Ethereum 2021 Q3 Quarterly Report: The Ecosystem is developing rapidly, and basic indicators are rising across the board

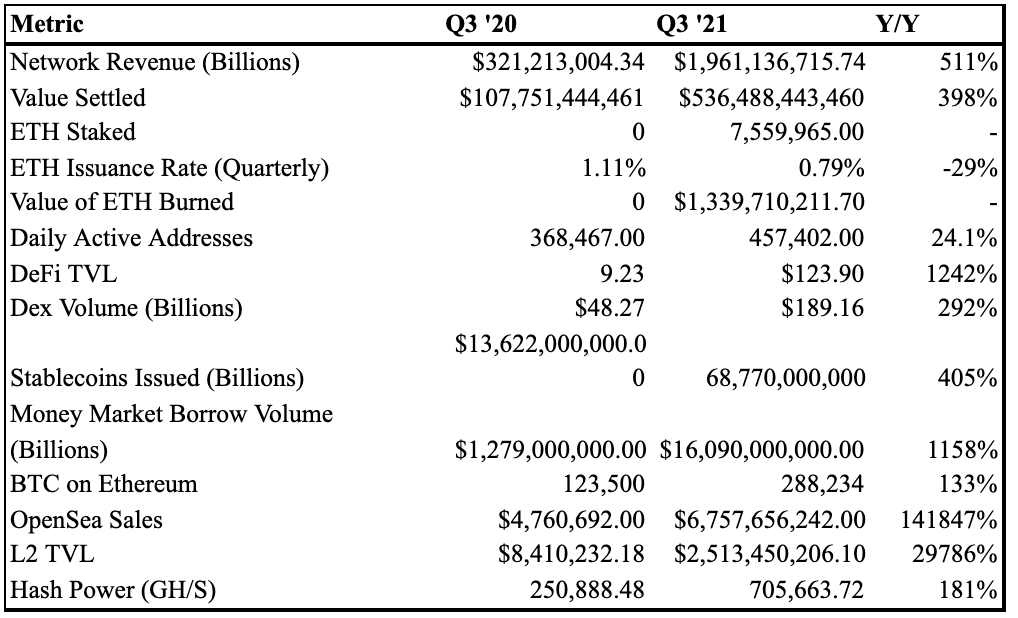

network income

protocol

network incomeAn increase of 511%. The total transaction fees paid by users to miners increased by 511% year-on-year, from $321.21 million in Q3 2020 to $1.96 billion in Q3 2021. Among them, EIP 1559, which was implemented in early August, burned $1.34 billion (68.2%).

Daily Active AddressesAn increase of 24.1%. This is an estimate of the number of daily users on the network, growing from 368,467 addresses in Q3 2020 to 457,402 addresses in Q3 2021, a year-over-year increase of 24.1%.

hash rateAn increase of 181%. The computing power dedicated to securing the Ethereum network through proof-of-work rose from 250,888 GH/S in Q3 2020 to 705,663 GH/S in Q3 2021, a year-on-year increase of 181%.

ETH issuance rateecosystem

Total value locked in DeFiAn increase of 1,242%. The cumulative value of all assets deposited into decentralized finance protocols increased from $9.23 billion in Q3 2020 to $123.9 billion in Q3 2021, a year-on-year increase of 1242%.

DEX Total TransactionsVolume increased by 242%. This includes all trading volume on decentralized exchanges. From US$48.27 billion in the third quarter of 2020 to US$189.16 billion in the fourth quarter of 2021, a year-on-year increase of 242%.

Total outstanding debt rose 1,158%. This highlights the amount of borrowed assets on decentralized money markets like Compound and Aave, which grew from $1.27 billion in Q3 2020 to $16.09 billion in Q3 2021, an annualized growth rate of 1,158%.

Stablecoin issuance growthup 405%. The number of "big three" stablecoins (USDT, USDC, and DAI) issued on the network rose 405% year-over-year during the quarter, to $68.77 billion from $13.62 billion in Q3 2020.

BTC on EthereumUp 133%. This represents the total number of Bitcoins on Ethereum, which has grown from 123,500 in Q3 2020 to 288,234 in Q3 2021, a year-over-year increase of 133%.

OpenSea SalesAn increase of 141,847%, from $4.76 million in the third quarter of 2020 to $6.57 billion in the third quarter of 2021, a year-on-year increase of 141,847%.

TVL on L2Up 29,786%. This represents the amount of value locked in layer 2 scaling solutions, from $8.41 million in Q3 2020 to $2.51 billion in Q3 2021, a year-over-year increase of 29,786%.

ecosystem

main highlights

EIP-1559

EIP-1559 marks the most significant change in the history of the Ethereum protocol and was implemented on August 5, 2021 as part of the London network upgrade.

In a nutshell, this upgrade restructures Ethereum’s fee market from a first-price auction model to one where users pay a fixed fee (called the base fee) and a priority fee (called the tip). Therefore, the most anticipated change brought by EIP 1559 is the introduction of a fee burning mechanism.

Instead of paying miners or validators directly, this mechanism burns the base fee, permanently removing ETH from the circulating supply. As mentioned above, this has resulted in $1.33 billion worth of ETH being burned in the month since its implementation in Q3.

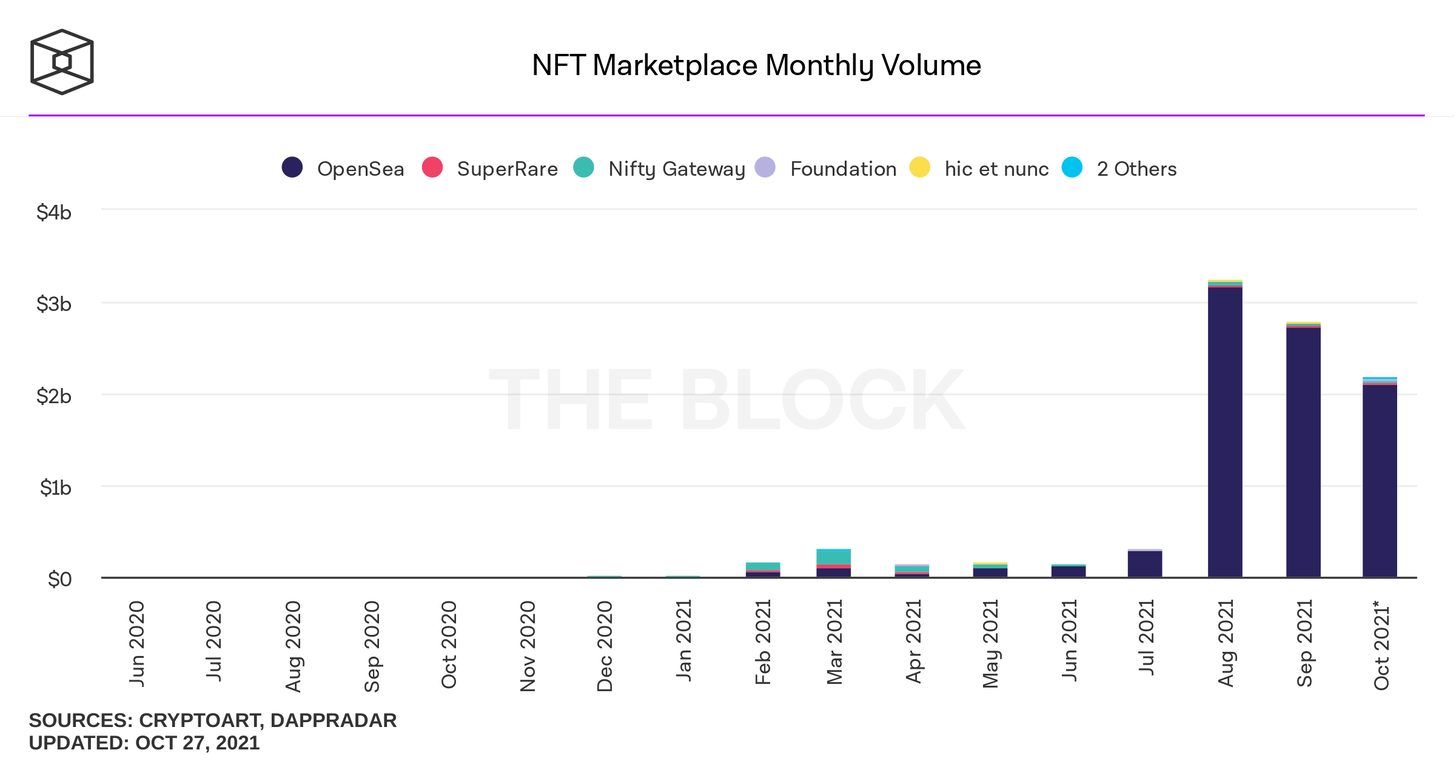

NFT craze

NFT market activity has exploded this quarter.

over $1 billionover $1 billion, the entire NFT market has experienced parabolic growth.

As mentioned above, OpenSea's transaction volume in the third quarter increased by 141,847% year-over-year to more than $6.75 billion, generating $162.7 million in revenue for the platform.

Valuations for other NFT collections have also surged. A prime example is Fidenza from Art Blocks, a generative art collection currently on the market for over $3.3 million. It turns out that the explosion of NFT minting was the main cause of the increase in gas prices,During the launch of The Sevens series,The price shot up to 7,300 gwei.

Facts have proved that the explosion of NFT minting is the main reason for the rise in gas. During the launch of the NFT project The Sevens series, its peak was as high as 7300 gwei.

andJay-Z、Odell Beckham Jr.andStephen CurryCompanies are starting to adopt the technology, with companies like TikTok announcing the launch of NFT collections on the Immutable X network, and Visa announcing that it hasBuy Cryptopunk。

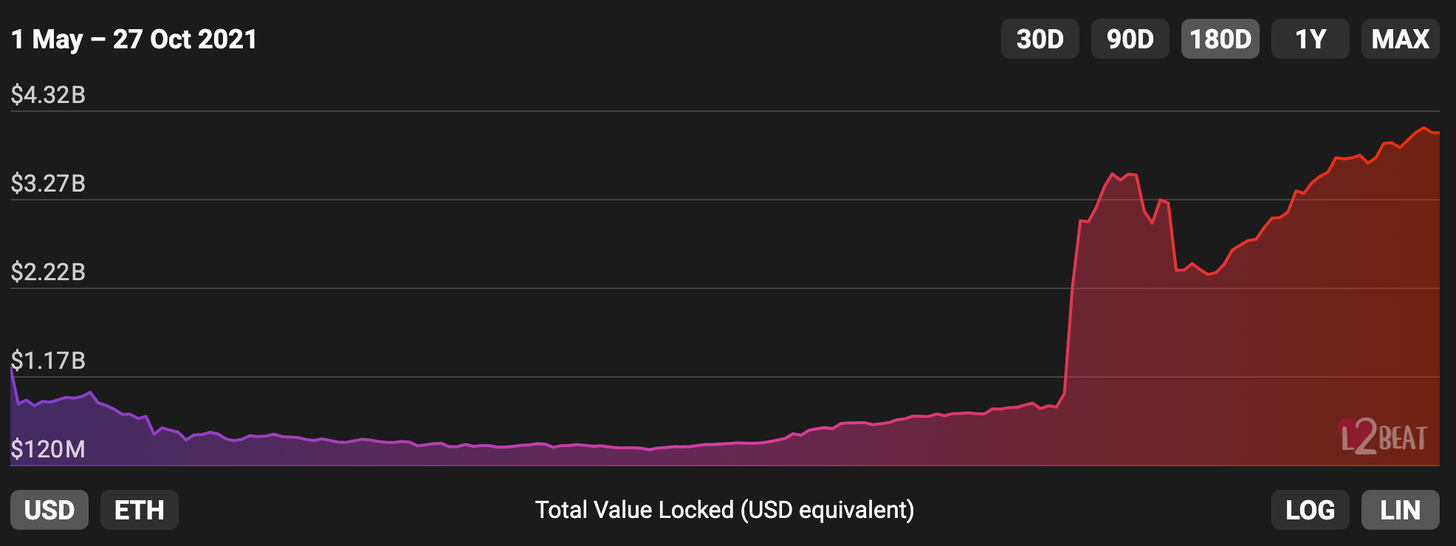

Tier 2 adopts

The last major highlight in the third quarter was significant progress in the Layer 2 (L2) segment. Most commonly in the form of optimistic rollups or zk-Rollups, L2 helps scale Ethereum by increasing transaction throughput and reducing fees, while inheriting the security of L1.

Two major milestones in this regard were Optimistic Ethereum's alpha in July and Arbitrum One's mainnet alpha launch in August. Both networks are built on optimistic rollup and have experienced significant growth. For reference, TVL on OptimismCurrently at $271 million, while Arbitrum holds assets worth $2.41 billion。

It’s worth noting that while both networks claim to have deployed major DeFi protocols, Arbitrum can launch and build new protocols without permission, in contrast to Optimism, which has to whitelist them. As a result, the adoption rate of Arbitrum is much higher than that of its main competitor, Optimsim. This was initially catalyzed by the Arbinyan Farm project, which went live on September 13th, and the farm rapidly recovered within 48 hours as DeFi degens rushed into the protocol seeking to absorb high yields.Accumulated value of $1.5 billion。

Another important sign is the growth of dYdX. As a decentralized exchange for trading perpetual contracts built on StarkWare's zk-rollup technology (StarkEx), the protocol has experienced rapid growth after the launch of its governance token, which provides users with a series of Attractive incentive program.

The protocol’s daily trading volumes briefly climbedto $9.7 billionfuture outlook

future outlook

Ethereum has significant catalysts in Q4 2021 and 2022.

The most important thing is "merging", the network will change the consensus mechanism, from Proof of Work (PoW) to Proof of Stake (PoS). The upgrade will phase out energy-intensive hardware miners and replace them with validators, with the network secured by capital in the form of ETH rather than computing power. As such, this will allow Ethereum to significantly reduce its energy consumption and exclude miners from being stakeholders in the network.

Additionally, the merger is expected to result in a significant reduction in the future issuance of ETH. When combined with EIP-1559's burn, this could lead to ETH deflation, dubbed by the community as "thesuper currency”。

Another upcoming protocol-level catalyst comes in the form of sharding, or changing the network architecture from a single-shard chain to 64 individual shards, each of which can process transactions. Although the timeline for the upgrade is unclear, sharding will be combined with L2 solutions to help ethereum complete its transition to a modular blockchain.

At the application layer, the catalyst for the continued growth of Ethereum DeFi comes from the rise of "DeFi 2.0". A new wave of protocols emphasizing capital efficiency, liquidity management, and multi-network deployment are at the forefront of Ethereum innovation. These new protocols, along with the increased adoption and development of L2, should combine to help new users join the Ethereum ecosystem.

There are several non-DeFi catalysts on the horizon for Ethereum as well. This includes the increasing adoption and financialization of NFTs, for example through offerings from companies like GameStop and protocols like Score Art, and onboarding new users through crypto games.

This could be through play to earn, such as the launch of new games like Illuvium on the Axie Infinity and Immutable X networks.

Summary of results

About Ethereum

Ethereum is an open source, decentralized blockchain network. Ethereum is the technology that is home to digital currencies, global payments and applications. The community has built a thriving digital economy, offering creators new ways to make money online. It's open to everyone, no matter where you are - all you need is the Internet (taken from the Ethereum.org website).