The dark forest of Ethereum is no longer dark. Is Ming MEV good or bad?

I. Introduction

I. Introduction

The Ethereum ecology has developed as mature as a modern city. Various DeFi protocols and NFT protocols are like high-rise buildings, but there are still many unknown corners in the colorful city. This is the dark side of Ethereum. forest.

The concept of the dark forest comes from "The Three-Body Problem", which describes the dark forest in this way: "The whole universe is like a dark forest, and different races are lurking like different hunters. Since they don’t understand other people’s intentions, the only option is to eliminate the exposed hunter.”

This is very similar to the current situation of Ethereum. On Ethereum, a user initiates a transaction, which will be spread throughout the peer-to-peer network composed of all nodes of Ethereum, and the content of the transaction is completely transparent, which means that any network Any full node can see the transaction content of most transactions. In short, any user's transaction is a "bright card" for the node operator, and they can see all the information of the transaction, including the address that initiated the transaction, the transaction amount, and the transaction gas fee. And we know that on Ethereum, miners sort transactions according to the gas fee from high to low, which means that when someone knows the gas fee of a user's transaction, they can adjust their own gas fee To actively control the order of your transactions.

As a result, there will be several situations in the Ethereum network that undermine the expectations and experience of the transaction sender (usually identified as a certain degree of "attack"), which are generally initiated by robots:

1. Front-running: refers to making a profit by making a specific transaction rank ahead of the target transaction (attacked transaction) in the same block, mainly for liquidation and arbitrage transactions;

2. Back-running: refers to making a profit by making a specific transaction rank behind the target transaction in the same block, typically targeting information input mechanism (Oracle) transactions or large-order transactions;

3. Sandwich attack: The combination of the above two attack forms allows the target transaction to be sandwiched between two transactions with a specific structure, thereby making a profit. The sandwich attack has greatly broadened the scope of the attack, and even an ordinary AMM DEX transaction may become the target. The attacker's first construction transaction creates greater fluctuations in the transaction price. After the target transaction is executed, the second construction transaction is executed immediately, and the tokens used to launch the attack are exchanged to complete the benefits.

Taking Uniswap as an example, its price model is x * y = constant. For example initial x = 10, y = 10, then constant = 100. Then when:

User A buys y with 1 x. At this time x = 11, y = 9.09 (x*y=100), user A gets 10-9.09= 0.91 y;

User B buys y for 1 x. At this time x = 12, y = 8.33 (x*y=100), user B gets 9.09-8.33=0.76 y;

User A sells all y. At this point y = 9.24, x = 10.82 (x*y=100), user A gets 12-10.82=1.18 x.

It can be seen that as long as user A can complete the buying action before user B, then an arbitrage of 0.18 x can be completed one after the other. Of course, there will not be such a large profit margin in the actual situation, but as long as the profit can To cover the cost of gas fees, there must be robots to arbitrage.

To a certain extent, there are many such arbitrage opportunities on the chain, but precisely because of the many opportunities, more and more robots are dedicated to arbitrage, which gradually forms a dark forest, that is, when you run a robot You don’t know whether you are a hunter or a prey in the eyes of other hunters, because when you are arbitrage, there may be other arbitrage robots waiting to arbitrage you.

There is still fair competition between robots, because after all, it is a competition in the technical dimension, but when miners participate, the whole pattern is completely different, because miners have the final decision on packaging transactions, so in this whole In this food chain, the miner is the man standing at the top of the food chain. This food chain is probably like this, miners eat big robots, big robots eat small robots, and small robots eat ordinary users.

Such an arbitrage pattern is the most harmful to ordinary users. The previous outbreak of DeFi led many ordinary users to form the habit of on-chain transactions, but the real reason for the surge in gas fees is that these robots continue to push up gas fees for arbitrage. Some time ago, the successful operation of Flashbots ate up many robots, which also reduced the gas fee. However, from the perspective of the development of the entire Ethereum, the low gas fee is also problematic for the security of the entire network. The fundamental reason for this is that the network security of Ethereum needs to be maintained by miners.

At present, the income of Ethereum miners comes from two parts, one part is block rewards, and the other part is gas fees. With the advancement of EIP1559, the income of miners is likely to decline. If the price of ETH also falls in the future, it will inevitably cause the income of many miners to fail to keep up with the cost. At this time, some miners will inevitably withdraw from the network, which will also indirectly affect network security. , so how to solve this problem is also a core of the ecological development of Ethereum.

A representative example is that Archer DAO is seeking a balance of interests between MEV and ordinary users. Its core logic is to transfer the benefits that were originally plundered by arbitrage robots to miners in a certain way. The arbitrage robots that don’t have many benefits in the Ethereum ecosystem are expelled from the entire ecosystem, and then this part of the benefits is given to the miners, so that the miners still have the motivation to maintain network security. At the same time, due to the advancement of EIP1559, the gas fee of ordinary users will also be reduced. .

Second, the joint

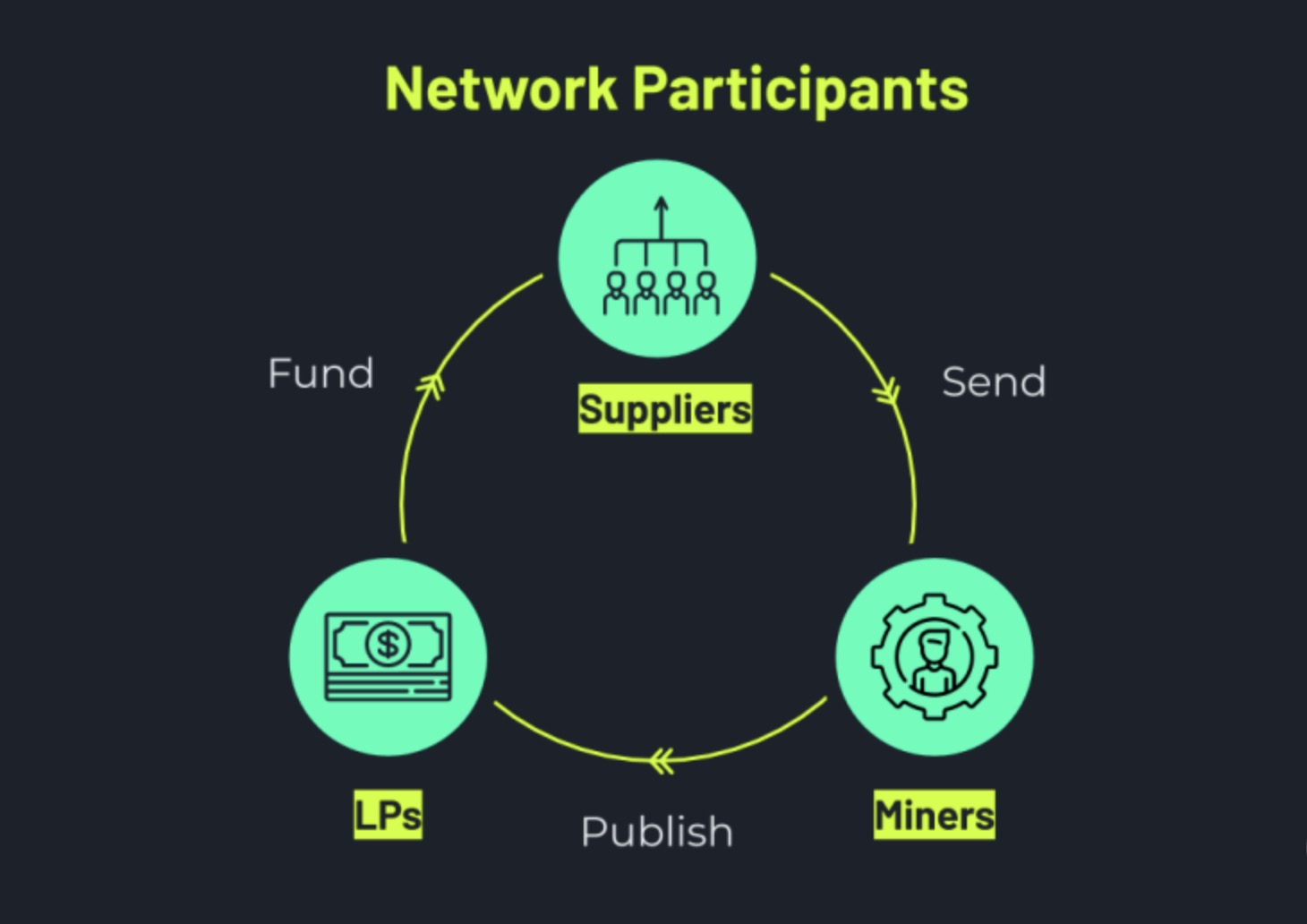

There are three main roles in Archer DAO, suppliers (Suppliers), miners (Miners) and liquidity providers (LPs). Suppliers mainly provide strategies. Most of them are composed of a group of scientists who are very proficient in chain business and arbitrage opportunities , they will provide strategies for Archer's arbitrage system, telling miners how to obtain arbitrage opportunities, and because miners are at the top of the food chain, they can maximize the arbitrage opportunities provided by suppliers, and then liquidity providers mainly provide funds to participate in the entire process.

As more and more suppliers participate, more and more arbitrage opportunities can be captured. As more and more miners participate, more and more transactions can be packaged, which means There are more and more arbitrage opportunities that can be realized, so with the development of the Archer DAO ecology, the income of miners in this ecology will also be higher and higher.

For example, on sushiswap, 8eth can be exchanged for 0.112YFI; in cream, 0.112YFI can be exchanged for 3,940USDC; and on Uniswap, 3,940USDC can be exchanged for 11.35 ETH. In this arbitrage transaction, a total of 3.35ETH can be generated, of which 1.675ETH is distributed to the miners, and 1.675ETH is distributed to the supplier strategy provider.

And we know that miners are the top predators of the entire arbitrage food chain on the chain. Their participation in arbitrage and liquidation may bring additional benefits to the entire Ethereum ecosystem. One of them is to improve the performance of DeFi and suppress Frontrunning bots results in fewer frontrunners.

Due to the more timely and efficient liquidation, it can reduce the mortgage rate in markets such as lending; the prices between different DEXs are becoming more and more consistent, and tokens have better price discovery; it will also lead to fewer front-running transactions, because front-running transactions There are fewer opportunities to submit transactions through private channels.

From this perspective, Archer can purify the DeFi environment while achieving higher returns by uniting miners, strategy providers, and liquidity providers. DeFi projects currently using the Archer system include Sushiswap, Uniswap, Cream, AAVE, Balancer, Compound, mStale, DODO, Curve, Oasis, etc. These DeFi projects use Archer to achieve more timely liquidation, token price discovery, and less Be the first to trade for a better user experience. This is why DeFi projects are willing to cooperate with Archer.

We believe that the Archer DAO project is logically self-consistent, but from the point of view of actual operation, there are two key points:

Whether there are enough strategy providers, because good strategists can also choose to arbitrage themselves, accessing Archer DAO can take advantage of the value of miners, but at the same time share part of the profits, so for strategy providers, it is inevitable There is a balance of interests considerations;

The participation of leading miners, the mining circle is a small circle, and the miners are very familiar with each other. If the leading miners unite and use some advantageous strategies, they can completely establish a more powerful ecology than Archer DAO, and these Miners have sufficient funds, and the demand for liquidity providers is very low;