ETH Weekly | V God said that the Ethereum white paper successfully predicted DeFi, but ignored NFT; the total trading volume of Ethereum futures and options will hit a new high in 2021 (12.27~1.2)

Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

1. Overall overview

Second, the secondary market

1. Spot market

In terms of the secondary market, the current ETH price may pull back slightly in the short term, with support at $3,500, $3,300, and resistance at $3,910.

Second, the secondary market

image description

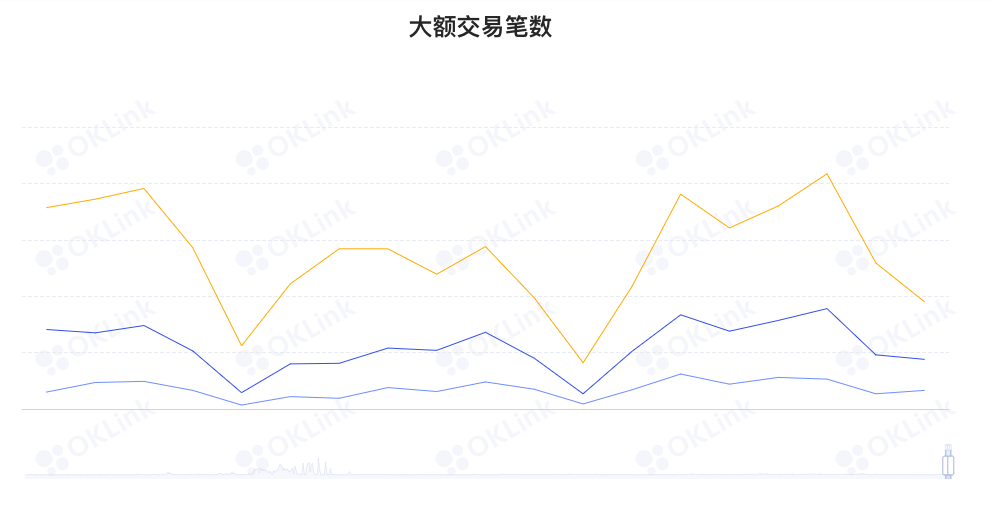

2. Large transaction

OKlink data2. Large transaction

3. Rich list address

OKlink data3. Rich list address

3. Ecology and technology

1. Technological progress

It shows that the current top 300 ETH holdings hold a total of 53.59% of ETH, a month-on-month decrease of 0.06%; in addition, the entire position distribution presents an elliptical structure, and the proportions of each part are: 1st to 100th, accounting for 39.9%, 101st to 300th, accounting for 13.69%, down 0.12% from the previous month; 301st to 500th, accounting for 6.11%, down 0.06% from the previous month; 501st to 1000th, accounting for 7.09%, up 0.02 from the previous month %; after the 1001st place, accounting for 33.23%, a month-on-month increase of 0.09%.

3. Ecology and technology

The Ethereum community proposes a new Eth2.0 sharding scheme, where block proposers include transactions in the execution load with shard data

2. Voice of the Community

The question turns into: what happens to the mempool in this case? Will the public mempool expand to accommodate all these transactions from block builders? Currently, flashbots help to send transactions directly to builders, skipping the dark forest of mempools. Once sharding occurs, can the common memory pool be completely abandoned due to scalability issues? The latest idea of censorship resistance for post-merge block proposers requires a common mempool, and the performance of mempools in the post-sharded world should be benchmarked.

2. Voice of the Community

On December 29, Musk said in an interview with podcast host Lex Fridman that his general approach to any transaction is to ensure that he understands it clearly, but he has never fully understood the Ethereum smart contract, and joked that it is because he is too Stupid. In addition, Musk also stated that although he does not know who Satoshi Nakamoto is, he believes that Bit Gold and digital smart contract inventor Nick Szabo (Nick Szabo) are "more responsible" for the evolution of the Bitcoin concept. Nick Szabo claims he is not Satoshi Nakamoto. (Forbes)

3. Project trends

(2) Vitalik: The Ethereum white paper successfully predicted DeFi, but ignored NFT

V God tweeted, “The applications envisaged in the Ethereum white paper include ERC 20 standard tokens; algorithmic stable coins; domain name systems (such as ENS); decentralized file storage and computing; DAO; wallets with withdrawal restrictions; machines; prediction markets.

3. Project trends

(1) Web3 content delivery network AIOZ Network has been launched on the main network

AIOZ Network has launched the main network on December 26. It is reported that AIOZ Network is a Layer 1 interoperable multi-chain Web3 content delivery network. In addition, AIOZ Network will launch a cross-chain bridge between Ethereum, BSC, and AIOZ Network on January 8, 2022.

(2) Sarcophagus, a decentralized disable switch application, raised $3.67 million

Sarcophagus, a decentralized disable switch application, completed an on-chain financing of US$3.67 million, with participation from Inflection, Infinite, and Lo Enterprises. Sarcophagus was incubated by Web3-focused Decent Labs. It is reported that Sarcophagus is a decentralized disable switch application based on Ethereum and Arweave. Users can upload files in Sarcophagus and specify the recipient of the private key. If the user fails to perform an action in the future or the set time expires, the recipient will receive the private key to open the user's files stored in Arweave. Usage scenarios include wills and trusts, password recovery, credential storage, etc.

(3) APWine, a tokenization protocol for income rights, has been launched on the Ethereum mainnet and Polygon

According to official news, APWine, an income rights tokenization protocol, has announced that it has launched the Ethereum mainnet and Polygon. DeFi users can speculate on the volatility of yields generated by different protocols through the 90-day futures pool on V1. In addition to hedging the risk of passive income, DeFi users can also expand their exposure without owning the underlying assets.

(4) DeFi trading platform Slingshot has launched Optimism

Earlier news, Slingshot announced the completion of $15 million in Series A financing, led by Ribbit Capital, K5 Global, Shrug Capital, The Chainsmokers, Jason Derulo (singer), Guillaume Pousaz (Swiss entrepreneur) and Austin Rie (co-founder of music company Morning Brew) People), Electric Capital, Framework Ventures, etc. participated in the investment.

(5) Gas DAO airdropped GAS tokens, and the Gas fee once exceeded 200 Gwei

Sebastien Borget, co-founder and chief operating officer of Ethereum-based metaverse game The Sandbox, said in an interview that in 2022, the game will launch a game testing period similar to the Alpha season every few months to learn from the plot (LAND) ) owner for more feedback. We will also migrate The Sandbox to Polygon to reduce high transaction fees and network congestion when interacting with the game.

4. Borrowing

DefipulseAdditionally, Borget said The Sandbox will launch a DAO for LAND owners in 2022. Once creators who hold LAND are able to build and share their interactive experiences, and the game migrates to Polygon, The Sandbox will be more widely available to the public, even for players who don’t own LAND, Borget said. (Decrypt)

The data shows that the value of locked-up collateral on the chain dropped from US$102.58 billion to US$100.98 billion last week, a decrease of 1.5% a week; a net increase of US$5.08 billion in the previous week and a net decrease of US$1.6 billion last week, a month-on-month decrease of 131%. Specifically, the amount of ETH mortgages dropped from 8.959 million to 8.94 million last week, a drop of 1%; the amount of BTC mortgages rose from 228,848 to 230,167, an increase of 1%.

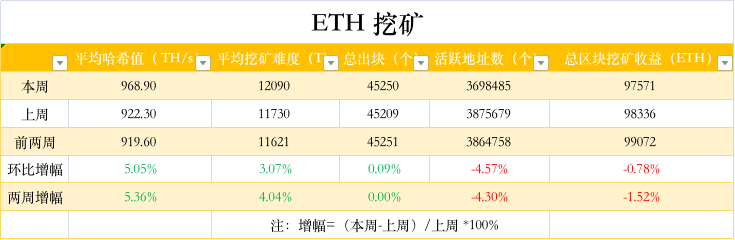

5. Mining

(data from etherchain.org)

etherchain.org5. Mining

4. News

image description

(data from etherchain.org)

Data shows that last week the Ethereum network computing power exceeded 1 petahash per second (PH/s) for the first time, hitting a record high; the current network computing power is close to 1PH/s, if every miner uses 1.5 GH/s equipment, then Now 1 million machines are needed to support the Ethereum network; the average computing power increased by 5% month-on-month to 968.9TH/s; the average mining difficulty increased by 3% month-on-month to 12090T; the activity on the chain decreased by 4.5% month-on-month. The trading enthusiasm dropped slightly, and the total mining revenue decreased by 0.8% month-on-month.

4. News

(1) The total pledge amount of Ethereum 2.0 exceeded 9 million ETH

The latest data shows that as of January 3, the total number of pledged Ethereum 2.0 Tokens exceeded 9 million ETH, reaching 9.246 million, and the current number of network validators is 276,617.

(2) The number of addresses holding more than 0.01 and 0.1 Ethereum hit a new high

Glassnode data shows that the number of addresses holding more than 0.01 ETH reached 20,293,248, a record high; the number of addresses holding more than 0.1 Ethereum reached 6,453,315, a record high.