Yu Jianing: The Top 10 Blockchain Fields in 2021 Are About to Take Off (Long Text)

About the Author

text

About the Author

Yu Jianing, Doctor of Economics, an authoritative blockchain expert, digital economist, served as the director of the Industrial Economics Research Institute of the Information Center of the Ministry of Industry and Information Technology, and participated in a number of national policy drafting and research work. Now Huobi The president of the university, the rotating chairman of the Blockchain Special Committee of China Communications Industry Association, etc., has won the Global Blockchain Leader Award, the Special Contribution Award for Blockchain Development, the 2020 Blockchain China Annual Person TOP10 and other awards, and was invited to be in Beijing University, Tsinghua University, Hong Kong University and other colleges and universities have taught, and their opinions have been widely reported by authoritative media such as CCTV's "Focus Interview", "Economic News Network", Xinhua News Agency, Guangming Daily, and Economic Daily.Digest

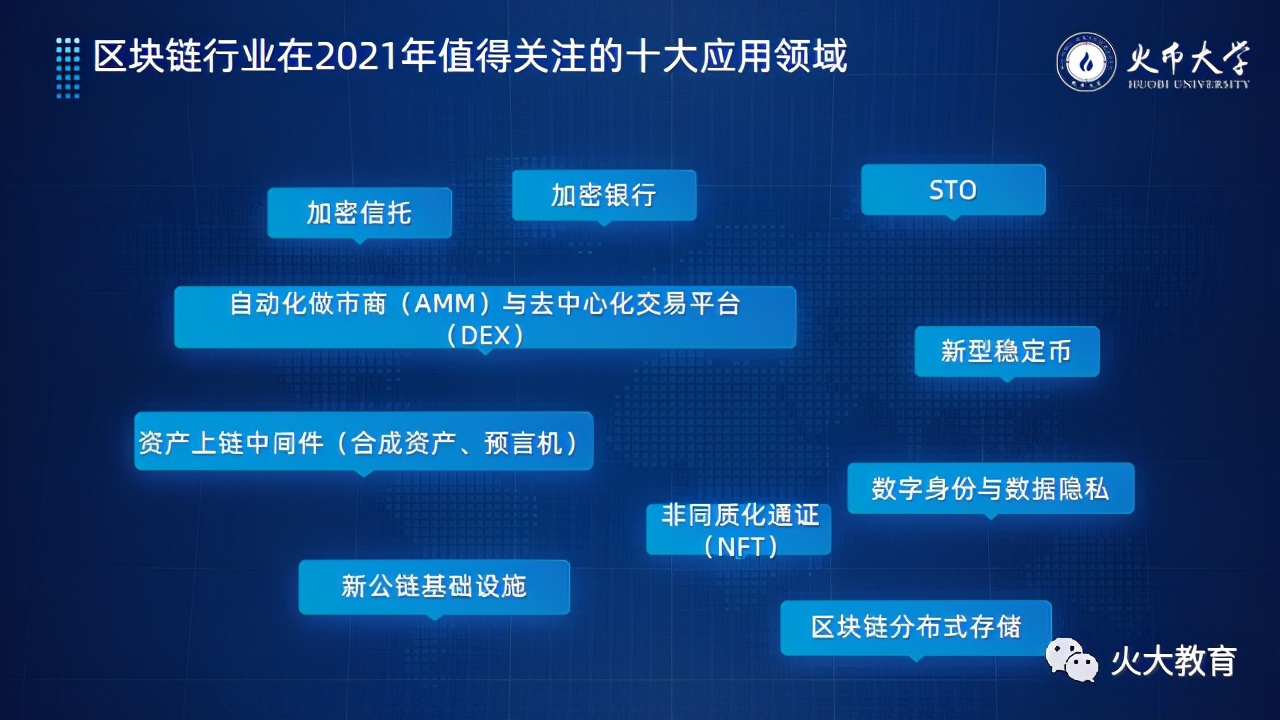

1. Track one: encrypted trust.Large investment institutions tend to invest in new mainstream assets such as Bitcoin through encrypted trusts or encrypted funds, and investors do not need to purchase, store and manage digital assets in person.

2. Track 2: Crypto Bank.At present, there are more than 30 banks that directly provide services to digital asset companies, and nearly 20 digital asset payment processors are actively developing banking-like services.

3. Track 3: STO (Security Token). STO is a manifestation of the pursuit of compliance and mainstreaming of digital assets, which will bring great changes in accelerating global asset liquidity.

4. Track 4: Automated market maker.Automated Market Maker (AMM) not only realizes transaction automation and unmanned, but more importantly, it introduces a new trading model to the financial market.

5. Track five: Algorithmic stablecoins.Algorithmic stablecoins that are still in a state of chaos, although they have not yet output "stable", reveal another order and rules for us.

6. Track 6: Asset on-chain middleware.Asset on-chain middleware such as oracles and synthetic assets will continue to iterate with the continuous development of the industry.

7. Track 7: Privacy Computing.In the future, in the ecosystem built by blockchain + privacy computing, each individual can truly have their own data control rights and digital identities, maximizing the value of data.

8. Track 8: Non-Fungible Token (NFT).The value of NFT is not limited to the field of art. At the breaking point of the combination of industry and blockchain, NFT will be a key bridge.

9. Track Nine: New public chain.In 2021, the public chain competition will further intensify, and the upgrade of public chain infrastructure such as the ETH2.0 Polkadot parachain slot auction will bring new opportunities for industry development and landing applications.

......

10. Track 10: Distributed storage.

With the development of 5G and big data, the volume of the cloud storage market continues to grow, and the demand for distributed storage continues to rise. The era of web 3.0 has come.

This article will share with you the ten most noteworthy blockchain application areas in 2021, and let's take a look at how blockchain technology and digital assets will be further integrated into industrial and economic development. Under the turmoil of digital assets, help everyone seize the opportunities of the times and realize the ideals of life and the growth of wealth.

The following is the full text shared by Dr. Yu Jianing, which is hereby organized by Huobi University:

1. Encrypted trust

Recently, the bitcoin market has been very good, and the entire digital asset market has also entered a "bull market." Many people refer to this round of bull market as "institutional bull" or "grayscale bull". It has been suggested that investors should allocate 5% of their funds in these digital assets. This also means that starting from 2020, the identity of digital assets has undergone a fundamental change, and it has begun to become a part of mainstream assets.

On December 11, 2020, MassMutual, one of the five largest life insurance companies in the United States, purchased $100 million worth of Bitcoin for its general insurance account through New York Digital Investment Group (NYDIG). This investment is only 0.04% of MassMutual's investment account funds (about $235 billion). MassMutual currently holds a $5 million minority stake in NYDIG.

On January 4, 2021, alternative investment company SkyBridge Capital (SkyBridge Capital) announced the launch of the Bitcoin fund "SkyBridge Bitcoin Fund LP". To launch the fund, SkyBridge Capital and its affiliates have invested $25.3 million. At the same time, on January 4th, the Bitcoin fund positions invested by Tianqiao Capital on behalf of its flagship funds (flagship funds) in November and December 2020 were already worth $310 million.

Tudor Investment Corp is an asset management company founded by billionaire Paul Tudor Jones. In May 2020, Paul Tudor Jones stated that his purchases of Bitcoin assets accounted for 1%-2% of his investment management scale. Tudor Investment's asset management scale is approximately US$38.3 billion, of which Tudor BVI Global Fund accounts for US$21.5 billion, and Jones purchased Bitcoin through Tudor BVI Global Fund.

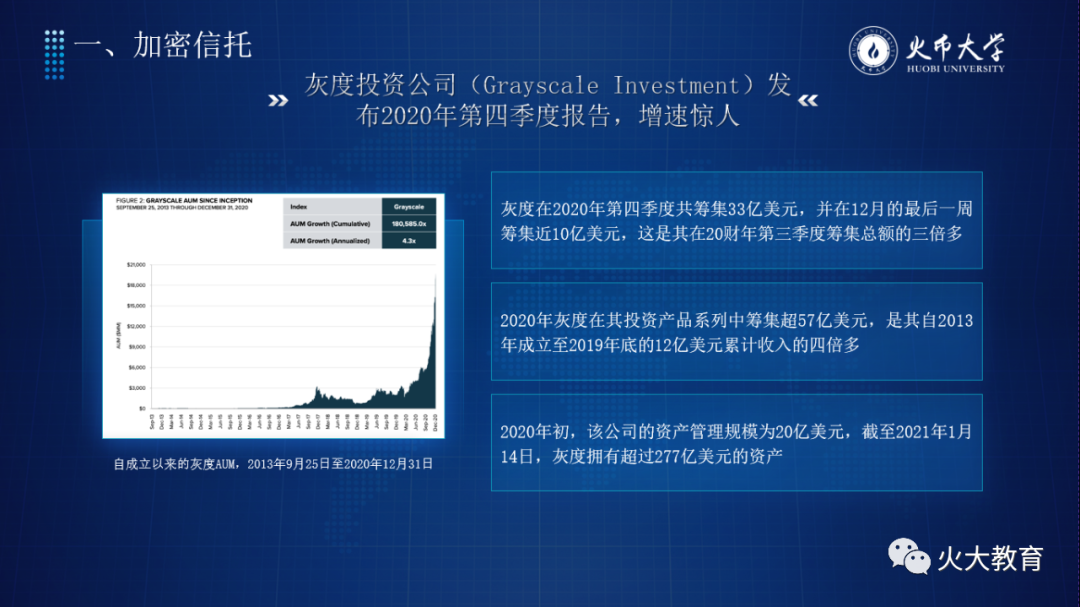

Behind the allocation of digital assets such as Bitcoin by these capitals and listed companies, there is a mysterious company "Grayscale". Last year, under the test of the global spread of the new crown epidemic, the devastating stock market crash and rising geopolitical tensions, coupled with the unprecedented policy of flooding the currencies of the world's major economies, traditional capital is eager to find a clear currency like Bitcoin. Invest in alternative assets with scarce attributes. Depositing digital assets such as Bitcoin through legal channels has become an urgent need for traditional investors. Grayscale seized this opportunity and built a bridge between traditional capital and the encrypted world.

Grayscale (Grayscale) was established in 2013, entered a period of rapid growth in 2020, and paid more attention to compliance: On January 21, 2020, Grayscale Bitcoin Trust (GBTC) was successfully registered with the US SEC, becoming the first compliant The standard digital asset tool of the US Securities and Exchange Commission; on October 12 of the same year, the registration application submitted by Grayscale’s Ethereum Trust (ETHE) in the SEC was officially approved, and its capital inflow and asset scale have doubled. It is already the world's largest digital asset management organization.

It is worth mentioning that after the Bitcoin Trust compliance registration application was approved, Grayscale began to frequently promote Bitcoin on American social media and traditional media. Last year, in a promotional video posted on social media, Grayscale directly called on investors to exchange their gold for Bitcoin. Two days ago, the Wall Street Journal ran two pages of a Grayscale Bitcoin commercial that read: “Bitcoin is coming, is your portfolio ready?”. This series of crazy publicity has brought Bitcoin into the field of vision of more people and attracted many traditional investors. A large amount of traditional capital, with Grayscale Encryption Trust as the main investment channel, poured into the encryption market one after another, continuously driving up the market heat, and bringing an "institutional bull" to the encryption world.

Currently, Grayscale holds a total of 10 trust funds and 9 single-asset trust products, corresponding to 9 digital assets such as Bitcoin and Ethereum; there is also a digital large-cap fund, including 4 digital assets, determined according to market value weighting The proportions are Bitcoin (81.63%), Ethereum (15.86%), Bitcoin Cash (1.08%), and Litecoin (1.43%). The annual management fee charged is 2%-3%. Grayscale’s Q4 2020 digital asset report shows that at the beginning of 2020, the company’s AUM was $2 billion. But by January 14, 2021, Grayscale already had assets of more than US$27.7 billion, an astonishing growth rate.

The reason why large funds tend to invest in digital assets such as Bitcoin through Grayscale mainly focuses on the following advantages: investors do not need to personally purchase, transfer and store digital assets, and do not need to additionally manage personal accounts, wallets and private keys. Therefore, it is possible to allow Investors can buy with peace of mind and peace of mind; the transaction price of products strictly follows the market trend, and large orders are no exception; its products have property rights, can be transferred, and have IRA investment qualifications.

2. Crypto Bank

As cryptocurrencies gradually enter the public eye, the demand for derivative financial services of cryptocurrencies is also increasing. The most direct one is banking services, which have already been launched in many places.

Earlier this year, the U.S. Office of the Comptroller of the Currency (OCC) announced that Anchorage, a cryptocurrency custody company, had approved its application for a banking license. As a result, Anchorage became the first encryption company in the United States to obtain a "federal-level" bank license, and the first encryption bank in the United States was born.

This is actually a milestone for the blockchain industry and even the financial field: First of all, for Anchorage itself, obtaining this banking license enables it to conduct business across the United States without having to apply for banking licenses from state governments one by one. The 49 licenses originally required for crypto banks to expand their business in the United States are now condensed to one; at the same time, the company has the endorsement of a "qualified custodian", and compliance enables it to attract more institutional investors.

For the entire industry, this incident shows that the encryption industry has begun to have the legal status to carry out related businesses and is moving towards the regular army; it marks that encrypted banks are increasingly becoming a track recognized by the outside world or authoritative fields; There are no clear boundaries anymore.

This is actually not an isolated case. At this stage, many traditional financial institutions with keen insight have also begun to explore the layout of the encrypted banking industry. At present, there are more than 30 banks that directly provide services to digital asset companies, 90% of which are located in Europe and the United States. At the same time, nearly 20 digital asset payment processors are actively developing banking-like services. Encrypted banks have gradually become a new track for financial institutions to accelerate their deployment, and digital assets and finance are achieving innovative integration.

3. STO (Security Token)

On December 10, 2020, DBS Bank officially announced that it has been approved in principle by the Monetary Authority of Singapore and has been granted a "Recognized Market Operator" (RMO) license, and will officially launch DBS Digital Exchange, a comprehensive digital asset trading platform. The businesses involved mainly include: security token issuance (STO), digital asset trading and digital asset custody services.

Among them, the STO that DBS Bank will publicly launch this time is a difficult bone for non-compliant trading platforms. DBS Bank has made it clear that it can support the conversion of stocks and funds of unlisted companies backed by financial or real estate assets into tokens for trading. This means that some companies and institutions that do not meet the listing requirements can convert their assets into digital assets and log on to DBS Digital Exchange after meeting the application standards and regulatory requirements, and traditional companies have also access to new financing channels. Compared with the trading and custody business, the STO launched by DBS Bank is regarded by some industry insiders as a "disruptive sector".

STO is in the intersection of cryptocurrency and traditional financial assets. The tokens in STO can be used to replace asset targets such as stocks and bonds, and are linked to real assets such as equity, debt, real estate, etc. For example, the issuance of stocks, bonds and digital bonds of private equity funds of non-listed companies can reduce the cost of global bond issuance, and at the same time connect global funds in a real sense. This is of great significance to the traditional financial industry, and a compliant STO will open up a new path for the real industry to carry out global financing. In my opinion, the shareholding of the Singapore stock exchange platform is more inclined to take a fancy to this part of the business, which actually confirms the views I have been expressing all along.

Following DBS Bank, on December 15, 2020, OSL, a digital asset trading platform under BC Technology Group, a Hong Kong-listed company, obtained Type 1 and Type 7 licenses from the China Securities Regulatory Commission. It is a digital asset trading platform audited by the Big Four accounting firms. After OSL is licensed, it can not only start business around STO, but also put BTC and ETH on the shelves. This indicates that Hong Kong is expected to become the world's first fully regulated STO trading market, which means that the encryption financial compliance in Asia has started, which is both It provides a favorable channel for traditional institutions to enter the market, and also enhances the confidence of the encryption market in its future prospects.

In fact, STO is not a new product that only appeared this year, it appeared as early as 2017. At that time, ICOs were rampant in the digital asset market, there was a serious lack of supervision, and chaos such as fraud was rampant. Especially after the credit crisis of stable currency USDT occurred on October 15, 2018, the market has become more and more fully aware of the dangers of the ICO unsupervised model. In order to solve the chaos caused by ICO, the US Securities and Exchange Commission (SEC) launched STO (Security Token Offering, security token issuance). The SEC hopes to carry out the public issuance of Token under a legal and compliant regulatory framework.

STO can enable the holder to own some kind of all rights and interests of a company, and be legally regulated by the US Securities and Exchange Commission (SEC), and also go through KYC (customer investigation), AML (anti-money laundering), qualified investor review and other regulatory links . Essentially, there is no STO without regulation. This has also made the market gradually realize that supervision is not a disaster, but a legal status, so that it can develop and grow in a fair manner.

The birth of STO is to tokenize all kinds of traditional assets so that they have high liquidity. On the one hand, the biggest advantage of STO is to actively accept supervision and operate legally and compliantly under the supervision and management of relevant departments, so that more traditional investors can safely and legally participate in token investment. On the other hand, STO can map real-world assets into digital assets, so that the ownership can be divided into smaller particles, and after the division, you can have better liquidity and increase the channels for asset realization and circulation. Therefore, STO is also called "IPO in the Digital Age" or "Smart Contractization of IPO". In a sense, STO has become a bridge and integration accelerator for the financial and digital asset world.

The advantages of STO include legal compliance, fast settlement, programmability, high liquidity, saving time and cost, and multiple practicability. Of course, the STO market has not developed fast in the past two years, which also reflects some important drawbacks, including: "new wine in old bottles", relatively high risks, immature system, and regulatory challenges.

STO is a manifestation of the pursuit of compliance and mainstreaming of digital assets. This process is a long and complicated process, and there is still a long way to go in the future. However, the tremendous changes brought about by STO in accelerating global asset liquidity are worthy of recognition, and it may be a trend in future financial development.

4. Automated Market Maker (AMM) and Decentralized Exchange (DEX)

DeFi (decentralized finance, that is, financial decentralized application DApp) based on public chains such as Ethereum will rise rapidly in 2020 and become a star track that has attracted much attention.

A group of "decentralized trading platforms (DEX)" that have emerged in this field are particularly eye-catching.

The automatic market maker (AMM) is one of the most critical technologies of the decentralized exchange platform (DEX), which has proven to be one of the most influential DeFi innovations, and it can create and operate for a series of different tokens. Publicly available on-chain liquidity. Under the technological innovation of automatic market maker (AMM), the trading volume of the decentralized trading platform Uniswap once surpassed the old leading digital asset trading platform Coinbase, and the slippage level reached the lowest spot level of the TOP3 trading platforms. This is the essence of technological innovation. Subversive power.

It can even be said that the automatic market maker (AMM) is one of the most influential DeFi innovations, and it also represents the direction of change in the way assets are traded.

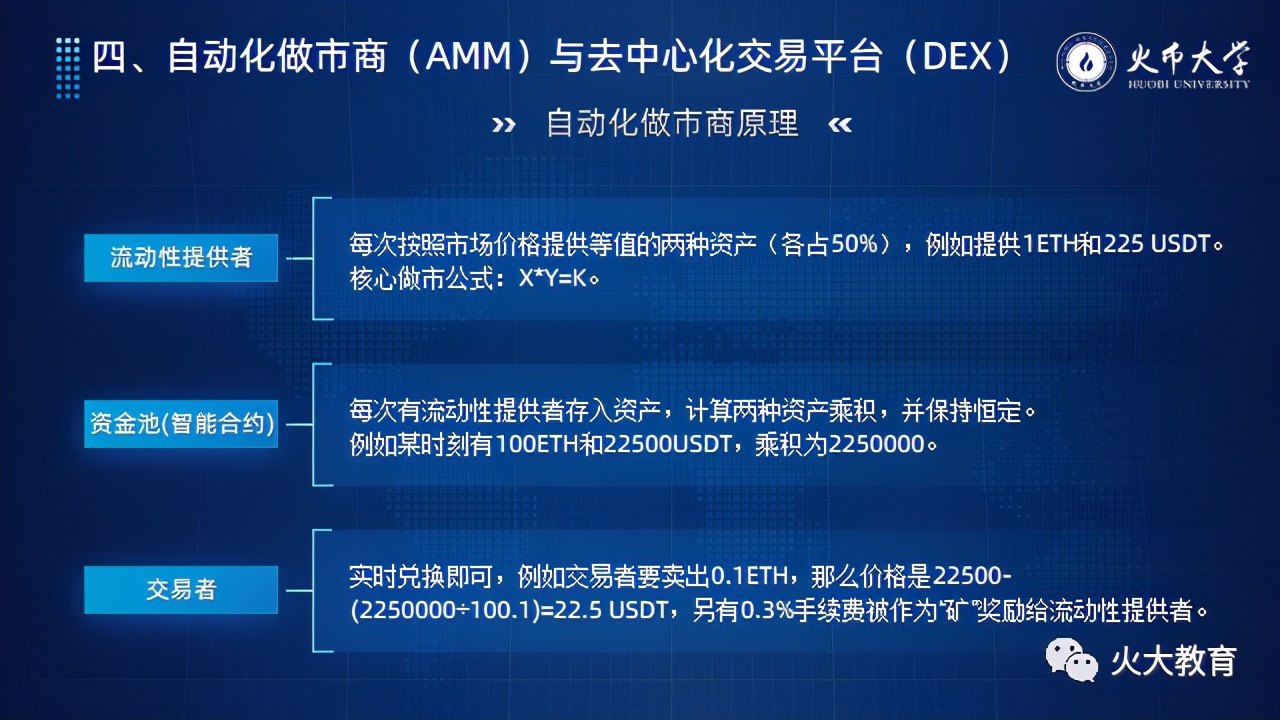

Let's briefly introduce the working mechanism of AMM. In the decentralized trading platform, there is a very important role, that is, "market maker", also known as "liquidity provider (LP)", refers to the entity that needs to provide liquidity on the trading platform. They provide liquidity for other trading users in the DEX, so as to obtain other users' transaction fees, and on some platforms, they can also obtain the platform's incentive pass at the same time.

The automatic market maker (AMM) does not require users to place orders, but directly calculates the exchange rate of transactions between two or several assets through algorithms, so as to realize "instant transactions" without waiting for pending orders. However, such a trading pool requires market makers to deposit a certain amount of assets in advance as a bottom position in order to have better liquidity and smaller transaction slippage.

Uniswap, which is relatively popular in the DeFi field, adopts the constant product market maker (CPMM) model. According to the Uniswap core market-making formula: X*Y=K, K is a constant, when the market maker works, it needs to charge the equivalent value of A and B assets according to the real-time market price, so as to ensure that the product of the two currencies remains unchanged. When traders need to trade, they can exchange directly in the trading pool according to the real-time ratio. In the case of keeping the product constant, if the quantity of one asset decreases, the quantity of another asset it exchanges will naturally increase, thus creating price changes.

Automated market makers (AMMs) have largely solved the liquidity problem of decentralized trading platforms. But some key challenges must also be overcome, such as unpaid losses, forced multi-currency exposure, and low capital efficiency. But it is worth affirming that the automatic market maker (AMM) not only realizes transaction automation and unmanned, but more importantly, it introduces a new trading model and concept to the financial market, which may bring financial markets A paradigm revolution has come.

5. New Stablecoins

At present, whether it is Bitcoin or Ethereum, almost all digital assets have violent price fluctuations, and their value attributes are difficult to be recognized, and they cannot be used as a universal payment tool. More often, they are still regarded as a speculative/investment target. Therefore, in order to realize the payment attribute of digital assets, it is first necessary to maintain price stability, and stablecoins came into being.

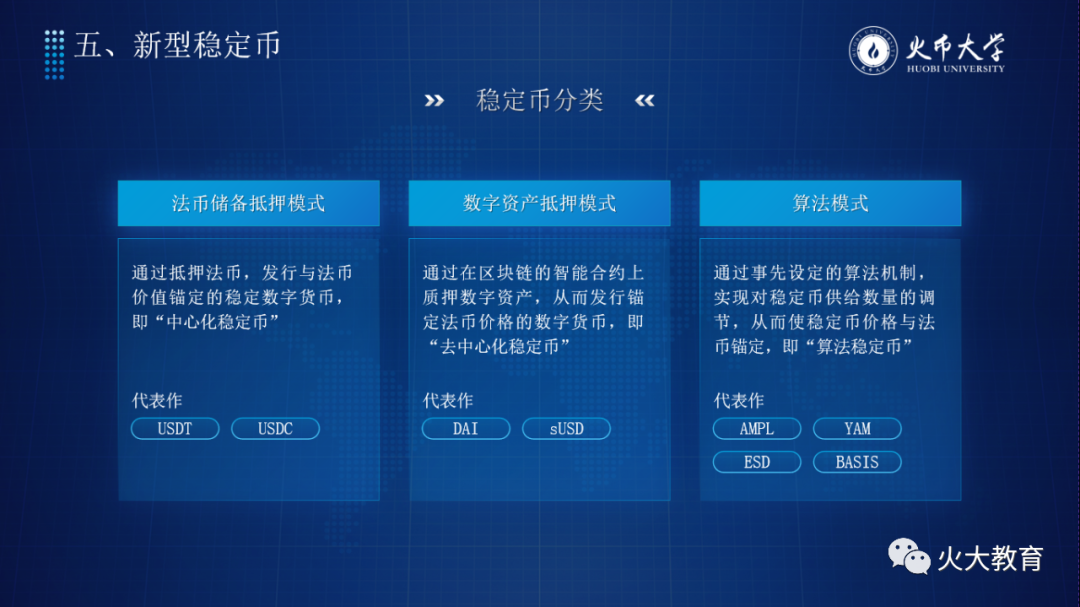

At present, stablecoins are roughly divided into three types of models:

The first is the fiat currency reserve mortgage model: by mortgaging the fiat currency, a stable digital currency anchored to the value of the fiat currency is issued, that is, a "centralized stable currency". At present, USDT and USDC, which are firmly in the top two positions in the market value of stablecoins, are both centralized stablecoins. This type of centralized stable currency has built an important bridge for the flow between fiat currency and digital assets, but they are too decentralized, so there are also many disadvantages.

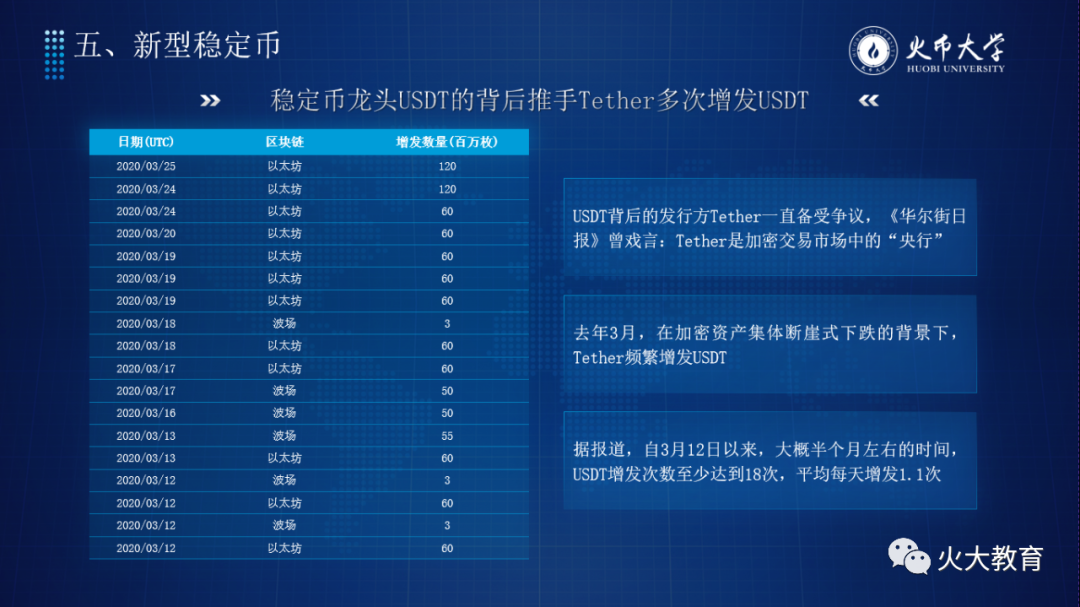

Tether, the driving force behind the leading centralized stablecoin USDT, has repeatedly issued additional USDTs, which has also worried investors. For example, at 07:31 on January 7th, Beijing time, Tether newly issued 400 million USDTs on the TRON network. This is already countless times Tether’s additional issuance. This has also fueled the desire for more stable stablecoins.

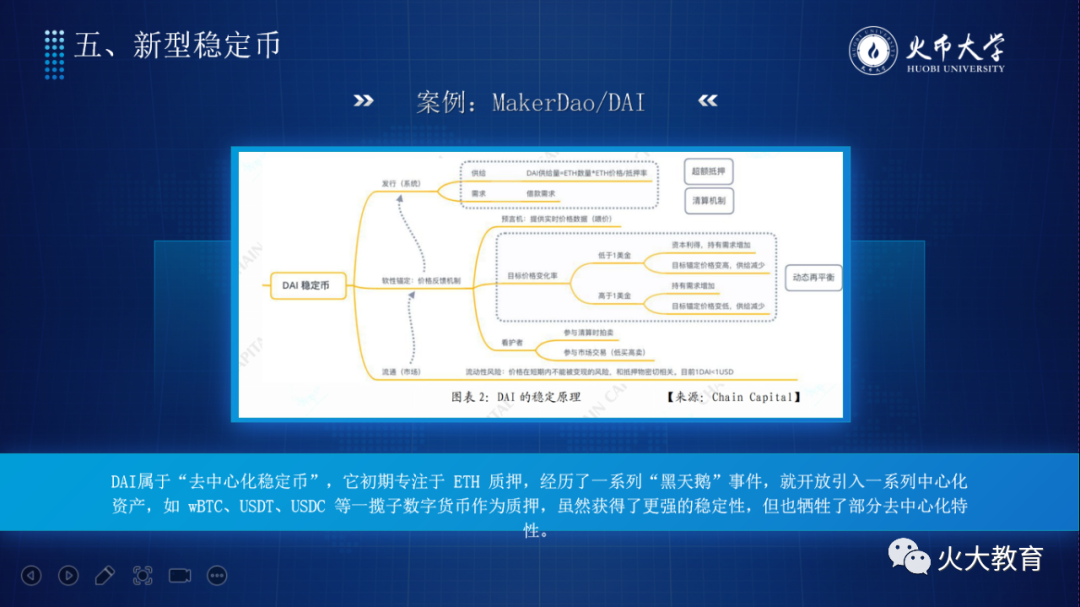

The second is the digital asset mortgage model: by pledging digital assets on the smart contract of the blockchain, a digital currency that anchors the price of the legal currency is issued, that is, a "decentralized stable currency". A representative case of this model is DAI issued by MakerDAO. It initially focused on ETH pledges. After a series of "black swan" events, it opened to introduce a series of centralized assets, such as wBTC, USDT, USDC and other digital assets as pledges. Although stronger stability has been obtained, some decentralization features have also been sacrificed.

The third is the algorithm mode: through the algorithmic mechanism set in advance, the adjustment of the supply of stable coins is realized, so that the price of the stable coins is anchored to the legal currency, that is, "algorithmic stable coins". This type of elastic stable currency is to adjust the price stability by adjusting the money supply through algorithms. It can be described as an innovative stable currency in the DeFi world. These stablecoins do not require the use of collateral, trying to build the native pass of the cryptocurrency industry through market supply and demand.

But there is no collateral, and there is no value support. It only maintains the currency price by elastically adjusting the supply of stablecoins to fluctuate around a certain value. The ability to resist price fluctuations caused by speculation is weak, and the time to deviate from the anchor price Above 50%, instability is its normal state.

There have been many predictions within the industry regarding the future of algorithmic stablecoins. Some believe that its anchor point will be lower than 1 US dollar, some believe that there will be an algorithmic stable currency that anchors a basket of fiat currencies, and some believe that with the support of DeFi and other encrypted digital currencies, a complete encrypted economy will soon Appear. In short, looking at the long history, the algorithmic stablecoin that is still in a state of chaos, although it does not output "stable", reveals another order and rules for us.

6. Asset on-chain middleware (synthetic assets, oracles)

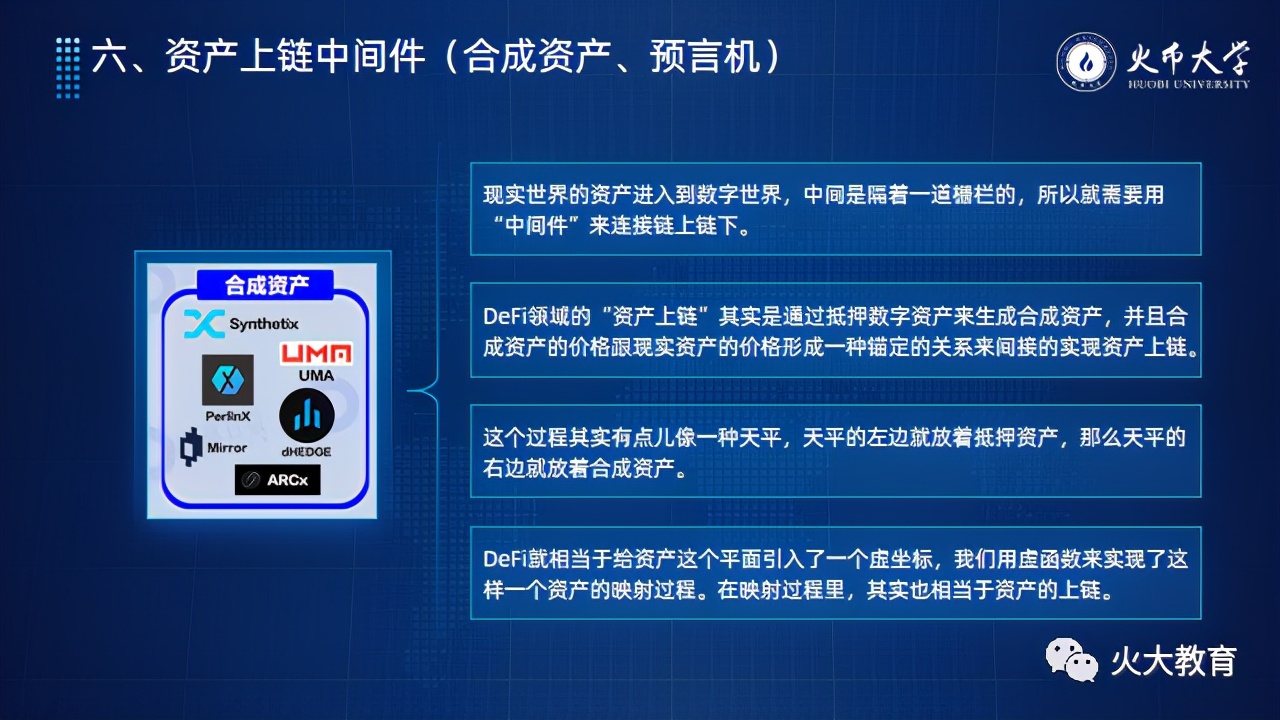

In a sense, asset on-chain may be one of the best ways to apply blockchain. In the past, when we talked about "assets on the chain", it actually meant that real-world assets, such as real estate equity and creditor's rights, were registered on the blockchain through the authorization or confirmation of rights by the authority. Obviously, this path is relatively long. Assets in the real world enter the digital world, separated by a fence, so "middleware" is needed to connect the on-chain and off-chain.

The "asset chaining" in the DeFi field is actually to generate synthetic assets by mortgaging digital assets, and the price of synthetic assets forms an anchoring relationship with the price of real assets to indirectly realize asset chaining. This process is actually a bit like a balance, where mortgage assets are placed on the left side of the balance, and synthetic assets are placed on the right side of the balance.

As Babbitt founder Chang Jia pointed out: "DeFi is equivalent to introducing a virtual coordinate to the asset plane. We use virtual functions to realize the mapping process of such an asset. In the mapping process, it is actually equivalent to the asset's upward Chain. Just like MakerDAO’s DAI, the first very successful synthetic asset, has been widely accepted, and it can actually be used as a dollar.”

We can understand synthetic assets as financial instruments that simulate the value of another asset, which can provide investors with more diversified capital allocation, opportunities to hedge risks, and tools to increase investment returns, thus becoming a price that opens up real-world assets exposure.

Then let me talk about another asset on-chain middleware-the oracle. The oracle is actually a tool for transferring data from outside the system into the system. When people mention the blockchain, they always say that all its transaction records can be checked on the chain, safe and transparent, but it must be known that the blockchain is a deterministic and closed system, and smart contracts running on the blockchain cannot directly Those who obtain data from the outside can only perform tasks in a closed and isolated environment. The oracle machine can serve as a two-way bridge between the smart contract and the outside world, act as middleware, and input the data outside the chain into the chain, thereby ensuring the authenticity of the data on the chain.

Take Chainlink, which has attracted more attention in the oracle field, as an example. Chainlink is a decentralized oracle network consisting of buyers and providers of data. Buyers request data, and providers return data in a secure and trusted manner. Buyers select the data they want, and suppliers bid to provide it. Suppliers must pledge a portion of LINK tokens when bidding, which can be deducted in case of misconduct. At the same time, Chainlink aggregates and weights the data provided using the oracle reputation system. Chainlink has a total of 21 trust nodes, that is, 21 collectors of real information. In information transmission, Chainlink requires no less than 14 nodes to submit information to calculate a trusted answer. In order to prevent trusted node gangs from doing evil, Chainlink has introduced a node reputation and mortgage token mechanism.

At present, the main function of the oracle machine is to transmit the quotation of digital assets to the smart contract on the chain to help the smart contract judge the settlement basis. The track of the oracle machine is also continuously deriving and iterating with the continuous development of the industry.

7. Digital identity and data privacy

With the development and changes of human society, the factors of production also change. In the agricultural age, land and labor are the main production factors; in the industrial age, capital and technology are the main production factors; in the digital age, data has become one of the most important production factors. Compared with traditional production factors, data as a production factor has unique attributes, such as easy replication; value aggregation and diversity; value cognition diversity; transaction relationships will change from buying and selling relationships to leasing relationships. Based on these unique attributes, we often face some challenges in mining data value.

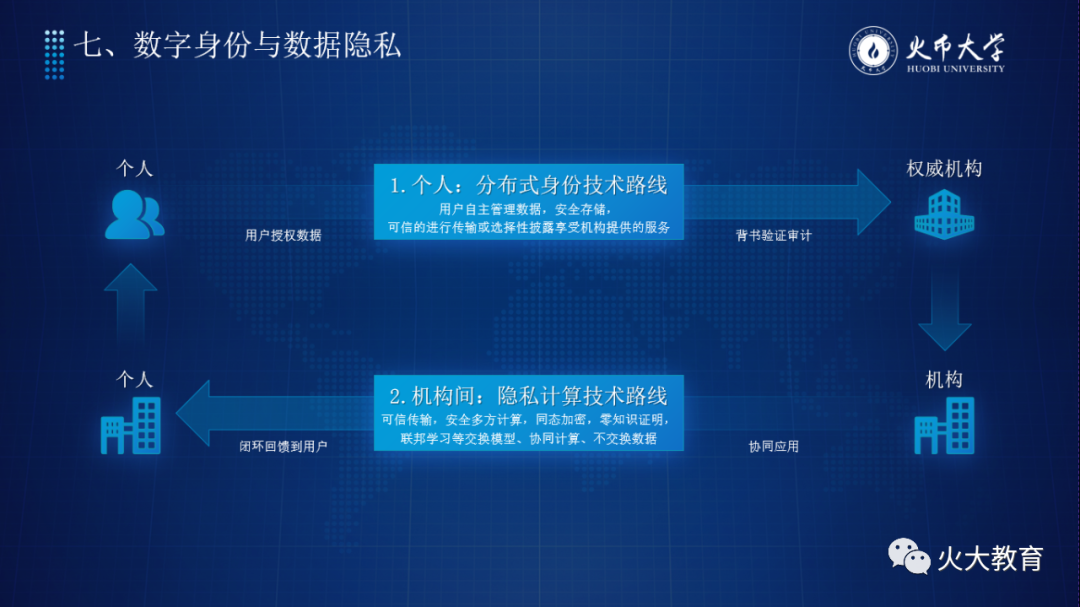

So how do we find the balance between efficient use of data resources and protection of personal privacy? In fact, the core of realizing data privacy protection is to establish a trust relationship between data users and data owners. At present, using blockchain + privacy computing to build a distributed trust mechanism based on blockchain may be a better solution.

On the one hand, using blockchain technology, we can put our own data on the chain and have our own "digital identity", so that multiple parties can establish a joint consensus scenario; at the same time, using cryptographic algorithms, the data on the chain is difficult to tamper with, and can be Traceability, so as to realize the safe storage and transfer of data; in addition, some data governance and auditing are done based on smart contracts, thereby supporting a distributed business model. On the other hand, the privacy computing solution based on scene optimization is more efficient and practical than traditional and general privacy computing solutions.

In short, blockchain and privacy computing complement each other, and can better tap the value of data elements in distributed scenarios. Blockchain technology focuses on multi-party participation, which can improve the security and transparency of privacy protection; privacy computing focuses on user data protection in the process of multi-party participation, which can minimize information disclosure, enhance the compliance of blockchain, and expand its degree of collaboration.

In the future, in the ecosystem built by blockchain + privacy computing, each of us can truly have our own data control rights, use our own "digital identity" to store data securely, and at the same time make "choices" when using a certain business. Sexual disclosure", so as to carry out credible and safe social activities, and truly release the value of data.

8. Non-Fungible Token (NFT)"In 2020, we will see more trendy shoe culture, joint design, and the rise of blind box economy. The core logic behind these is the rise of IP, and IP is the soul of all industries in the future. In such an IP era, how to realize the transfer of value and make the cultural attributes of products have more solid economic value? We can see that the new IP cultural form based on the blockchain has begun to rise with NFT (non-homogeneous token).

The full name of NFT is Non-fungible Token, and the Chinese name is

Non-homogeneous tokens". Our common Tokens (such as BTC, ETH, etc.) are all homogeneous, and there is no difference between each BTC, which can be interchanged and divided. The important characteristics of NFT are: each NFT has a unique and unique identity, two pairs are not interchangeable, and the smallest unit is 1 and is indivisible. We can understand postcards printed in batches as FT, and then postcards signed by stars are NFTs, because this postcard is a postcard signed by a star in a special Time, special place, and special scene are signed, which endows it with special meaning, so this postcard becomes unique and has collection value.

On October 7, 2020, a digital artwork appeared at Christie's Auction House in New York, and the artwork "Portrait of the Soul" without a physical body. This is the 21st work in a series of Bitcoin-themed artworks, and it sold for more than 130,000 US dollars, which exceeded many people's imagination.

In January 2020, more than 20,000 tickets for the European Football Championship were issued in the form of NFT. NFT tickets do not require the original issuing agency to participate in the verification, which ensures the authenticity of the tickets, reduces friction in the trading market, and facilitates ticket trading.

At present, NFT is mainly concentrated in the field of encrypted art, but in fact the cultural value lies in copyright. In the future, all industries will be closely integrated with IP, and the value of NFT is not limited to the field of art. In the next breaking point of the combination of culture, art and industry, in the next blind box economy, NFT will be a key bridge.

9. New public chain infrastructure

The blockchain is presented to the public as the underlying technology of the Bitcoin system. After more than ten years of development, the blockchain technology has integrated elements such as smart contracts, distributed ledgers, cryptography principles, and distributed storage to form a blockchain The new domain of the chain - the public chain, combined with the real world, solves the trust problem in the multi-party collaboration in the real world.

The public chain track has always been a popular track in the blockchain field. When it comes to public chains, we have to mention Ethereum ETH and Polkadot. Scalability has always been a problem that plagued the development of Ethereum, especially in 2020 when DeFi applications exploded, and network congestion led to high transaction fees. Insufficient performance makes it difficult for Ethereum to meet the requirements of the "world computer", and it also affects the user experience. Expansion is the top priority of the Ethereum network, and the progress of Ethereum in 2020 will mainly focus on expansion.

So what is Ethereum 2.0? We can understand ETH 2.0 as a port that handles all kinds of goods. The beacon chain is the lighthouse of the port, and all freighters must accept its command and dispatch. The shard chain is the freighter, which is responsible for the actual transportation of goods. One of the important goals of ETH2.0 is to expand the capacity of ETH 1.0 and greatly increase the throughput of contracts and transactions. Therefore, developers designed 64 shard chains to process transactions on the chain in parallel, thus providing Ethereum with high performance and reliability. scalability.

At present, the ETH2.0 beacon chain has been launched, and the overall launch of ETH2.0 is expected to take place in 2022. Facing the increasing demand for capacity expansion, Ethereum co-founder Vitalik Buterin proposed a new rollup-centric Ethereum roadmap in October 2020. Faced with this strategic shift, the community asked: What will be the biggest change in the Ethereum 2.0 spec (plan) after Phase 0 goes live? Vitalik: There are three most important changes. All these changes are for one thing - to make ETH 2.0 go online faster and let people use it faster.

Polkadot was developed by Parity Technology Company in November 2017, led by Gavin Wood (Lin Jiawen), the former CTO of Ethereum.

According to Gavin Wood's description in the white paper, Polkadot is a blockchain protocol designed to support "parachains created by various developers." To put it simply, Polkadot is a collection of blockchains composed of multiple blockchains heterogeneously. What it is doing is a set of operating systems based on blockchain technology, similar to Windows, Android, and ios. You can use Polkadot to develop various applications, and you can also connect existing applications to the Polkadot system through technology. The Polkadot system has extremely high cross-chain performance, which provides strong interactivity for various ecological applications, and is called "the king of cross-chains" by the industry.

Recently, Polkadot's "parachain slot auction" has become a hot topic in the industry. If Polkadot is a prosperous commercial street, slots are prosperous shops on the street. If you want to sell your own products in the commercial street, you must participate in the slot auction. At around 3:00 am on January 13th, Beijing time, the much-anticipated Polkadot parachain development work once again ushered in a major milestone. The parachain test network Rococo V1 officially opened for registration applications, which means that Kusama and Polkadot parachain slot auctions And going online will gradually kick off.

10. Blockchain Storage

Storage is not a new field. At present, there are four main types of storage industry: desktop storage, enterprise storage, cloud storage and blockchain storage.

With the development and maturity of blockchain technology, blockchain storage has begun to attract more and more attention. It aims to solve four key problems in the previous storage market:

Data storage costs are too high

Centralized data management is risky

Large-scale data transmission and maintenance are difficult

vulnerable to attack

Blockchain storage, also known as "distributed storage", refers to a decentralized storage system built with blockchain incentives, and is an effective combination of blockchain and storage systems. Blockchain itself is a distributed ledger and a decentralized database, which makes blockchain technology have inherent application scenarios and advantages in storage.

When it comes to distributed storage, IPFS must be mentioned. IPFS (Inter Planetary File System) is a content-addressable point-to-point hypermedia protocol designed to replace the traditional Internet protocol HTTP and create an open network transmission protocol for distributed storage and shared files. The nodes in the IPFS network form a distributed file system, and anyone can quickly obtain files stored on the IPFS system anywhere in the world. It has the advantages of fast download speed, global storage, security, and data persistence, and can well solve the problems existing in HTTP at this stage.

Among them, "content addressing" is an extremely critical part of IPFS. So what is "content addressing"? Suppose you want to download a photo from the Internet, you need to tell the computer where to find the photo, that is, the IP address or domain name where the photo is located - this is called "address addressing". IPFS, on the other hand, changes "address addressing" to "content addressing", that is, each file has its own unique hash value, which we can also understand as a fingerprint. When you want to download a file, just ask The network "who has the file with this hash value", and then a node on the IPFS network will provide the file to you.

Filecoin is a project developed by Protocol Labs (Protocol Labs), the same team as IPFS. It belongs to an incentive layer above IPFS, and the incentive mechanism is FIL token. Miners in the FIlecoin network can obtain FIL by providing customers with storage and retrieval services; on the contrary, customers can spend FIL to hire miners to store or distribute data.

To put it simply, the goal of the Filecoin project is the entire cloud storage market, utilizing all idle storage resources to form an algorithmic market. With the development of 5G and big data, the volume of the cloud storage market continues to grow. Under the enthusiasm of Filecoin, the storage field has attracted a lot of traffic and funds, ushering in more attention and opportunities.

We have entered the golden decade of blockchain development and prosperity

The most core and critical time in the 100-year process is actually the next ten years. Our grasp and understanding of digital assets will not only affect the fate and wealth of our generation to a large extent, but may have an impact on the fate of sons, grandchildren, future families, and generations. The wealth opportunities in the blockchain industry come from the realization of cognitive surplus. Having a blockchain thinking is to find the future wealth creation code. It is not easy to fundamentally understand the transformation logic of digital assets and blockchain business. Only by forming a fairly systematic cognition can we fully and accurately grasp their true value.

The blockchain is a "hydrogen bomb level" weapon in the business world, and its power comes from the "multiplier power" obtained by multiplying the network effect (space value) and financial leverage (time value). Blockchain is essentially a new species of deep integration and innovation that combines technological innovation, digital finance, economic community and industrial applications.

In the future, digital assets will be based on blockchain technology, and the commercial implementation of new technologies will not only require time and technical polishing, but also require practitioners to explore with forward-looking thinking. Blockchain thinking will become a global socially based way of thinking."About Huobi University"Huobi University founded by Dr. Yu Jianing is known as"Blockchain Whampoa Military Academy", is the most influential blockchain education institution in China. Huobi University focuses on education and research in the frontier fields of the digital economy, such as new applications of blockchain technology, new digital financial systems, and new distributed business models."Linking industries and empowering entities"、"As the school motto, with the core mission of cultivating top entrepreneurs in the blockchain and digital economy fields, it has trained a large number of talents for China's blockchain industry. At present, more than 10,000 trainees have been trained in Hangzhou, Shenzhen, Haikou, Silicon Valley, and Tokyo. , Seoul, Singapore and more than a dozen cities around the world have started courses in a cycle, and established strategic partnerships with global universities such as the University of Gibraltar, and won the "2020 Education Industry Strength Group","2019 Best Blockchain Training Institution

Technology leading education brand