DAO industry progress in December (bi-weekly report)

DAOrayaki DAO Research Bonus Pool:

DAOrayaki DAO Research Bonus Pool:

Voting progress: DAO Committee /7 passed

Voting progress: DAO Committee /7 passed

Total bounty: 160 USDC

Original Author: Paradigm

Original Author: Paradigm

Contributors: Demo, DAOctor @DAOrayaki

Original: DAOs: BadgerDAO front end exploit, Sushiswap DAO restructuring proposals, Updates on Fei<> Rari merger, Gnosis’s GIP 16 approved, Compound’s proposal #70 failed, Other Internet’s Pooltogether report, OpenAccessDAO, and more!

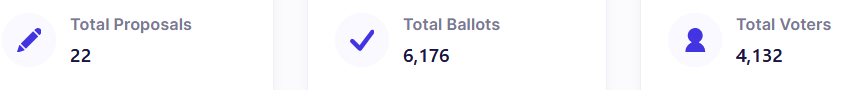

Quick Facts:

Quick Facts:

l BadgerDAO faces losses from user interface bugs. Badger has started the RFF process around governance and remuneration on recoverable assets. The BIP76 number to upgrade the smart contract has been launched.

l Compound's Proposition 70 failed. The community continues to evaluate audit recommendations from OpenZeppelin, Trail of Bits, and ChainSecurity, and discuss creating a repeatable process for future vendor selection.

l GFX Labs revoked the leadership of Fei Protocol<>Merger of Rari Capital.

be opposed to"be opposed to"vote.

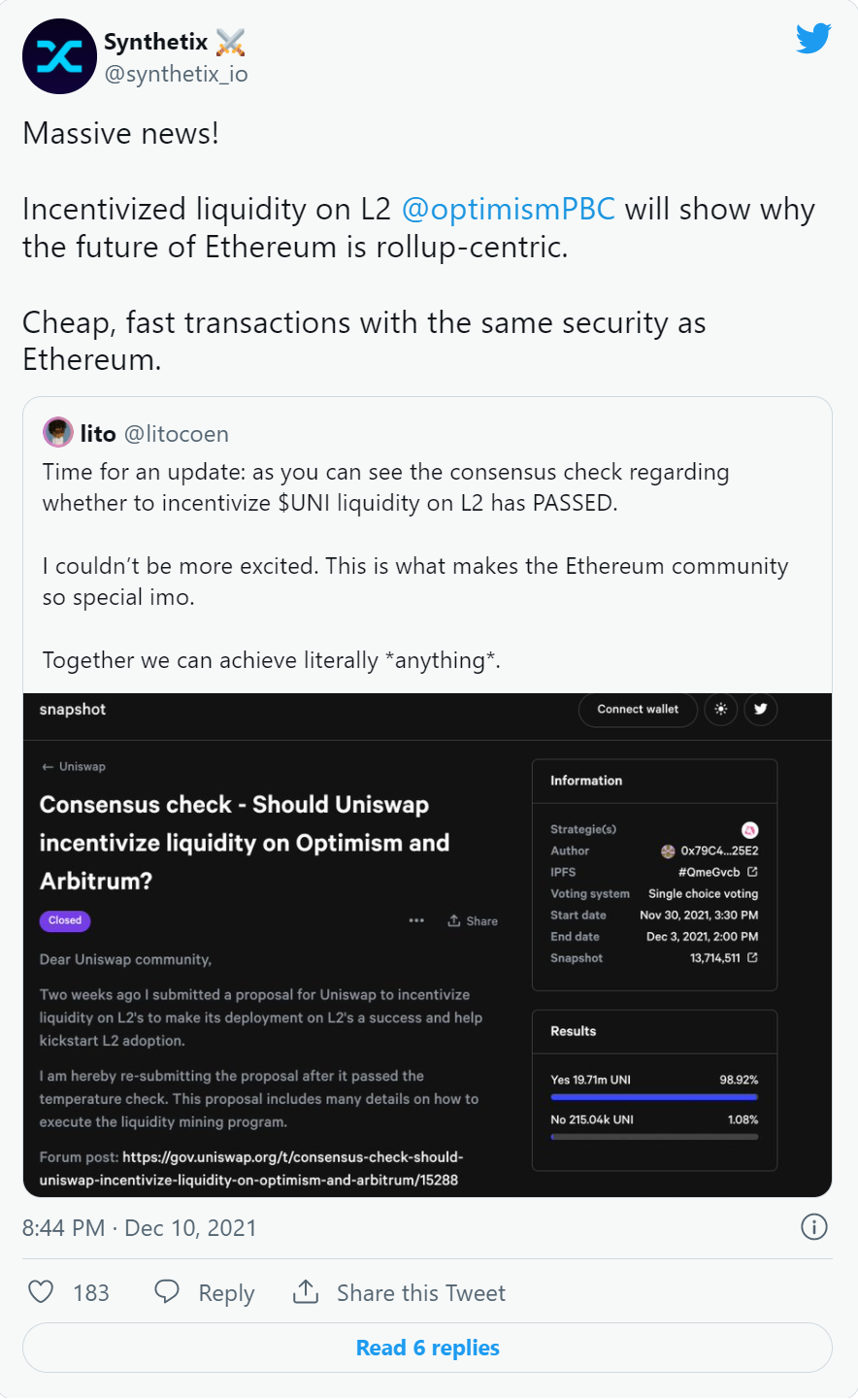

l Uniswap votes on consensus check voting to provide liquidity incentives on the Arbitrum and Optimism L2 platforms.

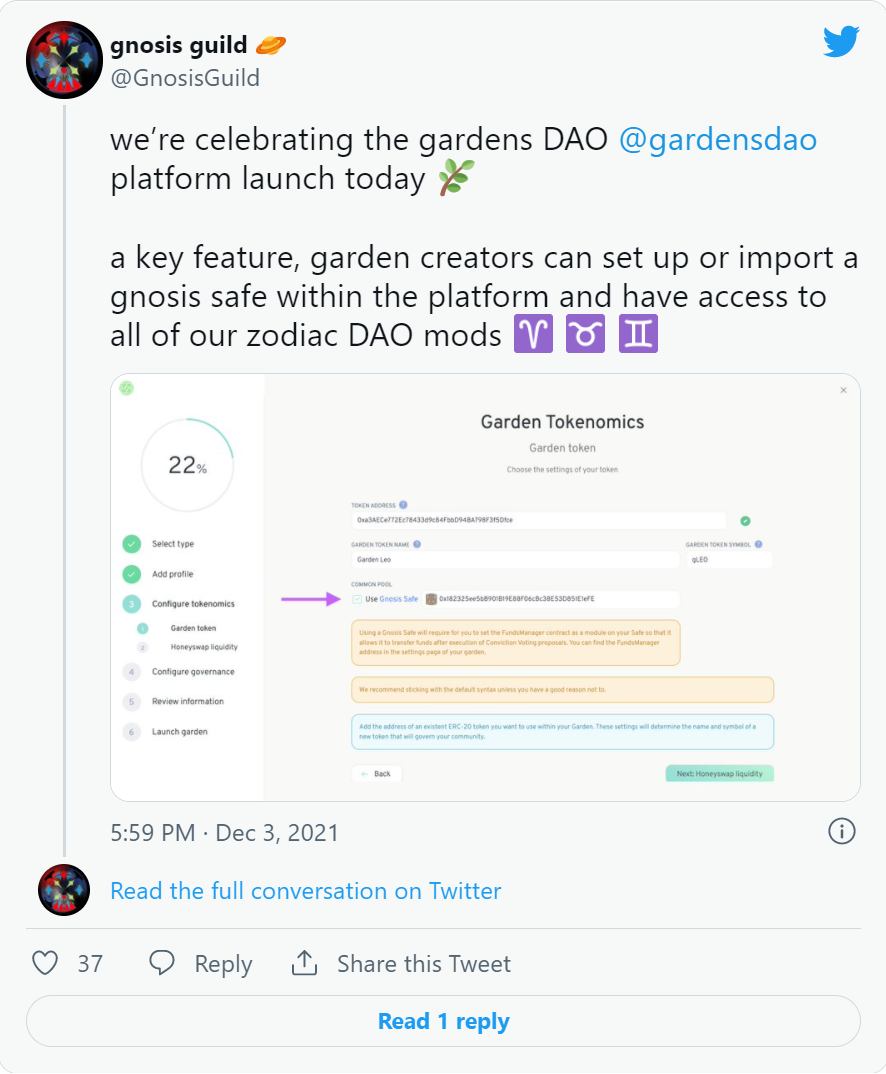

l GIP 16:Gnosis Chain<>xDAI/Gnosis merger passed. The merger will create Chain, dedicated to further on-chain and ecosystem development for DAO tools, governance experiments, and public goods.

l Messari released MessariGovernor - a free governance aggregator and voting platform.

l The Pooltogether report of other Internet came out.

l The internal problems of Sushiswap DAO have reached a critical point, triggering multiple proposals to realign governance and management.

l Colony token sale will start on December 14th.

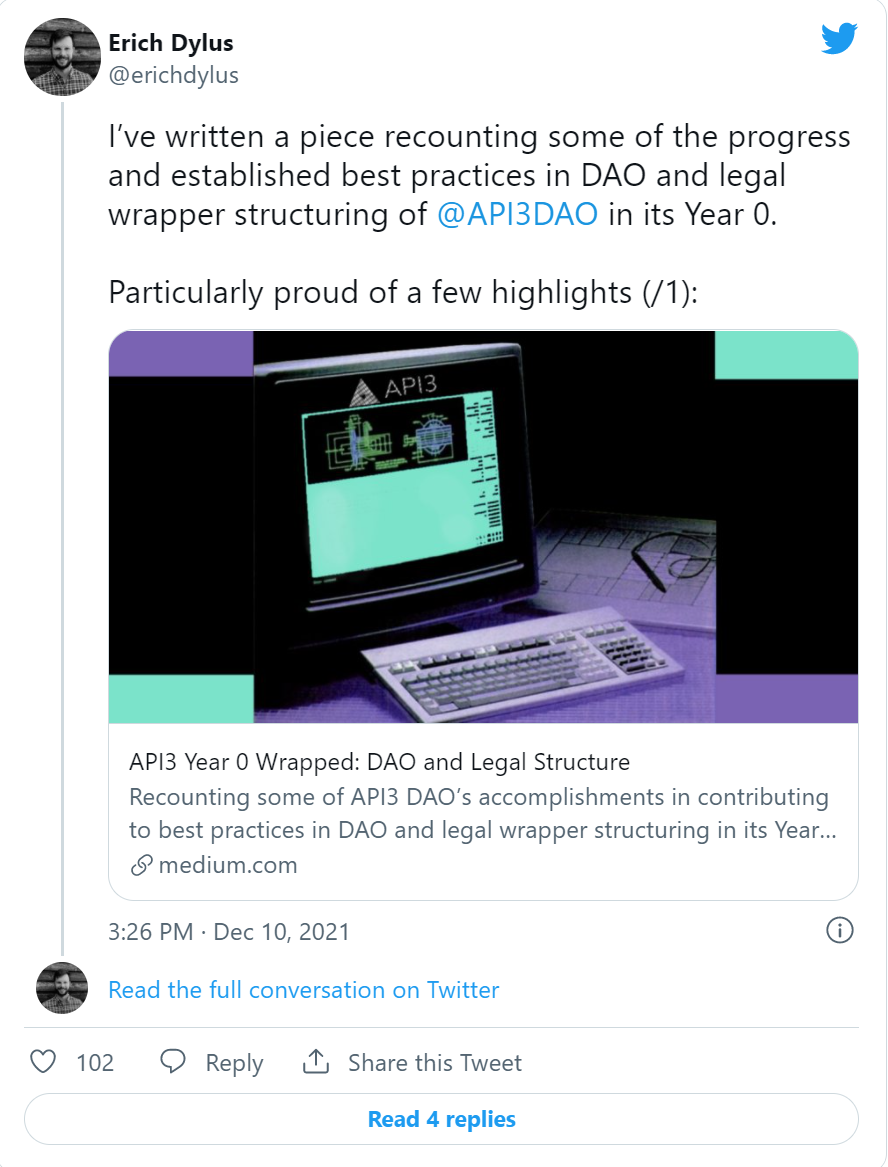

l Packaging for the first year of API3: DAO and legal structure.

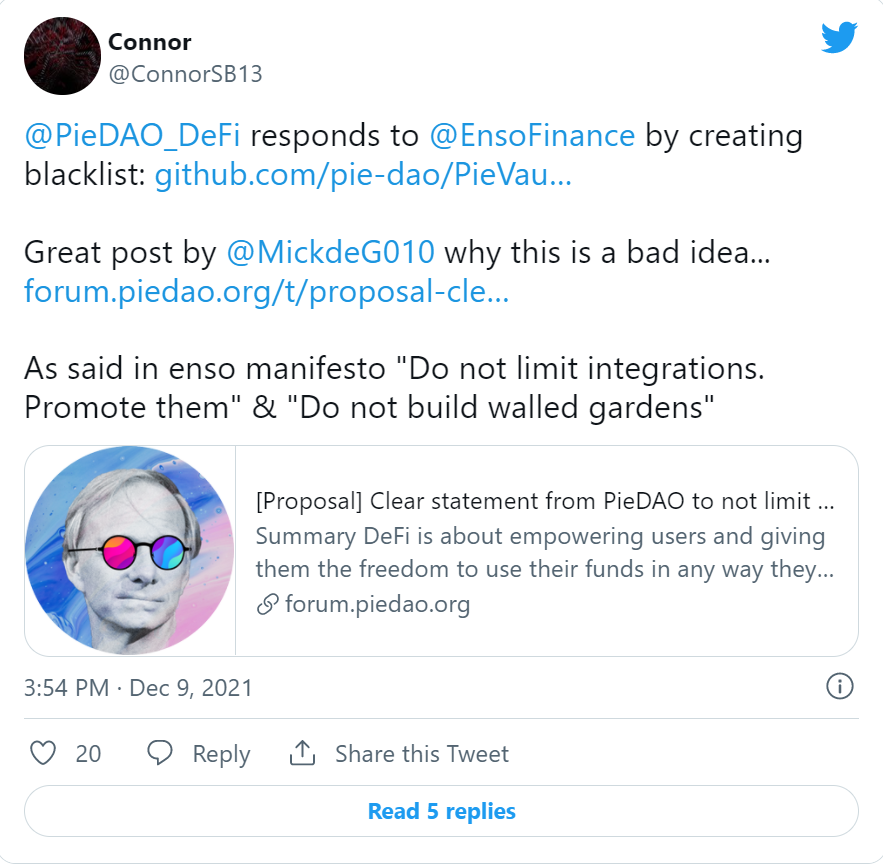

l Enso Finance launched a vampire attack on 6 indexing protocols, and PieDAO responded by blacklisting the contract addresses. At the same time, PIP 59 & IP 64 of PieDAO passed.

l Kyber's DMM protocol was renamed KyberSwap, marking the end of the testing phase.

l Index Coop announced the launch of the first Polygon-native Flexible Leveraged Index (FLI) — ETH2x-FLI-P.

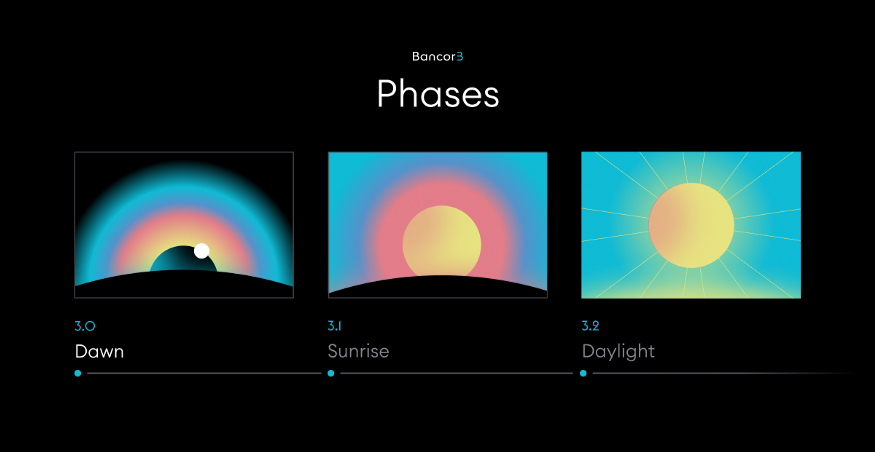

l Introduction of Bancor 3.

l mStable launches emission controller.

l Synthetix governance elections are currently underway.

l The Aave community voted to add ENS as collateral and designated Securitize as the whitelist for Aave Arc.

l The Gitcoin community is considering cooperation with PrimeDAO and DeveloperDAO.

l OlympusDAO transitioned to the on-chain governance mechanism gOHM.

l Gearbox Protocol launches DAO in a radical decentralized way.

l Dfinity’s on-chain governance considers DMCA takedown requests.

l OpenAccessDAO is inspired by open source access to academic peer-reviewed publishing.

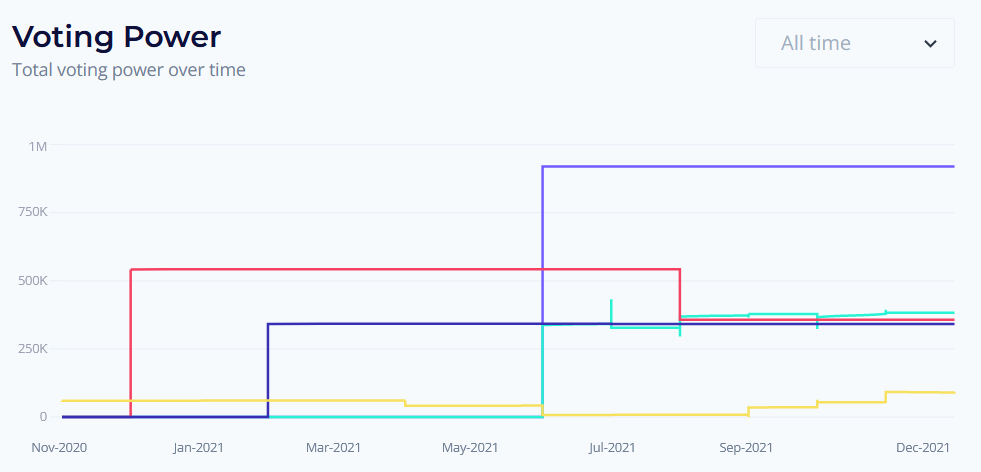

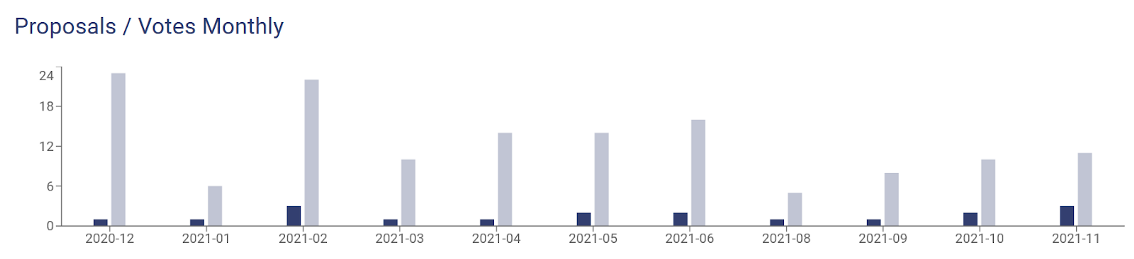

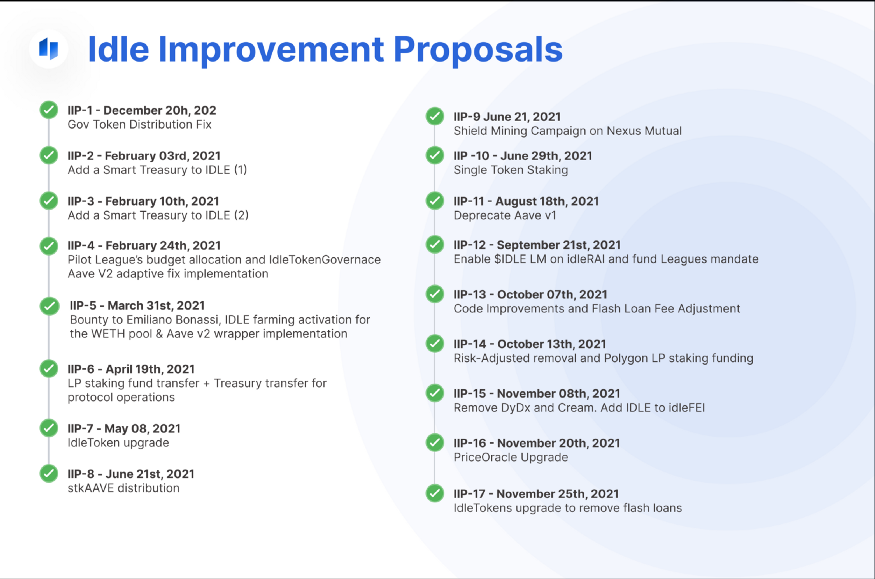

l The year of Idle DAO.

l Active proposals: Aave, BadgerDAO, Balancer, Compound, Curve, MakerDAO, GitcoinDAO, Index Coop, Idle, Kleros, Synthetix, PoolTogether, Uniswap, Yearn Finance,

l New and ongoing discussions: BancorDAO, mStable, Yam Finance, PieDAO, Nexus Mutual, LidoDAO, Akropolis, GnosisDAO, API3, Idle, KyberDAO.

overview

l And more!

overview

Simply put, a DAO is an organization governed by computer code and programs. As such, it has the ability to function autonomously without the need for a central authority.

“Instead of a hierarchical structure governed by a group of humans interacting in person and controlling property through a legal system, a decentralized organization is a group of humans interacting with each other according to protocols specified in code and enforced on the blockchain.” - Vitalik Buterin

DAO means "decentralized autonomous organization". It can be said that it is an open source blockchain protocol, governed by a set of rules created by its elected members, and executes certain actions autonomously without A middleman is needed.

Simply put, a DAO is an organization governed by computer code and programs. As such, it has the ability to function autonomously without the need for a central authority.

Just like DeFi is programmable currency and NFT is programmable media, DAO is an organization of programmable people.

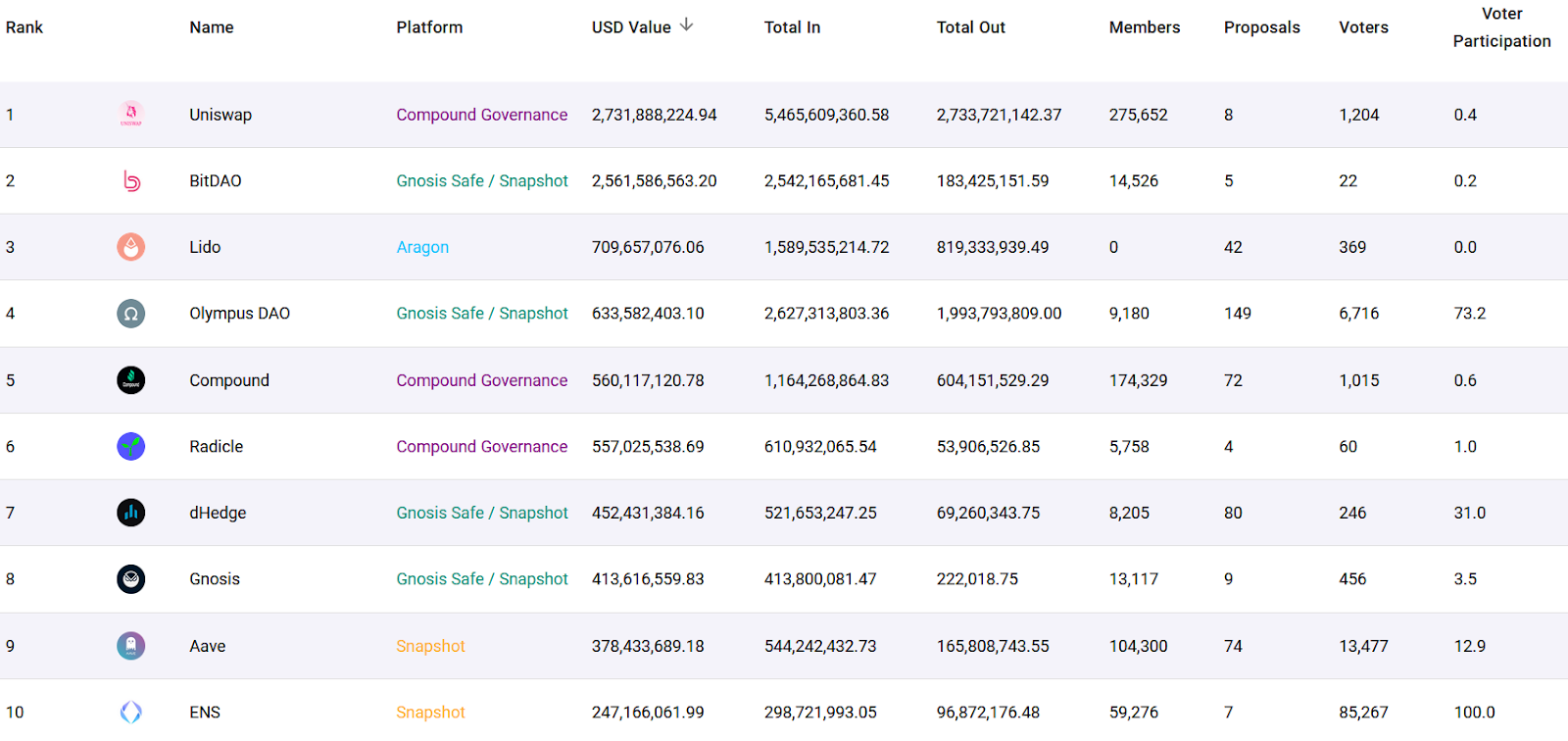

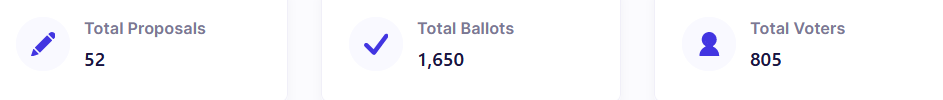

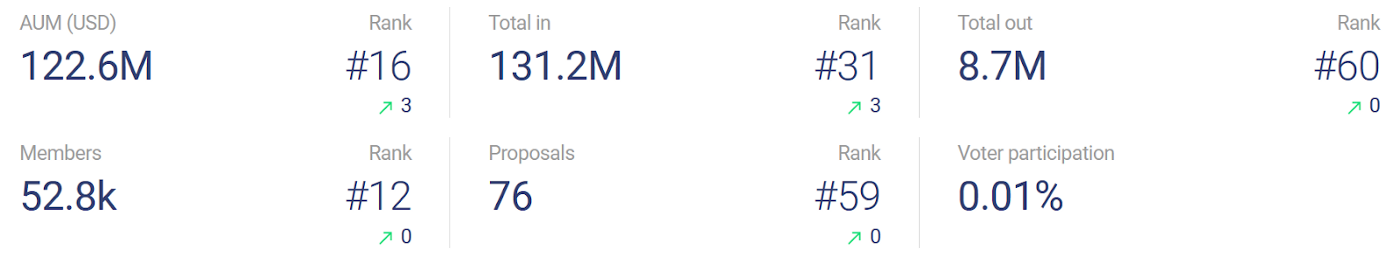

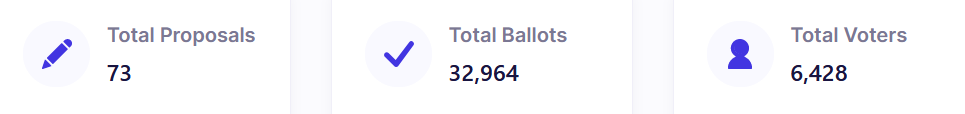

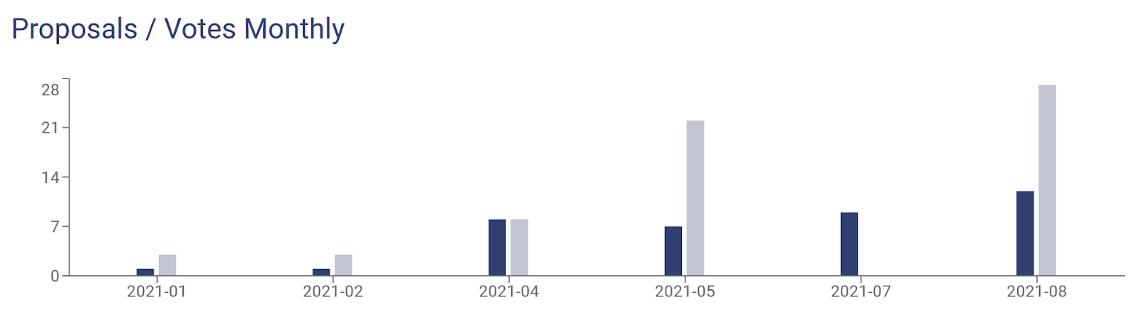

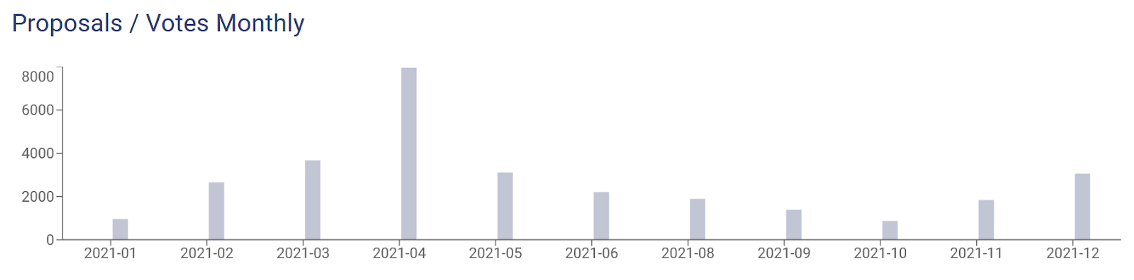

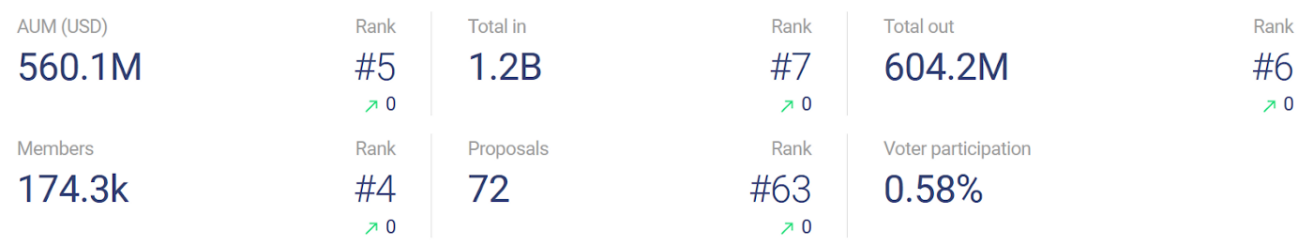

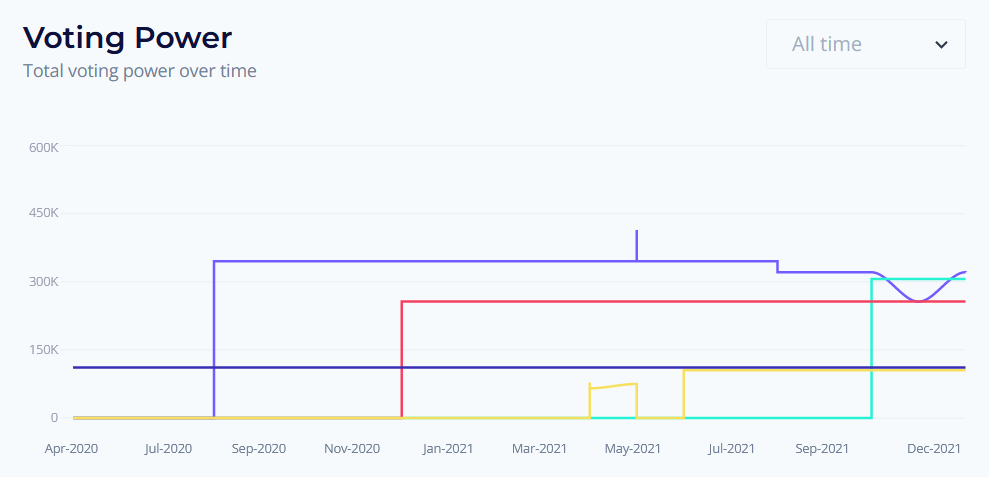

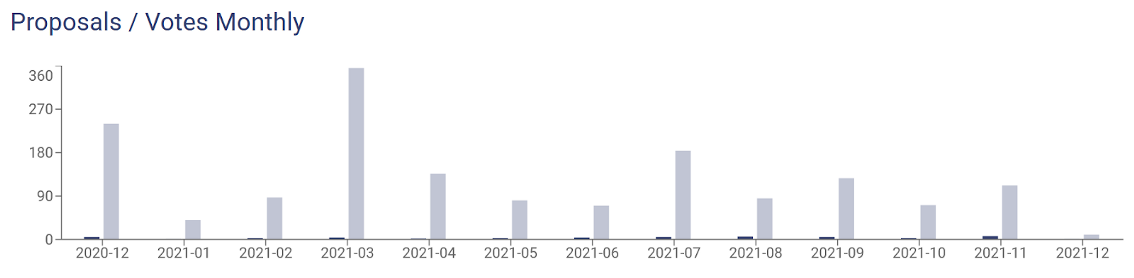

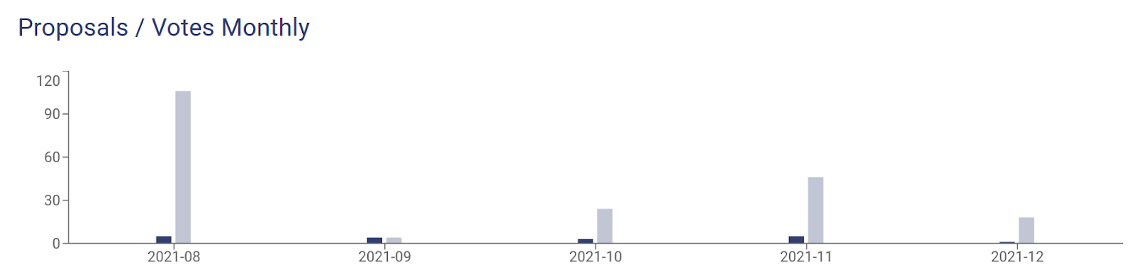

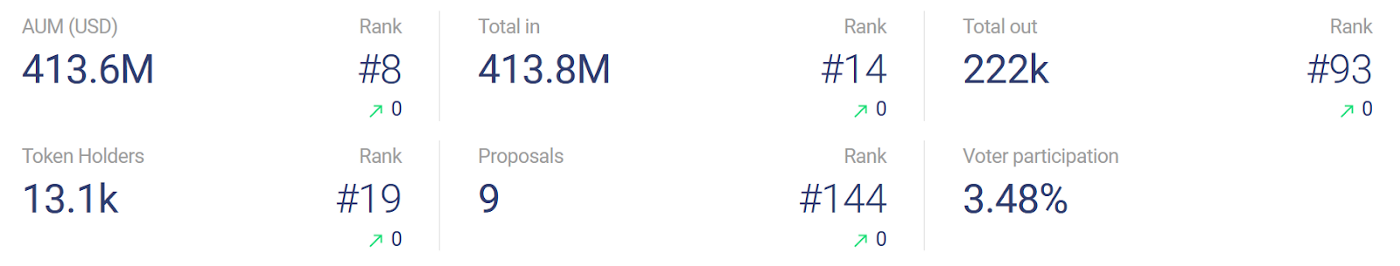

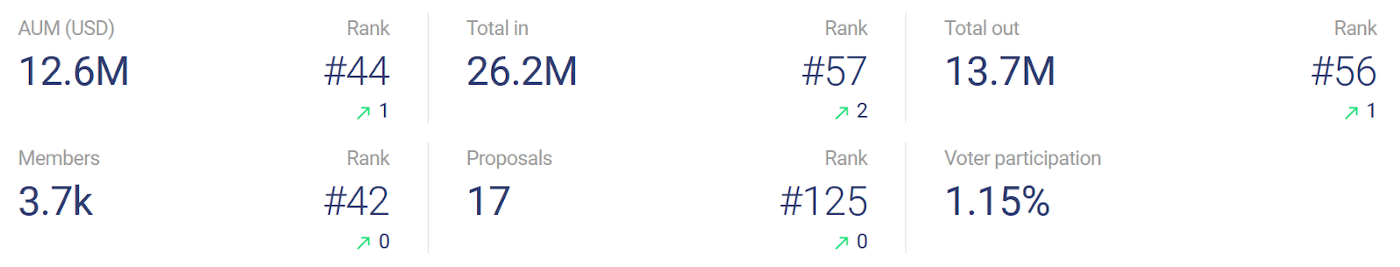

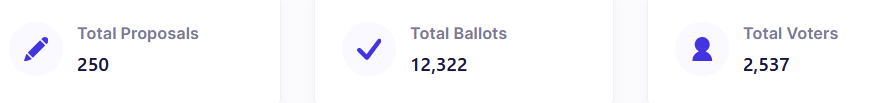

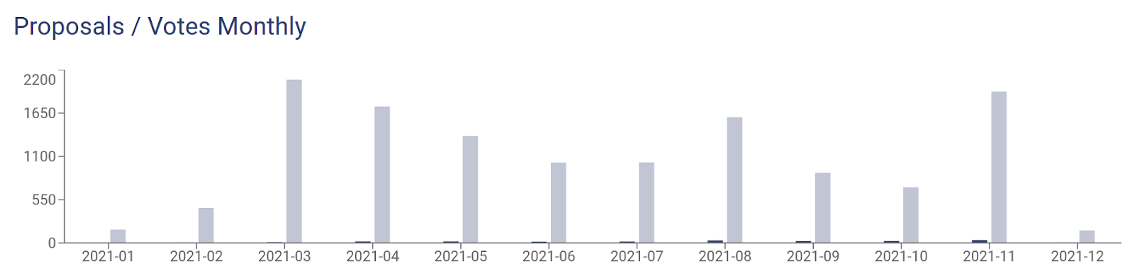

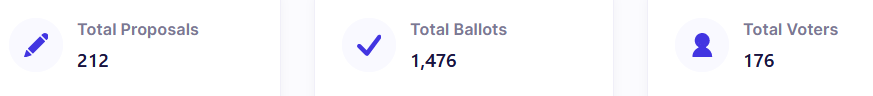

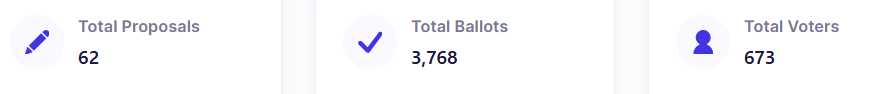

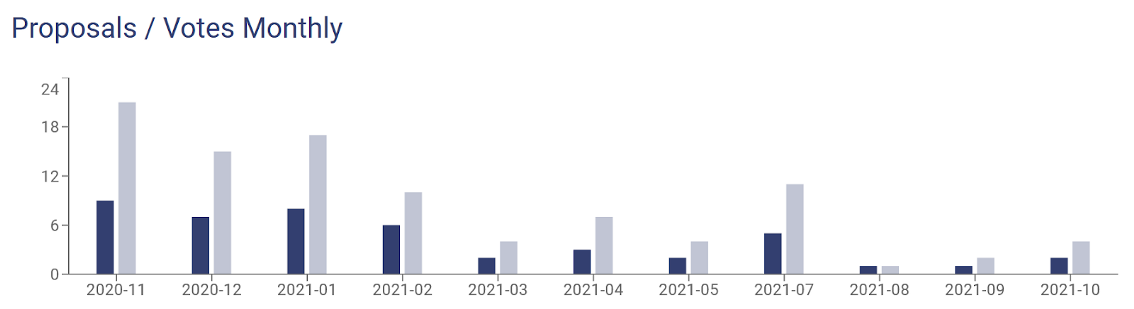

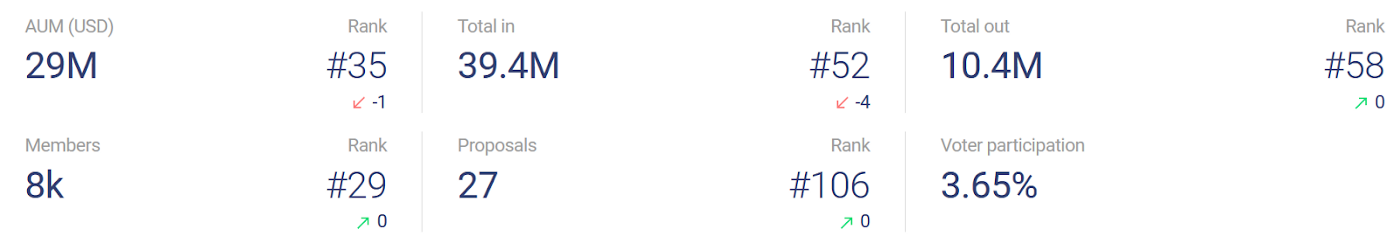

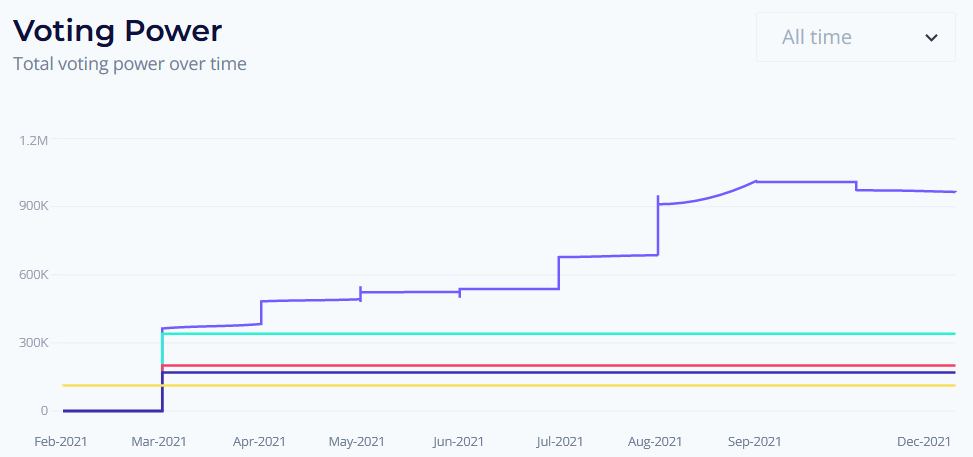

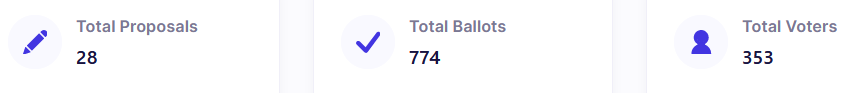

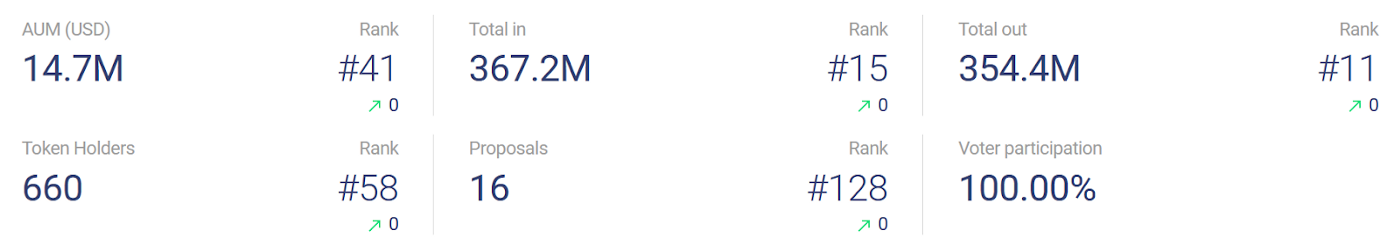

Source: Deepdao.io

Source: Deepdao.io

Top DAOs

Source: Deepdao.io

Source: Deepdao.io

Source: Deepdao.io

Source: Deepdao.io

frame

Source: Deepdao.io

frame

1. Aragon

What is composability? Composability refers to the general ability of a system's components to be recombined into larger structures, and the output of one component to be the input of another. Simply put, the best example is Lego bricks, where each piece is connected to each other.

In cryptocurrency, composability refers to the ability of decentralized applications (dApps) and DAOs to efficiently clone and integrate with each other (syntactic composability), and the integration of software components such as tokens and messages between them. Interoperability (morphological composability).

Web3 Composability: Vote on Snapshot → Zodiac Reality → Borrow $DAI @ MakerDAO → Pool $DAI @ Curve → Deposit Curve LP tokens @ Convex → Earn trading fees + $CRV + $CRX

Web3 Composability: Vote on Snapshot → Zodiac Reality → Borrow $DAI @ MakerDAO → Pool $DAI @ Curve → Deposit Curve LP tokens @ Convex → Earn trading fees + $CRV + $CRX

From a Web2 perspective, the implications of form composability are heartwarming: DAO token holders can already vote on Snapshots and use Zodiac Reality to trigger transactions from the DAO treasury, earning $DAI from MakerDAO Take a loan, pool $DAI on Curve, then deposit the resulting LP tokens into Convex for transaction fees plus $CRV and $CVX tokens. Composability like this is possible due to interoperability of tools and standardized definitions of tokens.

Colnoy

Recent blog posts:

Recent blog posts:

l CLNY Sale FAQ

Explore the principles of the DAO with Colony founder Jack du Rose:

The Commons Stack

DAO: A new way to manage common resources:

governance

Daohaus

HAUS Party LIVE!

Moloch

OpenLaw

OpenLaw

governance

governance

Aave

https://app.boardroom.info/aave/overview

A proposal to add Gelato's G-UNI DAI/USDC and G-UNI USDC/USDT pools as collateral to Aave's AMM marketplace.

Gauntlet has reiterated its proposal to renew its relationship with AAVE to actively manage risk parameters, and continues to discuss new market listings and a code licensing strategy for AAVE V3 code.

active proposal

l Certora Governance and Ongoing Formal Verification for the Aave Community [Ends December 20th]

Proposals that have been closed

Proposals that have been closed

l Appointment of Securitize as whitelist for Aave Arc [ends December 9th]

l Added stkAbpt voting power to AIP [ends December 6th]

l Add ENS as collateral [ends December 1st]

l What choice does the robot prefer? [Ends November 30th]

l Increased minimum AAVE holdings to 50 AAVE [ends November 28]

new and ongoing discussions

l Can we introduce some incentive/utility for holding AAVE tokens?

l Save the Lend tokens stuck in the Lend contract

l Aave V3 Release Policy: Code Licensing

l Aave deployment on Avalanche + asset verification list

l Add HAL push notification system on Aave

l Listing proposal: add BZRX (bZx protocol token)

The latest governance topics on the Governance Forum.

The latest governance topics on the Governance Forum.

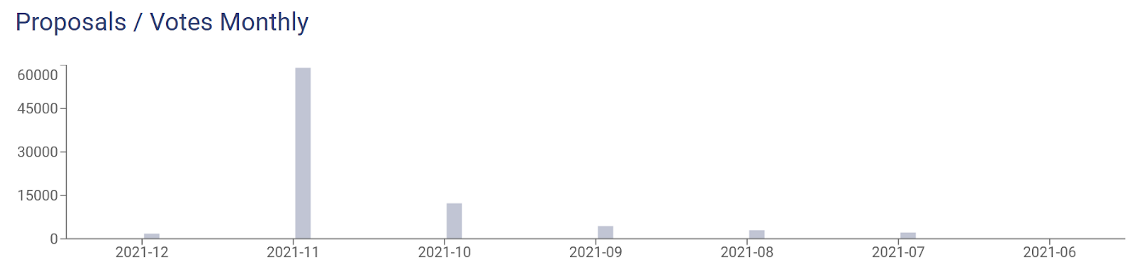

Akropolis

There have been no active proposals for these weeks.

source:

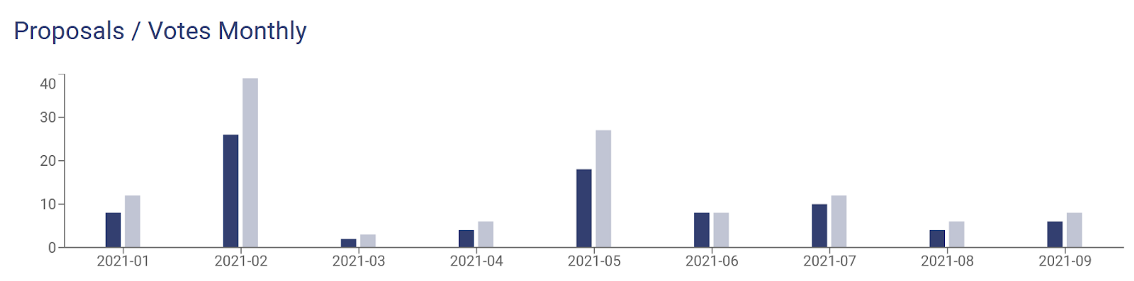

API3 DAO

source:https://deepdao.io

source:https://deepdao.io

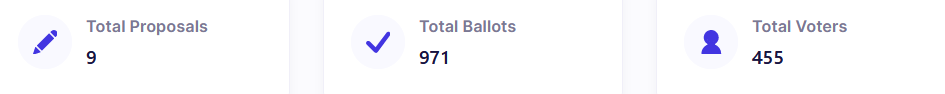

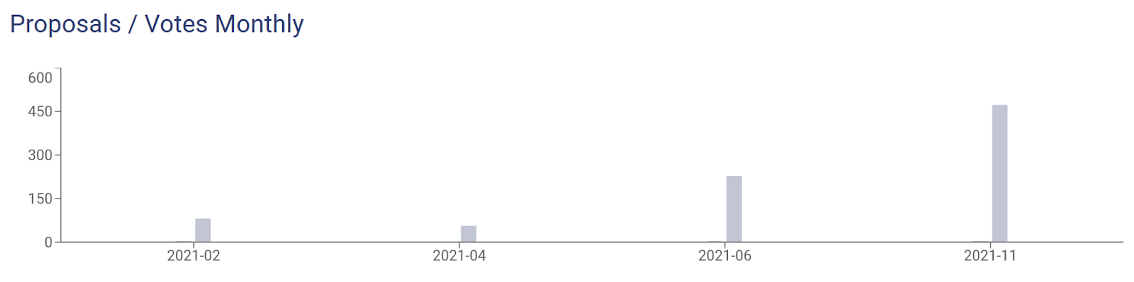

API3 DAO Tracker: API3 DAO currently involves 4198 members participating in 18 votes.

Official Proposal:

Official Proposal:

source:

The latest governance topics on the Governance Forum.

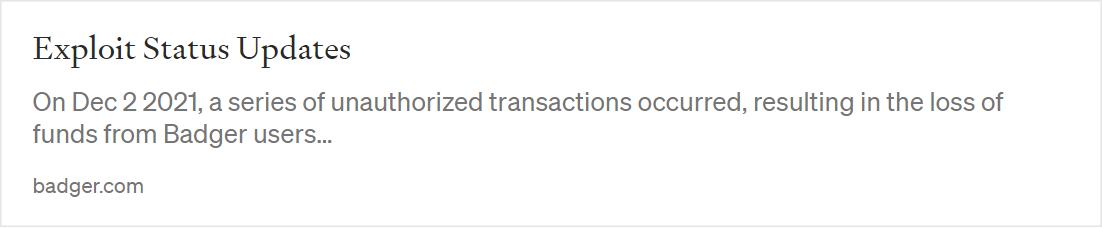

Badger DAO

source:https://deepdao.io

BadgerDAO faces huge losses from UI bug: Malicious token approvals added to BadgerDAO’s user interface have caused roughly $100 million in damages. While most defi exploits have focused on flawed smart contracts or oracle issues, the BadgerDAO hack represents a less common and potentially more troublesome form of attack.

Badger has received reports of unauthorized withdrawals of user funds. While Badger engineers investigate this, all smart contracts have been suspended to prevent further withdrawals.

While details are still emerging, it appears that the BadgerDAO frontend has been taken over by malicious actors over the past few days or weeks. The attacker was able to add malicious token approval transactions to the user's network interactions, allowing the attacker's contract to remove tokens or deposits directly from the victim's wallet. The scheme was revealed when the attackers started executing fraudulent transfers.

While initial reports indicated a loss of around $10 million, which was well within BadgerDAO's financial capabilities, it now appears to be around $100 million (including $50 million from a single user).

Front-end approval attacks can be particularly troublesome, as unsuspecting users can steal assets from wallets weeks or months later if they unknowingly move more funds. To avoid further damage, any user interacting with the BargerDAO website should use the Token Approval Checker to remove any potential approvals for the malicious contract (0x1fcdb04d0c5364fbd92c73ca8af9baa72c269107).

This mirrors a similar exploitation of token approvals on the Zapper frontend, which continues to result in sporadic user loss even months later. It also has similarities to an attack on Sushiswap’s Miso auction platform, where auction recipient addresses were exchanged for attacker addresses through a user interface attack.

Active Proposals:

Active Proposals:

Proposals closed:

Proposals closed:

New and ongoing discussions:

New and ongoing discussions:

Recent blog posts and news:

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Balancer

source:https://deepdao.io

Recent blog posts and news:

l Balancer Labs and Copper team up to pave the way for future revenue generation

Active Proposals:

source:https://deepdao.io

Active Proposals:

l Authorized Batch Repeater [Ends December 13th]

l Activation agreement fee [ends December 12]

l PrimeDAO <>Proposals that have been closed:

Proposals that have been closed:

l MTA <>BAL Treasury Swap [ends December 10]

l Transitioning treasury control to governance multisig [ends Dec 6]

l Approval of BeethovenX as a recognized friendly fork on Fantom [ends 11/22]

New and ongoing discussions:

New and ongoing discussions:

l FEI<>WETH Liquidity and Strengthening Connection with Fei

l [Proposal] Take the MTA stance to redirect rewards to the balancer pool

l [RFC] Treasury Swap Program GNO x BAL

source:

The latest governance topics on the Governance Forum.

Bancor

source:https://deepdao.io

Proposals closed:

Proposals closed:

l Check waiver function [ends December 8]

l Proposal: Whitelist SHEESHA to invest with 100k BNT [ends on December 8]

l Proposal: Increase the co-investment limit of ARCONA Pool to 1 million [ends on December 8]

l eRSDL LM Extension Proposal (Second Attempt) [Ends December 8]

l Proposal: increase TRAC-BNT fee from 0.2% to 0.5% [ends December 1st]

l eRSDL LM Expansion Proposal [ends December 1st]

New and ongoing discussions:

New and ongoing discussions:

l Propose a joint investment of 50,000 BNT to whitelist DUSK

l Proposal: activate the waiver function

l Proposal: Activate comment box and chart plugin on Snapshot

To read more about the different proposals and participate in the decision-making, check out the forum.

To read more about the different proposals and participate in the decision-making, check out the forum.

Bancor3: A First Look: Core contributors ChainLinkGod, DeFi Dad and Arthur DeFiance:

Bancor 3: Dawn Phase 1 Keynote @ DCentral Miami:

Compound

Deepdao.io

Compound’s Proposition 70 Fails: Following September’s Proposition 62 vulnerability in Compound’s auditor contract, the community has been working hard to improve its security practices. First, of course, is the short-term solution that comes with Proposal #63 to correct the error.

A long-term solution is provided in Proposition 70 in the form of a contract with OpenZeppelin to "implement security solutions to prevent and mitigate the loss of funds resulting from security risks posed by community-proposed compound protocol upgrades."

In another example of how DAOs can provide an often exciting level of transparency to previously opaque business/corporate processes, Trail of Bits “entered the chat,” offering a competing proposal in Compound’s governance forum. [View Forum Post]

Ultimately, Proposition 70 failed because the community decided to spend more time evaluating bids for code security solutions. The discussion is still ongoing, so be sure to click the link above and see how this important consideration for one of DeFi's most important protocols is progressing.

The Compound community continues to evaluate audit recommendations from OpenZeppelin, Trail of Bits, and ChainSecurity, and discuss creating a repeatable process for future vendor selection.

The Compound community continues to evaluate audit recommendations from OpenZeppelin, Trail of Bits, and ChainSecurity, and discuss creating a repeatable process for future vendor selection.

Active Proposals:

Proposals closed:

Proposals closed:

l 72 risk parameter updates for WBTC, UNI and COMP [ends December 6]

l 71 risk parameter updates for DAI, BAT, ZRX and ETH [ends on November 26]

New and ongoing discussions:

New and ongoing discussions:

l Audit composite agreement

l Risk parameter update 2021–11–30

l FRAX Listing Proposal

l Add market: LUSD

New and ongoing discussions:

The latest governance topics on the Governance Forum.

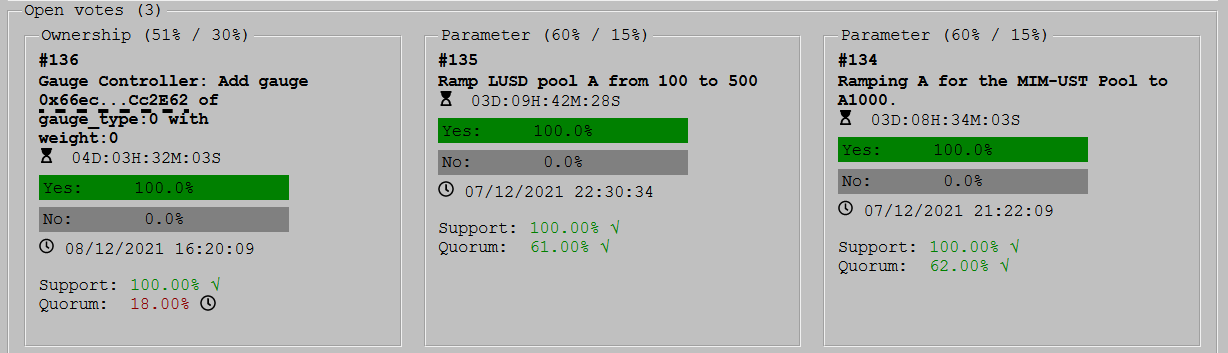

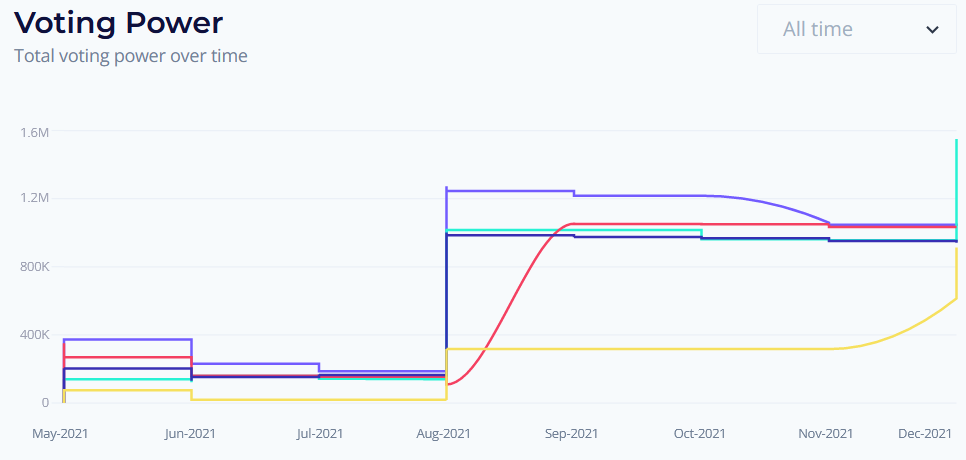

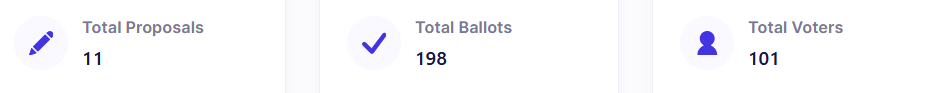

Curve

Voting. Power:

New and ongoing discussions:

l It is recommended to add rUSD/3CRV meter

Recent blog posts:

To read more about the different proposals and participate in the decision-making, check out the forum.

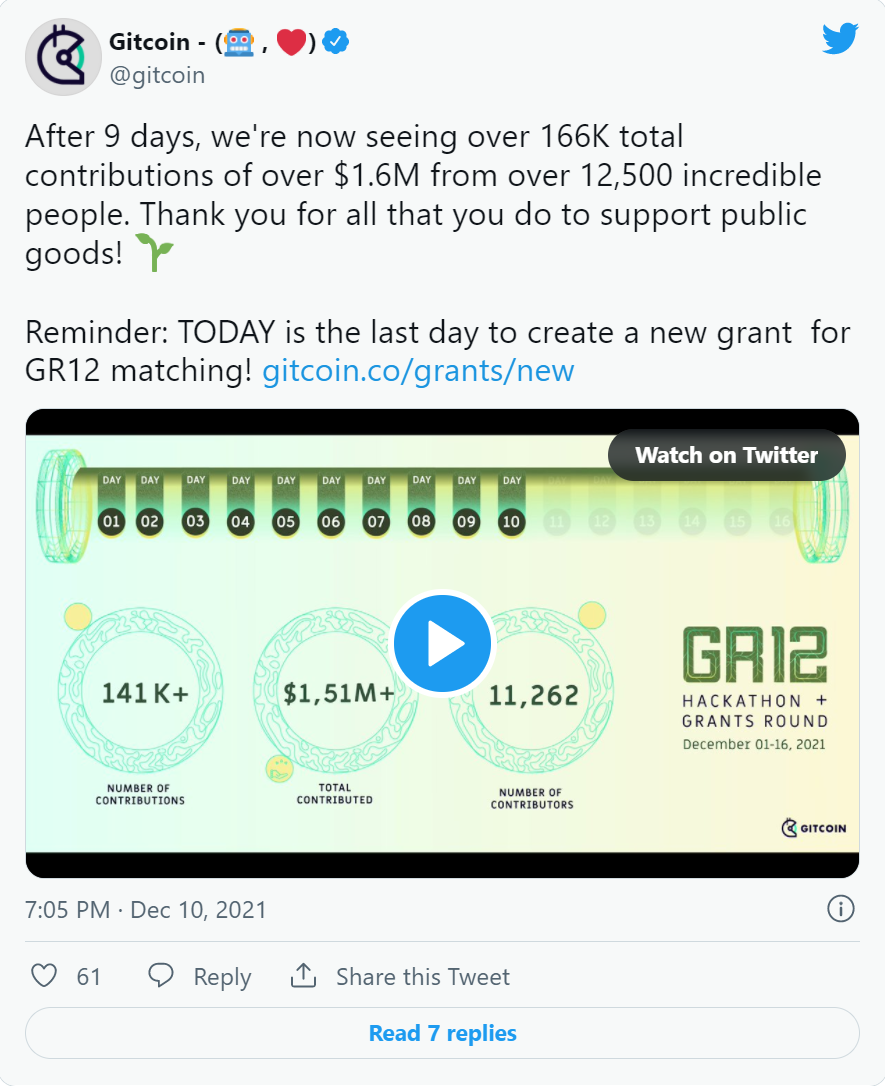

Gitcoin

Recent blog posts:

l Grant Round 12: Matching Cap

Active Proposals:

https://www.withtally.com/governance/gitcoin

Active Proposals:

l Redistribution of GTC to individuals who were unable to claim due to error [ends December 14]

l PrimeDAO partnership [ends December 14th]

Proposals closed:

Proposals closed:

l GR12 matching pool allocation [ends on November 29]

New and ongoing discussions:

New and ongoing discussions:

l Governance issues of GreatestLARP.com

l [Proposal] Redistribute GTC to individuals who cannot claim due to error

l [Proposal] Cooperation and mutual assistance with Prime DAO

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Recent blog posts:

Gnosis

Gnosis

Recent blog posts:

Proposals that have been closed:

Proposals that have been closed:

New and ongoing discussions:

New and ongoing discussions:

l GIP-17: Should Gnosis DAO upgrade Gnosis DAO Safe and create a separate Safe for active money management?

l GIP-19: Should Gnosis DAO burn 715k GNO?

l GIP 16 - Gnosis Chain - xDAI/Gnosis Merger

Recent blog posts and news:

Find the latest GnosisDAO proposal here.

Idle

Recent blog posts and news:

l Idle Community Initiative #3 Review

Active Proposals:

https://www.withtally.com/governance/idle

Active Proposals:

l M4 Treasury Alliance - Contributor Election [ends on December 14]

l M4 C&M Alliance - Contributor Election [Ends December 14th]

l M4 Developer Alliance - Smart Contract Developer Election [ends on December 14]

Proposals closed:

Proposals closed:

New and ongoing discussions:

New and ongoing discussions:

l Establish the IDLE/ETH centralized liquidity owned by the protocol

l Enzyme - bug bounty cooperation

l Messari launches governance tool with idle support

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Index Coop

Recent blog topics:

l Differentiate ETH2x products

l Index Coop November 2021 - Treasury report

l Introduce ETH 2x flexible leverage index on Polygon

Active Proposals:

Active Proposals:

l [COMPOUND-73] [Ends December 15th]

Closed Proposals:

Closed Proposals:

l [BALANCER] activation protocol fee

l [BALANCER] PrimeDAO <>BAL Treasury Swap

l [BALANCER-undefined] MTA <>BAL Treasury Swap

l [AAVE-undefined] Add G-UNI to Aave V2 AMM marketplace

l IIP-109: Deploy protocol-owned INDEX/ETH liquidity into managed Visor Vault on Uniswap v3

l [COMPOUND-72] Risk parameter update for WBTC, UNI and COMP

l [AAVE-50] Q2 Dynamic Risk Parameters

l IIP-116: Redirection of DPI, MVI, DATA and BED income to operating accounts

l IIP-116: Redirection of DPI, MVI, DATA and BED income to operating accounts

l IIP-115: Authorize investment accounts for Aave, Compound, Balancer, Element Finance, Notional Strategies, Ribbon Finance...

l IIP-114: Transfer USDC from Treasury to investment account and deploy effectively

l IIP-112: Update investment account multi-signature

l IIP-111: Create operational accounts on the Polygon network

l IIP-105 DG2: Launch of MATIC 2x Flexible Leverage Index (Polygon)

l IIP-104 DG2: start ETH2X-FLI (polygon)

l IIP-110: Form a Liquidity Pod

New and under discussion:

New and under discussion:

l Proposal: IIP-109: Deploy protocol-owned INDEX/ETH liquidity into hosted Visor Vault on Uniswap v3

l IIP-XX: Index buyback and reinvestment

l Proposal: IIP-110: Form Liquidity Pod

l IIP-54: BED:ETH Liquidity - Provided directly by Index Coop

l IIP-XY: MVI liquidity migrated to Visor Uniswap V3 pool

l IIP-75: Web3 Engineer - full-time job

Recent blog posts:

existhereFind the latest Index Coop proposals.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

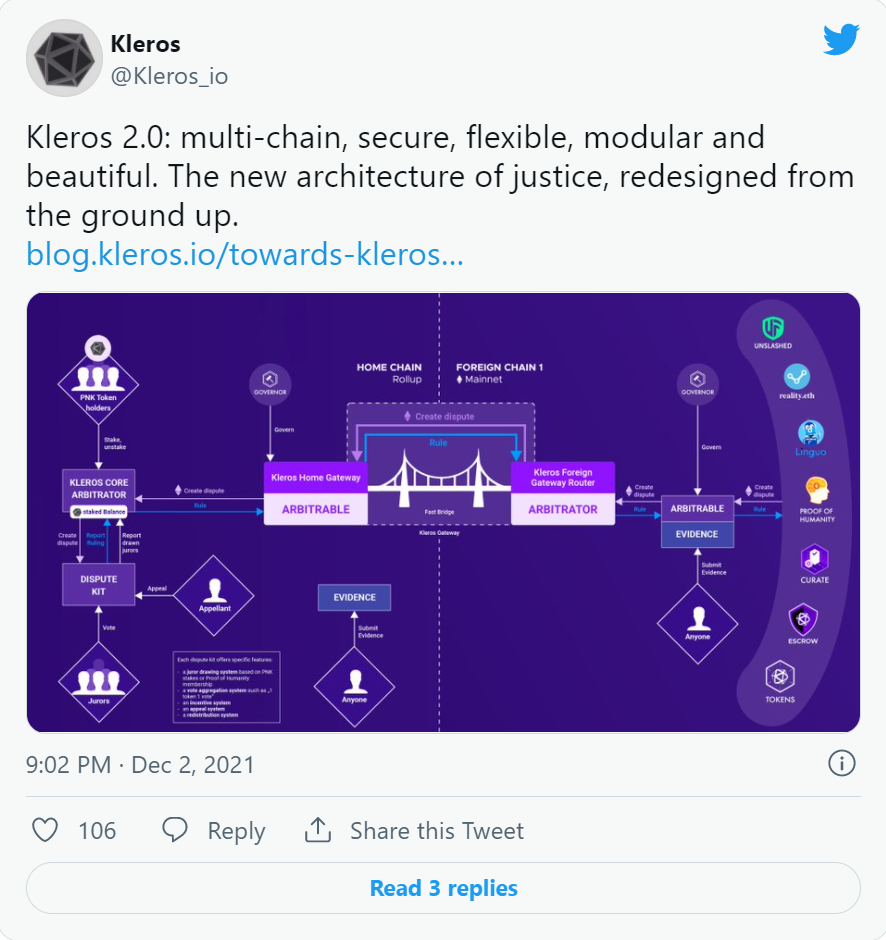

Kleros

Recent blog posts:

Active Proposals:

Active Proposals:

discuss:

discuss:

l KIP-47? Strengthen marketing

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Kleros Community Initiative (2021/12/8):

Recent blog posts:

KyberDAO

Recent blog posts:

Find all proposals here. Check them out on GitHub.

There have been no active proposals in recent weeks.

Find all proposals here. Check them out on GitHub.

Proposals that have been closed:

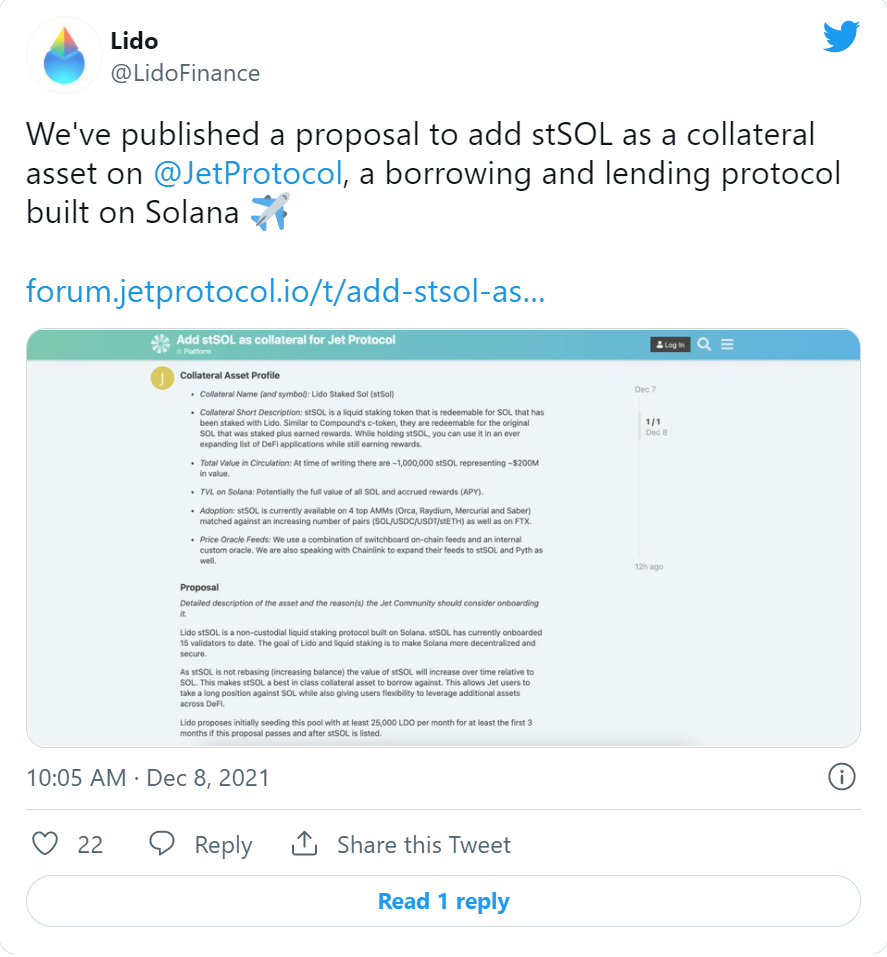

Lido

Proposals that have been closed:

l Proposal to set up a reward committee [ends on December 8]

l Proposal: Addressing tax and regulatory considerations around liquid staking [closes December 6]

l Proposal: Upgrade Lido on Terra protocol [ends December 1st]

New and ongoing discussions:

New and ongoing discussions:

l LIP-6: Intra-protocol coverage proposal

l It is recommended to set up a reward committee

l Proposals to address tax and regulatory considerations surrounding liquid staking

l Lido on Terra protocol upgrade

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

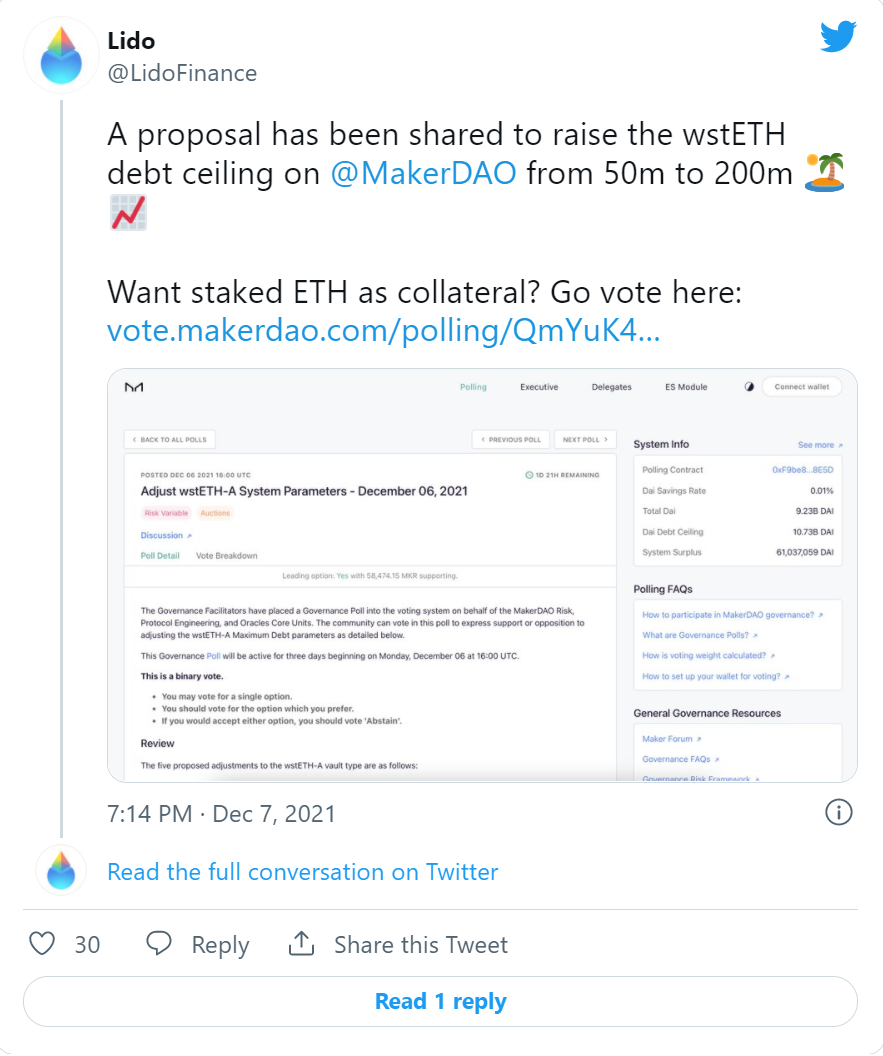

MakerDAO

active voting

2 Polls - Closes December 20:

l Community Green Light Voting——aUST (Anchor TerraUSD)

l Community Green Light Vote - G-UNIv3-DAIUSDP (Gelato UniswapV3 DAI-USDP LP Token)

closed vote

2 Polls - Closes December 9th:

l Adjust wstETH-A system parameters

l Adjust MATIC-A system parameters

7 Polls - Closes December 2:

l Added dust parameters for most Vault types

l Add the Dust parameter of ETH-B Vault type

l Use MakerDAO funds to fund MKR fees

l Added GUNIV3DAIUSDC2-A as a new Vault type

l One-time payment to government communications agency CU to deal with budgetary issues

l Parameter Change Proposal - MakerDAO Open Market Committee

l Added CurveLP-stETH-ETH as a new Vault type

2 Polls - Ends November 29th:

l Community Green Light Voting——MONETALIS (MONALIS Wholesale SME Green Growth Lending)

l Community Green Light Voting——SB-frOGI (SolidBlock Red Frog Digital Coin)

Execute the proposal:

l Parameter change, switch MKR attribution source [End on December 11]

New and ongoing discussions:

New and ongoing discussions:

l MIP39c2-SP27: add strategic finance core unit

l MIP41c5-SP2: Helper goes offline (RWF-001)

l MIP39c2-SP28: Add Maker Talent Core Unit (MT-001)

l MIP40c3-SPTF-A: Modify core unit budget, ORA-001 (Oracle Gas Costs)

l MIP40c3-SP45: Modify core unit budget, ORA-001 (Oracle Gas Costs)

Read more about the different proposals and participate in the decision-making.

There are a lot more!

Read more about the different proposals and participate in the decision-making.

Recent blog posts:andGovernance Forum

MakerDAO event calendar.

mStable

Recent blog posts:

l Guidelines for Emission Controllers

l mStable launches emission controller

l mStable ecosystem integrated with APY Finance

Closed Proposals:

Closed Proposals:

l TDP 29 — DAO<>DAO Exchange — Balancer

l TDP 28 — Fei Protocol & Ondo Finance LaaS Opportunity

l TDP 27 — Immunefi Bug Bounty Program

l MIP 22: Affiliate Referral Program

l Ministry of Finance DAO community signer election (December 2021)

l ProtocolDAO community signer election (December 2021)

l TDP 29 — DAO<>DAO Exchange — Balancer

l TDP 28 — Fei Protocol & Ondo Finance LaaS Opportunity

l TDP 27 — Immunefi Bug Bounty Program

l MIP 22: Affiliate Referral Program

l Ministry of Finance DAO community signer election (December 2021)

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

New and ongoing discussions:

l TDP 29 — DAO<>DAO Swap — Balancer

l TDP 28 — Fei Protocol & Ondo Finance LaaS Opportunity

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

AMA and Symphony Finance—mStable:

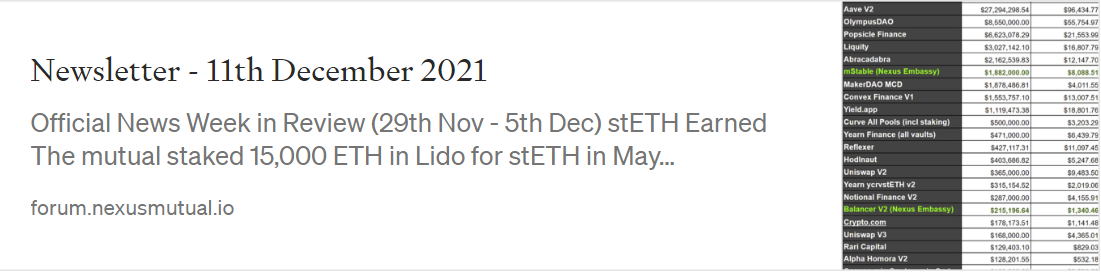

Nexus Mutual

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Vote on governance proposals here to determine the future of the protocol.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Recent blog topics and news:

Synthetix

Recent blog topics and news:

l Please join us on December 15th/December 16th for the next Synthetix Community Governance call!

l Atrium release

l Futures update

Active Proposals:

Active Proposals:

l SIP-192: Fee Pool Accounting Bug Fixes and Reimbursements [ends Dec 12]

Proposals closed:

Proposals closed:

l SCCP-156: Update LUSD Wrappr parameters

l SIP-192: Fee pool accounting bug fix and compensation

l SIP-180: Aelin protocol

l SIP-188: Add sETHBTC synthesizer

l SCCP-154: including sEUR to atomic swap

l SCCP-153: Increase the transaction volume limit of atomic swap

source:

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Pie DAO

source:https://deepdao.io

https://deepdao.io/

There are currently no active votes, some new proposals in the forum, and bounties on the bounty committee for analysis. The community is watching with interest to see what happens with Enso Finance's "vampire attack".

Proposals closed:

Proposals closed:

l [PIP-59] $PLAY INDEX - ACTION POINTS [ENDS DECEMBER 2]

l [PIP-64] 2nd Month - Reward Pie Composition [Ends on December 1st]

l Should the Treasury seek to outperform ETH or a less volatile benchmark? [Ends November 25th]

l Set the minimum distribution from treasury Farming? [Ends November 25th]

l Should PieDAO cooperate with Olympus DAO? [Ends November 30th]

l The gas cost is too high

New and ongoing discussions:

l fdsaf

New and ongoing discussions:

l [Proposal] PieDAO clearly states that it will not restrict user freedom

l Linear Finance x PieDAO——Synthetic PLAY Metaverse NFT Index (ℓPLAY)

l [PIP-59] $PLAY Metaverse Index — Prospectus

l [PIP-65] Staking rewards compounded to veDOUGH

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Enso Finance launched a vampire attack on 6 indexing protocols, and PieDAO responded by blacklisting the contract address:

PoolTogether

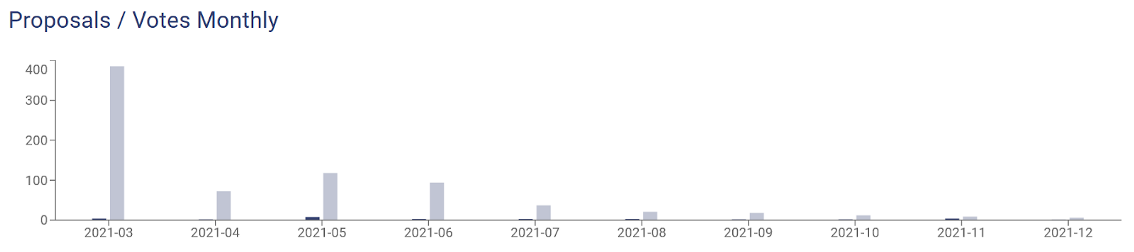

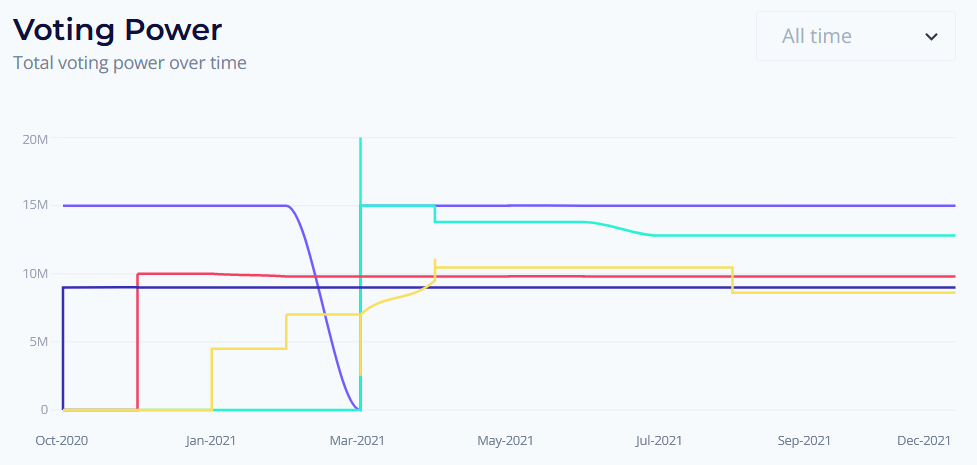

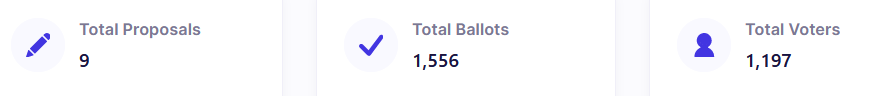

Other Internet's PoolTogether report: Other Internet is a "decentralized application research organization" focused on "social technology". They have participated in multiple DAOs as governance representatives and produced high quality research reports like this one published on Uniswap in August.

Their recent report on PoolTogether — funded by the PoolGrants program — is a great read detailing “PoolTogether’s off-chain governance and social architecture, with a focus on its Discord and governance forums.”

Proposals closed:

source:https://www.withtally.com/governance/pooltogether

source:https://app.boardroom.info/pooltogether/overview

Active Proposals:

l PTIPs 50 & 51: FEI & Avalanche [end Dec 14]

Proposals closed:

l PTIP-48: Funding Committee Grant (Season 2) [ends December 3]

New and ongoing discussions:

New and ongoing discussions:

l PTIP-50: POOL liquidity management

l PTIP-49:RabbitHole Quest

l PTIP-51: Authorized Avalanche Deployment

l PTIP-45: Fei/Ondo LP Partner

Active Proposals:

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

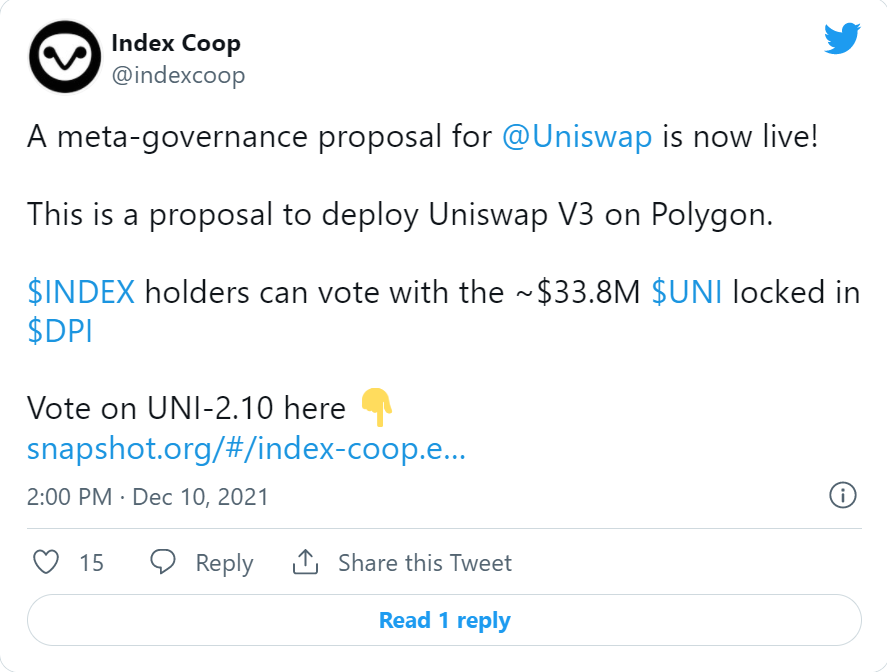

Uniwap

https://www.withtally.com/governance/uniswap

https://app.boardroom.info/uniswap/overview

Active Proposals:

Proposals closed:

Proposals closed:

l Consensus check - should Uniswap incentivize liquidity on Optimism and Arbitrum? [Ends December 16th]

l Consensus Check - Should Uniswap v3 be deployed to Polygon? [Ends December 3rd]

New ongoing discussion:

l Governance Proposal UP010 - Deploy Uniswap V3 to Polygon PoS Chain

l Deploy Uniswap V3 to Polygon PoS chain

l UNI should become an oracle token

l Deploy Uniswap V3 to Boba Network

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Proposals that have been closed:

Yam Finance

Proposals that have been closed:

l Contributor stream update [ends December 10]

l Contributor stream update [ends December 1st]

l Mainnet multi-signer update [ends December 1st]

New and ongoing discussions:

New and ongoing discussions:

l Marketing plan—Yam Finance

l Contributor stream update

Active Proposals:

Check out the latest YIP discussions here.

Yearn Finance

source:https://app.boardroom.info/ybaby.eth/overview

Active Proposals:

discuss:

discuss:

Check out the latest YIP discussions here.

Check out the latest YIP discussions here.

MISC

Rari <> Fei Merger

The biggest news in the DAO space right now is the upcoming merger between Rari and Fei Protocol. Two DeFi projects are looking to join forces under the $TRIBE token banner.

The proposal surfaced two weeks ago, with Fei and Rari leaders Joey Santoro and Jai Bhavnani posting simultaneously on another project's governance forum. Since then, the idea has been mulled over as more details emerged about how the merger would proceed.

The most significant development is the detailed merger plan submitted by GFX Labs, the company of Uniswap and Compound contributor Getty Hill. An overview of GFX's merger plans:

How to technically implement the merger, including ragequit/buyout functionality for individuals who do not agree to the merger.

The financial impact of the merger, i.e. the dilution for each group of token holders.

Compensation from GFX and long-term cooperation with Tribe.

For those interested in gaining insight into the ongoing merge discussions between two communities: the Fei Governance Forum and the Rari Governance Forum. Also, check out this podcast episode from Reverie's Jai, Joey, and Derek Hsue.

This proposed merger is a historic moment in the maturation of DAO-to-DAO business activity.

Update on Fei <> Rari Merger

This week, GFX Labs canceled their planned merger after the two communities raised objections to GFX’s proposed compensation and other aspects of the plan, such as the token exchange rate. From thread:

“We withdraw the proposal because we believe that everyone’s strategic vision may not be fully aligned, and we have high standards for both communities’ satisfaction with the proposal in order to set an example for future DAO mergers.”

Another update: An enterprising member of the Fei and Rari community - jakekidd.eth - has launched two simultaneous "temperature check" type proposals in the Fei and Rari Snapshot space, "one for the overall merger plan and one It's about compensating for the work done by GFX Labs." (Link to related discourse by Fei and Rari.)

The merger plan vote received nearly unanimous support in the Rari and Fei Snapshot spaces. Compensation plan votes are not conclusive, but are an interesting example of using token-weighted sums to determine final payouts. Jakekidd.eth proposes the following process:

"The resulting payment will be calculated as the dot product of the total number of votes for each option in the option list: a(0) + b(50,000) + c(100,000) + d(333,000) + e(1,000,000) ) + f(2,000,000) + g(3,500,000)

As a simple illustration of this formula, imagine a scenario with three potential vote sizes: A, B, and C. Let's say these options get 10%, 40% and 50% of the votes respectively; the final payout will be calculated as 0.1A + 0.4B + 0.5*C. "

TLDR seems to have strong support for moving forward with the merger between the two communities, but exact implementation details have yet to be determined.

l GFX Labs withdrew its leadership of the Fei Protocol-Rari Capital merger.

Sushiswap amidst confusion over team pay and protocol direction

Sushiswap’s internal problems have reached a tipping point, sparking several proposals to realign governance and management.

Over the past week, Sushiswap has seen internal tensions come into the open. While this conflict is specific to the Sushi project, it has parallels to operational struggles around chain of command and team relationships that have affected many other DAOs as well (see MakerDAO's recent contributor departure proposal).

The firing of core contributor AG has in part set off a flurry of activity. Additional attention was drawn by former member BoringCrypto, creator of Sushi's Bentobox software for Kashi loans and Abracadabra's MIM stablecoin. While personal animosity appeared to play a role in the comments, there were also concerns about transparency and accountability of funding.

On the other hand, some claim that contributors are underpaid compared to the value they provide to the Sushi ecosystem. CTO Joseph Delong even proposed a retroactive payment of 200,000 SUSHI (over $1 million) to each of about 20 core contributors (not counting himself). This is a test showing that less than 1% of releases to the core team are contentious.

While this appeared to be primarily intended to draw attention to long-festering compensation issues, it disrupted the price of SUSHI tokens and led to a lot of activity and competing proposals on the Sushiswap forum. This included several forum posts (some of which have since been deleted) culminating in a proposal to remove Joseph as CTO and his subsequent resignation. [Joseph Delong's article details the Sushi mirror.xyz leadership failure]

Among the leadership lapses identified by Joseph, some are broadly applicable to many organizations in the DAO ecosystem.

l Lack of clear authority to hire and fire core contributors, resulting in poor quality work and difficult-to-resolve personal conflicts

• Failure to expand management functions within the organization (such as hiring more project management staff), resulting in inefficiencies.

Amid this turmoil, some investment funds with large stakes in SUSHI stepped in, proposing new governance and organizational structures. While Sushi is billed as a community-led project that is not VC-backed, this may represent one of the positive benefits of participation by fund companies, who have a strong incentive to secure their investment through direct donations and advice.

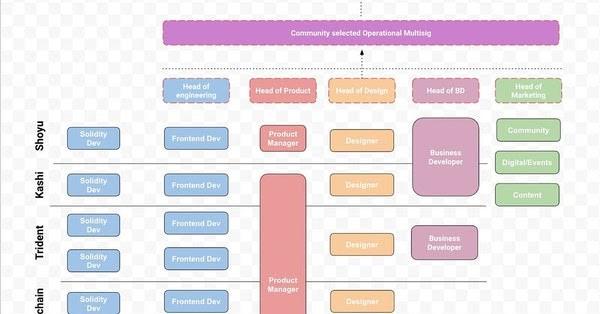

The restructuring proposal appears to have received significant support from the community and contributors, and includes the following elements to help Sushiswap improve organizational efficiency and governance oversight:

While there is currently some power vacuum within the Sushiswap core team, this incident may help put the DAO back on the road to success. By combining delegation of core team leadership with greater oversight, Sushi's DAO structure can be a competitive advantage rather than an organizational hindrance.

OpenAccessDAO

After ConstitutionDAO, there were a lot of ideas about how to bring crowds together, pool resources, and do cool stuff.

One of those ideas started with “SwartzDAO” — an effort to buy and then open-source access to academic peer-reviewed publications, inspired by the late activist Aaron Swartz. After some back and forth over the name of the DAO (some objected to using the name Aaron Swartz), the effort is now called OpenSourceDAO.

This project deserves attention. Check out the following resources to learn more and get involved: OpenAccessDAO FAQ, Twitter, Discord.

PrimeDAO $D2D

PrimeDAO is a "collective focused on researching and building next-generation coordination tools for decentralized organizations." Their focus is DAO-to-DAO coordination and "DAOplomacy".

This week, PrimeDAO announced the launch of a $D2D token developed by PrimeDAO to "curate, build and control a suite of DAO products and services." $D2D Token. $PRIME tokens will be replaced at a 1:1 ratio, with early users earning additional $D2D for their work. Read the announcement: Powering $D2D with Prime

See this governance forum post for more details on $D2D token economics. PrimeDAO also has active governance proposals for partnerships with leading DAOs.

Messari Governor

Messari has entered the governance tools chat to help resolve the DAO's "historically complex engagement process."

Messari announces MessariGovernor! Governor is our free, first-to-market governance aggregator and voting platform. Anyone can participate using MetaMask, CoinbaseWallet or WalletConnect.

Their new governor product pairs Messari's research center with a DAO governance tracker with built-in voting and delegation. The platform ensures that users never miss any major proposals or votes, while also providing additional context and analysis for each proposal. At launch, Messari Governor will support the Snapshot, Governor Alpha, and Governor Bravo frameworks as well as over 30 protocols and communities, including Uniswap, SushiSwap, Compound, OlympusDAO, and The Graph.

l ENS DAO voted for supplementary airdrops for users who were wrongly excluded from the token distribution:

l Rari developer t11 released a tool for automatic "no" voting in DAOs based on Compound and OpenZeppelin:

l OlympusDAO transitions to the on-chain governance mechanism gOHM:

l OHM fork Lobis received whitelist approval to use FXS in Frax protocol governance, which may reflect the influence of Convex Finance in Curve:

l BasketDAO arranges to close the protocol and transfer assets to a competitor:

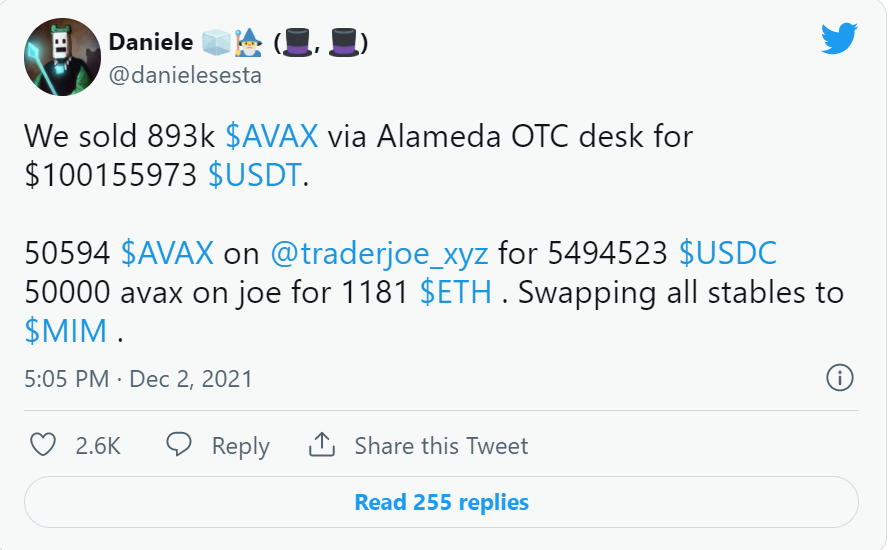

l The Danielle of Wonderland project sells $100 million in AVAX to convert treasury bonds into stablecoins:

4. Snapshot

Come and subscribe to Paradigm!

—————————————————————————————————————————

Primary source:

1. Project blog and forum

2. Research Articles

3. Conference room

4. Snapshot

5. Ledger