An all-round analysis of the competitive landscape of blockchain scalability solutions

Edit: Southwind

Edit: Southwind

By the end of 2021, Ethereum has grown to support thousands of applications in DeFi, NFTs, games, and more. The entire Ethereum network processes trillions of dollars worth of transactions annually, with over $170 billion worth of assets currently locked on the platform.

But Ethereum's decentralized design limits the number of transactions it can handle to 15 transactions per second. The result is long waits and fees of up to $200 per transaction, as Ethereum's popularity far outpaces this throughput. Ultimately, this discourages many users and limits the types of applications the ethereum network is currently capable of handling.

first level title

Competition or complementarity?

The goal of a scalable solution is toIncrease the transaction volume that a publicly accessible smart contract platform can handle while maintaining sufficient decentralization. Something to remember is that it is trivial to scale a smart contract platform with a centralized solution managed by a single entity (Visa can handle 45,000 transactions per second), but this brings us back to square one: a small group of powerful A world controlled by centralized participants.

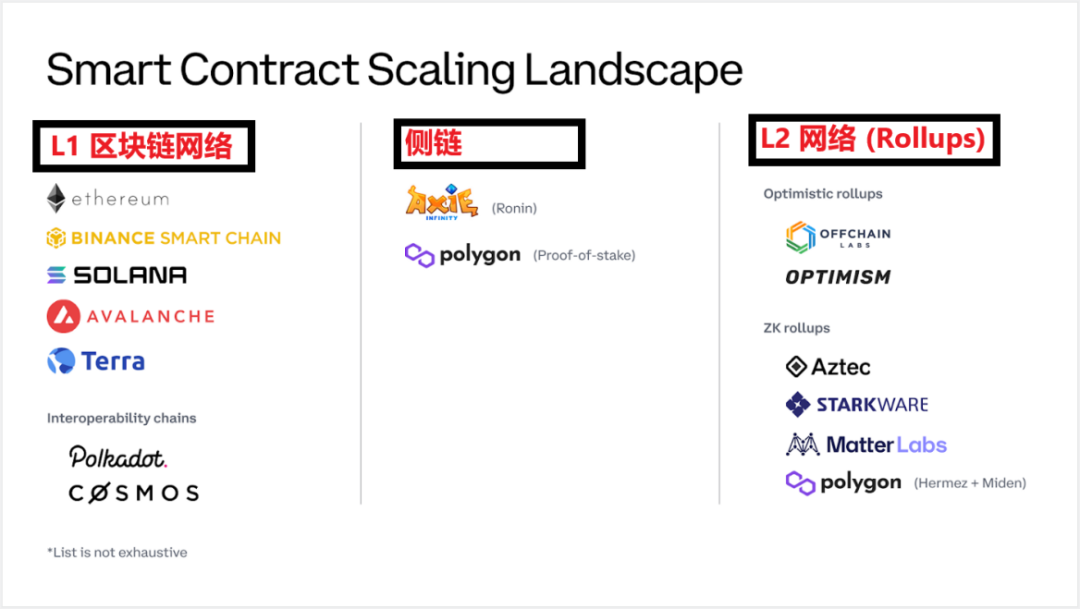

There are two ways to solve this problem:oror(2) Build a network that is complementary to Ethereum so that it can handle the excess capacity of Ethereum.Broadly speaking, they can be divided into the following categories:

L1 (first layer) blockchain networkside chain

side chain(slightly complementary to Ethereum)

L2 (second layer) network(complementary to Ethereum)

While they differ in architecture and approach, the goals are the same:Let users actually use these networks without paying high fees or experiencing long waits(such as interacting with DeFi, NFTs, etc.). The following diagram divides the current smart contract scalability landscape:

first level title

L1 blockchain network

Ethereum is aL1Blockchain, or an independent network that simultaneously executes transactions and secures funds. Want to convert 100 USDC to DAI using a DeFi app like Uniswap? Ethereum is where all of this happens.

Other competing L1 networks can do everything Ethereum does, the difference is that these new L1 network systems are designed to achieve higher throughput, thereby reducing transaction fees, but they usually increase the number of nodes in the center of the network. turned into a price.

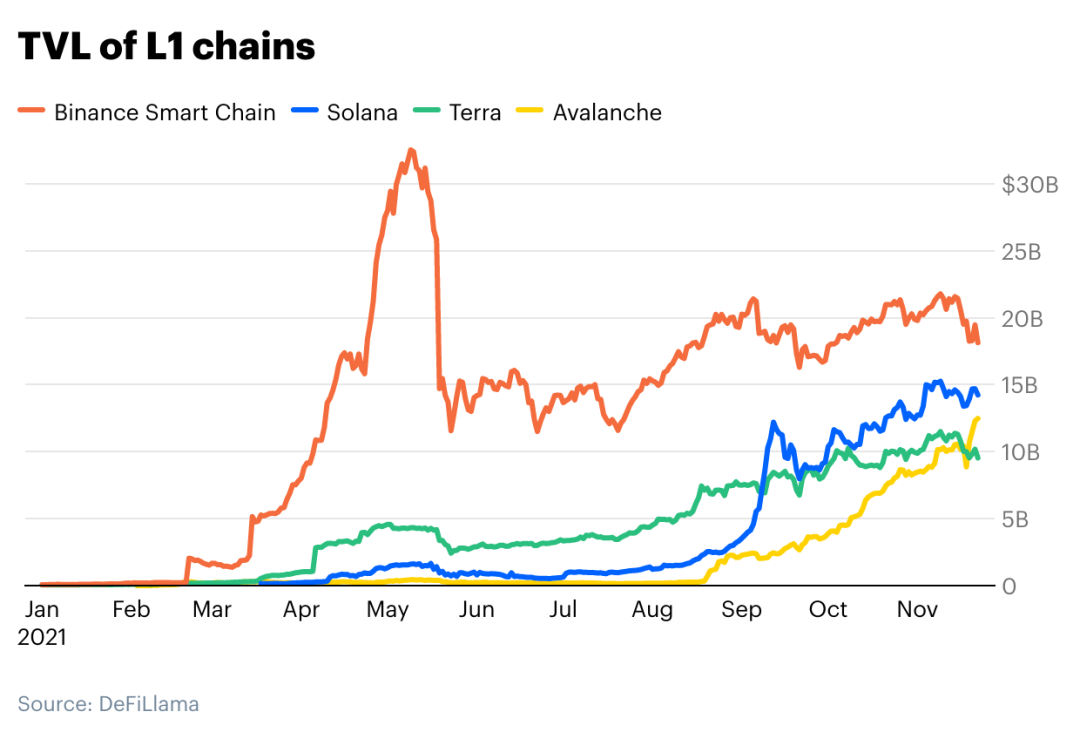

Over the past 10 months, several new L1 networks have come online, during which time the TVL (Total Value Locked) on these networks has skyrocketed from $0 to a combined$75 billionaround, currently mainly bySolana, Avalanche, Terra, and Binance Smart Chain (BSC)lead, and they all have growing ecosystems with TVLs exceeding$10 billionimage description

Above: TVL growth for major L1 networks other than Ethereum since 2021.

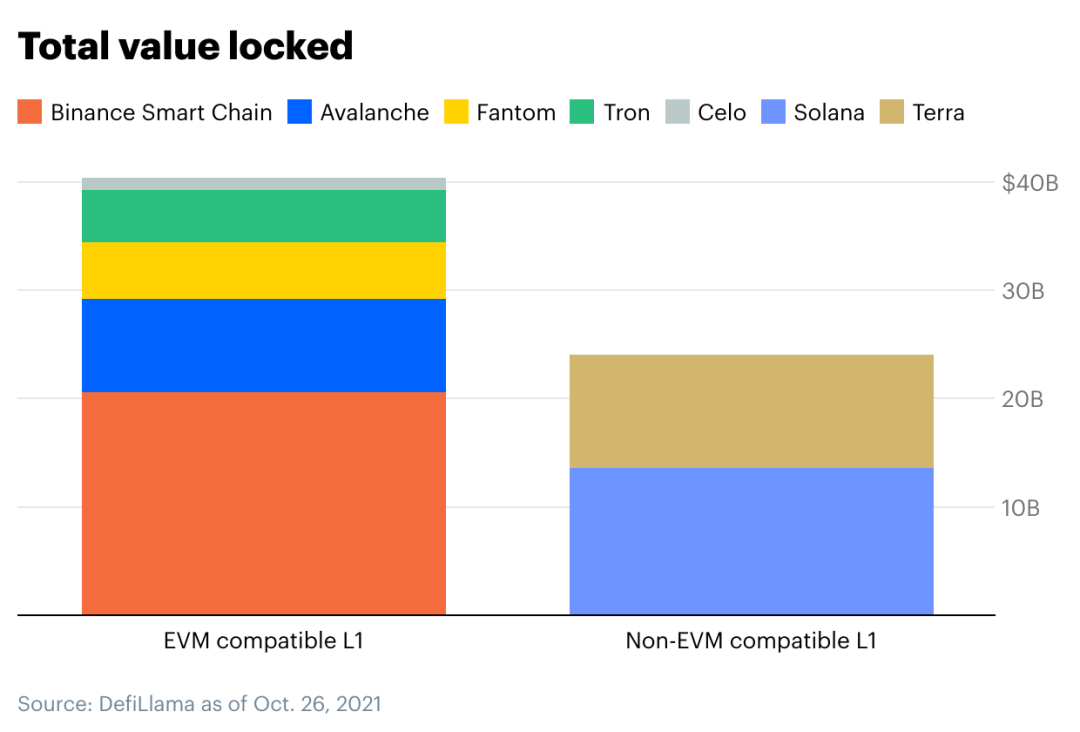

All L1 networks are competing with each other to attract developers and users.But doing so without any of Ethereum's tools and infrastructure that make it easy to build and use applications is difficult. To fill this gap, many L1 blockchain networks have adoptedCompatible with EVM(Ethereum Virtual Machine) strategy.

by

byBSCas an example. By releasing an EVM-compatible network and tweaking the consensus mechanism to achieve higher throughput and cheaper network costs, BSC has seen a surge in usage of many DeFi applications over the summer of last year. Ethereum applications (such as Uniswap, Curve, etc.) are similar. at the same time,Avalanche, Fantom, Tron, and CeloOther networks have taken the same approach.

andTerraandSolanaimage description

The TVL of the L1 network compatible with EVM is shown on the left side of the figure above; the TVL of the L1 network not compatible with EVM is shown on the right side. Data as of October 26.

A blockchain network focused on interoperability

andCosmosandPolkadotSuch a blockchain ecosystem focused on interoperability. Rather than building new independent blockchains, these projectsBuild standards that allow developers to create application-specific blockchains that can communicate with each other.For example, such a system could allow tokens on one gaming-focused blockchain network to be used in applications on another social-focused blockchain network.

Currently, more than $100 billion worth of assets are protected in blockchain networks built using the Cosmos standard, and these blockchain networks will eventually be interoperable. At the same time, Polkadot also recently ushered in a milestone (note: Polkadot recently started its parachain slot auction), and will also unify its blockchain ecosystem in a similar way.

side chain

side chain

Admittedly, the distinction between sidechains and the aforementioned new L1 blockchains is blurred. Sidechains are very similar to other EVM-compatible L1 blockchains, except that the purpose of sidechains is to deal with Ethereum's excess capacity, rather than compete with Ethereum as a whole. The ecosystem of sidechains is closely connected to the Ethereum community, hosting Ethereum applications in a complementary manner.

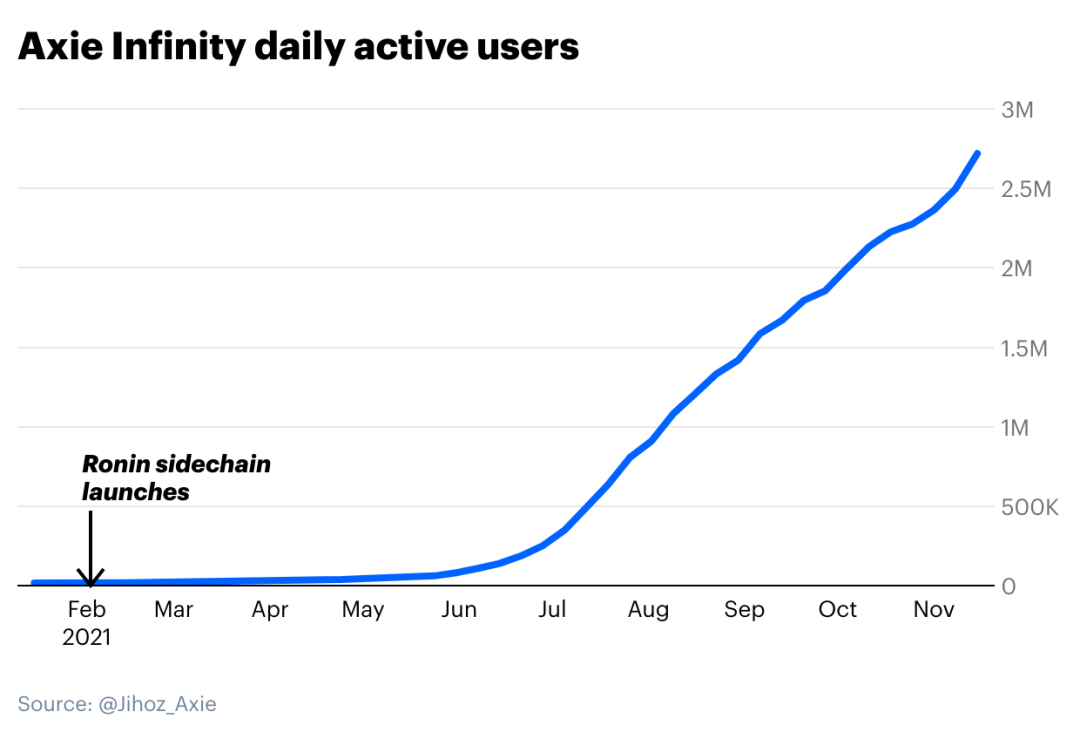

earn while playingearn while playing"gameAxie Infinityimage description

Above: The daily active users of Axie Infinity have shown rapid growth since migrating to the Ronin sidechain.

secondary title

Polygon PoS

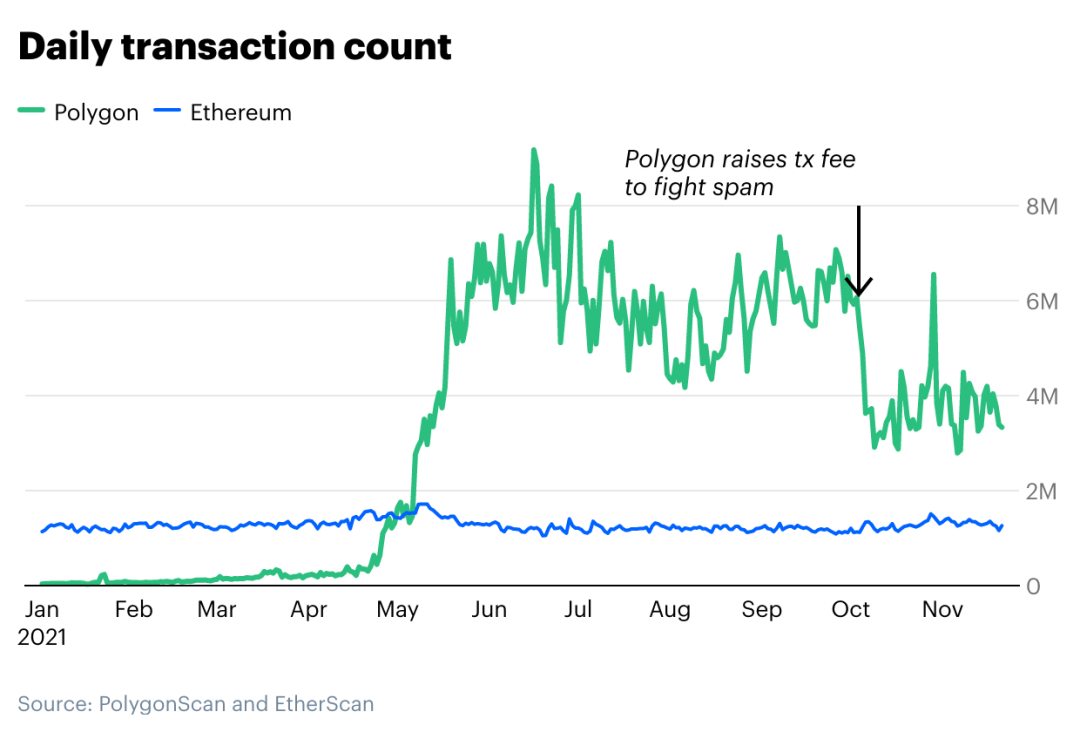

$5 billion$5 billion, deploying more than100 DeFi and Gaming Apps, including the well-known Aave and Sushiswap, and Quickswap, a clone of Uniswap.

Likewise, Polygon PoS looks no different than other EVM-compatible L1 blockchains, but it is part of a framework that scales Ethereum, rather than competing with it. The Polygon team said that in the future, the Ethereum network will still be a blockchain mainly used for high-value transactions and value storage, while daily transactions will be transferred to Polygon's low-cost blockchain. (Polygon PoS also maintains a special relationship with Ethereum through a process called “checkpointing.”)

image description

first level title

text

Both L1 blockchains and sidechains present an obvious challenge:Ensure the security of the blockchain network.To do this, they have to pay a new batch of miners or PoS validators, allowing them to verify and secure transactions, usually with the inflation of the network's native token (such as Polygon's MATIC, Avalanche's AVAX, etc.). However, this also comes with significant disadvantages:

Having a native token naturally makes your ecosystem more competitive, rather than complementary to Ethereum;

Verifying and securing transactions is a complex and challenging task that your network will be responsible for indefinitely.

But wouldn’t it be better if we could build on the security of Ethereum to create a scalable ecosystem? That's what we're going to talk aboutL2 network, specificallyRollups network. In short, the L2 network is an independent ecosystem that sits on top of Ethereum and relies on Ethereum for its security.

Crucially, this means that L2 does not need to have a native token —So not only are they more complementary to Ethereum, they are essentially part of Ethereum.Ethereum’s roadmap even saysEthereum 2.0 will be "Rollup-centric"secondary title

How Rollups work?

L2 networks are often referred to as Rollups because they "roll up" transactions to execute in a new (off-chain) environment in a bundle, and then send updated transaction data back to Ethereum (on-chain). Instead of letting the Ethereum network process 1000 transactions from Uniswap alone (which is expensive!), Rollups will batch transactions to complete the calculation off-chain, and then submit the calculation results to Ethereum (which is cheaper!) .

So, when the calculation results are published to Ethereum, how does Ethereum know that the data is correct and valid? How does Ethereum prevent people from posting incorrect information? These questions are what differentiate the two different types of Rollups:Optimistic Rollups and ZK-Rollups.

1) Optimistic Rollups

When computing results are submitted to Ethereum, Optimistic Rollups "optimistically" assume they are valid. In other words, the Optimistic Rollups network will let its operators publish any data they want (including potentially incorrect/fraudulent data), assuming it is correct!

But Optimistic Rollups also have ways to fight fraud. As a check and balance, any withdrawals to the Ethereum mainnet have a time window (~7 days) waiting period during which anyone can check for fraud (remember, the blockchain is transparent , anyone can see what's going on). If one of the observers can mathematically prove that fraud has occurred (i.e. by submitting a fraud proof), then Optimistic Rollups will revert (reverse) any fraudulent transactions, punishing the malicious actor and rewarding the observer (It's a clever incentive system!)

The downside of course is that when you transfer funds between the Optimistic Rollups network and the Ethereum network, there is a short delay to see if any observers have spotted any fraud. In some cases,This could take up to a week, but we expect these delays to decrease over time.

The key point is that Optimistic Rollups are inherently tied to Ethereum and are currently ready to help Ethereum scale. Therefore, with many leading DeFi projects deploying/moving to the main Optimistic Rollups network (includingArbitrum and Optimistic Ethereum), we have seen strong initial growth.

Arbitrum & Optimistic Ethereum

Off-chain Labs'ArbitrumNetwork and Optimism'sOptimistic EthereumThe network is currently the two main projects that implement Optimistic Rollups. It’s worth noting that both projects are still in their early stages, so the teams behind each still maintain a centralized level of control over their respective networks, but both plan to achieve decentralization over time.

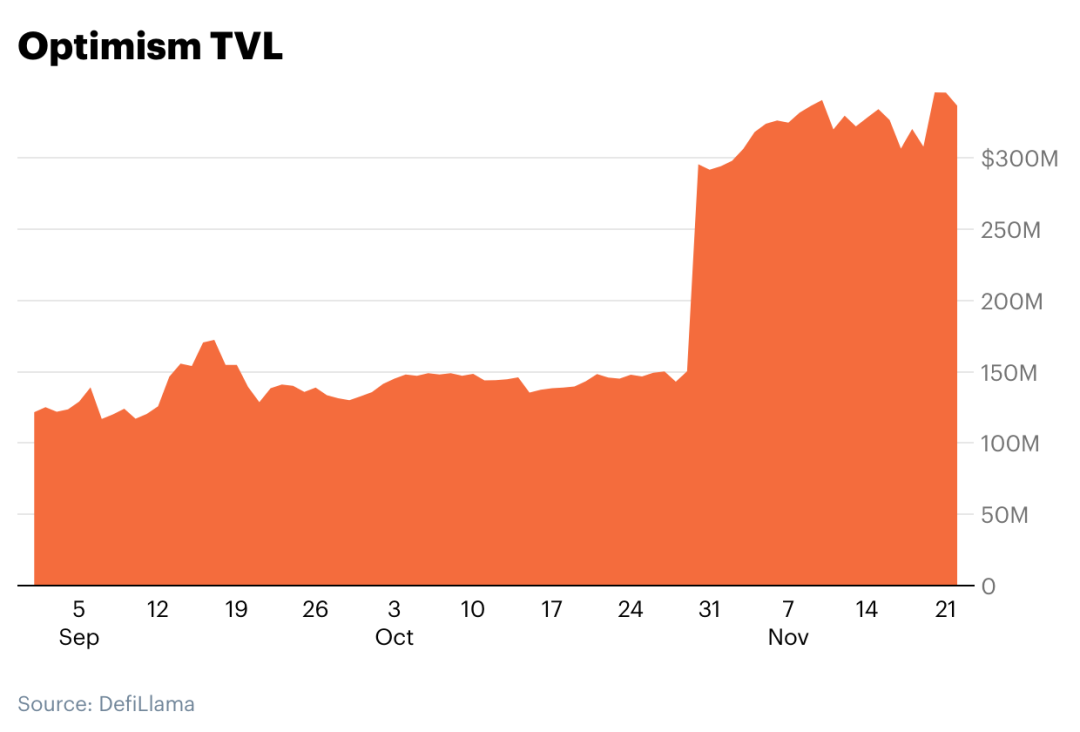

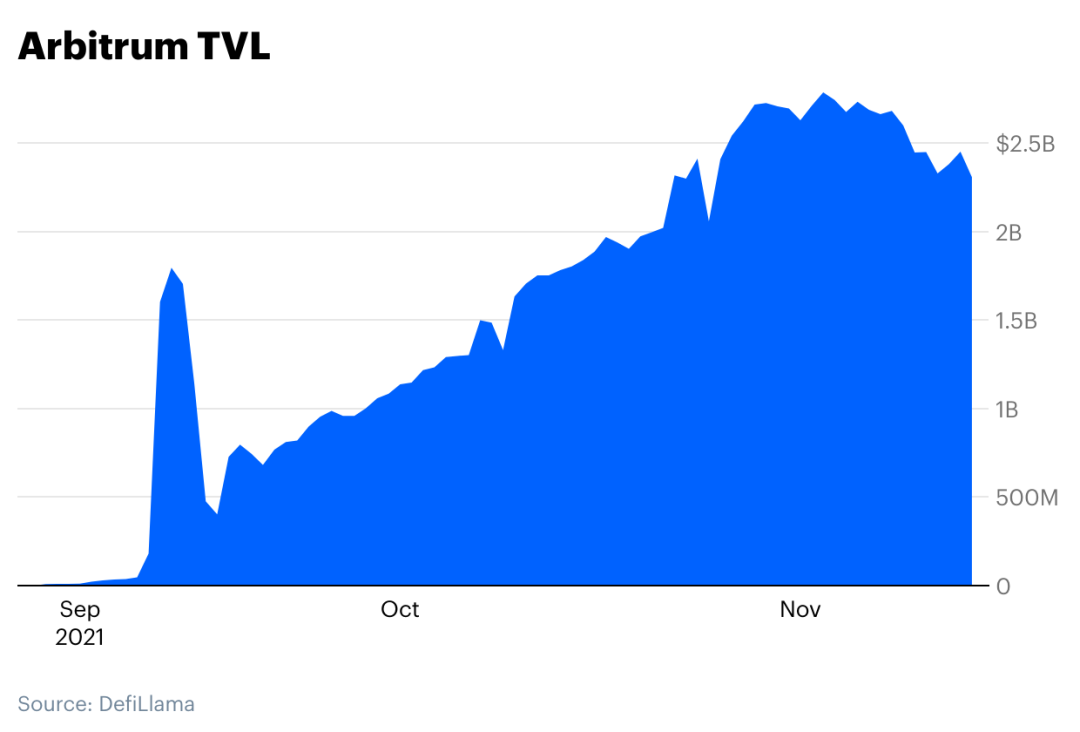

It is estimated that Optimistic Rollups can provide a 10-100x scalability improvement once matured. Even in the early days, DeFi applications on Arbitrum and Optimism have accumulated billions in network value locked up.

image description

Above: TVL growth for the Optimism Network

Arbitrum goes one step further, on the network60+ apps(including familiar DeFi protocols, such as Curve, Sushiswap, and Balancer, etc.), the total TVL is about$2.5 billionimage description

Above: TVL growth for the Arbitrum network.

secondary title

2) ZK Rollups

As mentioned earlier, Optimistic Rollups assume the transaction is valid and allow time for others to prove fraud. In contrast,ZK-RollupsThen it actually proves to the Ethereum network that the transaction is valid.

In addition to submitting the calculation results of the bundled transactions, ZK-Rollups also submits a "validity proof" to an Ethereum smart contract. As the name suggests, proof-of-validity lets the Ethereum network verify the validity of these transactions, making it impossible for relayers to cheat the system. This eliminates the fraud proof window like Optimistic Rollups do, so transfers between the Ethereum network and ZK-Rollups are virtually instant.

While instant settlement and no windowed waiting periods sound great, ZK-Rollups are not without tradeoffs. First of all, generating validity proofs requires a lot of calculations, so high-performance machines are required to complete them; second, the complexity around validity proofs makes ZK-Rollups more difficult to be compatible with EVM, thus limiting the smart contracts that can be deployed on ZK-Rollups type. Because of this, Optimistic Rollups has to enter the market one step ahead and is more capable of solving the current scalability problems of Ethereum; but in the long run, ZK-Rollups may become a better technical solution.

Adoption of ZK Rollups

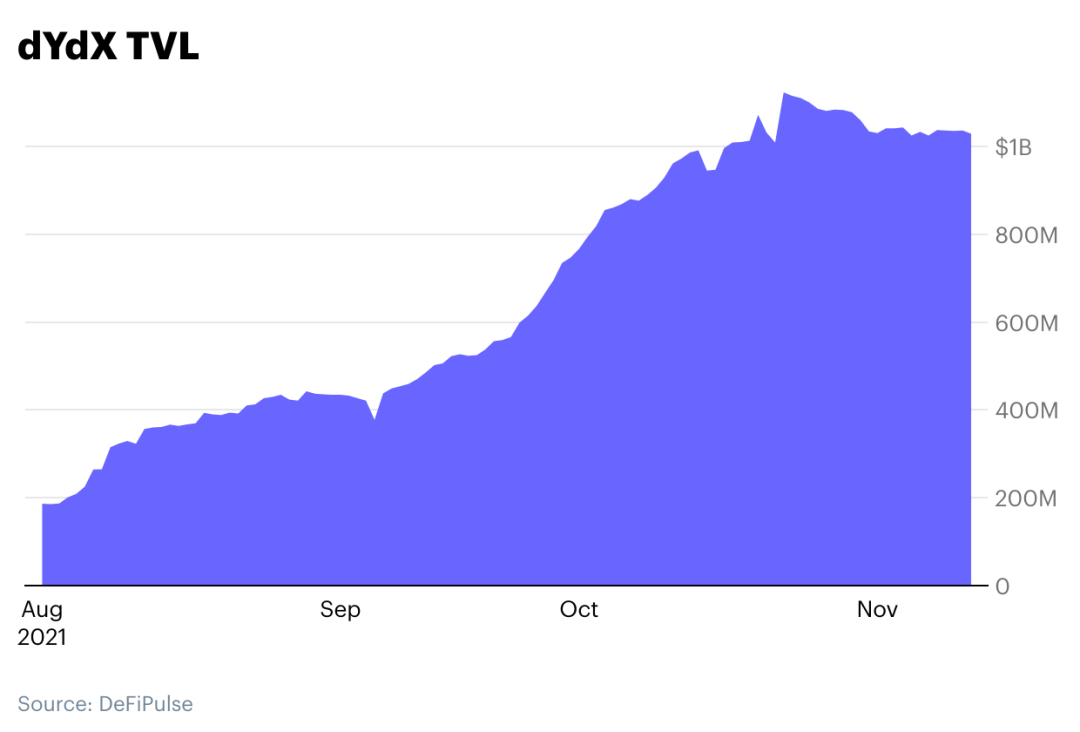

The ZK-Rollup landscape is deep, with multiple teams and implementations in progress or in production. Some notable players include Starkware, Matter Labs, Hermez, and Aztec, among others. current,ZK-Rollups mainly support relatively simple applications, such as payments or exchanges(Because the current application categories that ZK-Rollups can support are limited). For example, the derivatives exchange dYdX uses the ZK-Rollup scheme developed by the Starkware teamStarkEximage description

Above: TVL growth trend for the dYdX protocol.

However, the really laudable ZK-Rollups scheme isFully compatible with EVM's ZK-Rollups, which will allow it to support popular general-purpose applications (such as all DeFi applications) without the withdrawal delays like Optimistic Rollups. The main players in this are Matter Labs'zkSync 2.0, Starkware'sStarkNet, Polygon Hermez'szkEVM and Polygon Miden, both of which are currently working on the mainnet launch. (Aztec, meanwhile, is focused on applying ZK (zero-knowledge) proofs to privacy.)

Many people in the industry (including Ethereum co-founder Vitalik Buterin) areZK-RollupsIntegration with Ethereum 2.0 as a long-term solution to scaling Ethereum, mainly because ZK-Rollups are able to basically process hundreds of thousands of transactions per second without sacrificing security and decentralization. upcomingFully compatible with EVM's ZK-Rollupsfirst level title

fragmented world

Cross-chain bridgeCross-chain bridge, which is complex for the user and carries potential risks. For example, some cross-chain bridges (such as Poly Network) have been targeted by hackers

More importantly, the multi-chain world breaks composability and fragments liquidity. For example, Sushiswap is currently implemented on Ethereum, BSC, Avalanche, Polygon, and Arbitrum; the liquidity of Sushiswap was once concentrated on one network (that is, Ethereum), but is now distributed on five different networks.

ComposabilityComposabilityfirst level title

uncertain future

Will new L1 blockchain networks like Avalanche or Solana continue to grow and compete with Ethereum? Will blockchain ecosystems like Cosmos or Polkadot grow fast? Will sidechains continue to operate in harmony with Ethereum, taking on its excess capacity? Or will Rollups combined with Ethereum 2.0 win out? No one is sure.

While the future is uncertain, everyone can take comfort in the fact that there are so many bright teams working on solving the most challenging problems facing open, permissionless blockchain networks. Just as broadband ultimately helped the Internet power many revolutionary applications (such as YouTube and Uber), we believe that winning scalability solutions will eventually be seen through the same lens.