The stable currency exchange protocol "Platypus" led by Three Arrows has lower slippage than Curve?

On December 2, the Avalanche ecological stable currency exchange projectPlatypusAnnounced the completion of US$3.3 million in financing. This round of financing was led by Three Arrows Capital and DeFiance Capital, 0xVenturesDAO, Avalanche, Avalaunch, Avatar, AVenturesDAO, Benqi, CMS, Colony, GBV, Hailstone, Keychain, Mechanism, Muhabbit, TPS, Vahalla Capital and YieldYak and others participated in the vote.

Platypus literally translates to "platypus", the project is named after this, or it hopes to provide stable currency exchange services as smooth as the shape of the animal's mouth, and increase funds by further reducing the transaction slippage between stable currencies usage efficiency.On November 29, Platypus launched its Alpha product on Avalanche, allowing users to exchange between four stablecoins such as USDT, USDC, DAI, and MIM with low slippage, or to earn economic benefits by providing liquidity.

According to Platypus, there are several common problems in the existing classic AMM DEX and the stablecoin exchange protocol based on its variant algorithm:

1. Liquidity fragmentation: The liquidity pools of existing projects are often closed, and liquidity between different pools is not shared with each other, which will inevitably increase exchange slippage.

2. The pool building method is inefficient: Existing projects need to maintain a balanced state of assets in the pool when building a pool, that is, the tokens in the pool need to have the same amount of liquidity, which will cause the token with the lowest consensus in the pool to eventually become the growth bottleneck of the entire pool . This design also makes it difficult for existing projects to expand to more other emerging assets.

3. The "punishment" for a single currency entering and leaving the pool is too heavy: the impact on small users is limited, but for large liquidity providers, it is necessary to execute "single currency-multi-currency" or " "Multi-coin-single currency" exchange, so the loss will be quite large.

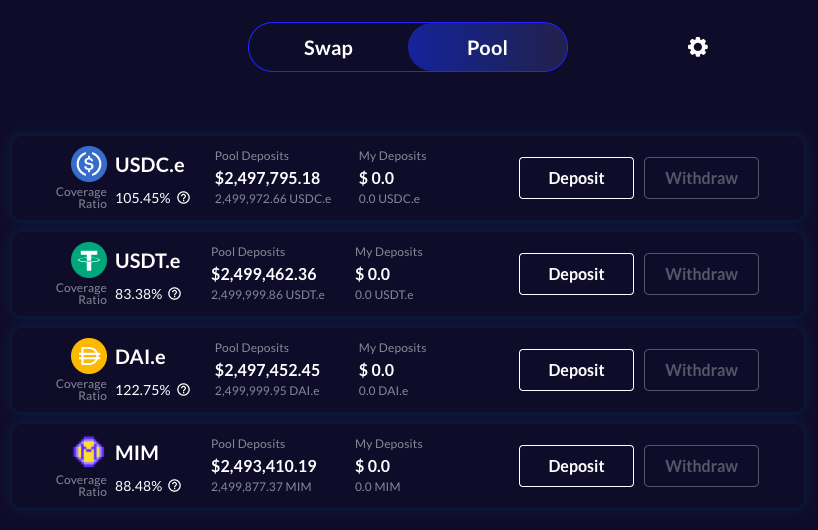

In order to solve these problems, Platypus designed a brand new architecture, which is officially calledOpen Liquidity Pool. Specifically, Platypus no longer uses the 1:1 pairing market-making method commonly used in previous projects, but allows liquidity providers to freely choose single-currency market-making. At the same time, Platypus introduces "coverage" when evaluating the equilibrium state of the protocol(Note: coverage ratio, the specific definition and operation of this concept, has not been found in Platypus' official documents and past Medium articles. Detailed explanation.)This new concept replaces the conventional practice of taking the liquidity ratio as the standard according to the official introduction. According to the official introduction, the open liquidity pool can do:

1. The liquidity between tokens is fully shared: lower transaction slippage is achieved under the same liquidity conditions.

2. Easy entry and exit of a single currency: Under the new market-making mechanism, a single currency will no longer have to bear excessive losses when entering and exiting the pool.

3. More flexible pool building methods: Since there is no need to maintain a balanced liquidity scale, it will be more flexible when adding new assets and can be adjusted completely on demand.

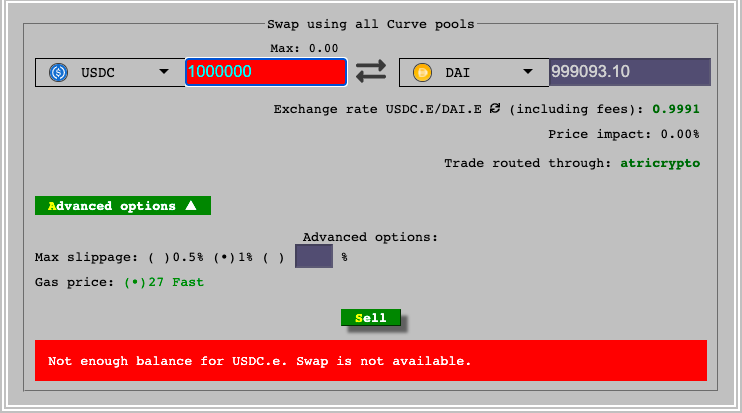

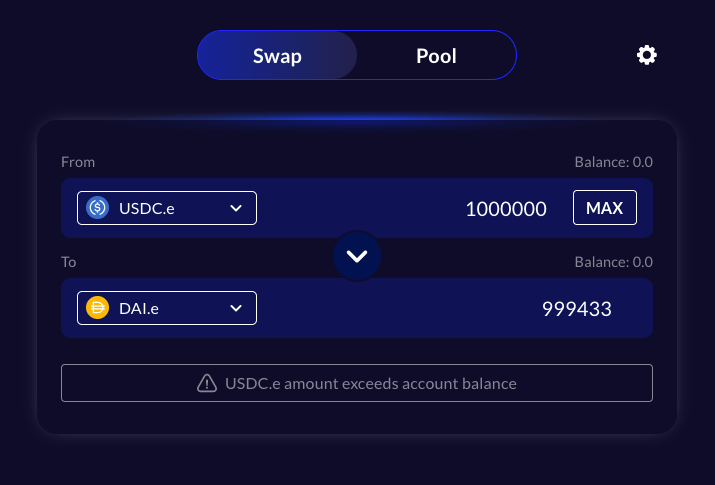

empty talk,In order to test the actual effect of Platypus, we compared the transaction performance between Curve, the top stablecoin exchange project on Avalanche, and Platypus Alphaimage description

image description

Platypus Alpha Trading Performance

As shown in the figure above, both Curve and Platypus Alpha can achieve a transaction slippage of less than 0.1% when executing million-dollar stablecoin transactions, and Platypus Alpha is even better when executing USDC-DAI conversions .

Although the exchange quotes between stablecoins will be largely affected by the proportion of assets in their respective pools, taking one transaction as an example cannot fully prove the exchange strength of the agreement (Curve’s current performance on more exchange paths better). But it is worth noting that the current overall liquidity scale of Platypus Alpha is only 10 million US dollars. In contrast, the current overall liquidity scale of the Avalanche version of Curve has reached 1.2 billion US dollars (not exactly a stable currency). From this perspective, the potential shown by Platypus is quite worth looking forward to.