Interpretation of the Holy Triangle of Terra Ecology

Note: The original author is Tommy Schreiner, and the following is the full text compilation.

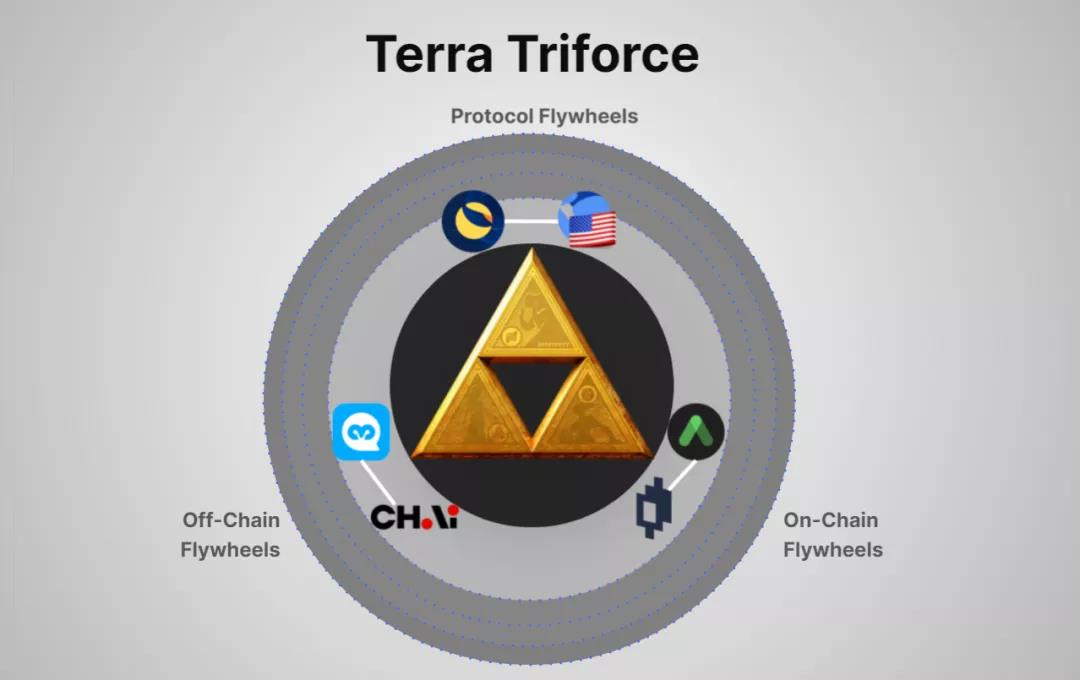

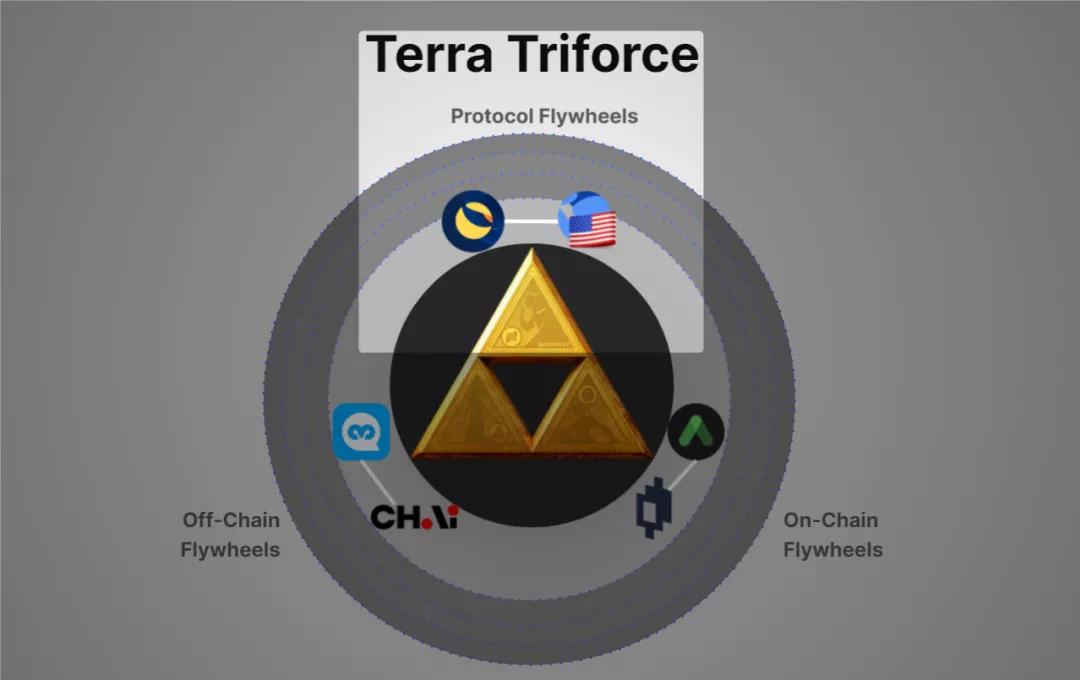

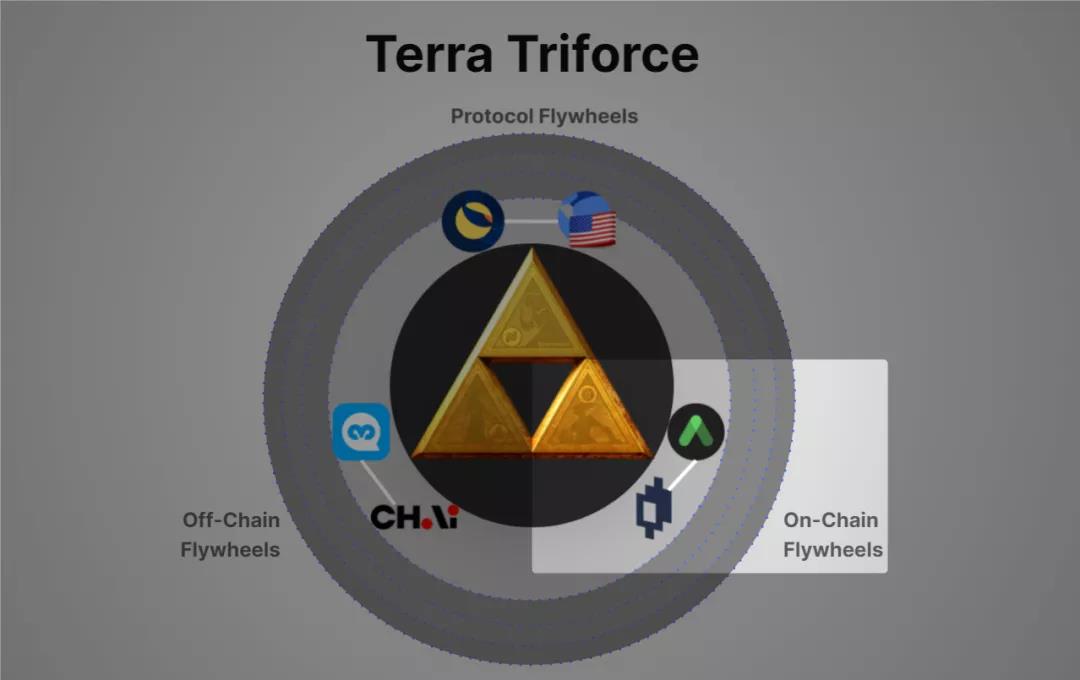

flywheel"flywheel", which is just another word for a circular incentive structure that connects every part of the system and supports each other in an endless loop. (Axie Infinity flywheel).

The remainder of this article describes each part as follows:

What is Terra Blockchain?

The Protocol Flywheel: How Do Luna and TerraStables Work?

Freewheel on Chain: What is Anchor? What is Mirror?

Off-chain Flywheel: What are Chai and Memepay?

Other Supplementary Agreements

What is the future of Terra? What is Columbus-5 and how is it a game changer?

Conclusions and comments

image description

Roadmap of the Terra Ecosystem

create

Terra is a blockchain project launched in January 2018 and the mainnet launched in April 2019. Terra is the first project developed by Terraform Labs, a South Korean company co-founded by Do Kwon and Daniel Shin.

Ecosystem Fund"Ecosystem Fund", the fund will be used to sponsor projects built on the Terra blockchain.

intention

The development of the Terra blockchain is guided by a single, driving goal, what can cryptocurrencies do for people in the real world?

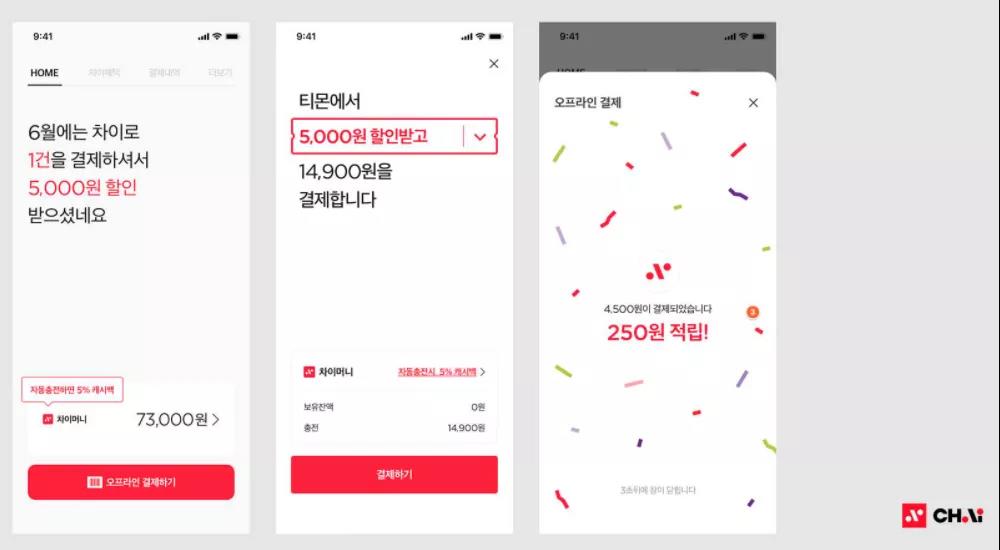

image description

Humanized application design of Chai app

technical specifications

"Terra is an application-specific proof-of-stake blockchain using the Tendermint consensus built on the Cosmos SDK." - Terraform Labs

Why Tendermint? Bitcoin's consensus mechanism requires very intensive hardware and power consumption to process transactions quickly through PoW (Proof of Work), which has created scalability and speed issues over time.

Tendermint aims to correct this problem by establishing consensus through a large number of distributed nodes without resorting to PoW, but using PoS (Proof-of-Stake). Their main goal is to focus on speed, security, and scalability of the blockchain, with an emphasis on cross-chain technology.

Here is a brief overview of the features provided by Terra Core built on Tendermint:

Developers can write smart contracts in the programming language and development environment of their choice.

Tendermint BFT (Byzantine Fault Tolerance) can secure and replicate an application across many machines even if ⅓ of them fail arbitrarily or maliciously. Note, however, that this is a relatively low tolerance compared to Bitcoin, which expires at the 50% threshold.

If ⅓ of validators are malicious, then the Terra blockchain will simply stall until consensus is reached, rather than forking the network.

Blocks and transactions are shared among nodes.

Can run on multiple chains as it is connected by Cosmos IBC (Inter-Blockchain Communication).

Keep in mind that some of the risks of DPoS (Delegated Proof of Stake) inherently make Terra Core vulnerable to some key risk factors: node centralization.

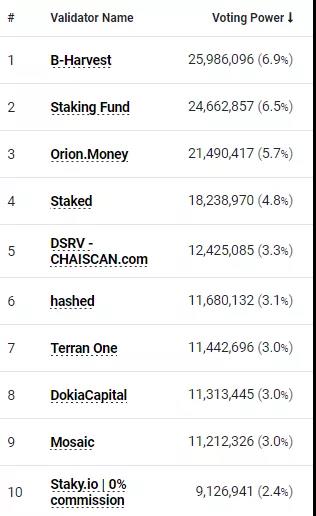

image description

The top few validate Zheer's voting rights and control rights; from terra.stake.id

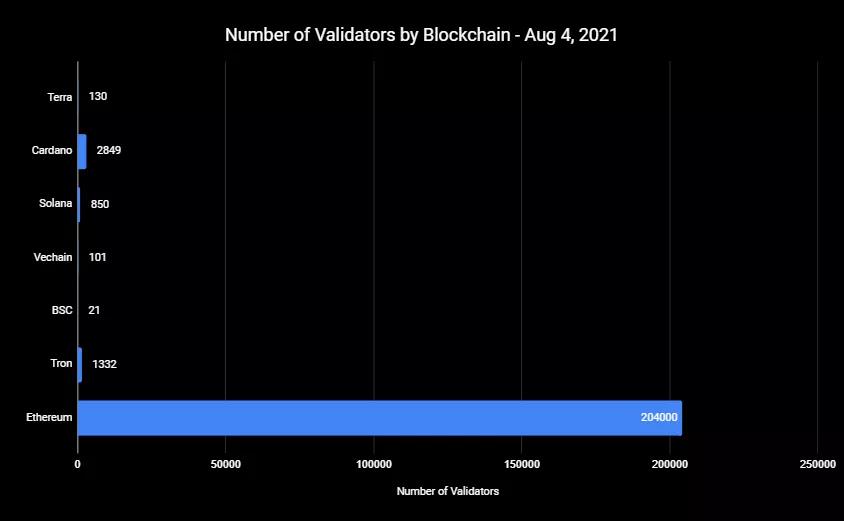

For Terra, there are currently only 130 validators. This number is expected to increase to 300 over time.

In this snapshot, the top 10 validators have 42% of the voting power.

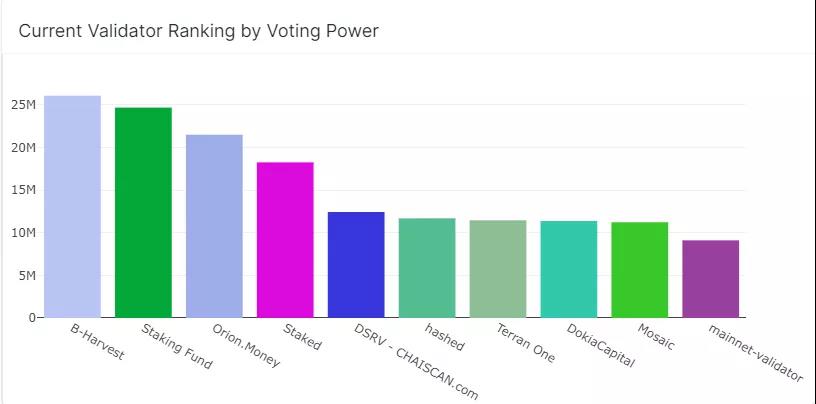

image description

Current validators are ranked by voting power, data from flipsidecrypto.com, using SQL code from 0XFRANK’s Terra dashboard

What steps are being taken to address this issue?

Do Kwon said that future airdrops will be issued to validators with fewer delegators (Note: Users who want to stake Luna but do not have or cannot run their own validators stake Luna to validators, known as delegators, or delegators ).

The Terra delegation program was launched to encourage delegators to disperse into smaller validators. Some of the requirements include having less than 1.5 million delegates, running a testnet validator, maintaining threshold uptime (≥99%), oracle voting (≤20% error), governance participation (over the past 10 votes ≥90%), and at least 3 months of running time. The total amount designated by the Terra Foundation for the program ($50 million LUNA) was recommissioned and distributed equally among the remaining 43 eligible participants.

image description

Number of validators per chain, data source @shegenerates

Note: Cardano has over 1200 validators who have never produced a block.

image description

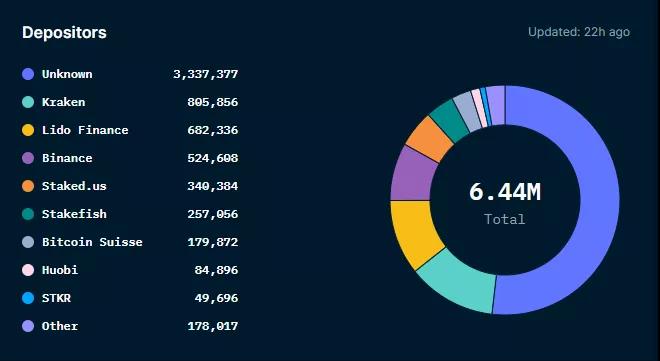

Classification of depositors for Eth2 staking on August 1, 2021. Data from nansen.ai

As Terra continues to grow and scale, it remains to be seen if they will reduce their reliance on large validators, but they are working to rectify this by delegating Luna stakers to small validators for airdrops and successfully launching Terra A validator program that re-delegates Luna to small validators who meet strict requirements such as uptime and voting.

4 The protocol flywheel: how do Luna and TerraStables work?

The operation of the Terra ecosystem adopts a dual-token design:

Luna, the token for governance, staking and validation

UST, its native USD-pegged stablecoin*.

*Note: There are other TerraStables such as TerraKRW, TerraMNT, TerraSDR, but UST is by far the largest, so we will only discuss UST in depth.

Why two tokens instead of just Luna and some other custodial stablecoins? Because Terra firmly believes in the decentralized and censorship-resistant ethos of cryptocurrencies, and more specifically, sees stablecoins as the backbone of the DeFi stack.

By design, custodial stablecoins do not serve these goals. While Circle’s USDC and Bitfinex’s Tether are stable, they are forever subject to how governments choose to regulate stablecoins in the future. As recently as July 19, Yellen asked regulators to draw up a framework around stablecoins as soon as possible. Custody stablecoins are also vulnerable to censorship. Circle can freeze USDC at the request of law enforcement, which could pose serious tail risks to individuals, businesses, funds, and ecosystems that rely heavily on USDC.

UST is an algorithm-pegged stablecoin. But before we dive into the mechanics of UST, we need to first understand Luna, which plays a key role in both the Terra ecosystem and the peg that maintains UST itself.

Luna

Luna is the governance, staking, and validation token for the Terra ecosystem. As a proof-of-stake blockchain, Terra Core requires validators to stake Luna to ensure system security. Another benefit validators provide is volatility absorption, which we will discuss in the UST section. As a reward for doing this service and taking volatility risk, they are rewarded with staking APR% from Gas, Tax, and Seigniorage fees.

Gas fees are applied to every transaction to discourage spam.

The stability tax is applied to every mint and burn transaction. There is it for Terra-Terra compatibility of the item on display reshuffling"Tobin tax", set to 0.35%. There is also a minimum spread tax, 0.5% for Terra-Luna swaps.

Seigniorage is the value of money minus the cost of producing it, e.g. $1 bills minus printing costs, or $1 terra minus minting costs (zero). Currently, seigniorage profits are distributed weekly to the community pool to fund the activities of the Terra ecosystem, and the remainder is used to reward the pool of Lunastakers. Rewards to minters will be issued over the course of a year to encourage long-term dedication.

Seigniorage is very important and it happens when Luna is burned. This happens when demand for UST increases, such as when people buy stablecoins on Terra. A portion of the burnt Luna went to the treasury to finance further operations, while the rest went to the mint. This also has the effect of making mining/validator power more valuable and scarcer, as the more Luna is burned, the more expensive it is to become a validator.

Motivators come in the form of validators, which we discussed earlier, and delegators. A delegator can be anyone who holds Luna and wants to participate in securing Terra. To do this, they choose one of 130 validators to delegate their Luna to. In return, they will receive a portion of staking rewards from Gas, Taxes, and Seigniorage, as well as weekly airdrops from certain protocols like Mirror (and many more). Individuals who delegate and verify must bind Luna, and no more transactions can be made until they are unbound. When it is unbound, it will no longer accrue rewards and cannot be traded immediately, instead it will be locked for 21 days. This ensures that large amounts of unlocked supply cannot be immediately dumped into circulation and destabilize the system, while also encouraging long-term thinking by delegators and validators who are securing the Terra network. It's a win-win situation.

UST

When it comes to Luna, one cannot fail to mention its native stablecoin, among which Terra Dollar or UST is the largest stablecoin.

As mentioned earlier, stablecoins are integral to on-chain applications. When users enter a new system, they often prefer stable assets to remove the risk to often volatile native assets such as SOL (Solana), MATIC (Polygon), FTM (Fantom), Luna (Terra), and even ETH (Ethereum).

First, let’s take a brief look at the types of stablecoins and how UST differs.

There are three main types of stablecoins:

Custody - USDC, Tether, GUSD, BUSD, TUSD

Overcollateralized Debt - Dai, sUSD, LUSD, alUSD

Algorithms - Ampleforth (AMPL), Fei, Frax, TerraUSD (UST)

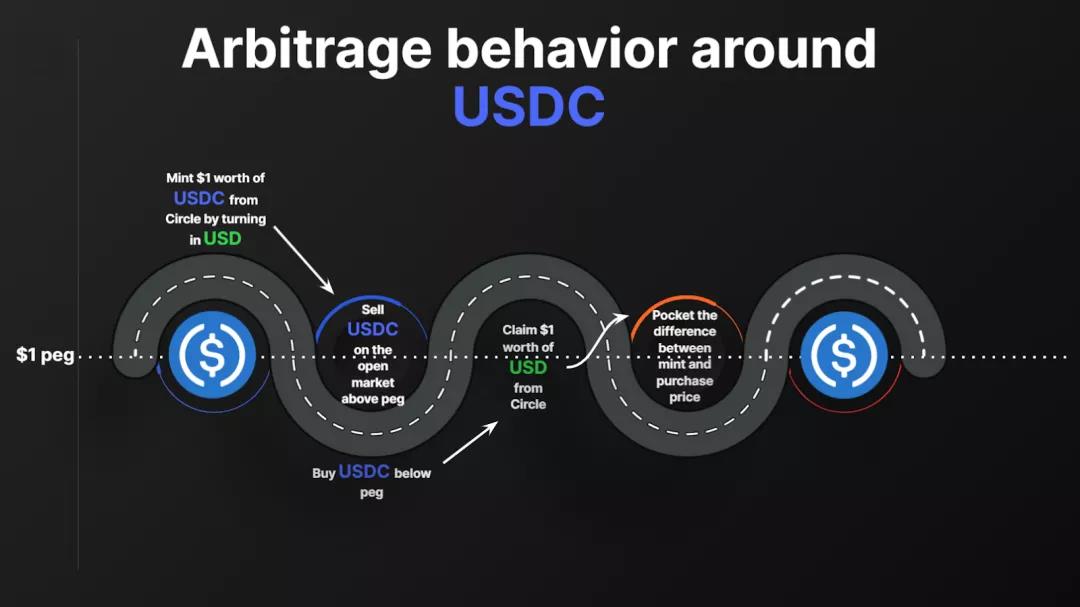

image description

Arbitrage around USDC

Overcollateralized debt stablecoins are similar to custodial coins in that they are backed by a currency, but in the case of cryptocurrencies, are usually overcollateralized by highly volatile assets such as Ethereum, Synthetix, etc. For example, Dai is backed by Ethereum (and more recently USDC, to create more stability), but to protect the stability of the peg, users wishing to mint Dai must stake 1.5x the amount of Dai they wish to receive Eth, and lock it in a CDP (Collateralized Debt Position). It's like a loan of their Eth so that they don't have to sell it, and in turn they receive a percentage of Dai, now backed by their Eth. In other words, you have to give $150 worth of Eth for every $100 you receive. This is called the collateralization ratio, and the MakerDao protocol sets it at 150%. However, since a CDP is a loan, it can and will liquidate all your Eth to pay it back if the underlying Eth drops in value too quickly.

Algorithmic stablecoins have a variety of mechanisms for retaining their pegs, from bond purchases to fractional collateralization to programmatic contraction and expansion, or even a combination of all of these. The risks of these coins often involve a lack of incentive to maintain the peg, as once the algorithmic stablecoin deviates from $1 and does not bounce back immediately, trust in the protocol's ability to regain the peg is broken, and this disillusionment brings about a sell-off Stress tends to form a death spiral all the way to zero.

So, what makes Luna so dependent on UST, and vice versa? Let us introduce the minting and burning mechanism involved between UST and Luna.

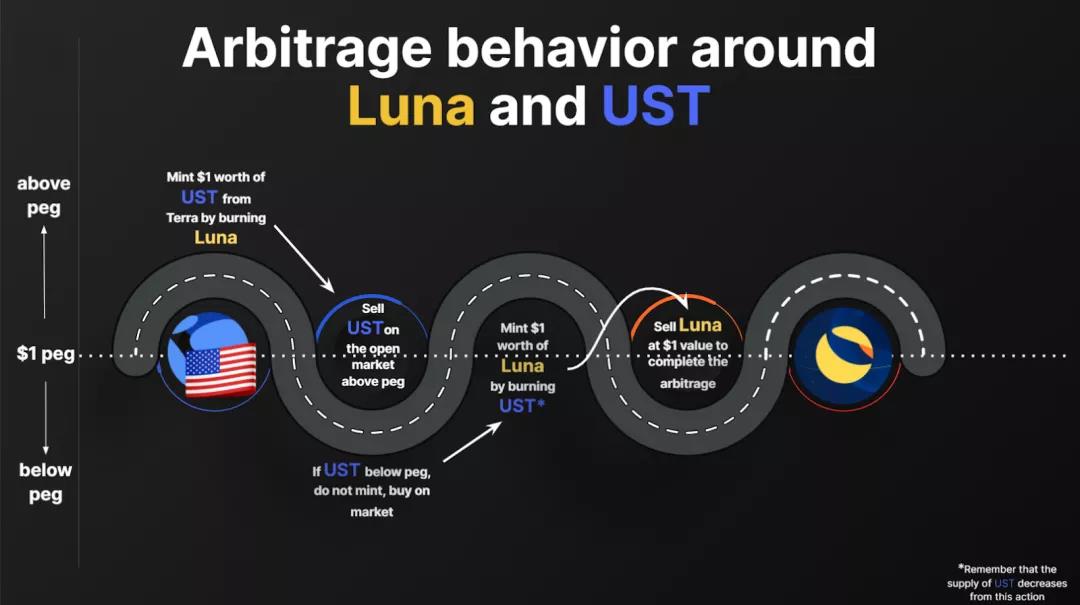

UST is an algorithm-pegged stablecoin that uses a mint and burn mechanism, with Luna and UST as leverage. This allows the protocol to expand and contract supply in order to maintain the UST peg. The peg is maintained entirely by arbitrageurs.

Let's consider the following two cases:

The price of UST deviates from the peg by 5%, reaching $0.95. This requires the protocol to shrink the supply of UST in order to maintain the $1 peg. To make this opportunity valuable to arbitrageurs, the protocol will let you mint $1 worth of Luna with your purchased UST, even though the price of UST is $0.95. This allows arbitrageurs to instantly earn $0.05 for every dollar of UST they buy. This increases the supply of Luna as arbitrageurs mint additional Luna from the protocol, and shrinks the supply of UST as they switch to minting Luna, eventually restoring the peg. Think of this mechanism as a free 5% discount on Luna when UST falls below $1.

image description

Arbitrage around Luna and UST

If you remember our example in custodial stablecoins, this is actually very similar to how you get your USDC back from Circle, except instead of turning in a tokenized version that lost the peg you get back a backed stable assets, but mint an unstable asset Luna, against an unbacked asset UST, and use it as arbitrage to get back the difference. By arbitrage this difference, you help UST maintain its peg by burning the assets you turn in, and are rewarded with a free discount on the assets you receive.

Well, go back! You might be thinking that arbitrage USDC would make sense since it is backed and backed by Circle, and the dollars you traded for USDC are effectively stable. A dollar is always worth a dollar (but with inflation! Never mind...). The relationship between Luna and UST is definitely not like that.

So what compels anyone to arbitrage unsecured UST with highly volatile Luna, especially to the levels UST needs to maintain its peg? Surely it will inevitably be forgotten because Luna will be sold off and people will no longer have an incentive to buy out of stock UST? UST doesn't have any backing, so it should go to zero and will take Luna away.

But the truth is, UST is somewhat backed up. Not by dollars or cryptocurrencies, but by the growth of the Terra ecosystem itself. How does one profit from the growth of an ecosystem? The answer is adoption! Earlier, we said that the most important thing for a stablecoin and blockchain is usage. So let's review what happens when UST is used and adopted.

We just mentioned that when the price of UST exceeds the peg, or is greater than $1, UST needs to be minted and restored to the peg. To do this, you must surrender your Luna, which will be burned. This reduces the supply of Luna, putting upward pressure on its price, making mining and staking even more scarce. But what does this have to do with growth? Well, with UST adoption and the protocol burning Luna, it continues to make Luna more valuable over time. Because Luna is used as an arbitrage tool to keep UST pegged, it needs to have value outside of it, otherwise, it will be sold to zero, and no one will voluntarily keep UST pegged.

Burning Luna helps give it more value, but remember that Luna's main source of income is usage of the network itself. Staking delegators and validators are paid in the form of fees, taxes, and seigniorage, so this helps drive value back into Luna and makes it essentially a call option on the growth of the Terra ecosystem, thereby promoting UST adoption.

UST is driven by the adoption of UST and the use of the network"of"ofStablize"Stablize", or just a coin trying to be stable.

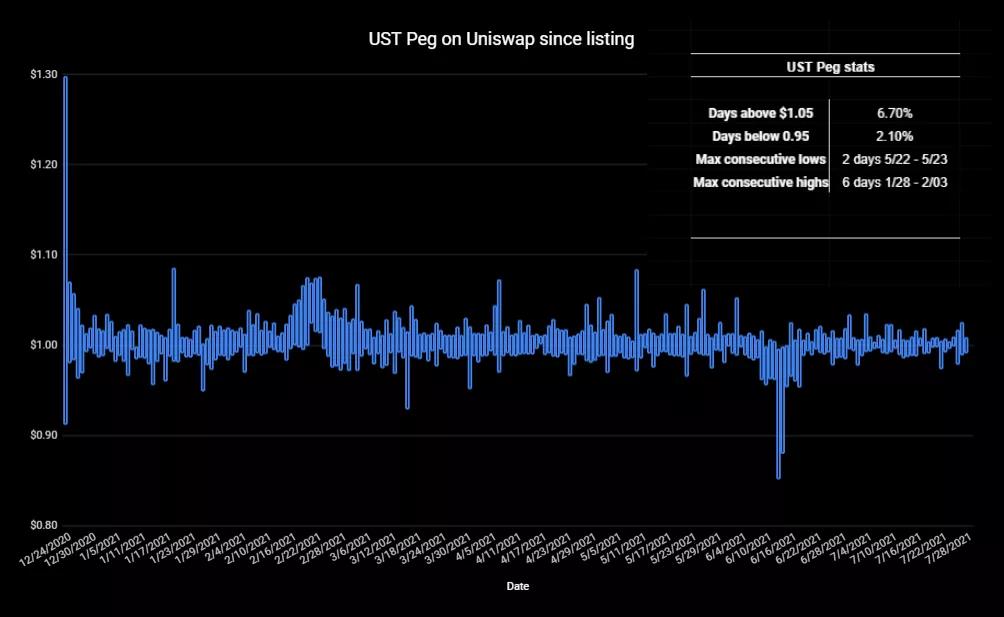

In fact, it's pretty stable for the most part, but it doesn't matter if it loses its peg for a day. By definition, a stable coin must retain its peg, especially algorithmic coins, which can exhibit extremely reflexive behavior. Once trust in the agreement is broken, a death spiral can occur in as little as a few hours.

So, what happened to UST in the days between 5/19 and 5/23? If you are familiar with UST, you will know that UST did lose the peg two days in a row, as you can see in the chart below.

cut in half"cut in half"At that time, the entire market fell by 50%-80%. But none of that is reassuring when a stablecoin supposedly a safe haven in the face of black swan events fails to be what it claims to be.

How did UST lose its peg?UST did lose its peg, but not because the underlying mechanism cracked under the stress as most assume, but because the oracle feed stopped providing Luna price data. One of the validator's responsibilities is to serve as an oracle, providing accurate price data through on-chain transactions from public nodes.

What happened is that Terra’s lending platform, Anchor Protocol, was experiencing significant stress due to volatility across cryptocurrencies. Users submitted 2.58 million requests in 30 minutes, and Anchor's nodes became overloaded. The Luna dump triggered over 4,000 liquidations, with the result that the network became overwhelmed and transactions were no longer accepted by the nodes that validators used to provide Luna price data.

Interruption of oracle data caused Terra protocol to automatically freeze Luna<>The UST swap market, so arbitrageurs can't do their basic task of getting UST back to $1.

UST did lose its peg, but not because the underlying mechanism cracked under the stress as most assume, but because the oracle feed stopped providing Luna price data. One of the validator's responsibilities is to serve as an oracle, providing accurate price data through on-chain transactions from public nodes.

What happened is that Terra’s lending platform, Anchor Protocol, was experiencing significant stress due to volatility across cryptocurrencies. Users submitted 2.58 million requests in 30 minutes, and Anchor's nodes became overloaded. The Luna dump triggered over 4,000 liquidations, with the result that the network became overwhelmed and transactions were no longer accepted by the nodes that validators used to provide Luna price data.

Interruption of oracle data caused Terra protocol to automatically freeze Luna<>The UST swap market, so arbitrageurs can't do their basic task of getting UST back to $1.

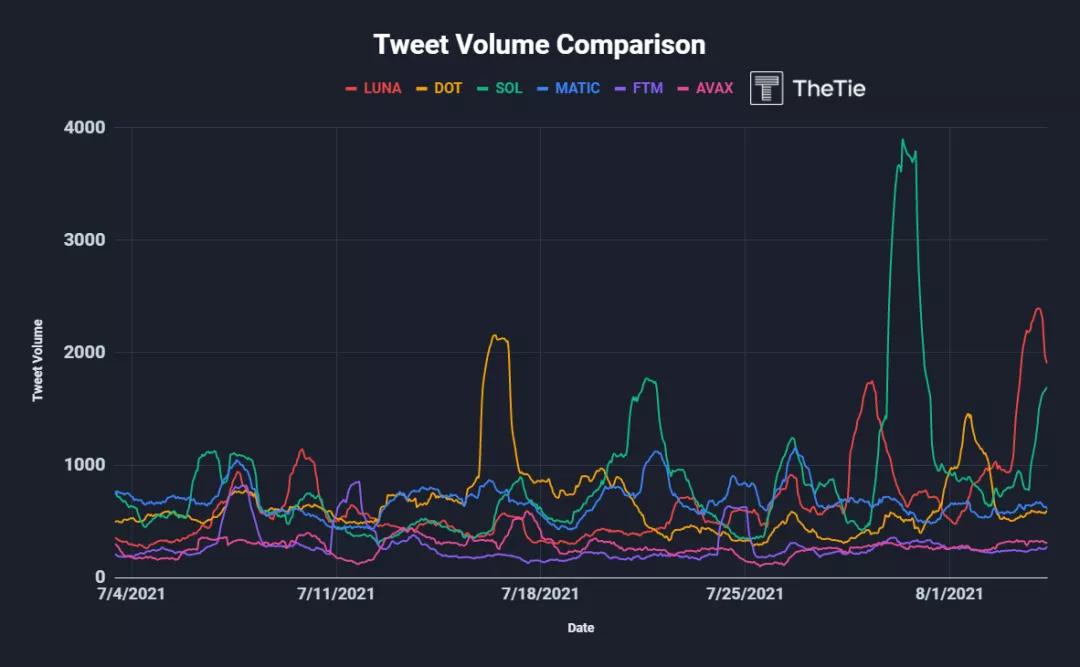

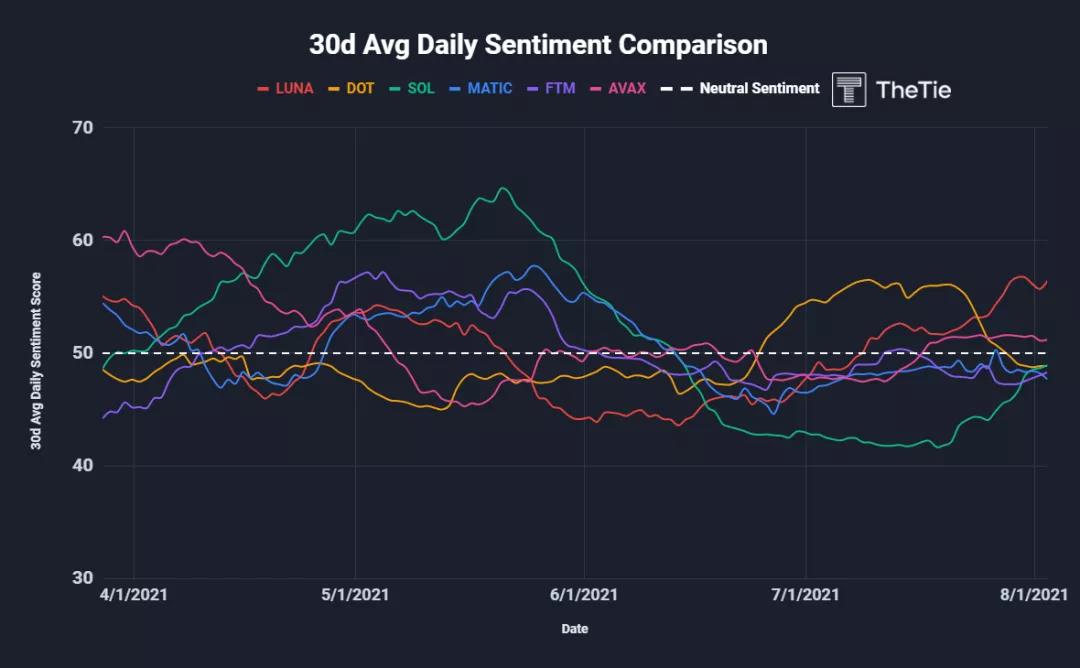

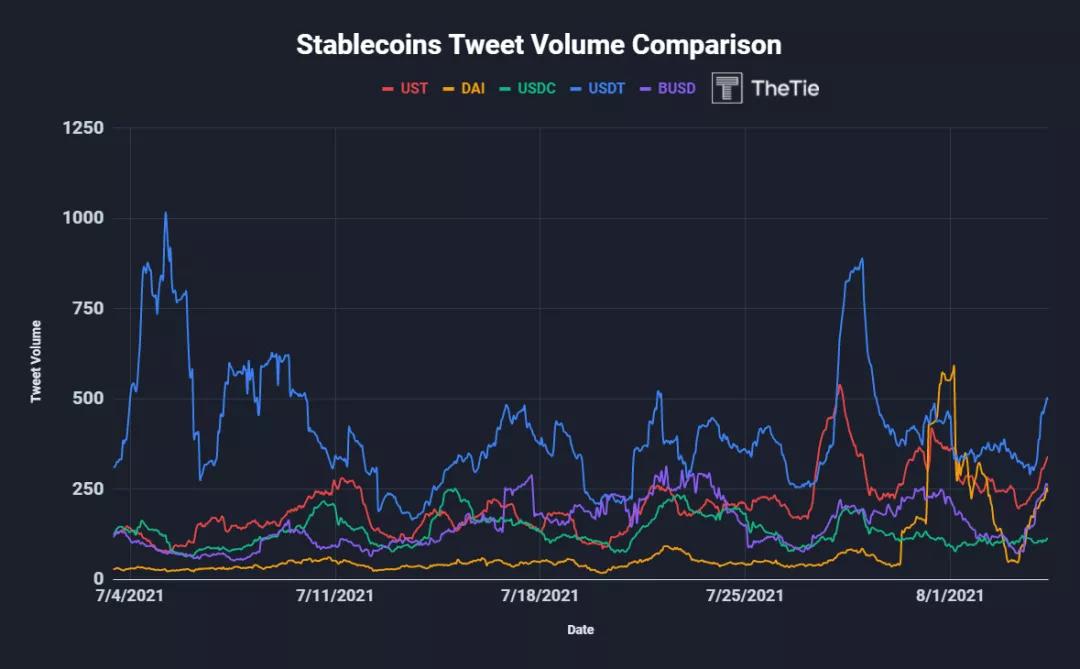

Sentiment + Number of Tweets

image description

image description

image description

In the last month after the Treasury Department held talks on stablecoin regulation, UST’s tweet ranked second among the top five stablecoins.

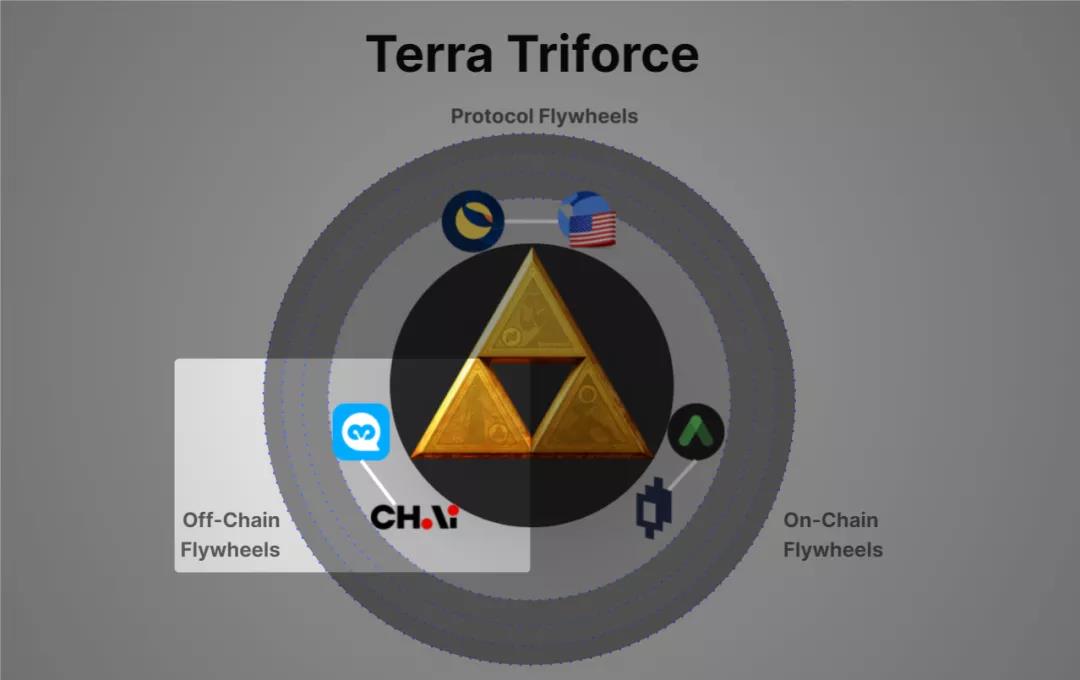

5 Freewheels on the chain: Anchor and Mirror

We've determined that in order for Terra to grow, it needs to adopt UST more, which in turn strengthens Luna's peg by making it more valuable. Luna also becomes more valuable with more network usage. That’s what the Protocol Flywheel is all about. UST powers Luna, which powers UST, and so on.

However, stablecoin adoption is one of the hardest areas to succeed. A good protocol design is not enough for a stablecoin to be pegged. Stablecoins need a massive network effect to succeed, which means adoption in as many applications and blockchains as possible. This requires strong partnerships and integrations with applications to facilitate usage.

Terra takes a unique approach to channel UST's demand and network growth. Rather than wait for projects to build on Terra and drive adoption organically, Terraform Labs chose to bootstrap the ecosystem by launching two native applications, Anchor and Mirror.

Anchor and Mirror are on-chain flywheels funded and launched by Terraform Labs to guide the needs of UST.

Anchor protocol

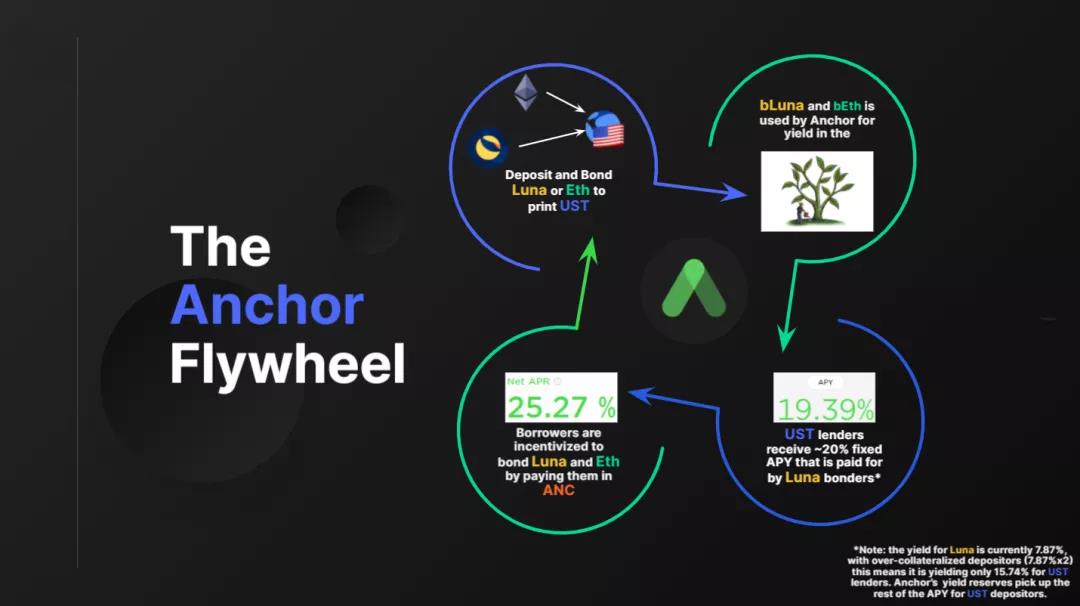

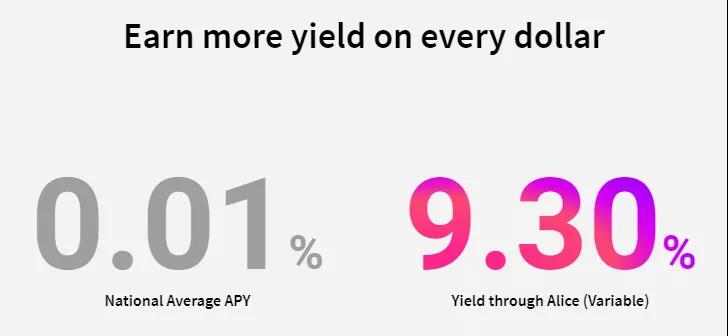

Anchor is a fixed APY savings product and arguably the most important protocol in the Terra ecosystem. It offers a fixed 20% annual interest rate on cash deposits, which is the highest rate for stablecoins around. The average interest rate on dollars held in U.S. bank accounts is just 0.03%. This fixed rate offering is the biggest driver of UST adoption as it is used as an advertising tool and key to its off-chain offerings.

Its 20% annual interest rate is often scoffed at as functioning like a Ponzi scheme where new savers pay old savers. But where do these yields come from?

Anchor is like a bank. When you deposit money in a bank, you are essentially lending your money to someone else, and the bank grabs the borrowing rate and pays you a pittance on the loan. A traditional bank is essentially a lending platform that pockets the proceeds rather than giving them back to you.

Anchor's rate of return comes from the assets that generate the income. As of this writing, Luna and Eth are the two collaterals accepted for deposits. With these assets, you can borrow up to 50% collateral to mint UST, which you can then spend in any way you choose. You can sell it for another asset, connect it to another chain for farming, or even deposit it back to Anchor for a 20% yield. For example, you can deposit $1,000 worth of Luna, mint $500 of UST, bridge it to Solana with Wormhole, and deposit UST into the Mercurial platform to farm with a 27.74% yield.

*Note: Rates are as of this writing and are variable.

What Anchor does is use your yield to generate deposits, instead of pocketing the yield or giving it back to you, it actually pays that yield to depositors in UST. This is how UST savers earn a fixed 20% APY.

Anchor is among the additional incentives to generate a steady stream of Luna and Eth depositors who enter the protocol.

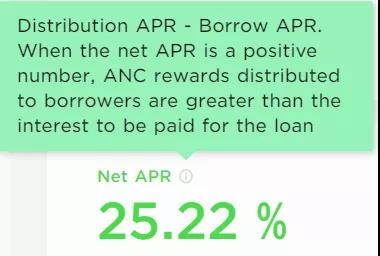

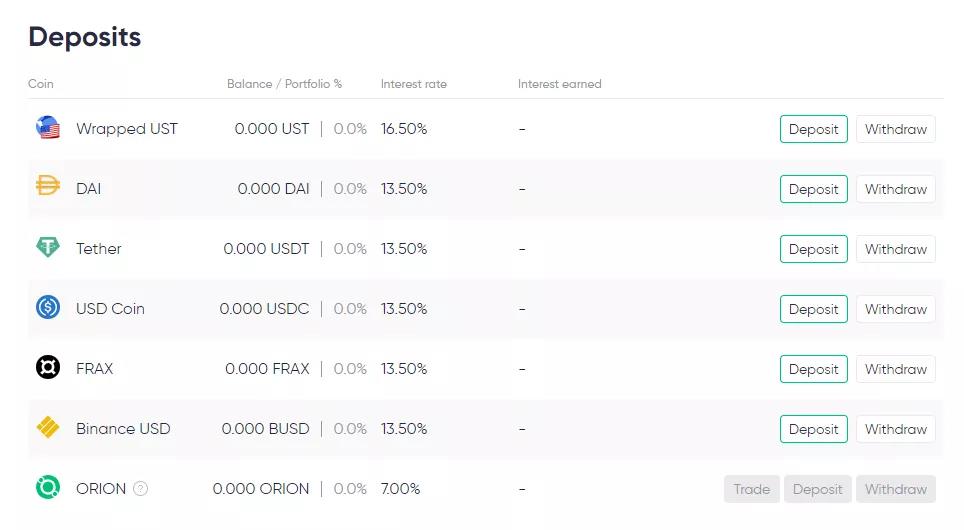

image description

Annual interest rate currently paid to UST borrowers as of 8/3/21

Anchor has a governance token, ANC, which is used for a liquidity mining program and pays borrowers an APR% over a period of time. These rates fluctuate based on borrowing demand and have been as high as 400% in the early stages of the protocol. ANC token itself can be used for unilateral fixed investment and ANC-UST LP pool to generate additional income.

risk

A key risk in the Anchor protocol is when the collateral deposited does not yield sufficient APR to pay UST's lenders. For example, if the staked Luna yields only 8%, and you multiply that by 2, since Anchor is 200% staked, this only creates a 16% yield. That's 4% less than the 20% promised to UST lenders.

To make up the difference, Anchor Protocol has a treasury that pays the difference. In good times, any additional Luna yield over 20% is used to top up the coffers. However, when the Luna yield market is depressed (usually during violent cryptocurrency crashes and bear markets), the coffers are constantly being emptied to pay UST depositors. As cryptocurrency traders and investors flee to stablecoins like UST and seek safe yields, more users deposit into UST, depleting treasury pools at an accelerated rate. Rewards for ANC borrowers rise to compensate (>200% in May crash), but this often does not attract enough funds to correct the imbalance.

Users became increasingly concerned after 5/20 that the Yield Reserve would run out, so TerraForm Labs injected $70 million from its Stability Reserve Fund to continue paying the fixed annual interest rate. Additional leverage such as increasing LTV to 65%, diversification of yield sources, and additional deposit assets such as SOL, ATOM, and DOT are steps being taken to mitigate the drain on yield reserves. The infusion of funds is expected to support $500 million worth of deposits earning a 20% annual interest rate over 1.5 years, according to the proposal.

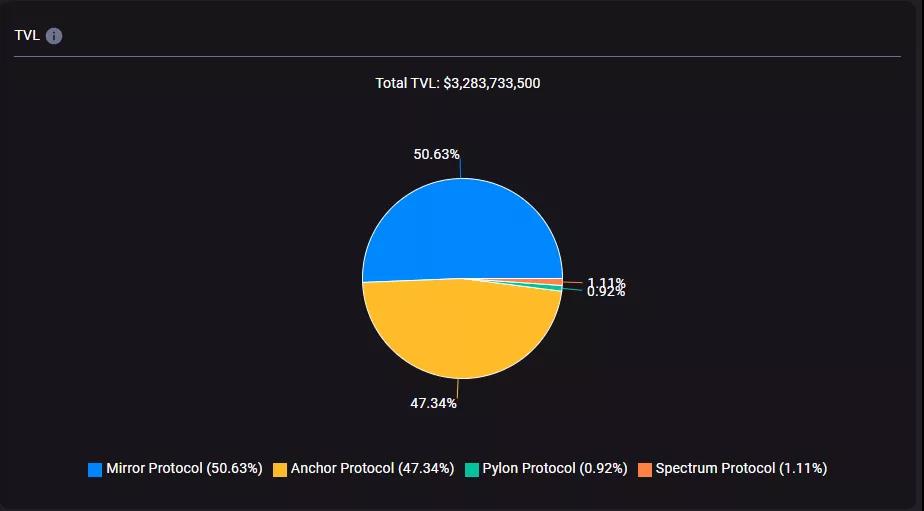

image description

Share of TVL in major Terra protocols as of 8/3/21

Anchor is the glue that holds everything together so it may be strong enough not to collapse.

Mirror Finance

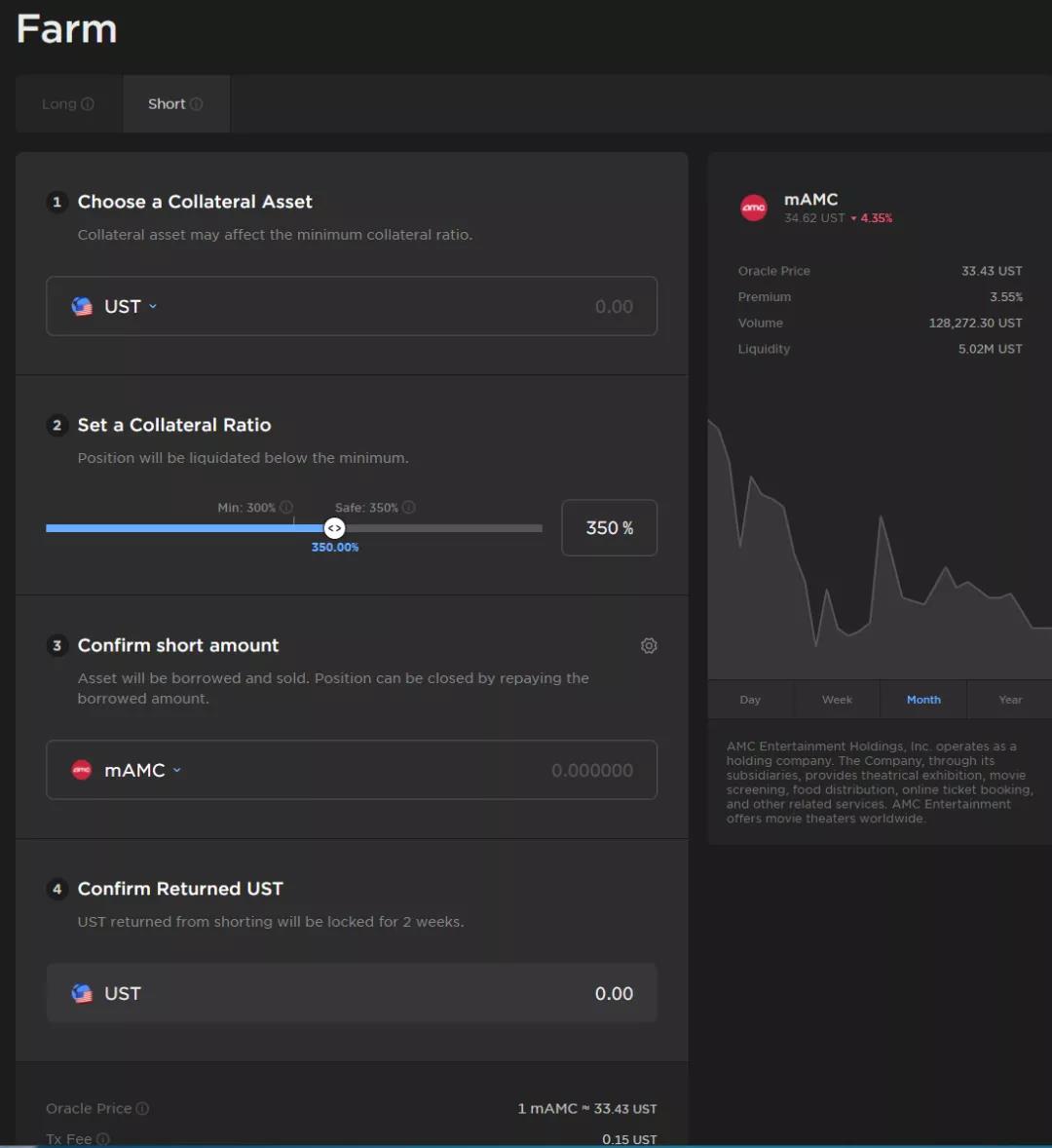

Mirror Finance is the other largest TVL owner in the Terra ecosystem. Mirror, launched in December 202, is a protocol that creates synthetic assets called mAssets (mirror assets),"mirror image"Its off-chain corresponding price. For example, mTSLA will track the price of Tesla. Assets currently listed on Mirror include mQQQ, mAAPL, mBABA, mTSLA, mNFLX, mUSO, mAMZN, mVIXY, mGOOGL, mTWTR, mMSFT, mSLV, and mIAU. Users can mint mAssets, exchange them, provide liquidity, and access"and"and"short"farm.

The protocol also has its own native token called Mirror Token (MIR). This is used to reward users who provide liquidity to the pool, it can also be used to earn governance voting rights, and earn a percentage of the protocol’s CDP withdrawal fees.

Just like Dai, users put their UST, aUST (yielding UST deposited on Anchor), or mAssets into Collateralized Debt Positions (CDPs). This enables users to mint mAssets. Minters must maintain their CDP collateral ratio and can adjust it as needed.

Long and short farms are new to Mirror V2. Just like they sound, they take a directional position in the asset in question, but allow users to earn APR in MIR.

Short farms borrow mAssets for you and sell them on the market for UST, and when you're done you have to repay that amount in UST (buy and return the borrowed mAsset). *

The song farm is basically an LP pool, you have to provide mAsset and equivalent UST to get MIR rewards and pool rewards.

*Tip: You can neutralize your short farm delta by purchasing an equal amount of mAsset in spot holdings via the swap interface. This can be done on top of earning 20% APY from Anchor as Mirror lets you use aUST as collateral! That way, if something happens to your mAsset holdings, you can use it as collateral. That way, if your shorted mAsset goes up, you hold the underlying equivalent, thereby repaying your short.

mAssets on Mirror trades 24/7, which means you can trade synthetic shares on the platform outside of market hours. When oracle prices and market prices diverge, it can often provide interesting trading opportunities.

Some of Mirror's surprising organic growth came from Thailand, its largest market.

mAassets are easy to move and redeem, for example, you can trade them on Ethereum’s Uniswap or Binance Chain’s Pancakeswap. Compared to Synthetix, which is backed by an extremely high 600% mortgage rate (which erodes investors' capital efficiency), it can only be used in a closed-circuit system like the Kwenta exchange.

Demand for synthetic assets drives demand back to UST, like Anchor, bootstrapping Terra's ecosystem, providing value to Luna and UST.

6 Off-chain freewheels: Chai and Memepay

The problem with putting everything on-chain, especially UST paired with a volatile currency like Luna, is that it becomes very vulnerable to the ups and downs of the overall market. If the market falls sharply, so will yields and investors' appetite to borrow less, putting Anchor's 20% APR flywheel in jeopardy. Investors then sell Luna to protect the value of their portfolios, will weaken the leverage that keeps the US Treasuries pegged, and you can quickly see how the flywheel reverses and goes the other way, potentially creating a death spiral.

To remedy this, TerraForm Labs needs to create demand for its stablecoin from outside the blockchain and cryptocurrency-centric world.

Chai and Memepay are off-chain flywheels that provide organic demand for Terra's native stablecoins such as TerraUSD and TerraKRW.

Chai

Funded by TerraForm Labs and launched on June 13, 2019, Chai App is Terra's premier payment network built on the Terra blockchain. The Chai app has a single purpose: to be the payment app of choice for merchants in South Korea. While most payment apps target customers, Chai has made a major effort to prioritize merchants.

The reason they do this is that in Asia, there is a lot of friction around settlement times for merchants. Fees can be as high as 2.7 percent per transaction, and settlement times can take days before merchants receive money in their accounts. This doesn't work when working capital is tight and needs to be used the same day or the next day. Just like how taxi drivers tend to refuse to swipe their cards and only accept cash because they need to use it right away.

Chai alleviates this problem by using the Terra blockchain to simplify settlement times (nearly instant) and cut fees down to 1.3%. Merchants can easily integrate Chai into their POS terminals through a Stripe-like checkout SDK. More than 1,700 merchants in South Korea have integrated Chai so far.

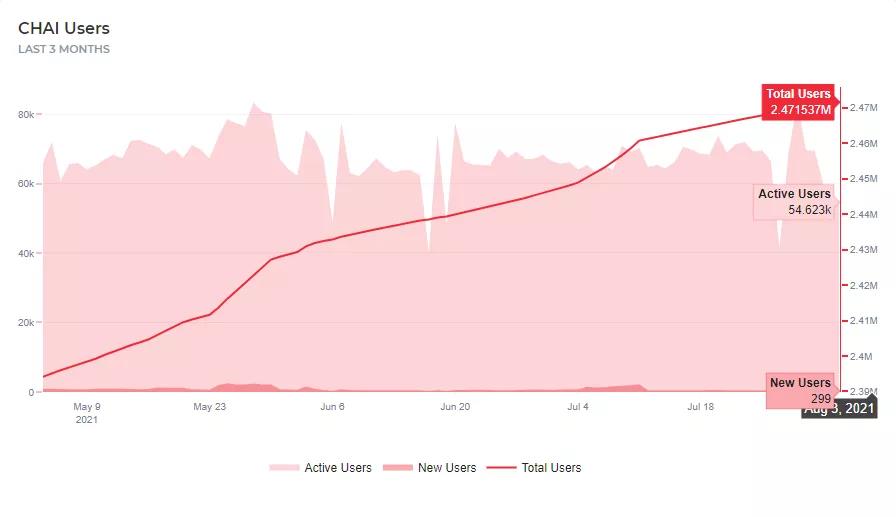

Chai App continues to increase their total users at a steady rate, averaging over 50,000 users per day, with a total user count of 2.47 million. Data source: https://www.chaiscan.com/

Chai App continues to grow their total users at a steady rate, averaging just over 50,000 users per day, with a total user count of 2.47 million and processing over $2 billion in transaction volume per year. For context, the total number of users of the Chai app equates to around 5% of the South Korean population.

For end users, Chai also provides the"boosts ", which are basically different types of promotions that merchants pay to appear on the app. Customers can easily find offers at merchants they are interested in and click to use them. As of May 10, 2021, Korean users no longer need a bank account to top up their KRT deposits after Chai integrates the Terra Station mobile network.

To bring our flywheel back, here's what happens when a Chai card user in South Korea buys a stablecoin.

Buy $1 worth of KRT (Terra's won-pegged stablecoin)

$1 Luna gets burned

Supply of Luna shrinks, creating upward price pressure

A higher Luna price creates greater value and stability for the token, which creates stronger support for the UST peg

Memepay

In 2019, a similar app launched in Mongolia called MemePay. It functions as both a money transfer and a payment app like Venmo, and works both online and offline. The app uses MNT (Terra's stablecoin pegged to Mongolian Tugrik). The app has much smaller usage than Chai, with only 3 percent of the Mongolian population using it, or about 90,000 users.

Other Notable Applications

Other Notable Applications

The Alice app + card will leverage Anchor’s yield to pay a portion of the dividends to users in a user-friendly way.

2. Orion Money

2. Orion Money

Orion Money's vision is to be a cross-chain stablecoin bank, providing seamless and frictionless stablecoin saving, borrowing and spending. Within the Orion Money stablecoin bank, there are planned to have three main products – Orion Saver, Orion Yield and Insurance, and Orion Pay.

Currently, you can deposit large amounts of stablecoins on the Ethereum network to earn Anchor’s yield.

3. Pylon Protocol: It is a set of savings and payment DeFi products built on the Anchor protocol to provide services for users. As can be seen from their documentation,"Pylon introduces a new model that aligns incentives between payers and payees, consumers and creators, patrons and artists, investors and entrepreneurs, borrowers and lenders, and more"。

Currently launched is a fair project launch platform called Pylon Gateway, which allows crowdfunding with yield. Users deposit UST into a pool to receive a share of the token distribution. The tokens of the project will be distributed proportionally according to the investor's share in the pool. Tokens of the Pylon Protocol"MINE "Mimic Luna's minting/burning role in the UST mechanism, absorbing the value of the tokens launched by the project on Pylon. Up to 10% of the rate of return generated by the project launch will be used for MINE repurchase.

4. Loop Finance - First AMM Dex on Terra

5. Mars Protocol - Terra's lending protocol will issue secured and unsecured debt to users. Users can earn protocol fees by staking MARS (similar to sushi).

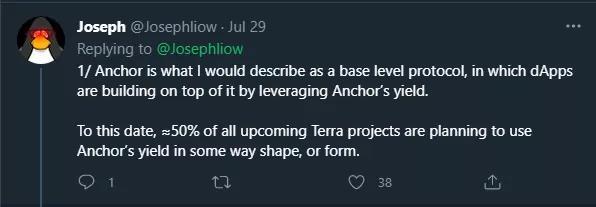

As of today, according to @Josephliow, roughly 50% of upcoming Terra projects plan to use Anchor proceeds in some way.

For a great list (but not all!) of existing and upcoming projects on Terra, check out this post by @FlynnToTheMoon.

7 What is the future of Terra? What is Columbus-5 and how is it a game changer?

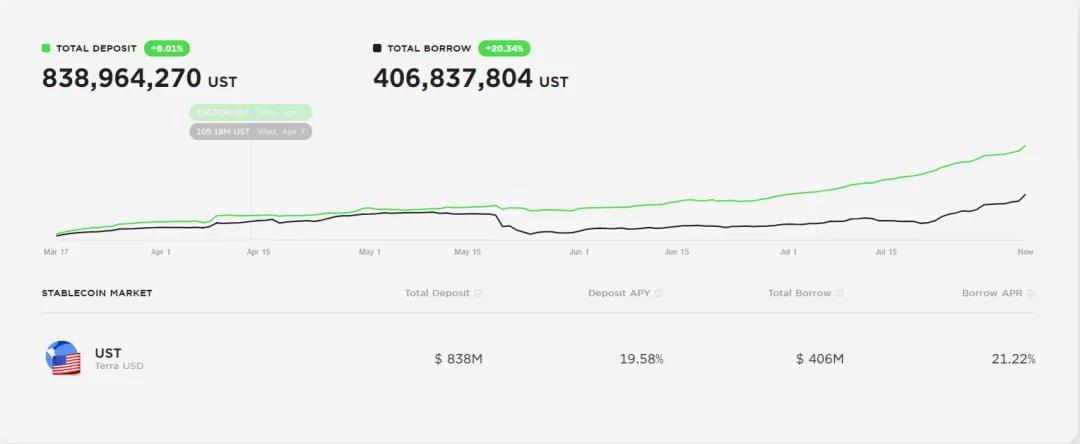

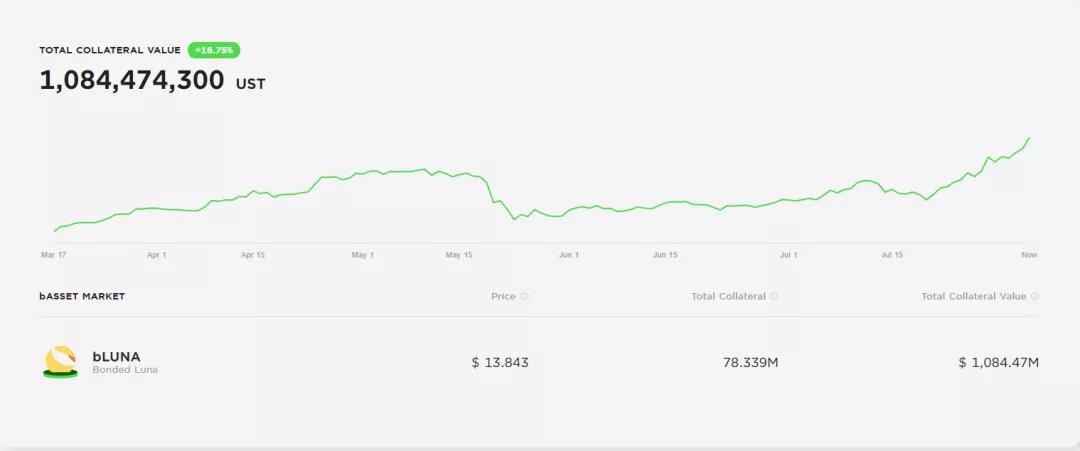

The Terra ecosystem is growing at an incredible rate. The graph below, from Anchor Protocol, shows the increase in UST deposited and borrowed over time, followed by the value of Luna collateral locked in the protocol.

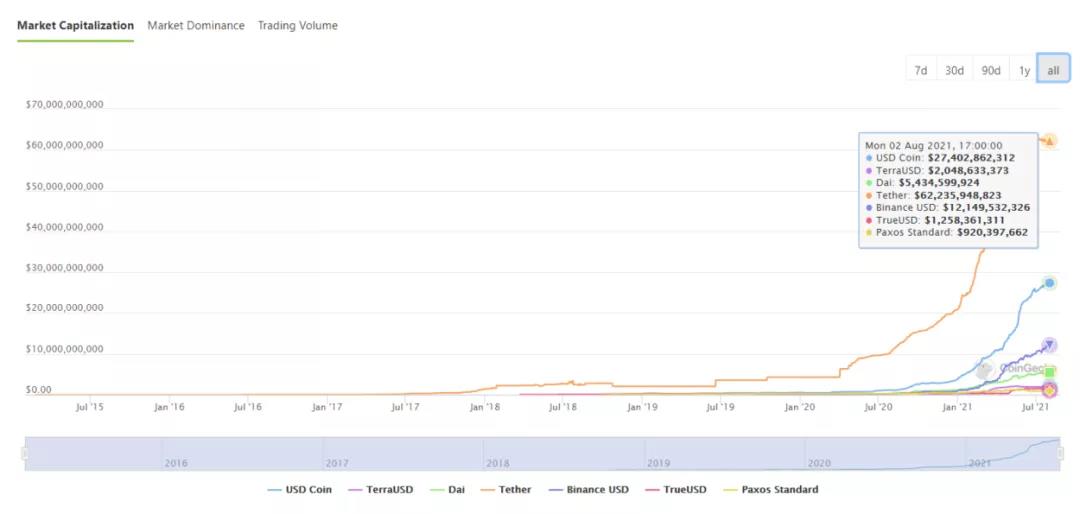

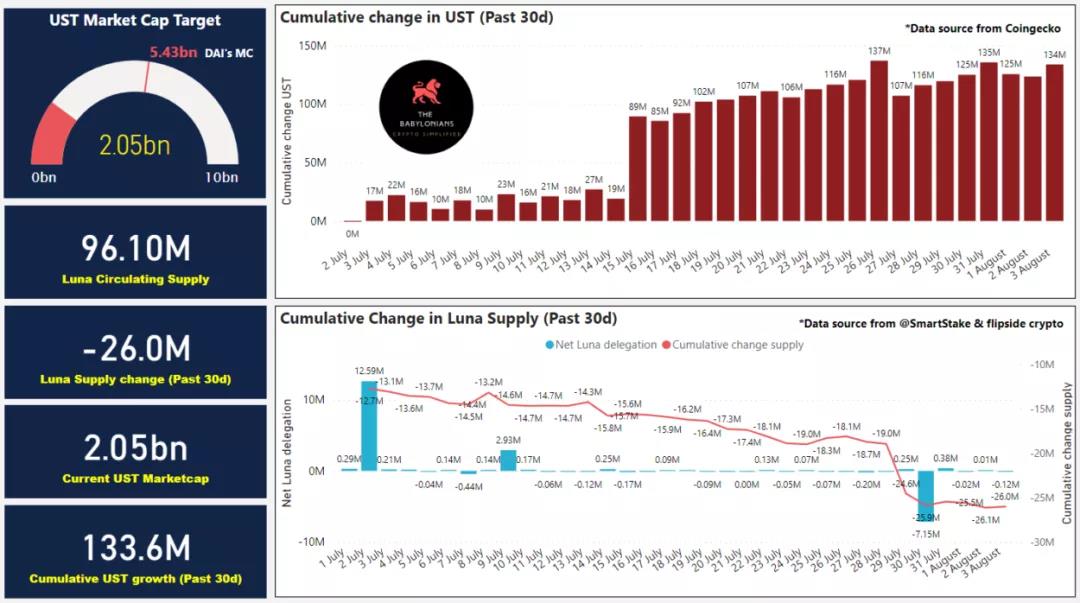

TerraUSD (UST) has broken into the top five stablecoins by market capitalization, but there is still a long way to go to reach the big leagues. Still, it’s an impressive feat to finish second to Dai when so many coins have failed, and it’s the only algorithmic coin in the top 9. Do Kwon said his goal for UST is to reach $10 billion by the end of the year, or a five-fold increase from now.

What's next for Terra? The next biggest update is Columbus-5. It has some key differences from many of the mechanics we just discussed, here are some important changes in the proposal:

Allocation of seigniorage. Currently, the protocol directs all seigniorage to the community fund (used to fund projects in the Terra ecosystem), but due to UST's rapid growth over the past year, the fund is currently overfunded. Col-5 will burn all seigniorage.

exchange fee. Currently, all exchange fees are burned. In Col-5, swap fees will be distributed to stakers. This should increase rewards for Luna stakers as the ecosystem continues to grow. Remember, this has the benefit of increasing the stability of the UST peg (backed by growth!).

Some technical changes, such as the upgrade of the cosmos-SDK and the performance optimization of the oracle.

dialogue"dialogue". This introduces a new interactive world to Terra.

These funds will be used to fund Ozone, an insurance protocol for insuring the Terra DeFi ecosystem, rather than burning excess community funds. This will first create insurance for the Anchor protocol.

8 Conclusions and observations

Do Kwon has a big vision for Terra, and they are well-capitalized to realize their goals. The role of the three flywheels of the protocol, on-chain and off-chain, is to directly drive demand for UST, which makes Luna more valuable through the burning mechanism involved, thus reflexively strengthening the UST peg. Terra's vision of cross-chain expansion and partnerships creates additional demand for UST and Terra's products, which will continue to strengthen the network.

Since Anchor is the key to the ecosystem, I do believe it could be too big to collapse. But I have some doubts about ANC liquidity mining to encourage permanent borrowing, when ANC is no longer useful, probably no one needs to incentivize borrowing from Anchor, and the training wheels will fall off.

The UST peg was a concern during those ill-fated days in May, but it was a technical issue of transaction overload from Anchor clogging the nodes used to read oracle prices, not the UST peg stabilization mechanism I take comfort from the more fundamental and serious flaws in the Shortly after the market turmoil, Anchor did introduce some changes to reduce the number of cleared transactions that would clog the network and"extrude"Oracle voting, Columbus-5 will provide more mempool priority, which can nip this problem in the bud and prevent similar days from happening again. From then on, the peg cannot deviate by more than 5%.

On Columbus-5, increased rewards for stakers while continuing to expand UST may be what Luna needs"zhupercycle "Catalyst, will make it into a long-term growth period.

The chart above from @The_Babylonians shows the path to UST to Dai level, and I think it's not out of the question that this could happen within a year. After all, users crave fixed income in an ecosystem that represents all the spirit of decentralized finance and cryptocurrencies, which is a very convincing argument.

The chart above from @The_Babylonians shows the path to UST to Dai level, and I think it's not out of the question that this could happen within a year. After all, users crave fixed income in an ecosystem that represents all the spirit of decentralized finance and cryptocurrencies, which is a very convincing argument.

This article is from The Way of DeFi, reproduced with authorization.

This article is from The Way of DeFi, reproduced with authorization.