【Deribit Options Market Report】0823——Cover Plan

included in topic

#daily options broadcast

#daily options broadcast

【Daily Review】

The broadcast data is provided by the Data Lab of Greeks.live and the official website of Deribit.

【Daily Review】

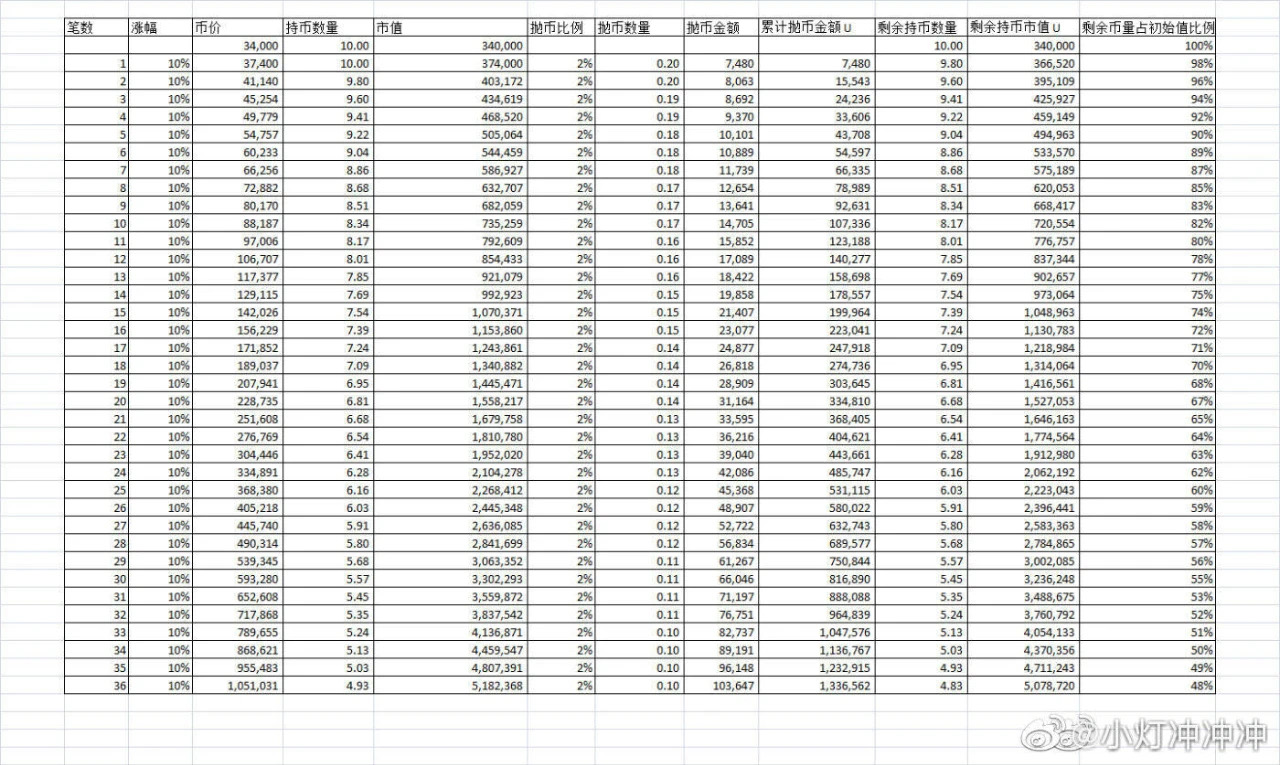

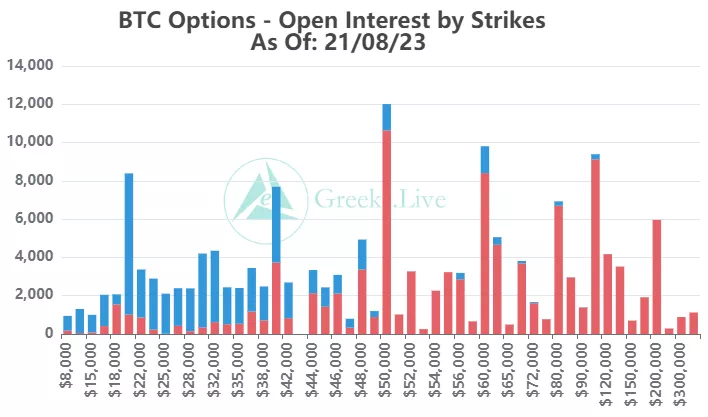

For those who want to sell call options and need to cover, they must plan the capital ratio above each strike price.

In the process of bull market, it is appropriate to gradually earn some interest through covered payment.

Then as for why the money should be gradually returned during the bull market, think about 312, 519, think about improving life, you need to save some money.

【Market Heat】

I am attaching a form here, according to this ladder toss, it has increased by 10 times, and 65% of the coins will remain. for reference.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

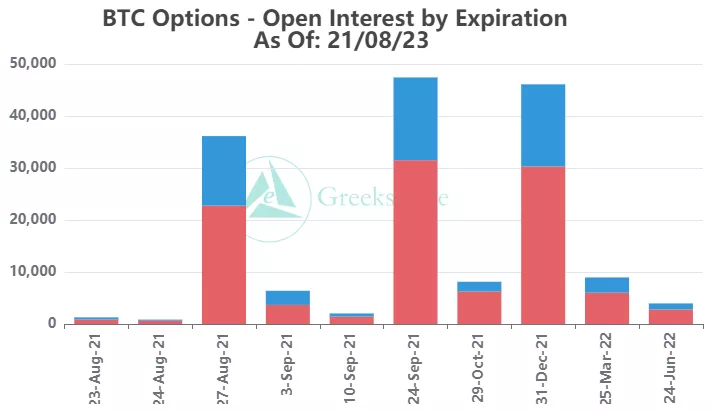

The open interest of options was 161,000, worth $7.97 billion, and the volume of options traded was 86,000.

【Historical Volatility】

10d 68%

30d 67%

90d 80%

1Y 79%

【IV】

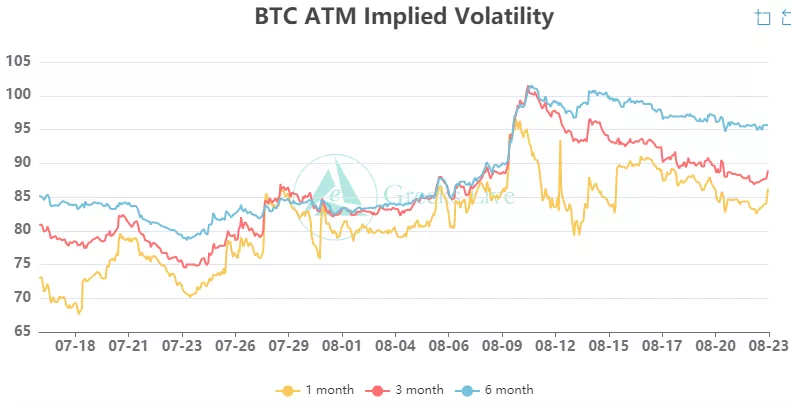

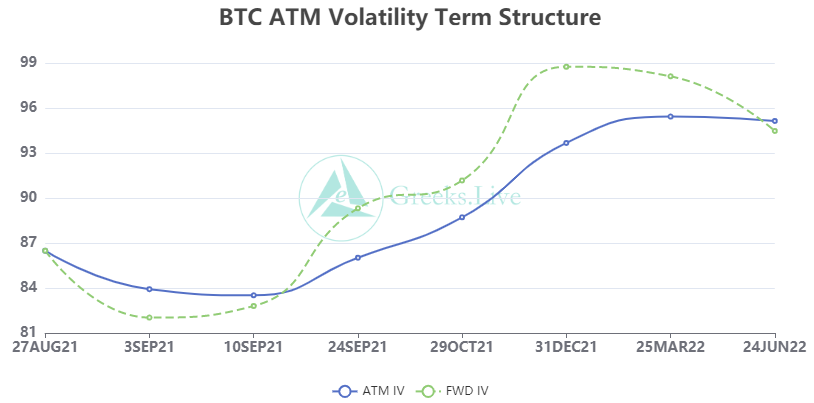

Implied volatility for each normalized term:

【Historical Volatility】

8/22:1m 83%, 3m 91%, 6m 95%,DVol 92%

Today: 1m 86%, 3m 92%, 6m 95%, DVol 94%

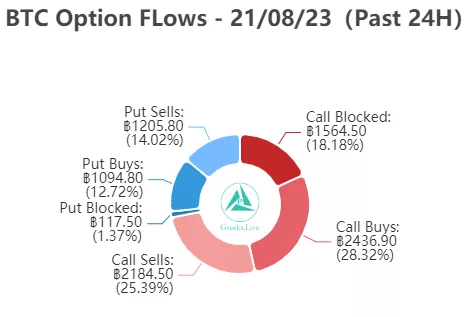

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

【Option position distribution】

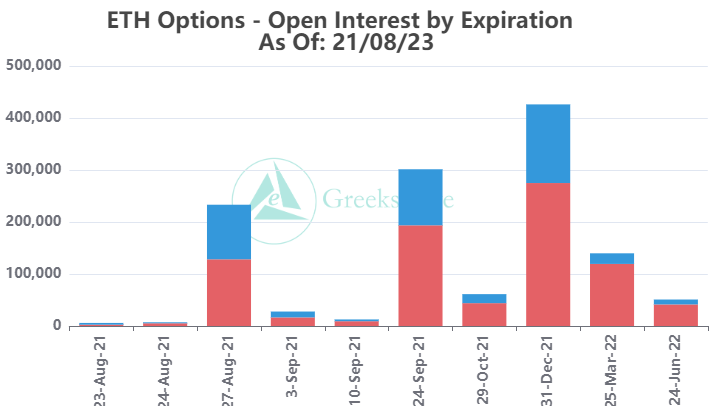

【ETH Options】

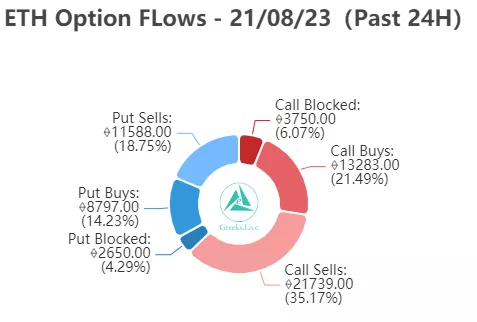

The open interest of Ethereum options is 1.27 million, worth 4.1 billion US dollars, and the trading volume is 55,000.

【Historical Volatility】

10d 82%

30d 78%

90d 109%

1Y 109%

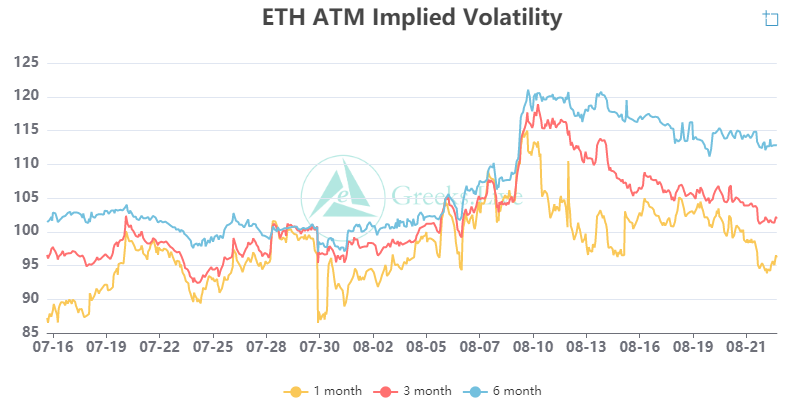

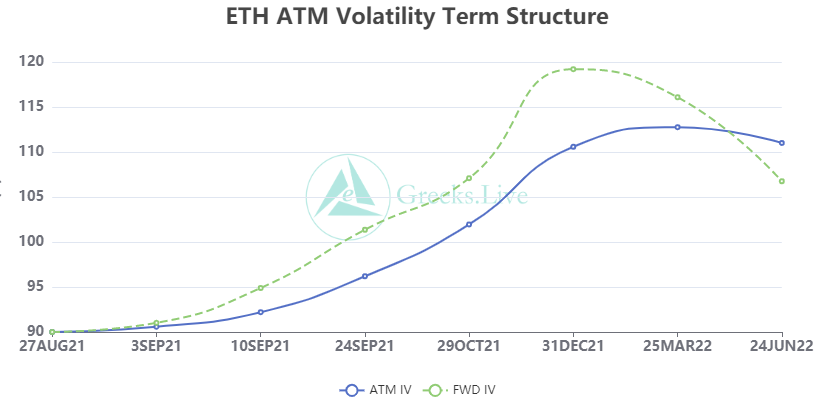

【IV】

Each standardized period IV:

【Historical Volatility】

8/22:1m 95%,3m 108%,6m 112%,DVol 105%

Today: 1m 96%, 3m 108%, 6m 112%, DVol 107%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

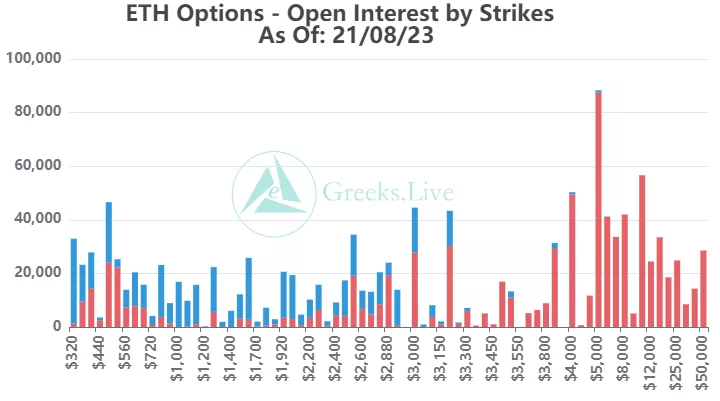

【Option position distribution】

From the perspective of Option Flows, the overall trading volume has returned to the average level, especially the selling of call options is very active. Yesterday, 21,739 calls were actively sold, accounting for 35%, but the transaction IV is not low, and the large transactions are still relatively small.