A brief analysis of Metis, a new star on the Layer 2 track: After the heat is over, how does the app look like itself?

Recently, the Metis application token METIS has been thriving in the secondary market. It has risen instead of falling in the volatile downward trend of the BTC market. It has increased by about 167% in the past 7 days. It is currently fluctuating upwards around $195.

The rise in the price of METIS has also brought the market's attention to the Metis project, which is an expansion project of the Layer 2 Optimistic Rollup technology, which aims to help Ethereum solve the problems of excessive gas fees and on-chain transaction congestion.

Metis was founded by a Canadian team, and its co-founder Elena Sinelnikova is also the founder of the blockchain non-profit organization Crypto Chicks, which is a women's organization dedicated to blockchain education, mainly providing women with learning and entering the blockchain field Opportunity.

Since Natalia Ameline, another promoter of Crypto Chicks, is the mother of Vitalik Buterin, the founder of Ethereum, some people believe that Metis is the project of the mother platform of "V God". Since Radio Caca (RACA), an NFT project on the BSC chain, claimed that it was supported by Musk’s mother, Maye Musk, its Token RACA rose from around US$0.003 in the secondary market and finally rushed to US$0.011, an increase of about 3500%.

It seems that the holders of the METIS token also hope that Metis will create a legend under the blessing of the celebrity halo of "Mother V God".

How long can the far-fetched "celebrity effect" last? Take the RadioCaca chain game as an example. After its popularity, the current price of RACA in the secondary market has fallen back to $0.003, and has returned to the initial starting point of the rise.

After the heat is over, how does the app look like itself? These are hot topics discussed by community users. There is no doubt that the sustainable development of blockchain projects still depends on its own technological evolution and the ability of the development team to do things.

Fortunately, the data can also explain the problem for Metis. According to L2Beat, the Layer 2 statistical data website of Ethereum, the amount of funds locked (TVL) on the Metis chain has increased by as much as 237% in the past 7 days, and the value of assets locked on the chain is nearly 207 million US dollars. Metis is currently locked in the Layer 2 expansion project. The one with the highest increase in warehouse value.

secondary title

Improve the Rollup mechanism to shorten the time for assets to return from L2 to L1

Metis is built based on OptimisticRollup technology, which gives it the advantages of the technical standard itself - low gas fee and extremely high processing speed. More than that, Metis has made technical improvements to improve the delay in extracting assets from Optimistic Rollup Layer 2 to Layer 1. Some users called this innovation "Metis Rollup", and because of this, Metis is considered a fork project of Optimistic Rollup.

In order to better understand the difference between Metis Rollup and Optimistic Rollup, let's first look at the working mechanism of Rollup.

Ethereum's Layer 2 Rollup expansion solution is mainly to migrate the longest and most expensive calculation process in the main network Layer1 (L1) transaction to Layer2 (L2) processing, smart contracts and DApps running on Ethereum Applications can also run on L2, which can reduce the demand on the current Ethereum main network, thereby increasing the throughput of the network and reducing the cost of transaction fees.

The specific operation process is manifested in that the Ethereum main network L1 only receives and records transaction data on the chain, and the main network guarantees data security. The actual calculation and storage are performed under the Ethereum chain, that is, on L2. The L2 network regularly packages the calculation results of the smart contract and submits them to the Ethereum main network L1 in batches.

For example, when a user submits a transaction to L1, the transaction data will be recorded on it; the calculation of the transaction is processed by the smart contract on L2, and then L2 packages the calculation results in batches and sends them back to L1.

For the process of transmitting data from the L2 layer to the L1 layer, different Rollup technologies have different processing solutions.

When Optimistic Rollup L2 submits data to the L1 layer of the Ethereum main network, the consensus mechanism adopts "fraud proof" - assuming that all submitting transactions are good people (unless proven guilty), the network believes that the vast majority of block validators are Credible, that is, the data submitted by L2 to L1 are all real. If there is a dispute, it is necessary to move the entire submitted L2 transaction to the L1 main chain, rerun the calculation and check the result verification, but this will increase the time cost of calling the contract on the main chain.

Therefore, in order to ensure the security of the transaction, when assets return to the Ethereum mainnet from the OptimisticRollup Layer2 network, there is a delay of 1-2 weeks.

Metis Rollup has improved the "transaction data verification section". It introduces "verifiers" in the calculation process of the L2 layer, and encourages the verification nodes to quickly verify through the competitive mining mechanism, that is, the transactions on MetisL2 are all verified by the nodes.

This is the same as the L1 network of other POS mechanisms, and transactions are verified by node verification. Therefore, there is no dispute about the data packaged and transmitted from Metis to L1, and there is no problem of interval and delay between assets being extracted from Metis to the Ethereum mainnet. It only takes a few hours or minutes to extract assets from Metis to the Ethereum L1 layer, which is the biggest difference between Metis Rollup and Optimistic Rollup.

At present, the main reason for limiting the ecological development of Optimistic Rollup is that it is not 100% compatible with EVM. The problem of network mismatch requires developers to change the underlying code of the application, which requires a lot of time and human resources for migration, which increases the difficulty for developers. Although the Optimistic Rollup official has stated that it will work hard to improve this dilemma, it still has not been completely resolved.

secondary title

Formulate DAC standards to specify DAO scenarios

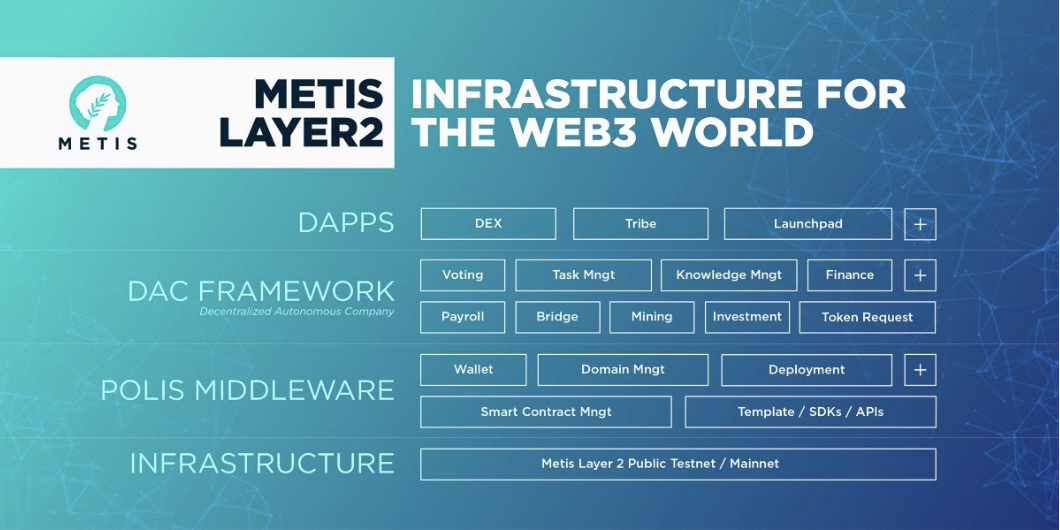

The goal of Metis is not only to reduce the gas fee on the chain and improve the transaction processing efficiency on the chain, but also hopes to become the infrastructure of the Layer 2 layer, and is committed to the scalability and ease of construction of the Layer 2 functions, so that developers can use the facility For the creation, management and development of decentralized autonomous companies DAC.

Metis proposes a new concept - DAC (Decentralized Autonomous Company), which is a decentralized autonomous company, which is more like a specific application scenario of DAO. DAO focuses on voting and governance functions, while DAC is specially designed to solve the daily operation and management problems of projects or enterprises, so that anyone can build a decentralized business on the chain. Changes in conditions to automate pre-approved tasks, allowing the project to function like an autonomous enterprise.

In addition, with the help of DAC tools, users can also build some functions that are exactly the same as the business model in the real world, such as establishing the procurement department, operation department, marketing department, finance department, human resources department, etc. In a word, it is to allow traditional companies to operate on the chain, so that enterprises operating on the chain can have various functions that companies under the chain have, and can also enjoy the benefits of information disclosure and transparency brought by blockchain technology.

Through the DAC framework, Metis hopes to build a sustainable and decentralized company on the high-performance underlying blockchain, and provides users with DAC preset tools, templates and interfaces, so that everyone can easily Build and publish DAO or DAC on the chain, run and manage your own communities, applications and enterprises. Metis has also developed a standard module for personnel in DAC or DAO organization to measure his contribution in DAO organization, such as work effect, wallet weight, etc.

At present, Metis DAC has empowered more application scenarios. Users can register and set up their own decentralized company DAC, pledge Token METIS to reap popularity benefits, and invite friends to join DAC. The more people participating in the DAC and the larger the scale, the stronger the liquidity earning power of the DAC, and the more METIS will be produced.

secondary title

Lack of asset access channel Metis chain application expansion is hindered

Since the launch of the Metis mainnet Andromeda in December, the native applications on its chain have attracted the inflow of encrypted assets.

At present, if users want to enter the Metis ecology, they need to transfer METIS to the ecology first, which is the fuel for transactions on the Metis chain. Since there is no CEX that supports METIS to directly recharge the Metis ecosystem, users need to bridge METIS to Ethereum first, and then recharge into the Metis ecosystem through the Metis Bridge.

It is also because the encrypted asset channel to enter Metis has not been fully opened, and users need to bridge assets multiple times to enter the ecology, which undoubtedly increases the threshold for users to use and restricts part of the traffic from entering the ecology, and its on-chain applications currently only exist in In the DEX scenario, other products did not explode on a large scale. Currently, there are two main DEX applications on the Metis chain:

DEX decentralized exchange Netswap

Netswap (NETT) is the first native decentralized exchange application (DEX) deployed on the Metis network. It uses the same Automated Market Making (AMM) model as Uniswap. The difference between the two is that Netswap will benefit from the Metis Layer2 network, with lower transaction fees and faster transaction speeds.

Netswap has also adjusted the liquidity reward model. It adopts the form of points and divides liquidity contributions into two categories. One is transaction contribution points, which are calculated according to the asset pairs traded by users and the weight of transaction volume; the other One is liquidity contribution points, which are calculated based on the amount of LP funds and time weight provided by users. Liquidity rewards will distribute Nett token rewards on the Netswap platform according to the number of user points.

DEXTethys Finance

Tethys Finance is a newly created decentralized trading application on the Metis mainnet, and it is also the DEX with the fastest growing amount of locked funds on the network.

Compared with the previous DEX, Tethys Finance has improved the product. It visualizes the user's participation in projects and their funds on the Metis mainnet. According to this page, users can manage their assets more efficiently, which is convenient for users to avoid farming and staking. Or assets are idle when LP is formed.

Currently, users can obtain Tethys Finance platform token TETHYS rewards by participating in liquidity mining for LP funds such as USDT-METIS and USDC-METIS.

Further reading:

Further reading:secondary title

Metis Layer2

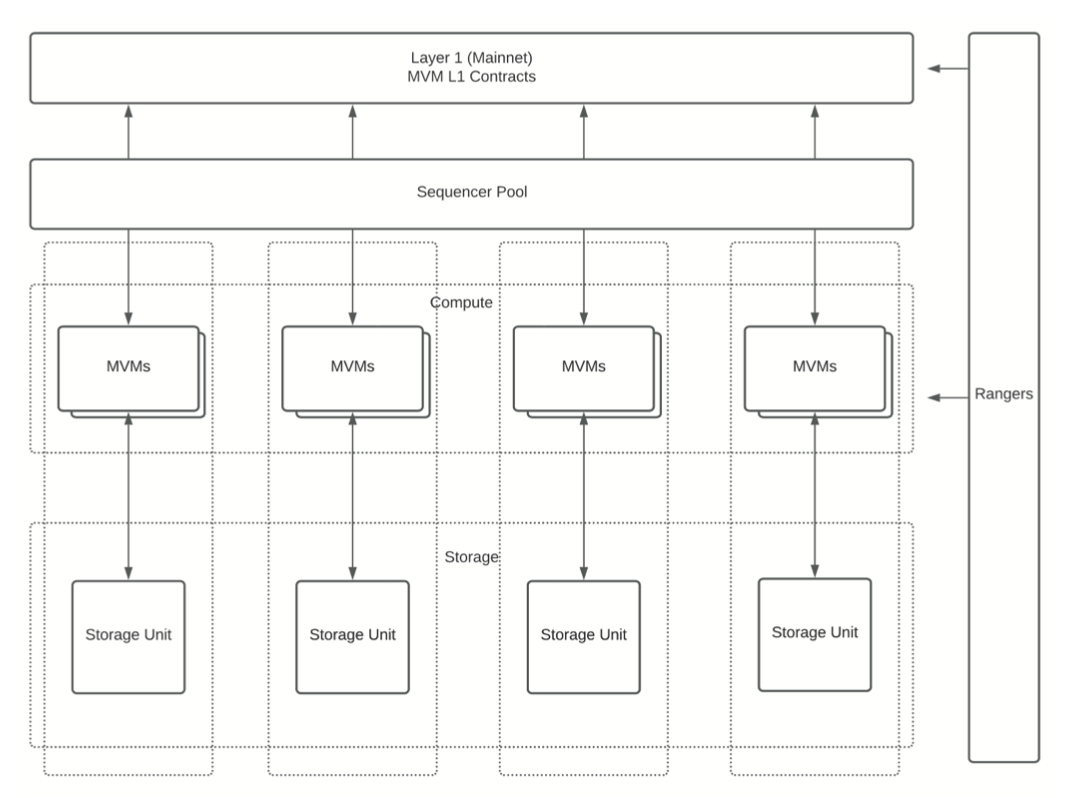

Metis will be one of a family of EVM-compatible Optimistic Rollups launching in the coming months. It uses a fork of Optimism's Optimism Virtual Machine (OVM), called the Metis Virtual Machine (MVM). MVM mirrors OVM in functionality and code execution.

Like other Optimistic Rollup designs, Metis relies on network participants called orderers to order and batch transactions before committing final MVM state changes to Ethereum. However, unlike other companies, Metis intends to launch multiple orderers that will be funneled into on-chain entities called Decentralized Autonomous Companies (DACs). Every Metis block, the protocol randomly selects a new orderer from the orderer DAC to push any state changes to Ethereum. Metis' sequencer pooling and selection process contrasts with the single-sequencer approach that Arbitrum and Optimism will initially use. However, both Arbitrum and Optimism discussed plans to move to a more democratized sorter selection process.

DACs are essentially DAOs. Metis represents them as on-chain organizations that allow users to collaborate and perform certain network operations, such as running a pool of sorters (as above) or running new applications on MVM. In order to be eligible to confirm a batch of transactions, an orderer must hold more METIS than the Dynamic Bond Threshold (DBT), a mechanism to inhibit malicious behavior and orderer indifference.

image description

Source: Metis white paper

The challenge process is critical to the functionality of Optimistic Rollup. Optimistic Rollup is "optimistic" by design, assuming that transactions that are not posted are fraudulent. They basically use a "not guilty until proven guilty" approach that relies on a system of "checks and balances" to deter fraud and ensure that Ethereum remains the arbiter of truth. All fraud detection on Metis is done with Rangers monitoring sequencer activity and challenging any misbehavior.

Although Metis uses a fork of Optimism's OVM, it has some features designed to improve upon the original design. These functions include:

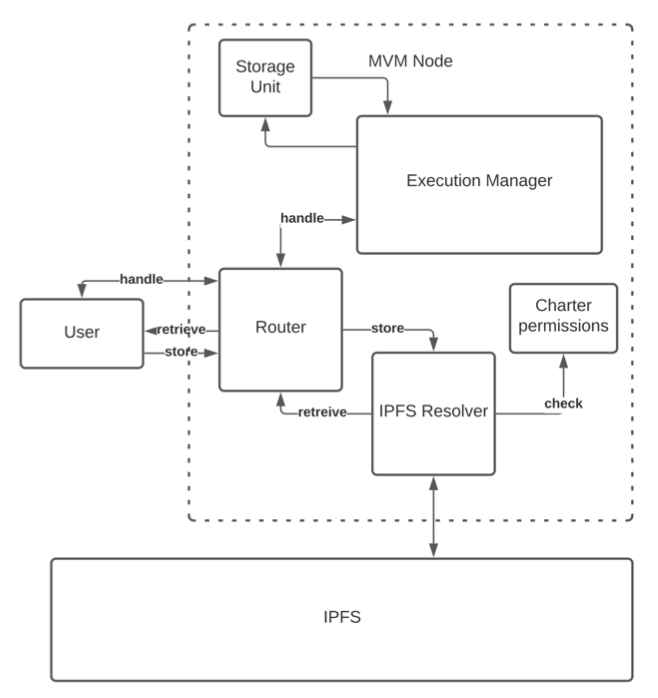

IPFS integration - cheaper data storage option than using secondary solutions

Faster verification due to state changes published to Ethereum using Rangers

Polis Middleware - Provides templates and support for an improved development environment aimed at those new to cryptocurrency

Multiple Execution Layers - Metis will allow the DAC to spin up new MVM execution environments to scale capacity as block space requirements increase

secondary title

text

image description

Source: Metis whitepaper

secondary title

Faster validation with Rangers

The main weakness of Optimistic Rollup is the waiting time to confirm the withdrawal of Ethereum L1 (or even another L2). This wait time is usually measured in days. Arbitrum expects withdrawals to take around three days, while Optimism expects around a week. These wait times are critical to the fraud detection process, but they can also reduce flexibility for users and create friction when trying to transfer funds to Ethereum or between different L2s.

secondary title

Polis

A key factor that may affect the adoption of L2 is the challenge of porting existing contracts from Ethereum to the new layer. Platforms that require projects to significantly adjust their existing contracts can become application deserts, as projects may shy away from development environments that require codebase overhauls. Instead, developers will aim for familiarity, which translates into maximum EVM compatibility.

Metis has an EVM-compatible design. It seeks to further ease the transition of existing Ethereum applications to L2 through its Polis middleware. The Metis team intends to help Polis bridge the Web2 to Web3 gap by providing developers with "low-code to no-code" templates for deploying and managing new applications. The combination of low fees and a low development learning curve can create a fertile environment for experimentation and innovation, key elements in nurturing an app ecosystem from the ground up.

Token Economics

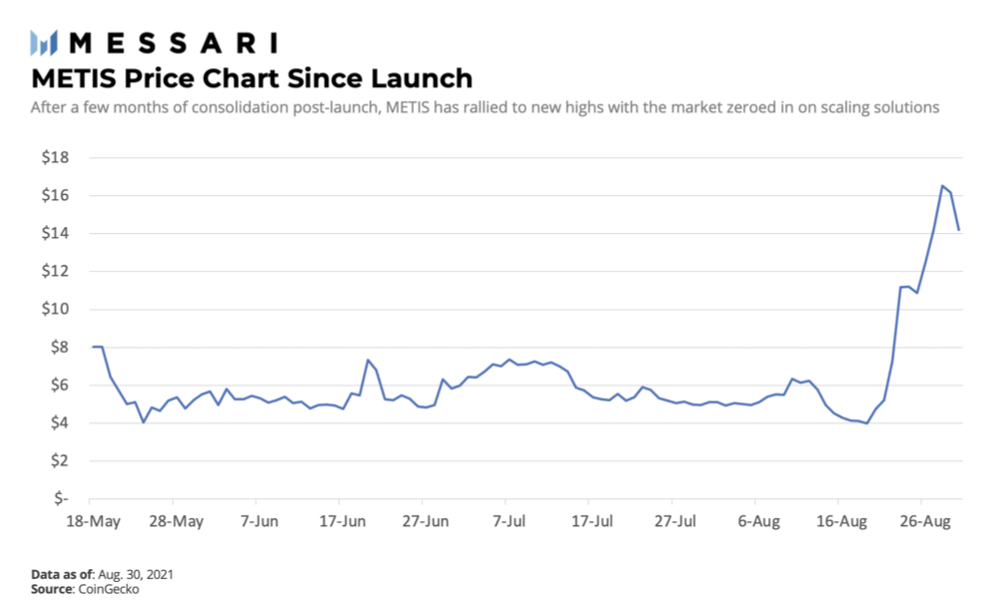

Token Economics

METIS tokens will be distributed for the first time on May 13, 2021 during the IDO via the PAID Network and the Initial Exchange Offering (IEO) with Gate.io. Launched at an IDO price of $5, METIS quickly rose to $8. It then consolidated around $5 for three months before rising to new highs in the recent market recovery.

The METIS token has three main use cases in Metis' L2 platform:

Transaction fees - users pay transaction fees in METIS

Staking for DAC - DAC contributors must stake METIS to become a sequencer, collaborate or start a new MVM layer

Rewards - DACs and Rangers are rewarded with METIS for contributing and winning Fraud Challenges, respectively. These participants may also lose METIS if they are found to be violating protocol rules.

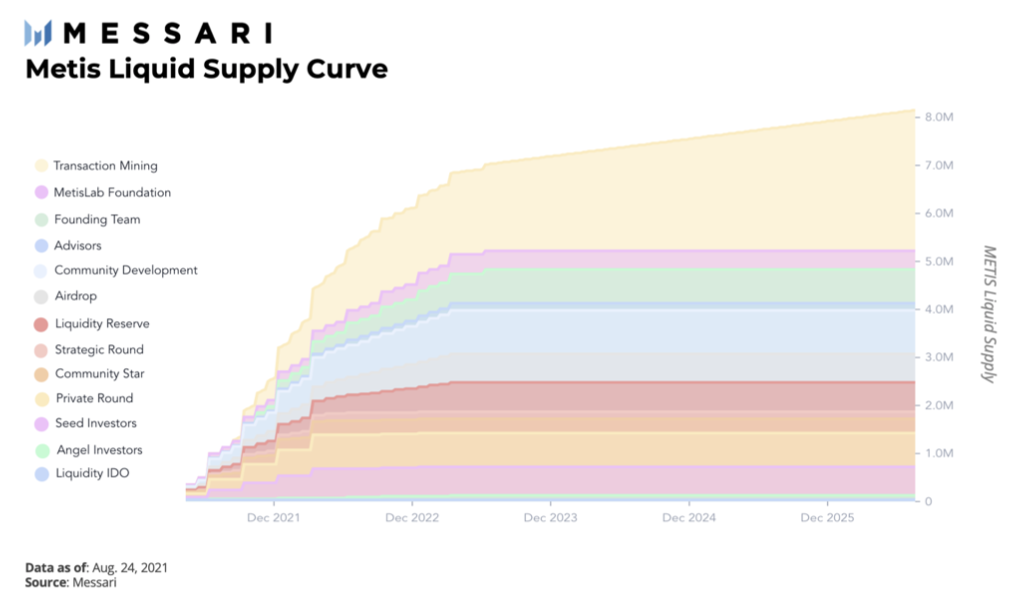

Metis allocates 49.3% (or 4.93 million METIS) to community programs (airdrops and community participation incentives), markets such as decentralized exchanges for sufficient trading liquidity, early contributors (public and private investors), teams and MetisLab Foundation. Allocations to teams, foundations, and private investors are subject to a 12-18 month vesting schedule, which makes for relatively low volatility in the early days of METIS.

The project has earmarked the remaining 5.07 million tokens for a ten-year incentive program to reward network participants such as orderers, rangers and community members for processing transactions (what Metis calls “transaction mining”). the process of).

The METIS inflation program will serve as an incentive to provide security and avoid fraud. But one aspect of a token that is often overlooked is its impact on project innovation and adoption. Token incentives, even inflationary ones, can steer ecosystem and user growth, as Polygon's rapid rise demonstrates. The Polygon team rewards validators and later liquidity providers on Aave and Curve with their MATIC supply.

route map

route map

As the Polis middleware tools continue to develop, Metis is focused on incentivizing the growth of the ecosystem, leading to an eventual mainnet launch in October. Metis has established relationships with DeFi, infrastructure and token launchpad partners including Trustee Wallet, OroPocket OpenDeFi, PARSIQ, PAID Network and more.