DeFi unicorn YFX, the valuation logic behind the investment of 23 institutions

Zhang Lei, a well-known investment tycoon, said that value investing is divided into two stages, one is called value discovery, and the other is called value creation.

The investment actions of 23 institutions not only help you discover the value of YFX, but also invite you to create value for yourself with YFX. Who you choose to walk with is more important than where you go. Choosing who to invest in is more important than the expected return.

The investment of 23 institutions is just one of the achievements of DeFi unicorn YFX in April. In order to let you understand the development performance of YFX in April, I sorted out the important news events released by YFX in Jinse Finance:

On April 7th, YFX won the first prize of $200,000 in the TRON 2021 Global DeFi Hackathon Developer Competition.

On April 9, YFX’s TVL exceeded $13 million.

On April 12, it received strategic investment from NGC, SNZ, DFG Group, Bixin Capital, Youbi Capital, Spark Digital Capital, Winkrypto and other institutions.

On April 16, the cumulative transaction volume of the second round of Genesis Mining of YFX reached 3.88 billion US dollars, the 24-hour peak transaction volume exceeded 1.383 billion US dollars, and the number of mining addresses exceeded 24,000.

On April 23, YFX was rated by Encryption Pavilion and obtained A grade.

On April 26th, YFX was rated by Cryptogram and scored 96 points, ranking first in the scores obtained in 10 rating items.

Get OKEx Blockdream Ventures, PrimeBlock Ventures (MXC Labs), Gate.io Labs, LD Capital, PetRock Capital, True Edge Capital, R8 Capital, ArkStream Capital, CryptoJ, 7 O'Clock Capital, Phoenix VC, NewTribe Capital on April 26 , Vega Ventures, 499Block, Jackdaw Capital, Red Chain Capital and other domestic and overseas investment institutions raised millions of dollars in financing, and expressed their desire for IDO.

The rapid development is the best comment on the development speed of YFX. Millions of dollars, they share the risk of innovation for YFX, and they invest in creating the future with YFX! So, how did YFX do it?

This article does not analyze the reasons for YFX's achievements from the perspective of YFX technology and team strength, economic model, industry, market space, etc., because you can know this part of the content through the content published by YFX on Jinse Finance. Therefore, I will only discuss why YFX deserves a valuation of millions of dollars from the perspective of token valuation, as well as possible future value returns.

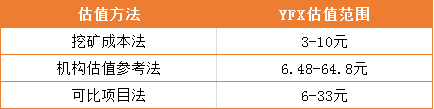

As we all know, DeFi projects cannot be valued like traditional startups or listed companies. Therefore, this article draws on the valuation methods of start-ups and the valuation tools commonly used in DeFi projects to discuss the value of YFX from three perspectives: mining costs, institutional investment references, and comparable projects.

Mining cost method: the price is expected to be higher than 10 yuan?

Mining cost valuation is a way for investors to value Bitcoin. In the same way, we can use an analogy to apply the method of mining cost valuation to the valuation of YFX.

It is reported that the miners in the first round of Genesis Mining of YFX mostly cost between 3 yuan and 6 yuan to obtain 1 YFX. About 19,000 people participated, and each person received an average of 217 YFX. Miners in the second round of Genesis Mining of YFX have a higher cost of obtaining 1 YFX than in the first round, but most of them are higher than 6 yuan and lower than 10 yuan. About 24,000 people participated, and each person received an average of 217 YFX.

According to the accumulated mining cost of 43,000 people in two rounds of genesis mining, the cost price range of 1 YFX is between 3-10 yuan. Assuming that miners are profit-seeking and rational, they will not sell YFX at a loss, and they will feel safe or profitable if they try to maintain the price of 1 YFX above 10 yuan, then the secondary market for 1 YFX The circulation price should be higher than 10 yuan.

Institutional valuation reference method: Can the price be expected to reach 60 yuan?

To evaluate a token, you can properly refer to the institution's valuation of the project, which is the institution's input cost.

According to Lianwen, YFX received millions of dollars on April 26. Although this amount is somewhat vague, it can be understood from the literal meaning that the investment amount of the institution will not be less than one million US dollars and less than 10 million US dollars. Therefore, institutions believe that the current value of YFX is between US$1 million and US$10 million.

The current total amount of YFX is 100 million, and the value of 100 million YFX is between US$1 million and US$10 million. That is to say, the above-mentioned 23 institutions involved in millions of dollars of investment believe that the price of one YFX is expected to be between US$1 and US$10, that is, between 6.48 yuan and 64.8 yuan (the exchange rate of RMB to US dollar at the time of writing is about 1 USD = 6.48 RMB).

If YFX destruction factors are taken into consideration (please refer to YFX’s destruction mechanism), the final circulation of YFX will be less than 100 million, then the price ceiling of 1 YFX is expected to go up a lot, depending on the future of YFX Income and development and the destruction it brings.

Comparable item method: Is 30 yuan reasonable?

At present, YFX has not yet entered the secondary market circulation, and is about to open IDO. Assuming that the more optimistic the platform is in the long run, the higher the value of the token is. If the total lock-up TVL is used to measure the size of the DEX or derivatives platform, the market value of the token is proportional to the TVL.

image description

Remarks: The chart data comes from CMC, 2021-4-28

As mentioned in the above table, Uniswap, Pancakeswap, Synthetix, Sushiswap, and Bancor are used as comparable projects to value YFX, and the corresponding YFX valuation ranges are: 33, 17, 17, 6, and 11 yuan. Therefore, according to the comparable project valuation method, the expected price range corresponding to YFX is between 6 yuan and 33 yuan.

From the perspective of the track, YFX and Synthetix are both derivative tracks, and the reference valuation of Synthetix is of great significance. Judging from the participation period and community expectations, the reference valuation of Uniswap is of great significance.

Combining the mining cost method, institutional reference valuation method, and comparable project valuation method, the valuation range of YFX is as follows:

To sum up, whether it is from the perspective of miners' cost or from the perspective of the comparable project method, the valuation of YFX is worth millions of dollars, and even the valuation of YFX by these institutions is somewhat low.

Jobs said that if you give people really good tools, they will naturally do things better and better. YFX is this tool, a tool that allows traders to better trade perpetual contracts. Therefore, this valuation can only be regarded as the "friendship price" in the initial stage.

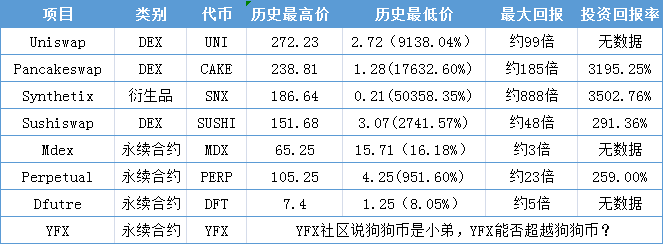

The return space of MEME coin YFX

Drucker said, "The greatest danger in turbulent times is not the turmoil itself, but still doing things with the logic of the past, anticipating the best way to create the future."

If the MEME factor of the YFX community is taken into account, the price expectation of YFX may be a different matter. After all, many community members regard YFX as the next Dogecoin, and many even say that Dogecoin is the younger brother and YFX is the big brother. If the above views form a strong community consensus, the value expectation and growth space of YFX, which is also a MEME coin, will be immeasurable.

image description

Remarks: The chart data comes from CMC, 2021-4-28

Can YFX outperform Dogecoin and outperform Dogecoin? Friends of time will witness this. So, don't be obsessed with "instant gratification." For example, the return brought by Wang Xing’s purchase of Bitcoin in 2013 was more than 100 times, even exceeding the income brought by the Meituan he created.

Please trust YFX and give YFX time. After all, it takes time for Huawei to build a car, let alone YFX, which is thinking farther, more essential, and creating the future in the DeFi derivatives track?

In the face of YFX, which is deeply cultivating the decentralized derivatives market and constantly refining its products, Mdex, Perpetual, and Dfuture (rabbits) who started early should be careful, and the rabbits will wait and see!