Tether CEO deletes Twitter account, its systemic risk sparks controversy again

Compiler: Chen Zou

Compiler: Chen Zou

The theory of Tether's collapse has been a ten-thousand-year-old stalk in the encryption community. At present, there are thousands of articles about the risks related to Tether, basically based on its lack of transparency and misleading the public.

I hope we have some clarity, if we don't act fast, bitcoin could drop below 1k. It's always been very difficult to tell our clients something real, which has fueled uncertainty in the market.

-Bitfinex & Tether CFO, Giancarlo Devasini, "Merlin"(October 2018)

Just before 2019, Tether had claimed that each USDT was backed by an equal reserve of U.S. dollars. But no financial institution has been able to confirm this, and Tether has never been publicly audited by a reputable accounting firm.

Tether CEO Jean-Louis van der Velde's deleted his Twitter account last week after a Bloomberg report questioned Tether's reserve backing. So far, Tether has not been able to convince anyone on its reserves. But it tried to dispel public doubts by releasing some fragmented information, but it only further aroused public dissatisfaction, and at the same time added another stroke to Tether's criminal evidence.

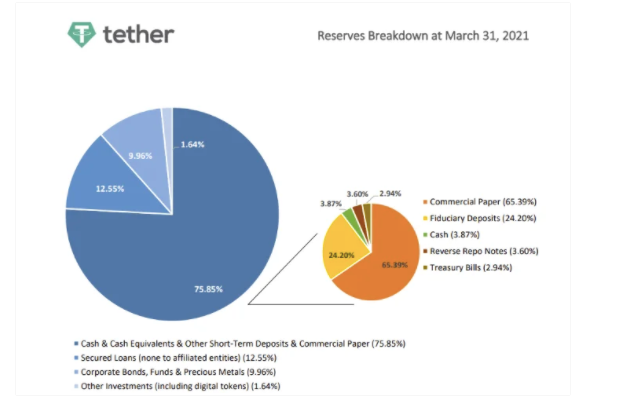

This is a visualization icon of reserve assets announced recently by Tether. It is said that Tether will provide the transparency that the public has expected for many years in the near future, but it is in"Commercial paper"Recently

Recently

Since Tether’s inception, researchers and skeptics have frequently attacked Tether on three fronts:

Lack of transparency on so-called reserve assets backing USDT 1:1

Its link to unregulated offshore exchange Bitfinex

Deals with shadow banking organizations around the world.

Tether responded to public doubts in a rather perfunctory manner. After all, a customized icon can be done in 10 minutes, and this is Tether's unrivaled transparency.

Commercial paper

Tether has $30 billion in commercial paper, according to the unidentifiable icon. The market for commercial paper is actually not as large as imagined, and many evidences show that Tether is not one of them.

Federated Hermes,Deborah Cunningham, Chief Investment Officer of Inc. Global Liquidity Markets, said in an interview with Bloomberg,

"It's a small market with lots of people who know each other. If a new person comes in, it's usually very conspicuous."

The current regulated commercial paper market is actually very small, but there are still many gray and even black areas in the offshore market.

Private issues"Private issues", which was not the sensible answer the public expected.

black box

Tether's lack of transparency is mainly due to its dealings with various gray assets. Financial Time has disclosed that it lent $1 billion to Celsius Network, which has come under scrutiny from regulators across the U.S. for offering some unregulated financial products, mostly high-yield products.

The investigation found that Tether used bitcoin as collateral to loan billions of dollars to the cryptocurrency company Celsius Network.

—— Financial Time

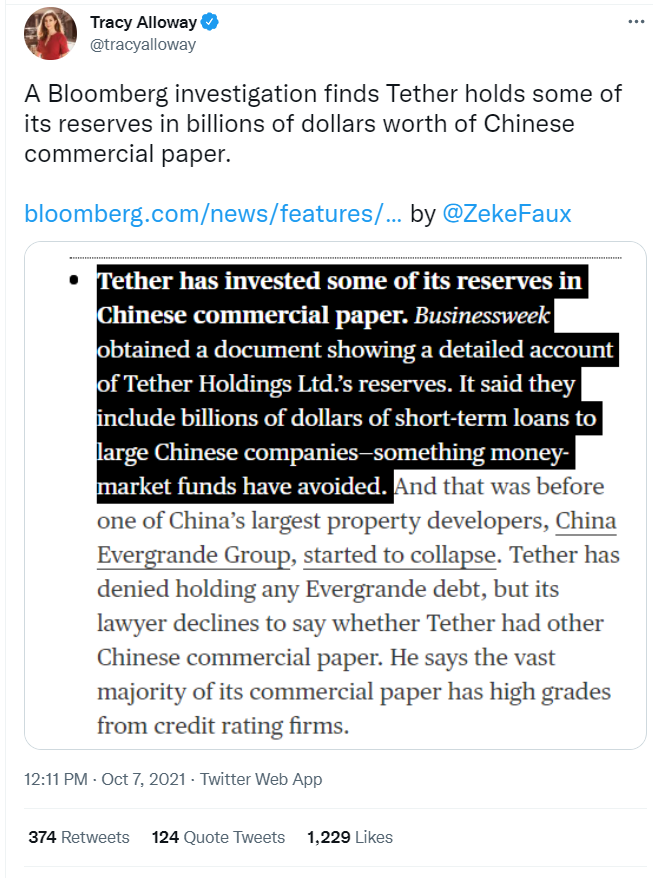

Since Tether does not disclose its partners and what it calls"Commercial paper"The name of the issuer of the short-term debt has made people increasingly inclined to speculate on the worst outcome-a large part of USDT loans are lent to Chinese companies, and Evergrande may be one of them. And recently, Tether announced that it does not hold any commercial paper from Evergrande.

These concealing methods made investors more convinced that Tether was hiding some shady facts, but in the end investors had no choice but to choose to believe these Tether executives, although no one could find any actual data to prove what Tether executives said the words said.

Tether CEO Deletes His Twitter Account

The Twitter account @urwhatuknow originally belonged to Tether CEO Jan Ludovicus van der Velde has reportedly been deleted.

It seems that the Tether CEO (or someone else who controls the account) deleted the Twitter account, which happened just after Bloomberg disclosed the risks of Tether, making people want to speculate about the truth behind the matter.

A similar account exists on the bitcointalk forum (nicknamed urwhatuknow, source), but it appears that the account was hacked in 2018.

The only information about him found in Italian newspaper searches showed that he had been fined for selling pirated copies of Microsoft software.

--Bloomberg

Perhaps deleting an account is an easy solution for any regular user who feels that social media is becoming a burden. But for the executives of a $70 billion company, this is a matter of principle. In particular, the act of deleting accounts occurred after the public once again had one of Tether's reserve issues.

Instead of trying to fix the problem, Tether executives seem to be ignoring the public completely, offering vague reserve estimates in the form of pie charts, and even blaming 99% of individuals who question Tether's practices for artificiality."mujahideen"(People who use justice as an excuse to achieve their goals by any means).

Tether’s lawyer, Stuart Hoegner, told me on the phone that Van der Velde and Devasini wanted to stay out of the public eye. He called Tether's critics"mujahideen", they want to destroy the company.

-- Bloomberg

I don't think anyone wants to destroy Tether. The business management department should be responsible for the survival of a company, rather than passing this responsibility to investors. As long as the business model of the enterprise is built on a solid foundation, then the enterprise will survive. But if the foundation doesn't exist, it does provide an excuse for the impending collapse.

The results of Tether PR only made things worse, and these executives constantly tried to convince the public with unconvincing data. Clearly the public is not stupid, especially when the evidence you present has no confidence in it.

Bitfinex

Bitfinex is registered in Hong Kong as RenRenbee PTE. Co., Ltd. and has obtained a license to engage in financial business. At a time when MtGox has collapsed and the cryptocurrency market is facing various difficulties, this license has helped Bitfinex create a pretty good reputation in the market.

Although, Bitfinex, ended up suffering a similar fate as MtGox. It announced in August 2016 that it had been hacked and lost 120,000 bitcoins. While the hack had many fallout, Bitfinex created"Unus Sed Leo "Tokens, used to repay its customers for lost BTC. The hack has raised many questions in the blockchain space, as well as many questions about the credibility of Bitfinex.

In November 2017, Bitfinex's Hong Kong license was revoked.

After the license was revoked, Bitfinex moved out of Hong Kong, officially, but it likely never operated in the region. About a year later, Bitfinex said it was registered as a financial entity in the British Virgin Islands.

Which entities back Tether, and why?

So far, Tether has been good at finding regulatory loopholes around the world. The lobbying strategy made Tether what it is today. Tether provided an artificial support line for the BTC price and largely disrupted the market. And now the power from the bitcoin lobby has multiplied 10x, just like the price of bitcoin.

The obfuscation of who supports and lobbies others to support Tether is verifiable, and all of this is related to Blockstream, a group that currently controls the development of Bitcoin. Blockstream executives, some of Tether's top supporters, have touted USDT but struggled to provide convincing arguments. So they employed the same tactics as Tether executives — berating journalists and hitting back at those who asked real questions. This is very similar to Tether's tactics, accusing anyone who asks a similar question is FUD.

Samson Mow is Blockstream's CFO.

Summarize

Summarize

"This article is simply an attempt to perpetuate false and stale anecdotal information about Tether based on innuendo and misinformation spread by disgruntled individuals who have no involvement in or direct knowledge of how the business operates"

- Tether's response to Bloomberg article, Yahoo Finance

Once again, Tether reacted aggressively to those who questioned its practices. But most importantly, its response is based on the fact that journalists and those individuals who want answers and research on the topic do not have direct knowledge of how businesses operate.

This is true. Tether has been hiding its operations and business practices in various subtle ways. With no shred of transparency, it's natural to assume the worst, and in this case, those guesses are often the truth.

The current war on Tether has just begun. And when Tether collapses, Bitcoin will also be destined to generate huge volatility, and this is exactly the purpose of BTC whales lobbying American politicians who are in need of economic support.

This article is from Bitpush.News, reproduced with authorization.

This article is from Bitpush.News, reproduced with authorization.