What are the questions worth thinking about behind the explosive digital art track NFT?

guide

guide

The use value of NFT and physical collectibles is very different, and the rights of ownership are also quite limited.

NFT has created a fiery financial market, and the underlying value and artistry of digital assets are overshadowed by interests.

From secondary creation to direct theft, from digital artwork to tweets, theft in the NFT market is still rampant.

When the same digital asset can be uploaded on different chains, the non-homogeneity and exclusivity of NFT will be challenged.

NFT lacks the protection of legal enforcement means, and due to the anonymity of the blockchain, it is very difficult to safeguard the rights of NFT.

Cryptocurrency is moving closer to supervision under the measures of various countries to combat money laundering, and NFT may eventually be regulated.

The internal contradictions of virtualization and decentralization, as well as the external contradictions of speculation make NFT stay on the impossible ladder.

After the concept of NFT was implemented, many people seemed to see the savior of digital assets in the virtual world where fish and dragons are mixed together. The debate on the Internet and copyright has been going on for more than 20 years since the Internet became widely used by consumers in the mid-1990s. On the one hand, the Internet has broken the physical limitations of time and space, allowing various digital assets such as music, paintings, novels, etc. to attract a large number of audiences with unprecedented diffusion, but on the other hand, the zero-cost replicability of the Internet exposes digital assets Under various acts of theft and plagiarism.

Traditional copyright protection laws can play a leading role in the physical world, but when applied to the virtual network world, it becomes stretched. At the same time, large technology companies such as Amazon have monopolized the sales of virtual digital works, and various original authors have not been able to reasonably share their due profits. At this time, NFT came head-on with a new solution.

NFT (Non-Fungible Token) is a non-homogeneous pass. By using specific digital assets or physical assets as digital units and creating a series of identifiable data blocks stored on the blockchain, a traceable and non-tamperable token. Non-homogeneity means irreplaceability and uniqueness, so NFT can be used to verify ownership and allow transactions and sales on the digital market. It should be noted that NFT usually has ownership and does not grant copyright to the buyer.

"Ownership refers to the right of the owner to possess, use, benefit from, and dispose of his property according to law. Ownership is the most important and complete right among property rights, with three characteristics: absolute, exclusive, and perpetual. , including the four powers of possession, use, income, and disposal.

Copyright, also known as copyright, includes the following personal rights and property rights: right of publication, right of signature, right of modification, right to protect the integrity of works, right of reproduction, right of distribution, right of rental, right of exhibition, right of performance, right of projection, right of broadcasting, right of information network dissemination rights, filming rights, adaptation rights, translation rights, compilation rights, and other rights that should be enjoyed by the copyright owner. "

Simply put, NFT has the following advantages:

1. As a non-homogeneous token, it provides the only proof of property rights for digital assets and realizes the integration of data and assets.

2. Creators of digital art can profit from each transfer, which better protects the rights and interests of creators.

3. NFT can be combined with smart contracts, which is more convenient than physical assets in terms of promotion, transaction, payment and delivery.

secondary title

1. Platonic collections

If you own a pair of Van Gogh's "Sunflowers", the owner can hang it on the wall, let the gorgeous bright chrome yellow light up the whole hall, and also can enjoy the flowers blooming like burning flames up close, and there is no other place in the world No one else can own this authentic painting like him. The uniqueness and rarity make owning this painting extremely satisfying. This is the physical and psychological value of owning collectibles.

But when I own a valuable NFT of a cypherpunk avatar, a low-pixel avatar full of rock and heavy metal temperament, the visual experience I can enjoy is no different from that of the public, and anyone can download and use it at will. Therefore, the meaning given to collectors by NFT is not in use value, but in psychological value. The meaning of NFT is to have the sole ownership of digital artworks. This mechanism establishes a direct connection between the creator and the collector, just like getting a message and autographed photo written by an idol. This emotional connection is unique and irreplaceable. Replacement. The emergence of NFT has shaken our traditional perception of "owning" collectibles. Compared with other physical collectibles, owning NFT is more like a pure platonic love that pursues spiritual communication. It would be wonderful to say that this is a higher and purer respect and love for digital artworks.

In addition, there are few exports that NFT can satisfy the owner materially, mainly relying on issuance and resale to make profits. Although the rights of NFT owners are limited, the crazy growth of NFT and the record high NFT auction price tell us that things are not simple. A large number of opportunists smelled new business opportunities, gathered in groups and stared at them, constantly looking at the NFT market, and ready to divide the benefits from it at any time.

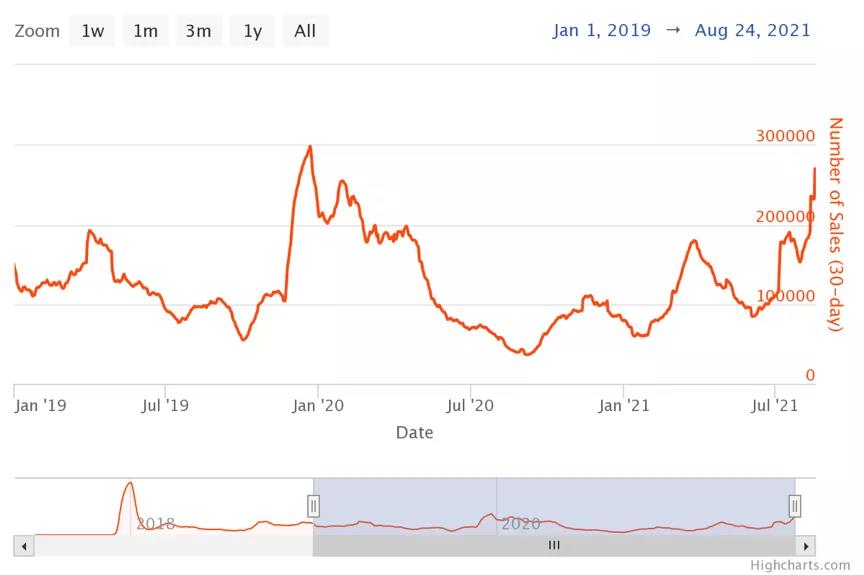

According to nonfungible statistics, in recent years, the sales volume of NFT has fluctuated within a certain range, but sales have experienced unprecedented breakthrough growth since July 2021. In contrast, the trend of prices pushing up the value of NFT is very obvious. On the one hand, with the addition of more well-known artists and leaders in various industries, the quality or popularity of NFT has increased. But on the other hand, the crazy rise in prices is also indispensable for the bubbles stacked in it.

image description

Total NFT sales

Data source: nonfungible

secondary title

2. Crazy and senseless copyright infringement

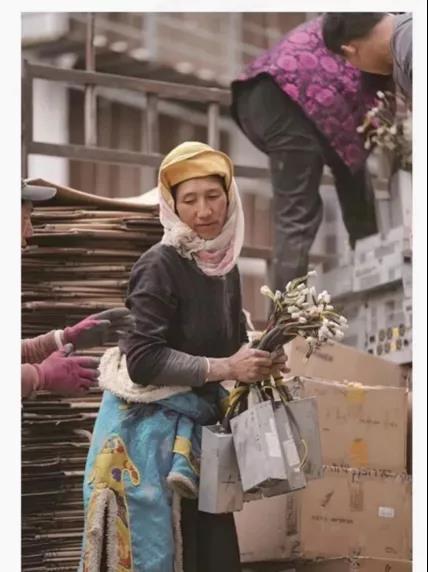

In July this year, when the mine in Sichuan was cleared, a photo titled "Summer Dora Moving the Mining Machine" became popular on the Internet. In the photo, the expression of the Tibetan woman is full of narrative sense, the cable in her hand resembles a wheat ear, the whole picture is full of warm yellow tones, and the rich colors of Tibetan costumes are dissolved in it. This picture records the historic moment of the closure of the Sichuan mine with a very artistic atmosphere, and it reminds people of the French painter Jean-Francois Millet's "The Gleaners".

In July this year, when the mine in Sichuan was cleared, a photo titled "Summer Dora Moving the Mining Machine" became popular on the Internet. In the photo, the expression of the Tibetan woman is full of narrative sense, the cable in her hand resembles a wheat ear, the whole picture is full of warm yellow tones, and the rich colors of Tibetan costumes are dissolved in it. This picture records the historic moment of the closure of the Sichuan mine with a very artistic atmosphere, and it reminds people of the French painter Jean-Francois Millet's "The Gleaners".

But soon, this photograph was re-created and named "Woman Holding a Bouquet" and uploaded to Opensea in the form of NFT. The painting style of the second creation draws on the stained glass of the church, which adds a religious and mysterious atmosphere compared with the original painting. The painting was fired to 2021 ETH. The original picture is from Caixin's article "Development | China Farewell to Bitcoin "Mining"", and the second creation is from a mysterious creator with the account name username2021, and the original creator's consent was not obtained in the process.

This kind of secondary creation without the consent of the creator, or even direct copying and making as NFT for profit is not uncommon. A digital artist with the pseudonym Weird Undead, after publishing multiple digital paintings, discovered that his works had been stolen and sold as NFTs on OpenSea. Weird Undead and her fans subsequently filed a series of legal notices to OpenSea, and it is reported that Weird Undead imitators have been using IDs called Tokenized Tweets to sell the creator's works. Weird Undead called it a "crazy and senseless copyright infringement"

In addition to encrypted artwork, the tweets of some "reputable" celebrities in the encryption industry have also been secretly made into NFT auctions. Since Twitter CEO Jack Dorsey auctioned his first tweet and sold it for a high price of 2.9 million US dollars, many thieves began to extend their claws to the Twitter of some famous people. These include Meltem Demirors, chief strategy officer at CoinShares, and Neeraj Agrawal, communications director at Coin Center. These big names have expressed their dissatisfaction and concerns on Twitter.

""The NFT crowd... is behaving like a total cult"

"I've never had such backlash before, and I've been very vocal on very intense topics like Trump, racism and sexism.""

A well-known international visual artist who has written several graphic novels told ABC Science News that he has been harassed online for refusing to sell his work in the form of NFT.

From secondary creations to outright theft, from digital artwork to tweets, rampant theft exemplifies the dark corners of the bright future of the NFT market. These corners are the carnival of the thieves who claim to "protect originality and respect copyright", but it is also accompanied by the worry, anger and even fear of the original creators. When thieves are the first to make NFTs of works that do not belong to them, where are the original creators? When the original creator uses his work again, he is regarded as an imitator. Isn't this the tragedy of NFT?

secondary title

3. The predictable fate of NFT being regulated

At present, each digital asset can generate a unique hash code and stamp it with a time stamp, upload it to the blockchain and anchor it to the Ethereum public chain to complete the deposit. Most of the NFTs are carried out on the Ethereum public square. However, with the development of blockchain technology and the growth of different public chains, if the same digital asset can be uploaded on different chains, the non-homogeneity and exclusivity of NFT will be challenged. Imagine that when two or more people hold real estate certificates for the same real estate issued by different institutions, the credibility of such certificates will inevitably be greatly reduced. The same is true for NFT. Non-homogeneity endows its underlying assets with uniqueness, but when this homogeneity is broken, the issue of digital asset confirmation goes back to the origin.

In addition, as a decentralized ownership protection mechanism, NFT lacks the protection of legal enforcement means, and due to the anonymity of blockchain accounts and wallets, NFT rights protection is very difficult. On the one hand, NFT is likely to be resold to countries that lack intellectual property protection, so NFT is out of legal constraints and protection; Rights require a sound protection mechanism.

In addition, due to the anonymity of the blockchain, the NFT market can easily become a hotbed for money laundering. Criminals can use the stolen money to buy NFT and complete money laundering in transfer hands. Such a market with a huge market volume and high privacy makes it difficult to trace the flow of stolen money. Cryptocurrency has moved closer to supervision under the measures of various countries to combat money laundering. I am afraid that NFT will eventually be regulated. Therefore, the regulatory era of NFT is foreseeable.

secondary title

4. NFT on the Impossible Ladder

The Impossible Ladder, also known as Penrose's Ladder, is a famous geometric paradox. This paradox describes a ladder that cannot exist in real life. Each ladder seems logical, but when connected together, it becomes incredible. There can never be a highest or lowest point on a ladder. Whether it is going up or down, it is always trapped in an infinite loop. The mystery of this paradox actually comes from a fault in a certain direction. Due to visual errors, the turning point of the ladder connects the ladders of different levels together, and finally leads to an infinite loop on one level.

In real life, this paradox also occurs. The fault in reality refers to the phenomenon that the development of a certain stage cannot be connected to the next stage, and finally causes things to fall into an infinite repetition and stand still. The causes of faults can be endogenous or exogenous. And NFT seems to have fallen into such a vicious circle. It was originally thought that it had built a ladder to digital assets, but the internal contradictions of virtualization and decentralization, as well as the external contradictions of speculation caused faults to appear, making it impossible to reach the next level. A level breakthrough.

Although there are many contradictions in NFT, the NFT craze has put many issues worthy of discussion back on the table, such as the meaning of digital assets that are rarely mentioned, the ancient problem of the Internet and ownership, and the contest between decentralization and centralization. It is undeniable that NFT has given answers to the thinking and solutions of these problems. Maybe this answer is not mature enough and comprehensive enough, but NFT is indeed exploring and verifying with practice.