DAOrayaki|Take Olympus DAO as an example to evaluate how the community drives the value of the project

Olympus DAO ($OHM) is a decentralized reserve currency protocol with exciting incentives, meme culture, and a super-strong community. In this post, we investigate how the social aspects surrounding Olympus DAO helped push the protocol to stand out.

overview

overview

Each $OHM token is backed by at least 1 DAI as well as other treasury assets including protocol-owned liquidity. $OHM aims to be a global unit of account backed by an intrinsic commodity basket, allowing for a free-floating reserve currency designed to preserve its purchasing power compared to a USD-pegged stablecoin. Olymus recently added $OHM-$ETH bonds, meaning the native token is now backed by a potentially long-term appreciation asset.

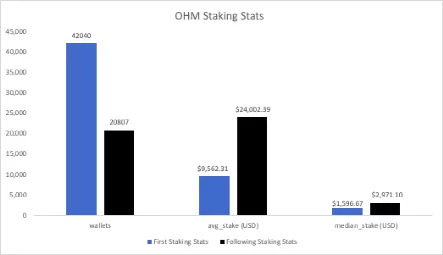

Users can obtain value from Olympus DAO in two ways: staking and bonding. By staking OHM, users can obtain additional OHM from inflation emissions from the treasury. This allows stakeholders to maintain a higher relative share of the total $OHM supply, incentivizing longer holding time frames assuming growth. In addition, bondholders provide capital in exchange for discounted OHM with multi-day vesting periods. In theory, bondholders could sell tokens for a small mid-single-digit profit once the vesting period is over, but most end up betting in anticipation of higher future returns

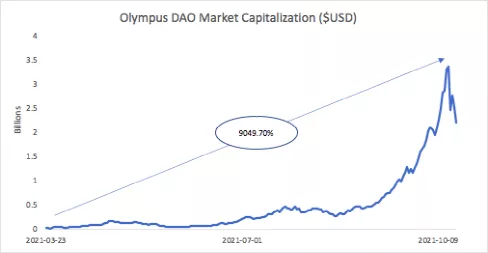

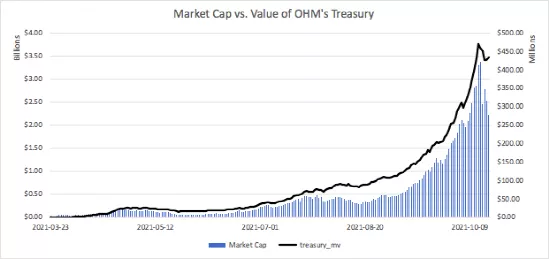

OlympusDAO has grown exponentially since its launch in March 2021

This 90x increase in market cap can be attributed to several key innovations of the protocol, as well as the use of game theory to maximize utility for stakeholders.

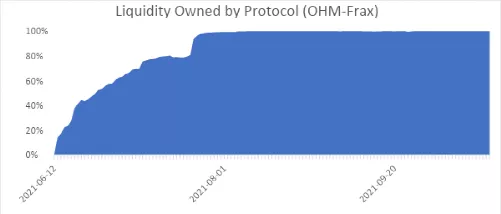

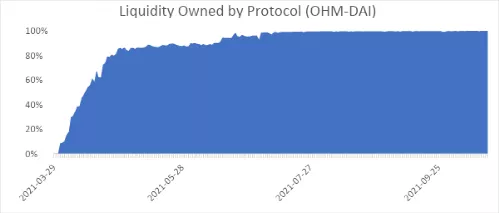

Protocol-owned liquidity (POL) is one of the most innovative concepts to emerge in DeFi this year. It solves a key problem facing protocols: access to native token liquidity within DEXs and their own protocols. The initial solution to the above problem was to provide temporary incentives for users to provide liquidity to various markets. These incentives are driven by inflationary emissions and create a trend towards highly productive mining. While it is certainly an effective tool for collecting liquidity, the protocol notes that liquidity is essentially rented, and once the incentive ends, users simply transfer funds to another protocol. The growing frictionless nature of the crypto ecosystem further increases the elasticity of capital, particularly inter-blockchain flows. Temporary incentives can also create sell pressure on native tokens once consensus is reached that future rewards relative to opportunity cost are no longer worthwhile.

secondary title

This offers several advantages over incentivized liquidity:

1. $OHM will always have a liquid market

2. OlympusDAO does not need to pay for liquidity through symbolic incentives, allowing inflationary emissions to accumulate to gamblers who comply with the agreement, rather than miners who only pursue income and may leave the project

3. The agreement generates LP fees to diversify the income stream of the agreement

secondary title

A basic way to assess the rise of Olympus

From a fundamental perspective, users may compare treasury accrual statistics to market capitalization to identify fundamental value drivers. Regressing OHM's treasury market capitalization vs. market capitalization from May 29, 2021 to October 18, 2021 yields some fairly stark results

The value of OHM's vaults is highly correlated with OHM's market capitalization (R² is 0.971). For every $1 increase in Treasuries holdings, market capitalization increases by $6.52. However, this comparison to determine causality is partially flawed because treasury values and market capitalization values are related to each other and are actually the result of bond buying activity.

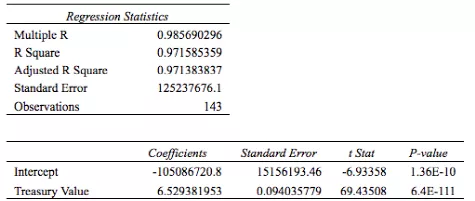

Nonetheless, we use treasury value as a predictor of market cap 15 days later:

The decline in R² can be attributed to variables with short-term volatility, such as daily bond buying activity, $OHM trading activity, and collateral supply percentage. As expected, the direction of market Treasury value accrual precedes the direction of the mirror image of market value.

Regardless of correlation, applying basic metrics to determine causality is challenging given that quantitative statistics are blurred lines between independent or dependent variables

Furthermore, conducting financial models such as DCF is extremely complex given the unpredictability of treasury growth rates.

secondary title

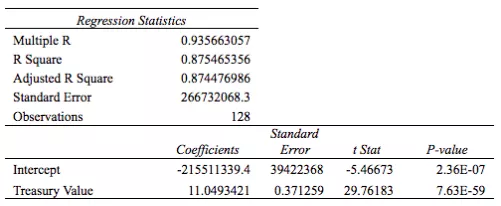

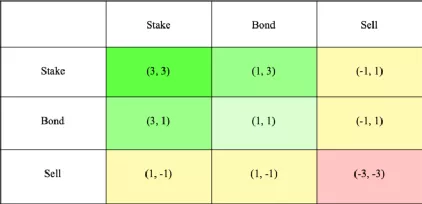

Game theory (3,3) and its associated value

As OlympusDAO started to gain traction, more and more Twitter users started using the (3,3) catchphrase in their Twitter bios. Both crypto-native individuals and professional investment funds are notable players. This has proven to be a very effective marketing strategy, as not only does it serve as a constant reminder of the protocol itself, but its growing popularity encourages unfamiliar users to research the meaning behind the phrase. (3,3) Banners are also an easy way for OHMies to interact with each other and make new Twitter connections.

(3,3) Based on the idea of game theory, the Pareto efficient result is that everyone can pledge their OHM. A simplified version of this game-theoretic matrix can be described in the OlympusDAO documentation. If everyone is betting on $OHM, given that the bond will keep being bought, then the circulating supply will decrease and the price will increase, which will lead to the greatest overall outcome.

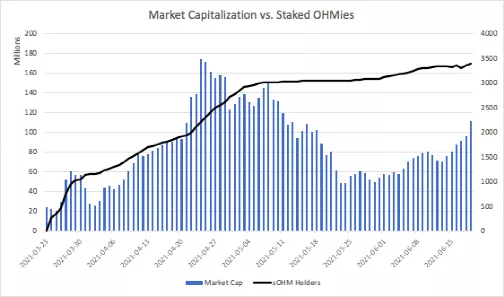

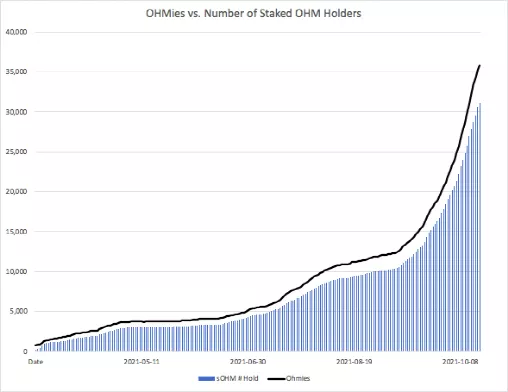

The resilience of the community was shown back in May, even though the cryptocurrency was in the midst of a major market crash as the market cap dropped from $180 million to $45 million, stakeholder numbers actually increased during the period, and from No single-day reduction has been seen.

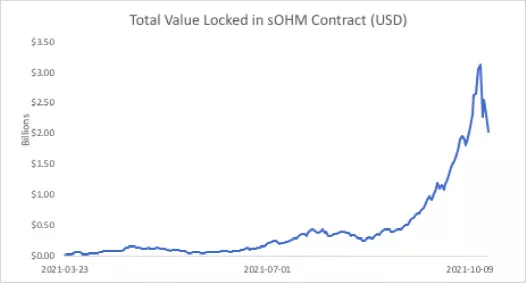

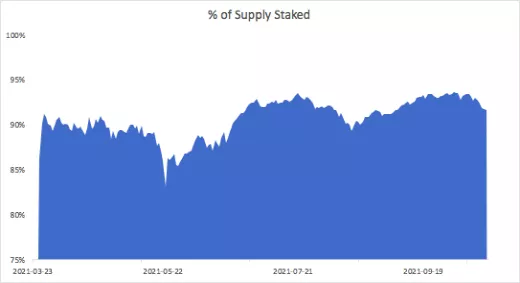

The rapid growth in the number of OHM and staking OHM has not dampened the long-term sentiment of ordinary people towards the protocol, as the percentage of supply staked continues to hover near 90%, further reinforcing the positive dynamics in the community.

secondary title

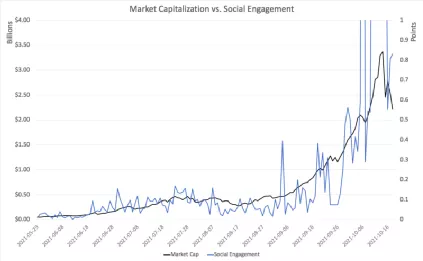

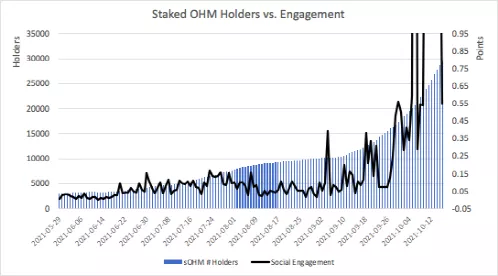

Social engagement score is highly correlated with price and peaks before large capital inflows

LunarCrush.com provides digital media insights into various cryptocurrency projects. Using their social engagement metrics, we can measure the correlation between social engagement and OHM market capitalization. Between May 29, 2021 and October 18, 2021, the correlation between market capitalization and social engagement is 72%. Unusual fluctuations in the positive spiral in engagement scores have reduced relevance metrics in negative ways, especially over the past few weeks.

Social engagement is simply defined as total mentions of a particular item, whether via tweets or hashtags, across all media channels (including Twitter and less frequently Reddit/YouTube).

The correlation between market capitalization and social engagement can be attributed to the positive feedback loops that the crypto community tends to endure:

1. Social engagement is driven by mentions like likes, hashtags and comments, all of which increase discoverability and capital inflow

2. The marginal benefits of the agreement for each new member can be said to increase, because all members have economic incentives to discuss their joint investment, and larger communities have higher potential for title and narrative control

3. Due to the massive opportunity and incredible rewards that early community members who cannot keep up with a particular project can generate, the FOMO of later users is very powerful as they are the main price driver during the peak of the popularity and value accumulation cycle

Applying this framework specifically to Olympus, there appear to be two distinct events where a spike in social engagement is followed by a price increase.

In Scenario 1 and September 3, Olympus recorded its highest daily engagement score (3.96 million) since its inception. Before this particular point, both price and engagement stagnated for several months. The ensuing rush into Olympus can be seen by the price jump from $312 on September 3 to a recent $1,100. On September 3, Tetranode and other big names posted news about Olympus on Twitter, and a large AMA took place between Sushi and Olympus on Discord.

secondary title

The relative popularity of the Olympus forked ecosystem partly explains the value of Olympus

The Olympus DAO community is currently one of the most visible on Crypto Twitter, as they often proclaim their leader OHMZeus and adore the (3,3) catchphrase.

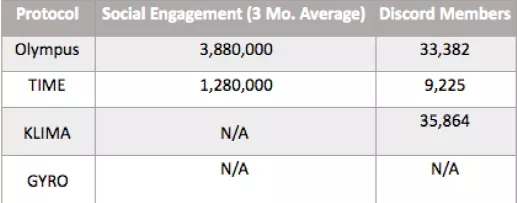

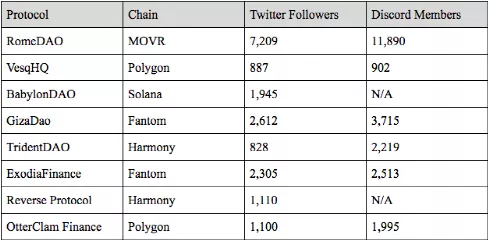

Here is an overview of some OHM community metrics compared to other notable (already launched) forks:

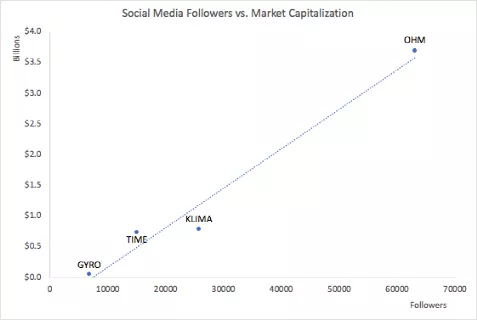

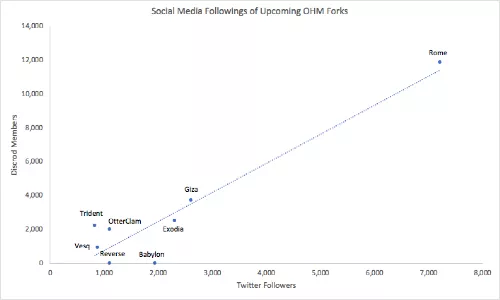

Using this particular chart below: we can draw conclusions about the relative value each protocol holds. OHM is the clear leader due to its first mover advantage, innovation through Pro bonds, leading social media, current liquidity advantage and easy access (ETH). KLIMA was able to quickly gain traction through its "green" narrative and effective community development. KLIMA actually has more Discord members than Olympus. Both TIME and GYRO live on less popular blockchains, so capital inflows are currently much smaller.

This "relative value" can again be attributed to the positive feedback loop mentioned earlier. Look at this cycle from another angle: the less popular a project is on Twitter, the less likely it is to be discovered by investors and the smaller the market cap.

Other upcoming OHM forks gained traction on Twitter:

Rome DAO stands out in particular because it uses OHM rather than a stablecoin as its initial backing, meaning the success of the protocol depends heavily on OHM itself. Rome is also one of the first OHM forks to be announced on Twitter, giving it a first-mover advantage in entering the OHM community. The graph above also shows that discovery eventually leads to engagement, as the migration from Twitter to Discord is a step users with some level of interest will take.

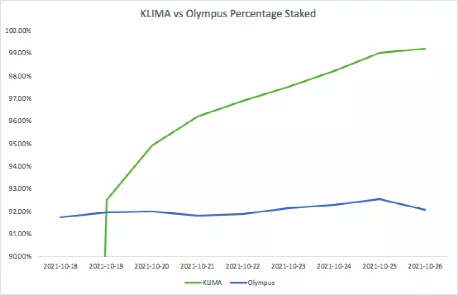

Since the agreement was launched last week, KLIMA's supply ratio has soared to 99%, while Olympus has hovered around 92%. Although this graph shows that KLIMA has a stronger community, KLIMA was launched in a more favorable environment. Olympus has set a precedent for mutually beneficial consensus actions.

Given these conclusions, formulating a thesis on the direction of social activity can predict the future value of Olympus forks and Olympus itself:

1. Will Avalanche and BSC see increased capital inflows, resulting in higher potential value for TIME and GYRO?

2. Can KLIMA become more popular than OHM because of its green narrative?

3. Will the idea of Olympus really help to promote the value of the fork and stay away from Olympus?

4. What catalysts will help GYRO, KLIMA and TIME move towards OHM's 61,000 Twitter followers?

5. Will Olympus' liquidity ownership and mortgage model continue to receive attention?

secondary title

Social media engagement and number of holders are strongly correlated with price increases

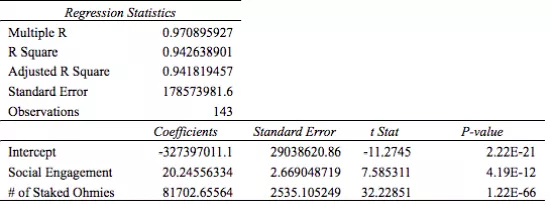

By utilizing social engagement and the amount of OHM staked as independent variables for the market capitalization outcome, the R² is 94.2%, which is impressive considering both metrics are the result of community action.

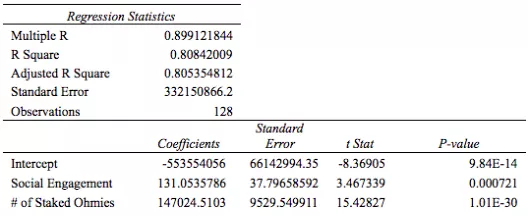

When social engagement and sOHM numbers are used as predictors of market capitalization 15 days later:

When social engagement and sOHM numbers are used as predictors of market capitalization 15 days later:

secondary title

Top Crypto Twitter High Influencers Introduce Many Discussion Points Around Olympus

Famous Twitter users play a huge role in the flow of capital within the ecosystem. An influencer can even change a price by the simple act of following another Twitter account, as "alpha" seekers keep track of notable moves.

secondary title

The most influential figures on Olympus are:

1. Daniele — the founder of the OHM fork

Daniele is often compared to Andre from Yearn, as he has been at the helm of many notable projects to date, including $TIME and $SPELL. He gets further exposure to $OHM for continued incentive to improve $TIME

2. Tetranode — Crypto Whale

Tetranode is known for spotting opportunities early and his relatively early presence in the community helped bring $OHM into the spotlight

3. Co-founder of jawz-OHM

Jawz has more than 16,500 Twitter followers and frequently posts Olympus-related alphas and innovations.

4. banteg - Core contributor to Yearn Finance

secondary title

Sentiment analysis peaks ahead of final price rise

Average Sentiment is an output indicator and a weight between bullish and bearish sentiment. Using algorithms, tweets are parsed for specific keywords and subsequently categorized. The graph above shows that average sentiment and price are not very correlated, as sharp price swings do not necessarily imply changes in overall sentiment. Strong opinions will be expressed on a particular item regardless of price.

in conclusion:

in conclusion:

OlympusDAO presents an interesting experiment in the idea of using community metrics to capture value. The results show that community metrics as predictors of fundamental value differ less from fundamental metrics than others believe. Utilizing community-driven metrics can fill some of the gaps in current crypto valuation models and may help quantify hidden value that has long plagued fundamental investors.

As the world becomes increasingly digital, the notion that assets are driven by tangible value will crumble. Meme culture, as perfectly exemplified by Togo Kang, allows natural communities to enact for reasons other than purely economic gain. The resulting connections, ideas and products from these natural communities cannot be measured by sheer numbers. Considering that social tokens and DAOs will help onboard the next billion users into crypto, having an effective toolset to evaluate these projects and communities will be a great asset for any investor.