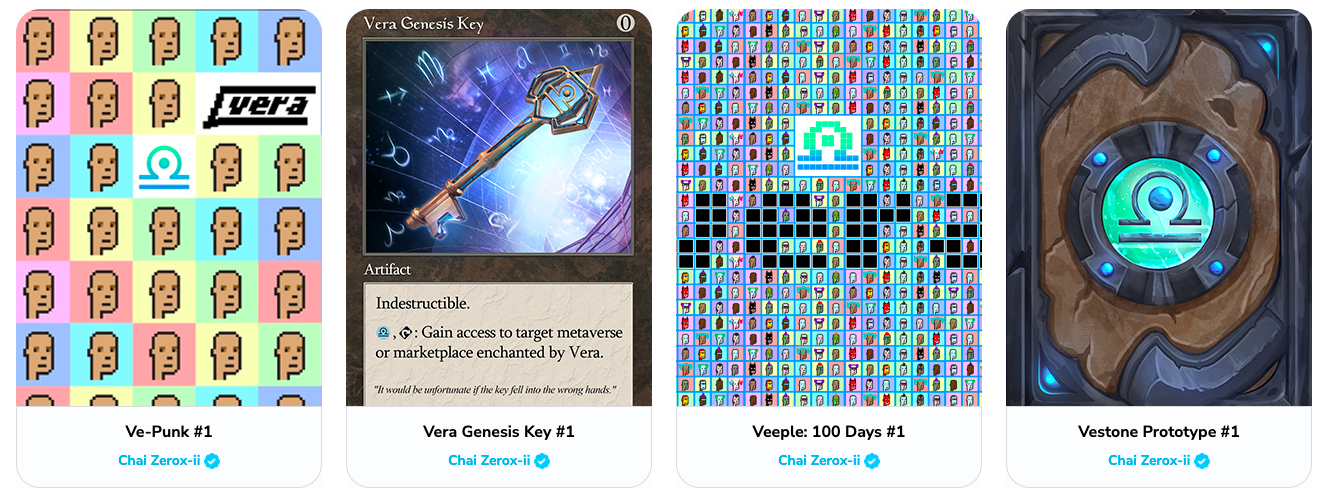

Dialogue with "Vera Labs" to unlock the new posture of leasing NFT

In 2021, NFT will be very popular. In the first half of the year, the total market value of NFT was 2.5 billion U.S. dollars, and in July alone, sales soared to 1.5 billion U.S. dollars. Due to its uniqueness and the emergence of more applications, NFT has developed into a new way for people to display their wealth and identity. However, the high amount of Beeple, CryptoPunks, and BAYC is prohibitive for ordinary people. Is there a better way for ordinary people to participate? Lease NFT is born from this application.

In order to further understand how leasing NFT works and where its value lies, Odaily’s 138th Chaohua Community invited Vera Labs Operations Director Jeralyn Tan to share with you the establishment opportunity, operating mechanism, development overview, and future planning of Vera Labs.

secondary title

Q1: Please briefly introduce Vera Lab to everyone.

A1: Vera is one of the best options for any user looking to rent, lend or mortgage NFT assets.

secondary title

Q2: According to the introduction just now, Vera Lab is mainly engaged in non-custodial NFT leasing. Why did you think of doing this? What is the specific process and pricing of leasing? How much money do I need to mortgage to rent an NFT?

A2: We believe that true decentralization should be custody-free (where possible), so that at no point does a custodial intermediary be required to hold NFTs, and no legal contracts need to be signed.

Our leasing process is fairly simple:

1. Lenders list NFT in the rental market provided by Vera.

2. Enter the required terms, such as term and rental requirements.

3. Confirm online.

Congratulations, your NFT has been successfully launched.

1. The tenant clicks on the online NFT and specifies the required lease period.

2. Agree on the listed amount and collateral.

3. Confirm the rent.

Congratulations, you have successfully rented out NFT.

Regarding the live demonstration video released by the Vera NFT leasing mainnet, you can pay attention to it later:https://www.youtube.com/watch?v=NEI4wTc_ygY。

Vera provides financing tools, not asset appraisals. The price depends entirely on the owner of the NFT. It's like listing an asset on an exchange and selling it without setting a price. Rates and fees on the Vera platform will be flexible as it is primarily based on price discovery. Ideally, we'd prioritize getting community input before finalizing it. However, this mainly applies to our own market platforms/exchanges. For other platforms, it will be decided by DAO.

secondary title

Q3: Will leasing impact the buying and selling market? If some people only want to obtain "bragging rights" for a certain period of time, leasing can replace buying?

A3: Rent will definitely affect the buying and selling market, but it is not a means of replacing buying and selling. for"show off"While leasing is possible, I wouldn't say it won't happen. I can have an NFT worth 1 million, but most likely I won't lend it out or rent it out. Even with collateral, I may not feel comfortable doing this. With Vera, it's different because of seller protection. It doesn't really matter how the renter uses the NFT, when I'm not using it, I'm still generating passive income.

secondary title

Q4: What kind of groups (specific portraits) are Vera Lab targeting? What can leasing through NFT help these people achieve? As Michael Arbach said before, there will be empowerment for event passes, ticketing, music, entertainment, games and other fields, and he can talk about it in detail.

A4: The customers/partners that Vera focuses on are games and Metaverse, especially those who want to continue to create new Play to Earn models. Vera will add superpowers to these customers' products, giving users even more ways to play2earn. We're introducing the concept of Play2Own, where if you do certain things in the game, you can end up owning an awesome NFT because someone else, like the game, an advertiser, or a sponsor, is paying for your NFT.

secondary title

Q5: According to information, during Art Basel in Miami, Vera let two strangers successfully rent a $1.5 million NFT agreement on the Ethereum mainnet for the first time in front of more than 3,000 participants at the Sagamore South Beach Hotel — Bored Ape Yacht Club#65 and XOiD#1918. Can you talk about how you successfully persuaded strangers to accept the lease indirectly?

secondary title

Q6: If the price of the NFT held by the user rises sharply during the leasing process, can the leasing right be transferred to obtain a corresponding proportion of income? If not, in the face of users with such demands, does the team have a better solution to protect the interests of users and improve user retention.

secondary title

Q7: Apart from the help to users and consumers, what is the significance of NFT leasing to the establishment of the entire NFT ecology and even the metaverse beyond?

A7: Currently, our use cases are more on GameFi and Metaverse. But imagine a use case about concert tickets - say Jay Chou's concert. I purchased an annual concert ticket that entitles me to a virtual concert every month. But maybe in February, I'm so busy with work that I can't attend at all. At this point I can rent it out to anyone who needs it.

secondary title

Q8: Why is Vera Lab doing this? What are the strengths of the team? What is the current progress in terms of business and partners? For example, the team mentioned that it will expand deployment on Polygon, BSC and Solana. What is the current situation?

A8: In many cases, people try to acquire NFTs, but they can't buy them at full price, and they can't find a solution for financing. We've done a lot of research but haven't found a project that addresses this issue so far. Financing, lending, and borrowing are the core functions of the financial system, and they are also necessary for the NFT market. And this kind of function is exactly what the current market lacks.

And so, here comes Vera. We provide decentralized financing, leasing, lending and other basic financial services for NFT marketplaces, games or applications. Our mission is simple: build open, secure, and powerful NFT financial products that allow people around the world to participate equally. As our founder Dennis always said:"Vera has invented the wheel, brakes and steering. go invent the car"。

There are many NFT projects that are proposing experimental new NFT standards or protocols, but they have absolutely no go-to-market strategy or idea that even considers whether a real-world business would want to use it (or other NFTs). A project has no real value without real world recognition and acceptance from the businesses associated with the asset. Vera was built by engineers who have worked with companies that have actually used blockchain technology to generate income for several years. We are positioned to build a decentralized infrastructure with a viable market strategy to help the creation of NFT decentralized applications , Reduce technical complexity and financial risk - this is exactly what the market needs to discover the utility of NFT.

We have quite a few partnerships that we cannot fully disclose due to confidentiality agreements. Focusing on games + NFTs (Metaverse), we have Totem, Chainguardian, Highstreet, NetVRk and Demole.

You can read more here:https://blog.vera.financial/tagged/partnerships。

About our list of partners:https://docs.vera.financial/ecosystem。

secondary title

Q9: Apart from the current progress, what are the future development plans of Vera Lab?

secondary title

Q10: It is undeniable that NFT is currently in an overheating period. When the market returns to rationality, the inflated NFT price falls, and user enthusiasm fades, how will the NFT rental market dominated by Vera Lab respond?

text

secondary title

Community Featured Q&A

A1: What should I do if I rent NFT and lose it if it is attacked?

Q1: We prioritize security and will be audited at multiple levels. Insurance is something we're working on, but with our technology, your NFTs are less likely to leave your wallet. Unless it goes back to the owner.

Q2: Suppose I rent a BAYC and sell it on Opensea or send it directly to someone. How will this project solve this problem?

A2: This is unlikely, our technology will disable the ability to transfer it or list it anywhere else. As long as it's not paid in full (under our mortgage program) or in rent, then you're not the true owner. Basically you can only use it, but not use it to generate income. That's how our Seller Protection was designed, and it's the first of its kind on the market. There are lease agreements available, but they just use NFT collateral as a precaution. But in the final analysis, you still have to trust each other more or less.

A3: I would like to ask, the price of NFT before renting is 2 ETH, and it becomes 1 ETH after renting. Whose loss is this?

Q3: Again, the rental fee is determined by the owner. The rent we agreed is 0.1ETH, and the NFT will be reduced to 1ETH tomorrow, and my rent is still 0.1ETH per day. This is a contract that both parties agree to. Unless the NFT is a direct sale, that's a completely different story.