Learn about DYDX governance tokens in one article

secondary title

dYdX is a decentralized derivatives trading protocol. It adopts the design of "off-chain matching + on-chain settlement" to make funds and transactions more secure and transparent, while also ensuring high performance and response speed. As the world's leading decentralized contract trading platform, dYdX has significant advantages: low transaction fees and no gas costs; extremely fast withdrawal processing efficiency, and can withdraw from Layer 2 without waiting; security and privacy In terms of performance, StarkWare's two-layer technology improves security and privacy through zero-knowledge proof; in terms of transaction processing, dYdX transactions can be executed immediately and confirmed on the blockchain within hours; in terms of margin utilization, dYdX can cross With margin, one account accesses positions on different trading pairs.

secondary title

DYDX is a governance token that allows the community to govern the dYdX protocol through voting.

Further reading:Three-minute quick overview of dYdX airdrops, transactions, LP reward rules and claim methods

secondary title

000 DYDX) are allocated to participating DYDX pledge users (insurance pool)

distribution mechanism

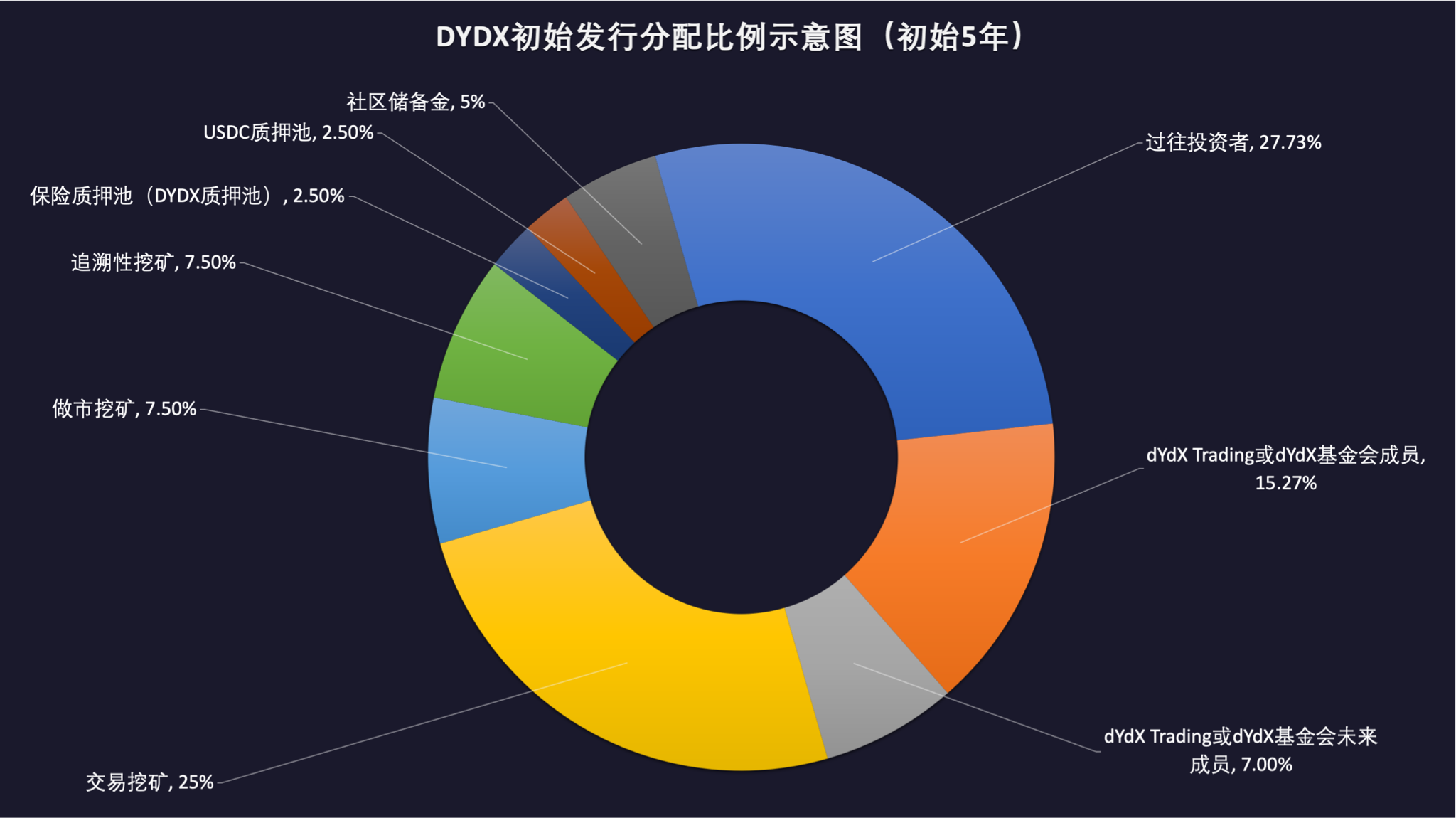

50%(500,000,000 DYDX) to the community, as follows:

25%(250,000,000 DYDX) distributed to users of transaction mining

7.5%(75,000,000 DYDX) distributed to retrospective mining users

7.5%(75,000,000 DYDX) distributed to market makers and mining market makers

5%(50,000,000 DYDX) allocated to community reserve funds

2.5%(25,000,000 DYDX) distributed to users participating in the liquidity staking pool

2.5%(25,000,000 DYDX) are allocated to participating DYDX pledge users (insurance pool)

● 27.73%(277,295,070 DYDX) distributed to past investors

● 15.27%(152,704,000 DYDX) to future members of dYdX Trading or the dYdX Foundation

● 7.00%(70,000,000 DYDX) to future members of dYdX Trading or the dYdX Foundation

secondary title

DYDX is mainly used for contract governance and fee discounts.

secondary title

The specific discount fee of DYDX will be determined according to the amount of DYDX held in the user account.

secondary title

What is the start and end time of the DYDX token reward campaign?

Retrospective mining starts from 15:00:00 UTC on August 3, 2021, and ends on August 31, 2021 15:00:00 UTC.

Transaction mining starts at 15:00:00 UTC on August 3, 2021 and ends at 15:00:00 UTC on August 3, 2026, for a period of five years.

Market-making mining starts at 15:00:00 UTC on August 3, 2021 and ends at 15:00:00 UTC on August 3, 2026, for a period of five years.

The insurance pledge pool starts at 15:00:00 UTC on September 8, 2021 and ends at 15:00:00 UTC on September 7, 2026, for a period of five years.

secondary title

Is there anything to pay attention to when participating in mining?

For users participating in the liquidity staking pool and insurance staking pool, if they need to withdraw the pledge, they need to send a request before the freezing period of each period (EPOCH). The current freezing period is 14 full days.

At 15:00:00 UTC on September 8, 2021, 8 days after the end of the first period, all DYDX tokens will be automatically unlocked for the first time; by then, there will be approximately 8.11% of DYDX token liquidity in the market.

secondary title

DYDX acquisition rules

At this stage, there are five different ways in which DYDX tokens can be obtained. (non-US users)

If you have used any generation of dYdX products in the past, including Layer 1 spot, leveraged contracts and Layer 2 contract products, you can participate in the retrospective mining project that is only open to old users.

If you are a new user of dYdX Layer2 contract products, you can participate in our transaction mining, liquidity staking pool and insurance staking pool.

Currently, only selected market makers can lend USDC from the liquidity pool. In the future, the community can vote on which market makers can borrow from USDC

secondary title

retrospective mining

Overview: 7.5% (75,000,000) of DYDX tokens will be distributed to dYdX through retroactive mining. The snapshot as of 00:08:00 on July 26, 2021, China time distributes DYDX to all historical users of the dYdX protocol. There are five levels of distribution, depending on the usage of all dYdX protocols. Retroactive mining cannot be offered to companies located in, incorporated in, or otherwise incorporated in the United States or any other prohibited jurisdiction pursuant to the U.S. usage restrictions of DYDX and the dYdX Layer 2 Agreement or users who are residents of the United States or any other prohibited jurisdiction. Any accounts clearly associated with bot activity speculating on future airdrops are also excluded from retroactive rewards.

Any historical volume on the dYdX Layer 2 protocol will count toward the user's claim milestone. At the end of the 0 period, any unclaimed DYDX will be forfeited and automatically transferred to the community treasury.

text

How to check my reward amount?

Users can go to this page to check their quota: trade.dydx.exchange/portfolio/rewards

secondary title

transaction mining

transaction mining

Overview: 25% (250,000,000) of DYDX tokens will be distributed to dYdX trading users through transaction mining.

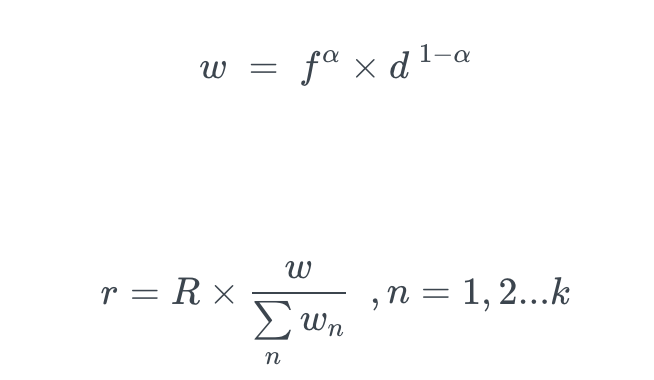

25% of the DYDX tokens will be distributed to all users participating in the dYdX contract transaction in the smallest unit of each period (28 days) within five years, and 3,835,616 DYDX will be distributed in each period. The DYDX tokens that each trading user can obtain in each period (28 days) will be determined by the proportion of each user’s transaction fees and holdings in the overall transaction fees and holdings. The specific calculation formula is as follows:

Notes:

Notes:

r: The number of Tokens obtained through transaction mining.

R: The total reward that will be distributed among all traders in the pool during the period

f: the total transaction fees paid by the trader during the period

w. Individual trader score

, the sum of all traders' scores.

d. Trader's average open interest across all markets during the period (measured hourly)

k. The total number of traders in the period

α, a constant in the range that determines the weight of fees and open positions. The initial value is α=0.7.

How to check the rewards that have been obtained in the current period?

https://trade.dydx.exchange/portfolio/rewards

For the current period, users can view their transaction fees, holdings and rewards on this page:

For past periods, users can check this page: https://dydx.community/history/rewards

7 days after the end of each period, users can claim rewards for transaction mining

secondary title

Market making mining

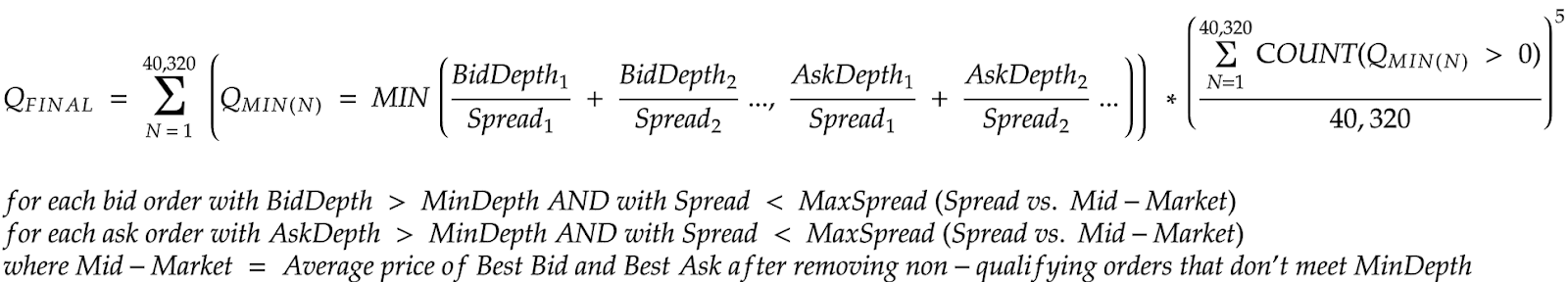

Overview: 7.5% (75,000,000 DYDX) of DYDX tokens will be distributed to dYdX’s liquidity providers through market-making mining.

mining rules

7.5% of DYDX tokens will be distributed to liquidity providers in each period (28 days) as the minimum unit within five years, and 1,150,685 DYDX will be distributed in each period.

Any Ethereum address can earn these rewards, but it must meet the requirement of providing more than 5% of the pending order liquidity in the previous period

The DYDX tokens that each liquidity provider can obtain in each period (28 days) will be determined by the depth of its market making, the bid-ask spread, the current length of time and the number of supported trading pairs; the specific calculation rules are as follows:

7 days after the end of each period of rewards, liquidity providers can claim token rewards through the API provided by dYdX.

secondary title

Liquidity staking pool:

Overview: 2.5% (25,000,000 DYDX) of DYDX tokens will be distributed to dYdX stakers through the liquidity staking pool. In order to further improve the liquidity network effect and motivate professional market makers, DYDX will be allocated to users who pledge USDC to the liquidity staking pool. Recognized and community-approved market makers will use pledged USDC to make markets based on the Layer 2 protocol, further increasing the available liquidity in the market.

How do users participate in staking liquidity?

Users can participate on this page: https://dydx.community/dashboard/pools/liquidity

click pledge

Before staking for the first time, allow the dYdX protocol to use USDC

How to issue and claim DXDX token rewards?

Pledgers can start and exit the liquidity staking pool at any time, and the rewards of DYDX will be calculated in real time and distributed to the staking users according to the proportion of each user's USDC in the overall liquidity pool.

How do users withdraw cash from the pledged pool?

To be able to withdraw funds after the end of the period, the pledger must request to release the pledged funds at least 14 days before the end of the period. If the staker does not request a withdrawal, their staked DYDX will be rolled over to the next period. You can operate on this page: https://dydx.community/dashboard/staking-pool/liquidity

Which market makers can participate in fund pool lending?

The first approved market makers include Wintermute, Amber Group, Kronos, Sixtant and DAT Trading, who have been actively making markets on the dYdX Layer 2 protocol this year.

Although the market maker cannot withdraw USDC from the dYdX Layer 2 protocol, it can only use the funds for market making; however, if the market maker loses funds due to market making and cannot replenish the liquidity staking pool, the USDC pledged by the user may also will lose money.

secondary title

Insurance pledge pool:

What is the purpose of the insurance pledge pool?

User safety and protection have been a major concern since the launch of the dYdX Layer 2 protocol. To this end, DYDX will be allocated to users who pledge DYDX to the insurance fund pool, thus providing additional security protection for the dYdX Layer 2 protocol.

2.5% (25,000,How many DYDX tokens will be distributed through the liquidity staking pool?

000 DYDX) will be distributed to dYdX stakers through the liquid stake pool

When will the insurance pledge pool go online?

September 8, 2021 at 15:00 UTC.

How do users participate in staking liquidity?

Users can participate on this page: dydx.community/dashboard/pools/safety

click pledge

Before staking for the first time, the dYdX protocol must be allowed to use DYDX

How to issue and claim DXDX token rewards?

Pledgers can start and exit the liquidity staking pool at any time, and DYDX rewards will be calculated in real time and distributed to staking users based on the proportion of each user's DYDX in the overall liquidity pool.

How do users withdraw cash from the pledged pool?

To be able to withdraw funds after the end of the period, the pledger must request to release the pledged funds at least 14 days before the end of the period. If the staker does not request a withdrawal, their staked DYDX will be rolled over to the next period. You can operate on this page: https://dydx.community/dashboard/staking-pool/liquidity

secondary title

community treasury

community treasury

secondary title

governance

DYDX gives holders the right to propose and vote on amendments to the dYdX Layer 2 protocol. DYDX governance is based on the AAVE governance contract and supports voting based on DYDX holdings.

secondary title

governance content

At the same time, DYDX holders will have direct and irrevocable control over:

Allocation of funds from the community treasury

New Token Listing on dYdX Layer 2 Protocol

Risk parameters of the dYdX Layer 2 protocol

Allocation of funds for market makers in the liquidity equity pledge pool

Adding a new market maker to the liquidity staking pool

When there is a loss, determine the expenditure amount of the insurance fund pledge pool

Governance contract itself

secondary title

proposal type

There are four types of proposals with different parameters that affect the length and execution of the proposal. The executor must validate each type of proposal:

Short-duration lock executors can execute proposals that typically change reward and incentive contracts or community treasuries that require quick intervention.

Long-duration lock executors can enforce proposals to change parts of the dYdX Layer 2 protocol that affect governance consensus.

secondary title

More

More

http://trade.dydx.exchange/portfolio/rewards

Retrospective mining and transaction mining to obtain DYDX quantity query:

http://dydx.community/dashboard/staking-pool/liquidity

Liquidity pledge pool address:

https://dydx.community/dashboard/staking-pool/safety

Insurance pledge pool address:

http://dydx.community/dashboard/

Governance voting link:

https://forums.dydx.community/