Analyzing 60 projects, I found that the best token economic model is…

This article comes fromMirrorThis article comes from

, the original author: Lauren Stephanian&Cooper Turley, compiled by Odaily translator Katie Ku.

Token distribution is inseparable from every Web3 project. At the heart of the ecosystem, tokens are the new form of equity. Tokens typically have governance rights and allow community members to be key decision makers in a product, service or protocol as co-owners of a shared treasury.

Since 2013, blockchain project founders have been thinking about who to allocate tokens to, how to maximize benefits, and what kind of "value-added" space is provided for holders of different roles.

In this article, we aggregated and comprehensively analyzed the token distribution of 60 projects (protocols) (sourced from GitHub, Medium data from 2013), and found a significant trend.

Key Trends in Token Distribution

Tokens tend to be distributed to 6 main roles:

community treasury;

core team;

private investors;

ecosystem incentives;

airdrop;

public sale.

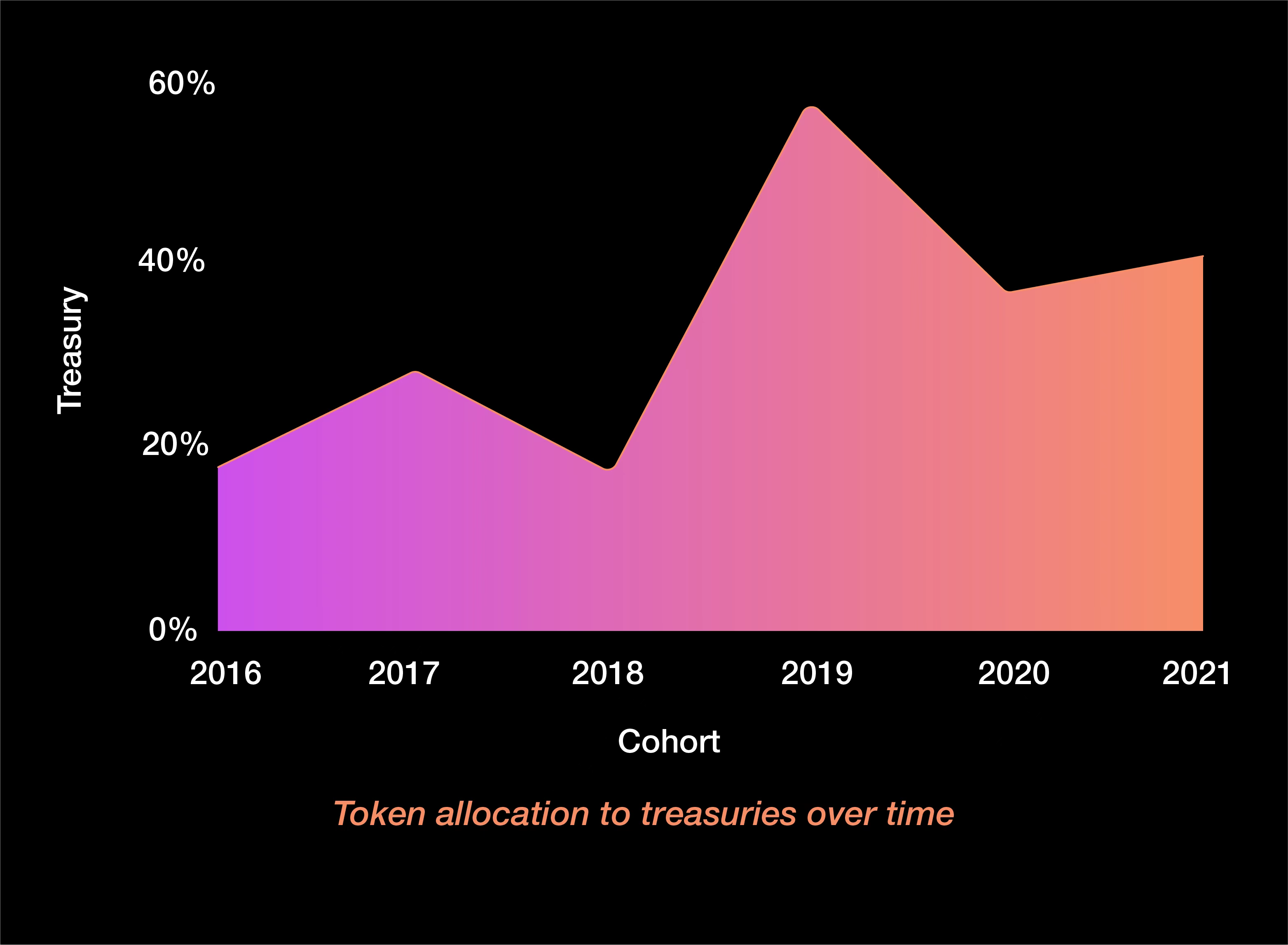

community treasury

The community treasury holds tokens for future governance. The treasury tokens are often viewed as a “reserve pool” for a project, distributed to different stakeholders through voting proposals.In 2016, the average allocation to the treasury pool was around 20%, but by 2021, this has grown to over 40%.

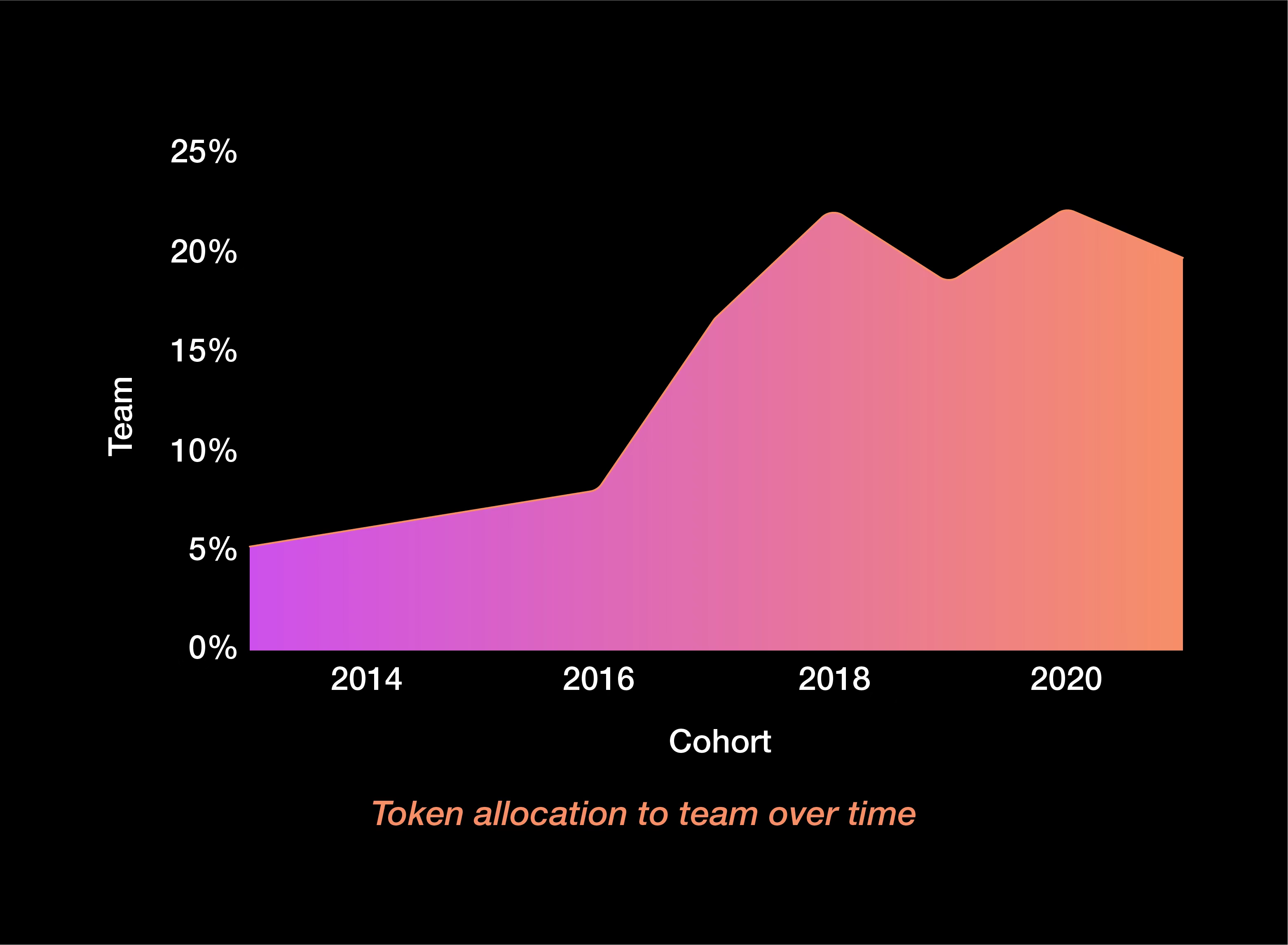

core team

core team

This portion of tokens is reserved for founders, current and future employees. These tokens are subject to a maximum lock-up period and often reflect the team's equity in the company issuing the token.The token distribution ratio of the team has also been on the rise

, rising from 5% in 2013 to around 20% in 2021.

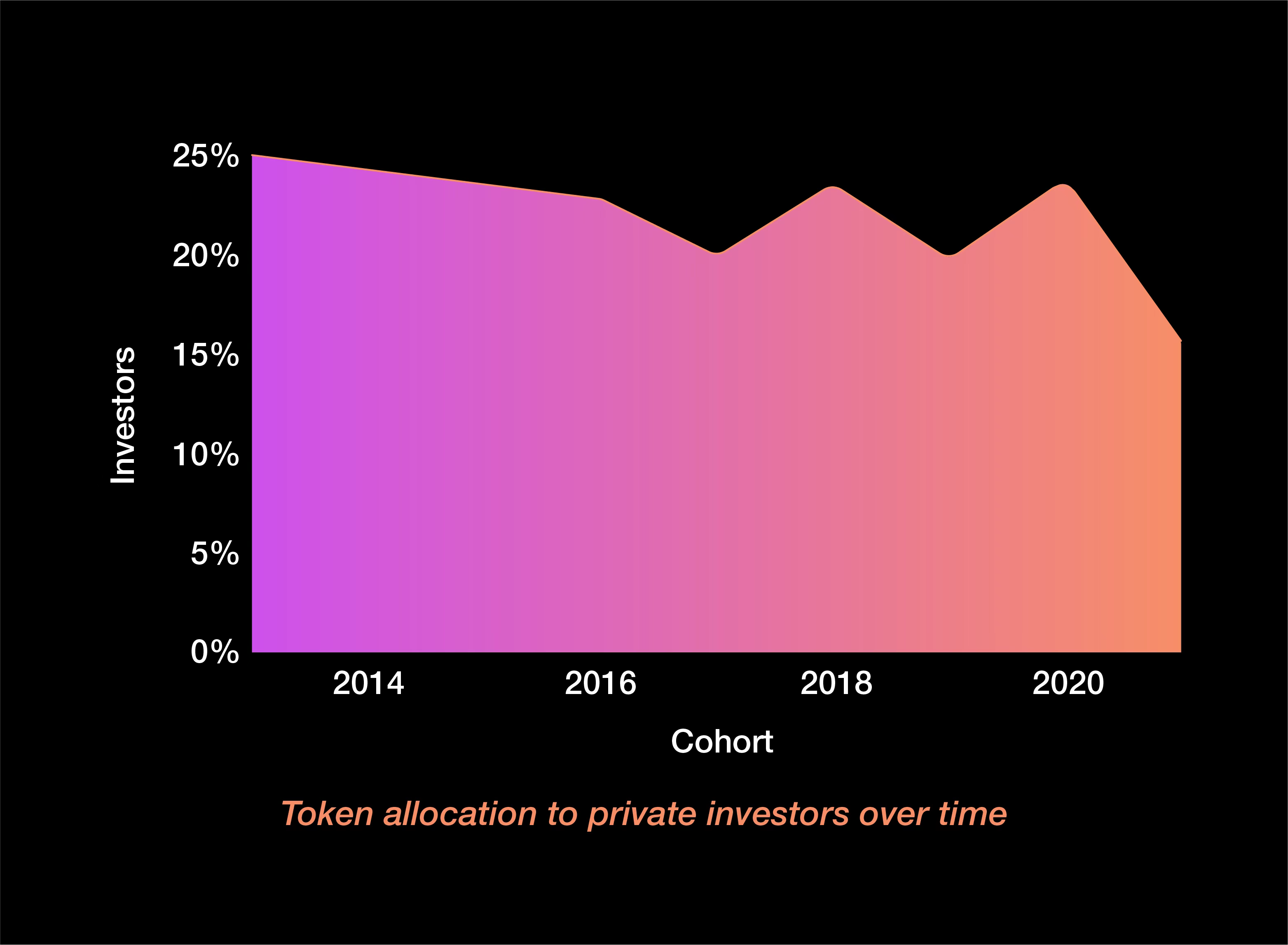

private investor

This part is distributed to capital providers who have purchased equity and converted it into tokens or purchased tokens directly. These tokens are also subject to staking, usually aligned with the core team., from 25% in 2013 to about 15% in 2021.

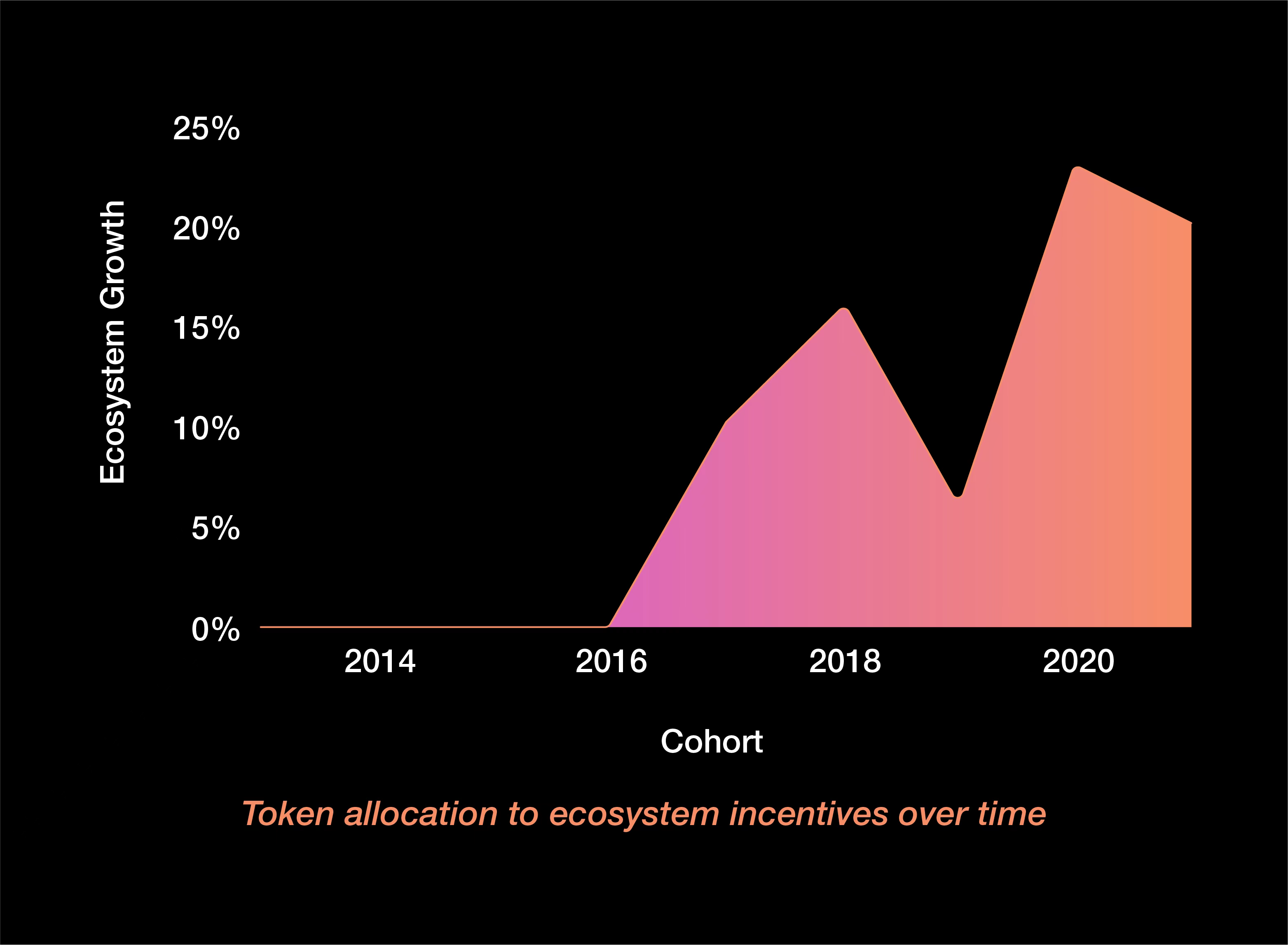

ecosystem incentives

ecosystem incentives

This portion of tokens was earmarked for growth plans at launch. Ecosystem incentives, typically at launch, allow users to earn from a pool of pre-designated tokens. Incentives have emerged as an alternative to public sales, including growth programs, liquidity mining, and yield mining.secondary title

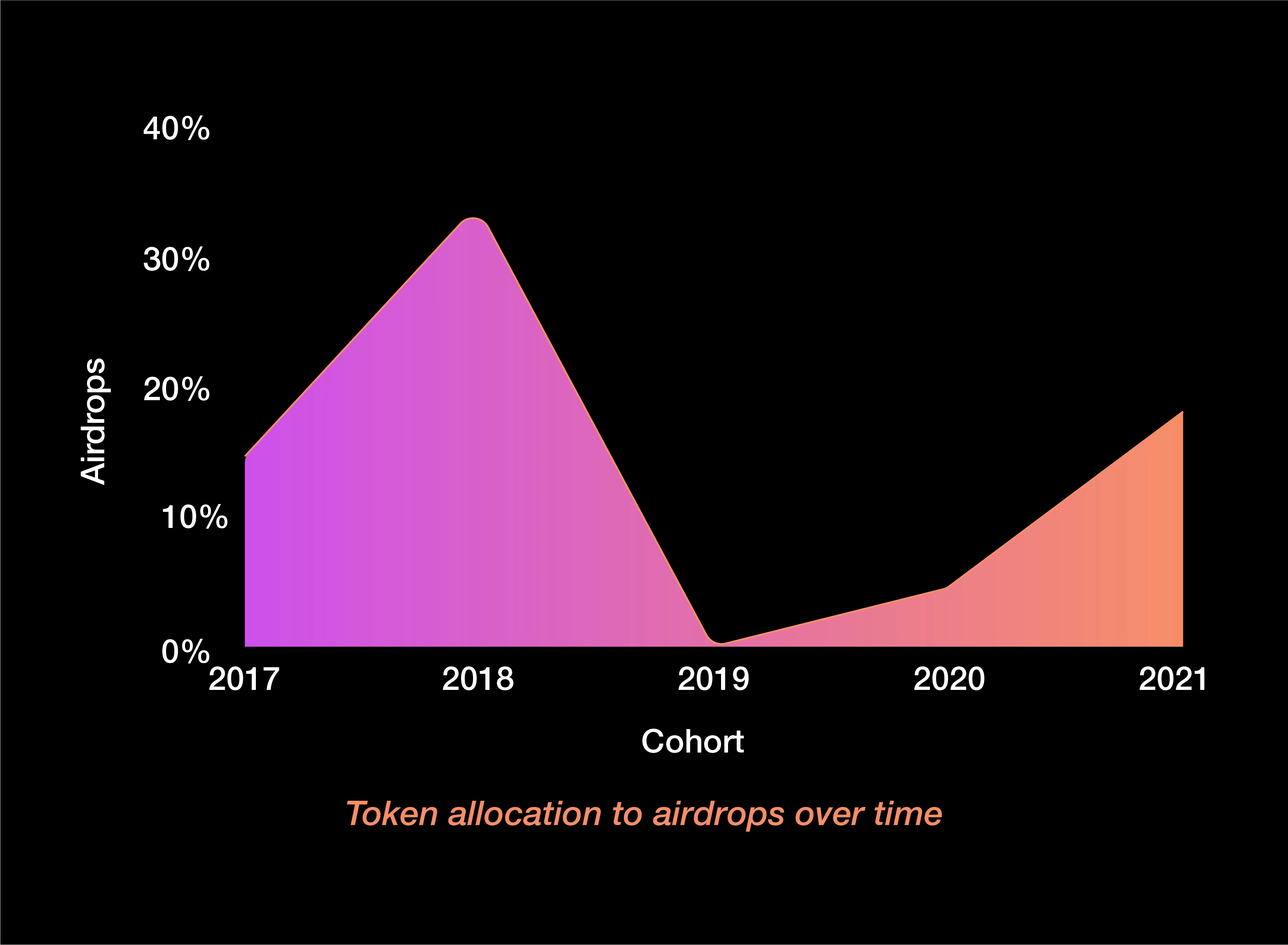

airdrop

airdrop

This portion of tokens rewards past user appreciation actions. The airdrop is liquid at the beginning, and can be applied for according to the pre-set allocation of each address designed by the core team.

Airdrops grew in popularity during 2017 and peaked in 2018.After a short cooling-off period, the proportion of tokens distributed by airdrops has increased in recent years

, from nearly 0% in 2019 to 15% in 2021.

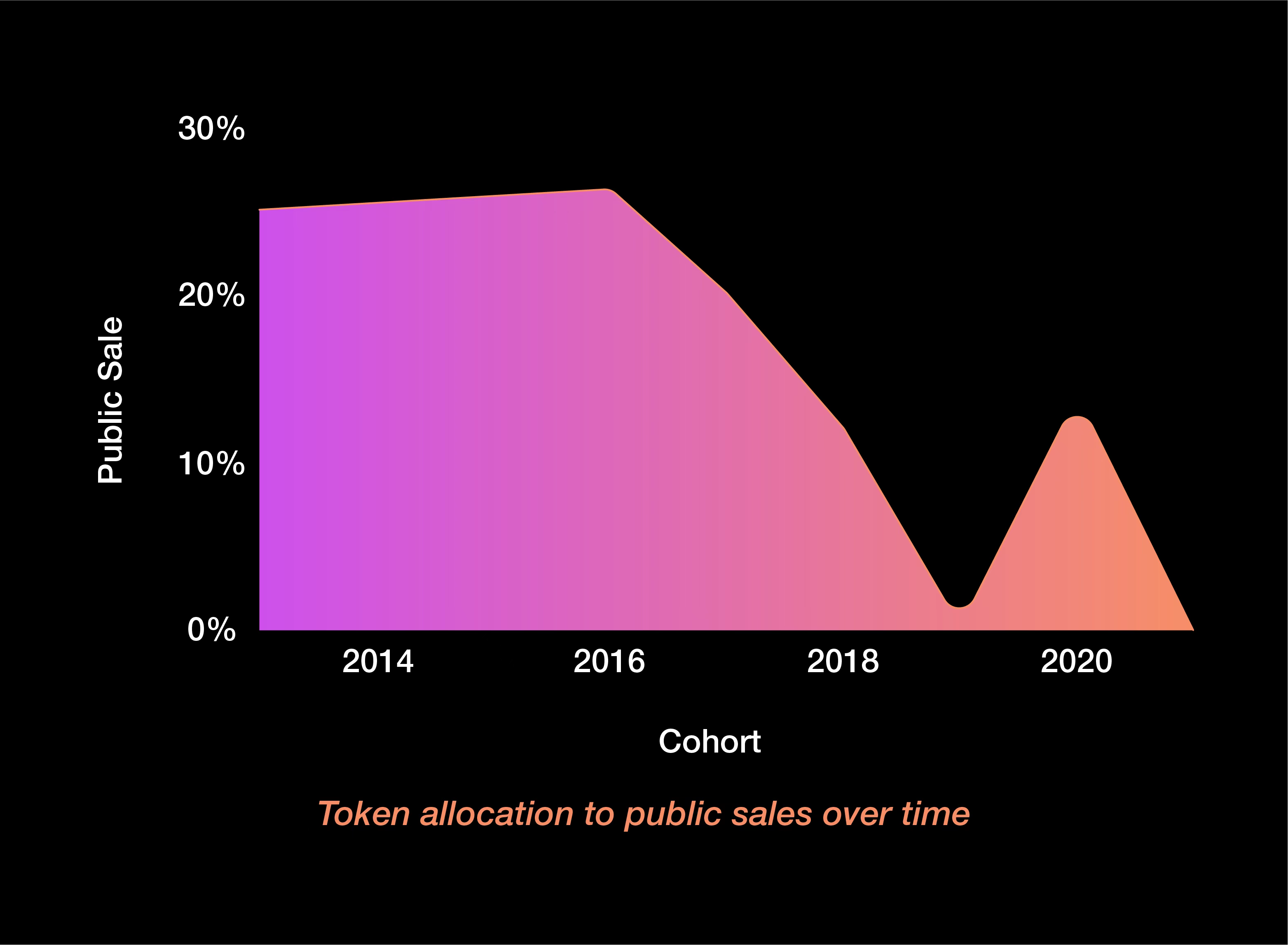

public sale

These tokens are for the general public. Public sale tokens are sold at launch and are liquid in initial proportions.The percentage of tokens sold to the public dropped sharply

, from 25% in 2013 to nearly 0% in 2021.

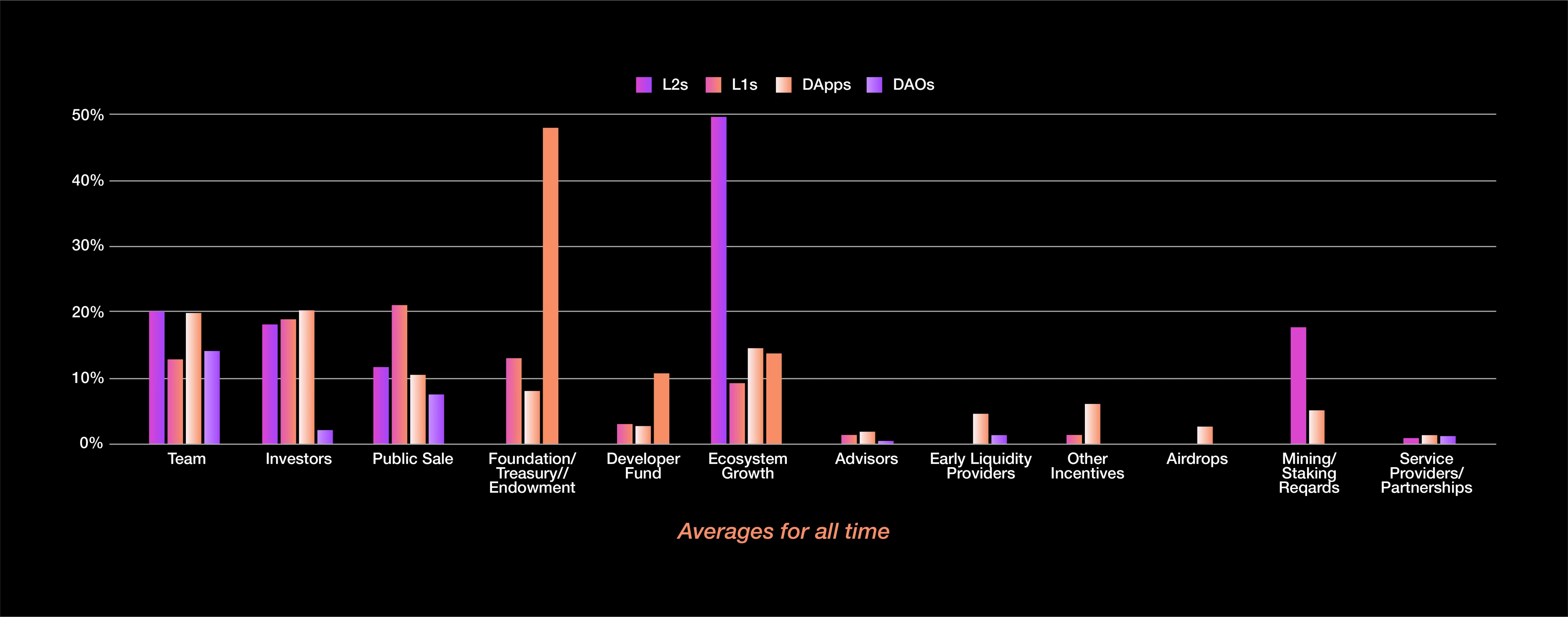

Allocation of Tokens by Project Type

Projects on different tracks often correspond to different distribution ratios.

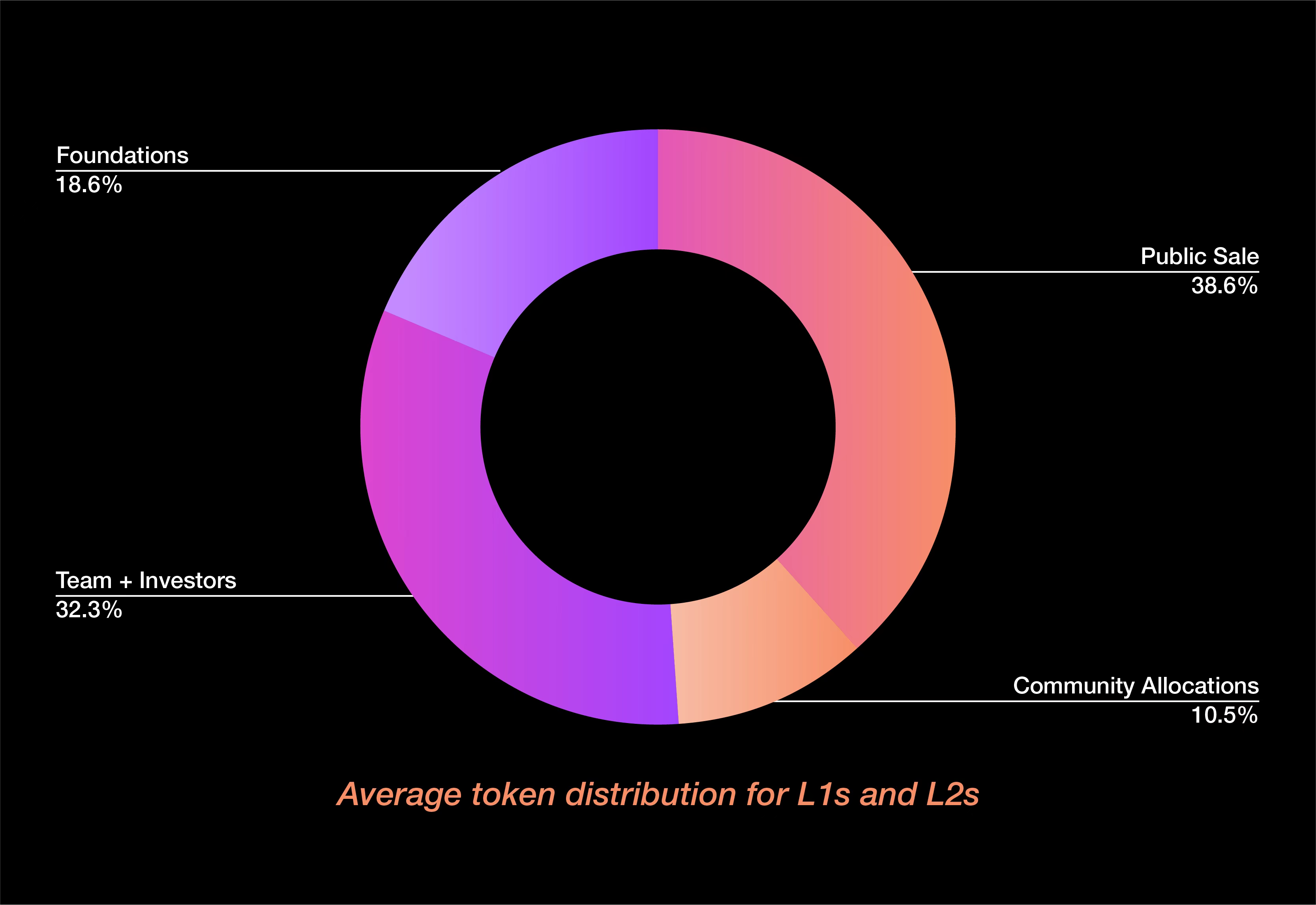

Layer 1 and Layer 2

L1 and L2 tend to dedicate the largest portion of their token supply to early stakeholders and their public sale.

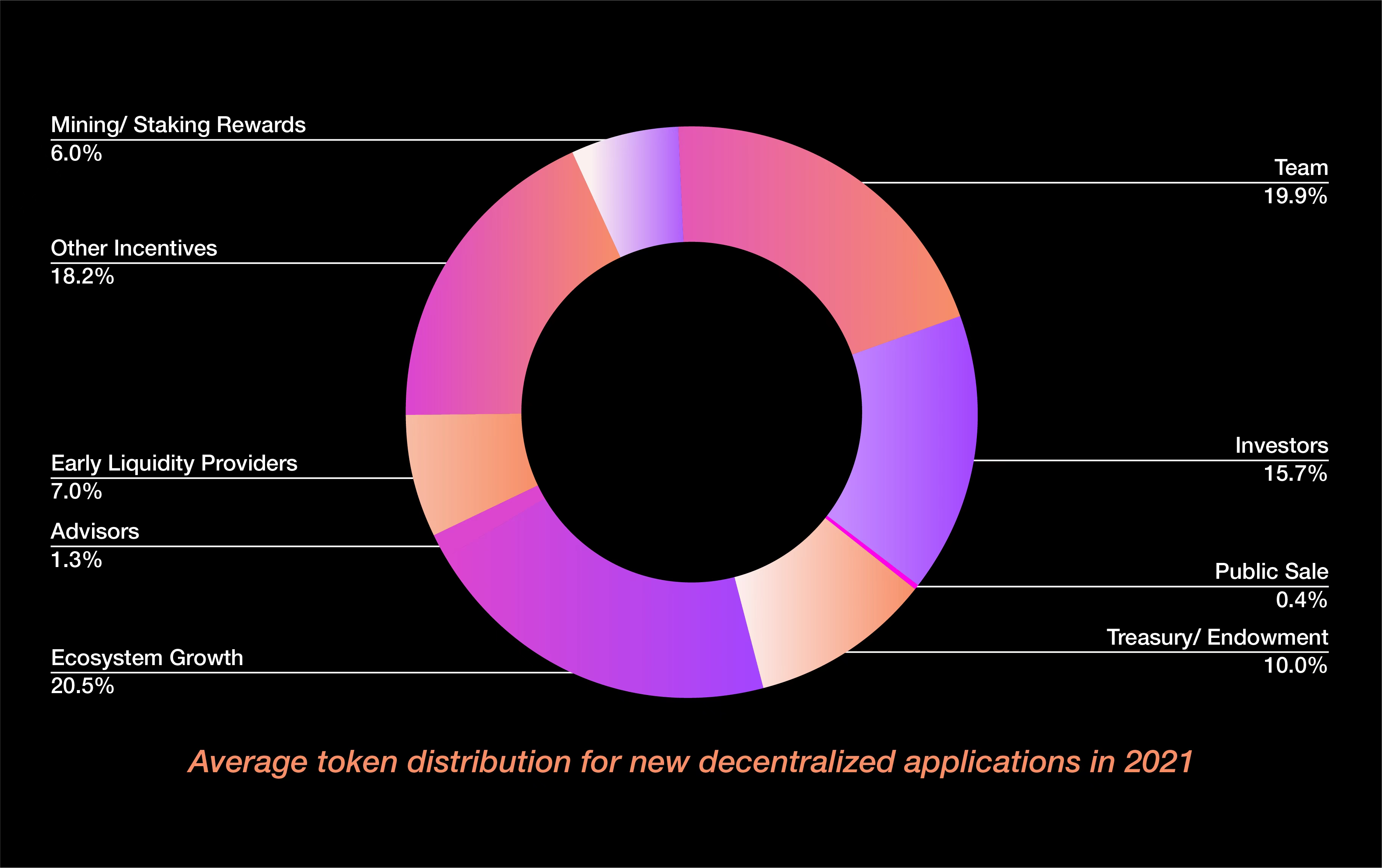

DApps

These projects are usually from earlier projects of their kind, which means that these projects usually raised funds during a time when public sales were more popular.

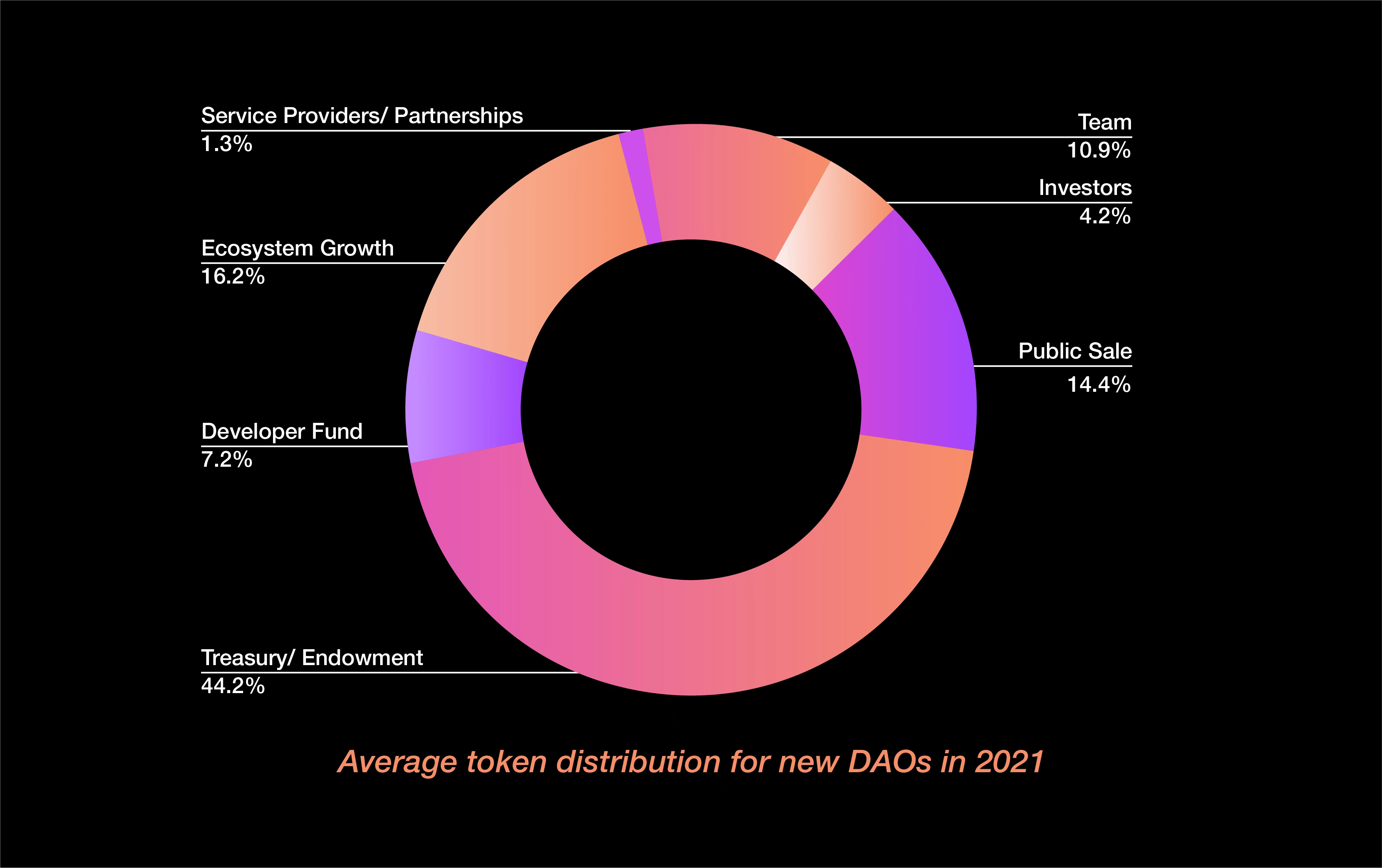

DAOs

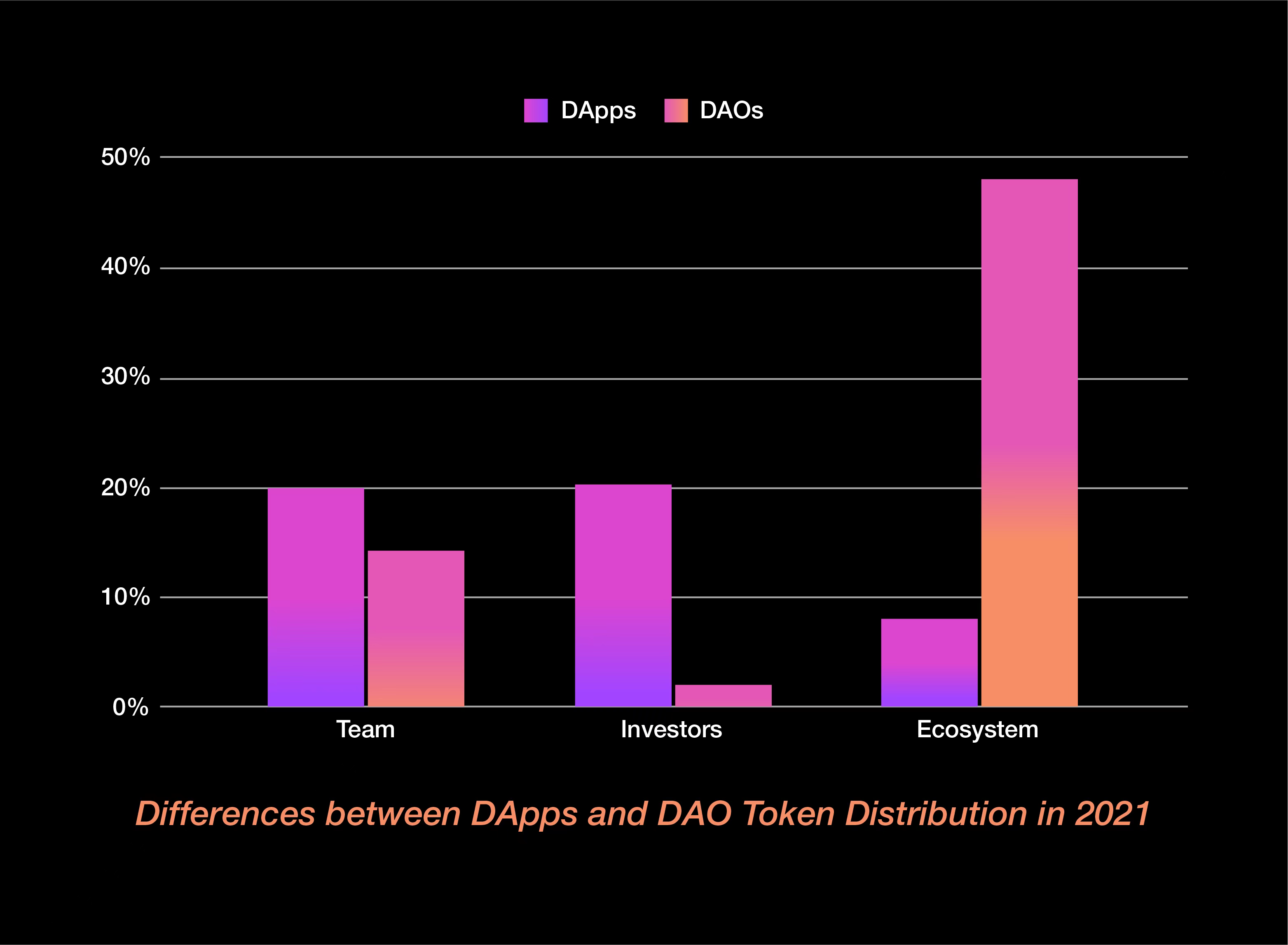

For DApps, the team's allocation is around 20%, while investors' allocation is around 15%. Approximately the same percentage of tokens is reserved for ecosystem incentives.

DAO contributes less to the team, averaging around 10%. The minimum is usually allocated around 5% to investors, while the largest portion goes to treasury and ecosystem incentives.

In 2021, we see a clear shift in tokens in favor of the community. Whether it's airdrops, ecosystem incentives, or treasury pools, The DAO is the driving force behind this change.

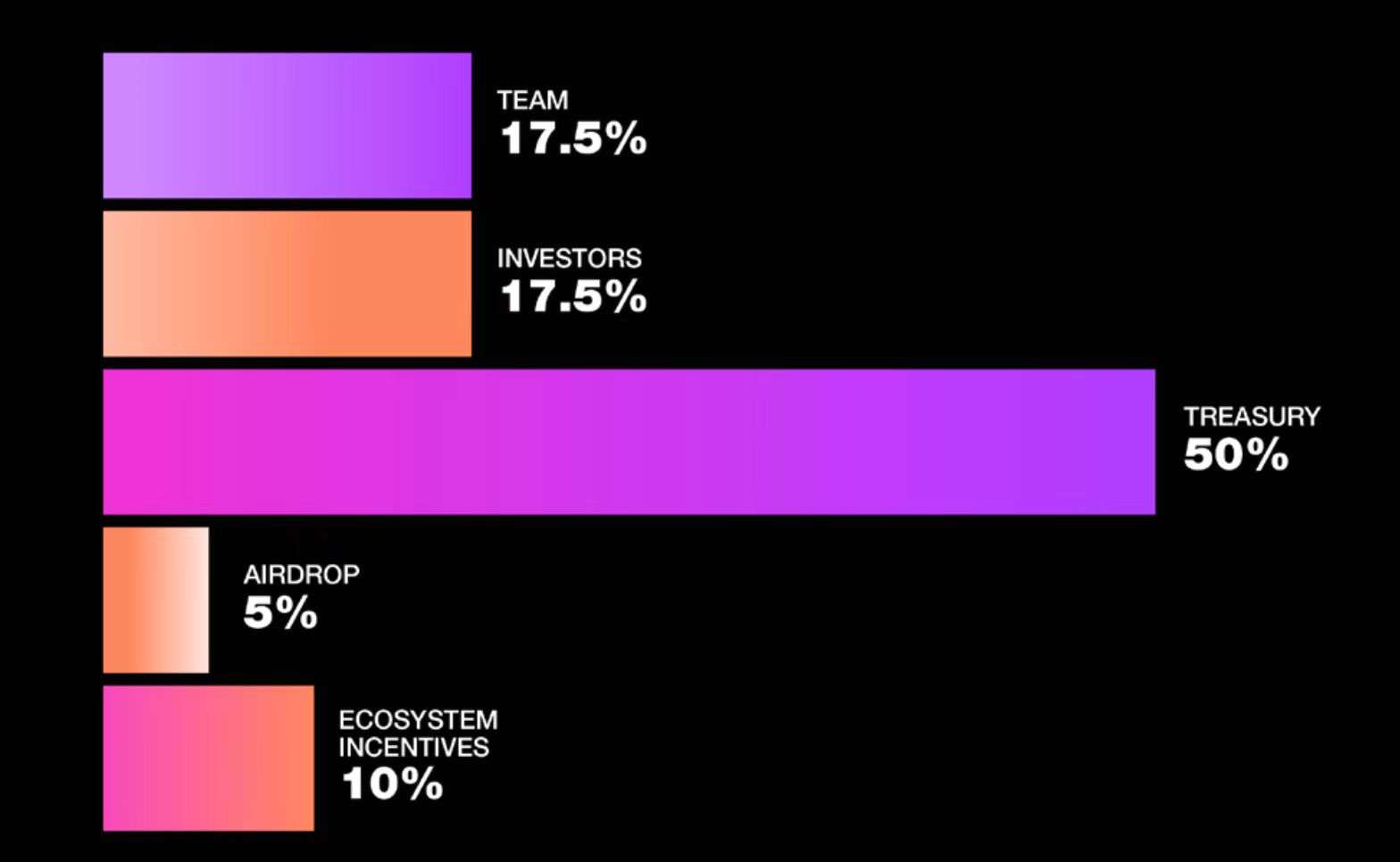

The optimal ratio of token distribution

For teams planning to distribute tokens in 2022, here are our suggested token distribution ratios:

Note that the team and investors are allocated the same amount, which gives the project the flexibility to invest more tokens in the other direction.

It seems common practice to set aside 50% for the treasury, although this percentage should be increased or decreased relative to the distribution of airdrops or ecosystem incentives.

0% of tokens earmarked for public sale. In the case of a public sale, these tokens should be withdrawn directly from the team, investors, and community treasury, in that order.

Overall, this distribution ratio can be used as a rough baseline for your team in 2022.

key points

key points

While Web3 is evolving, this bull market has changed the dynamics for all involved.

The distribution ratio of investors is decreasing;

The team ratio is increasing;

Airdrops have become the cornerstone of most distributions;

Public sales have all but disappeared;

The DAO has transferred most of the ownership to the community treasury and ecosystem incentives.

A competitive investor market means teams are raising money at higher valuations while investor ownership is shrinking. With more than $30 billion in venture capital invested in the cryptocurrency space this year, founders currently have the upper hand when it comes to negotiations.

A few years ago, founders set aside 5% of their funds for themselves and the early-stage team. In 2021, the founders will reserve about 20%, which is more in line with the traditional venture capital model.

While investor ownership has decreased, they still represent an average of 15% of the total token supply, down from 25% a few years ago.

We have noticed a direct rise in the percentage of tokens distributed to the community, especially through airdrops. Airdrops became popular and have become a major turning point for any token launch these days.

Under legal constraints, public sales have been replaced by community treasury reserves and designated ecosystem incentives for value-added actions.

The most plausible reason is the proliferation of DAOs, which have seen an explosion of interest from both original crypto users and newcomers.

What's next?

As a token founder, it is important to recognize that these dynamics will change as the market evolves.

In a bull market, founders have the upper hand. In a bear market, investors have the upper hand.

One common denominator is community. If there's one thing that's true, it's that we often see the community take more than half of the token distribution, even if that distribution is based on governance.

Contributor expectations focus on those who can do capital allocation and operations, i.e. in terms of money management and diversification.

Outside of direct governance, we see ownership flow to those who create meaningful value for a product, community, or protocol. In addition to optimizing secondary market liquidity or financing, we note a clear intention to put tokens directly into the hands of those who continue to create value for a given network.

As we head into the new year, we expect more token distributions to be skewed towards active contributors rather than those who simply provide funding.

Although the above data is not comprehensive, we hope that this report can provide a stronger belief in the token distribution of the project party, and also provide a signal for insiders.