An article comparing zkSync and Starkware, the two-layer solution of Ethereum

Compilation of the original text: The Way of the Metaverse

Compilation of the original text: The Way of the Metaverse

Recently, @dareal_sisyphe published a comparison article on Ethereum’s second-layer solution zkSync and Starkware, analyzing it from six perspectives: team, technology, data availability, funding and supporters, current product and roadmap, and personal impression. The following is a compilation of all content.

To say that ZK rollups will be huge would be an understatement.

There are two beasts that have been working on this technology in the background for several years. Their time to shine is coming. So, what opportunities exist in this area? What is the difference between these two projects? When will they issue coins?

The following is a comparison of zksync and StarkWare.

Be forewarned, this is a huge subject that I'm trying to grasp, and I may take some shortcuts, or make some mistakes in my explanations. Feel free to correct me or make more precise suggestions in the comments.

There are already a lot of resources detailing what ZK Rollup is and how it differs from Optimistic Rollup.

Here, I only focus on the basics behind zk rollup and the difference between the two main players in the zk game - zksync and StarkWare.

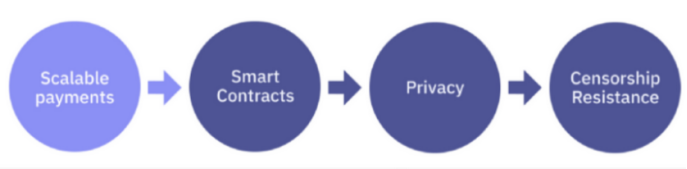

Basics: Ethereum rn is what we call it"single chip microcomputer"Modular"Modular". This means using blockchain only for what it does best: consensus, and moving the burden of execution and data availability (DA) off-chain. But how do we move execution and DA in a way that fully inherits L1 safety?

zk rollups: With zk rollups, thousands of tx are batched into a single, mathematically verifiable zk proof, and only this proof is stored on-chain.

Next, let's compare zksync and StarkWare. We'll try to be clear and follow the angles below for comparison.

data availability

technology

data availability

funding and backers

Current Products and Roadmap

Personal Impressions and Opportunities

team and beginning

StarkWare: Started May 2018. The team consists of world-class cryptographers and scientists. The core staff is the former chief scientist of Zcash, who has been an innovative pioneer in the zk field for many years. They are turning academic theories into real-world products through Starknet. They are undoubtedly the most famous team in this game.

Zksync: Started in December 2019. In fact, in the zk field there is a"second best"technology

technology

Both projects have a similar architecture, with a rollup smart contract plugged into the Eth blockchain to store zk proofs of L2 state transitions. Additionally, they both have 2 off-chain actors responsible for powering the network.

Provers: A small number of nodes that do the heavy lifting. They compute all txs and aggregate them into succinct zk proofs. They run on dedicated hardware and can be black boxes. All we know is that they are mathematically impossible to forge fake ZK proofs.

Validator: A large number of nodes responsible for anti-censorship work. They verify the validity of the proofs submitted by the prover. No specific hardware is required. Everyone can run.

Additionally, both projects must race to overcome a major technical problem, which is to create a general proof-of-ZK system.

This is a holy grail, because until now all ZK lines required specific applications. This means only one ZK rollup per application and no EVM compatibility.

Guess what, zksync and StarkWare both do it, but technically differently.

StarkWare: The encryption technology they use is based on STARKs. They are the pioneers of this technology, which has two main advantages over SNARKs (used by zkSync):

"T"transparent"transparent", which means that the system works without trust settings. They can be produced 10 times faster than SNARKs. But the problem with STARKs is that the technology is not as mature as SNARKs, and if it allows Turing completeness, it will be difficult to make it compatible with the EVM.

Additionally, Starkware created Cairo, a specific programming language that allows running discretionary programs powered by STARKs. But since so few are willing to learn a new programming language to do smart contracts, they are now working with @nethermindeth to create Warp, a transpiler that seamlessly converts solidity smart contracts to Cairo to enable @StarkWare EVM compatible.

zksync: The zk system used is based on SNARKs (especially PLONK). Therefore, the security of the entire system rests on a credible ceremony introduced in the fall of 2019. It involved many well-known cryptocurrency players, including Vitalik Buterin. The system is provably secure if at least one of the participants is honest, so I'm comfortable not thinking"trusted settings"The argument can be used against zksync.

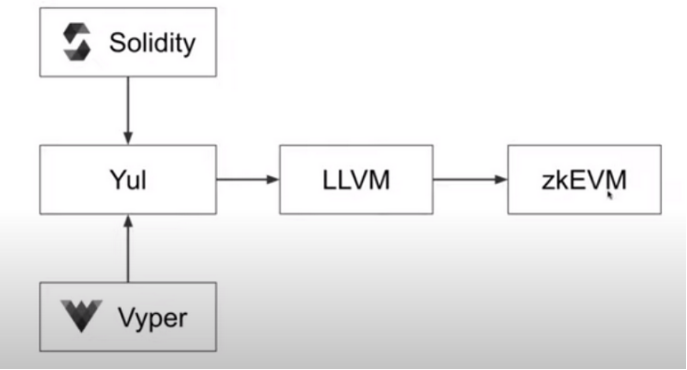

Despite many optimizations by the zkSync team, SNARKs are still slower than STARKs. However, their system allows EVM compatibility in a more natural way than STARKs. The fact that smart contracts can be converted (almost) opcode-by-opcode by the zkSync compiler makes solidity the go-to for zkSync"main citizen"Data Availability (DA)

Data Availability (DA)

zk rollups remove the burden of txs computation from L1 and allow ETH to scale to 2-3K tps. That's good, but not enough. use"rollup only"In this method, the burden of DA is still on L1, and the tx data is written into L1 through calldata.

DA is super important. This is the key that allows you to see what happened to the tx on Etherscan. Without this, the execution of tx becomes a black box. This might be ok if you prefer cheap tx over direct tracing on L1. Therefore, zk rollup must provide a choice to the user. Either your tx data is written on L1, but the fee is a bit higher, or you prioritize super cheap tx and trust some entity on L2 to guarantee the availability of your tx data. In this way, L1 can be freed from the burden of DA, and ZK rollup can be extended to 20-30k TPS.

StarkWare: Solving DA's challenges with the Volition system. Volition allows end users to choose between rollup settlement of tx (on-chain DA) and effective settlement at the level of a single tx (off-chain DA). In the case of effective settlement, off-chain DA is controlled by a centralized"Data Availability Committee"(DAC), a committee made up of prominent cryptocurrency entities.

It sounds like centralization, but it's a trade-off for ultra-cheap TX voluntarily chosen by end users.

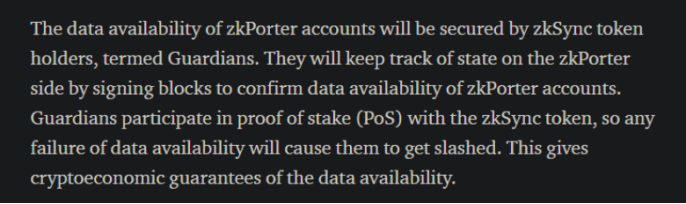

zksync: The solution to the DA challenge is zkPorter, a sharding infrastructure that works seamlessly with zkSync's zk rollup. Imagine that zkSync rollup is shard0 that guarantees DA on the chain. Then other shards can choose different DA policies and store tx data off-chain.

The main difference between StarkWare's Volition and zksync zkPorter is that for Volition the choice of settlement is tx-based (the user selects DA for each tx) and for zkPorter it is account-based (a zkPorter account can only Generate tx with off-chain DA).

In addition, for zkPorter, the off-chain DA system is more decentralized, because DA is incentivized by zkSync native tokens"protector"network rather than centralized"DAC"guaranteed.

funding and backers

StarkWare:

A $6 million seed round (Pantera/Naval/Vitalik) was completed in May 2018.

Completed $30 million in Series A financing (Paradigm/Sequoia/Cb Ventures) in October 2018.

Completed a $75 million Series B round last March (Paradigm/3AC/Alameda)

Completed $50 million in Series C financing (Paradigm/3AC/Alameda) in November last year.

Currently, StarkWare is valued at $2 billion. It was a world-class financing, with prominent investors. The bigwigs and the Ethereum Foundation are in it. Vitalik himself also comments on most of the articles produced by Starkware. Shu and Sam are also in the same boat. How could such a project fail?

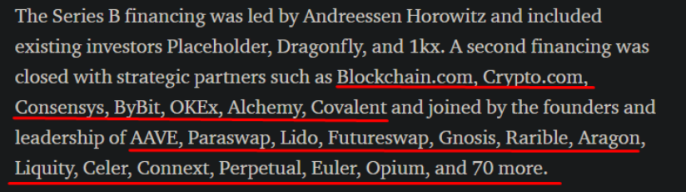

zksync :

Completed US$6 million in Series A financing in March last year

(Binance/Cb Ventures/AAVE/ Balancer/Curve)。

Completed $50 million in Series B financing in November last year

(Horowitz/Placeholder/Crypto.com etc.).

Fewer big names on the board, looks like a big Defi/CEX crypto family fund. This sounds funny, but it actually matters, because the success of ZK rollup will depend heavily on the integration of DeFi protocols and direct CEXs. So I am very bullish on the rapid integration of the zksync ecosystem.

Current Products and Roadmap

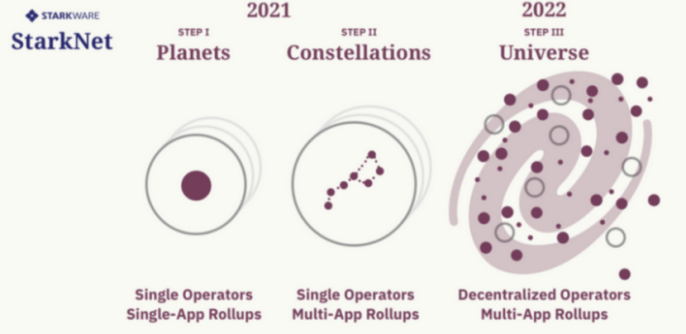

StarkWare has had an incredible evolution as they relentlessly translate their top cryptography papers into real world innovations. Their roadmap is summarized as follows:

planet"planet"stages and allows the creation of permissioned, application-specific zk rollups powered by Cairo and STARKs. If you don't know, think @dydxprotocol, @Immutable or @deversifi. Since they are 3 main applications, they are driven by the production version of StarkEx.

So far, StarkEx has settled more than 5 million txs and $250 billion in value through these applications. The efficiency of StarkEx is now proven, and StarkWare will soon be on the roadmap"constellation"stage. On November 29th, they released the Alpha version of StarkNet on the mainnet. StarkNet is the permissionless, multi-application, general-purpose zk rollup we are looking forward to.

Initially, StarkNet will be powered by a centralized validator, and applications will be deployed sequentially via a whitelist, just like Optimism. Therefore, its plan is to develop the ecosystem, and in the roadmap"universe"The stage will gradually decentralize StarkNet.

The zkSync roadmap is summarized in 4 steps as follows:

The first phase corresponds to zkSync 1.0 launched in June 2020, roughly corresponding to zk rollup, but without smart contract integration, allowing sending and receiving tokens. Despite the lack of composability, promising projects have already deployed on it, and all indicators point to exponential interest in zkSync 1.0.

The second phase will be launched with the mainnet deployment of zkSync 2.0, which corresponds to everything we expect: full EVM compatibility on Zk rollup and composability of smart contracts.

zkSync 2.0 was originally planned to be deployed on mainnet in August, but technical issues delayed the launch. These difficulties are now resolved on the testnet, and in October last year, zksync announced that it was close to completing technical steps and deployed an AMM-like testnet to demonstrate EVM compatibility.

The delay Matter Labs took to ensure LLVM/Solidity compatibility might be frustrating at first, but it will help zksync win a lot of time as it allows all eth tools and dependencies to integrate natively with zkSync 2.0.

Personal Impressions and Opportunities

StarkWare is really impressive. This is the most promising infrastructure project I've seen in a while. All-star teams, world-class innovation, top-tier funding. Remarkably, they are not just building a ZK Rollup. They are thinking about everything. We talked about Cairo and Warp. But they're also working on bringing true randomness to ETH with Veedo, L1s to L2s communication via conditional txs, Batch-Long flash loans and other genius stuff. they use"Distributed AMMs"Approaches to address the mobility fragmentation of AMMs between L1 and L2 are indeed encouraging. They are looking globally.

The only technical issue I'm seeing with StarkWare right now is the Solidity integration via the Warp adapter. Starknet was optimized for Cairo first, and the Solidity transponder was added on top of it. I'm not a strong techie but I'm worried"Solidity translation"It won't be straightforward in every case, and it may cause compatibility issues with some smart contracts.

Also, other questions I see are: Where are the opportunities for us civilians? StarkWare is already worth $2 billion, but there are currently no plans for a fair token launch.

On the other hand, I also like zksync's community-first approach, and its support for"Solidity as a principal citizen"of emphasis. Their entire technical effort rests on a true EVM experience without any tradeoffs, which will likely pay off in terms of adoption. zksync is also deeply integrated with the current Defi/CEX landscape, which bodes well for future protocol onboarding and adoption.

In terms of opportunity, zkSync has announced the existence of a native token and they will have a fair token launch and potential airdrop sometime in the future. This is super great for the community, but I have a feeling the Zk rollups native token will be overstretched since everyone and their team is waiting for it.

I also want StarkWare to be in"universe"phase to launch a native token. Because they're going to have to decentralize their network at some point and incentivize the provers.

All that said, my opinion is that the most impressive execution on zk rollup comes from StarkWare, but the grassroots community/open source vibe makes zksync more appealing to me.

Here are my final personal notes:

In terms of opportunity, perhaps we should shift our focus away from rollups' native tokens and towards emerging projects that will find a user base on these rollups. ETH was a paradigm shift, and projects that attempted to replicate orders on-chain were quickly replaced by AMM models that were better suited to this new environment. Likewise, ZK rollups are a paradigm shift for ETH, and maybe (just maybe), replicating AMMs on rollups is a mentally retarded idea; maybe TVL won't be an important metric on rollups; maybe CLOBs are worth reconsidering.

These are ad-hoc examples, but the idea is that perhaps the best opportunities lie in projects that leverage these rollups to do things that are not possible on L1, rather than duplicating what's already there.

If you've made it this far, congratulations.