Why Layer 2 Can't Save Ethereum: Limited Composability, Fragmented Liquidity, and Friction

Text: 0xjim Compiler: Zion Editor: karen

Since Ethereum has been plagued by high gas fees due to its network overload, many have claimed that Layer 2 will be the cure-all: solving Ethereum's nasty gas problem forever.

Quite frankly, I thought so too until a few weeks ago - Ethereum would be the absolutely perfect crypto platform once layer 2 transactions on Ethereum hit critical mass.

But when I started digging into layer 2 solutions and started getting more involved in deep conversations around layer 2 on Twitter and Discord, I started to realize that while layer 2 is a very Both are needed and reasonable solutions, but they also have their own potential problems that could prevent the platform from reaching its true vision of being the world's supercomputer.

Layer 2 has its own potential problems that few people are aware of or talk about.

Still, Layer 2 is definitely a step in the right direction, and they will be needed even in the event of an eventual merger of ETH2 later this year. They provide throughput and speed that cannot be achieved purely on the Ethereum 2.0 layer 1 network.

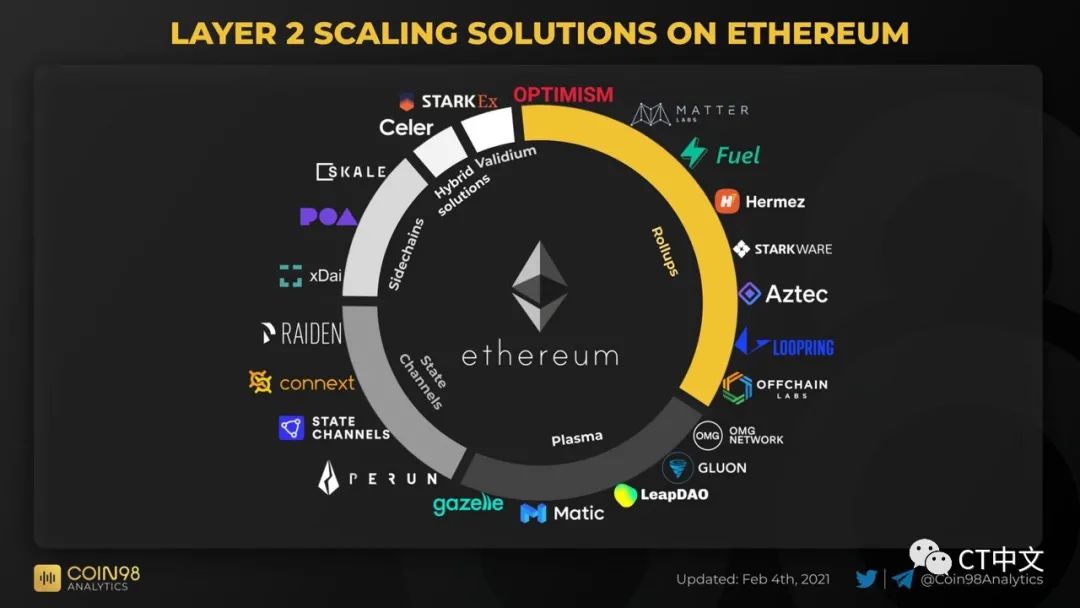

But they are far from perfect. Maybe that's the way, there are so many solutions to scale Ethereum: sidechains, subchains, payment channels, roll-up...

first level title

limited composability

Yesterday, I talked about the real power of decentralized finance is composability - derived from the open source nature of the technology.

In my personal opinion, composability is the strongest aspect of DeFi.

Yes, open finance is great -- allowing unprecedented access to financial services, something that is inaccessible to nearly 2 billion people in the world.

Equally great, for the first time since the rise of Web 2.0, individuals are taking back control of their finances, data, and possessions from intermediaries like Facebook, banks, etc.

But for me, the added composability is really important. It creates entirely new, never-before-seen financial products and changes the way we look at finance.

My heart sees DeFi, a network of never-ending innovation. Like how the internet created companies we never imagined in the 90s: Netflix, Postmates, Zoom.

Unfortunately, with the implementation of layer 2, composability may be limited - or completely disappeared - because the layer 2 does not currently interoperate.

In other words, one layer 2 application cannot easily communicate with another layer 2 application - defeating the power of composability.

On L1, a transaction can interact with multiple DeFi protocols to create a brand new financial product.

On L2, transactions can only interact with DeFi protocols that exist on its own chain.

For example, Aave is only available on Polygon, and Uniswap is only available on Optimism. We cannot conduct a transaction that calls both Aave and Uniswap smart contracts.

Due to this fragmentation, composability is limited, and thus the magic of DeFi is greatly limited.

fluidity

fluidity

Another problem with the fragmentation of Dapps on different L2 chains is that their associated liquidity is also fragmented.

Liquidity is very important in any financial market because it provides a healthy market where buyers and sellers can meet and exchange goods in the open market without making too much compromise on buying and selling prices, or Will cause wild price fluctuations.

Currently, all liquidity exists on Ethereum - which provides a healthy and deeply liquid market for all financial products and tokens on the platform.

first level title

friction

Finally, as we are approaching the end state of a multi-chain L2 world on top of Ethereum, there will be serious friction in moving between each L2 in order to interact with DeFi.

We will likely see a lot of bridges between L2s, so when we try to move funds between chains, expect long transfer times.

Multiple accounts are also expected - one or more for each L2 chain. From a user experience standpoint, keeping track of funding for these scaling solutions will be a headache.

Let's say we have AAVE on Polygon and we want to swap it for UNI using Uniswap on Optimism.

conclusion

conclusion

Of course, these issues are certainly fixable, and likely will be soon after all major L2 scaling solutions are publicly released - thanks to the firepower of the Ethereum developer community.

I think we'll eventually see some integration in the L2 space -- a few winners will emerge based on the strengths of each technology.

I hope there will also be a strong interoperability protocol between them to keep composability and fluidity - either through the Polygon framework or through a strong L2-to-L2 bridge network.

Anthony Sassano said it best:

You can think of what's happening now in the second layer ecosystem as an "adopt and innovate" phase, where many different solutions are being tried and tested at the same time. Of course, not all solutions will be successful in the long run.Ultimately, I don't think any single solution will "win" the scalability war. As I said, each scalability solution has its own advantages and disadvantages. Some are great for payments, some allow EVM compatibility, and some offer greater scalability at the cost of decentralization.

Editor's note: The original title is "Layer 2 Won't Save Ethereum", and the title of this article has been modified according to the readability of the communication channel.