69 charts comprehensively review 2021 and look forward to 2022

Compilation of the original text: The Way of the Metaverse

Compilation of the original text: The Way of the Metaverse

Elias Simos used 69 charts on Twitter to show the most interesting parts of the encryption industry in 2021, and at the same time told his 2022 outlook. This article will take you to see what these 69 pictures are all about.

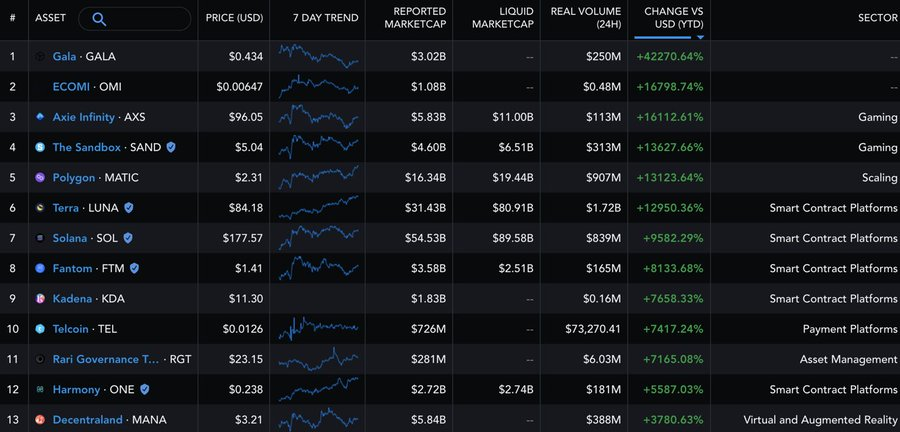

1. The best-performing crypto asset with a current market cap of over $200 million. 2 clear themes for 2021; Metaverse and Smart Contract Chain. The two themes are equally important.

2. Unlike the barbaric growth of various smart contract blockchains, although the growth of Bitcoin and DeFi (1.0) on Ethereum is obviously lagging behind, it has also increased by 2 times year-to-date.

Meanwhile, SolLunAva (Sol, Lun, Avax) formed a league of its own.

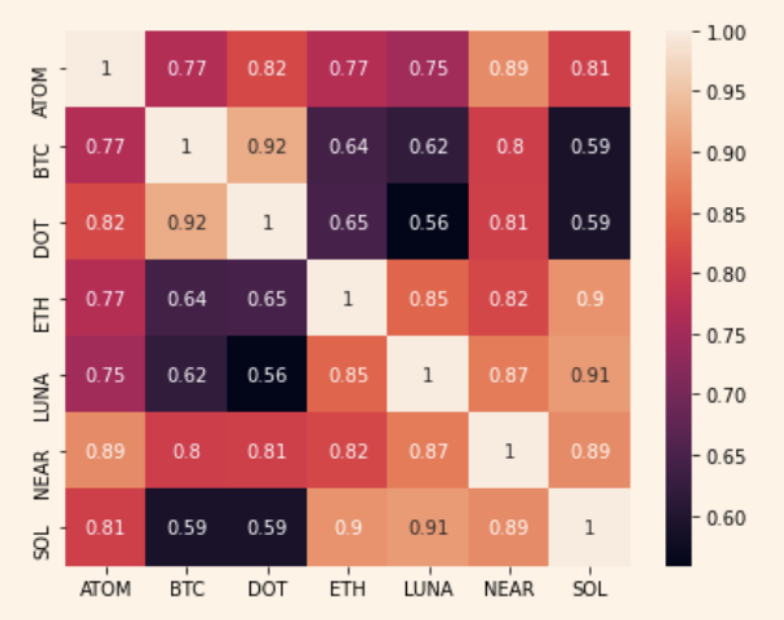

3. Of course, the difference in return profile causes crypto correlation to weaken in 2021. If this trend continues, 2022 will indeed be a battle between long alpha and short beta.

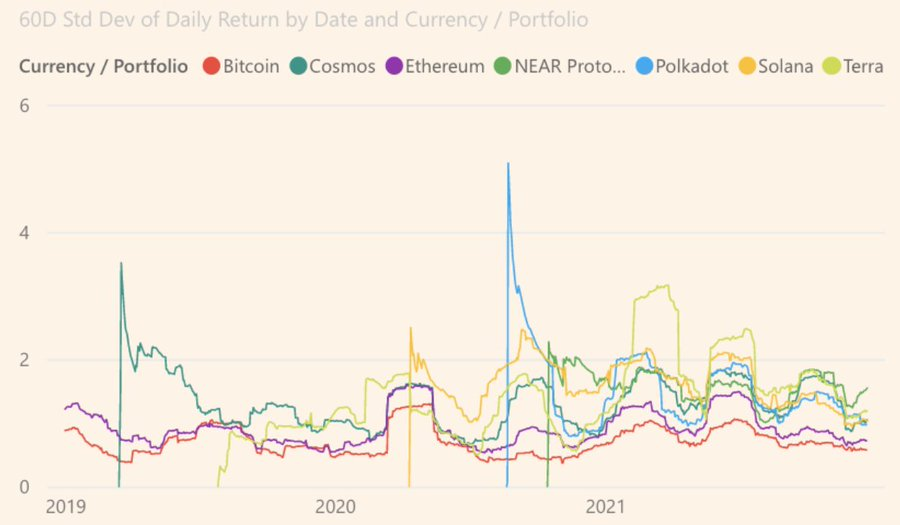

4. Encrypted assets are still volatile in general, but in the second half of the year, the volatility has weakened. The long-term trend remains flat.

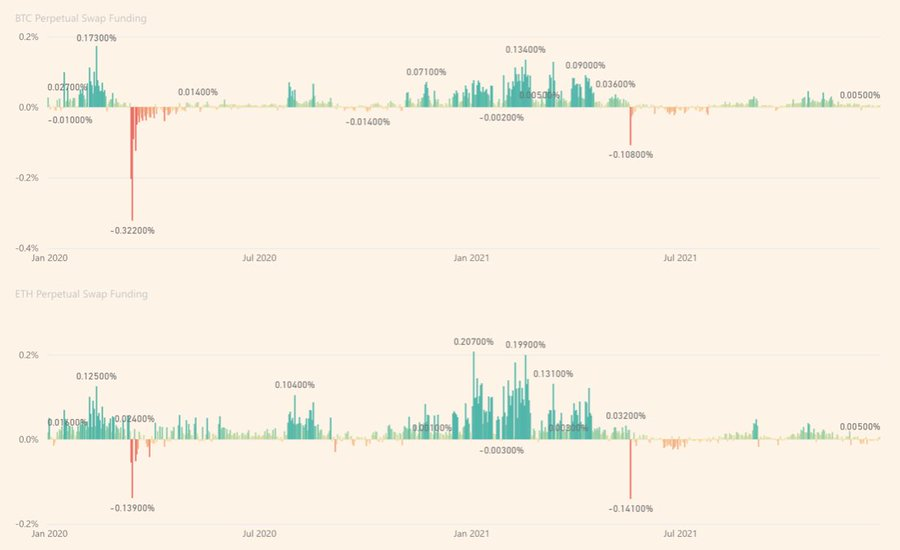

5. In the midst of volatility, the extreme negative financing rate of perpetual contracts continues to send out intergenerational buying signals.

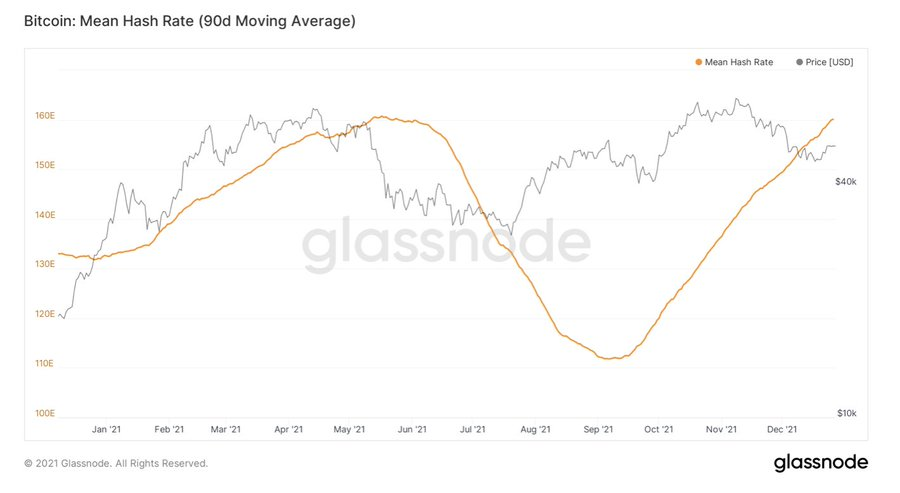

6. The big volatility this year was caused by China banning bitcoin mining in May.

Bitcoin lost 1/3 of its computing power at the time; but it has now fully recovered. That being the case, what is left of this ban?

7. As predicted earlier in this topic, it has been a brutal year for Ethereum DeFi. Compared with ETH, DPI (DeFipulse Index) fell by 80%.

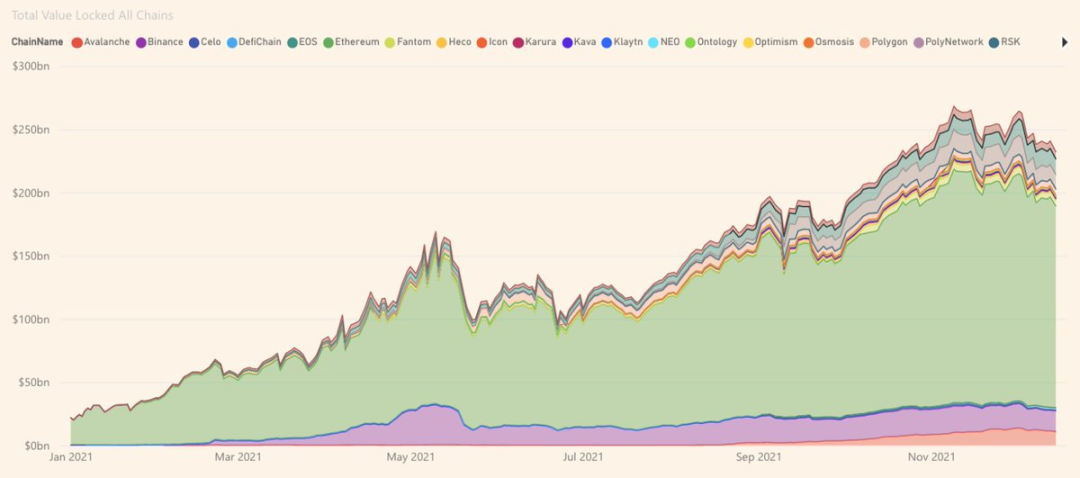

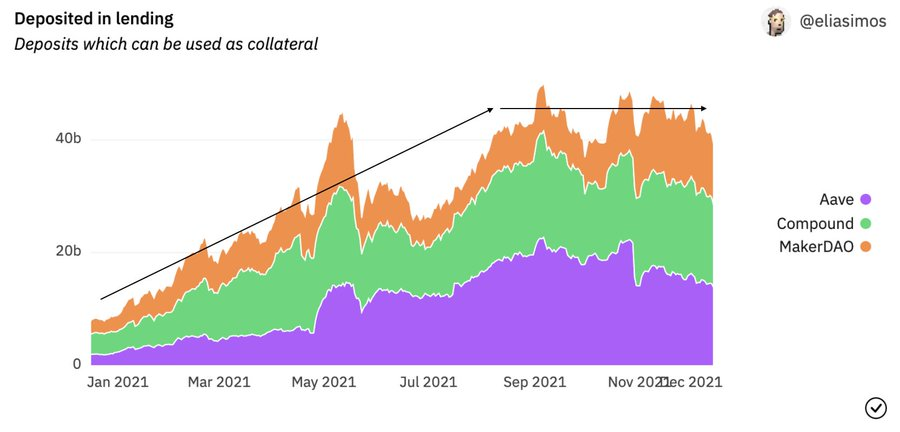

8. When looking at the level of asset loading in DeFi applications, the picture does not explain this at all.

2021 will see huge growth on all fronts -- at least in dollar terms.

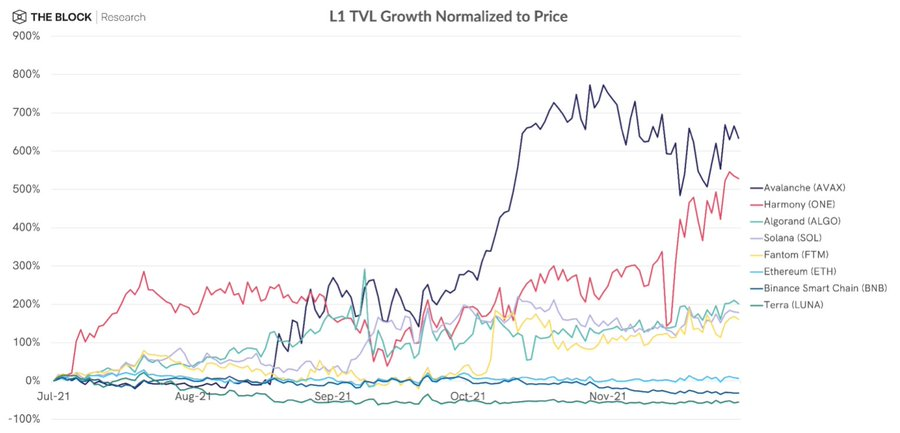

9. Again, when normalized against L1's token price appreciation, the case for Ethereum DeFi doesn't look surprising.

Ethereum Killer and sidechains are showing a W trend here.

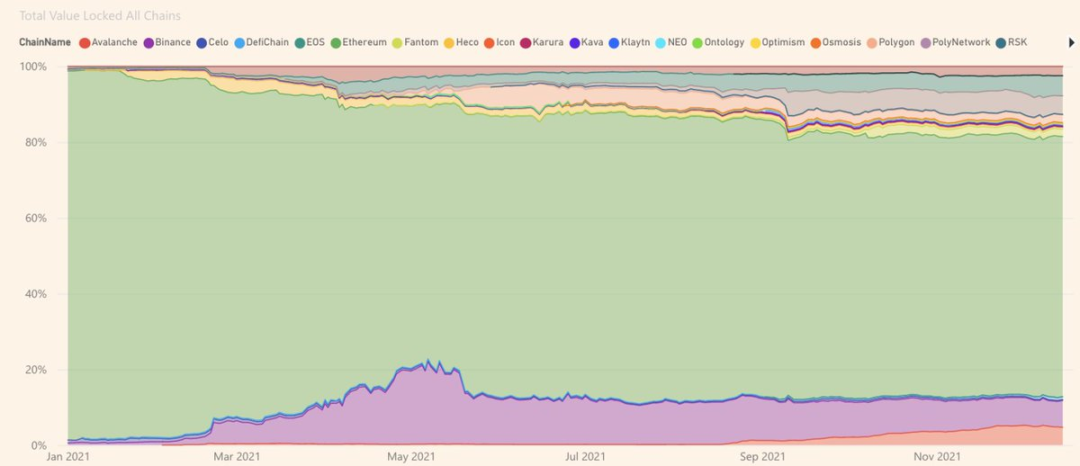

10. Just as they are trending in increasing market share.

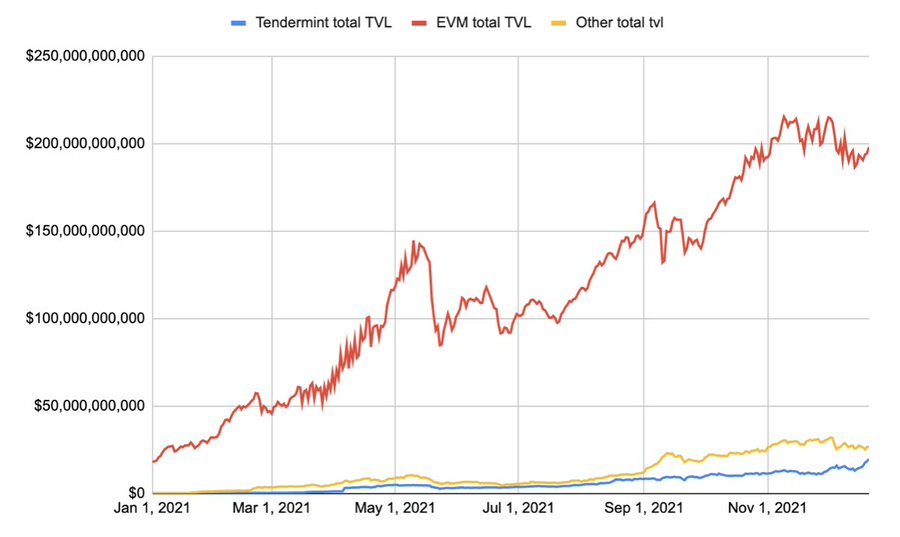

11. However, there is a flip side to all of this. Most of today's asset value exists in EVM-compliant environments. These dwarf everything else by many orders of magnitude.

EVM becomes the standard.

Also, have you noticed a pickup in Tendermint-based TVL lately?

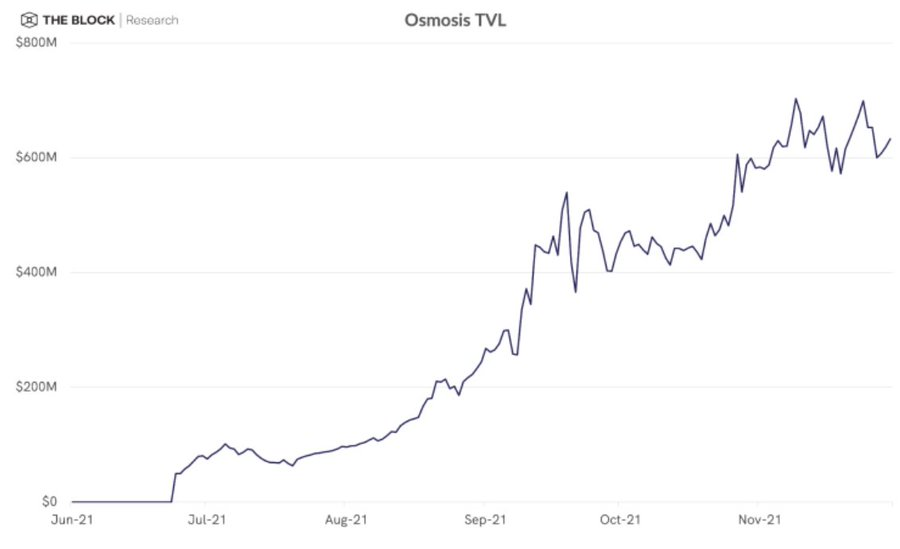

12. There are many advantages to building an application-based chain.

With IBC enabled and facilities like Osmosis, Umee, Stargaze and the wider Terra ecosystem coming online and hitting their stride, the opportunity cost is also much lower.

More of these are expected in 2022.

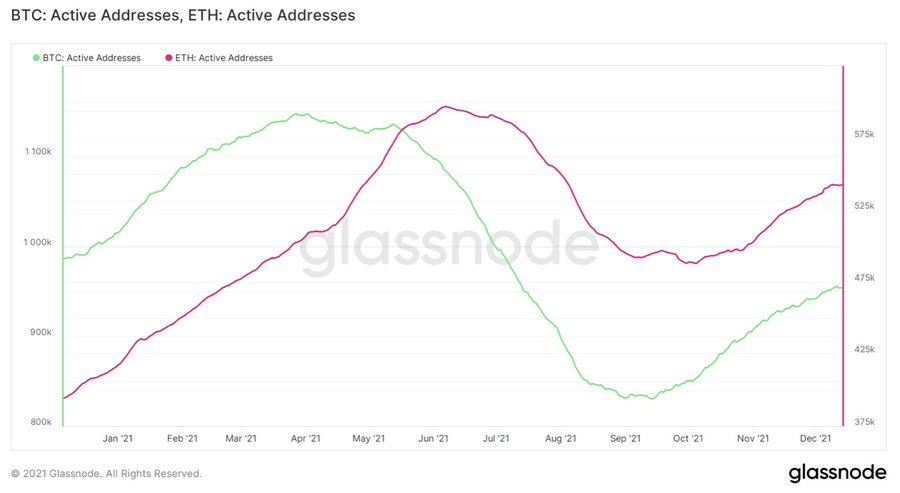

13. Now, looking at the active addresses, the float of BTC seems to be nearly double that of Ethereum.

Bitcoin active addresses are in a clear overall downward trend in 2021, while the opposite is true on Ethereum - even in the face of record high gas costs in USD terms.

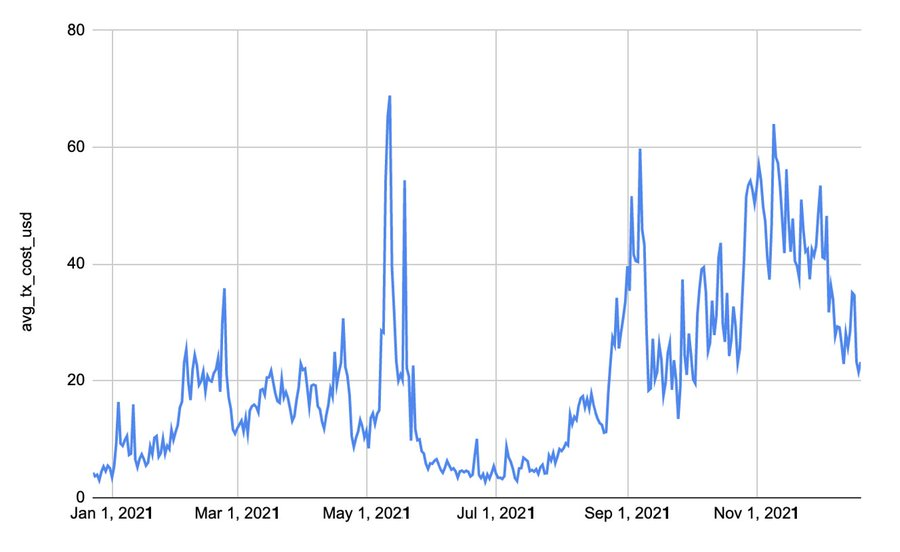

14. Speaking of gas on Ethereum...it's just as brutal for users.

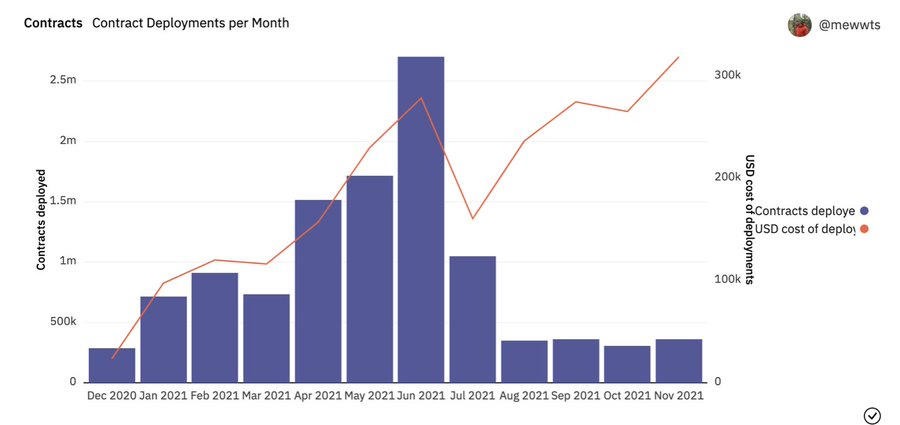

15. The same goes for developers.

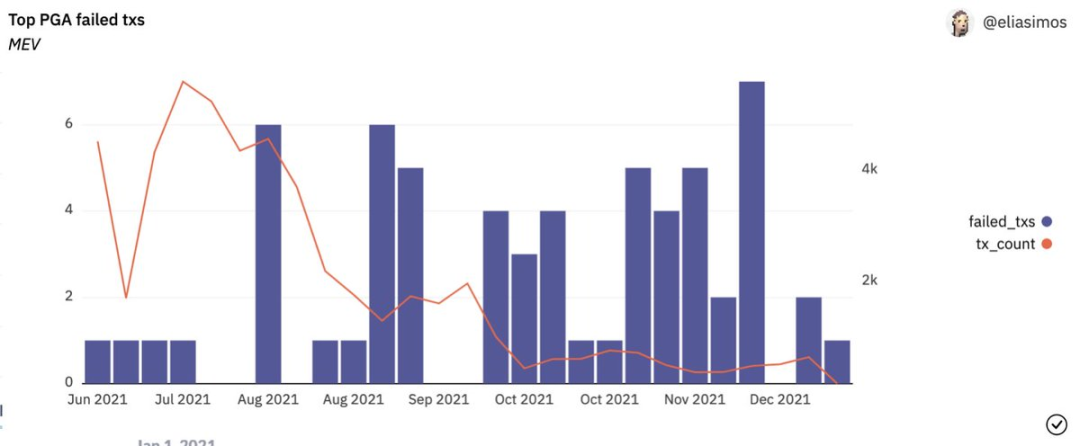

16. MEV is undoubtedly a major theme in 2021.

With gas exploding upwards, the scale of MEV withdrawals on Ethereum has slowed in tandem, most likely chasing opportunities in cheaper EVM-compatible environments as activity in those environments has increased.

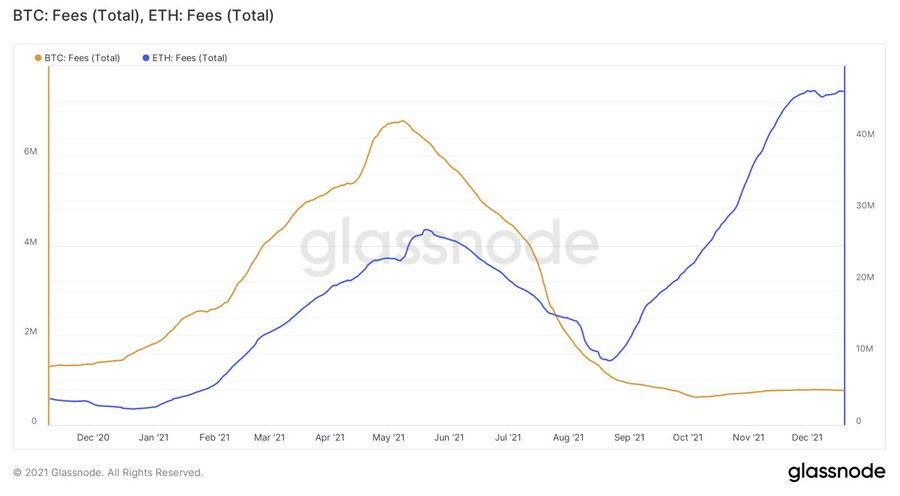

17. On the other hand, due to the persistence of high gas, the income of Ethereum miners has risen; for most of 2021, their total fee income is higher than that of Bitcoin miners.

With the Ethereum merger coming in 2022, validators will be rewarded with MEV and fees + inflation.

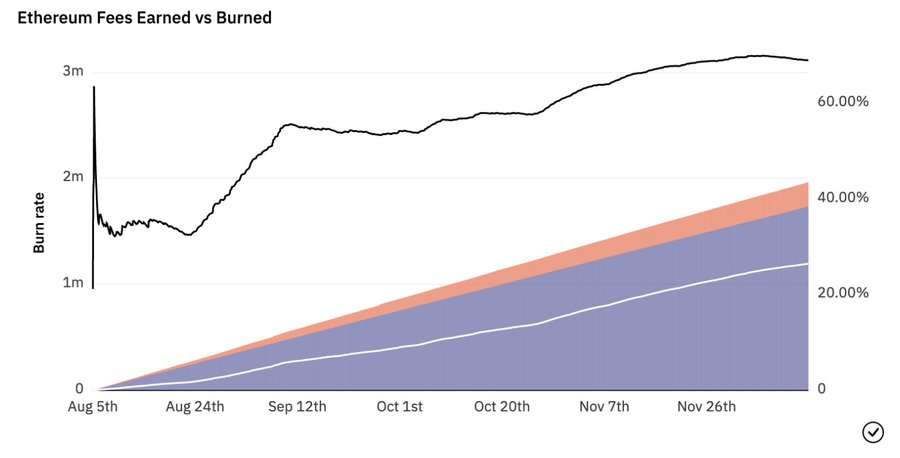

18. After EIP-1559, ETH holders also benefit from high gas to some extent.

So far, 1.2 million ETH has been burned, which equates to a whopping $5 billion at current prices. This is equivalent to an annualized repurchase of 2% of ETH's market capitalization.

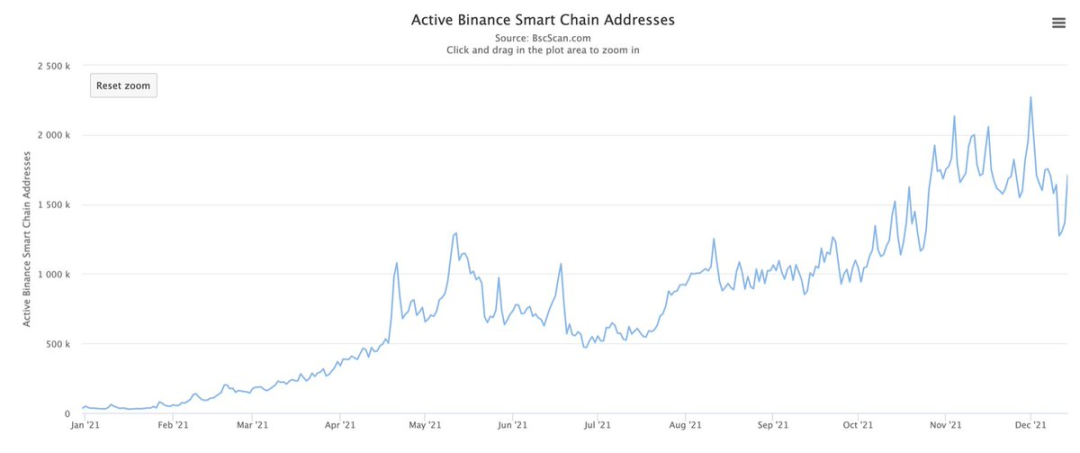

19. As this all unfolds on Ethereum, an EVM-compatible environment steps in to meet user needs.

For the most part, the number of active addresses has been moving up and to the right with no real signs of stopping.

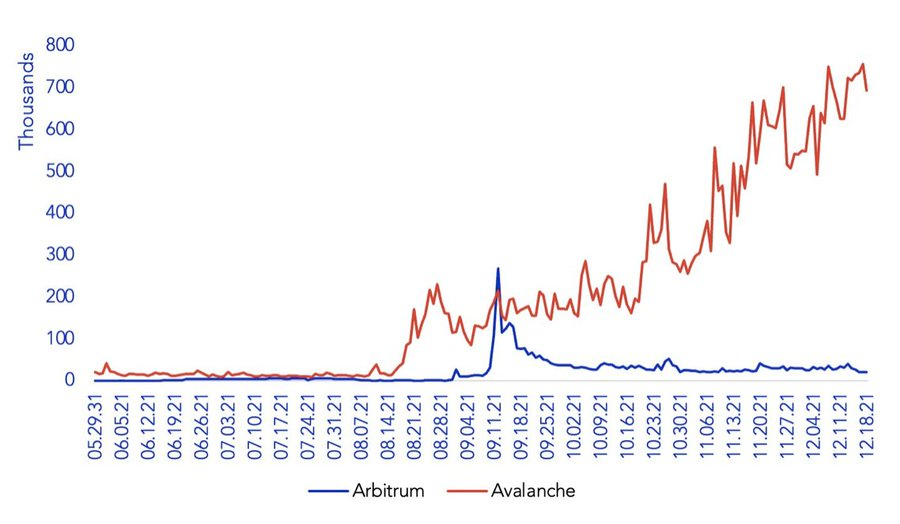

20. Despite a lot of promise, L2 Rollup (at least the broadly defined developer platform type) activity is still lagging.

Let's wait and see what happens when they enable their own token.

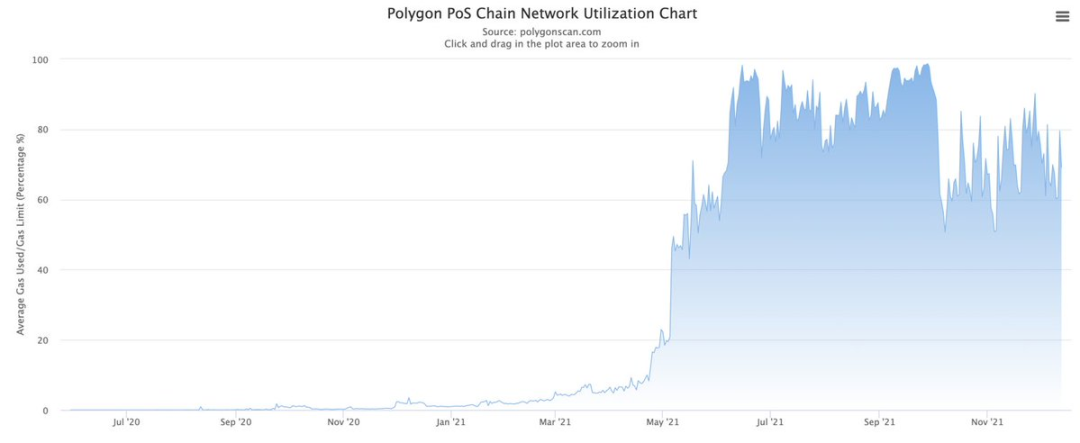

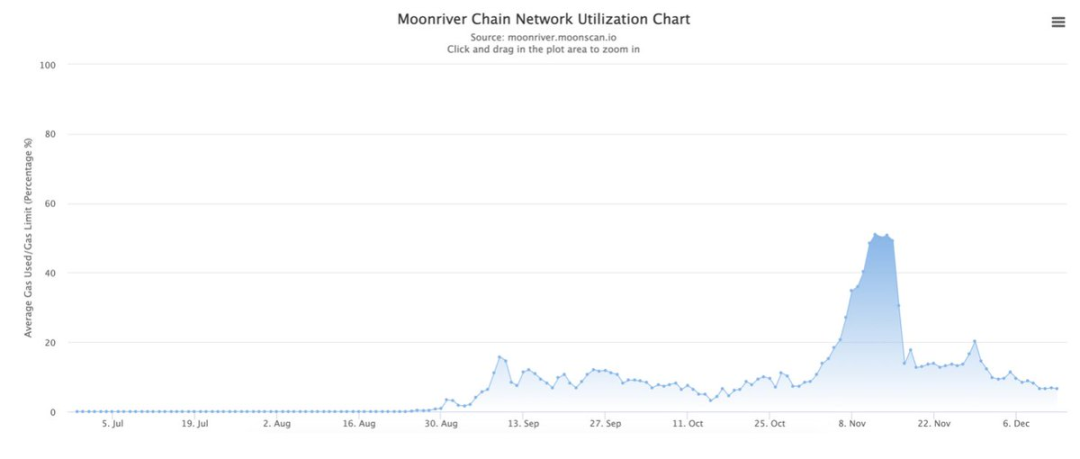

21. However, there is a small problem in the whole EVM compatible chain narrative. In 2021, we learned that even the most popular products can reach their limits.

22. However, after more EVM compatible environments, such as Moonbeam and Evmos are launched, the global EVM block space will continue to increase and may become more and more commoditized.

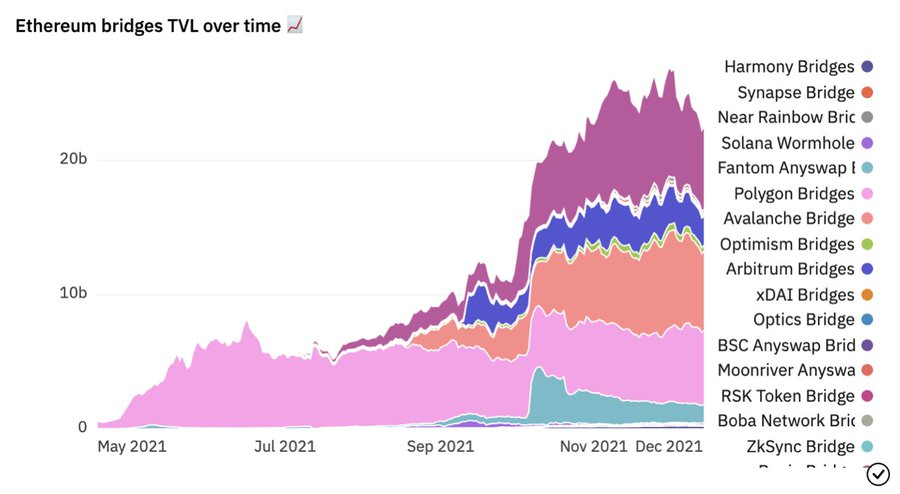

23. The massive migration to other EVM-compatible environments is evident in the explosion of activity away from Ethereum.

From $200 million in assets before May to over $20 billion in multi-signature assets locked into bridges to other ecosystems.

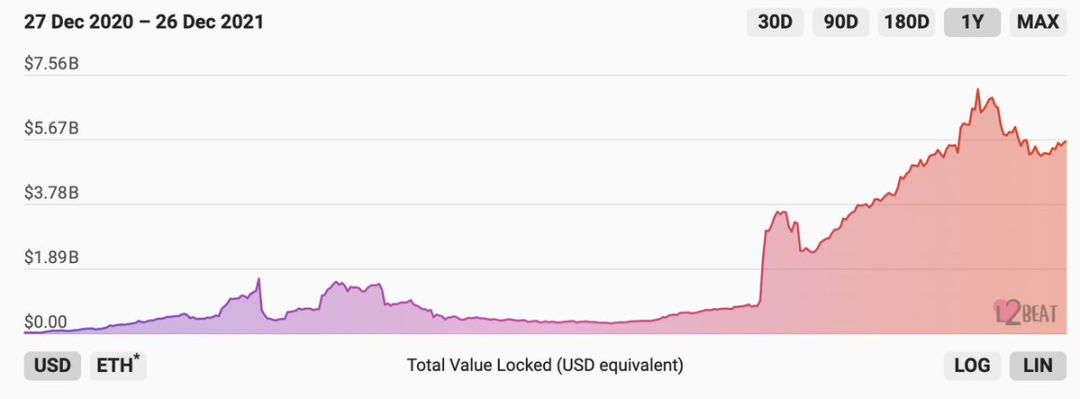

24. On the other hand, the various L2s only managed to attract about $5.5 billion in assets in total.

Again, let's wait and see what happens when they enable their own token.

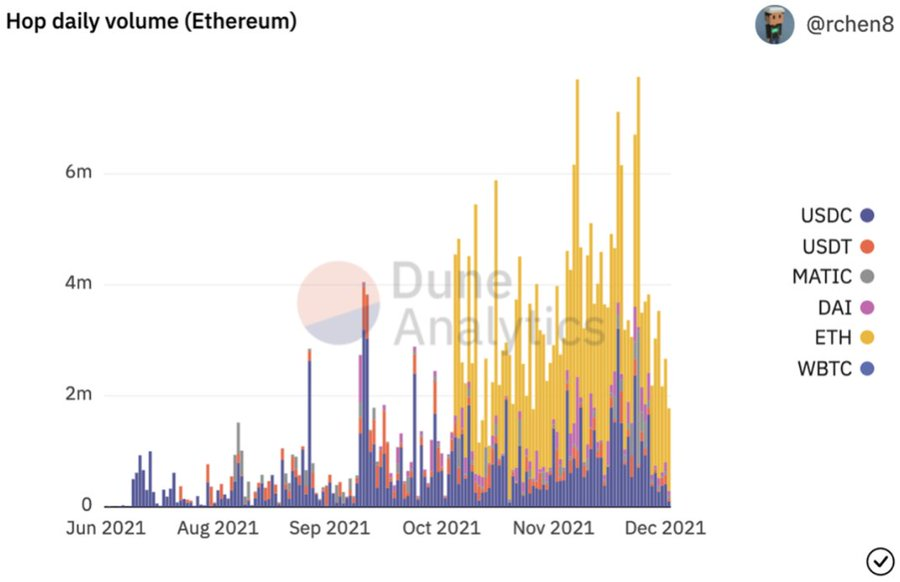

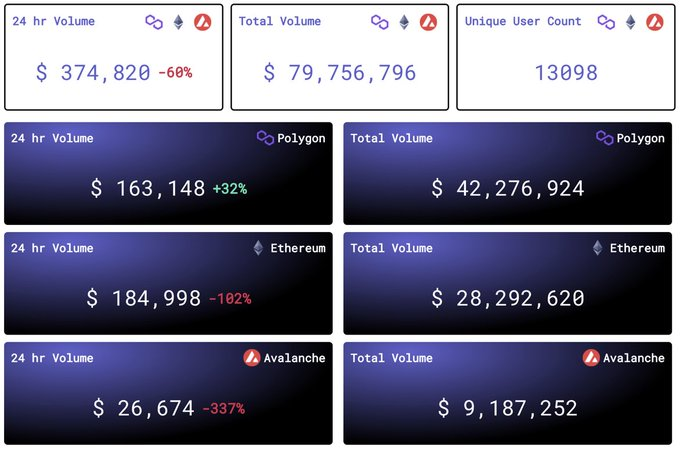

25. At the same time, routing and liquidity protocols are heavily involved to meet the transfer needs of cross-EVM environments.

Arguably, these are still capacity constrained, but we should expect that to change in 2022.

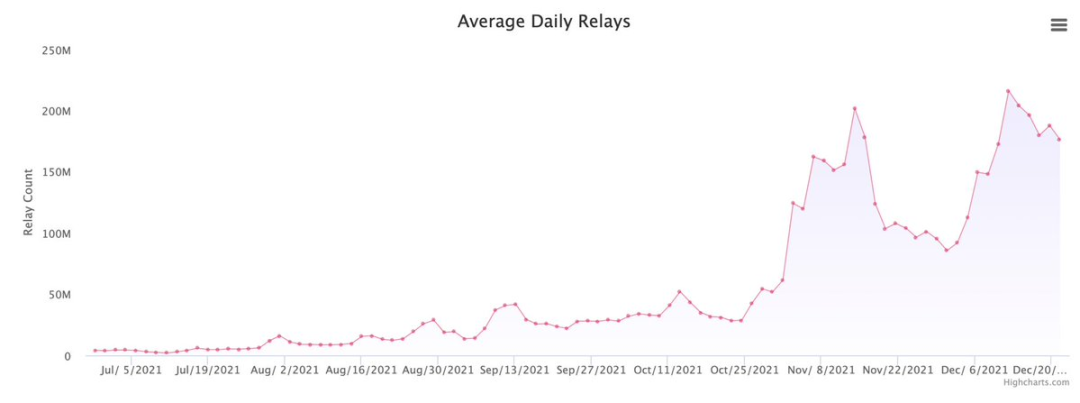

26. Pocket Network saw increased activity as developers attempted to deploy in environments other than Ethereum.

Developers need high-quality read/write bandwidth. Pocket offers a very competitive price point.

$POKT may just be one of the best options for long-term holdings in a multi-chain direction.

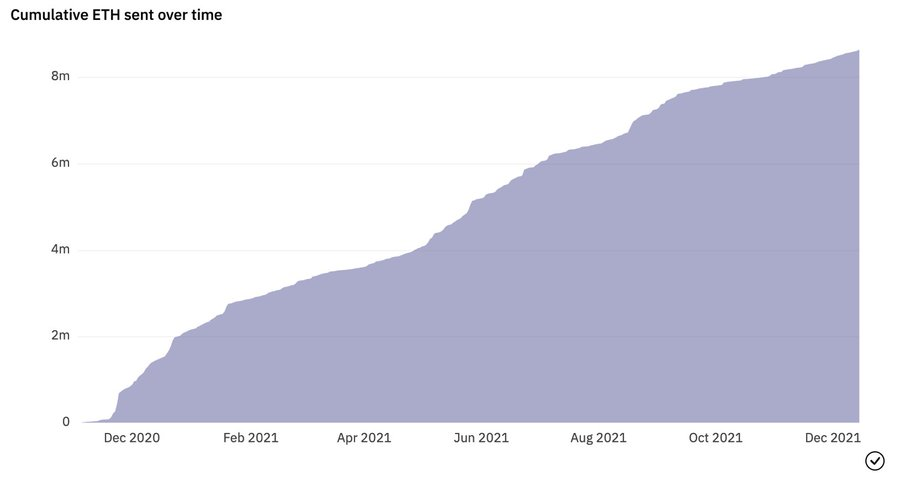

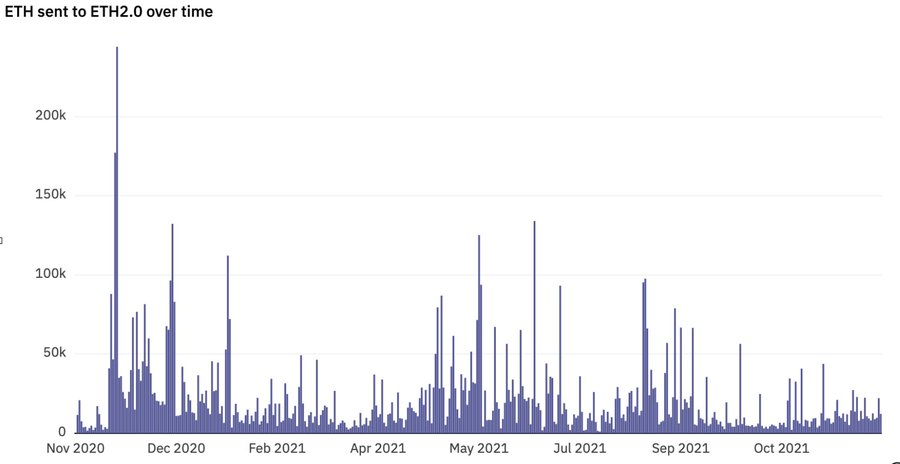

27. A little change, in 2021, the ETH pledged on the newly launched beacon chain will increase by 8 times, exceeding 8 million ETH, in order to transition to PoS.

28. Although it appears that over time, deposit rates are gradually moderating throughout 2021.

Contrary to popular narrative, Ethereum merger time stakers will be looking for an exit, and I expect a new surge in deposits.

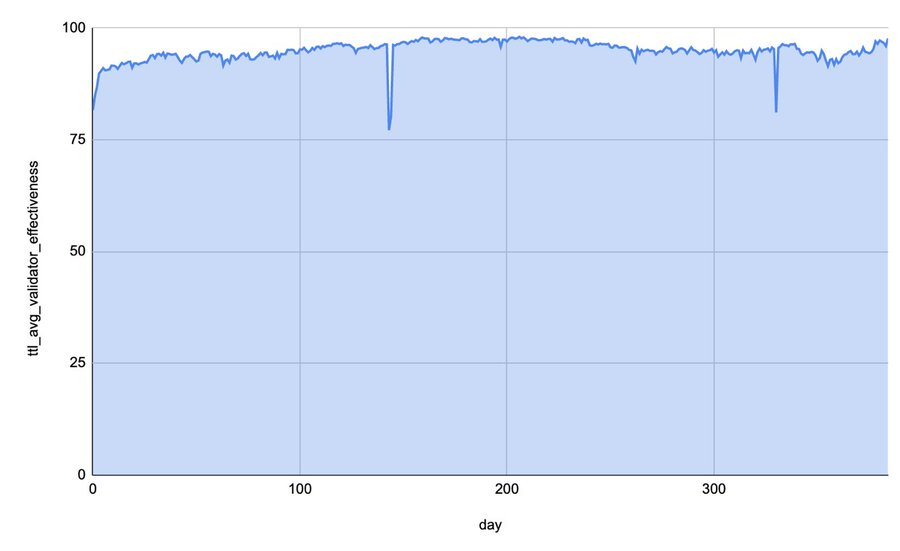

29. On the network, validator effectiveness has consistently been between 90% and 95%, with several sharp drops during network upgrades.

It will be very interesting to see how validators behave once they are faced with coordinating more complex activities than just proofs.

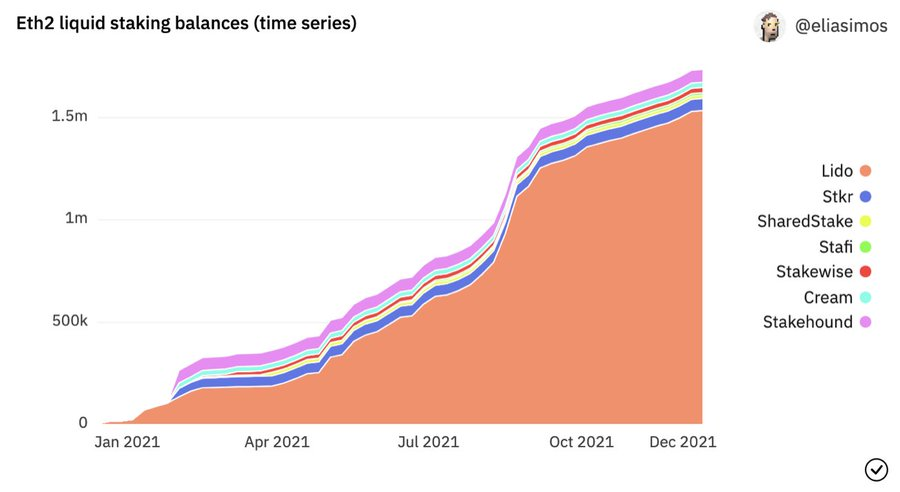

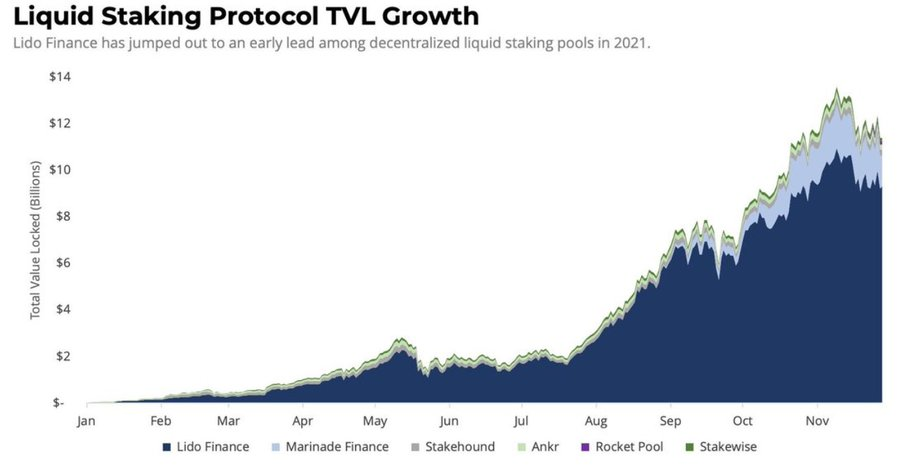

30. Authorized beacon chains work in pure PoS and no delegation, and liquidity staking has taken off, solving a real pain point for users with smaller balances and providing entry and exit for larger users.

Lido has always dominated the category.

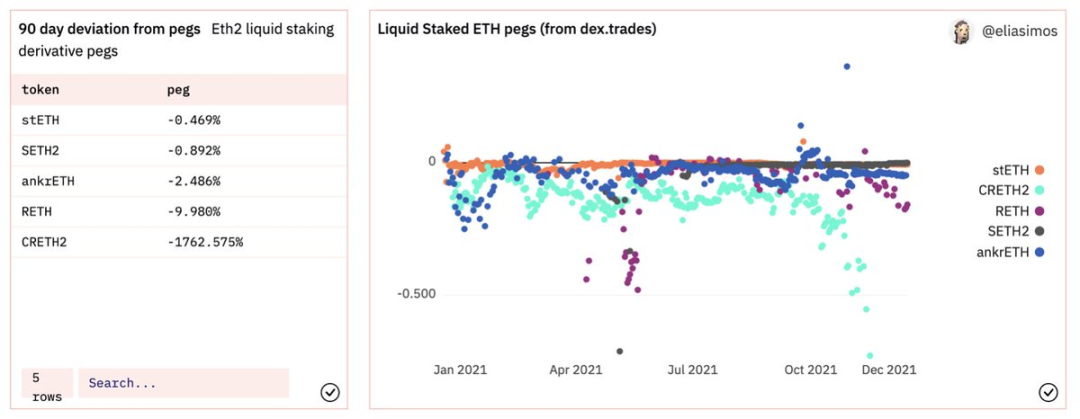

31. This is not only reflected in the TVL, but also in the way the derivative assets linked to it behave.

Among the many contenders, stETH (Lido's liquid collateral derivative) is the largest.

32. Liquid Staking is not just an eth2 phenomenon. Lido is also making a lot of headway on Terra, while liquidity staking pools are popping up in a bunch of other proof-of-stake chains. Such as @meta_pool, @MarinadeFinance and @KaruraNetwork.

Looking forward to more in 2022.

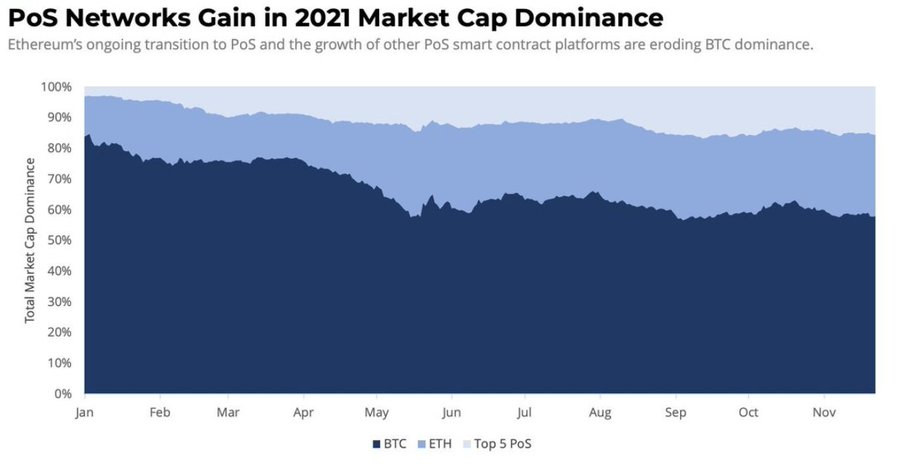

33. Zooming out and looking again, in 2021, the PoS protocol has always occupied the central position.

From where I stand, the genie is out of the bottle. Most new networks are launched in PoS and some PoW (ETH, ZEC) are planning to transition to PoS.

PoS will soon become the de facto standard.

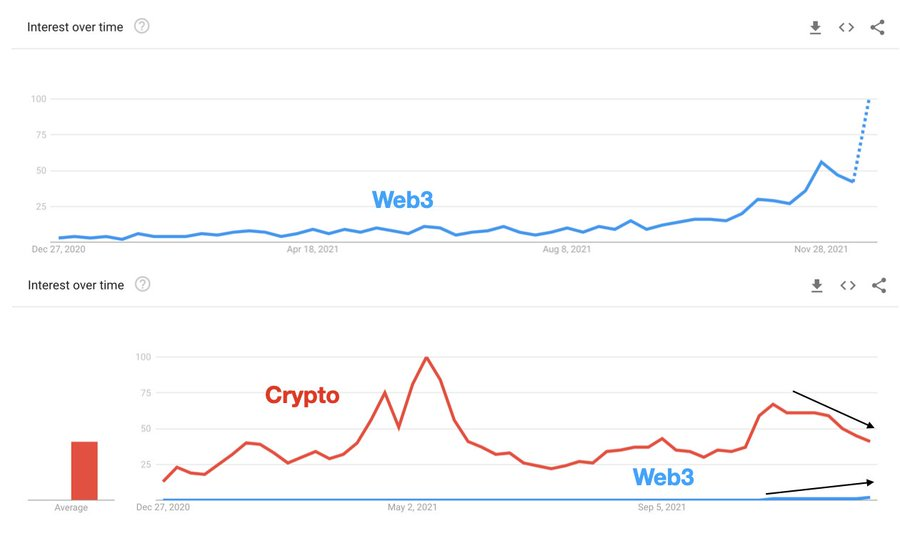

34. The web3 narrative has been heating up throughout 2021, with interest in the term accelerating in the fourth quarter.

However, it looks like the world still refers to web3 as...encryption.

The turnaround at the end of the year is worth watching.

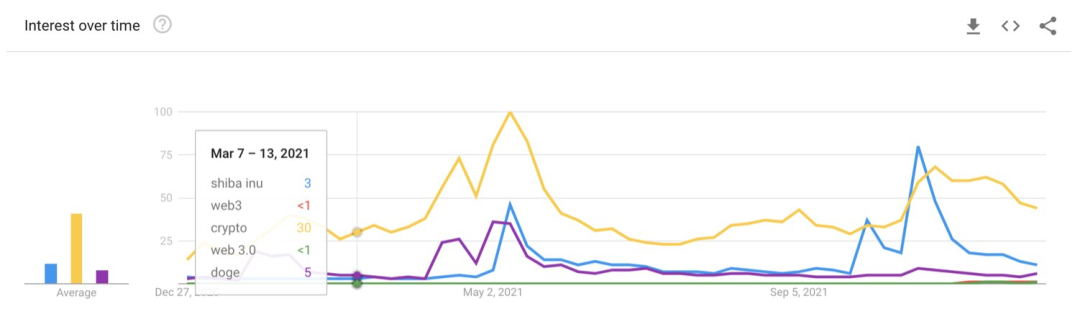

35. Regarding trending terms, it’s worth noting that crypto’s mind-sharing dominance as a term was briefly eclipsed by … $SHIB.

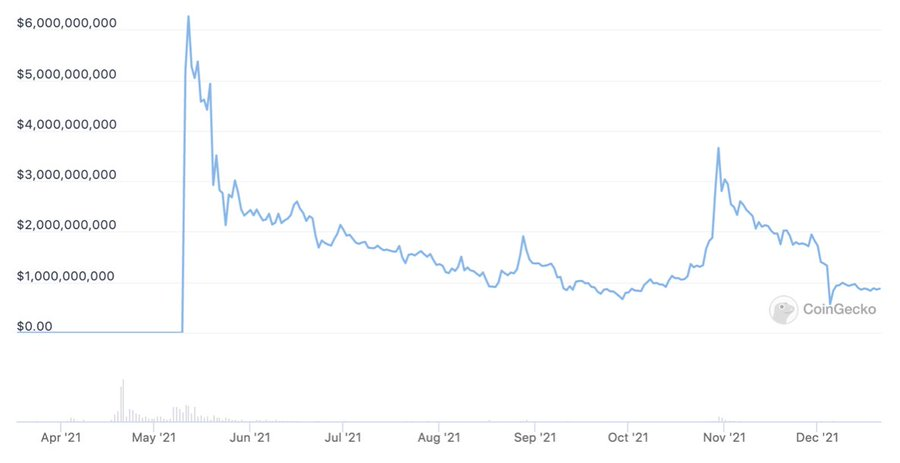

36. When it comes to meme coins, SAFEMOON once reached $6 billion FDV, and finally stopped at $1 billion FDV.

From here we can deduce 2 things; (i) people like meme coins and (ii) almost no one pays attention to FDV.

This is either your alpha or your bane.

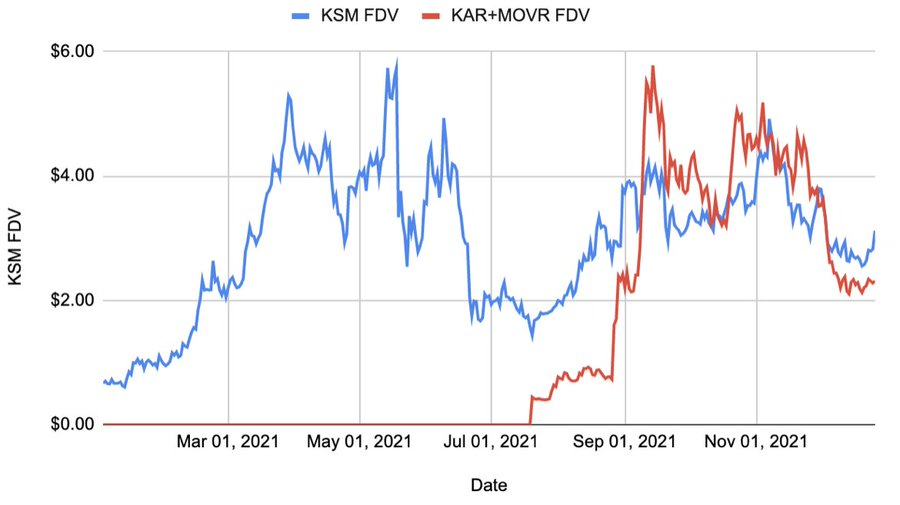

37. Again, I say this though, but in the world of shared security, the market seems to be approaching FDV in some sense.

The FDV combination of Karura and Moonriver (the two largest Kusama parachains) oscillates around the FDV of Kusama itself.

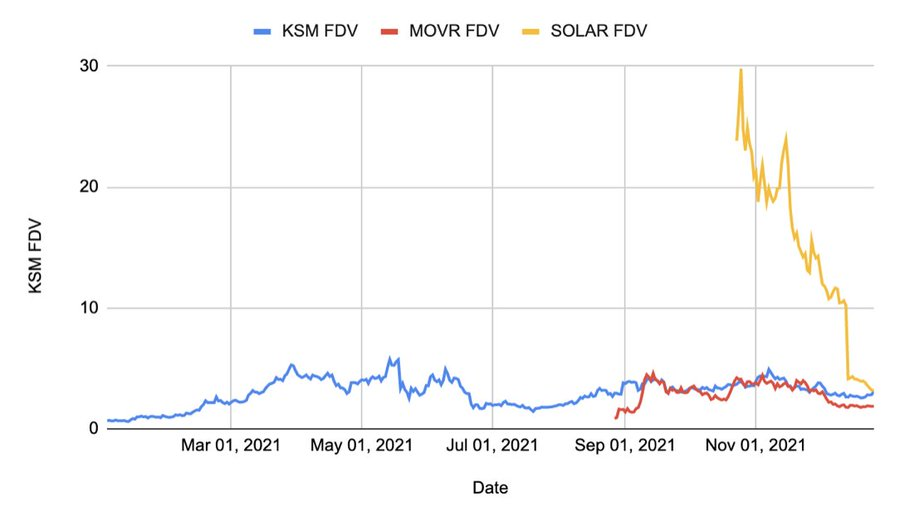

38. Solarbeam is the native DEX on Moonriver, and its value is almost the same as KSM's FDV.

It's clearly correcting sharply, but as more releases come online, one should keep an eye on L0 as an indicator of what's being built on top.

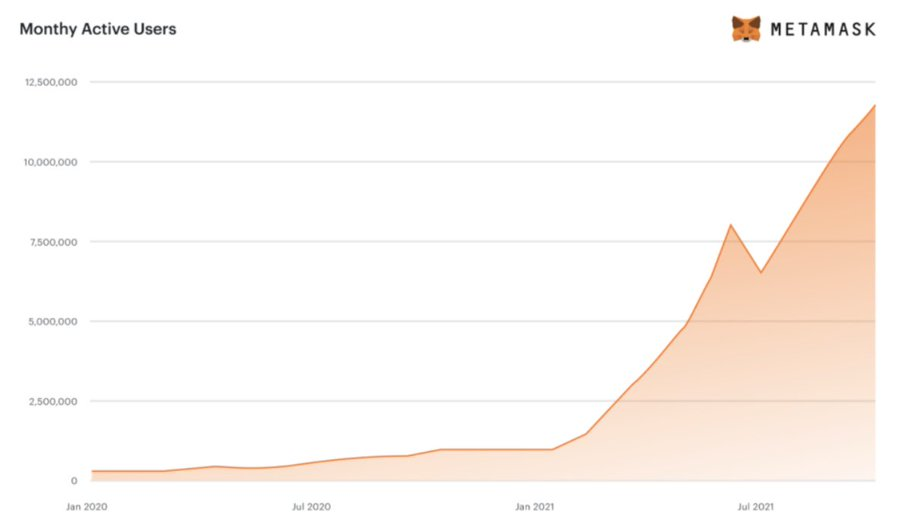

39. In any case, 2021 is the breakthrough year of web3/crypto.

The most interesting statistic here is undoubtedly the 10x increase in Metamask's user base MAU.

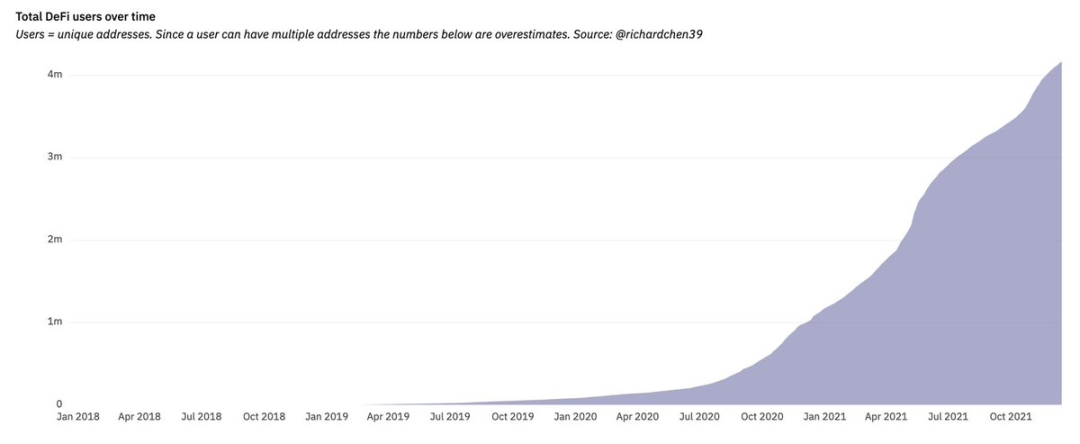

40. Despite DeFi falling out of favor in investors’ minds and portfolios, the number of unique Ethereum addresses interacting with DeFi protocols has increased 4x.

Sure, there could be a lot of airdropping wool involved, but does that necessarily mean right?

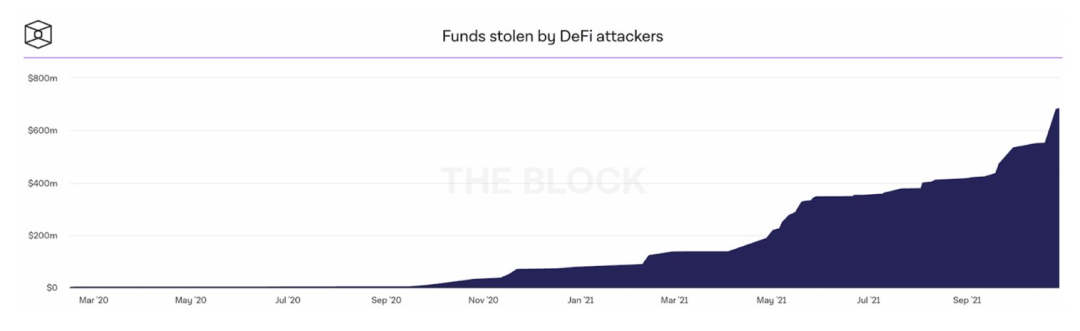

41. But while these new users enjoy the wonders of DeFi, they also encounter a lot of nasty shocks.

Funds lost in DeFi hacks are truly at an all-time high in 2021.

Remember new friends; stay safe @NexusMutual

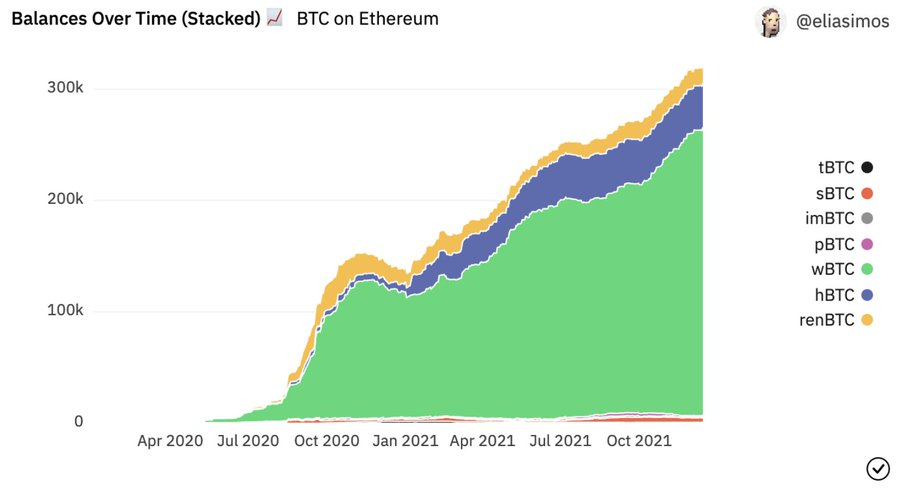

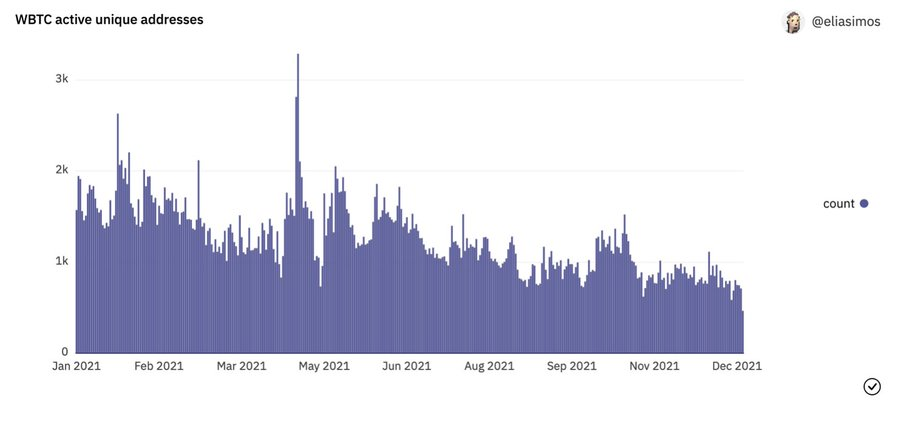

42. WBTC on Ethereum continues to dominate the wrapped bitcoin market.

43. It is clear that the medium of wrapped bitcoin is primarily used for yield farming rather than trading.

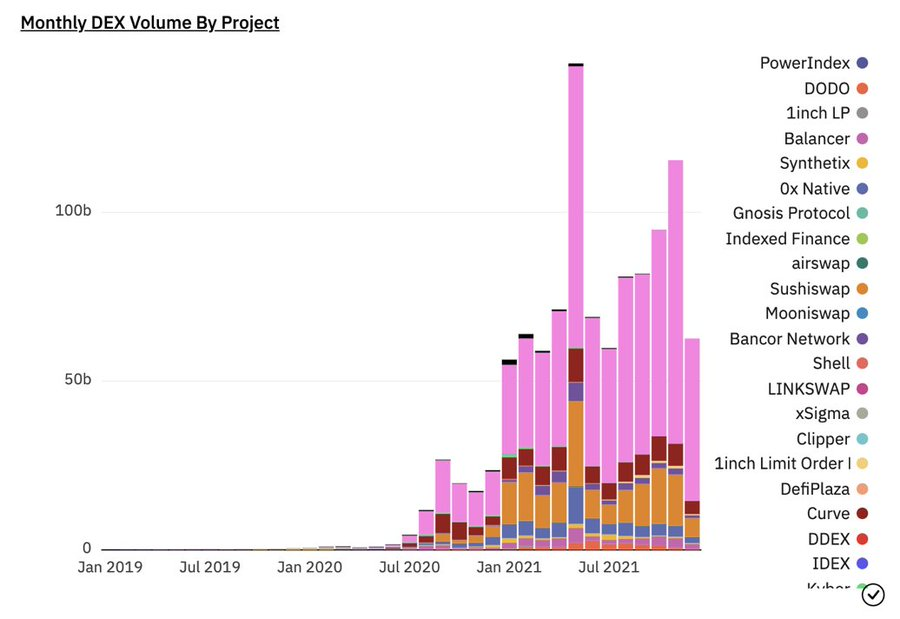

44. The trading volume of DEX continues to grow, and Uniswap continues to dominate in many aspects.

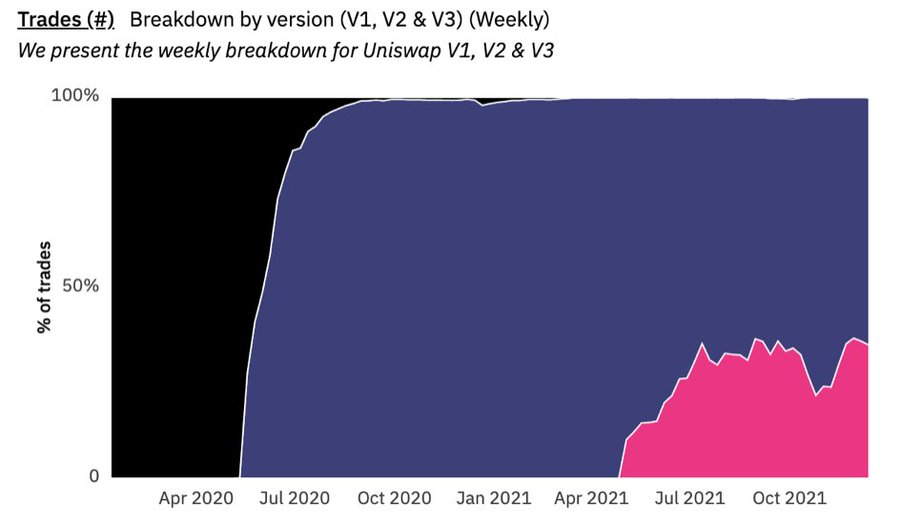

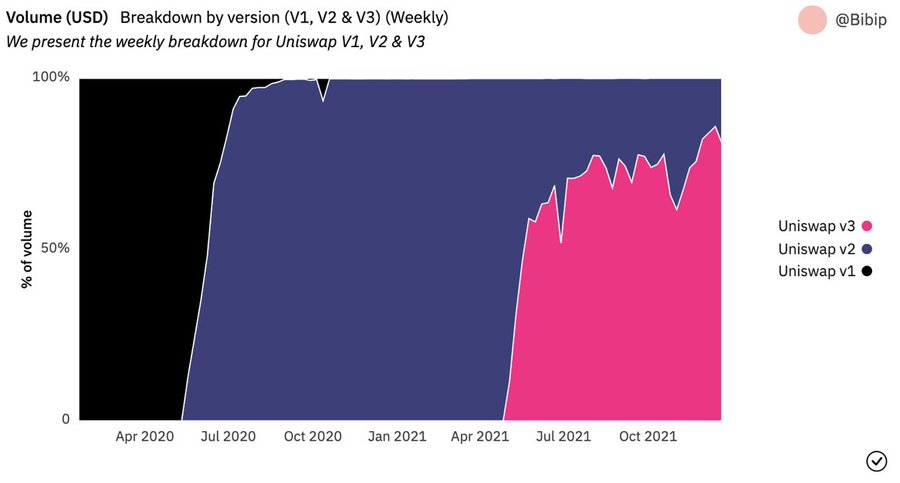

45. Speaking of Uniswap, its v3 is arguably one of the most innovative DeFi protocols to launch in 2021, introducing a host of new features and capital efficiencies to the system.

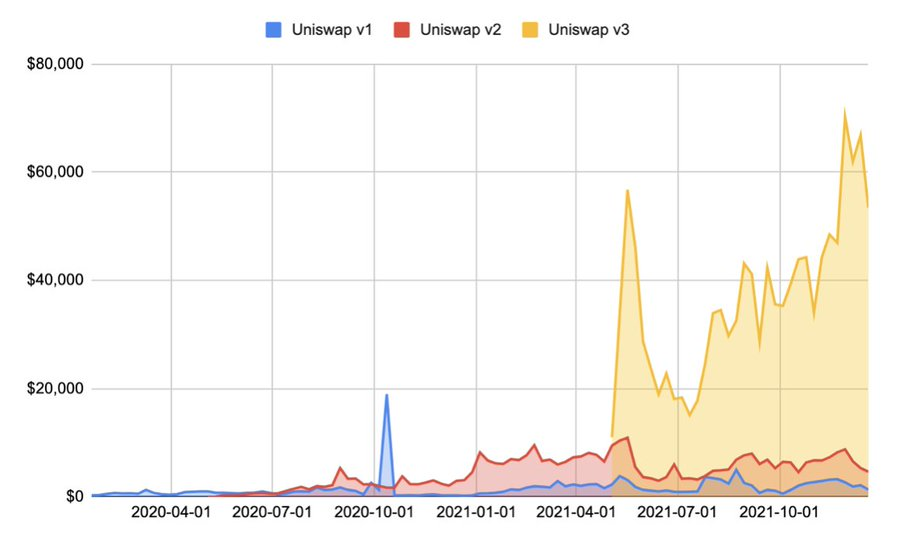

However, although it accounts for the majority of transaction volume, it is not growing as fast as v2.

46. Obviously, v3 is a protocol for professionals. The average deal size was about 30 times higher than v2, reaching a staggering $60,000 by the end of the year.

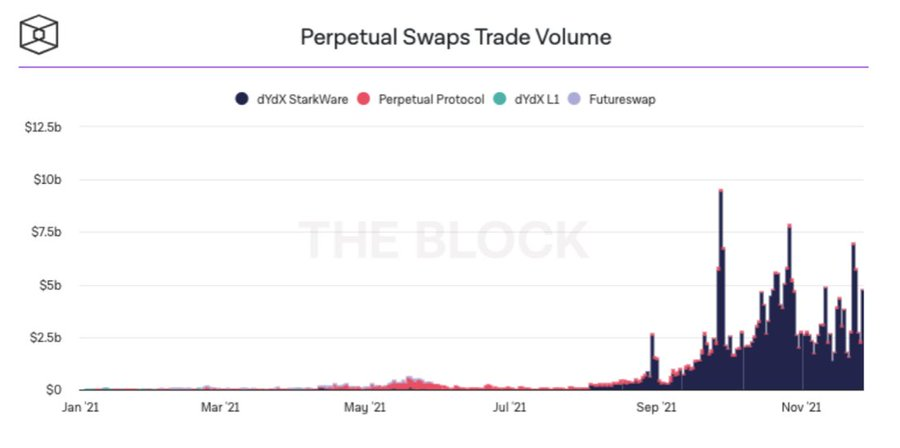

47. The prospect of on-chain derivatives starts to shine in 2021. The deployment of dydx on StarkEx shows that L2 can and will likely help developers introduce more computationally expensive applications into the open web3 field.

Exciting stuff!

48. On the other hand, lending agreements show less explosive growth in 2021, with less growth in asset deposits compared to asset price growth relative to the dollar.

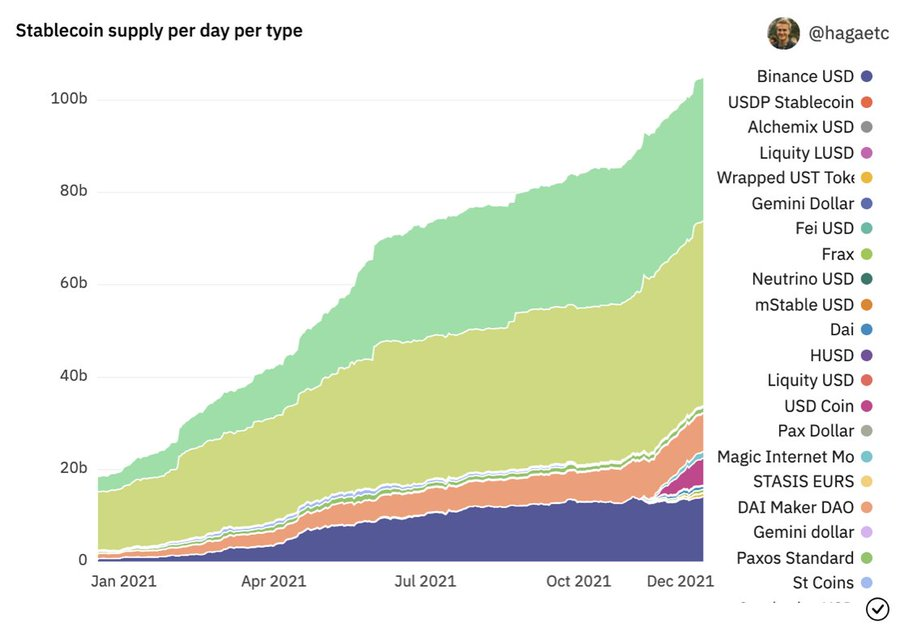

49. There are different stories about stablecoins. The category of Ethereum alone has grown 5x, bringing more and more utility to the world of on-chain interactions.

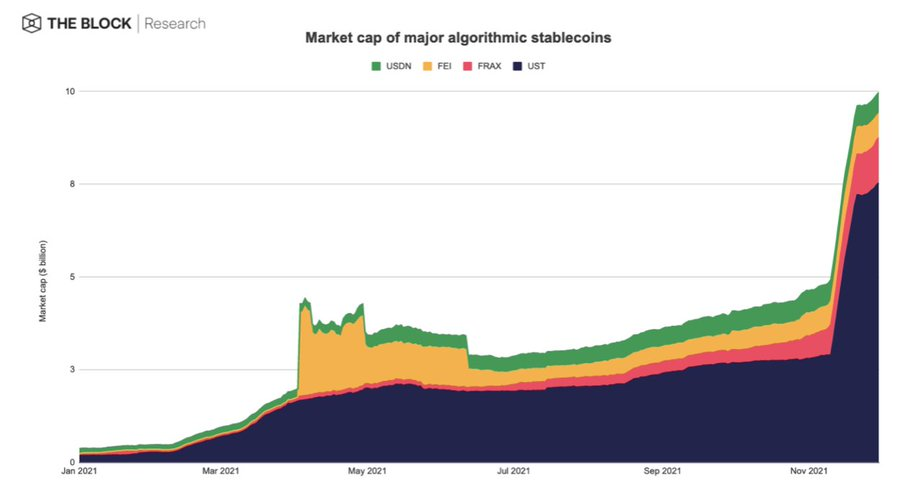

50. Of course, you can't just look at the category, but also highlight the fact that algorithmic stablecoins are having a breakout year, with USD UST leading the way.

After a series of experiments, the algorithm model is becoming more and more mature-although it has yet to be tested by the bear market.

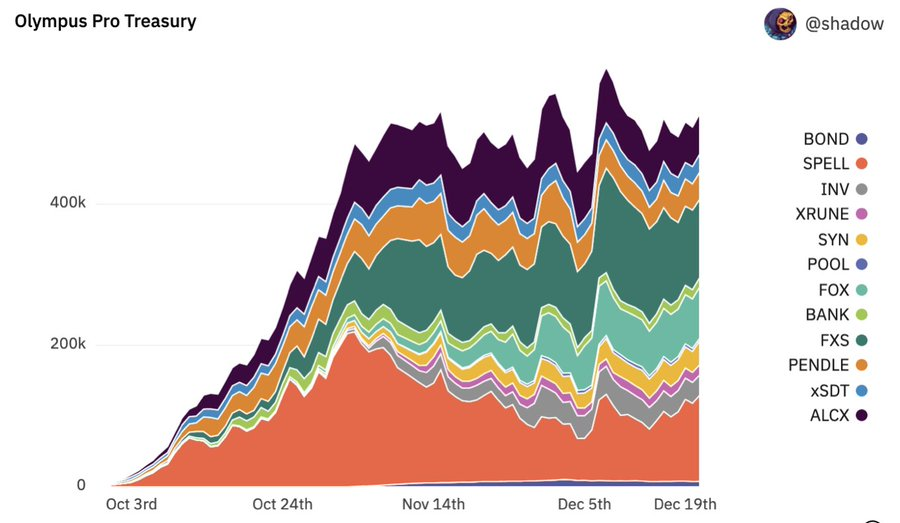

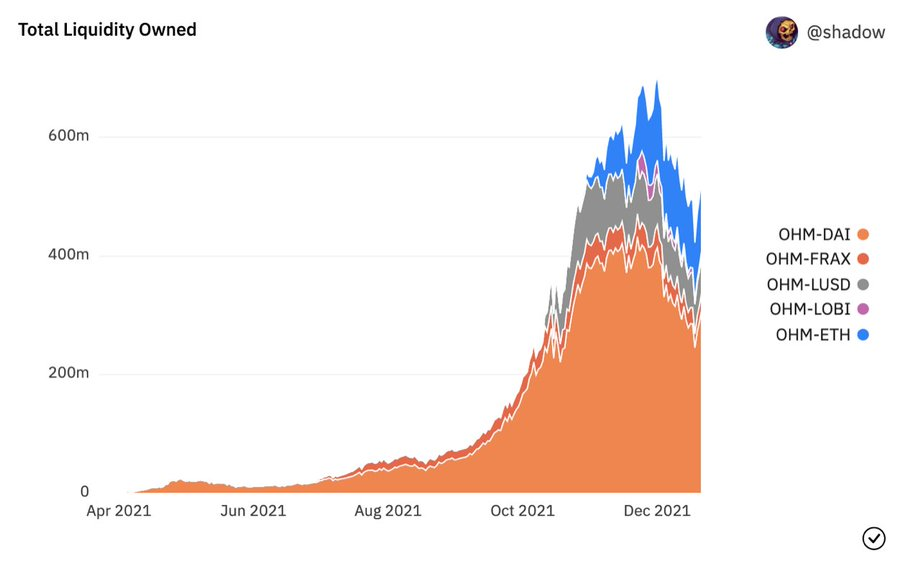

51. It is also impossible to talk about DeFi without paying attention to OlympusDAO.

Sophistication or massive innovation of the core liquidity mechanism, it's up to you to judge.

To me, the latter looks more innovative and the former less.

52. No matter which way you cut it, you can't ignore the fact that OHM has built a lot of stable assets to support OHM.

This clearly shows that the huge coffers the protocol has amassed in 2021 will play a major role in what happens in 2022.

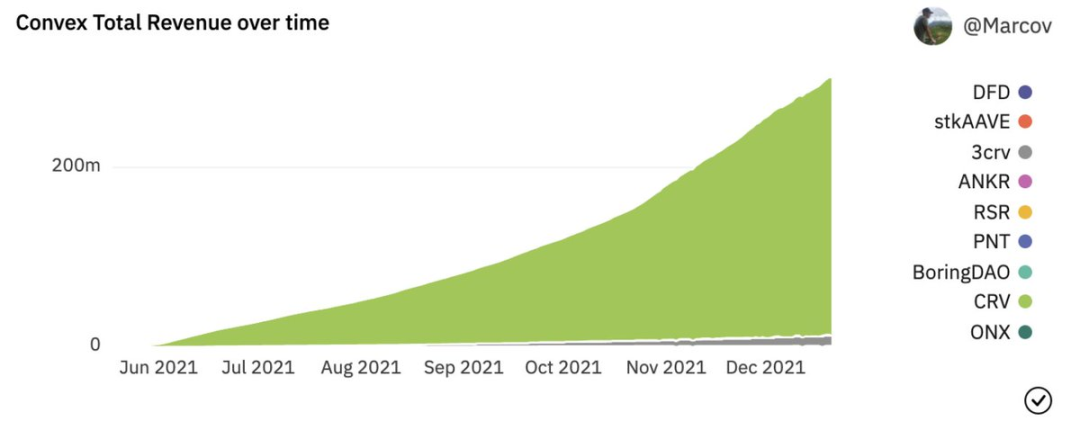

53. Finally, you cannot understand the rise of Curve and Convex without looking at DeFi in 2021.

These two protocols pave the way for "worthy" governance tokens.

Entities scrambled to acquire CRV and CVX for cheaper (more) liquidity incentives.

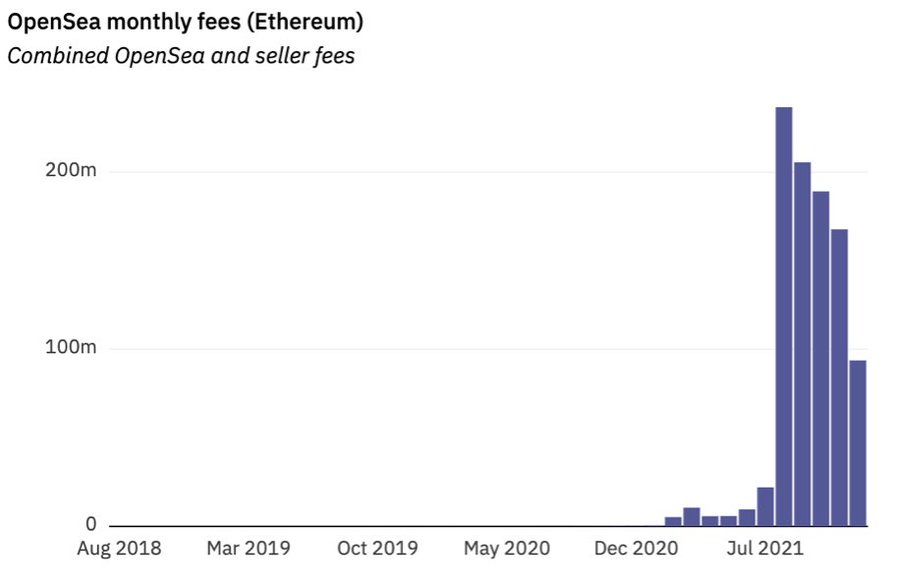

54. Well, DeFi is cool. But you know what's cooler?

EN-EFF-TEES may be the biggest web3 story of 2021. Indeed, OpenSea, which dominates market activity, speaks for itself.

On a linear scale, the activity of previous years is even negligible.

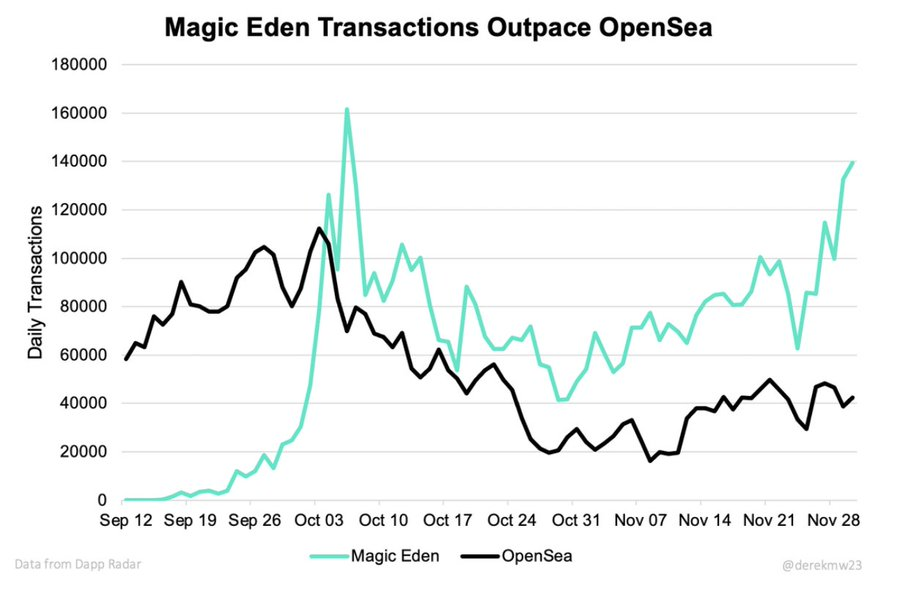

55. NFT marketplaces have sprung up on various chains, and the lower fee environment allows for different types of user activity compared to Ethereum.

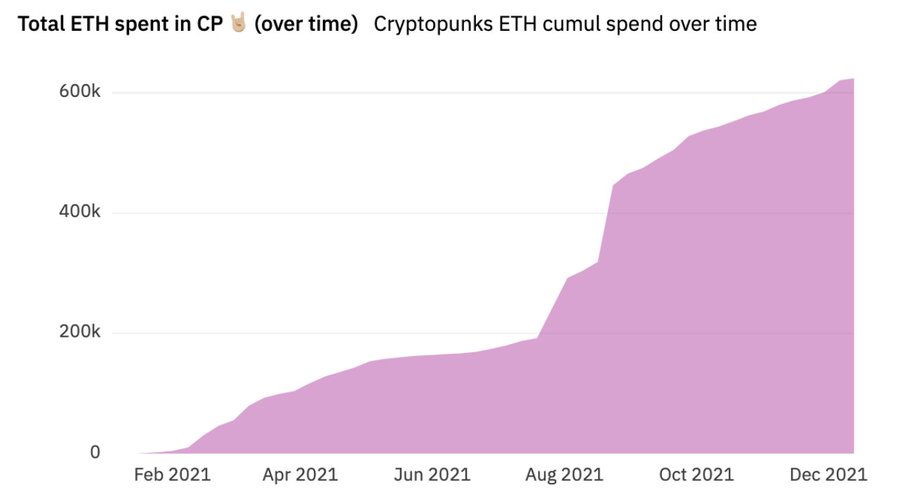

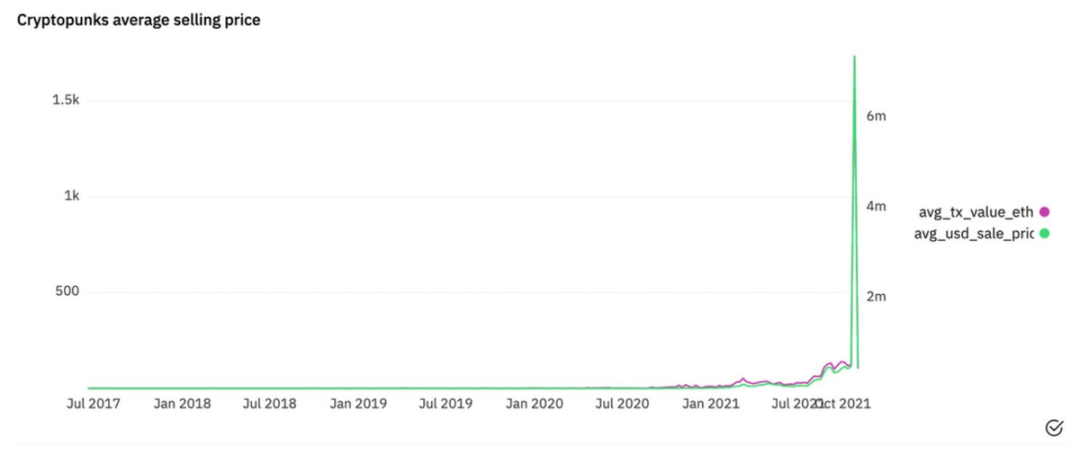

56. If you don’t mention OG, then don’t talk about NFT.

Total transaction volume via CryptoPunk contracts surged to 60x in early 2021 - totaling 650k ETH.

This does not include private sales, packaged cryptopunk sales, etc.

57. Of all the sales that pushed CryptoPunks to these highs, the most notable was the Flash Loan laundered Cryptopunk #9998 sale for ~125K ETH or $500M.

This becomes a great indicator of how much subjectivity there is in on-chain data.

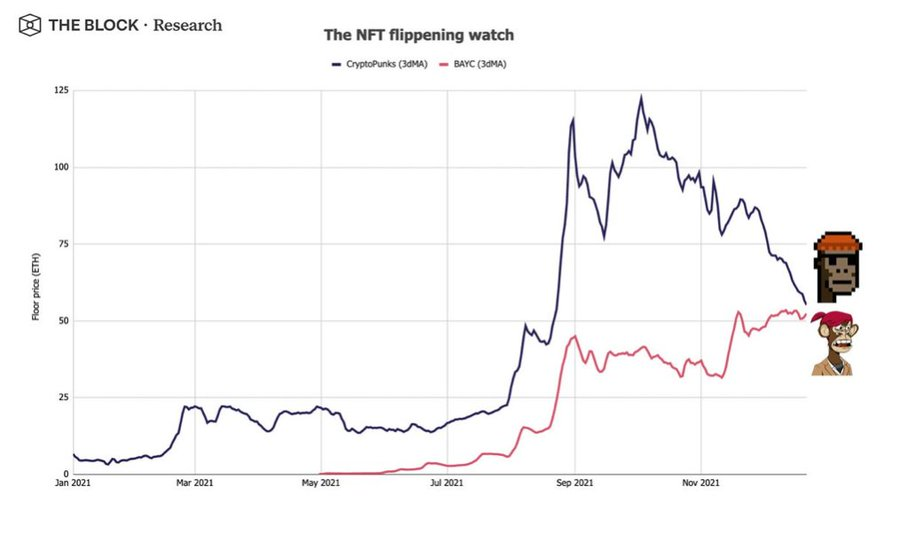

58. Another important pfp NFT story this year is Bored Ape (BAYC).

The story of growing from a small community to a celebrity platform in droves is full of drama.

Not to mention that BAYC temporarily exceeds the floor price of Cryptopunks at present.

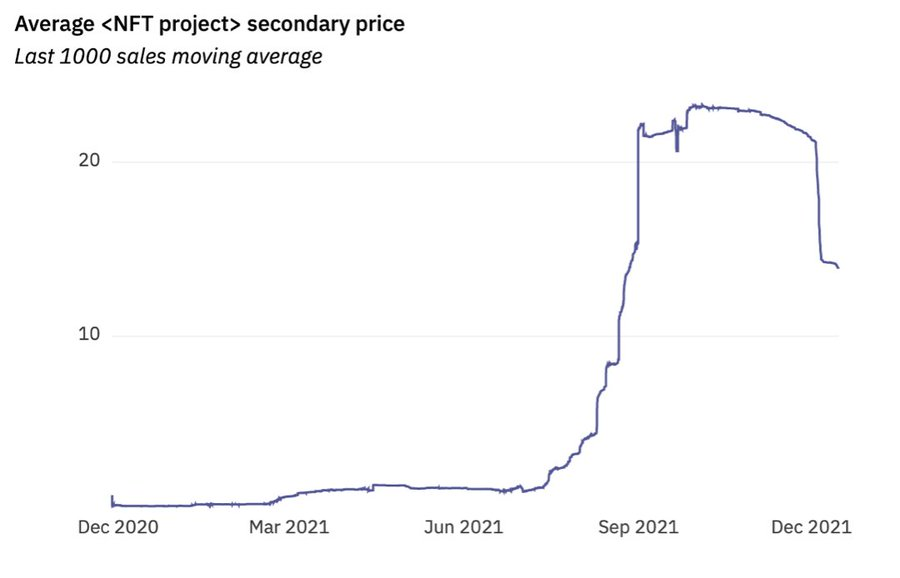

59. In the upsurge of new releases flooding pfp games and old NFTs achieving a billion-dollar market value, the average price of NFTs changing hands ranges from less than 0.1 ETH to about 15 ETH.

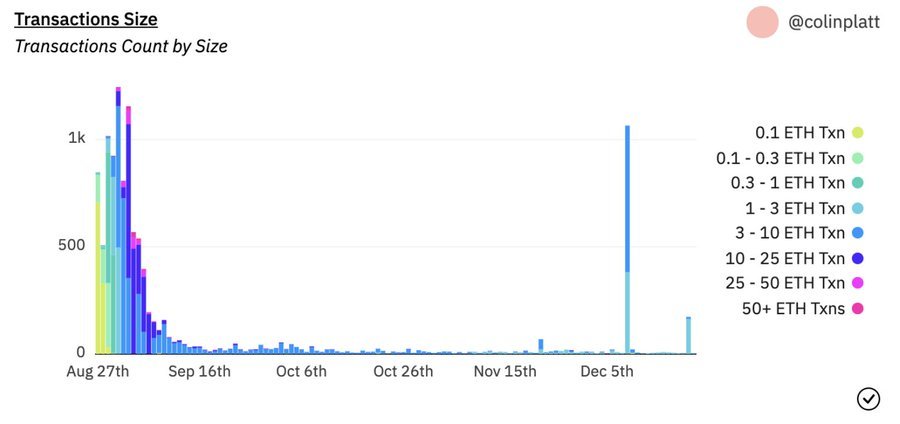

60. In my opinion, the most interesting release of the year is Loot.

Touted as the best thing since Coca-Cola, Loot broke new ground in terms of community-stimulated new knowledge and ideas.

And then no big moves in Loot...except for bottom buyers in early December? !

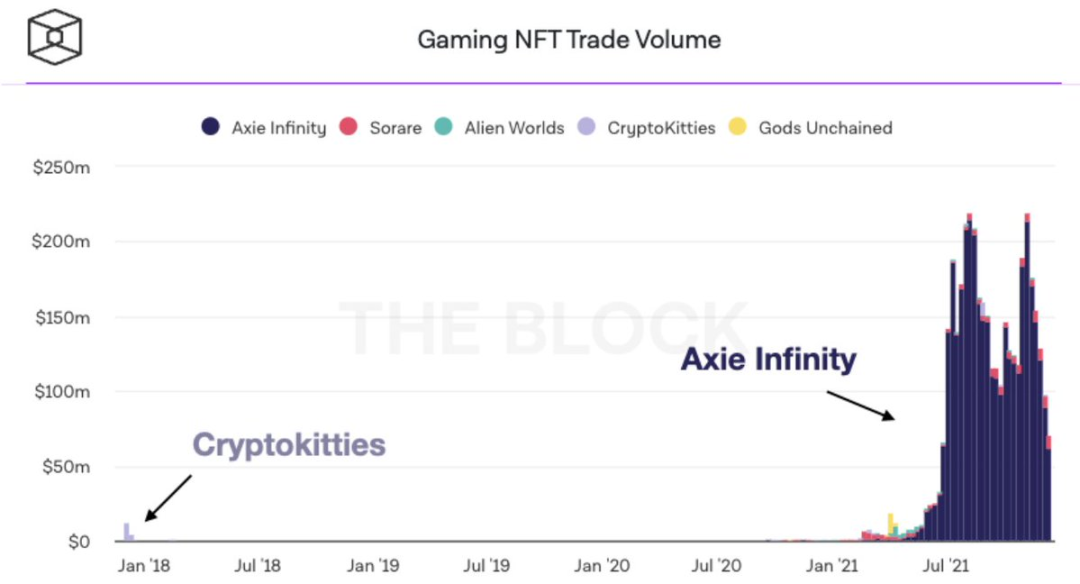

61. Tangent to the NFT category is Axie Infinity.

This is another breakthrough story for 2021, bringing the Play-to-Earn (P2E) and GameFi narratives to the table.

Market chaos ensued as investors scrambled to ride the hype train, valuations soaring in the process.

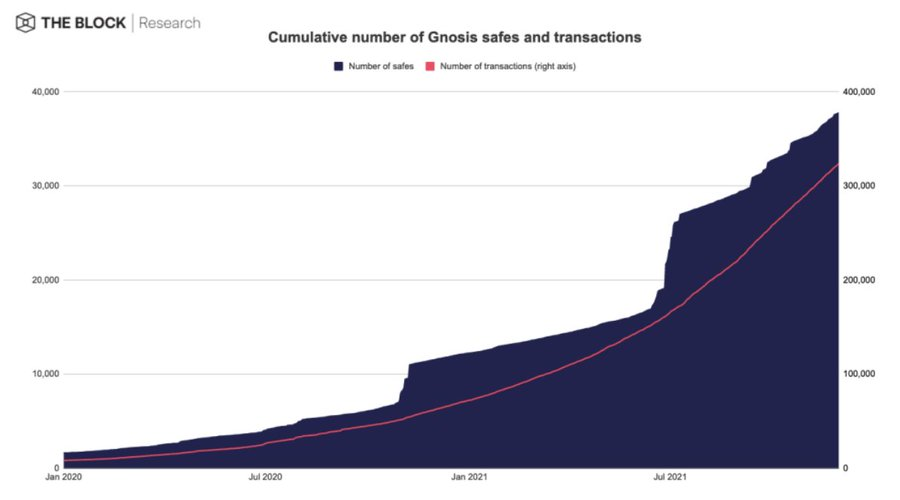

62. Many of the activities that support the discussion on this topic are, of course, DAOs.

The best stats I could find here were the activity around Gnosis Safe, arguably one of the cornerstones of the DAO's building blocks.

Execute 3 times as many deals in 2021.

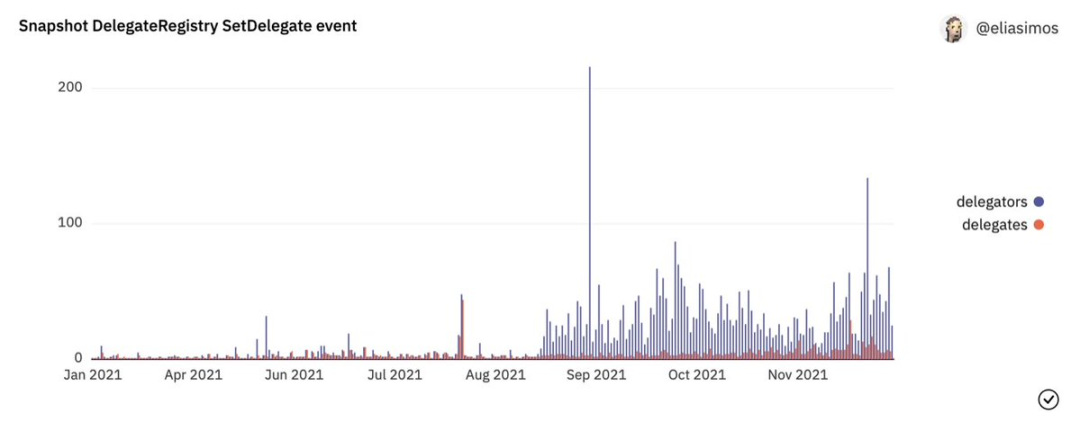

63. Another cornerstone product of The DAO is Snapshot — a tool that helps DAOs perform off-chain voting with on-chain validation.

In terms of delegates and principals, activity on Snapshot has increased significantly since September.

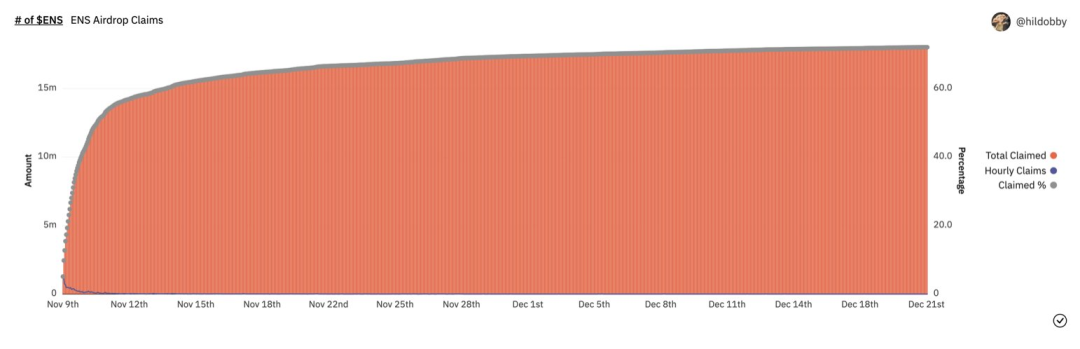

64. One of the most interesting DAO launches of 2021 is the ENS DAO.

Interestingly, it captures both the DAO trend and the important bootstrapping mechanism available to builders in web3;

Retroactive Token Airdrop

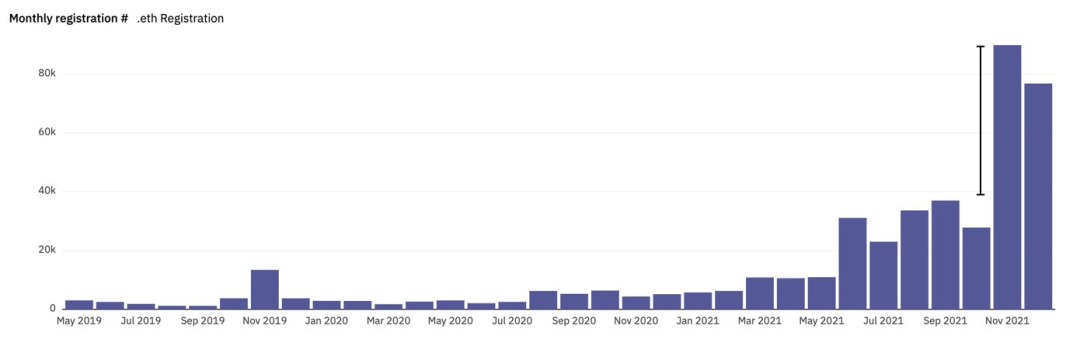

65. ENS devolves full responsibility for its user base sometime in November 2021.

Shortly thereafter, .eth registrations more than doubled from the prior 5-month average.

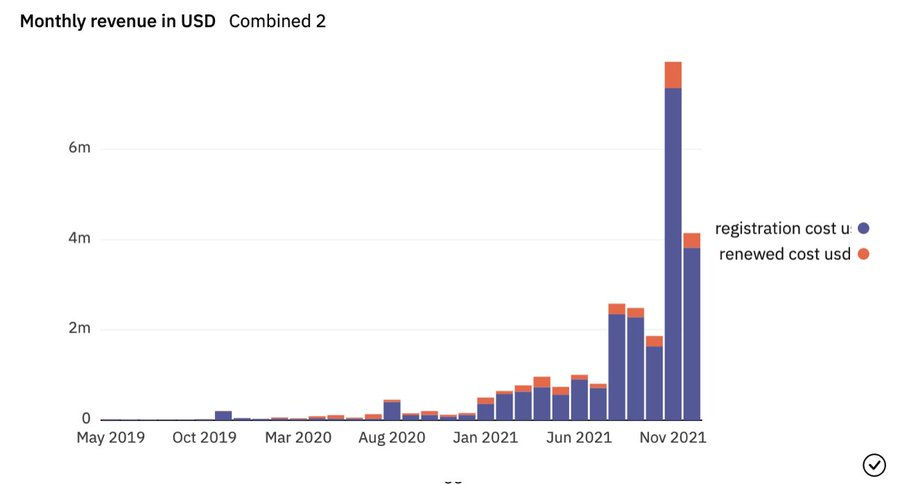

66. As .eth registrations increased significantly, so did the newly formed ENS DAO treasury.

The vault collected as much ETH in 2 months as the remaining months of 2021 combined.

Proof of how well-planned airdrops can drive development.

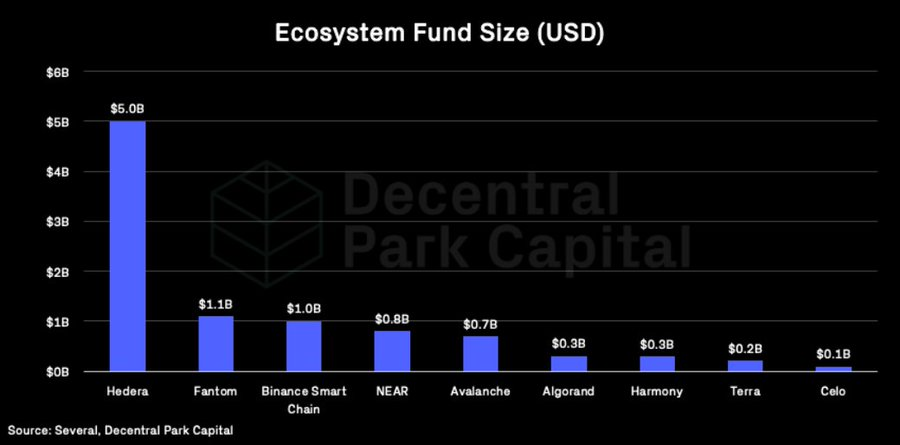

67. So where does all this lead us?

2021 opens up new possibilities for web3 developers. Value is slowly moving to the application layer, while new requirements emerge at the base layer.

There is also plenty of cash and tokens to fund new protocols and products.

2021 is truly a breakout year for crypto/web3, with a record number of new unicorns.

This is what adoption looks like.

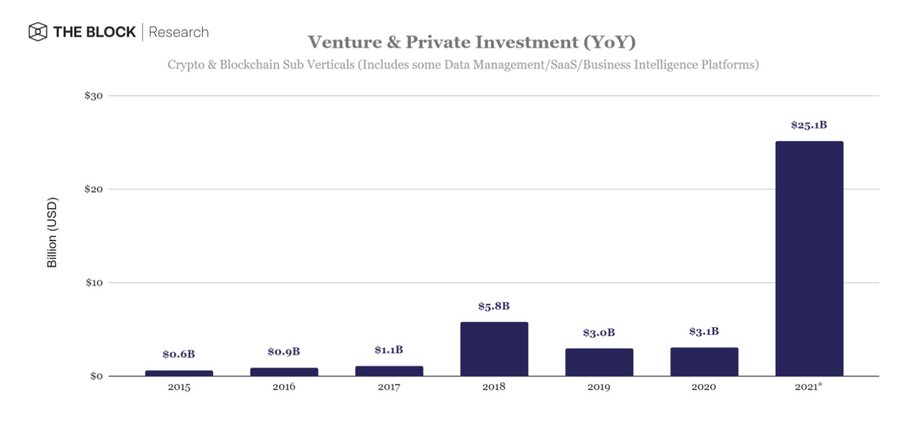

69. With the flood of venture capital pouring into Web3 and the massive talent migration underway, 2022 looks pretty good.

Unless the macroeconomic level pulls us back.

My take: stay fit and learn to love technology and the long term.

We are winning this game.