Harvard Blockchain Club: Crypto First, Gaming Second? In-depth analysis of the dilemma and way out of chain games

Original Author: Yang Deyuan, Zeng Yueqi, Harvard Blockchain Club

Original compilation: 0xzshanzha

In the 80s, text-based MUD (multiplayer dungeon) games dominated. Adventurers love multiplayer real-time RPGs with rich lore, fantasy worlds, compelling mechanics and RNG-based gameplay with P2P elements, which sounds a bit like we're in 2021 The so-called metaverse.

But at the time, a key piece of the puzzle was missing: a vibrant in-game economy powered by blockchain. This has come a long way since Satoshi Nakamoto published the white paper.

With the introduction of Ethereum, smart contracts, DeFi, and NFTs, we have witnessed the emergence of on-chain games such as Ether Bots and Crypto Crabs, the exponential growth of money-making games such as Axie Infinity, and the emergence of guilds such as YGG.

And with the development of Layer 1 this year, Layer 1 such as Solana and Wax have become the track for new institutions with their low transaction costs and high efficiency, and a large number of VC funds have poured into the industry (for example, FTX and Lightspeed Venture Partners’ 1 billion and $200 million for Binance and Animoca).

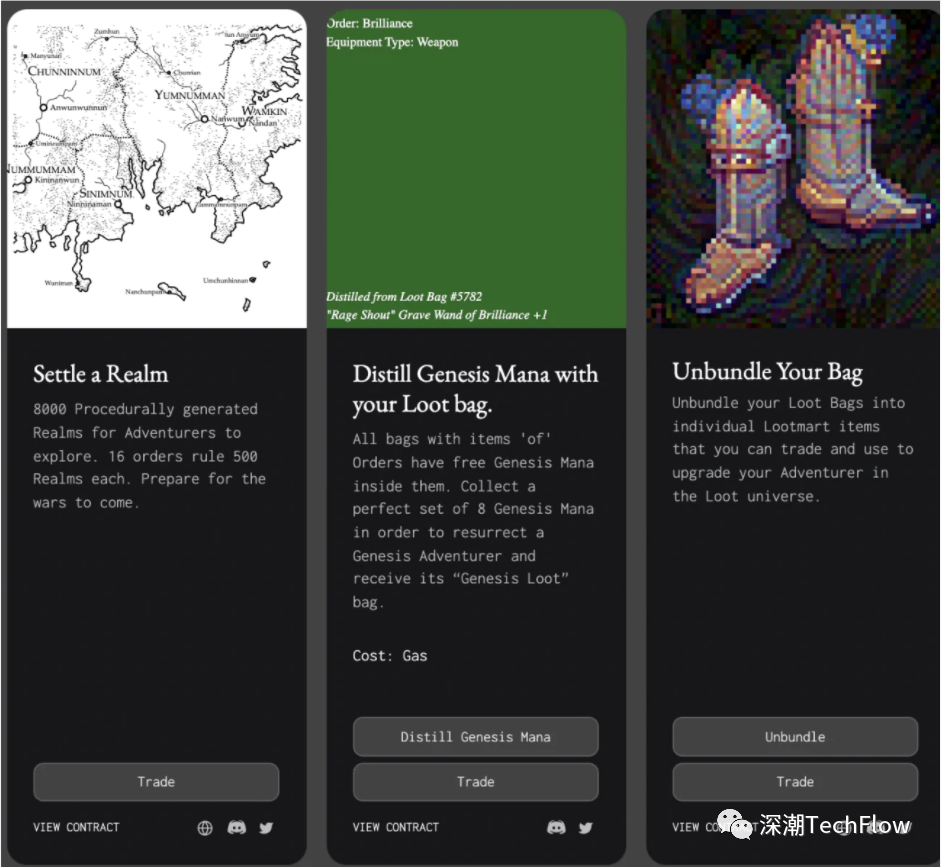

This year also witnessed Dom Hofmann's The Loot Project - "Adventurer Equipment Randomly Generated and Stored on the Chain" - a bottom-up reimagining of MUD games in Web3.0. The figure below shows that LOOT finally returned to MUD game type.

There's a lot to look forward to.

First of all, blockchain and games are complementary, and blockchain promotes the organic formation of neoclassical game economy. One because games provide blockchain with utility and adoption, and two because chains provide games with security and real asset value. For example, Axie Infinity, a Pokemon-like card game, offers many families affected by the pandemic a way to earn income by selling axie nfts or ERC20 tokens (such as $SLP) through an earn-in-game model Methods.

Many new players and non-players alike, due to the motivation from playing the game, they systematically learn what is Ethereum, what is DEFI, what is proof of stake (POS), what is impermanent loss, and other broader areas Blockchain technology, thus creating a virtuous circle. At present, the total market value of AXS, the governance token of axie Infinity, exceeds 8 billion US dollars.

On-chain assets are the first real bridge into the metaverse, and projects like Loot and axie are certainly steps in the right direction. But they're not enough to get the next billion users into the metaverse.

In this article, we will take a canonical approach to explaining that the current gaming industry is more hype than substance, and hereby offer a warning to GameFi (blockchain gaming) enthusiasts, while emphasizing three specific issues that need to be addressed question:

One is that there are problems with the "encryption first, games second" model, the second is that the current decentralization of gamefi is an illusion, and the third is the problem of user governance rights.

secondary title

GameFi: How far have we grown now?

Few today doubt the powerful mutual complementarity of blockchain and video games. The idea is simple: before blockchain, assets in video games were managed top-down by game studios. They are mutable, replaceable, and out of the user's control as they only exist on the production company's servers.

Games rarely allow asset transactions between players, especially on third-party sites, and those sites that allow player asset transactions are also strictly regulated, allowing only legal use of in-game items.

Even in games where you can trade, you can't legally own assets because studios have little incentive to hand over their profits to users. But with the use of blockchain, all assets are on a publicly distributed decentralized ledger and can be easily transferred between parties.

In addition, the tokenization of game assets can promote the development of market economy and strengthen the intrinsic value of props, even outside the specific game ecosystem.

For players, in addition to spending money, there is also a new way of making money: earning money by playing games (P2E) mode, players can use their money in various ways (such as selling or earning profits by buying shares) to make money. Earn nft in game to make money. And vice versa, NFT gets value from the game.

NFT is a very powerful tool for the gaming industry. This standardization allows any in-game item (such as guns, spaceships, elixirs, farmland, or even a cute cyber dolphin) to be used across games and different blockchains, even if they are made by different studios maded.

secondary title

Level 0: Collectibles

Examples: CryptoPunks, Bored Ape Yacht Club, Cool Cats, Doodles

CryptoPunks are prime examples of Level 0 character NFTs. In some ways, we believe Punks captures the growing beta of the Metaverse, owning a Punk means you are an OG in the NFT space, means you are a serious collector with huge reach.

secondary title

Level 1: Basic Interaction

Examples: CryptoKitties, Crypto Crabs, Ether Bots

Punks serve no purpose other than speculation and influence.

At the same time, CryptoKitties offers an additional gamification component: reproduction. Players can trade cats and try to unlock some rare traits, but that's about it. Apart from interacting with smart contracts through Metamask, there is little real gaming here.

secondary title

Level 2: Exploration

Examples: Decentraland, Sandbox

Decentraland and Sandbox represent the evolution of Level 2 gaming: virtual platforms that allow users to create, experience and monetize content and applications.

Land in Decentraland and the Sandbox is permanently owned by players. There is a fixed supply of land that users purchase from a blockchain-based land ledger. Landowners control what is posted to their portion of the land, identified by a set of Cartesian coordinates. Content can range from static 3D scenes to interactive systems such as games. Land is an irreplaceable, transferable, scarce digital asset stored in an Ethereum smart contract.

secondary title

Level 3: Complex Gameplay (GameFi)

Example: Axie Infinity, Gods Unchained

Building on the foundation of Level 2, the rapidly developing Level 3 game in early 2021 finally has a shippable game. Users can open the client, enjoy exciting graphics, mechanics, and pay to play games, instead of playing farming mini-games through the browser wallet interface.

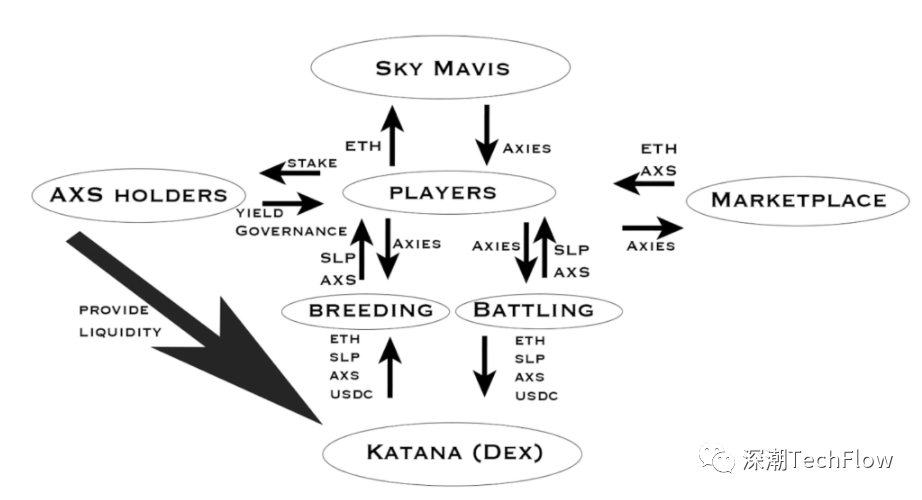

Axie Infinity leads the way. Axie users start playing by investing in axie NFTs and $AXS native tokens. There, they can earn $SLP by playing, as the earned tokens can be exchanged for other crypto assets or fiat currencies.

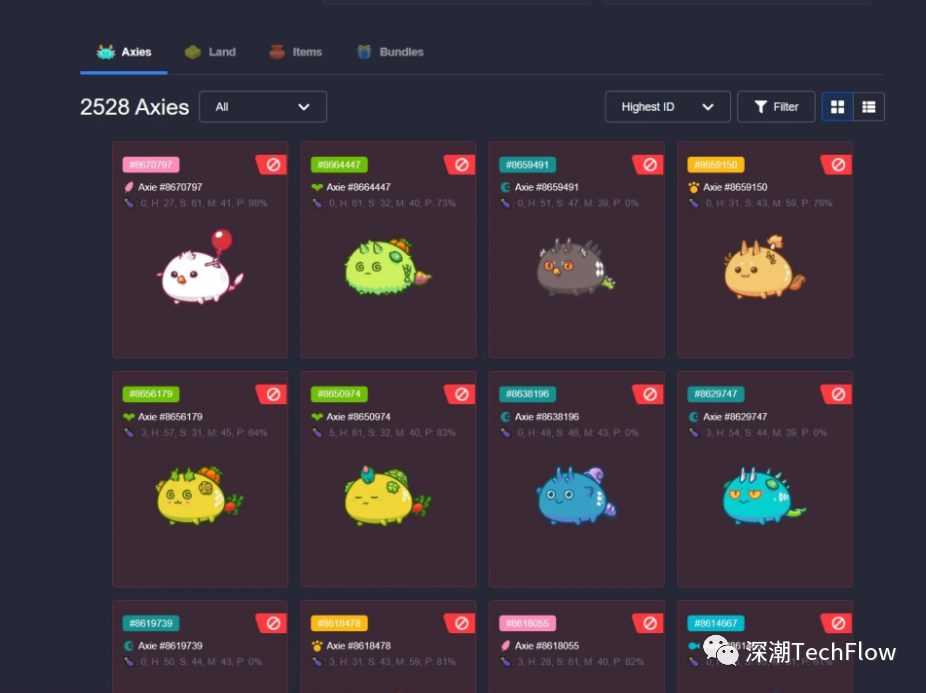

During the difficult economic times brought on by COVID-19, many users in the Philippines are earning more than their usual monthly salary simply by playing axie Infinity. The picture below is the game screen of axie.

The problem with level 3 games like axie Infinity is that costs are based on token inflation and new players must offset this inflation with a constant capital infusion to keep the economy in balance. The economy relies on new money, and if the growth rate of new players drops or old players stop reinvesting, the economy will systematically collapse due to hyperinflation of Axies and SLPs, making everyone a potential "rug puller". The play2earn economy of Level 3 depends on the capital that people put in, making a profit only when others buy it: in this case, there is no social surplus.

Granted, many successful businesses survive on unsustainable models that eventually become profitable through economies of scale and increasing returns to scale. Axie has a lot of cash to burn because they have a lot of institutional investors, from a16z to Mark Cuban.

However, as we show later in this article, the problem with axies is that as the economy grows, the purchase price inflates significantly, further destabilizing the economy.

The picture below is the game economy system of axie.

There is a fundamental question with all Level 3 games: if the game is no longer profitable, will people continue to play it? I don't think so, at least not yet.

Current GameFi projects lack the complexity and mechanics to create a truly fun experience.Most players play games purely for profit, as current games with high monetization levels don't have enough gameplay.

Growth will undoubtedly slow as axie prices continue to appreciate. Currently, to play axie Infinity, let alone win, players must pay at least $100/axie for teams of 3 and teams of hundreds (starting on November 8, 2021). For a common meta-level team of simple beasts, aqua, and axies, they cost upwards of 1 ETH ($4400).

In addition, there is a deflationary cycle. When players leave, they put their assets on the market, reducing the market value of the item. When the market value drops, people are more likely to leave the game, which only further weakens the value of the game item. Momentum works both ways—games crash just as quickly as they take off.

secondary title

Level 4: The pipeline game of the future

We've decided to classify Level 4 games as an exciting future game project that plans to improve games like axie Infinity and Gods Unchained in some significant way.

We're currently looking at games like Gala Games' miranda, Star Atlas, Phantom Galaxies, Aurory, Untamed Isles, and Shrapnel.

These games fall into different categories and go in different directions. Some have adopted Unreal Engine 5, while others have opted for a more blocky, cartoonish art style. Some are first person shooters, others are tcg games. Some companies are planning to partner with DeFi projects to build collaborative dApps, while others are working on cross-chain interoperability.

secondary title

Encryption first, gameplay second

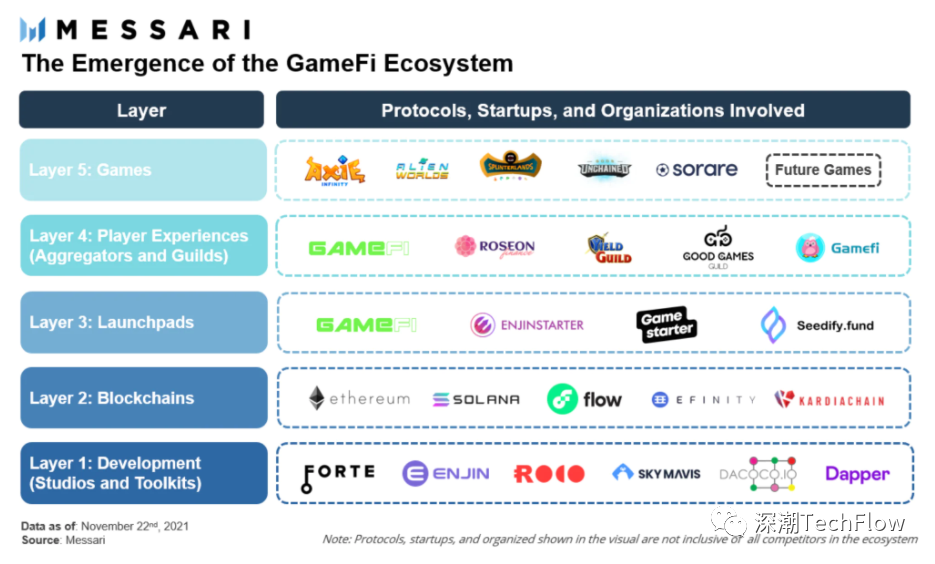

The image below is the Messari Gamefi map.

The crypto first, game second model is being adopted by studios that prioritize cryptography and financing over gameplay, and is the first of three challenges that current Level 3 games must address.

It is worth noting that this model does have an advantage: it makes it easier for independent developers like Star Atlas' studio to raise funds, either through NFT before the game is released, or through pre-sale of tokens to investors, or raise money the old-fashioned way by selling equity.

This is critical to the development of many Level 4 games and is the key to the success of various DeFi projects. However, we believe that it brings a lot of asset risk and speculative behavior, which is not good for the entire ecosystem, which will lead to a decline in game quality and negative user experience.

Excessive hype and previous success stories (such as axie Infinity), fueled game asset inflation before the game was released.Companies can set initial prices much higher than non-crypto games, which creates a huge barrier to entry.

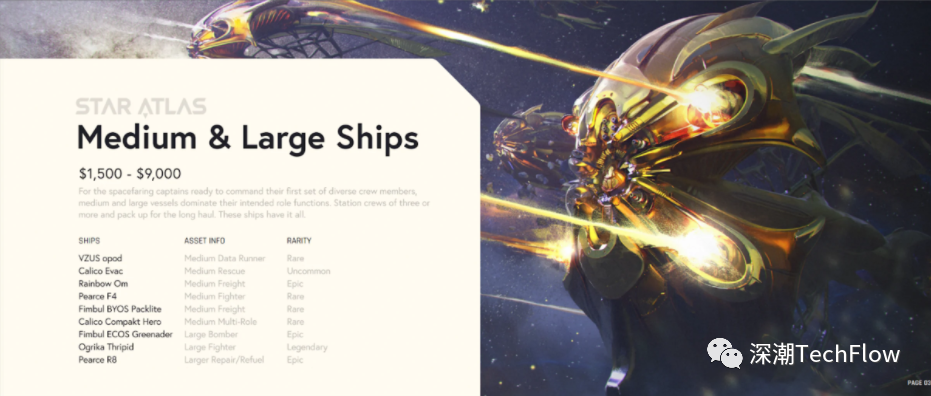

As an example, Calico Guardian in Star Atlas (a game that's supposed to be out in 2-10 years) sells for at least $25,000. Even a mid-sized boat of poor quality will cost at least $1500. That's the developer's list price, and all sales proceeds go straight into their pockets. Titanship, as Discord has been hyping, could bring in a million dollars. The picture below is the official suggested price of the spaceship.

Incredibly high asset prices reduce interest in the game from potential players and overburn the ecosystem.These price points not only exclude potential players, but also force players to spend a lot of money to play a poor game, or if they don't want to spend a lot of money, they are forced to play the role of indentured slaves in the game.

Due to the volatility of crypto assets, players are forced to take incredibly high risks. And this problem is exacerbated by the layering of assets.

In order to encourage players to buy more advanced assets, game companies will greatly increase the power level and corresponding benefits of more expensive non-functional games. This means that the price-to-reward ratio (financially and opportunistically) is much lower for lower-cost projects. Ten low-tier NFT ships for $100 will pay back less than a single NFT ship for $1,000.

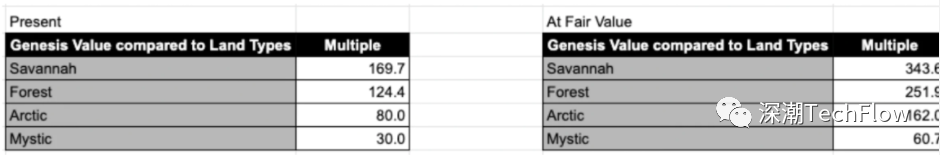

For example, axie Infinity divides the land into 5 categories (Savannah, Forest, Arctic, Mystical, and Genesis), forcing individuals to contribute a lot, or excluding them.

A plot of Genesis Land sells for 550 ETH, while a plot of Savannah sells for 3.5 ETH.

However, the tiered land system means that certain buildings can only be built on more expensive land, or on multiple connected parcels, generating more revenue through economies of scale and increasing returns to scale. The highest level of land usually ensures that the unit cost of producing a product falls as the scale of production increases, while having multiple lands linked together (buying in bulk) means that unit labor productivity rises as the scale of production increases.

In other words, the layered nature of the axie economy not only provides better returns to those whales who can afford it, but also actively excludes individual retail investors from the game's earnings. According to the distribution of AXS game earning rewards, a genesis plot is worth 343 prairie plots, which means its true value should exceed 1130 ETH.

The figure below is the earnings estimate from axie discord.

Other games like star atlas have encountered the same problem: even though there are more cheap ships such as Opal Jet and Pearce X4, the gaming experience brought by these cheap ships is greatly limited (such as Lack of ability to mine asteroids and ability to fight).

As an example, how can an Opal Jet approach a "medium security area" if, in combat, a $28,900 C9 Capital Class ship can vaporize an Opal Jet with a laser cannon in seconds?

Ultimately, the “crypto first, gaming second” model presents a conundrum: the player is forced to choose between being a worker or an investor.

Those who are willing to pay huge sums of money are forced to become investors because they have to bear the risk of these expensive assets. Those who are less willing to invest, or simply don't want to get in the game too much, are forced to become workers on a "scholarship" system -- they borrow expensive assets from investors, use them to make money, and at the same time give investors most of the profits—It's a 21st century serfdom with a rent-seeking guild between them and the game.

As such, it attracts speculators and large lending associations like ygg, who are not really gamers, which may be good for the token's short-term price, but ultimately bad for the project's long-term growth.

in other words,

in other words,The model of YGG and other guilds is not necessarily positive for gaming community building, as they encourage the hiring of labor.It is also important to emphasize that,This workforce is mostly wage earners from third world countries with little negotiating power over their wages; this is not the "future of gaming" we dream of.

Finally, we want to point out that while there is class stratification and the need to pay to play in traditional games, the very nature of GameFi and the "play2earn" model of all crypto games exacerbates this problem while directly causing many Games cannot live long and healthy. Unlike traditional Gacha games (games with in-app purchases for cheap winning thrills), GameFi projects crash faster when they try this approach.

One solution is a "gaming first, encryption second" model.

This model highlights the gaming experience while maintaining the security of encrypted components: having fun and making money are not mutually exclusive, but emphasizing the former is important.

We envision that in the near future, new content from different developers and studios can be added to the game through votes from different nodes. Specifically, what makes a game interesting in the long run is the slow learning of mechanics (through a solid understanding of game logic and mechanics), or the slow progression felt by the player putting in the time, rather than just buying expensive premium assets.

Simply put, games can be designed to reward skill, like League of Legends, or they can be designed to reward hard work (resource acquisition), like Clash of Clans. Some of the most popular games, like Clash Royale, balance these two elements: units can be upgraded to get more rewards, cards are properly tiered based on rarity, and all cards are reset to Same intensity level.

Essentially, the "game first, crypto second" model means that not everyone can make money, only those who can play have the opportunity to make money, and how much they can make is affected by the capital they invest, Of course, it also depends more on their game skills and game time investment.

Even those who don't have enough money can make money with their unique skills and understanding of the game, rather than being forced to be weaker because of the cheapness of a particular asset.

secondary title

The illusion of decentralization

The second challenge that Level 3 games must address is decentralization.

The sale of in-game assets is by no means a phenomenon unique to GameFi, but the crypto gaming industry advertises its game assets as a completely separate and uncontrollable market.

This is deceitful: Because studios have ways to maintain control of assets, these games are still centralized in most cases, despite many crypto game leaders marketing that they are decentralized. For example, Axie, many axies have been banned. The picture below shows the banned Axies.

The first and most fundamental question is whether these games should or need to be as decentralized as the game developers claim.

In "centralized games" (such as CSGO on Steam), accounts can easily be banned from transactions. This led to many problems, with assets worth millions of dollars locked in trading bot accounts.

While many might argue that these locked assets push up the equilibrium price by reducing the total supply, the ban is somewhat justified and prevents bots from simply moving their assets to another account, And continue to attack and violate the terms of service, which is very important for stabilizing the game economy.

However, there are also many reasons why the decentralized nature of blockchain assets is worth protecting. This raises a question if we assume that decentralization is something we want to maintain and enforce:Is the current crypto game ecosystem implementing these ideas? How can these games evolve to better create the ultimate decentralized metaverse world?

In the current field of encrypted games, although game developers cannot directly prevent asset transactions because they are independent on the blockchain, they can significantly reduce the value of assets by prohibiting them from entering the game. This will remove most of the utility belonging to the asset.

If properly tokenized on exchanges and other trading platforms such as the axie Infinity marketplace, it could easily replicate the no-trade functionality of centralized games. For example, when axie Infinity discovered that Chinese studios were paying players to play multiple accounts simultaneously to maximize revenue, they banned all of axie's accounts and warned the player community on Twitter against further violations.

Of course, the axies themselves are still tradable, but cannot be used by anyone in the game, making their trade value worthless. Because game companies monopolize the reduction and removal of asset values, these assets are still highly centralized.

Going a little deeper, games like Star Atlas claim to be anonymous developers, meaning they're receptive to the idea of gradually letting themselves out over time and letting other game developers take over for them.

They claim in many official forums that, over time, new developers can replace the development team if needed by the community.

In their white paper, the studio claims that "blockchain technology using the Solana protocol" enables a "serverless and secure gaming experience." NFT tokens earned and traded in Star Atlas create an environment that replicates real-world assets and The tangible economy of ownership.

As for not using a server, their reason is,If the game does not have a server, server failure will not affect the game, thus maintaining the stability of the game asset value and user base.

However, we believe that due to the speculative prices discussed above, companies are more motivated to start a new game, sell their own tokens to raise funds, and due to the hype and fast spreading nature of cryptocurrencies, the cost of acquiring customers is low.

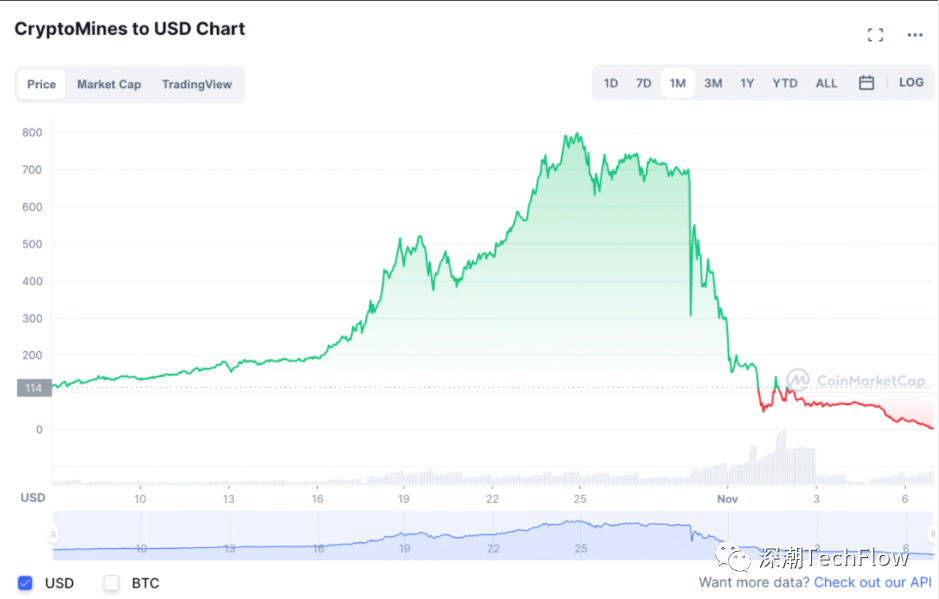

For example, take the CryptoMines game on BSC, a project that claims to have over 230,000 users. When the development team failed to control the FUD (Fear, Uncertainty and Doubt), the project party saw the price of their token drop from $801 to $4 in two weeks, and they proposed a complete game shutdown plan, And promised to launch a new NFT completely independent of the original game, declaring that the NFT of the original game has no effect.

In reality, there are several structural hurdles to overcome in order to solve this problem.

The first is the issue of intellectual property rights: while the company itself cannot control the trading and transfer of NFTs, the images and names used in the game are protected rights. We know intellectual property protection is important and need to prevent indie game studios with more money from creating Mirandus 2 or axie Infinity 2 out of existing assets for convenience and destroying gamefi's user base.

While protecting and growing intellectual property is important to the game's growth, there also needs to be a clear transition plan.Unlike other forms of protection such as patents, trademarks do not have a clear validity period and can be kept forever, so the transfer of ownership requires clear information disclosure.

Our proposal is to allow these companies to own the trademark for a predetermined, public, flexible period of time, allowing the companies to develop their intellectual property through collaborations, marketing, intellectual property, design, etc.

The trademark would then be transferred to the game's DAO or DAO-like structure, where the community could vote on partnerships.

These partnerships will be submitted to the DAO and thus voted on: they require a minimum number of game-native tokens or NFTs which will be locked by smart contract writing during the voting period to coordinate interests and prevent one-time marketing plan.

Additionally, there were issues with the servers running the game itself. This can be solved in two ways.

The first way is proposed by Gala games. Gala Games is currently using a node service. They claim that they can "run a decentralized game hosting platform" in the future. We think this framework has great potential. New content from different developers and studios can be added to the game through different node votes, which allows us to infer that future servers will no longer depend on a single game.

Or we suggest that game developers start a fund that they themselves fund directly, until they decide they no longer support the game, at which point they advertise the fund and hand over legal control to the DAO.

That way, if the game is still popular, the community can decide to maintain the server, or migrate to a new server entirely in due course. Generally speaking, that money should come from the company's profitable revenue, as well as new content creators looking to keep the economy growing.

In reality, new content creators can choose to enrich the existing infrastructure by adding new playable content, or they can create an entirely different game that includes the same Nfts.

If the new game offers a much better platform than the original game, the DAO could vote to suspend support for the original game and divert funds to the new game, thereby weeding out the original developer.

secondary title

Governance: A Big Illusion

Majoritarian governance refers to voting on the chain to determine changes to proposed protocols or game systems on the chain. This is a huge illusion that needs to be addressed, and it's an issue that's critical to developing Level 3 games.

While gaming requires user feedback and data to design the best product to maximize consumer experience, on-chain mobile governance has historically never effectively solved the problems any anti-majoritarian rule-maker has ever faced .

first,

first,Majoritarian governance is harmful in the long run because individual individuals lack the skills, knowledge, and long-term motivation to maximize game growth.

Given that most game development teams have the expertise to design complex economic structures (necessary to balance game revenue generation), we should trust teams to make meaningful decisions while taking user feedback and input into account.

We believe that a promising project with a long-term vision like Phat Loot Studios' untame Isles will continue to listen to user feedback, just as they have done with character art design.

It is important to note here that this can be achieved through data collection and pooling, with an annotation that reflects NFT holdings that developers can consider, rather than through tokens.

This also raises another question about exclusion and alienation, because many people have already invested a lot of money in the game through the purchase of NFT (the purchase of NFT is crucial to the operation of the game). This token-based governance system forces individuals to also purchase such tokens and penalizes those who allocate funds to in-game NFTs.

In terms of incentives, it seems infeasible to give the power to change fundamental parts of the game to those with more money, since their motivation is to protect their own interests rather than the balance and health of the game as a whole. This can lead to changes and votes that are easier to pass based on protecting the higher-level assets they hold, thus imbalances in power and alienates ordinary players.

While there is little governance policy in place in the crypto gaming space due to the lack of any type of governance structure, the consequences of crypto whales can be seen in other instances of governance in the crypto space.

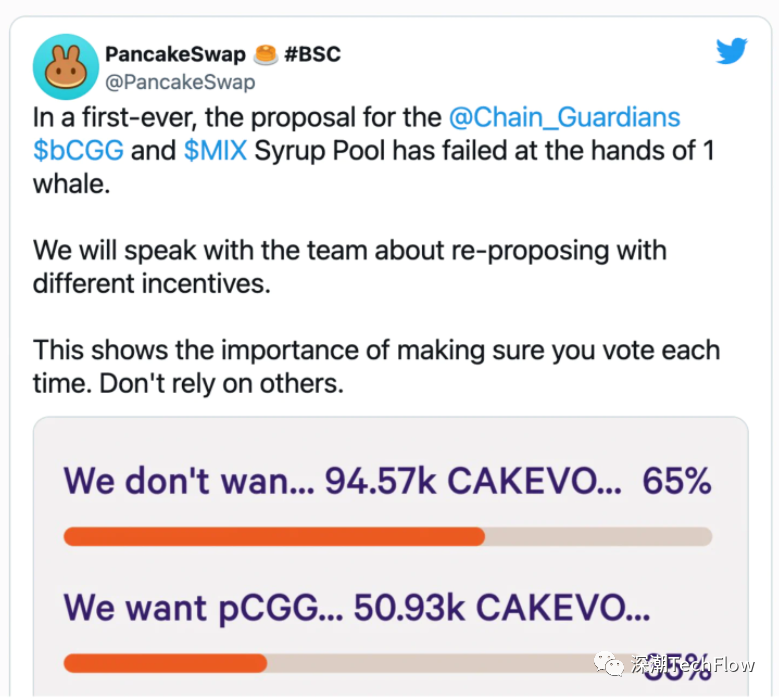

In April 2021, on PancakeSwap, the largest DeFi platform on Binance Smart Chain, a proposal to change the pool was submitted. The change (which was backed by the developers) was overturned by a user whale who pledged over 94,500 votes using his cake tokens. That made him the largest single voter against the proposal, with a 65% majority. Holding almost twice as many tokens as the entire proposal, this whale single-handedly blocked a vote that the majority hoped would succeed.

This suggests that ceding power to those whose motives may not always align with the collective can be damaging. What happened next was equally worrisome: the Binance dev team made the suggestion over and over again, until the whale finally dropped its objection.

Decentralized finance (DeFi) protocols have been striving for quality and fairness, but many fall short due to their governance voting mechanisms: Moving the decision-making process on-chain sounds like the next blockchain revolution, but it The validity is still not recognized by law.

The picture below is the result of the pancake vote.

This obviously presents a question about how to incentivize, as whales will only be allowed to vote without damaging their portfolio.

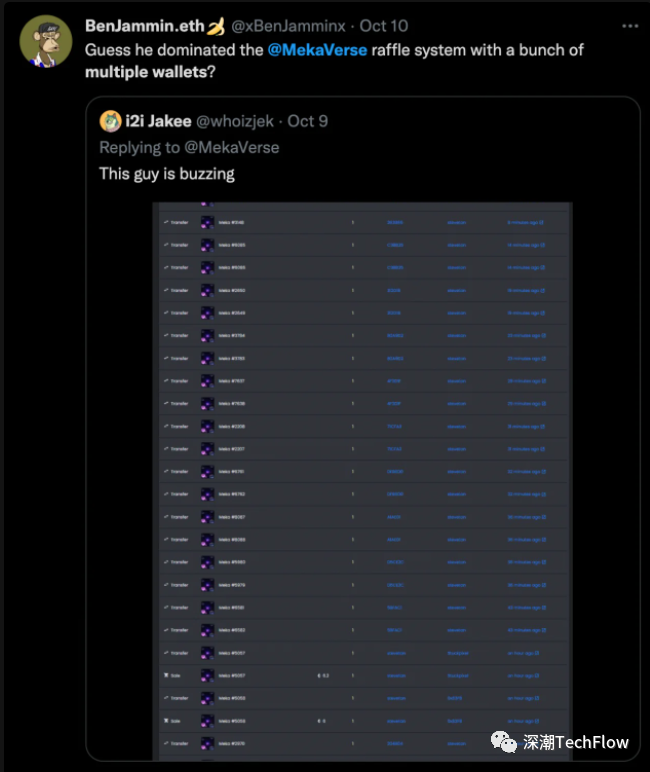

Of course, we also have to ask, since whales are the ones who put a lot of money into the game, don't they have the right to do so? After all, they take most of the risk. Even if we try to circumvent the whale problem by building a common alternative of one wallet per ticket instead of one token per ticket, we will faceAn equally troubling issue: the Sybil attack problem, where a single user could create 500 wallets, use scripts to distort governance or unfairly obtain airdrops, thereby undermining democracy.

also,

also,A token-based voting system alienates players and creates a power imbalance between haves and have-nots.Not only does it exclude those who own fewer tokens, but even those who own other assets, such as NFT assets created directly in the game, are forced to maintain a large supply of tokens to prevent policies that are harmful to them .

This is disastrous for NFT asset holders, because they are actually the most affected by the game. In the case of axie Infinity, the ones most affected by game changes are the land and axie players. However, those who vote on game development proposals are AXS holders.

Secondly,

Secondly,There are few successful implementations of current game-based DAO frameworks.Due to the lack of transparency and the progress of DAO development, hardly any policies were voted on.

There is little material on specific examples or structures of how voting would be done, and while games like axie Infinity and Star Atlas have proposed structures for basic governance and proposals, there haven't been any major decision votes, nor any regular votes.

It is worth mentioning that those games that want to be truly decentralized can use some of the ideas mentioned earlier in the DAO voting as the basis for the subsequent voting process.

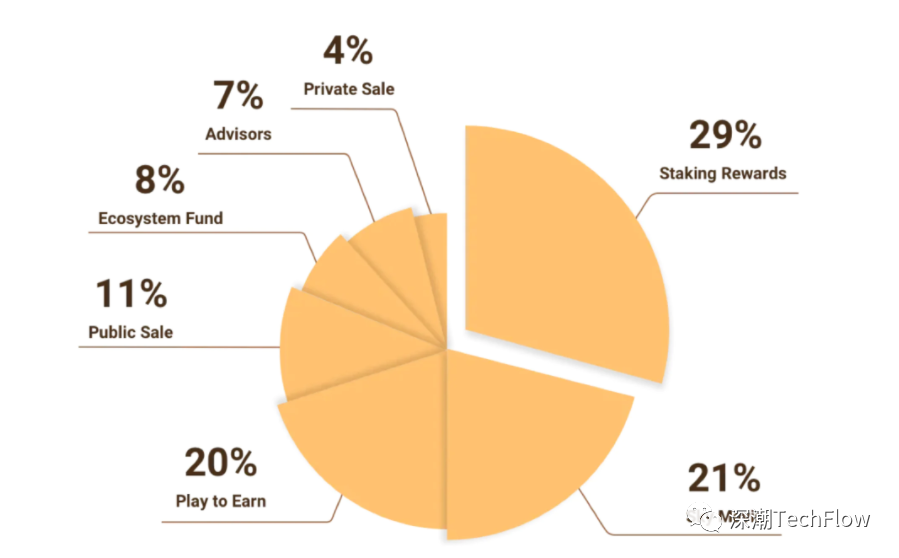

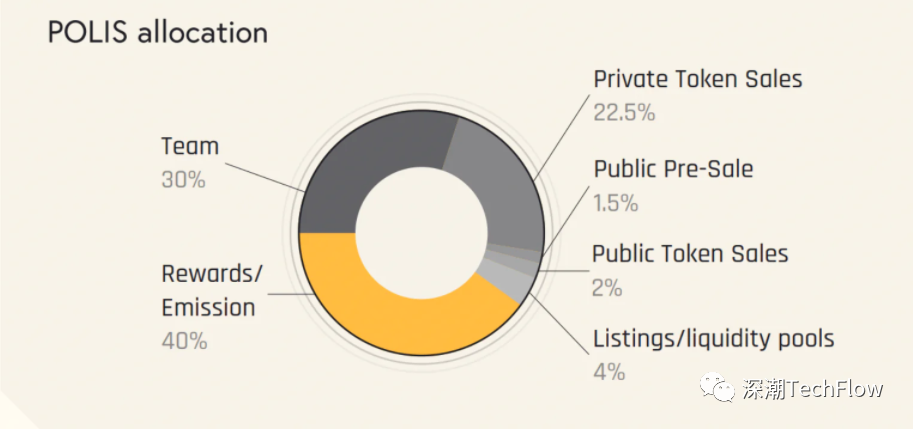

The figure below shows the distribution of Star Atlas governance rights.

Finally, the early distribution of tokens hinders the realization of the DAO structure in the current environment.

One is that the worst case scenario is that a game development team that itself plans to do rupull (con and schemes) executes rug.

The second is that even if we assume that developers will not do this, there will be many tokens distributed to private owners and employees due to the need to raise funds and reward employees in the early stages. Therefore, even if major players are able to acquire most of the valuable tokens in the market, they still lack relative voting power.

Note that this is not just a problem for a few games, but for the entire gamefi world. Currently, the average share allocated to team investors and private equity investors is 20.3% and 13.2%, respectively, and public sale ownership is 9.17% (based on data from 3 games axie Infinity, Star Atlas and Splinterlands). Games that can be collected from data, in some extreme cases like star atlas, POLIS (their governance token) public offering tokens only account for 2% of the total POLIS allocation, while private placements have 22.5%, thus leaving many Issues such as public governance, democracy and land distribution issues.

Even in a fairer game like axie Infinity, where the amount is the same for public and private placements, teams still keep the majority of tokens, giving them the final say.

Although many claim that this distribution system may change over time, say through play2earn and staking. But we countered that this strategy also works for private equity firms, who may earn more due to their first-mover position.

In any case, it may be years before the public has the final say on governance policy. At the beginning of the game, when the most important decisions are made, companies and funds will have control without governance tokens. therefore,in conclusion

in conclusion

Given the playability and economic value of games and NFTs, GameFi presents an opportunity to bring the next tens of millions of new users into the cryptocurrency space.

Since mid-2021, we have witnessed the first explosion of crypto games. More than twice as many wallets interact with gaming nfts and games than DeFi. YGG (Yield Guild Games) is currently valued at $6 billion as they and other on-chain guilds continue to bring users from emerging economies such as the Philippines into the crypto economy. Sandbox will one day be a bigger company than Roblox, and there will be more sandbox games.

If we can solve the problems of the "encryption first, game second" model one by one, the illusion of decentralization and the problem of governance rights, the gamefi revolution will inevitably happen.

Finally, we'll quote a quote from the Loot Project website:

There is a storm brewing, and each of us is bound to be affected by it, can you feel its presence right now?

It's time for us to work hard for this world again. Are you willing to join us to fight together to change your destiny, or choose to remain the same, repeating the hardships of the past to get rewards that can only maintain your life?