous cross-chain communication protocol - Axelar

text

This project is very interesting. The overall title and concept coincide with the issues we are discussing today. What he hopes to do is to empower DAPP developers and the blockchain ecosystem, which has been considered from the beginning of the design. Some problems that different heterogeneous chain ecologies are incompatible under the current situation.

1. The official vision

(1) For the underlying developers

Plug your blockchain into all other blockchains

(2) For DAPP developers

Deploy your DAPP anywhere, and realize cross-chain assets and information between any chains through Axelar.

(3) For users

Directly interact with DAPPs of all blockchain ecosystems from the wallet.

This picture comes from the official document, it seems too complicated. We simplify it to the following text flow.

text

3. Axelar cross-chain protocol process

Assuming there are chains S and D, Axelar provides cross-chain services for these two chains

Status information across chains

Axelar obtains and synchronizes the state information in each blockchain system through validators in the Axelar network running nodes of different chains, such as a block hash, current block height, etc. The core process of state information cross-chain is as follows:

(1) The user of chain D initiates a request to obtain the state information data of chain S from the cross-chain bridge account or directly on the Axelar blockchain through the API provided by Axelar, denoted as Q.

(2) Each verifier of Axelar must run the node software of chains S and D. The Axelar verifier queries the API of its chain S node software to get the answer A, and sends A to the Axelar chain.

(4) Anyone can take out the signed answer S from block R+11 and publish it to the D network. Users on the D network can query the answer through the API provided by Axelar.

Asset cross-chain

Asset cross-chainDSuppose the user requests to exchange x amount of tokens on the source chain S for x amount of pegged S tokens S' on the target chain D, and store them in the user's address W on the D chain

superior. The workflow is as follows:D(1) The user sends a cross-chain transfer request to the cross-chain bridge account (x, W

), the request is caught by the listener and routed to the Axelar network.S(2) Axelar's current validator cluster uses threshold signature technology to jointly create a new deposit address D on S

. and broadcast it to the Axelar network.S(3) Users get D by monitoring the Axelar blockchainS。

, then send x amount of S tokens to address DD(4) The verifier queries whether the user has successfully transferred the money. If the verifier with a weight greater than a certain weight in the Rth block broadcasts that the transfer has been successful, the verifier signs the transaction txD,, the transaction sends x amount of S' tokens from to W

And broadcast the signature result at block R+11.D(5) Anyone can take out the signed transaction tx from block R+11

And publish to the D chain, so far the transfer of cross-chain assets is completed.

Compared with the LayerZero mentioned above, this solution is more complicated, and the verification process and logic are also more. In general, the big difference is that LayerZero uses an external oracle as part of the verifier, which ensures security and plays a role similar to an intermediate consensus layer. Axelar uses the BFT Byzantine consensus to build a third-party chain. Axelar synchronizes the information of other chains to the Axelar network through CTP, and then the nodes on the Axelar chain pass information on other chains through threshold signatures.

This scheme is not much different from the scheme adopted by Anyswap and THORChain in essence, and it can also be represented by the notary mechanism. This type of scheme is almost the most important genre among all cross-chain communication schemes.

4. Advantages of this program

(1) Independent third-party chains can exert greater imagination

The Axelar network for heterogeneous chains is essentially a blockchain network. Although it supports a DAPP on chainA to cross-chain to ChainB through Axelar as a transfer method, the optimal solution for developers is still to directly Deploy DAPP on Axelar. In this case, no matter where the subsequent version is deployed, it will only diverge downward, not connect upward.

If Axelar can develop its own ecosystem well, then Axelar may have the ability to become the so-called Layer3. This status is similar to the relay chain in the Polkadot ecosystem. At that time, ETH and BTC may even have the opportunity to be called sub-chains of Axelar.

(2) There is no need to rely on third-party oracle machines, and the efficiency and overall cost may be lower

Although LayerZero's solution has low deployment costs for endpoints and relayers, it is also very lightweight. However, the use cost and efficiency of the oracle will become an important factor affecting the choice of DAPP developers.

For example: If project A wants to transfer the debt data of the main contract on ChainA to ChainB through LayerZero and Chainlink. However, Chainlink calls may require payment, and Chainlink push data does not directly monitor the block data of each chain like Axelar, but pushes it regularly or according to rules. For example, one push per minute, or no push if the debt fluctuation is not higher than 1%.

The frequency of this asynchronous heterogeneous chain communication is very high, and the corresponding cost will be high. Therefore, the comprehensive cost of Axelar's general solution may be much lower.

text

5. Subjective outlook judgment

(1) In terms of overall product design ideas, the product form of the Axelar project is closer to projects like Anyswap, because most users have a higher tolerance for the decentralization of the intermediate consensus layer. Chainlink, the service provider and ecological situation of the chain where anyswap is located, 99% of users may not be very clear. Users will only pay attention to which cross-chain communication solution with the highest adoption rate is recommended by their chain. This shows that the real test of the general heterogeneous cross-chain solution is the To Layer1 ability of the project party. For now, we haven't seen much action from Axelar. And in terms of technical solutions, we don't think it has enough advantages to produce self-propagation effects.

(2) In terms of narrative ability, the upper limit of narrative ability temporarily displayed by Axelar is much lower than that of cosmos and polkadot. Although both are cross-chain, and Axelar may even be more practical, both Polkadot and Cosmos have proposed standardized blockchain protocols. This makes its overall narrative ability far surpass Axelar.

(3) Polkadot and Cosmos

text

1. Basic information

Polkadot and cosmos are the projects with the loudest voice, the richest ecology and the highest market value in this market. Generally speaking, the values and product concepts expressed by these two projects are much higher than the aforementioned layerZero and Axelar.

The specific solutions of Polkadot and Cosmos are not discussed here, and there are so many documents in various languages. We demonstrate from the overall plan.

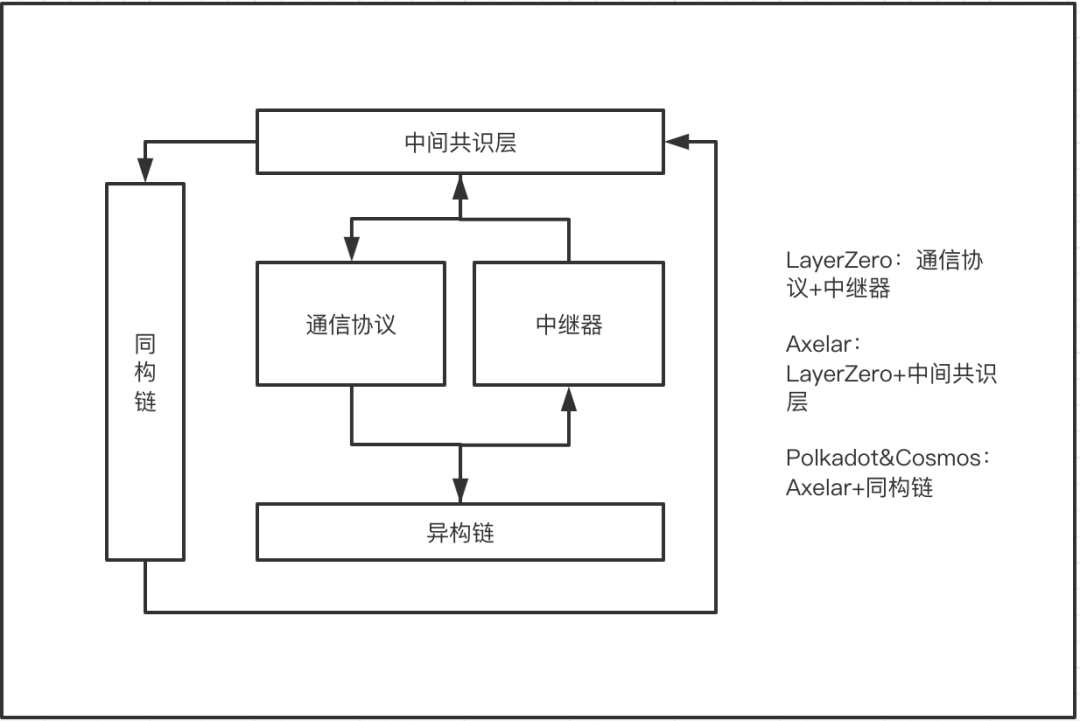

The narratives of Polkadot and Cosmos both mentioned cross-chain solutions between heterogeneous chains, such as cross-chain solutions between substrate and Tendermint chains and ETH, BTC and other chains. The basic principles are not much different from those of Axelar and LayerZero. An intermediate consensus layer completes the cross-chain through the notary mechanism.

But Polkadot and cosmos have told another story that seems more attractive - standardized blockchain and isomorphic cross-chain solutions. To put it another way: create an ecological Wanchain interconnection.

2. Compared with LayerZero&Axelar shape

As can be seen from the above figure, I simplified the complex process (the identification on the thread is not accurate, such as Polkadot’s heterogeneous cross-chain requires a bridge chain instead of directly interacting with the relay chain of the intermediate consensus layer) and then I can get Results: The above three types of solutions are not essentially different on the issue of heterogeneous cross-chain, but the three types of thinking on the big topic of cross-chain are different.

Polkadot and Cosmos believe that isomorphic cross-chain security and stability are the best, and the technical debt of later products is low. Therefore, although heterogeneous cross-chain is also supported, the focus is indeed the isomorphic cross-chain in the system of substrate and Tendermint .

Axelar believes that a unified standard is the most efficient and safest way to solve heterogeneous cross-chain, so Axelar Network was established. It inherits cross-chain communication and relayer services, and provides an intermediate consensus layer that interacts with heterogeneous chains.

Which solution will attract more attention and have greater prospects in the market competition in 2022?

(4) Comprehensive analysis of prospects

text

1. The current market competition pattern

a. Heterogeneous chain competition incentives, multi-chain parallelism is a foregone conclusion

b. The giant whale deposits in ETH, and the users deposit in multiple lower-cost and better-experienced Layer 1—BSC, AVAX, Solana.

c. Combined innovation has become the mainstream of innovation

d. EVM has a very high ecological share

2. Reference model benchmarking

From the perspective of ecological development, these three schemes are all different in terms of narrative and ecological development strategies. Let's compare and analyze each dimension in the form of a table:

From the table, we can see what the prospects for the future of the greatest difficulties faced by each program are. And the user base that needs to be expanded.

Due to its greater ambition and ambition, Polkadot&Cosmos faces greater challenges.

A conclusion can be drawn with certainty, unless its own tools are perfect enough and its ecology is active enough to form its own school. Otherwise, it will be difficult to accomplish the vision described in the white paper.

At least in the current multi-chain competition, it seems that the isomorphic chain core solutions of Polkadot and Cosmos are not in line with the current mainstream.

However, Cosmos and Polkadot still have some subtle differences in some designs. For example, Cosmos provides a set of solutions that use IBC and pegs to complete heterogeneous chain cross-chain.

In short, the functions provided by Cosmos are equivalent to the ability to build an Axelar-like network very quickly and efficiently. And this network also has the possibility to interact with other isomorphic chains in the future.

The advantage of this is that even if the core isomorphic cross-chain cannot be completed, the efficient adoption of heterogeneous cross-chain can be regarded as the result of the Cosmos ecology.

However, Polkadot's XCMP (not yet finished) has a large consensus coupling with the relay chain, and it is difficult to split it independently. Developers need to build a cross-chain system with heterogeneous chains such as BTC and ETH. While this makes the intermediate consensus layer less expensive to develop, it is indeed far from the described vision.

first level title

03

first level title

Seer's point of view

(1) LayerZero's solution may be the fastest to market

Because LayerZero's solution is closer to the actual needs of DAPP developers in the current market, taking the situation of Synthetix at the beginning of the article as an example, Synthetix can use LayerZero+Chainlink to quickly complete the integration of Layer1&2 debt pools.

(2) Axelar faces the greatest homogeneous competition

Compared with the entry point of lightweight and rapid deployment like LayerZero, Axelar's solution is more homogeneous, with Polkadot&cosmos on it, and Anyswap&THORChain in parallel. The adoption rate of Layer1 will be its biggest obstacle, and I am not optimistic that Axelar can beat Anyswap in this regard. Because although the latter is currently focusing on asset cross-chain, it is not difficult to upgrade to message cross-chain from the scheme design, and it already has a very high Layer1 adoption rate. Axelar is not content to just become a lightweight communication component, because the overall narrative and value capture capabilities are poor.

(3) The projected adoption rate of Cosmos will be higher than that of Polkadot

Cosmos's more flexible architecture makes its technical difficulty lower, and its more application-oriented design style has enabled many excellent products to emerge from the current Tendermint-based ecology, including the recently popular LUNA (Terra).

(4) The Polkadot ecology is facing a huge challenge