Foresight: How Colony Accelerates Avalanche Ecological Development through DAO

investment logic

Bet on Avalanche: the highly adaptable consensus mechanism provides unlimited expansion space, and the ecological potential is huge

Selecting the community: a paradigm shift in market investment, derived from the community spirit of DAO

Binding ecology: providing node liquidity and long-term ecological development

text

born in the community

The epidemic since 2020 has given birth to an era of extremely loose monetary policies. Institutions have begun to invest in cryptocurrencies as a macro hedge after obtaining huge amounts of funds in the traditional financial system. Technology giants with top resources have also begun to invest in the encryption market. Institutions have made the encryption market more and more crowded, the price of encrypted assets has risen, and it is becoming more and more difficult for individual participants to gain a foothold in this market.

Ecosystem Farming proposed by Colony gives community members the opportunity to participate in Avalanche's primary market investment, and returns the opportunities that were previously only available to institutional investors to community members. Return rights to community members through the form of DAO, and create value are passed on to community members.

The hard-core technical team gave birth to the high-speed development of Avalanche

The public chain is like the infrastructure of a city. It provides the energy, transportation, and communication functions of the city. It can grow a variety of business, social, entertainment and other activities, provide users with application scenarios, and attract users to form Economic system. The team led by Turing Award winner Professor Emin Gün Sirer provides a new public chain design solution in Avalanche, providing a new space for developers and users who pursue performance.

A third-generation consensus mechanism that can adapt to the environment

Avalanche has created a brand-new consensus mechanism. The previous consensus algorithm is mainly divided into the Classical classic consensus mechanism through multiple rounds of voting by all nodes in the network, and the Nakamoto Nakamoto Nakamoto style that relies on POW workload proof. The classic consensus mechanism with As the network expands, the cost of nodes operating the network also begins to increase in scale (often proportional to the square of the number of nodes n), which limits the growth space of the network and cannot support large-scale networks with more users. Decentralized Nakamoto The Satoshi consensus algorithm can expand the network to support a large number of users. But at the same time, because the random entry and exit of miner nodes affects the speed of block generation, the efficiency is low.

Emin Gün Sirer, a Turing Award-winning professor who majored in distributed systems at Cornell University, Ted Yi, Emin's professor who contributed to Libra's consensus algorithm as the first author, and Kevin Sekniqi, a Ph.D. in cryptography, are the founders. Avalanche's "third-generation consensus protocol" is designed based on metastable states and repeated random sampling. The metastable state means that the system does not maintain a specific stable state, but starts random sampling and obtains consensus when voting is required. Therefore, the node threshold of Avalanche is relatively low, and anyone can stake 2,000 AVAX Becoming a node ensures decentralization while reducing energy consumption.

Avalanche's consensus is based on random spot checks based on probability, and the number of spot checks depends on the size of the network. However, compared with the classic consensus mechanism, the complexity is controllable (proportional to the logarithmic function, and the order of magnitude is lower than the first function). Connor Daly, the founder of Pangolin, said in an article that the probability of repeated sampling of a node and drawing a wrong conclusion is extremely small, less than 0.0000000001%. Random checks are made on different node samples, and after a certain number of times, it will be found that these results will be It tends to be consistent, making it impossible to reverse the final result. It seems that there is only one snowflake at the beginning, but an avalanche is formed in the process of continuous snowballing, and the avalanche protocol Avalanche is named after it.

The configurable Avalanche consensus mechanism gives developers the opportunity to choose nodes and adjust network parameters to balance security or performance. A large number of developers are attracted by the Avalanche mechanism and join in the construction of this ecology. For example, Connor Daly, the founder of DEX Pangolin, put the network The security performance of the network is improved to the point that 80% of the nodes need to collude to endanger the security of the network, that is to say, more than 80% of the nodes give different answers.

image description

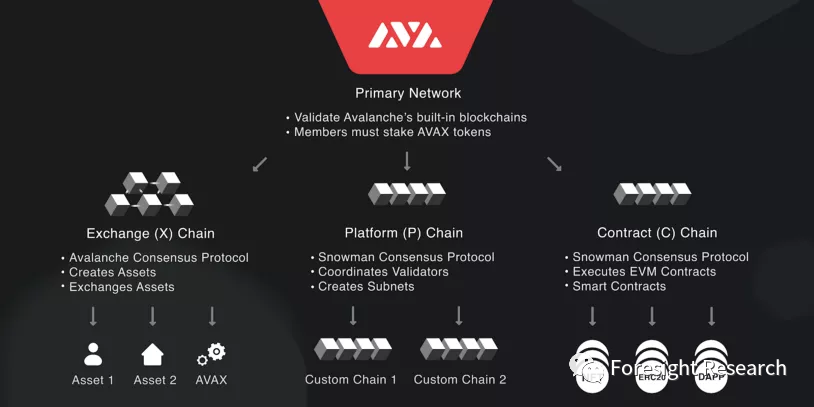

Avalanche network architecture

Avalanche's network architecture adopts a three-chain parallel three-dimensional structure, which are the transaction chain X-Chain for creating and exchanging assets, the contract chain C-Chain that carries smart contracts and is compatible with EVM, and coordinates monitoring validators and creators. The platform chain P-Chain of the Internet. Avalanche is composed of three interoperable blockchain systems. From the architecture design of the blockchain, it provides a scalable basis on the chain. The classification function prevents the main chain from being blocked by different requirements. overload.

On the premise of not sacrificing decentralization, the blockchain can choose two expansion methods:

By providing vertical expansion of blockchain transaction processing speed, improving the efficiency of data structure, or requiring higher-performance hardware, but still encountering the bottleneck of storage required for smart contract calls. 2. Increasing the number of blockchains for horizontal expansion, Horizontal deployment of multiple parallel chains is theoretically unlimited, but interoperability between independent parallel chains needs to be guaranteed.

The Subnet subnet supported on Avalanche’s P chain chooses horizontal expansion. The subnet needs to process transactions through virtual machines, and Avalanche supports EVM, Bitcoin Script VM, Cardano’s UTXO model, Solana’s transaction engine, etc. etc., to provide users with cross-chain asset liquidity. Although EVM has a strong network effect, we may expect developers to innovate.

Compared with the open source public blockchain, the designer of the subnet can determine the visibility and access rights of the subnet by adjusting the verification node set, so as to achieve the security and privacy of the custom protocol.Only verification nodes that meet the standards can send transactions, view the content on the chain, and download blocks. And while the subnet of the P chain can customize the GAS fee standard, it can coordinate and monitor the validator and the subnet through the P chain, and directly obtain data from the public chain. Environmental efficiency support.

How Colony Becomes the Core Builder of Avalanche Ecosystem

Colony, as the first community-driven project incubator in the Avalanche ecosystem, contributes to the Beta revenue of the market while increasing the potential revenue of the project.

Colony will build its ecology from 4 directions:

1. Become a node: positive cash flow gives tokens intrinsic value

10% of Colony's net asset value is used to pledge nodes. According to the fundraising of 20 million, there are 2 million US dollars available. Assuming that the nodes meet the standards within one year, and the online rate is as high as 80%, AVAX maintains For $119, you can calculate:

Colony holds 16,806.7 AVAX*According to the average annualized rate of return shown on Avascan 9.82%=1650.42 AVAX (here we ignore the possibility that Colony as a node may accept entrustment from others to generate income).

For the convenience of calculation, we ignore the fluctuation of AVAX tokens:

CLY investors can get 1650.42AVAX*119 USD/10,500,000 market circulation = 0.018 USD EPS.

If we value Colony purely from the perspective of mining income, we can use the simple analogy of the EPS earnings per share of existing mining companies and the rolling price-earnings ratio of TTM-PE:

Investors give a price-earnings ratio estimate of 20-130 times for mining stocks, and the market gives different prices for different mining capabilities and strategies. Colony’s mining business can refer to the price-earnings ratio valuation given by the market , superimposed on the value-added space of AVAX tokens, then the holders of CLY may give a higher price-earnings ratio, indicating that investors are willing to pay a higher premium for the expectation of Avalanche's growth in the future.

Of course, there are still many uncertainties in the income of liquidity mining, including the selected DEX, trading pairs, and the value fluctuation of AVAX. Here, a simple estimate of the income of Colony as an LP on Avalanche may be different from the actual income. There is a big discrepancy, but it can be seen that Colony's future cash flow income is also quite considerable.

2. Provide liquidity for DEX: obtain funds to repurchase tokens to reward the community, and at the same time enhance ecological value

30% of Colony's net asset value provides liquidity in the Defi market, that is, 20 million US dollars * 30% = 6 million US dollars. Assuming that Colony provides liquidity on the Avalanche head DEX, Trader Joe and Pangolin provide an average of 3 million US dollars .

Assuming that Colony is an LP with a large amount of funds, it chooses the top liquidity pool to obtain stable income. For example, the token income APY of USDC.e-WAVAX is 16.29%, and the service fee income APY is 30.59%. Liquidity mining 488,700 + service fee income of 917,770, a total of 1,406,400 US dollars.

Choose the leading liquidity pool in Pangolin, such as WETH.eWAVAX, with a service fee of 15% APY, plus 4% of mining income, and a year’s APY income of 19%, then Colony’s income in one year is 570,000 US dollars.

Conservatively calculated as an LP with a total income of 1.9764 million US dollars. According to the price of 1.67 US dollars, Colony can repurchase 1.1834 million CLY tokens, accounting for 11.2% of the 10.5 million tokens in the public offering. And the subsequent income will continue to be invested in the repurchase of tokens .

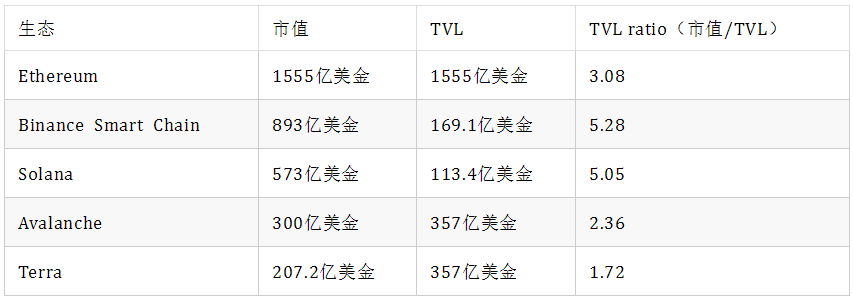

At the same time, the TVL value that Colony contributes to Avalanche can refer to the possible value through TVL ratio. As of December 22, according to the data of Defi Llama and CMC, the total TVL value of Defi is 249.89 billion US dollars, of which:

TVL ratio is the ratio of market capitalization divided by TVL, which can help determine whether DeFi assets are overvalued or undervalued. Avalanche, as one of the top five public chains by TVL, has a TVL ratio that is only higher than Terra, the lowest among the five assets, indicating that AVAX is compared to other Assets are relatively undervalued.

Assuming that the price of AVAX remains unchanged, it means that Avalanche is a continuously undervalued asset. From the perspective of valuation, there is more room for valuation repair. If the price of AVAX rises and the TVL Ratio falls, it may be that TVL attracts more The addition of funds, resulting in a siphon effect of economic development.

3. Avalanche Ecological Index Fund: Capture the market value Beta of Avalanche's ecological growth

At present, Colony has not yet launched index funds. We can refer to the existing index investment business model to estimate the possible operating income.

Index Coop now has 5 types of indexes, among which the Leverage product is a leveraged product for a certain ecology, such as ETH 2X Flexible Leverage Index. Among them, the Leverage product index for ETH is similar to the Avalanche exclusive ecological fund launched by Colony The degree is relatively high. Although the Avalanche ecological fund provided by Colony will not provide leverage, the investment groups covered are more similar, so here we evaluate the income of the standard ETH2X.

Index Coop announced that its income in November was US$723,710. In the three months from the beginning of the agreement to November, the total income was US$1.88 million. Among them, ETH2x-FLI, an index fund based on Ethereum funds with 2 times leverage, contributed 58% of income.

Index investors have grown from less than 5,000 investors at the beginning of the year to more than 30,000 holders in December, and the TVL has also reached 500 million US dollars in the past month. This shows that index investment products are getting more and more With the favor of many investors, more individual and institutional investors began to consider joining index investment to obtain stable long-term investment.

As the first Colony to launch the Avalanche ecological index fund, we can expect more first-mover advantages and attract more investors to participate in index investment. At the same time, it should be noted that the composition structure of index funds, the way of anchoring value, and management fees are all issues that need to be considered by the Colony community.

4. Primary market investment: focus on ecological investment, covering multiple tracks

Colony is deeply bound to the Avalanche ecology, and through official partnerships, it can obtain more primary market resources and lay out various tracks.

Now Colony has publicly invested in 7 projects:

Calculated according to the market price, excluding projects without TGE, Colony’s primary market return has now been 16,833,858.9 US dollars, and this can be airdropped by holding CLY tokens. According to the current market price, the cost is 1.67 US dollars. At the same time, it should be noted that the investment decision-making of Colony is still centralized, and we need to pay attention to the details of community voting governance in the future.

Colony's four major businesses will bring relatively stable cash flow income, endow CLY tokens with intrinsic value, and make CLY tokens an asset that can continue to generate economic benefits. However, most encrypted assets rely on market heat and narrative, lacking intrinsic value , traders driven by speculation lead to a large number of price fluctuations. Even without considering the income from investment in the primary market, the three businesses of Colony can understand the cash income of Colony in real time through open and transparent on-chain data.Whether it is participating in governance as a member of DAO or holding such tokens, tokens as a representative of ownership mean the power to obtain economic benefits.

The strength of the trading team from a mature market

Colony's founding team all come from the trading background of traditional finance, and the world's top ex-IBM technical team. The trading experience from mature markets gives them a deeper understanding of risks and benefits.

CEO, Elie le rest,Invested in digital assets in 2014, and established the quantitative hedge fund ExoAlpha in 2019 with a management fund of up to 500 million US dollars.

CIO,Dr.Jean-Baptiste,Since 2015, he has started quantitative transactions. As the co-founder of Olymp Capital and Olymp Fund, he has achieved 44% IRR in transactions, and managed ExoAlpha with CEO Elie.

COO,JEAN-MARC BONNEFOUS,In 2007, he served as the CEO of Tellurian Capital, a private equity firm in the commodity market, and served as the global commodity and derivatives trading director at BNP Paribus, a top European investment bank. He has accumulated 15 years of trading experience.

CTO,ALEXANDRE COSTANTINI,Lead software architecture at IBM.

DAVID LIFCHITZ,Quantitative Trading Manager,Served as the risk control director of the US market at Ashmore Group, a private equity firm that manages more than 90 billion US dollars.

token economy

token economy

Colony created the highest financing record for Avalanche, raising a total of more than 20 million US dollars. The plan of Colony's team is to cover more users from the beginning and give every ordinary user a chance to participate.

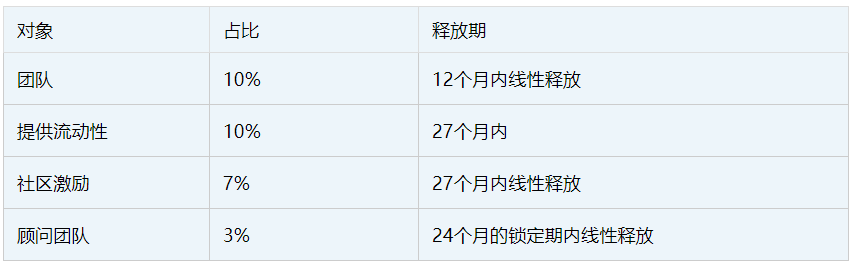

Token distribution: The total circulation of CLY is 15,000,000, and 70% of the tokens have been sold in the open market. The remaining distribution details are as follows:

Financing situation: A total of US$21 million was raised in the private and public offering rounds, and 70% of the tokens were sold. Initial circulation: 16.6 million CLY (excluding liquidity tokens). Initial market value: US$6.6 million (based on the IEO price of US$0.40, Excluding liquidity tokens):

With more than 10,000 token holders, in addition to 20,000 pledgers, these users will eventually become the airdrop targets of early investment projects as early supporters. Community members who start staking now can get The first batch of airdrops including TaleCraft, Platypus, and Imperium Empires began. CEO Elie publicly demonstrated the situation of Colony’s public fundraising on Twitter, with more than 13 million tokens pledged and TVL about 35 million US dollars. Top 20 on the list.

Token Value: Equity Assets

Become an early investor in the project and capture value growth through CLY tokens.

The tokens of DAO are the direct value reflection of the investment portfolio. Holding tokens is the system of holding and investing in DAO, which truly empowers community members to hold the value of tokens. The value of the project represented by the tokens encourages long-term investment, thereby stabilizing Token value. At the same time, investors in the secondary market are encouraged to hold tokens, and by holding tokens, they can obtain the benefits of investing in the primary market, which greatly reduces the cost of holding multiple projects. At the same time, the deep binding relationship between Colony and Avalanche , Holding CLY is also indirectly holding Avalanche's ecology, and at the same time gaining value from ecological growth.

Pledge provides triple rewards to encourage long-term value investment

Node Staking Rewards

LP Liquidity Rewards

Project Token Airdrop Rewards

At the same time, the pledge of tokens is provided, so that more tokens can be deposited in the fund pool, and the long-term value can be stabilized. Pledging CLY tokens can obtain:

CLY holders need at least 50 CLY tokens (the threshold requirement of 50 CLY may be adjusted or reduced through DAO's community governance), and the lock-up period is 20 days. Community members who pledge less than 20 days will not be able to obtain the upcoming Started airdrop award. If you cancel the pledge within 20 days, the pledge days will become 0 days and you need to start over.

Investment agency

Investment agency

The seed round led by Foresight Ventures, Avalab, and GBV raised 1 million US dollars. As the official investment fund of Avalanche, Avalabs is a team managed by an American LP. There are only a handful of investment projects in the primary market. For Colony The investment shows the fit between the project side and the ecological side. GBV Capital is also an investment institution under Genesis Block, which operates one of the largest over-the-counter transactions of cryptocurrencies. Investment institutions also include Avalaunch, Avatar, Yield Yak, NGC Ventures, Spark Digital Capital , MEXC Global, Synaps and ZBS Capital.

Competitive Analysis

Competitive Analysis

The community form pioneered by Colony needs to attract funds from ordinary investors to participate in the primary market investment, and the existing market has emerged to help traders on the chain of asset management agreements.

Asset management platforms in the secondary market: Taking Enzyme and dHEDGE as examples

Enzyme: The circulating market value is 145 million US dollars, and the fully diluted total market value is 148 million US dollars

As an asset management protocol, it allows anyone to create an investment Portfolio, or choose to join a fund created by others based on market performance. Enzyme provides a market for investors to choose or create their own funds, mainly in the secondary market , the back-end implementation consists of a set of smart contracts, which automatically execute functions such as investment, redemption, asset custody, trading, and fee distribution, replacing traditional funds. Enzyme is more like a fund supermarket in essence.

dHEDGE: The circulating market value is 145 million US dollars, and the fully diluted total market value is 148 million US dollars

Summarize

Summarize

Different from existing asset management, Colony provides an investment opportunity to participate in the primary market that was previously limited to large institutional investors or KOLs.It is attractive enough for ordinary users who want to participate in the primary market but lack funds and access. They only need to join DAO or hold CLY tokens to obtain the benefits of the primary market, and at the same time indirectly hold the value of the Avalanche ecology room for value growth.

Colony, as the incubator of Avalanche, still relies on a centralized team to invest in the primary market before the realization of DAO in 2022. In the case of in-depth cooperation with Avalanche ecology, Avalanche's project resources and the incubation ability of the community behind it allow them to serve as The first primary market investor in the form of a community is special. At the same time, as a participant in the primary market, Colony and its investors have to bear project risks in addition to the original market risks, and need to accept a longer-term lock-in for funds For investors who mainly trade in the secondary market, they need to mature for a longer period of time.

As an investment DAO focusing on Avalanche ecology, Colony participates in the construction of Avalanche ecology through community drive. As a DAO, Colony redefines the contribution to ecology and projects as an incubator, from participating in the early investment of projects to enriching the application scenarios of ecology , to actually maintain the ecology as an Avalanche node. Colony is in a public chain ecosystem. It is not only the contribution of ecological builders to provide market value beta, but also the investment in first-level projects through the community's DAO. And this is just the beginning. Colony's vision is to launch a A global platform covering investment, incubation, and trading.