The history of Animoca Brands: from being forced to delist to becoming a big winner in the encryption market

Article written by Richard Lee

In the upsurge of NFT and metaverse concepts this year, Animoca Brands can be regarded as one of the biggest winners. Its The Sandbox is one of the most popular NFT projects at present. In addition, it is also the developer of Axie Infinity Sky Mavis, Decentraland, Dapper Labs, etc. An early investor of star projects, and has invested in more than 150 NFT/metaverse projects.

In fact, Animoca Brands was a company with traditional mobile game development as its core business two years ago, and was delisted from the Australian Stock Exchange for various reasons. Today, the project’s revenue in the first three quarters alone has reached US$670 million, making it a unicorn company on the NFT track.

With the outbreak of chain games and metaverse tracks in the second half of this year, Animoca Brands, a long-established unicorn in this field, surfaced.

Founded in 2014 and headquartered in Hong Kong, Animoca Brands is the developer of blockchain games such as the sandbox game The Sandbox and F1 racing F1 Delta Time. In addition to product development, Animoca Brands is also an early investor in NFT star projects such as Axie Infinity developer Sky Mavis, Decentraland, and Dapper Labs, and has invested in more than 150 NFT/metaverse projects.

first level title

01

back to life

The company, co-founded by technology entrepreneur Yat Siu in 2014, was not a well-known mobile game developer and publisher until the end of 2017 when it entered the blockchain, and its business scope even involved e-books.

Animoca Brands was listed on the Australian Stock Exchange (hereinafter referred to as "ASX") in January 2015, but its long-term performance has been mediocre, and it has repeatedly used financing to supplement cash flow. According to Crunchbase data, Animoca Brands conducted a total of 9 rounds of post-IPO financing from 2015 to 2019, with a total of 34.3 million US dollars, to promote various mobile games, e-books, VR, chain games and other businesses, but the results were very low at that time. micro.

image description

Source: 61finance

In the second half of 2017, under the pressure of ASX for performance inquiries, Animoca Brands carried out three reforms to streamline costs and increase revenue: adjusting the compensation structure of directors, selling non-core assets, and layoffs, of which all executives cut their salaries by 50% %. During the year, the company sold 318 of its 524 mobile games—most of them casual games—for a total of $8 million, and its headcount plummeted from more than 110 to fewer than 70.

By the beginning of November this year, the company's total number of employees worldwide had reached 527, and it had become a giant on the NFT track. What happened in between?

The change originated in early 2018. Animoca Brands executive chairman and co-founder Yat Siu told the chain catcher reporter that Animoca Brands acquired a game company that had participated in the development of Cryptokitties at that time. Cryptokitties was the first blockchain game that was hot at the time.

"This is our first time participating in blockchain games and NFT. We immediately realized the power and benefits of this, and how NFT will revolutionize the existing game industry by providing players with digital property rights", Yat Siu said that since then, Animoca Brands has focused on NFT-based games.

In January 2018, Animoca Brands signed a one-year licensing and distribution agreement with Cryptokitties developer Axiom Zen. Animoca Brands has the right to exclusively distribute Cryptokitties in China, which will be divided into 30% of the net income.

In August of the same year, Animoca Brands acquired Pixowl, the development company of the UGC (user-generated content) game platform The Sandbox, for US$4.875 million. According to the announcement of Animoca Brands, The Sandbox mobile game had more than 1 million monthly active users at that time. In addition, Pixowl also plans to launch a blockchain version of the game.

"We acquired Pixowl and Sandbox for less than US$5 million, which proved to be a very successful investment." Yat Siu told the chain catcher.

The Sandbox is currently one of the most successful projects under Animoca Brands. As of December 21, the total market value of The Sandbox token SAND in circulation was US$4.7 billion, ranking 37th in the Coinmarketcap market ranking, and its diluted market value reached US$15.3 billion. At the same time, The Sandbox's virtual land transaction volume remained high, and Republic Realm broke the virtual land sales price record on November 30 with a purchase amount of US$4.3 million.

Yat Siu told Chain Catcher that there were many opportunities for this acquisition in 2018, including Martin Varsavsky, one of Pixowl's supporters, who is Yat Siu's entrepreneurial friend, Pixowl has accumulated in brand IP, etc., "but the most important thing is , Pixowl and its founders have deep insights into blockchain and NFT.” According to Yat Siu, these elements allow the team to gain a leading position in both the blockchain and traditional gaming fields.

In the following October and November, Animoca Brands invested in Decentraland and Dapper Labs respectively.In January 2018, Animoca Brands cooperated with the WAX blockchain again to introduce user-generated items for its game The Sandbox on the WAX platform. At the same time, the two parties carried out an equity swap, replacing the company’s stock worth $250,000 with WAX Token.

As of the end of fiscal year 2018, Animoca Brands' revenue is still mainly supported by traditional mobile game sales, and cryptocurrency-related investments have only brought losses of one million yuan.

In November 2019, Animoca Brands completed another important investment, leading the $1.465 million financing of Axie Infinity developer Sky Mavis with $420,000. Axie Infinity had already emerged at that time and was at the forefront of the chain game revenue list. At the same time, through cooperation, acquisitions, etc., it has obtained sports IP copyrights such as Formula 1, the American Professional Baseball League, and the Bundesliga, accumulating resources for blockchain games and NFT development in the direction of sports IP.

At this moment, ASX issued an inquiry letter and delisting warning halfway.

According to subsequent disclosures by Animoca Brands, ASX alleged that the company had three problems: internal governance issues, extensive participation in cryptocurrency-related activities, and trading violations. Among them, the company has not backed down on the accusations of participating in encryption activities; as for internal governance issues, Animoca Brands acknowledged in its response that its operations have suspected violations, but did not disclose details.

In March 2020, ASX formally removed Animoca Brands from its listing list on the grounds of "lack of adequate resources, systems and controls to fulfill its obligations under the listing rules". At that time, the company's total market capitalization was $124 million.

In fact, the impact of delisting is more reputational than profit-in the five years since the public fundraising, its stock price has rarely risen significantly.On the contrary, the delisting has brought space for Animoca Brands to flex its muscles. It is no longer limited by the fear of violating the rules of listed companies, and can gradually enter the deep water area of the NFT field.

In 2020, Animoca Brands will focus more on the development and expansion of its own assets: The Sandbox publicly issued SAND tokens and listed on Binance, its F1 Delta Time game launched the token REVV, and ecological activities such as NFT pledge mining, NFT auctions, etc. Also online from time to time.

On the other hand, Animoca Brands has successively acquired at least 9 encryption companies such as NFT market QUIDD, sports NFT ecosystem lympo, prediction market project Prosper, independent game developer Blowfish Studios, and NFT solution provider Bondly in recent years.

At present, at least 8 subsidiaries of Animoca Brands have issued tokens, but except for The Sandbox, which was acquired, other projects are mediocre in terms of market influence and token prices.

first level title

02

More like a16z in the NFT field than a game developer

image description

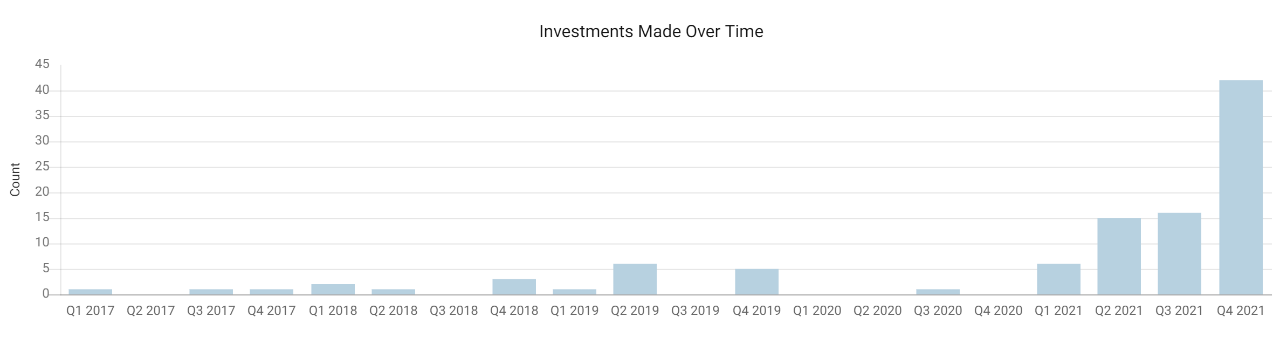

Source of Animoca Brands’ quarterly investments in recent years: Crunchbase

Entering 2021, the investment pace of Animoca Brands has significantly accelerated. As of December 24, Animoca Brands has accumulatively made at least 81 crypto-related public investments, including Yield Guild Games, Bloktopia, GuildFi, ConsenSys, DeHorizon and other well-known projects. In addition, the number of investments in the fourth quarter of this year accounted for 51% of the whole year, and leading investment projects accounted for more than 36%.

In December, Animoca Brands and BSC jointly launched a US$200 million chain game investment fund, and the investment frequency in the future may continue to maintain a fast pace. At present, the company's official website shows that it has invested in more than 150 NFT/metaverse projects.

Yat Siu told Chaincatcher that he believes that in the field of blockchain, projects related to the Metaverse are more likely to drive mainstream adoption. And "NFT represents the best opportunity to realize an open metaverse." Yat Siu said.

image description

Source: Animoca Brands official website

According to the financial report released by Animoca Brands in early December, the total revenue of Animoca Brands from January to September this year was 670 million US dollars, of which income from investment and digital asset income accounted for 79%, which was approximately 529.6 million US dollars.As of the end of November, the company held digital assets with a reserve value of approximately US$15.87 billion, including US$112.1 million in mainstream tokens such as BTC, ETH, and USDC, and US$456.3 million in third-party liquidity assets such as AXS and FLOW. Most of them are ecological currency assets such as SAND.

In addition, Animoca Brands also received several rounds of large-scale capital injections in May, July, and October this year. Star capital in the encryption and traditional fields, including Coinbase Ventures, Samsung Venture Capital, Sequoia China, and Blue Pool, etc. Extended an olive branch, and even attracted the participation of 3A game giant Ubisoft's venture capital institutions, the latest round of valuation reached 2.2 billion US dollars.

In a March post on the Animoca Brands blog about "Why Invest in Yield Guild Games," Yat Siu attributed the company's aggressive investment to an "ecosystem argument." This logic means that,Animoca Brands invests in the builders of the NFT ecosystem, even if the other party is a competitor, in the end Animoca Brands, as the main producer of chain games and NFT, will "benefit from the ecosystem".

“We believe that true digital ownership (virtual property rights) is the cornerstone underpinning the entire open virtual world: ownership of digital assets can control them, which leads to economic freedom, thereby unlocking economic opportunity, which brings GameFi opportunity, for a fairer Society has opened the way." Animoca Brands said on its official website.

In its external declarations, Yat Siu's investment choices are usually guided by "values". Yat Siu told Chain Catcher that Animoca Brands will give priority to investing in projects that develop an "open metaverse", rather than teams that set up boundaries and barriers like Apple and Google.

In an interview with Decrypt, Yat Siu said that he sees an open and decentralized digital world and a confrontation between technology giants will take place. For example, at the end of October, the Web2.0 social media giant Facebook took the opportunity to change its name. Describe to the public the virtual extended kingdom it tries to build.

Compared with policy regulation, Yat Siu believes that Facebook, Tencent and other technology giants that usually monopolize data ownership are the real "threats." andAnimoca Brands can be called an "urgent" investment, which is to make the previous open metaverse happen faster.

In fact, the investment style of Animoca Brands is very reminiscent of a16z. It is also high-strength and high-frequency investment. It weaves a huge network of resources and relationships within the encryption ecosystem. At present, many emerging encryption projects are behind It is these leading venture capital institutions that are pushing.

However, this type of investment style is also causing some criticism. For example, the founder of Twitter recently tweeted that Web3 is not actually owned by users, but by venture capital institutions (VC) and their LPs (limited partners). It ended up being a centralized entity with a different label, and it was even implied that a16z controlled the Web3 concept.

In his view, venture capital institutions actually control a large number of Web3 project token shares and obtain huge profits, which is far from their vision and also runs counter to the spirit of Bitcoin. They should use the huge profits for real freedom. and open source software funding.

The above remarks have caused many objections in the encryption industry, but they have undoubtedly brought us more thinking angles, that is, how venture capital institutions maintain the balance between institutional interests and public interests. In view of the huge controversy, a16z, Animoca Brands and other venture capital Investment institutions may need to re-examine this point.