Grayscale is hard to save, what happened to GBTC?

This article comes fromCointelegraph, original author: Marcel Pechman

Odaily Translator |

Odaily Translator |

Grayscale’s Bitcoin Trust Fund GBTC discount continues, a situation that not only presents investors, but also presents itself with unique new challenges for Grayscale.

Grayscale Bitcoin Trust (GBTC) is a publicly quoted private Bitcoin investment vehicle that has been providing investors with exposure to Bitcoin (BTC) since 2013. However, compared with exchange-traded funds, also known as ETFs, the Grayscale Bitcoin Trust Fund is quite different in terms of convertibility and liquidity.

In terms of organizational form, the trust fund is more like a company, or a "closed-end fund" that can only be sold to accredited investors initially, at least in terms of regulatory form. This means that the number of available shares of GBTC is limited, and retail traders can only obtain investment opportunities through the secondary market, and GBTC shares cannot be exchanged for native Bitcoin positions.

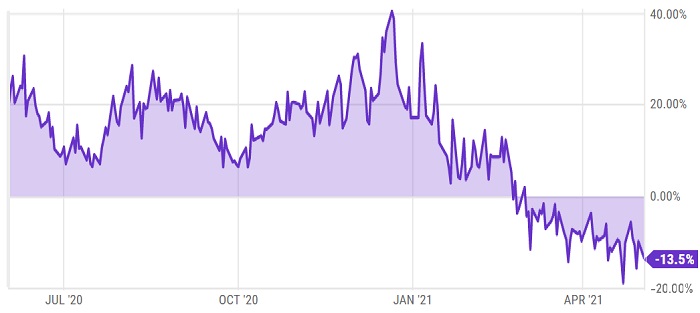

Historically, GBTC has traded at a premium to the equivalent bitcoin held by the fund due to excess demand from retail investors. In contrast, institutional clients seem to be a bit "simple and crude", and their usual practice is to buy shares directly from the Grayscale Bitcoin Trust Fund and sell them directly to make a profit after a six-month lock-up period.Grayscale Bitcoin Trust shares have traded at a premium to their net asset value (NAV) for most of 2020, with premiums ranging from 5% to 40%.

Bitcoin ETFs are less risky and less expensive than trust funds. What's more, Bitcoin ETFs have no lock-up period, which means retail investors have direct access to buy shares at par. The result is obvious. With the emergence of better bitcoin investment tools, the advantages and market appeal of the Grayscale Bitcoin Trust Fund are gradually disappearing.

secondary title

Can the parent company save Grayscale?

Above: Grayscale Bitcoin Trust Fund Premium vs NAV, Source: Ycharts

Starting from late February, the premium of the Grayscale Bitcoin Trust Fund began to enter the unfavorable area, and GBTC holders began to desperately switch positions to avoid falling into expensive and irredeemable difficulties. Although the price of Bitcoin reached an all-time high in mid-March 2021, the bull market did not give GBTC holders enough confidence, which eventually led to a discount of up to 18% on the Grayscale Bitcoin Trust Fund.

On March 10, 2021, Grayscale’s parent company, Digital Currency Group (DCG), announced plans to purchase approximately US$250 million in issued GBTC shares. And at the discretion of management, it was ultimately decided to use cash on hand to finance the purchase transaction. Although Digital Currency Group did not specify the reasons behind the move, the high discount rate will undoubtedly put pressure on the group's reputation.

As the situation worsened, Digital Currency Group announced plans to convert its bitcoin trust fund into a U.S. exchange-traded fund, although no specific guarantees or deadlines have been announced. On May 3, Digital Currency Group disclosed that it had purchased $193.5 million worth of GBTC stock as of April 2021, and also plans to increase GBTC stock repurchase potential to $750 million.

But the problem is that the assets managed by the Grayscale Bitcoin Trust Fund are as high as 36.3 billion US dollars, which means that buying 750 million US dollars of GBTC stocks is simply a drop in the bucket, and it is difficult to alleviate the current discount dilemma.

For Grayscale, there may be some important questions to answer right now, such as:

* Can parent company Digital Currency Group ease the discount by repurchasing GBTC shares?

* Will Grayscale actually convert the Bitcoin Trust to a Bitcoin ETF?

secondary title

In the future, can Grayscale be saved?

As the actual controller of Grayscale Bitcoin Trust Fund Management, the parent company Digital Currency Group can indeed purchase GBTC shares at market prices and withdraw equivalent Bitcoins for redemption. It is worth mentioning that this type of buyback is actually profitable, as buying GBTC at a discount and selling Bitcoin at the market price is always profitable, and there is not much risk in doing so.

Other than some periodic holding reports, we currently have no way of knowing who exactly has been dumping GBTC at a discount to net asset value—however, the "major shareholder" of the Grayscale Bitcoin Trust, which owns 5 Neither BlockFi nor Three Arrows Capital, institutional investors with a stake of more than 100%, reported reducing their GBTC positions. In addition, investment management company Marlton also publicly supported Digital Currency Group's repurchase of GBTC:

“We support this move by DCG and believe it represents a more constructive approach to mitigating the large discount between the market price and NAV of GBTC shares. We remain confident that GBTC remains the largest Bitcoin fund in the world competitive advantage, and appreciates that GBTC recognizes the need to take meaningful steps that align with shareholder value creation and secure the best path forward."

In addition, Marlton has been urging Grayscale Trust to modify the trading method of GBTC into a Dutch auction, hoping to improve or even eliminate the negative premium problem through this method. Judging from the above, it is likely that retail investors are now exiting the Grayscale Bitcoin Trust Fund at all costs, but it is not yet possible to confirm this.