Insight into the development of the stablecoin market: the development of centralized stablecoins is hindered, and the rise of decentralized stablecoins

Text: Morty Editor in charge: karen

Stablecoins have become one of the most common and practical value mediums in the crypto market. In the early days of the development of the encryption market, the basic asset in the eyes of investors is BTC, and other cryptocurrencies need to be exchanged with BTC. However, the huge volatility in Bitcoin's early days has led to greater risk exposure for crypto investors.

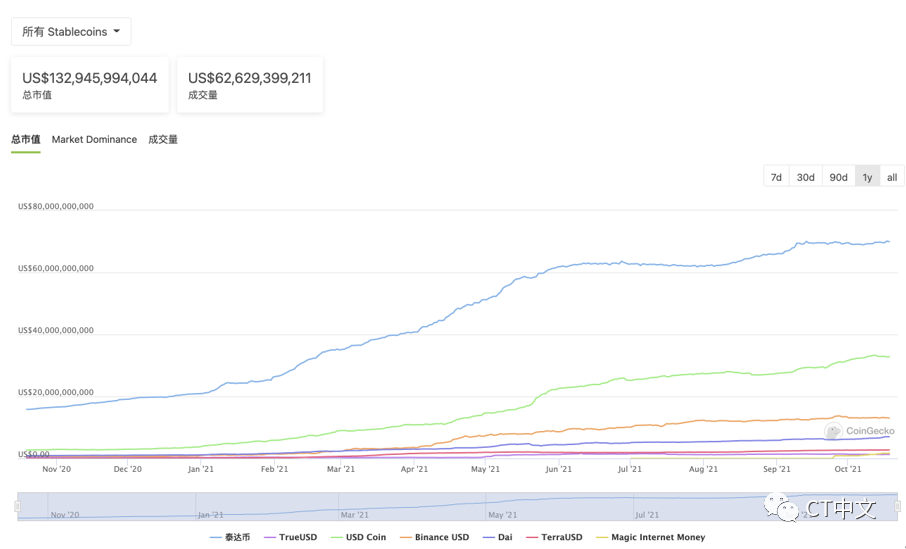

The Rapid Expansion of the Stablecoin Market

The Rapid Expansion of the Stablecoin Market

Usually the USDT, USDC and DAI we mentioned are USD stablecoins, pegged to USD value. We can divide the types of stablecoins into centralized stablecoins and decentralized stablecoins according to different issuing institutions.

USDT, USDC, etc. are centralized stablecoins issued by two centralized institutions, Tether and Circle. DAI, UST, USDN, etc. are decentralized stable coins. DAI, UST, etc. are basically minted by over-collateralization of encrypted assets to avoid being affected by fluctuations in the value of encrypted currencies.

In addition, a very special type of stable currency has emerged in the DeFi world-algorithmic stable currency. Protocols such as Fei Protocol and OlympusDAO are all algorithmic stable currency protocols. However, the algorithmic stable currency is more like a social experiment on human nature in the DeFi world, and it will take time to test whether it can really succeed.

Why?

Why?

Because the U.S. dollar is the most liquid asset in the world, both Tether and Circle support the 1:1 exchange between USDT, USDC and the U.S. dollar. In the era of the flood of the new crown crisis, the liquidity of the US dollar has reached the point of flooding.

first level title

The Potential and Future Development of Stablecoins

Today, stablecoins have become an existence that cannot be ignored in the encryption market. Whether it is deposits and withdrawals or cryptocurrency exchange, we need to use stable coins to complete.

In addition to being widely used in encrypted market transactions as a basic trading pair, stablecoins are also used in many real-life scenarios, including:

1. Cross-border remittance: The average time for a normal international remittance to arrive is 3-5 working days, and we need to go to the bank to handle it, while the stable currency remittance only takes a few minutes;

2. B2B/B2C payment: With the development of globalization, distributed offices and borderless capital markets need to use encrypted stablecoins to pay salaries or make borderless investments;

3. Digital economy: The expansion of leading companies around the world will also face payment problems-people in different countries have different payment methods. In addition to active localization, these leading companies are also considering accepting stablecoins/cryptocurrencies for payment.

The stable currency solves the complex and cumbersome problem of cross-border remittance process, and greatly simplifies the transfer/payment process. It is foreseeable that in the future development and transformation of the digital economy, it will gain a large number of enterprise-level adoption.

Source: CoinGecko

Source: CoinGecko

Therefore, we have reason to believe that with the expansion of the encryption market and the development of the DeFi ecosystem, the use cases and adoption of encrypted stablecoins will become more extensive. At the same time, encrypted stablecoins will also be endowed with more practical significance during the development process. These factors will further promote the development of the stable currency market value.

Resistance to Stablecoin Development and the Rise of Decentralized Stablecoins

Thanks to its inherent secrecy, cryptocurrencies are one of the important ways to avoid regulations and taxes. Therefore, as the market value of encrypted stablecoins continues to grow, this problem has gradually become an "elephant in the room" and cannot be ignored. Financial regulators have also begun to focus on the use of encrypted stablecoins.

The FSB (Financial Stability Board) issued a report stating that in order to address regulatory arbitrage and harmful market fragmentation risks, as well as the greater financial stability risks that may arise from the entry of stablecoins into the mainstream of the financial system, effective international regulatory cooperation and coordination are essential. National implementation of global stablecoin regulatory recommendations is still in its early stages, and international coordination is key to overcoming regulation.

And the boots of regulation have already begun to fall.

The issuer of the stablecoin USDC, which focuses on compliance, stated on October 5 that it had received an investigation subpoena from the US SEC law enforcement agency in July 2021. The SEC asked Circle to provide "documents and information about certain assets, client programs, and operations."

Regarding the focus of supervision, Andre Da Roza, a lawyer from Hong Kong's Allen & Overy law firm, believes that the lack of transparency of stablecoins and their mortgage methods is a key issue facing regulators.

Bloomberg also pointed out in the article "AnyoneSeen Tether's Billions?" that people have remitted $69 billion in cash to a company that is almost stitched with red flags. Most participants in the cryptocurrency market, including some very large and complex operators, do not seem to care about any risk.

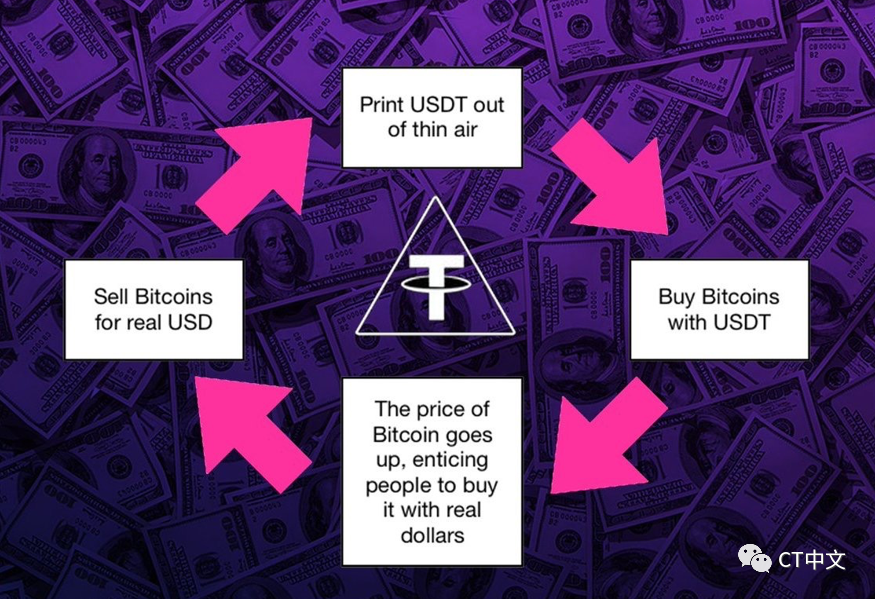

In addition to this, there is also the view that Tether has been artificially pushing up the value of BTC by injecting USDT worth hundreds of millions of dollars.

Twitter @CryptoWhale believes that Tether’s purpose in doing so is to create enough FOMO (fear of missing out) to attract more people to trade cryptocurrencies and pave the way for their profitable behavior. This time Tether used the huge benefits of BTC ETF adoption as a cover for their huge fraud.

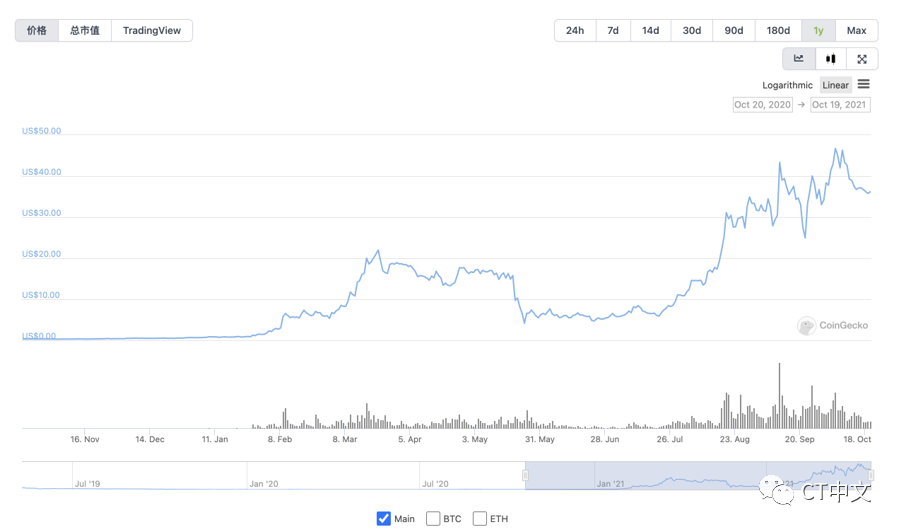

The risks faced by centralized stablecoins are actually opportunities for the development of decentralized stablecoins. Let’s put aside algorithmic stablecoins for the time being. In the process of rapid development of the DeFi ecosystem, the market size of decentralized stablecoins minted by over-collateralization has also achieved considerable development.

The market value of DAI mentioned above has reached 7 billion US dollars, and the market value of UST is 2.7 billion US dollars.

However, since the use cases of decentralized stablecoins are generally concentrated in the fields of Compound and AAVE mortgage lending, the adoption is not high, so it cannot promote the further increase of the market value of decentralized stablecoins.

Source: CoinGecko

Source: CoinGecko

As the risks faced by centralized stablecoins become more apparent, the adoption of decentralized stablecoins will gradually increase. However, it should be noted that due to the high threshold in the encrypted world and the influx of emerging investors, the paradigm shift of stablecoins from centralization to decentralization will occur subtly rather than rapidly. And this will also promote the steady expansion of the entire stablecoin market to a trillion-dollar market value.