After Avalanche and Fantom, which other public chain ecosystems are gaining momentum?

text

Looking back at the industry focus over the past period of time, the collective outbreak of new public chains is undoubtedly one of the most noteworthy trends.

From Solana to Avalanche, to Fantom and Terra, one after another Ethereum’s external public chains have achieved breakthroughs in secondary market prices, and at the same time ushered in vigorous development at the ecological level, driving a round of new public chains and their Side project "Xiaoyangchun".

However, although this round of market is quite strong, because it came too fast, except for a small number of forward-looking players who completed their layout early, most investors may not have received too many dividends.

If the coexistence of multiple chains and an interconnected world is really the future trend, then the story of the new public chain will obviously not end here. Looking around the public chain track, in addition to the star players mentioned above, there are also some projects that are not inferior in overall strength, but the pace of ecological construction is half a step slower. In this article, we will take stock of some of these high-quality representatives, and briefly sort out their recent key actions and ecological layout status.

One thing that needs to be stated is that this article does not constitute investment advice. It is only to talk about some subjective opinions based on the construction pace of major projects on the current public chain track. Readers, please don’t forget DYOR (do your own research).

secondary title

1. Harmony

Harmony is a high-performance public chain that focuses on state sharding.

Harmony's sharding technology combines its unique EPoS mortgage mechanism and VDF-based random number algorithm, which can take both decentralization and security into consideration. At the same time, Harmony's network layer optimization achieves the best cross-shard routing and fast block propagation.

The reason why I put Harmony first is because the status quo of this ecology is highly consistent with the paths of previous major ecological outbreaks:

From the perspective of "ecological incentive funds", on September 10, Harmony officially announced that it will provide treasury funds worth more than 300 million US dollars in the next four years to support ecological construction;

Judging from the "leading project banner effect", Sushiswap and Curve have been deployed on Harmony, and the proposal to introduce Aave was passed last month. Harmony intends to attract Aave to move in through huge financial incentives;

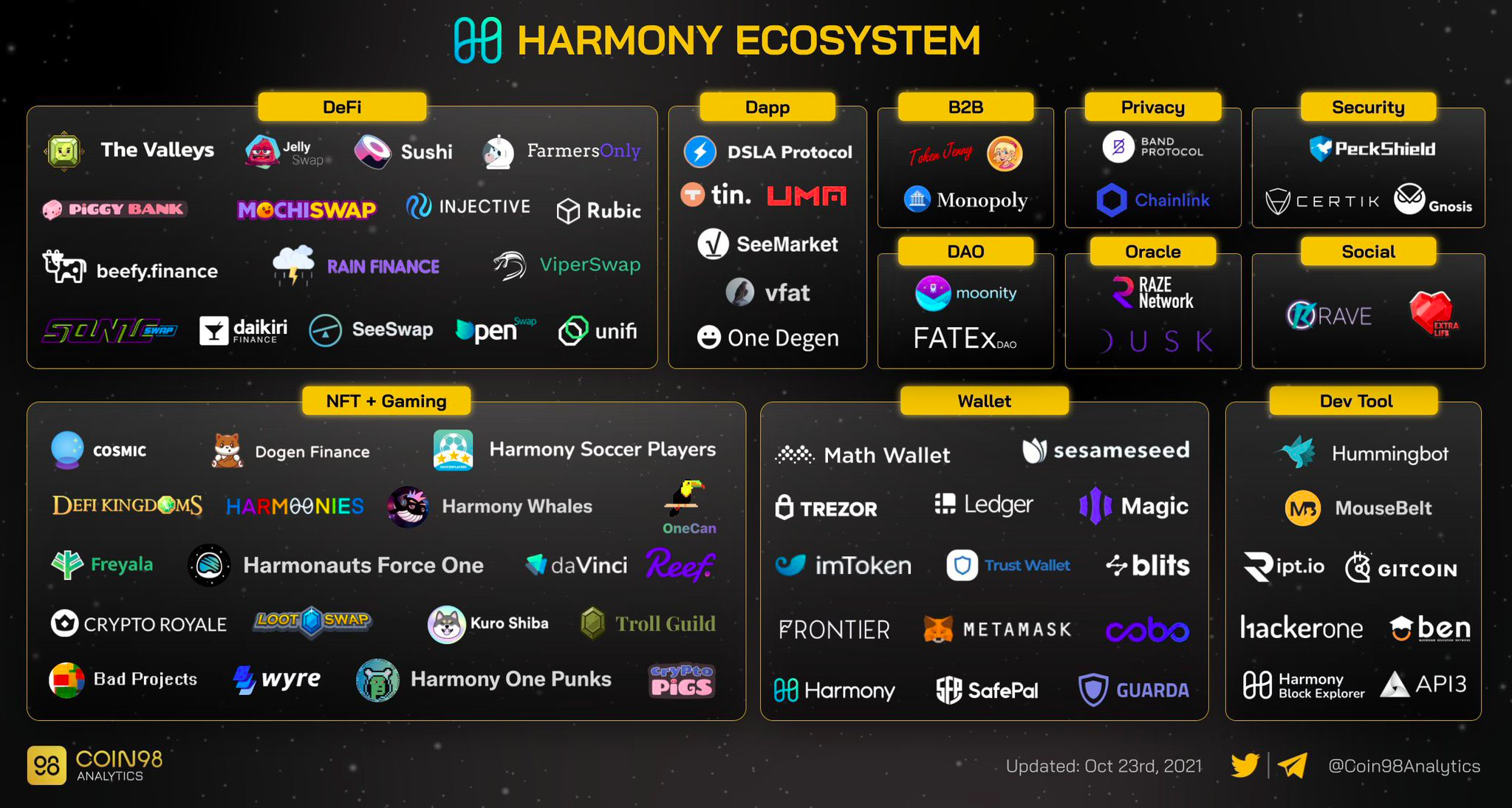

As for the progress of ecological applications, in addition to Sushiswap and Curve mentioned above, there are currently Defi Kingdoms, ViperSwap, and so on, which currently have relatively large overall liquidity in the Harmony ecosystem. From the perspective of product functions, these projects all belong to the subdivision track of DEX. There is still a certain market gap in the lending subdivision track. This situation is expected to improve with the launch of Aave and other similar projects.

secondary title

2. Celo

Celo is an emerging public chain that I like very much as a user. The biggest difference between Celo and other public chains is its main concept of "decentralized mobile payment". A very important part of this is to implement and promote DeFi applications on mobile devices.

At the end of August, Celo officially announced the "DeFi for the People" plan, intending to provide more than 100 million US dollars in funds for publicity, funding and incentives to promote the construction of the ecosystem. Among the first batch of partners of the program, we can see Aave, Curve, Sushiswap, 0x, UMA and many other leading DeFi applications.

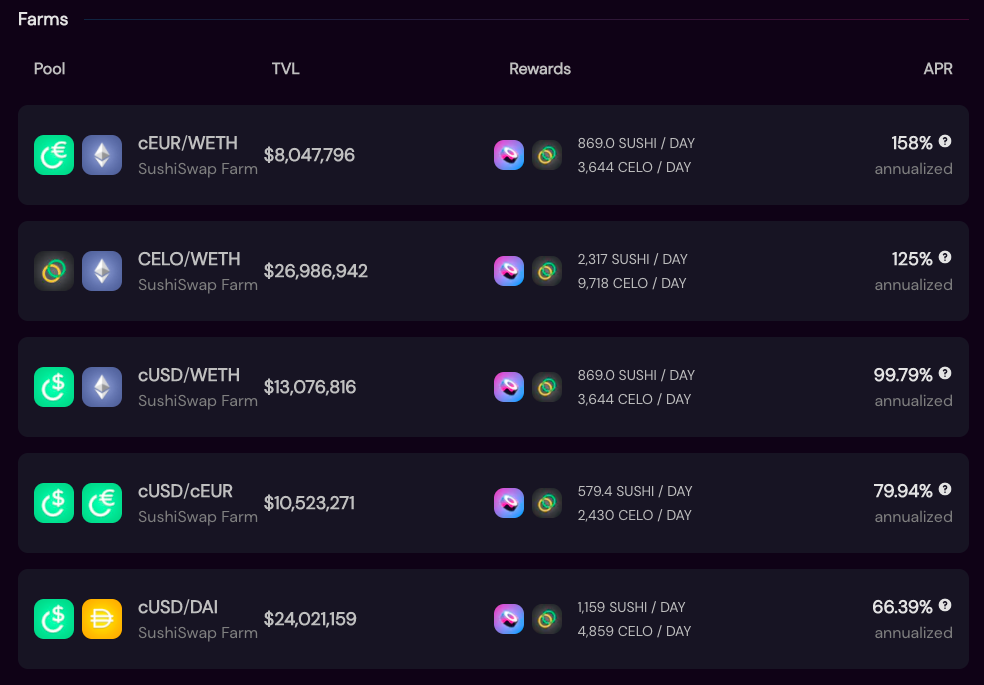

On October 14th, SushiSwap has launched a liquidity mining reward of US$12.6 million on Celo based on this plan. The current stable currency pair (cUSD/DAI) has considerable income. As of the evening of October 23rd, the annualized data can be Up to 60%+.

From an ecological perspective, the more mainstream applications in the Celo ecosystem have basically been selected for the "DeFi for the People" plan. In addition to the leading project mentioned above, it also includes the old non-destructive lottery project PoolTogether, as well as eco-native projects such as Ubeswap and Moola Market .

secondary title

3. Polkadot and its affiliated smart contract platforms (such as Moonbeam)

If the governance proposal #118 can successfully pass the community referendum, the Polkadot mainnet will officially launch the parachain slot auction on November 11, 2021, which also means that long-awaited projects in the ecosystem will gain access to the mainnet. Network opportunity, officially opened the prelude to the ecological construction of the Polkadot main network.

Due to Polkadot's unique blockchain architecture, its ecological construction rhythm is completely different from other public chains. Some of the factors mentioned above are not applicable to Polkadot's current situation, but considering the deep foundation of this king-level project, its The next movement and trend still deserves the market's high attention.

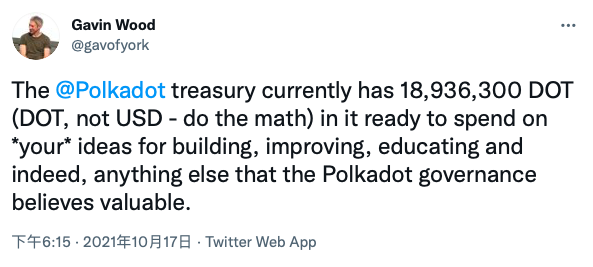

It is worth mentioning that on October 17, Gavin Wood tweeted that the Polkadot treasury currently holds 18,936,300 DOTs (note that they are DOTs, not U.S. dollars, and you can calculate the price yourself). The idea of education, and anything Polkadot governance deems valuable. This sentence is understood by many people as Polkadot’s response to the huge external ecological incentives.

At the ecological level, for the list of the highest-quality projects in the Polkadot ecosystem, you can directly refer to the projects that have previously won the Kusama Pioneer Network parachain slot, such as Acala, Moonbeam, Astar, Bifrost, Phala, etc.

In a sense, Moonbeam itself is more like the traditional public chain than Polkadot, which is also in line with the recent consensus crescendo view - Polkadot is more and more like a Layer0 relay protocol.

secondary title

4. NEAR

NEAR, which claims to have the most elegant sharding technology, is also one of the new stars that cannot be ignored on the public chain track.

From the perspective of the secondary market alone, it may not be appropriate to say that NEAR is still gaining momentum, after all, its token has risen so much. However, in terms of ecological data, whether it is the overall lock-up scale or top applications, the current performance of the NEAR ecosystem still has a certain gap compared with Avalanche and others.

Like the other major public chains mentioned above, NEAR has recently announced huge ecological incentives. On October 21, Proximity Labs, a research and development organization focused on investing in the NEAR ecosystem, announced that it will allocate 40 million NEAR tokens (worth more than 300 million US dollars) in the next four years to support projects, institutions and individuals based on NEAR development . It is reported that well-known projects including Curve, Sushiswap, and Dodo, as well as native projects such as Ref, Burrow, and Onomy, have reached cooperation with NEAR and will become early beneficiaries of the incentive plan.

Last week, Aurora just completed the first round of financing of 12 million US dollars, Pantera Capital, Dragonfly Capital and other well-known institutions participated in the investment, which may speed up the development of Aurora itself and the pace of construction of the entire NEAR ecosystem.

secondary title

5. Algorand

Different from other public chains, Algorand chose a path of "outward growth", that is, based on its rich academic and traditional industry resources, it links the blockchain and the traditional world, promotes the mainstream adoption of blockchain technology, and finally builds an A financial public chain that can serve the real business world.

Although there are differences in the development routes, the three elements proposed above are also applicable to the development of Algorand. On September 10, the Algorand Foundation announced the launch of the Viridis DeFi Fund, which will provide 150 million ALGOs (with a total value of more than 300 million US dollars) to promote the growth of the DeFi ecosystem on the Algorand chain. The fund's first move was the launch of two SupaGrants worth $5 million, designed to incentivize the community to build oracles and cross-chain bridge services.

At the ecological level, Algorand’s application system is still significantly different from other public chains. First, it mainly focuses on native projects, such as Yieldly, Tinyman, Algodex, etc. Second, there will be some projects related to mainstream financial markets, such as SIAE , Vesta Equity and more.

secondary title

The public chain war is far from over

Due to space limitations, this article cannot cover all the players on the track. It is just a brief summary of the projects that I am interested in recently from a subjective point of view.

Since the concept of the blockchain was born, the public chain has always been one of the most challenging and most value-capturing tracks. Now, with the outbreak of application layers such as DeFi and NFT, the status of the public chain is rapidly rising, and the competition within the track has also ushered in a new climax.