Please check the first 4D Crypto wealth password in 2022

TwitterAdam CochranTwitter, for its prediction of the ultra-yield theme sector in 2022, including judgments on 48 promising cryptocurrencies, compiled by Odaily translator Katie Ku.

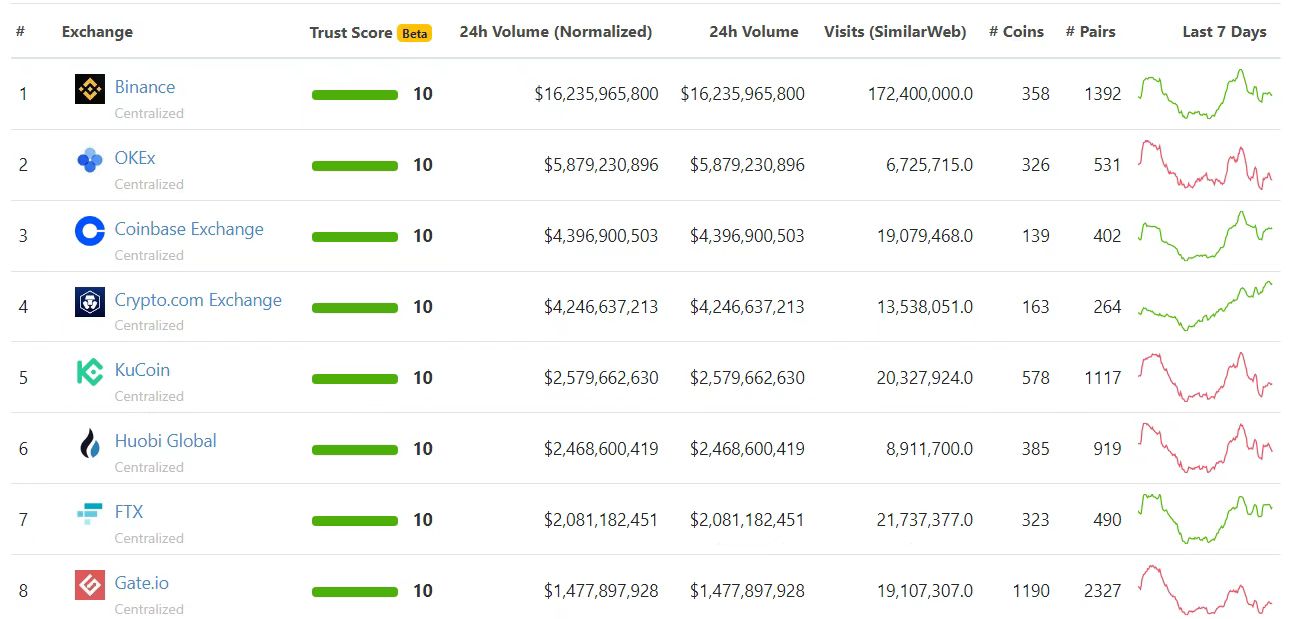

1/204 As I promised, here's my 2022 cryptocurrency "shopping list" and 2022 start year predictions article. Let's analyze why certain assets are chosen, how to operate them, and the bullish case for each asset.

2/204 First, here's a "shopping list" of what I think will be great in 2022. This means that instead of buying all of these assets at once, I will prioritize "buying the dip".

3/204 I think it will also outperform the index, the main asset (BTC) and its peers. This means that some good projects did not appear in this list. For example, Solana has made a breakthrough this year, but it is predicted that it will be difficult to break through next year.

4/204 Solana is likely to rise as well (or slightly above an index). Many projects in its ecosystem are also under the spell of FDV (fully diluted valuation), so even if they are great products, they are unlikely to perform well in the new year.

5/204 To be on this list of my 2022 cryptocurrency "shopping list":

the product is in operation;

There is a catalyst to make it explosive in 2022;

Compared with peers, there is room for growth;

There is external cash flow.

6/204 There are still many great technologies and projects that did not make this list, because 2022 is not their breakout year at all. People greatly underestimate the time it takes to build, market and sustain market growth.

7/204 I think there are good reasons for these assets to outperform. However, it's worth remembering that obviously not all of these assets will be hit. You also can't put all assets equally in one portfolio.

8/204 As a long-term value investor, I may reconfigure my investment portfolio, I am willing to have a 60%-70% error rate, hold the project for more than 5 years, and lose up to 100% on any asset I buy 3 years.

9/204 Normally I wouldn't have a loss like this but investing in real assets that aren't just hyped is like investing in a startup, you need to invest for the long term.

10/204 So why are these assets on the list? The following is a summary of my 2022 year-opening forecast article:

Cash flow is king, followed by infrastructure.

11/204 We've had another frothy, hyped bull cycle. It attracted a lot of people into the circle and made a lot of money, but in fact everything was nothing.

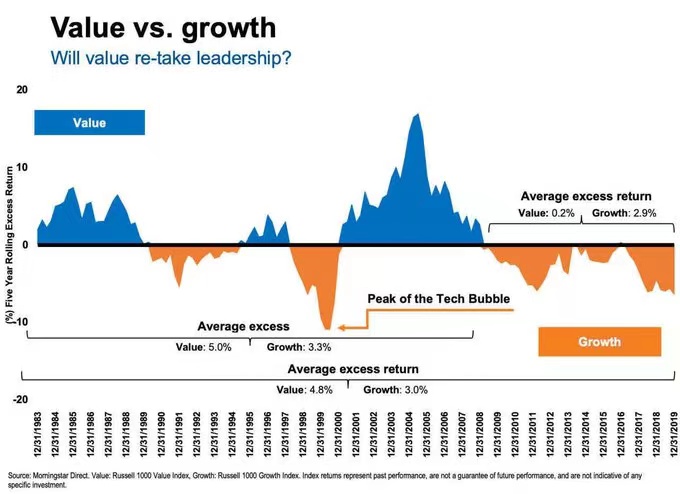

12/204 When traditional markets go through this, we see a shift from what we call "growth stocks" to "value stocks" as people look for really stable returns to protect speculative currency gains.

13/204 We don't really have "value" stocks in most crypto cycles. Almost everything is priced in terms of the "future" (let's be honest, retail investors have no idea how much something is worth, especially in the future).

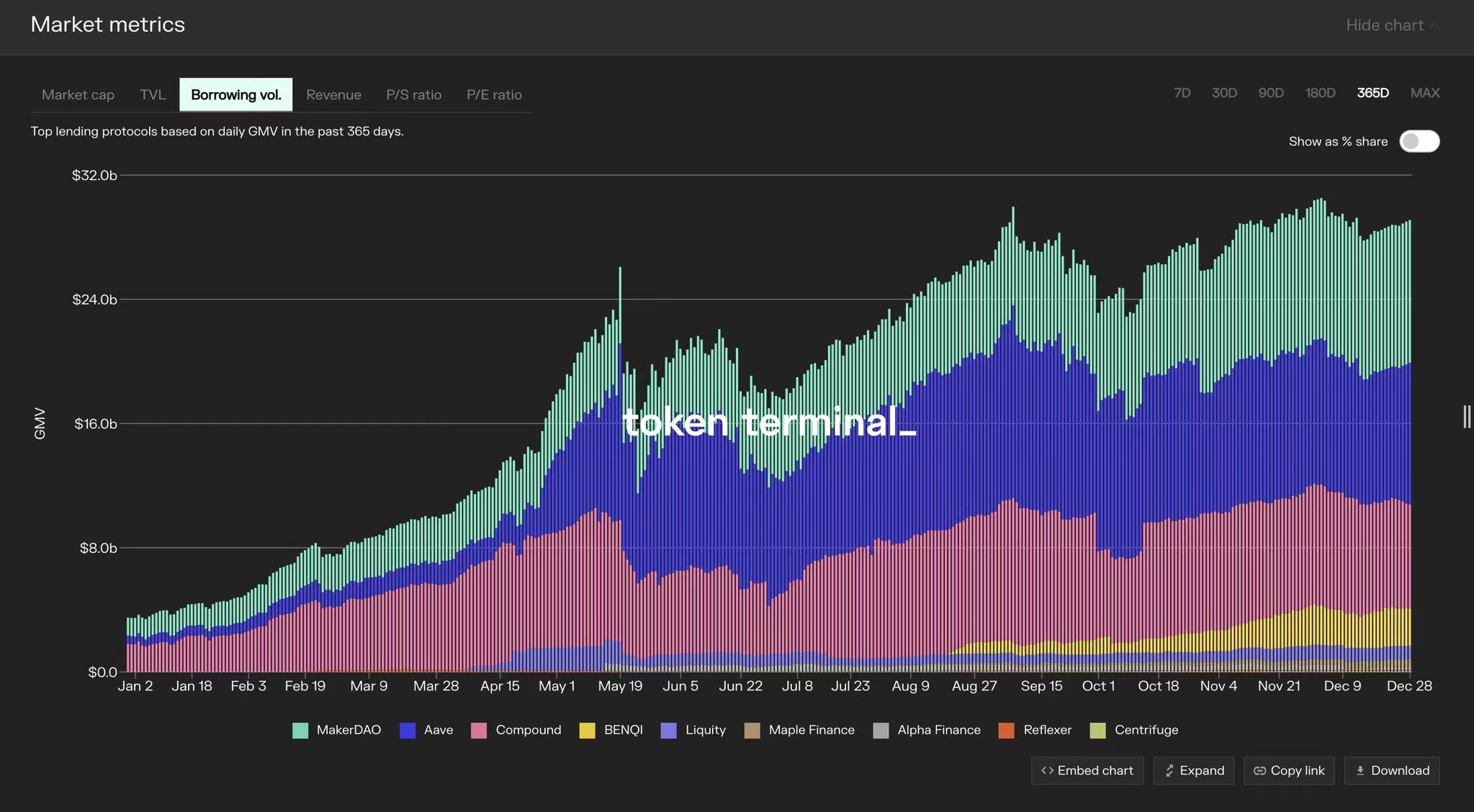

14/204 However, this is starting to change as crypto gains popularity and we are starting to see protocols actually generating revenue. Cryptoasset analysis tool TokenTerminal gives us a good look at a number of protocols that are starting to drive real revenue.

15/204 Even those agreements that do not bring benefits to tokens still have huge demand at present, such as lending agreements, and the average lending rate will increase by 10 times in 2021.

16/204 Dissecting the quality and source of benefits is important and complex. But one thing is for sure, protocols with real gains tend to fare far less well in 2021.

17/204 Because 2021 is the growth cycle for cryptocurrencies, when we are stuck at home with checks in hand and eyes sparkling, we look at the market together and think "yeah, this dogecoin could be future".

18/204 So anything not loaded and loaded will be penalized and oversold. Because the reality is that most people don't realize the time, complexity, cost, or potential ceiling of growing their business.

19/204 At the end of the day, it's all about cash and value. If you provide a valuable service that is worth protecting or controlling, people will buy. If you have a profitable product, people will buy it too.

20/204 Because the cash fuels the build team, building a product that bridges the chasm and delivers value. That's why you'll see many of the products I've picked for 2022 come from classic DeFi products made by teams that have spent more than 5 years in the market.

21/204 The bubble will fade and we will move to products that make money and have a broad, real, value-add user base.

22/204 The second category is infrastructure. This year, with the help of L1, we learned that there are still many gaps in the tooling.

23/204 I don't think we've done a lot of that this year, not enough. But what we do is validate the requirements.

24/204 We saw the debut of L1 and L2, which let us know how unusable and insecure cross-chain bridges are. We also learned that in L2 with lag, people are willing to pay a premium for instant.

25/204 From Vitalik's earlier "Ultimate Battle" article, we learned that Ethereum's path forward actually looks very much like a multi-chain world. When forks exist, moving between them is a bit like moving between L2s.

26/204 We are starting to see some subnetworks being done by Avalanche, with projects like Cosmos and Atom under consideration.

27/204 All of this confirms a huge critical problem. In a multi-chain world, the availability of data and assets is a huge gap. We need reliable data, cross networks/chains/forks, and move assets quickly that way.

28/204 Most solutions such as multi-chain indexes, on-chain tokens, or fully fledged scaling solutions will not have their case for excellence in 2022. My guess is 2023-2024.

But some like real-world assets, on-chain futures and cross-chains may be ready for prime time.

29/204 Infrastructure investment is plentiful and most will be mediocre.

Just like the AMM boom we saw after Sushi, 99% of companies will fail. But the winner will grab years of market share like a bandit.

30/204 Other things may pop up during the year, and maybe we'll stumble upon a new raw data, or a new extension technique, that will do us real good.

But all of these are short-lived for me, I have no interest in investing in short-term projects.

31/204 Instead, 2022 is the year to focus on the real value drivers that I think can break through, outperform 2022 performance, and then hold and sustain value going forward.

Let's start analyzing this cryptocurrency "shopping list" together.

32/204 This list is sorted by game tier list.

33/204 I will explain each category and the assets within it.

Remember, these are my personal picks that make sense in my smooth long-term portfolio, with diversified exposure, high risk tolerance, etc.

This is not investment advice, remember.

34/204 I'm not good at naming things, these are my top picks for 2022 that will perform well and stay strong.

They are basically assets that I bought, staked or locked up.

35/204 A big motivator for these assets is not that I personally think they will only appreciate significantly in the future, but that they have a lucrative external return driver that gives them potential.

36/204 This means that the returns earned by staking/locking these assets have an APY (annual yield) payout that covers a significant amount of the asset's cost risk and is external non-dilutive income.

37/204 What's more, most of these assets are also tokens large enough that you can borrow liquidity from multiple providers, allowing you to defer taxes while still doing other things.

38/204 soMy top four picks include the following four assets:

$ETH

$YFI

$CVX

$KP3R

39/204 $ETH

This should be obvious, I keep saying that ETH 2.0 drives huge economic cycles.

As the merger (merge) approaches, the sound of the encryption war drum will be louder, and I think we have already fired the first shot in 22 years.

40/204 Before EIP-1559 was implemented, so was the prediction that ETH 2.0 would actually create a price upcycle, so that would be 10x potential.

41/204 With the growth of scaling solutions, ETH will be a tough opponent to beat in the EIP-1559 burn and upcoming merge, and I think it will outperform any major asset .

42/204 $YFI

For Yearn, I'm going to follow last week's best picks.

Their growth, external revenue ($100M+/yr, excluding incentives), change in token model, upcoming buyback ($45M) and use case makes me think they beat ATH this year.

43/204 $CVX

I came into contact with CVX very early and called it the "king builder" of DeFi.

I think it's likely to continue going strong into 2022, but it wasn't on my top performers list before then.

44/204 Three things changed that:

Votium bride: they are growing much faster than I expected and validate the model;

Curve V2: will acquire most of the AMM (Automatic Market Maker) volume for new projects;

Convex extends beyond Curve (see cvxFXS).

45/204 I hope to continue to lock in my CVX (about 50% annual income, about 2.4 times the price-earnings ratio), and CVX may grow another 2 times this year.

46/204 With these changes coming quickly towards the end of the year, I still probably wouldn't hold back if CVX traded at 8x to 10x its current value over the next few years, which would still make it one of the most profitable P/E assets out there.

47/204 I think CVX might be worth it if it can take down other DeFi protocols as well, not to mention if Curve V2 can take down the AMM (Automated Market Maker) market.

48/204 For CVX, I just plan on relocking my $CVX each cycle, delegating to the Votium app, and continuing to earn rewards as it takes over DeFi governance.

With current returns, CVX is down 50% and you can still break even on staking.

49/204 #KP3R

Last week I wrote a post on Keeper as my pick.

The general point of view is:

You bought two agreements for one dollar.

The FixedForex project is actually what the founder of Yearn Finance built Curve for international currencies.

50/204 TradFi Forex has a daily off-chain transaction of $6.6 trillion. Eventually, some will move on-chain.

Keeper is growing fast in this market and it has helped change the game for international users as payment channels bite us.

51/204 Another guess I have is that at some point $CVX started eating #KP3R like they would eat FXS. This will add compound interest value to both.

52/204 strong advantages:

I think this category of assets has a key catalyst in 2022 to outperform their peers strongly.

Many of these assets are oversold, but some have growth potential.

53/204 So which assets fall into this category?

$FLX (Reflexer protocol)

$CRV

$ALCX

$BAL

$ZRX

$FXS

$RBN

54/204 $FLX (Reflexer protocol)

The creators of the $RAI stablecoin, I have a dedicated post for them. Roughly the content is that $RAI is the purest stablecoin, however neglected, it contains many key catalysts.

55/204 I think in the long run Web3 will adopt its own stablecoin and you will see a weakening of dollar denominations. $RAI is the perfect candidate, which is its long-term driver.

2022 will be its first breakthrough.

56/204 $CRV

I don't have an overview specifically for Curve, but the bullish side here is simple.

Although I think the output value of its stable mining pool (StablePool) is too frothy, Curve2.0 has changed everything.

57/204 Currently, new projects are usually invested through the Sushiswap Onsen pool, while major projects are usually traded through Uniswap.

The complexity of 58/204 UniV3 caused many traders to lose money intermittently. This is great for professional market makers, but mainstream users don't appreciate the complexity.

59/204 Sushi is also going through its own period of chaos, and while I think it can come out of it, it will take a while to gain a foothold, leaving a huge gap in the AMM market.

60/204 I think most of them are filled by $CRV, $BAL and $ZRX.

But Curve incentives will easily be the new way for projects to incentivize their mining pools at launch.

61/204 This will bring new users to Curve, help them capture routing volume, and get more projects interested in Convex and Curve.

The only way this wouldn't be the case is if Curve is too slow to roll out more V2 pools, or governance gets in the way of too much judgment.

62/204 Overall, this is a huge opportunity. I think they will easily capture these advantages and will bring significant superior performance (measured by price appreciation + staking returns).

63/204 $ALCX

This is another project that I haven't specifically discussed, but $ALCX is one of the few projects that I think has "growth" potential in 2022.

It's one of the riskiest of these senior assets, but also has high potential.

64/204 AlchemixFi's self-pay loan is one of the best new DeFi designs we've seen in the past few years, but it's not without its hurdles like token economics and efficiency.

65/204 They are back on the development map and have been working on AlchemicxV2, fixing many key issues and making some ambitious additions.

66/204 When we think about growth rather than value, the most important question is "can this be a basic primitive element that other protocols use?"

The answer is yes.

67/204 This self-paying lending model creates enormous opportunities for investors to take risk and leverage in an evolving system, but returns have a ceiling.

68/204 A new strategy model was added, making it essentially a mini Yearn from which you borrow money and pay it back yourself.

69/204 This is a project that I am prepared to pay myself for years because I think it changed the mechanics of the game. However, I think the release of V2 could be a game changer for $ALCX that will perform better this year.

70/204 $BAL

Balancer is a classic DeFi protocol that has been oversold and overlooked.

71/204 But to sum it up, whether anyone visits the Balancer website or not, it has huge potential to become one of the most important AMMs in the space.

Balancer excels at creating incredible foundations and flexible techniques.

72/204 While the technology is still struggling to be gas efficient, it has become an incredible cornerstone, underpinning some great use cases and high performance capital efficiency.

73/204 Their partnership with Gnosis on Cowswap will make them a key component of future asset management.

74/204 While I think classic DeFi will have a strong year, I think $BAL has huge potential to outperform, especially as they move to a veToken model (which makes them another great Convex candidate).

75/204 While they may do well this year, I think their real strength will be in the multi-year time frame, I'm counter-guessing that they'll be a Top AMMs.

76/204 These are things that Balancer's multi-asset capital efficiency cannot do.

So, if they execute correctly, it's a market perfectly suited for them.

77/204 $ZRX

0xProject is another overlooked DeFi infrastructure component that I think will make 2022 a breakout year, driven primarily by end-user wallet adoption.

78/204 This is actually two components of my 2022 start article, as it has both strong external benefits/adoption and a key pillar of the multi-chain future, as 0x is the strongest competition to build cross-chain DEX tools opponent.

79/204 If we relate $ZRX to the CEHV blockchain OSI model, I think 0x will sit in the lower layers of the infrastructure and be the tool most public chains and wallets use for order filling.

80/204 Currently, when users transact in MetaMask and other major wallets, they use 0x without knowing it. This trend will continue as we see retail footprint expansion in L2 through accessibility.

81/204 I think with the expansion of L1 and L2 in 2022, the possible launch of MetaMask token, requests for quotes (RFQs) and some key tool upgrades for cross-chain transactions will make it a driving year for 0x, but here is also a Think long term.

82/204 Token economics are unsatisfying for some and this will definitely make prices oversold, but I think in the future 0x will be as ubiquitous as leading banking software, which will strongly drive returns to node operators , and in turn pledge.

83/204 $FXS

I added Frax to this crypto "shopping list" a few weeks ago and it has already exceeded my expectations.

To sum it up, Frax is probably the best integrator in the stablecoin space.

84/204 I underestimated them for a long time, but they have proven time and time again to be strong performers when it comes to experimenting with new financial models, and are definitely great at building diverse value-added cross-chain bridges with other protocols the best.

85/204 A recent example is their collaboration with Convex on Frax FPI and cvxFXS integration, which will be airdropped in the coming weeks.

86/204 If there are two things in this field that are not worth underestimating, they are the ruthless builders and the ruthless bridge builders.

Frax contains both.

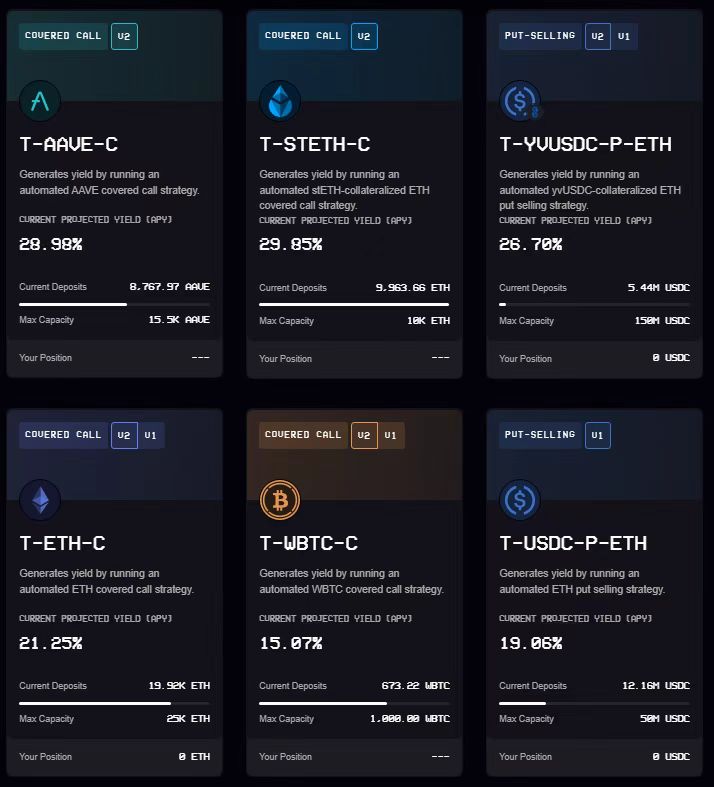

87/204 $RBN

Ribbon is one of the few assets I like that is in a tough spot at FDV (fully diluted valuation).

But I think token economics, distribution model, upcoming lock-in model and external benefits more than make up for it.

88/204 My theory is that no matter how hard we try, we cannot teach 99% of people to make good choices correctly.

A joke from CMS illustrates this well:

I trade options professionally, but I still don't think I should be allowed to trade options.

89/204 But that doesn't mean options can't be hugely profitable when used wisely.

90/204 users participate in and benefit from treasury pools using predefined pre-built option strategies.

As we've seen at Yearn, the best strategies for treasuries are the ones that are so complex that even if you know what they're doing, you can't really replicate it.

91/204 I'd bet 90% of vault holders on Ribbon couldn't replicate their vault strategy, but they're probably happy to get 30% back on projects like ETH and USDC.

92/204 This means that Ribbon will drive value through extrinsic rewards and not just the distribution of $RBN.

And, since it doesn’t mine like the Yearn treasury, its model can generate decent returns in bull or bear markets. This is very unique to this field.

93/204 Token economics and pool caps hold them back because the reality is that you can't get infinite scale returns from options.

But that's why I find Ribbon interesting.

I think this might be the only way to achieve the fork.

94/204 Just like a large number of retail investors cannot establish advanced mining strategies and need the assistance of Yearn, most people cannot establish selection strategies and need the help of Ribbon.

Ribbon needs more options players to help it grow.

95/204 Most option protocols require order-of-magnitude provider growth and cannot easily attract users at scale.

So Ribbon and the upcoming on-chain options protocol actually make each other viable.

96/204 Not to mention that Ribbon is redesigning its token economy and switching to a veToken model and is another prime candidate for future Convex integration.

97/204 These are my "safe" operations in 2022. I don't think most of them will hit 10x growth, but I do think they will offer strong growth with less downside risk and clear value.

98/204 This list also includes some games that I think will fall into this category in the future, but they are still in the early incubation stage.

The list of 99/204 outperforming assets is as follows:

$FTM

$AVAX

$ZEC

Gearbox

Euler Finance (note, there is a similarly named protocol that also exists for tokens)

100/204 $FTM

In the L1 collection, Fantom is favored by its kind.

Unlike other VC-heavy L1, and VC-owned projects, Fantom feels more like early Ethereum.

The 101/204 aBFT model offers strong scalability, staking provides reliable staking (and substantial APR rewards for holding), it has many early-stage projects, and good builder incentives.

102/204 I think Fantom has attracted a lot of new users and builders and has paid off handsomely this year as users look for more L1s after the L1 boom ends.

103/204 $AVAX

Avax broke out sooner than I expected, so I'm more on the sidelines, thinking it might struggle to continue its stellar performance.

But honestly, if you look at it in a single basket, I think it still performs better.

104/204 Compared to Polkadot, Cardano and Polygon etc., Avax has the clearest scaling path of any major EVM (Ethereum Virtual Machine) based asset right now, and I do think the subnet model is a game changer.

The 105/204 subnet model is basically like a miniature version of a fork, allowing anyone to build purpose-driven appchains, so I think a lot of the early experiments we need for Ethereum forks will be in the Avax subnet.

106/204 Capturing this kind of innovation will benefit, so I think Avax still has a good year ahead.

107/204 $ZEC (Zerocoin)

I respect but disagree with some of BarrySilbert's elaborations (although they are at least valid), but the Zcash coin is one that I fully agree with.

108/204 ZCash's privacy advantages are one thing, but the amount of ecosystem-critical research ZEC does is where the real magic lies.

109/204 ZCash has been working on zero-knowledge proofs long before most people in the industry have heard of the term.

110/204 As early as 2018, Zooko, founder of V God and ZEC, proposed a vague concept of how to merge Zcash and Ethereum:

That said, the merging of 3 coins is interesting. The idea is "Zcash frontier version", which is to merge ETH and ZEC coin balances, combine ETH PoS (proof of rights mechanism) + fork, and integrate with ZEC first-level snark architecture, then "pure Zcash" may be more conservative.

111/204 This doesn't sound like the Zcash integration we're going to do today, but it's the core idea that drives my personal investment in ZEC.

112/204 As we get clearer about what the merged, forked, sidechain, multi-L2 future world will look like, it is clear that there is a huge opportunity for a second-layer ZK transport protocol on Ethereum.

113/204 The details are unclear, it can run in L2 style like Starkware application, or it can run on L2 cross-chain bridge like rollup (Arbitrum/Optimisim).

114/204 In the end, my point is that Zcash finally builds the privacy transfer/zk-snark layer that Ethereum has always needed, while the rest of the world ignores it as a separate thing.

115/204 Maybe it just continues as a separate chain and we get better at interoperability across chains. However, I think that at some point ZEC will be integrated into the world of Ethereum, and either way will be a key part of the value transfer of Web3.

116/204 Gearbox protocol

Governance tokens for gearbox.fi exist but are not yet tradable. Looks like airdrops/mining from the protocol will likely continue.

117/204 The protocol is basically to help bring leverage / bring margin to DeFi.

As we know, the average leveraged trading volume of CEX exceeds the spot trading volume by at least 5:1.

118/204 But this kind of advantage is lacking in DeFi, which also means that in the early stage of investment and construction, when the token is not listed on the centralized exchange, it is already missing.

119/204 Suppose you find a new token you want.

You have $100 in collateral.

On CEX, you can go long $2,000 of tokens, but in DeFi, you can only mine with that $100.

120/204 With the Gearbox protocol, you have the opportunity to open credit accounts that allow you to take out leveraged positions and use them in various DeFi applications, allowing you to be in a decentralized environment for the long term.

121/204 This is a game changer, not just for Gearbox, but I actually think Gearbox will drive the classic DeFi 1.0 blue chip growth this cycle.

What perps/futures did to CEX volume, it will do to DeFi volume.

122/204 Although the coin is not yet tradable, I think it will be strong in 2022.

123/204 Euler.finance

Euler is likely to be the first major revamp of the lending model since Aave.

This is a whole new vision of lending protocols.

124/204 A smart contract/account model and the ability to create independent pairs from a diverse set of oracles including AMM pools creates a huge opportunity for different asset growth.

125/204 The problem with most lending agreements is that they are only as strong as their weakest asset.

That's why we've seen Cream face so much destructive behavior.

126/204 Euler carefully balances four types of markets:

Collateralized, crossed, isolated and protected.

127/204 This would allow them to maintain the independence of the risk market, but without the need for a license, while still allowing them to leverage collateral to borrow primarily and diversely.

128/204 Not only do I think this will make Euler itself competitive, but like Gearbox, I think this will create benefits for blue chip DeFi tokens.

129/204 Borrowing is difficult on many new protocols where user funds are locked.

Euler will free up a lot of idle capital for more diverse markets, which will breathe a lot of life into the blockchain space.

130/204 value-driven/multi-year outperformance:

I don't know if 2022 will be their breakout year for these kinds of bets, but I can make a strong case that it's possible. I believe that even if they don't break out this year, they will outperform most assets for years to come.

131/204 These assets include:

$MKR

$HNT

$LDO

$COMP

$RARE

$SNX

$SYN

$GNO

132/204 If you're a value investor who's believed in this space for years, take a moment to dig deeper.

133/204 $MKR

With great cash flow, $DAI hasn't disappeared, it's one of the few organizations that has survived multiple iterations of community and leadership, and made it into a real world asset.

134/204 I'd rather they stick to pure money, but I can't carve out a profitable path in front of them that pays off steadily every year.

135/204 As we move to a market dominated by institutions and bankers with lower return targets than crypto traders, they will continue to eat these assets at a steady pace.

136/204 $HNT

Is this a bubble? Yes.

Is 2022 the year of their rise? Leave it to fate.

137/204 They still have a long way to go, but the global reach of Helium nodes is impressive, and the way we're seeing telcos fumbling with 5G and pursuing Helium in 5G and IoT physical connectivity layers is impressive deep impression.

138/204 I am willing to accept the fact that 2022 is not likely to be their outperforming year, but it is still on my "shopping list" as I will be buying it with other profits throughout the year as it has obvious long-term competitive advantage.

139/204 $LDO

Having an LDO is basically having an index of all possible L1 and L2 solutions.

It consumes these resources quickly and is a profitable path.

People worry about FDV (fully diluted valuation). This is a rare case that I haven't encountered.

The 140/204 chance to earn from 10% of all L1/L2 captures is worth it.

Much of what was pre-sold earlier has changed hands off-market with higher prices and years of lockup.

141/204 Also, there is a future path to gobble up staking/node operations for non-L1 protocols.

For me, $LDO is one thing I buy so that I don't have to focus on what the next profitable L1 is and I can just own part of it.

142/204 $COMP

A lending giant with a team that excels at problem solving.

First explore multiple chains by selecting the application chain.

They have trouble dealing with substrate.

143/204 But the team continues to execute and I have no doubt they have been working on the Lisk model.

144/204 Here's what's left.

145/204 Multi-chain Dapps are not bad either.

But Lisk Dapps are where interoperability needs to arrive for future efficient use of money.

In this regard, there is probably no team with more confidence than Compound Labs.

146/204 One of the only Dapps we've seen that structures itself in this way is Luna.

147/204 There are huge benefits and flexibility to running your own Lisk, and $COMP will be the basis for validators on their Lisk, which is why they will have a lot of OTC transactions.

148/204 I'm kind of looking forward to the infrastructure they build on the Avax subnet, but regardless of how it lands, I think the COMP chain will melt down because it's already oversold.

149/204 $RARE

There are two major auction houses (Sotheby's and Christie's) in the classic art world.

They are all already aware of the growing market for NFTs and digital products.

150/204 Sotheby's have been actively exploring this world in a way that shows they really know it.

But in both competitions, I think one of two things will happen.

151/204 Whichever auction house leads in NFT transaction market share will buy one to solidify that lead.

Alternatively, the party that lags behind will catch up by buying the market.

152/204 This acquisition will focus on the native NFT game market with the most similar branding, professionalism and user setup to traditional auction houses, so I think this will be the future of the $RARE token.

153/204 I think they were either bought by a classic auction house or at least a large stake in a classic auction house.

My guess is 2022. But only possible.

154/204 $SNX

In the previous Frax, I said that you should not underestimate the ruthless builder or the span bridge builder.

SNX too, is vastly oversold.

155/204 This year alone, they have significantly increased demand and the ecosystem is piloting 5 new products, all in sUSD.

It also integrates well with FixedForex, so I think the benefits of KP3R help push them too.

156/204 If one of their ecosystem projects or partners has a breakout year, so does SNX.

They have a lot of shots, so this bet is all about numbers and confidence in the builders.

157/204 $SYN

The cross-chain bridge infrastructure is critical, and so are the benefits.

Users are willing to pay for Synapse because it is the best cross-chain bridge between L1 and L2.

158/204 They need to expand their pairing offerings, but I decided to try every cross-chain bridge this year.

This is the cross-chain bridge we are going to use.

159/204 $GNO

Judging from current products, Gnosis will be the only one capable of achieving MEV scale.

After the xDAI merger, the leading product with its own extended network will be pushed into each Gnosis Multisig.

160/204 Can you think of a project that is worth taking seriously without using Gnosis Multisig?

nonexistent.

All the biggest pools, the best builders, and the biggest funders will be at the forefront of GNO scaling and MEV prevention.

161/204 Risky but with potential:

I don't know if this type of asset will be successful.

We're in a high-stakes world right now, and if they don't capture the market, there's potential for loss, but these products have strong potential.

162/204 For example, we know that the volume of perpetual contracts moves on-chain. CMS holdings has been shouting from the rooftops for years, but we don't know who will win most of the market.

163/204 Maybe a few players got some small breadcrumbs, but 1-2 players took their chances.

As an industry, on-chain perpetual contracts will definitely perform better.

164/204 If you can spread your bets across every potential player, the big gains (especially multi-year gains) from the winners will make up for the underperformers.

165/204 So who falls into this category?

$PERP

$FST

$CAP

$MCB

$DPX

$HND

$API3

$ANGLE

166/204 $PERP

Perp has a strong lead in the field and DyDx has certainly spoiled their momentum, but as I said earlier, I think they have a clear path to victory.

167/204 Perp really need to quickly execute the long tail of on-chain futures, but if they can do that with Curie (their V2), then 2022 will be a breakout year for them.

168/204 $FST

Futureswap (futures trading) is another important futures operation.

One thing I like is that it integrates directly with Uniswap V3 positions for capital efficient positions on the AMM.

The simplicity of its pools may be a key driver.

169/204 $CAP

This is a 100% loser in this game and I love it.

I was skeptical of them at the time of release, but the execution by a community-driven anonymous team is pretty solid.

I don't think it takes the top spot in perpetual contracts, but has a lot of upside potential.

170/204 $MCB

MCDEX is too hard for me, I'm only half sure.

I think this is the least likely to be number one. But considering the upside potential of all perpetual contracts, and the high-quality user experience investment, if it does win, it's still worth staking.

171/204 $DPX

If anyone can offer options to mainstream users in an accessible, scalable way, Dopex is the way to go.

It is the best on-chain setup and user experience.

The 172/204 Dopex game is well integrated with the Ribbon.

Ribbon needs extensions from Dopex, and Dopex needs extensions from Ribbon, so there's huge potential here.

173/204 $HND

Hundred Finance is probably the earliest/riskiest of these assets.

It just recently appeared on my shopping list and I haven't started shopping yet.

174/204 But this is vfat0's cross-chain lending, which is still in its early stages.

If anyone knows the inner workings of the mining token economy, it's vfat, so this is one to keep an eye on.

175/204 As the market recovers into the new year, I plan to put a lot of money into this area and increase position size as liquidity grows.

176/204 $API3

Another asset that I think can hold my thigh.

As we move into a multi-chain and fork future, we really need more oracle diversity and new types of data availability.

177/204 I think API3 is easy to overlook, but I think they have built a solid foundation for a complex problem.

So 2022 is a make or break year for them, and I think the odds are better given the long-term infrastructure needs.

178/204 $ANGLE

Like I said on FixedForex, if you're American, you probably don't know the pain points international users have when it comes to currencies in this market.

179/204 Angle aims to be like MakerDAO, but starting with a decentralized euro.

My hunch is that they expanded into other currencies and secured their position with key partnerships with Convex and KP3R.

180/204 The only reason they rank so low is that they already have strong overperformance.

I think they will outperform by a wide margin over the years, but key drivers are needed to deliver in 2022.

181/204 High Stakes: This is my 50x or 0x game.

If they show up, they're great. I think most people don't show it. This is the absolute risk assigned to you.

182/204 Who is at the highest risk boom or bust?

$GEL

$NFTX

$RAMP

$THALES

$PICKLE

$BABL

$PREMIA

$PENDLE

183/204 $GEL

Automate smart contracts. I think other technologies like KP3R and OpenZepplin Defender could make them money, but if they can build the proper libraries and integrations for any major updates, it's a win for them.

184/204 If I were them, I'd focus on finding every big user of KP3R or OZ Defender, then go to those protocol competitors and get them to use Gelato.

An enemy of an enemy can be a friend.

185/204 $NFTX

The adoption of mainstream NFTs is likely to continue to grow.

Mainstream players aren't going to push up the cap price because they're not going to buy $100,000 PFPS.

Segmentation is what moves tokens.

186/204 When 100,000 people can buy one more small unit, retail prices fluctuate.

NFTX offers this possibility, which can be combined between different projects and gamified.

If we do see a boom in NFT trading in the CEX market, NFT trading will also benefit.

187/204 $RAMP

I like the cash-driven consumption channel.

This is the only viable token.

188/204 $THALES

The option space where $SNX comes into play. Perfect robust product. Not as attractive as Dopex, but the price is also very low.

189/204 If Ribbon really explodes, then it will indirectly develop all options providers. Because it needs to push capital into new markets.

Given the way $THALES is priced, it was imperative for me to get some exposure here.

190/204 $PICKLE

Another place where I can't get started is due to low liquidity. The automatic pledge of liquidity mining pools, oversold and part of the Yearn ecosystem, has not been very popular recently.

191/204 This is still a good product and I think it has a chance to become popular as we see more pools grow because of the low market cap and ability to generate external income.

192/204 $BABL

infrastructure mechanism.

I think some aspects of issuance and token economics are prosaic, but doable. The product user experience is confusing, but the technology is solid.

193/204 As we move into an increasingly retail-oriented world, I think wallets/interfaces like Zapper and Argent will be looking for more treasury strategy style integrations for their users.

194/204 $PREMIA

It's the least interesting option, but still a quality product.

Given my strong thesis for Ribbon, it will likely perform better against the backdrop of Ribbon's growth.

195/204 $PENDLE

I love Pendle, I think it's amazing.

I don't think most users even understand what it's trying to do, let alone how to use it.

It would be a huge bonus if Pendle focused on education and integrated it into the treasury strategy offering.

196/204 I made the mistake of overestimating the financial sensitivity of the users, so they performed below my expectations.

I think there's a clear path for them to get the growth that product deserves in 2222.

197/204 Mining Possibility:

With potential tokens on the horizon, I think this type of protocol might be worth interacting with, but nothing has been announced yet.

198/204 These categories are not broadly classified, but they are still shared with everyone:

Cowswap

Element Finance

Opyn

Cozy Finance

Pods

Volumex

199/204 Here's my curated and crypto "shopping list" for 2022.

Again, this is not financial advice.

You shouldn't copy blindly and expect to win.

200/204 I tend to keep track of assets and maintain my shopping list, which I update about every three months. I scale positions proportionally, balancing different levels of risk.

201/204 Overall, I think 2022 will be an exciting year for cryptocurrencies. The rebirth of classic DeFi blue-chip stocks, exciting new DeFi models, and some technologies are beginning to cross the chasm.

202/204 There are many other assets that are not on this list but are doing well, especially when the overall market is doing well. These are just my personal bets on assets that have a "chance" to outperform.

203/204 As a standard disclaimer, I obviously have a financial interest in many/most of these tokens (or all of them as you read it) and have my own biases.

204/204 Hope this article has been helpful in guiding your own research starting points and ideas for constructing assessment projects. Let's toast to an exciting 2022, no matter what this crazy world throws at us.