Understand the business landscape of encrypted lending unicorn BlockFi in one article

last night,Crypto lending platform BlockFiAnnounced that it has raised $350 million from investors including Tiger Global and Bain Capital Ventures. So far, it has completed a total of 450 million US dollars in financing. Previous investors include many large funds in the industry, including: Valar Ventures, Morgan Creek Capital Management, Coinbase Ventures, Galaxy Digital, Susquehanna Government Products, Winklevoss Capital, etc.

borrow money

borrow money

Encrypted lending companies that undertake deposit and loan business assume the responsibilities of banks in traditional finance. Therefore, when you look at each company, the business volume is very large.

Lending business can be divided into centralized and decentralized. As far as the centralized platform is concerned, Genesis has the largest loan scale overseas, followed by BlockFi. The main domestic players include ZhenFund Investment, PayPal Finance, which entered the market earlier and the largest scale, Jihan Wu with a background in Bitmain, MatrixPort created by Ge Yuesheng.

In terms of developing the lending business, BlockFi's "promotion method" is a bit like Grayscale Fund. Grayscale announces how many bitcoins it has accumulated at a daily rate to give potential customers a sense of FOMO, while BlockFi is keen to announce how much interest it has distributed to users to attract coin hoarders.

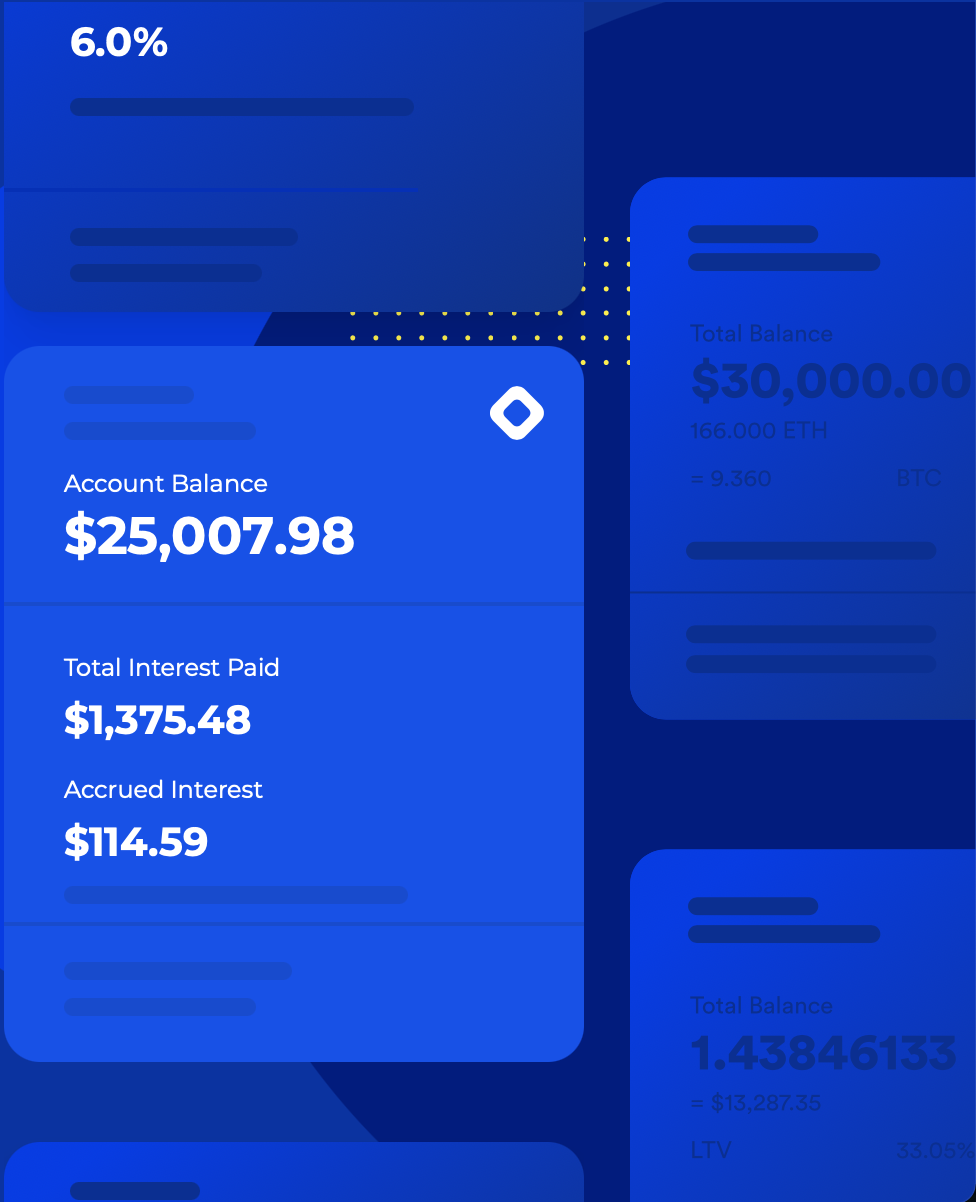

On its social homepage and official website, it will "scroll" to display the huge interest it brings to deposit customers.

According to official information, BlockFi's current deposit annualized return can reach up to 8.6%, and there is no minimum investment threshold.

This interest rate may not be attractive in the encryption circle, but for many institutions and large investors, this low-risk investment method is still an indispensable option. There are also many currencies that support deposits. In addition to mainstream currencies, holders of leading innovative currencies such as UNI and LINK can also participate.

With deposits, what is the "export" of funds?

according to

according toCointelegraphAccording to the statistical data in January 2020, BlockFi's loan interest rate is between 4.5% and 11.25%, and the custodian is the most subject toNYDFSRegulated by the New York Department of Financial ServicesGemini。

As can be seen from the figure above, the scale of funds under BlockFi’s management at that time was US$400 million. according toThe BlockAccording to the statement, part of the funds on the BlockFi platform are used to invest in Grayscale’s GBTC transactions. Previously, GBTC had always had a premium. Investors locked Bitcoin into GBTC to obtain corresponding trust shares. As time went by, the premium of trust shares would exceed the level of net assets, resulting in a price difference. A large part of BlockFi's profits also come from this.

According to the latest news at the end of October last year, in BlockFi’s filing with the U.S. Securities and Exchange Commission (SEC), it was mentioned that it held 5.07% of the trust, amounting to more than 24.2 million shares.

However, as GBTC has started to see a negative premium in recent days, BlockFi may face some challenges in terms of deposit utilization and continued profit growth.

secondary title

Other business

In January this year, BlockFi officially launched the OTC trading platform. Thanks to its reputation in the industry, existing institutions and high-net-worth clients, it is logical to launch this business. BlockFi will act as an intermediary and even a guarantor, providing spot, margin trading and credit products to buyers and sellers. At present, the business has supported mainstream currencies including Bitcoin, Ethereum, and Litecoin.

On January 30 this year, BlockFi submitted the Bitcoin trust registration documents to the US Securities and Exchange Commission (SEC), but no news of approval has been released so far.

However, BlockFi has decided to issue Bitcoin trusts to qualified institutional and accredited investors outside the United States.

According to the announcement, BlockFi will issue shares through a private placement, and Fidelity Digital Assets, a subsidiary of Fidelity Investments, will be responsible for hosting the bitcoin associated with the trust. Coin Metrics provided index and pricing data for the trust, and Grant Thornton LLP acted as auditor. The trust’s sponsor, BlockFi subsidiary BlockFi Management, charges a 1.75% sponsor fee.

As for the credit card business, BlockFi said it will step up its launch after this financing. We don't know whether the big capital leading the investment of such a large amount of financing this time is laying out the business layout for the next possible explosion.

According to the official website, the full name of the credit card is BlockFi Bitcoin Rewards credit card. It does not sound like a traditional credit card, because it can support Bitcoin payment. To encourage adoption, 1.5% of Bitcoin can be returned for each consumption. "Mine" should be able to interact with the credit lending business in the future.

According to the official reminder, users who need to apply for card opening need to join the waitlist. Issuance of the card will also be subject to customer geographic, regulatory and underwriting restrictions, and fees and terms may vary accordingly.

So, what will be gained in a few years from this capital raise? Can BlockFi's new business open up a new continent? We will continue to pay attention.