YC in the Web3 era: How does Terra break the encryption world and traditional business?

Author: Mario Gabriele

Author: Mario Gabriele

Original compilation: siqi, penny, Jessie

There is a natural barrier between the encrypted world and the real world: the large price fluctuations of encrypted currency make it impossible to be truly applied in real life.Terra, born in South Korea, tries to solve this problem. Compared with other public chains,Terra is special in that it introduces blockchain technology into traditional payment scenarios such as e-commerce and retail, allowing ordinary people to interact with the Web3 economy without knowing it.

This is where Terra's great potential lies. By integrating encryption applications into the daily financial needs of ordinary people, Terra may have the largest user base in the encryption field.

What is Terra? It can be a public chain, a digital bank, a payment processor, or a pioneering financial innovation concept. The developers of the Terra ecosystem even regard it as the Y Combinator in the encryption field.

Since its launch in the summer of 2018, Terra has accumulated a large amount of funds, and its stablecoin UST currently has the fourth largest lock-up volume in the world. Terraform Labs behind Terra is also creating various infrastructures along different financial scenarios, endowing Terra with a wider range of application scenarios, and perfectly utilizing the strong network effect of currency.Founder Do Kwon is a gifted leader who inspires Terra's contributors and articulates the project vision in a powerful way. The vitality of the Terra community is the long-term driving force for the entire ecological development, and the core of the community atmosphere is the personality charm of Do Kwon himself.

Some call it the Jobs of the crypto world.

In today's article, we will study Terra from different perspectives, discussing its development history, prosperous ecology, strengths and weaknesses.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

01. How Terra is built

Do Kwon: The Pursuit of Decentralization

Daniel Shin's Business Intuition

02. Terre’s stablecoin “family”

The Significance of Stablecoins

UST and Luna

Is UST reliable?

How Terra's Stablecoins Are Widely Adopted

03. Terraform Labs: Seeding the Ecosystem

04. Prosperity of Terra Ecology

05. Understand Terra

The Lego of Finance

Y Combinator in the Web3 Era

"Top-down" evolution

06. Risks and challenges of Terra

Are Algorithmic Stablecoins Really "Stable"?

Throughput that can lag

Too low-key product and team

07. Encrypted version of "Jobs": Terra's unique advantages

Do Kwon's charisma

first level title

01

first level title

How Terra was builtThe birth of Terra is inseparable from Do Kwon and Daniel Shin. Terra is Do Kwon's second venture. Based on the first entrepreneurial experience, Kwon came into contact with the concept of "decentralization" and entered the Crypto field, creating Terra. Because of his e-commerce entrepreneurial experience, Shin came into contact with Kwon and his Terra,

Quickly helped Terra lock an application scenario that will generate huge commercial value: e-commerce payment.

"Terra's founding team saw several pain points in the financial system: such as slow payment customs clearance, high payment fees, etc. Blockchain is just the best choice to solve these problems. Terra is using blockchain technology to solve financial problems. template on the

Do Kwon: The Pursuit of Decentralization

text

Anyfi provides end-to-end network sharing services, the company's mission is: "Connect the world for free (free connection world)". Through Anyfi, users can define themselves as new nodes and share their own network bandwidth. For example, if you are within the range of your own wifi and set the Anyfi function, then your mobile phone can be used as a "sub-router" Extends the range of that signal, providing access to people outside of wifi coverage. In fact, Anyfi can also be seen as a decentralized network.

Anyfi

image description

Do Kwon's entrepreneurial career got off to a smooth start. In 2016, Anyfi received $1 million in investment from the South Korean government, angel funds, and some early clients.Due to the distributed nature of Anyfi, when Kwon researched "decentralization" and "peer-to-peer network" for the needs of product and business development, he also began to come into contact with the blockchain and the entire encryption field behind it, and There was great interest in this.

In 2017, Kwon and his college friend Nicholas Platias wrote a white paper together, drawing out the prototype of Terra.Combined with his observations on cryptocurrencies, Kwon wanted to make a project that could be used as an actual currency.

But until he met his future partner, Shin, Kwon didn't really think about how to commercialize his idea.

secondary title

Daniel Shin's Business Intuition

Daniel Shin had already had a successful entrepreneurial experience before joining post-Terra.

In 2010, Shin founded Ticket Monster (TMON), a group buying platform in South Korea. TMON is one of the earliest e-commerce platforms in South Korea, and defeated its rival Coupang (compared to Groupon) in the group buying war in the Korean market. After a series of financing, TMON was sold to Living Social 18 months after its establishment. As its business layout in the Korean market, TMON was subsequently sold to Groupon for $260 million.After selling TMON, Shin has been providing consulting and incubation services for Internet companies in South Korea and Southeast Asia as a mature entrepreneur. Therefore, he came into contact with Do Kwon and became very interested in Crypto and Kwon's project itself.

TMON's business practice made Shin keenly discover a very suitable application scenario based on Kwon's theory: e-commerce payment. In Shin's view, instead of using large servers to manage complex transaction information, a decentralized solution is feasible.

And thus Terra was born.Although it was at a low point in the global encryption market at the time, Terra quickly completed a round of investment of US$32 million in the first half of 2018 because Terra’s usage scenarios were clear enough and Shin’s endorsement was in place.

Its early investors include not only exchanges such as Binance, OKEx, and Huobi, but also TechCrunch founder Michael Arrington, Polychain Capital, Hashed, etc.

first level title

02

first level title

Terra’s Stablecoin “Family”

A brief summary of what Terra is doing is that it has greatly improved the payment processing process of e-commerce companies through blockchain technology, but it is not easy to do this, and it requires the support of very complicated back-end mechanism settings, " "Stablecoins" are at the heart of this complex process.

As mentioned earlier, Terra was created because Do Kwon realized that the volatility of digital currencies makes most digital currencies unable to be used for value exchange like real currencies, so Terra Protocol is first and foremost an algorithm-based stablecoin protocol , which provides a stable currency system.Unlike most currency protocols that focus on minting stablecoins pegged to the U.S. dollar,Considering the strong regional nature of fiat currencies, Terra stablecoins are actually a rich currency portfolio linked to various major currencies in the world to meet the needs of stablecoins in different regions and scenarios.

To understand the value of Terra, we must first understand the important role of "stable currency" in the field of encryption and the current state of development.

secondary title

The Significance of StablecoinsAlthough one of the original intentions of Bitcoin is to provide a digital cash substitute, the huge volatility caused by limited supply and speculative mentality makes it impossible to become a mapping of legal currency, and it is difficult to realize the attributes of a medium of exchange.

After all, no one would choose to buy something with a currency that might appreciate 20% in 24 hours. The same goes for other cryptocurrencies.

You can imagine a scenario: If you choose to use BTC to buy a tablet worth $1,000, when the price of BTC is $58,000, you need to pay 0.01724 BTC, and 10 minutes later, the price of Bitcoin reaches $60,000. That means you actually paid $1,034 for the pad, and two days later, when bitcoin reaches $69,000, that payout will be $1,190.

In actual commercial applications, such fluctuations are undoubtedly very scary. Therefore, the concept of "stable currency" is quite important.Stablecoins are a form of cryptocurrency that, unlike Bitcoin and other speculative currencies, have at their core the goal of emulating fiat currencies that are more stable than cryptocurrencies, thereby making themselves less vulnerable to extreme price swings.

Through some specific mechanisms, stablecoins try to anchor the price of a certain legal currency as much as possible, and most stablecoins choose to peg to the US dollar.

The existence of stablecoins provides a medium for the encryption ecology, and provides a way for crypto investors to reserve assets in the encrypted world. The development of DeFi also benefits from stablecoins.

Fundamentally, Kwon and Shin's design of Terra is to solve the problem of "BTC buying TV". The realization of this solution started when Terra launched its own stable currency.

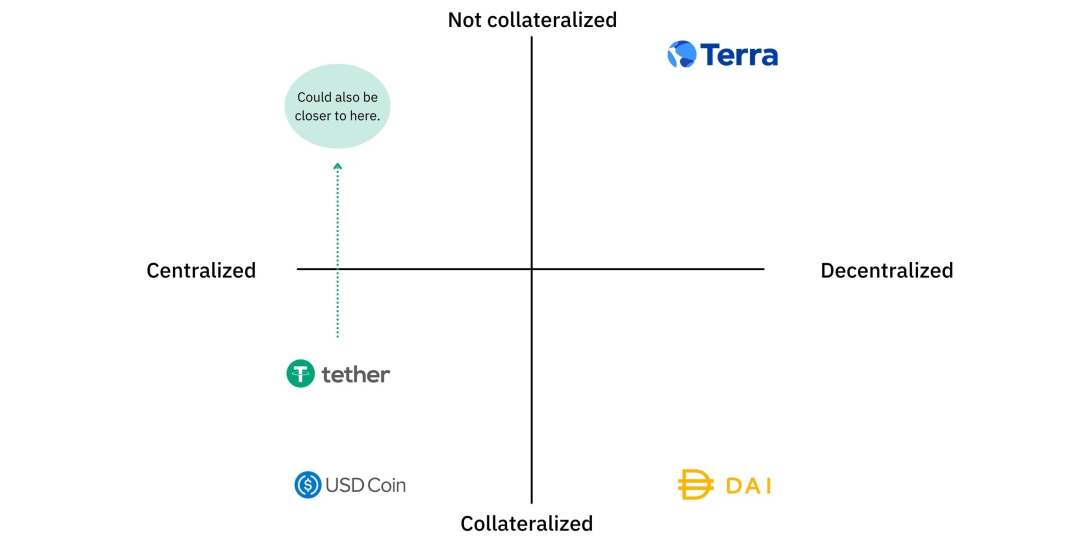

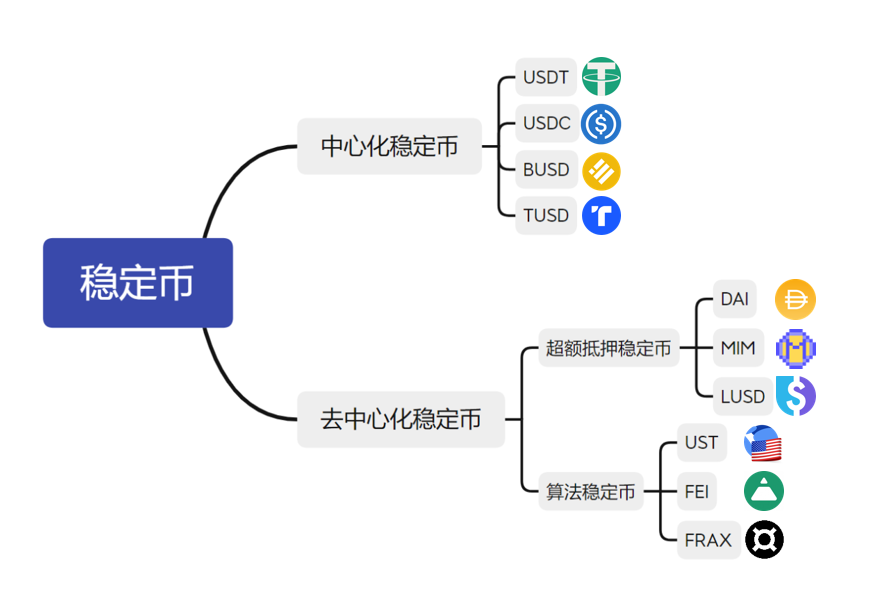

How do stablecoins keep themselves stable? Different types of stablecoins have different value mechanisms, but in general, they can be quickly classified by whether they are decentralized or not, and the type of asset collateral. It should be emphasized that this is not a simple binary classification.According to different issuers, stablecoins can be divided into centralized stablecoins and decentralized stablecoins. USDT, USDC, etc. are representatives of centralized stablecoins, which are issued and operated by two centralized institutions, Tether and Circle. The foundation behind centralized stablecoins is still fiat currency. Stablecoins issued by decentralized entities (such as DAI issued by MakerDAO) or in some way (algorithm mechanism) areDecentralized stable currency。

Decentralized stable currencyMortgage mechanism VS algorithm mechanism:

Divided according to the casting and value anchoring mechanism of the stable currency. DAI, UST, etc. are basically minted by over-collateralization of encrypted assets to avoid being affected by fluctuations in the value of cryptocurrencies, while some stablecoins are completely controlled by codes. Higher, but also more risky.

Tether :Some of the current mainstream stablecoins are:

USDC:That is Tether, also known as USDT, is currently the largest stable currency, with a market value of 76 billion US dollars and a daily trading volume of nearly 70 billion US dollars, that is, the corresponding volume of legal currency is used in the Crypto field in the form of USDT tokens . USDT is directly linked to the U.S. dollar, and its issuance model is that the user remits a certain amount of U.S. dollars to the bank account of Tether Company. After Tether Company confirms receipt of the corresponding funds, it will transfer USDT equivalent to the amount of U.S. dollars to the user. The price change of USDT mainly depends on the degree of credit recognition of the issuing company, the depository bank and the US dollar by the stablecoin holders. Tether's transparency and compliance issues are problems that it cannot get rid of as a centralized institution.

USDC is a stable currency launched by Circle. The mechanism is similar to USDT. It is managed by a consortium including Coinbase and Bitmain. Like USDT, USDC also claims that it "can be exchanged for US dollars at a 1:1 ratio."DAI is collateralized by on-chain assets and is decentralized。

Classification of mainstream stablecoins Source: footprint

first level title

UST and Luna

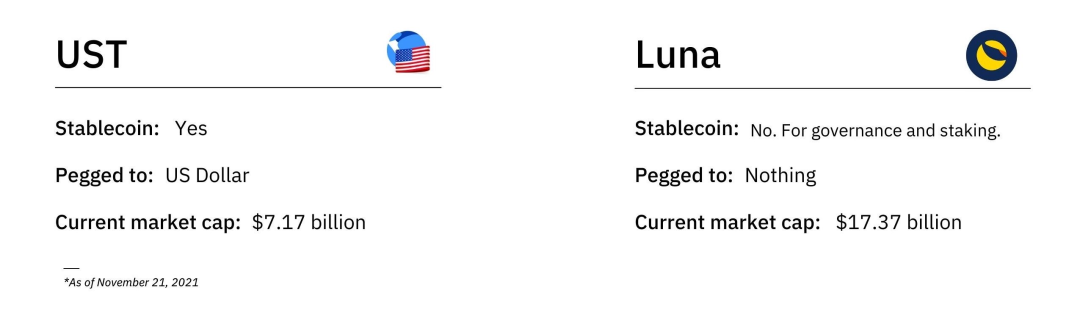

Terra uses a dual-token model: TerraUSD (algorithmic stablecoin, also known as UST) and Luna (governance, pledge token).

Note: Depending on the country/entity where Terra products are used, Terra’s stable currency is actually linked to a series of national legal currencies. For example, TerraUSD (UST) is pegged to the US dollar, and TerraKRW (KRT) is pegged to the Korean won, which is pegged to the Mongolian national grid. Rick's stable currency MNT, and the stable currency SDT anchored to the Special Drawing Rights SDR of the World Monetary Fund. Different stablecoins basically operate in the same way. For the convenience of discussion, we temporarily use UST as a representative of Terra stablecoin for discussion.Unlike Tether, USDC or Dai, UST is not collateralized by legal tender or specific assets on the chain. As a representative of algorithmic stablecoins, UST's value stabilization mechanism is linked to Luna:For every UST minted, one dollar worth of Luna must be burned

, Luna's arbitrage mechanism guarantees the peg between UST and the US dollar.

As a stablecoin, the price of UST remains stable at $1, but there is no difference between Luna and other volatile coins, and the price fluctuates greatly.

In addition to different degrees of volatility, as a governance and pledge token, Luna holders can participate in the governance and decision-making of the Terra public chain. If they put their Luna tokens on the Terra Station (essentially a Platform entrance) mortgage, they can also earn a certain percentage of fees through governance behaviors.

Here is a concrete case:

When a consumer purchases a $100 sweater through credit card payment on the website of Seoul clothing company Great Fox, with the help of the payment ecological product launched by Terra, Great Fox only needs 6 seconds to complete the transaction settlement and funds into the account , it may take 5-14 days to transfer in the traditional banking system. The whole process will not have any impact on the consumer's purchase experience, and for enterprises, Terra's transaction fee rate is only 0.5% (traditional methods require 2% to 3%), and this 0.5% or $0.50 will The miners who were given to participate in the transaction verification were qualified to participate in governance because they mortgaged their Luna to Terra Station. Obviously, the rewards after governance encouraged governance participation to a large extent.

This function endows Luna with great value, and it becomes an asset that can bring continuous income to holders, and thus solves the problem of "low participation in governance", which is a problem faced by many projects.

At the same time, Luna also plays an important role in stabilizing UST.

The exchange relationship between UST linked to the US dollar and Luna is: every 1 UST can be exchanged for Luna equivalent to 1 US dollar. Arbitrageurs can take advantage of this ratio dislocation to obtain benefits, and the price of UST will therefore remain stable in the long run.

In the exchange of UST and Luna, there is also a premise that creating UST requires or destroys certain Luna tokens.

When the price of UST rises above the peg, that is, 1 UST > 1 US dollar, arbitrageurs can send Luna equivalent to 1 US dollar to the system in exchange for one UST. As the market supply of UST increases, the price of UST begins to fall, while the price of Luna increases due to the decrease in supply;

When UST falls below 1 US dollar, that is, 1 UST < 1 US dollar, the same thing will happen in reverse, and arbitrageurs can choose to exchange 1 UST for Luna worth 1 US dollar, that is, more Lunas are exchanged for equivalent US dollars;

Immediately afterwards, because the supply of UST decreased, the price increased, while the price of Luna decreased again, and finally 1 UST = $1 again.

Terra's stability mechanism also includes "seigniorage". Whenever Luna is burned to create UST, the system will collect this fee, and this part of the proceeds will eventually be paid to the miners who staked Luna on Terra Station. Kwon explained in detail in a recent tweet that "the exchange fee for burning Luna to obtain Terra will be paid to stakers who have staked Luna for more than 2 years", an operation that compensates stakers for the cost of Terra fluctuations.

It's a very elegant system, even if it takes a while to understand. Because UST is not collateralized, it can be expanded infinitely. Compared with the collateral mechanism, Terra's stablecoin system does not need to accumulate a treasury the size of a Scrooge McDuck to serve a large population. It is also decentralized.

secondary title

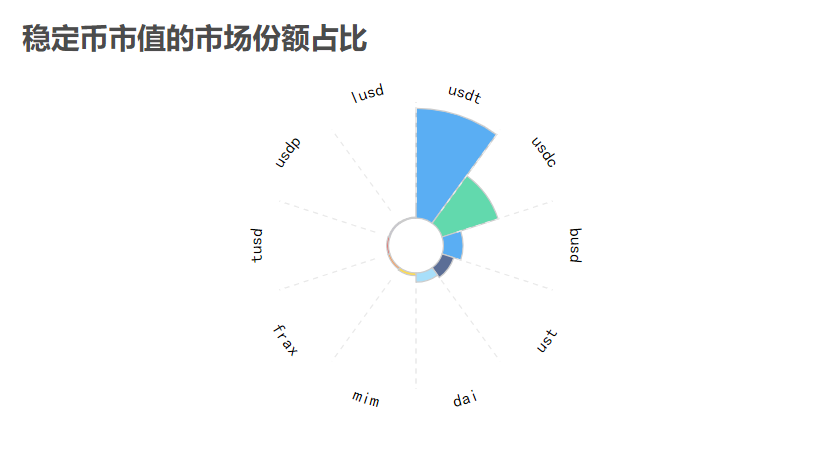

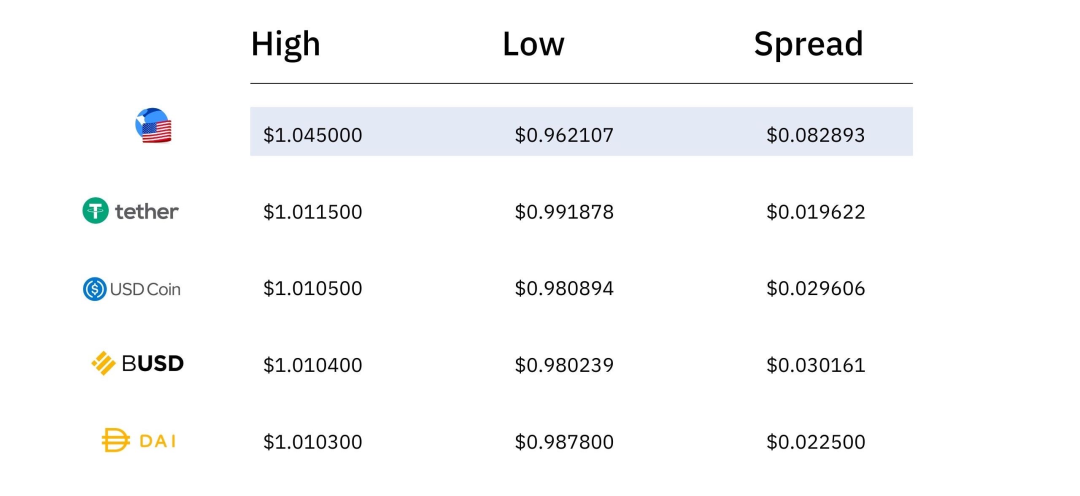

Terra's stablecoin is undoubtedly successful in terms of its widespread use. The latest market value of UST is 8.542 billion US dollars. It is currently the fourth largest stable currency in the world. Its market value ranks after USDT, USDC, and the token BUSD launched by Binance. If the scope is narrowed down to "decentralized stablecoins", UST has recently overtaken DAI to take the number one spot.

image description

Market share of stablecoin market capitalization source: CoinMarketCap

But it needs to be admitted that, as an algorithmic stablecoin, Terra's UST still shows greater volatility than other stablecoins.Terra's stablecoin system is supported by LUNA. When the price of LUNA fluctuates sharply, the stablecoin is very likely to be unanchored. This is also a common doubt about the Terra system in the market.

Data from CoinGecko and CoinMarketCap

secondary title

How Terra's Stablecoins Are Widely Adopted

Stablecoins are just one of Terra's answers to the question of "how to better solve payment". In order to truly realize the vision of "Alipay Ecosystem in the Blockchain World", Terra's team needs to create more usage scenarios for UST.

For the new currency to become a viable payment method, stability is necessary, but it is not enough, because "money only has value when it is spent", which means that external participation is also needed to achieve the whole market. Consensus on the value of the currency.

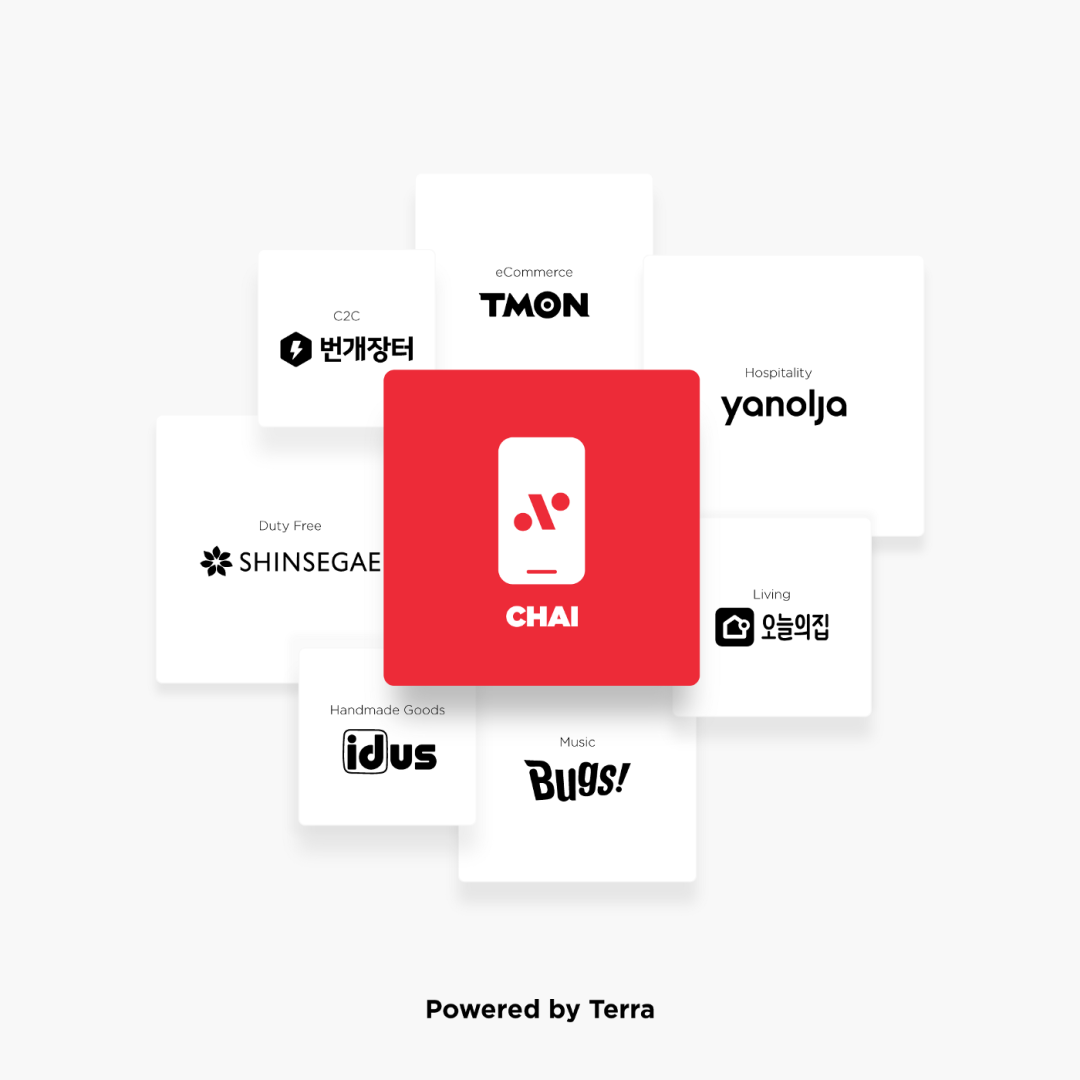

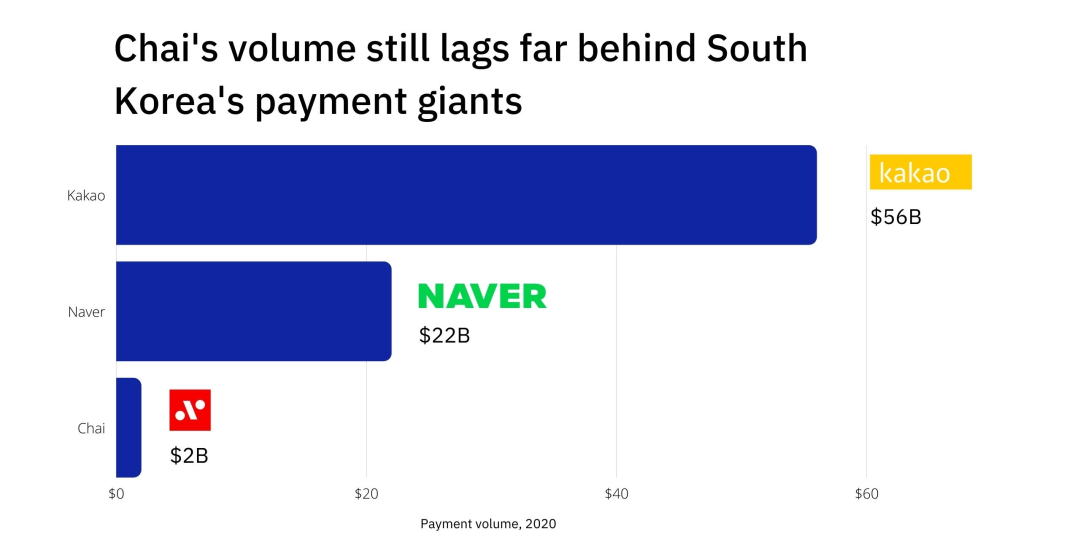

CHAI is the first and best application template.

As a separate entity from Terra, CHAI is run and managed by e-commerce-savvy Daniel Shin as CEO. In December 2020, CHAI received US$60 million in financing. In addition to the US$15 million A round of financing in February, CHAI has received a total of US$75 million in financing, with major investors including Softbank and HOF.

Although the bottom layer of CHAI is blockchain technology, it solves payment problems in the real world, and it is also aimed at ordinary enterprises and users, and users of CHAI do not need to have any knowledge and understanding of blockchain.

Daniel Shin said in an interview with the media that CHAI’s API helps companies integrate as many as 20 payment options, one-stop access to local payment gateways, digital wallets, wire transfers, carrier billing, PayPal, and debit cards and Payment channels such as credit cards save a lot of time and network engineering costs for enterprises. At the same time, CHAI's handling fee rate is about 0.5%, which is far lower than the 2-3% transaction fees charged by other credit institutions in Korea. Fast settlement process is also one of the advantages.

At present, more than 2,000 enterprises have used CHAI, and Nike Korea Branch and Philips are all CHAI customers. On compliance issues, CHAI has a fiat currency payment gateway regulated by the Korean government and can connect to about 15 large banks.For C-end customers, CHAI also provides digital wallet and debit card services,

For users, using CHAI App or CHAI debit card to spend in cooperative merchants is no different from other bank cards, and they can also get discounts or points cash back. At present, CHAI Pay has accumulated more than 2.5 million users.CHAI embodies Terra's core philosophy well:Abstract complexity into simplicity.

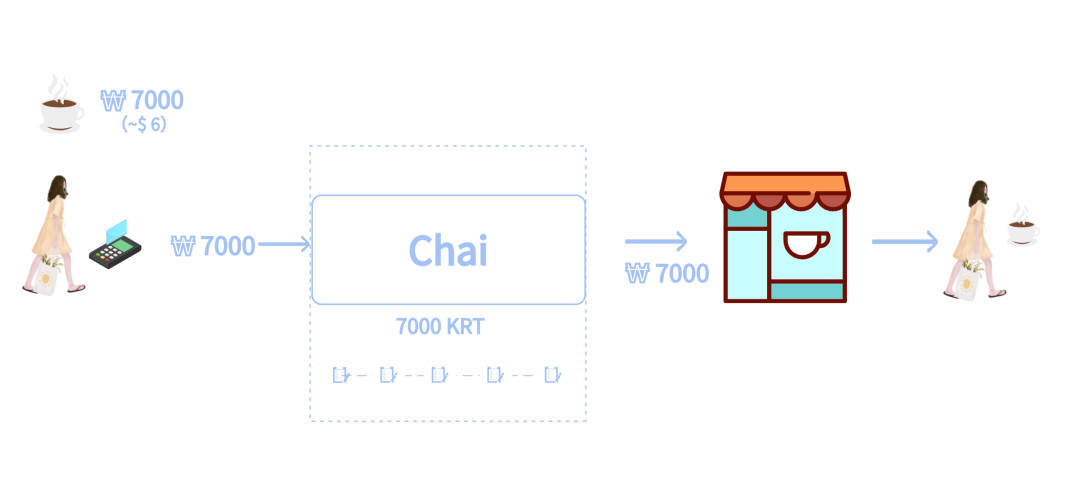

CHAI first accepts payment in any legal currency at the front end, and converts it into a stable currency in Terra's own system such as UST in the background, and then transfers it to the enterprise account in the form of local legal currency.

The following figure is a very direct case:

A consumer in Seoul who pays ₩7,000 for a cup of coffee chooses to pay via CHAI, and the won payment that flows out of her bank account becomes 7,000 KRT (Terra’s won-pegged stablecoin) within CHAI’s processing system. ), through the blockchain, KRT is finally seamlessly transferred to merchants in the form of Korean won. Neither the consumer nor the merchant needs to know that the payment is briefly turned into a stablecoin. At the same time, Luna worth ₩7,000 is destroyed, the market supply of Luna decreases, and the assets held by Lunatics become more valuable.

And here's what's amazing about CHAI: It allows ordinary people to already interact with the Web3 economy without even knowing it.Most of the target users of the public chain are crypto aborigines or people interested in crypto-industrial investment. Terra introduces ordinary users outside the crypto world into its own system. During the whole process, they do not need to have any experience with blockchain or crypto. touch,

For most CHAI users, there is no difference between CHAI and Kakao Pay or Naver Pay, but it is indeed more convenient to use.

first level title

03

first level title

Terraform Labs: Seeding the Ecosystem

Although there are many types of currencies, Terra is not just a minting or lending agreement. Around its underlying currency system, Terra is building and introducing a larger financial service system. Therefore, Terra is evolving towards a public chain ecosystem focusing on DeFi. Among them, Terraform Labs played a very important role.

Terraform Labs, the parent company of Terra's UST and CHAI products, has played a critical role in Terra's success. It not only provides financial support, but for the prosperity of the entire Terra ecology, Terraform Labs also actively builds the required solutions. The aforementioned payment system CHAI is a good example, and there are many others. The company has also raised multiple rounds of funding since 2018. Earlier this year, Terraform raised $25 million from Galaxy Digital and others.

It should be pointed out that the logic of Terra's ecosystem building is different from that of most public chains.

The reason why Terra's stablecoin can achieve a cold start and squeeze into the front row of competitive stablecoins in such a short period of time is largely related to its ecological support, which provides sufficient support for UST's cold start and rapid development. source of demand. In addition to CHAI and memeChat, there are many similar cases.

Terra Station

Terra Station is Terra's official digital wallet. Users can convert their LUNA into Terra stablecoins such as UST through Station. In addition, Terra Station is also the entrance for LUNA holders to participate in on-chain governance. In essence, Terra Station is indeed like its name, a site linking individual users and the entire Terra ecosystem.

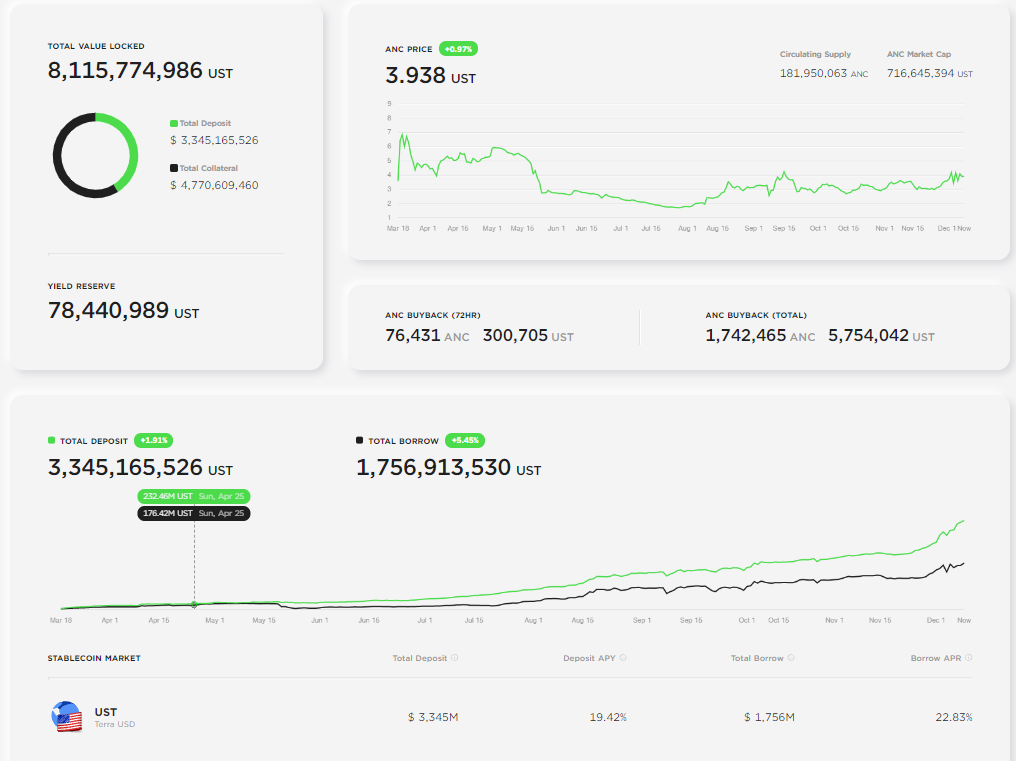

Anchor

secondary title

Anchor will be launched in March 2021. Its biggest highlight is to provide a stable annualized savings rate of about 20%. Perhaps a 20% rate of return is generally attractive to crypto users who have experienced the DeFi mining boom, but for users in the traditional financial world, 20% is quite attractive, so Anchor attracts a large number of users and funds for Terra .

As of now, the total value locked (TVL) of Anchor has reached 6.64 billion US dollars, ranking the 10th DeFi in the world.

In order to generate income, Anchor will lend deposits, but it only accepts assets with native pledge income as borrowing collateral, such as Terra’s core token Luna, and recently supported stETH (by cooperating with pledge service provider Lido), Therefore, Anchor can obtain additional pledge income from mortgage tokens, which is used to subsidize depositors. Equivalent to the actual income of the system, in addition to the borrowing rate, it also includes the pledge income of the pledged tokens.

In addition to being an independent product, Anchor also provides an open source SDK to support the product integration of other encryption projects. For example, a new encryption wallet developer can implement the function of allowing its users to obtain a 20% savings return by adding Anchor's SDK to the product Serve.

Anchor

image description

Pylon is a DeFi product in the Terra ecosystem. It is also incubated by Terraform Labds. The bottom layer of Pylon's business is also based on Anchor. All UST deposits from Pylon will be automatically deposited into Anchor to earn fixed income (~20%). Pylon can use This income is used to link to more service providers or entrepreneurs.

Like CHAI and memeChat, Terraform Labs is still preparing Anchor-like products for different countries and regions, including Tiiik, a savings application that also targets at a 20% savings rate (priority is open to users in Australia), targeting consumer-grade applications. Interest product Saturn Money (support deposits in GBP and EUR).

Mirror

secondary titleMirror is the Robinhood of the Terra world.

Users on the Terra chain can realize US stock index transactions through the Mirror Protocol. Mirror Protocol uses the Terra stablecoin UST as the main collateral to mint synthetic asset tokens, which serve as mirror images of various stocks, ETFs and other financial assets. Any investment demand based on synthetic assets such as US stocks in Mirror will eventually be transmitted back to UST, providing value for Luna and UST.

Compared with traditional exchanges, Mirror has several obvious advantages: it is open 24*7 and has no national borders, which means that theoretically any equity can be used, splits are simpler, and transactions are faster. After Mirror was launched this year, a large number of users flooded in rapidly, with an average daily registered account reaching 2,000.

Mirror's challenge to the regulatory authority is also very direct, and Do Kwons and Terraform Labs have been sued by the US SEC for this reason. Individual defendants Do Kwon and Terraform Labs subsequently countersued the SEC, suing the Commission for violating SEC rules and the defendants' individual rights under the US Constitution.

Prism

secondary title

Prism's idea of asset splitting brings new forms of market liquidity. For example, a person in need of liquidity can sell their assets or future proceeds from yLuna. Likewise, someone could decide they want a yield-generating asset with no potential liquidation risk, and buy pLuna. Essentially, Prism creates instruments for interest rate swaps.

Ozone

secondary title

Ozone Protocol is a decentralized insurance protocol for the Terra ecosystem.

According to the setting, Ozone provides protection in the event of technical failure in the Terra DeFi ecosystem, covering multiple risks in the Terra ecosystem. More bluntly, if for some reason an error occurs, causing users to lose access to their Luna or UST , then Ozone will compensate for the potential loss. Ozone is currently being audited by auditing companies Oak Security and Certik, and is preparing for its official launch.

The existence of Ozone makes it possible for Terra's ecology to be further enriched. Based on the Ozone protocol, even if any accident occurs, the user's assets can still be protected. The risk of them trying new Terra dApps is almost eliminated, and the natural participation rate will also increase. For developers, the existence of Ozone allows their products to be faster. achieve a cold start.

One of Ozone's first big clients was Michael Arrington, an early investor in Terra. Arrington Anchor Fund first deposits institutional capital into Anchor Protocol, and the withholding is guaranteed by Ozone. Under Terra's income mechanism, the income equivalent to LP has increased by another 20%.

first level title

04

first level title

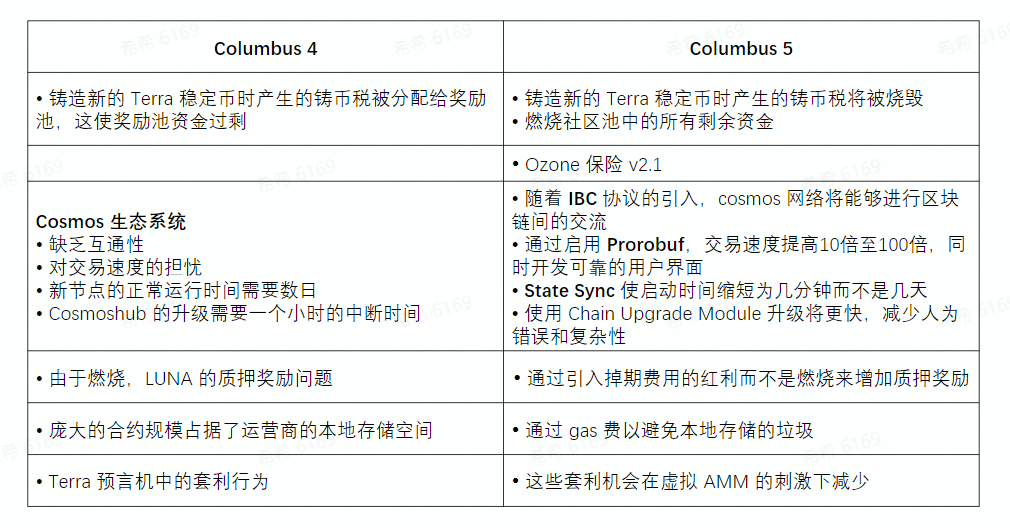

The Prosperity of Terra Ecology

In September, Terra announced the completion of the "Columbus-5" upgrade. This is an upgrade to Terra's core system, which facilitates the transfer of assets on the IBC chain. In addition, this upgrade also includes improvements to other core attributes, namely: burning all seigniorage; upgrading to Stargate; integrating Ozone (Terra ecological insurance protocol) and Wormhole. Among them, Terra's inter-blockchain communication (IBC) integration is expected to increase the adoption of its stablecoin TerraUSD (UST) throughout the Cosmos ecosystem.

image description

Comparison of Columbus-4 and 5

In addition to these technical upgrades, like most public chains, Terra is also actively injecting vitality into its ecosystem through capital.In July 2021, Terra announced the launch of$150 million eco-fund

Here are some notable projects:

Mars

secondary title

Mars Protocol is a financial service product on the Terra chain, and more specifically, Mars will operate as a "cross-chain lending platform". Under the management of the "Martian Council", Mars provides borrowers with collateralized and non-secured assets while providing lenders with new ways to earn interest on mortgage funds. One of the main innovations of the Mars team is that its yield will react to the situation.

Mars’ longer-term plan for itself is to become a fully functional decentralized bank.

Astroport

secondary title

Astroport is a decentralized exchange on the Terra chain, similar to Sushi or Uniswap in the Terra ecosystem. As the Terra ecosystem grows, so does the need for the popular "Automated Market Maker" (AMM). Astroport will not only bring new features to the Terra ecosystem, but will also increase demand for stablecoins like UST.

“Astroport is definitely the most interesting project I know of so far. You can think of Astroport as a hybrid of Uniswap and Curve. It will offer typical AMM pools as well as stable swap pools and hopefully pool liquidity in the future. What makes Astroport really interested in Terra is that the main trading pair will be based on UST. This means that most of Astroport's funds will increase the supply of UST and burn Luna. In order for Terra dapps to really take off, you need a DEX, so I think this It will be one of Terra's cornerstones and an important moment in its history."

Levana

secondary title

Essentially, Levana brings 2x leverage to Terra by using Mars. For example, users can not only buy Luna, but also 2x Luna, which generates double returns if the token value increases. Afterwards, Levana intends to leverage various assets including index tokens. Like Mars and Astroport, it was incubated by Delphi Digital. Additionally, Levana is allocating 50% of its tokens to the community and foundation, hoping to operate as a true DAO.

secondary title

digital bank

Terra has consciously built products that can be widely adopted from the beginning, in addition to the aforementioned CHAI and its partnership with MemeChat, there are many more products to achieve the expansion of UST and other Terra stablecoins in the real world target of the scope of use. Digital banking is also one of them.

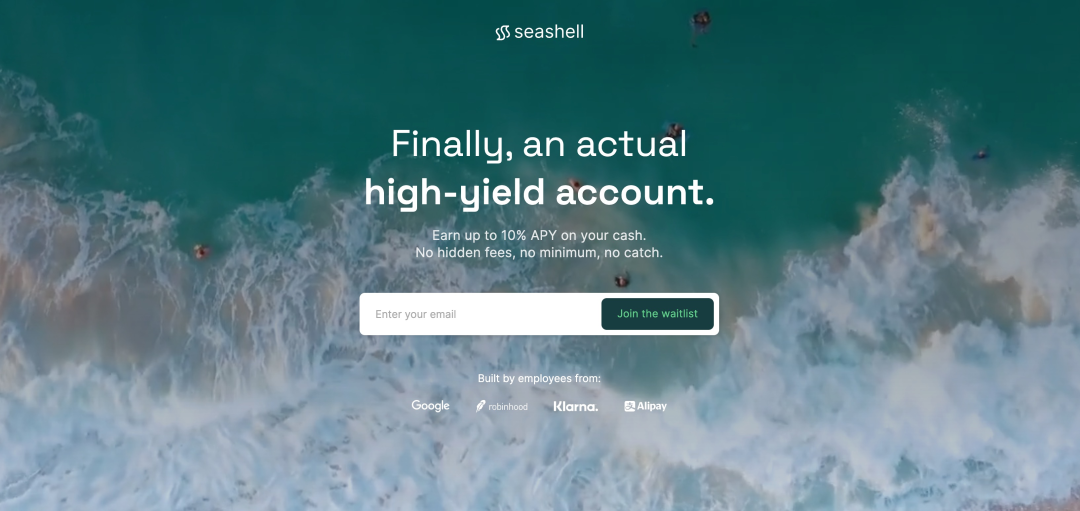

A similar strategy is being pursued by Seashell, which claims to offer 10% APR and also leverages Anchor yields.

Seashell

image descriptionTerra officially supports these ecosystems. Terra team member 0xwagmi once said:

Kado is another company contributing to the Terra ecosystem. Kado is not a digital bank, but instead focuses on improving the payment experience and making it easy to use stablecoins on the internet. According to the information provided by Kado's official website, the team is still developing a savings product.

secondary title

Games and NFTs

0xwagmi further predicts: "Terra sees games as a very early field in the ecosystem. Gamers will get stablecoins like UST, and we expect DAOs and game guilds to become very large in the ecosystem." The game field has caused a sensation and has the opportunity to enter the NFT field.

Hashed was one of Terra's earliest investors, and the company's creative studio, UNOPND, is reportedly developing five different games for the Terra ecosystem, some of which are "Play to Earn" models. In addition to Hashed, other game publishers also plan to join the Terra ecosystem. Not long ago, Do Kwon announced on his Twitter that Gameville will be bringing games like Summoner's Wae to Terra.

Random Earth is the OpenSea of the Terra ecology. Its founder Stargazer mentioned that the reason they chose to build on Terra is: "Terra has a very high TVL in DeFi. After we tried various protocols as end users, we found that Terra is a It is a very attractive ecosystem, and there are many blue oceans to be developed."

secondary title

other

other

White Whale。Additionally, there are many other interesting projects on Terra:

Angel Protocol。White Whale provides users with a method of automatic arbitrage in UST, in addition, it provides a series of other automatic trading strategies, which are very simple and easy to use for users. Therefore, White Whale may also bring more participants into Terra's ecosystem like CHAI."

Nexus。Using the benefits of Anchor, Angel allows charities to easily set up high-return endowment funds, and the donated funds obtained can also continue to generate income indefinitely for the operation of the foundation.

Nebula。By combining Mirror and Anchor, Nexus hopes to practice a DeFi strategy with higher returns. More critically, Nexus aims to eliminate the risk of principal being liquidated in most investments.

Sigma。Nebula is an ETF product on Terra that allows users to purchase a portfolio representing a specific theme.

Orion Money。Using leveraged order book technology created by Random Earth, Sigma brings options trading to Terra.

Suberra。With Orion, users can earn 20% APR on any stablecoin. This means you can deposit Tether, USDC or UST into the platform and get the same return. With Ozone's insurance agreement, Orion can also protect the user's principal investment.

Valkyrie。For businesses to accept recurring payments in stablecoins, for example, through Suberra, The Generalist can accept annual subscription payments in UST.

first level title

05

first level title

The above content is a series of introductions to Terra as a product and platform. The particularity of Terra lies in how to understand what Terra is doing and the deep concept behind it? Here are some different perspectives:

secondary title

The Lego of Finance

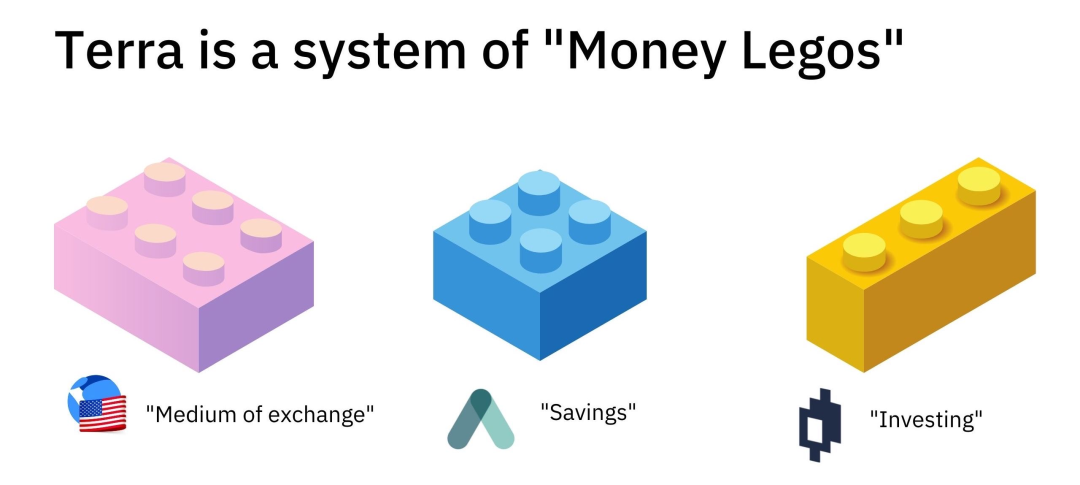

The first understanding of Terra is "the Lego of finance".

Terra first created a composable financial infrastructure: UST stablecoin is the "medium of exchange" module, Anchor is the "saving income" module, Mirror is the "comprehensive investment" module, Prism is the "interest rate derivatives" module, Ozone is the " Insurance" module. On the basis of the above modules, other developers can continuously create new scene applications.

By embedding these underlying elements in the ecosystem, Terra creates the premise to make it easier for others to build products.

secondary title

Y Combinator in the Web3 Era

Terra will also be considered by some to be the YC of crypto.YC is no stranger to everyone. This famous incubator has cultivated some of the most influential companies in the past fifteen years and has played a role that cannot be ignored in the development of the Internet entrepreneurial ecology.

But only financial support is not enough, because YC's help to early entrepreneurial teams is all-round, so only when Terra can provide more in-depth support, it can be called YC of Web3. When asked what he hoped Terra would look like in 1, 5, or 10 years, Terra team member 0xwagmi said: "The most important thing is that we can see a group of outstanding founders emerging from this ecosystem." people (like YC, which started out as just Paul Graham and now has hundreds of founders supporting YC and the YC ecosystem). Terra is just getting started.”

secondary title

"Top-down" evolution

Compared with other public chains, Terra is also special in that, as a decentralized practitioner, Terra also has its "top-down" side, which can be reflected from a series of dapps led by Terraform Labs, and the official discussion The language models of its monetary mechanism, market model and fiscal methods are also actively learning from the central bank. In many cases, Terra encourages ecological progress in ways it deems most beneficial, with purposes similar to those of a central bank.

Do Kwon himself often mentioned the case of Singapore. He pointed out that Singapore is located in the tropics, with a hot climate and inconvenient transportation. Friendly laws, reasonable tax structure, etc.first level title

06

Terra Risks and Challenges

secondary title

Are Algorithmic Stablecoins Really "Stable"?

Terra is also at risk of failure.

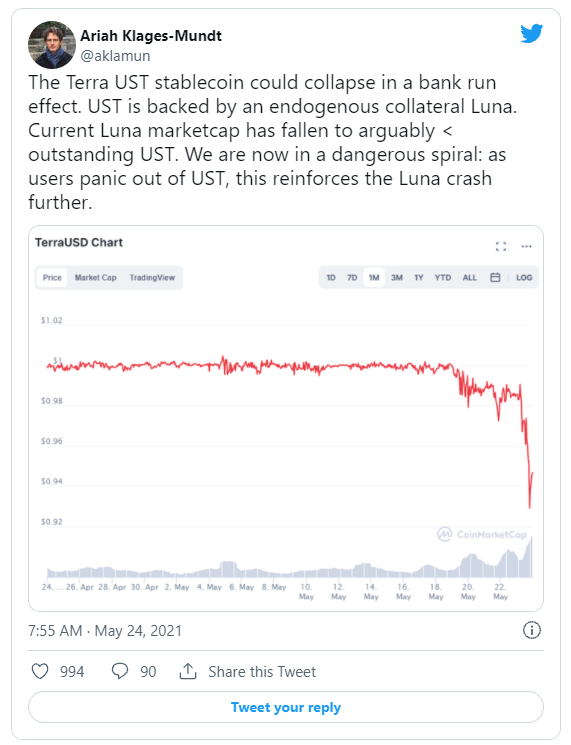

In late May of this year, the cryptocurrency field experienced a major shock. On May 19th, Bitcoin fell by 30%, and the entire market fell along with it. Over the next few days, Luna's price dropped to $4.10, down 75% from where it was trading a week ago.

As investors lost confidence in Luna, the market demand for UST also began to fall. Under Terra's currency mechanism, the price of UST fell below its pegged $1, and UST holders exchanged their UST for Luna. As a result, when the market demand for Luna dries up, the supply of Luna increases again, and the inflation of Luna makes its price fall further, exacerbating the vicious circle.This risk, commonly referred to as

The “death spiral” is a common risk of algorithmic stablecoins.

Since there are no other assets as endorsements, but secondary tokens as implicit guarantees, for example, the issuance of UST is not premised on Luna being mortgaged, and the latter is an important part of the former's price anchoring mechanism (and vice versa) Once the market's confidence in the "pseudo-reserve token" disappears, the bank run effect will follow.

In June of this year, a project called Titan encountered a "death spiral." Like Terra, Titan also operates using an algorithmic two-token system. Token Iron is a stablecoin backed by 75% USDC and 25% Titan's own governance token.

When the price of Titan started to drop, so did the price of Iron. Iron holders then discovered an arbitrage opportunity, trading $0.90 worth of tokens for $0.75 worth of USDC for $0.25 worth of Titan, but the process caused more Titan to be created and flowed into the market, causing severe Inflation, the value of Titan eventually fell to almost $0, and the project failed.

Although they are both algorithmic stablecoins, it is not fair to compare Titan with Terra. The elite founding team and the active community behind them make Terra have stronger vitality and stability. More importantly, Terra has successfully built Products used by millions.

The above allowed Terra to successfully pass the panic in May, UST returned to the original fiat currency anchor level, and Luna also stopped falling, which shows that Terra's system has withstood the test.

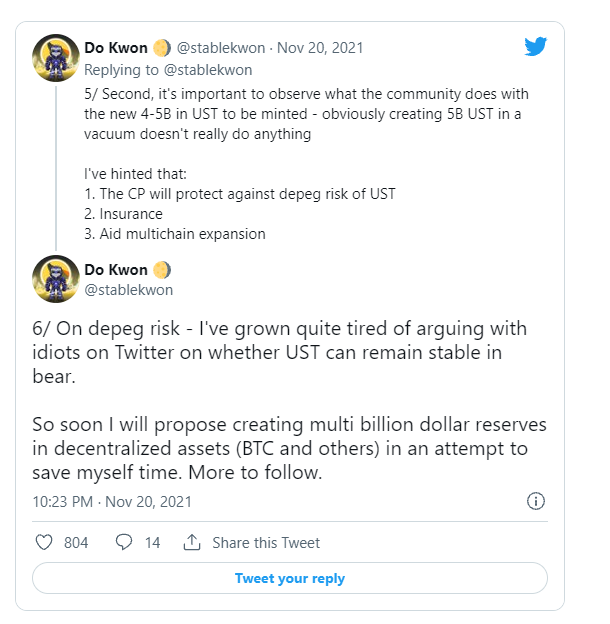

For Kwon, the biggest protection of UST is the demand it was built on. Thanks to CHAI, memeChat, Anchor, Mirror, and many other products that use it, UST has a steady and fast-growing user base. Even if Luna drops, demand for UST won't disappear.

Delphi Digital's CTO Luke Saunders summed up this for Terra's stablecoin matrix, "The utility built around UST has a huge stabilizing effect that other stablecoins lack."

But many may feel that risk seems to have been priced into Terra. After all, if it were completely secure, Luna could be worth orders of magnitude more than it is currently.

secondary title

Throughput that can lag

Terra is built using Cosmos' proof-of-stake mechanism called Tendermint, which allows 10,000 transactions per second. Kwon has previously said that Terra currently handles up to 1,000 transactions per second. Although Terra is unlikely to reach the 10,000 cap in the short term, considering Terra's aggressive and expanding scope of usage and the increasing number of projects in the ecosystem, throughput may become an obstacle to its next development.In response, Terra is investing in improvements and upgrades, and has launched "Project Dawn"(a new funding scheme for critical infrastructure and core technology improvements)

0xwagmi noted: “Terra is investing heavily in scaling the Terra chain and infrastructure to support massive scale and usage, and this will take time.”

secondary title

Too low-key team and productTerra doesn't seem to be getting the attention it deserves.

After all, in terms of market value, Terra is the 13th largest encryption project in the world, surpassing other more well-known products such as Uniswap, Axie Infinity, Stellar, Aave, Filecoin, Helium, Sushi, etc., and Terra has a real landing scene, a very attractive Leaders and their own ecology.

first level title

07

first level title

While many of the things that make Terra great and unique have been discussed before, there are a few more things I'd like to add here. Perhaps the most important reason for this is Do Kwon himself.

secondary title

Do Kwon's charisma

Do Kwon is a gifted leader who inspires Terra's contributors and articulates the project vision in a powerful way. But this ability has its price - Kwon seems to be a high-strung person with strict standards for everything.

0xwagmi said: "Do Kwon has a natural and absolute power. I have not seen anyone like him. In many ways, I regard him as the Steve Jobs in the encryption world. He has raised a lot of incredible questions for the team. requirements."

Do's military experience also influenced his management style. 0xwagmi said: "Do's leadership style is very strong, he is very product-focused, and deep down in his heart, he firmly believes that he is a developer, which can be seen in his participation in daily product discussions."

It’s worth noting that Kwon’s plunge into the crypto world isn’t just driven by money, saying: “We’re not going to embark on a journey to become a billionaire.”

secondary title

strong community cohesion

Many people cite Terra's community as one of its main strengths. Stargazer, the founder of the Terra ecological project Random Earth, commented on this: "Terra has a very active community. Compared with other ecosystems, Terra's cohesion is very strong, and I think this community attraction will be its success. The essential."

And Kwon himself plays a very important role in community cohesion. Stargazer also highlighted this point: "I believe most of the cohesion comes from Do Kwon himself. He is an open, warm, caring and charismatic leader, and Do Kwons sets the tone for the strong atmosphere in the Terra ecosystem".

Part of what makes the community strong is that it has genuine trust from the developers.

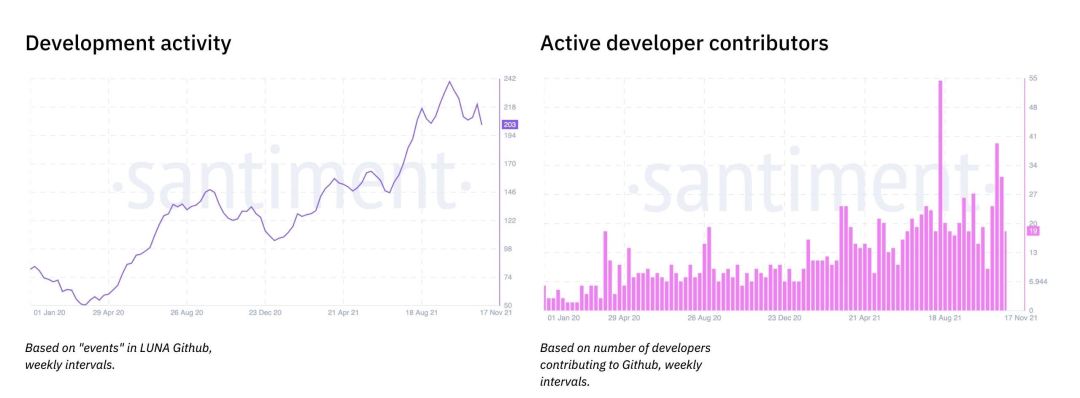

Earlier this year, Terra announced "Project Surge," an initiative to grow the ecosystem. Specifically, Surge incentivizes community members to spread Terra to different chains. This program encourages members to join various DeFi projects and protocols and decide whether Terra will participate or not. Terra is motivating community members to participate in Terra's development in various ways.In the past year,image description

Santiment

secondary title

Building for the multi-chain future

Even though Terra operates its own Layer 1 infrastructure, these projects can thrive even if other chains replace it. In fact, Terra is also in many ways built for the possibility of multiple chains in the future. Its most important product is not its core infrastructure, but its stablecoin. Getting UST widely adopted is a top priority for Terra, and the team is actively working on enabling more chains to support the Terra stablecoin.

Terra’s team member 0xwagmi explained: “We are a Layer 1 that supports native experience, and any protocol/project on any chain can use UST. In the long run, we hope that most UST can be bridged to other chains and platforms; We lean towards a multi-chain future in many ways. Just like the team will have Android and iOS teams, we hope that the team will build cross-platform in the future.”