Federal Reserve: CBDC issuance will make USDT and other stablecoins disappear

Foreword:

Foreword:

This article introduces the characteristics of CBDC and stable currency, and discusses whether CBDC can replace stable currency. (This article has a total of 2414 words, and the reading time is about 5 minutes)"Recently, Federal Reserve Chairman Jerome Powell said:"If a CBDC is issued, there will be no need for stablecoins.

Recently, major countries in the world are increasing their research on CBDC. A stablecoin is a virtual asset whose value is pegged 1:1 to the U.S. dollar. This article lets us look at the potential of CBDCs and stablecoins by comparing their main characteristics.

The most stable digital asset issued by the state and private sectors

Since its value is pegged to the major currency, the U.S. dollar (USD), it is called"stable currency"stable currency

The advantage of stablecoins is their flexibility. Since it is a branch of virtual assets, transactions are very fast regardless of the country. Because of this, it replaces the U.S. dollar as the key currency in the virtual asset market, and many exchanges support virtual asset transactions with USDT as a trading pair. Users can buy USDT with Korean Won and trade it, or sell virtual assets and convert them to USDT. USDT is popular because it can be easily exchanged back to USD.

image description

The value of USDT is fixed at $1 (Source = CoinMarketCap)

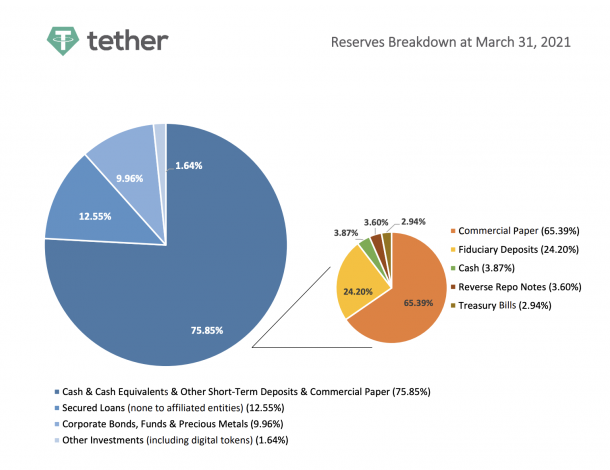

CBDC leads the way in terms of value and payment reliability"So let’s compare CBDCs and stablecoins. What both have in common is that they are easily exchangeable and manageable digital currencies that have the same value as fiat currencies. However, CBDCs are superior to stablecoins in terms of value and payment reliability. Because in stablecoins, temporary value changes sometimes occur due to sudden demand and supply changes, while the main body of CBDC management is the central bank, so the value volatility is zero. In terms of payment reliability, CBDCs are also leading the way. The value of CBDC is guaranteed by the central bank and can be exchanged for legal tender at any time. For stablecoins, the cash reserve of the issuing unit determines the reliability of its payment. For example, if 10,000 USDT is issued, the Tether account should also be prepared with 10,000 USD in cash so that users can exchange USDT for USD at any time. The problem is that the proportion of Tether’s cash holdings is not high. Tether’s asset details released for the first time in May this year showed that out of 75.85% of the cash assets, the proportion of cash was only 3.87%, which caused controversy. If Tether has a large outflow of short-term deposits due to some kind of problem"If the phenomenon occurs, then Tether cash payment will be very difficult. Unlike banks, holders do not have access to legal aid at this time. That said, in terms of reliability, CBDC wins out.

image description

As of March 2021, Tether's paid assets, cash is only 3.87%

In terms of utilization rate and expansion in the virtual asset market, stablecoins are winning

In terms of currency use, the situation is somewhat different. The downside of a CBDC is that it is a legal tender and its use will be largely limited to within the borders of the country. In contrast, stablecoins can be used anywhere in the world and have the same value. Therefore, stablecoins have more advantages in the role of trading media between different types of virtual assets in the world. For example, on the 20th, MasterCard began testing a service that allows users to make payments after converting them into USDC within the system when they request payment from a merchant that owns virtual assets. This is an attempt to expand the use of virtual assets in day-to-day transactions through the use of stablecoins.

By using the relatively simple blockchain network instead of the complex network of bank transfers, the time and fees of the transfer process or exchange are significantly reduced. The potential of this stablecoin can be seen through the Libra (DM) project previously led by Facebook. Initially, Libra was highly anticipated as a large-scale stablecoin project linked to global currencies, but it was stranded due to government pressure due to concerns about negative impacts on global monetary policy. Whether countries allow the use of stablecoins is the key. Judging from the characteristics alone, it is very unlikely that CBDC will completely replace stablecoins. Besides being the same blockchain-based digital currency, the two assets differ in their detailed characteristics and uses. However, considering the risks from a political point of view, the status of stablecoins is somewhat unstable in the recent atmosphere.

At present, major virtual asset market countries such as the United States, China, and South Korea hold negative positions on the virtual asset market and the virtual asset system circle. Recently, there has been a regulatory trend towards stablecoins in addition to Bitcoin."Recently, U.S. Treasury Secretary Janet Yellen"Urged on the Internet to develop a regulatory plan for stablecoins within a few months. Recently, the market capitalization of the world’s major stablecoins has grown exponentially, exceeding $110 billion (about 126 trillion won). Exchanges holding stablecoins are free to transfer assets abroad, and unrestricted foreign exchange outflows can lead to problems with foreign exchange management policies, which financial authorities consider to be the main risk. At the same time, there are concerns that stablecoins could be misused for money laundering because they are an easy way to obtain dollars. For this reason, the virtual asset exchange Aprobit stopped supporting USDT transactions on the 8th to prevent legal risks caused by stablecoins in the special payment law business declaration. On the same day, the Bank of Korea also provided the "Research on Stablecoin Regulatory Trends and the Role of the Central Bank". While observing the trend of managing stablecoins at the national level, the focus of attention is whether stablecoins can escape the fate of being restricted.

Conclusion:

Conclusion:

When a user uses CBDC, the user's financial status and payment details are traceable. This is different from the anonymity of general virtual currencies. It is impossible for a state-issued CBDC to allow users to pay merchants anonymously when spending money on goods. Therefore, the popularization of CBDC in the next few years is the general trend. However, judging from the characteristics of CBDC and stable currency, the two are likely to coexist peacefully. The key lies in the attitude of the national government towards stable currency.