A beginner's guide to the encryption industry in 2022: How to survive the bull-bear cycle?

Compilation of the original text: The Way of the Metaverse

Compilation of the original text: The Way of the Metaverse

When my tweets for newcomers to crypto went viral, I learned that this type of stuff was valuable to my readers, which is why I decided to write this simple blog post for someone relatively new to the field. guide.

I understand how difficult it is to navigate the dynamic and chaotic crypto industry. The goal of this post is to help those new to the business understand information overload so you can build a foundation that will help you navigate bull-bear cycles in this space.

Base

Base

The first rule is to survive. Don't go bankrupt, which means don't go all in, and don't be liquidated. Sell only on your own terms and don't go after astronomical figures because you'll force yourself to believe something you don't. Wishful thinking won't help you survive.

Be sure to read Fred Ehrsam's post on how to survive the crypto cycle.

Curiosity is the best predictor of longevity in the field. If you're curious, you've likely turned your inner speculator into a builder or power user. But sometimes you have to look for more signals than just price.

You will want to find your place. Think of it as a quest to discover how it can be useful to other people, even if you're only here to chase generational wealth. You don't have to quit your baby boomer job to get involved, just spend your weekends figuring out how you can help like-minded people in the field.

The best way is to have people around you who can help you too. When I first entered the crypto space, I felt very alone. I've been lucky that over time I've managed to be around people who are in a similar position. If you can't meet someone like this in real space, Crypto twitter (CT) is where the community meets and getting the right exposure is crucial.

If you're not on CT, you might be missing out. Everyone's CT experience is slightly different as it depends on which accounts you follow and engage with. First of all, you need a good team like you had in school. Your parents probably don't want you to hang out with bad people. The same rules apply to CT.

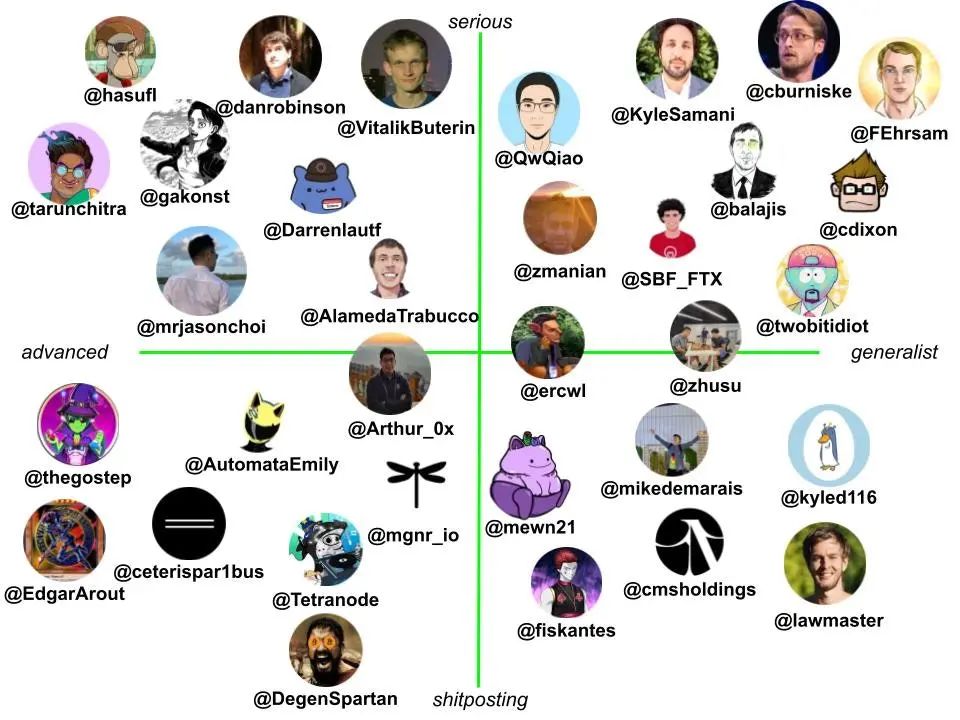

I provide a selection of curated CT accounts that you can follow and populate your social and knowledge graph. These are my picks, so this is a biased list. Follow your curiosity and let it grow in every direction.

The x and y axes are just to give some context. I realize the CT account above is heavily skewed towards ETH. This is why I provide some additional accounts for non-ETH ecosystems. You can view the full list here.

Also, if my personally curated lists aren't your thing, you can check out hive.one for an algorithmically curated list of the most influential accounts in the entire crypto space, as well as individual clusters like BTC, ETH, SOL, DOT, or NFT.

Make sure you follow groups that expand your knowledge and open your mind. Those around you can guide you to where you are best suited. Following people who ask the right questions and suggest the most interesting answers will give you the best answers to your key questions: How can I be useful to like-minded people in the cryptocurrency space?

To learn to deny CT

While some people love to tweet about leaked alpha opportunities, most are just smart beta games. Be skeptical of anyone claiming "alpha," real alpha is synthesized in your head from bits and pieces of Twitter, governance forums, and private conversations.

Chatter on CT is great at capturing people's current mood and is good at identifying what's going on right now, but CT is less accurate at predicting where we're going.

Sometimes, we tend to forget the value of those who think outside the bubble and not participate in the cycle. Make sure not to overestimate CT, as CT is primarily where sales happen. But mastering CT will help you.

Telegram and Discord

Once you start thinking of Twitter as a discovery layer, you might want to join selected Telegram (TG) or Discord groups for deeper exploration. Usually you need to focus on a few projects, try to get a feel for the vibe of the project, ask if there is a way you can help a particular community.

Public Telegram groups are almost always noisy places, making it difficult for people to navigate or have meaningful conversations. Almost all crypto projects already have a Discord channel in their early days. This is much better for structured research and dialogue on projects.

Examples of thriving and inclusive Discord communities are Alchemist, OlympusDAO, KlimaDAO, Forgotten Runes, and Abacus. (Disclaimer: Zee Prime participated in the investment)

reading and podcasting

Even though I've covered some basic reading in the twitter thread I mentioned above, there are still some things that are worth reading, perhaps more niche ones. That's why I created a resource guide, a catalog of interesting content and podcasts in the industry.

Note that it may contain ideas that are outdated or invalid, but this does not reduce their value.

Also, if you're looking for a great crypto podcast, then Uncommon Core is for you, and if you want to listen to something more technical, then Zero Knowledge Pod is more for you.

"But I'm not a builder!"

One problem with the industry is that it primarily identifies coders as builders. This is not entirely true, there are many productive efforts in the crypto space that do not involve coding but are of great value to the community.

For those "oh, but I don't know how to code" questions, I have 2 answers:

1. The smartest people in the encryption field I know are not programmers;

2. If you think this might be what you want to do, then learn programming (for example, Uniswap founder Hayden learned Solidity by trying to implement Vitalik's blog post, and now he is leading one of the largest encryption projects in the industry );

And there are too many things that can be done. The project side needs community managers, governance organizers, project managers, product owners, marketing or sales personnel, etc. Lurking in Discord groups and staying active when needed is the best way to build active beginner muscles.

across the cycle

It all starts with Bitcoin, which is why understanding Bitcoin, Bitcoin enthusiasts, the associated culture, and the changing narrative can be a solid foundation. Why do Bitcoin enthusiasts call every token a scam? Why do people in the Bitcoin community hate Ethereum? Why do people in the Ethereum community hate Solana and Polkadot?

The cryptosphere is fraught with conflict, and these conflicts are likely to persist, making it difficult to agree on fundamental truths given the semantic and cognitive differences of each cluster.

Generally speaking, when you enter the crypto space, defines your world view or crypto view, if you came here in 2013 and made a fortune buying bitcoin, your views will be the same as those who came here in 2020 , and those who make a fortune by holding SOL are different.

A lot of people get into trouble once they "make it". So getting it right just once is enough to create generational wealth. You may then defend your wealth and hope that others will help you protect it, even though it may be less profitable for them.

Here we stumble upon the "early arrival" problem. Why is there a problem? Once a project is successful, success is "priced in". Expecting something to go up 100X when it's already up 100X can be a luxury, so manage your expectations.

Everyone's sights are set at 100x or 1000x, and while such opportunities are rare, it takes some knowledge of the industry to do it without luck. It is not a good idea to pursue astronomical returns when you first come here.

If you don't get involved very early in some big project, you may be driven to some early, but often possibly a lower quality project, as seen with the large number of OHM forks that have come out this cycle. Be cautious about replicas, few replicas can create sustainable wealth. There is a fine line between being open-minded and being naive.

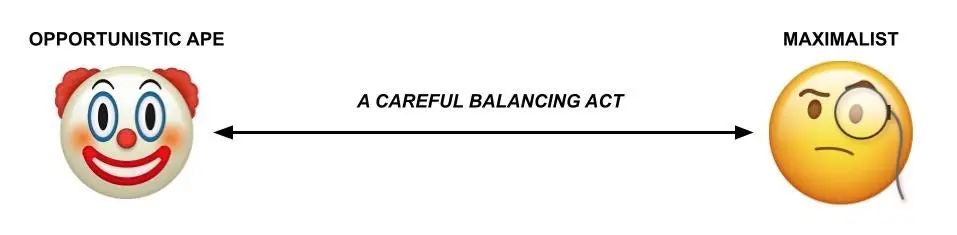

Over time, you'll learn to strike a balance between being closed-minded and being too open-minded, between "my coin is the only coin" and "hey, a fifth imitator of X is sure to pull the strings". But the jury is still out on how to define the middle ground.

The most successful people move in cycles, and they don't get bogged down by narratives. In fact, every cycle teaches us something. Winners are usually those who are flexible and focus more on the future than the present.

Being married to ideas is suboptimal. It's good to get rid of some path dependencies and separate your past from your future. The crypto space is changing very rapidly, be able to change with it, but don't forget the lessons of history.

in conclusion

in conclusion

Your success in crypto may depend on your ability to "follow your curiosity". You can follow it in many ways. You try to learn how to build your own MEV bot, or you can spend a few days reading the market and doing background analysis on it.

Curiosity and drive are the best predictors of success in this field. Build a foundation with an already established community, then venture into uncharted territory. Formulate theories and then be able to update them.

But the process is not as important as the substance. Find your own way to ask better questions and talk to smarter people. Joining a crypto tribe makes you feel like you’re taking part in history, and chances are, you are.