Analyst | Carol Popsicle Editor | Tong Produced | PANews

In 2020, the blockchain industry is thriving. The currency prices of BTC and ETH have risen by 302% and 464% respectively, leading the digital currency market to a bull market in an all-round way. The total market value of the cryptocurrency market has expanded from approximately US$191.863 billion to approximately US$760.056 billion, which is equivalent to a nearly four-fold increase. Affected by the large asset premium, the mining scale of these two mainstream digital currencies has also expanded to about 7.6 billion US dollars, and the possibility of miners obtaining excess profits has increased.

Under such a hot market, many new industry hotspots have emerged in the blockchain field. Among them, DeFi has attracted the most attention in 2020. According to statistics from Arcane Research, the lock-up scale of DeFi has increased by about 2100% throughout the year, and the number of independent addresses has increased by 10 times throughout the year.

secondary title

The cumulative financing of 407 projects throughout the year was 3.566 billion US dollars, and the investment and financing market was the most active in the fourth quarter

Throughout 2020, a total of 407 projects in the global pan-blockchain field disclosed financing information (excluding acquisitions), and a total of 434 investment and financing incidents occurred, and many projects completed multiple rounds of financing within the year.

Judging from the timing of investment and financing disclosures, the fourth quarter is the time with the most investment and financing events of the year. The total number of investment and financing events disclosed in the quarter is about 151. The total number of investment and financing events disclosed in the third quarter is 126, and 72 in the second quarter. , 85 in the first quarter. This is basically consistent with the overall market trend, and the number of investment and financing events throughout the year has steadily increased over time.

Among the 434 investment and financing incidents, a total of 306 disclosed the investment and financing amount at the same time, involving 293 projects, and the cumulative disclosed investment and financing amount was about 3.566 billion US dollars.

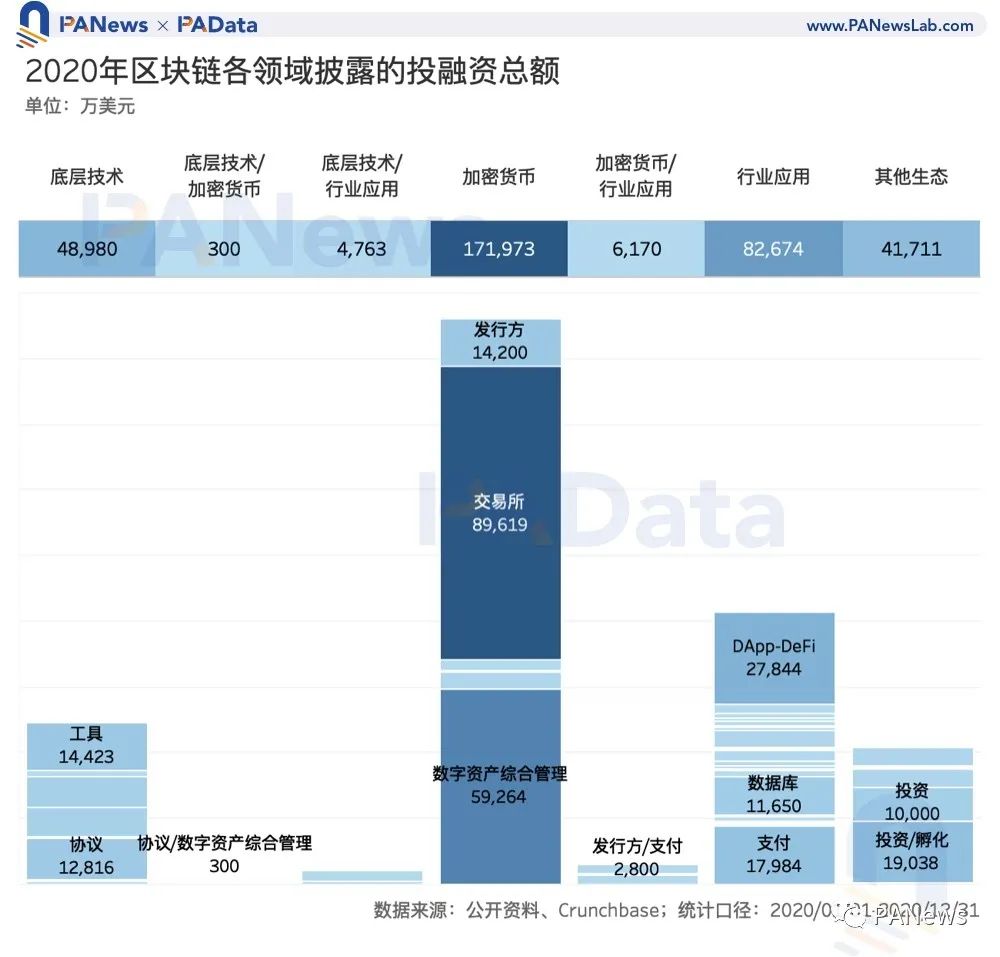

The average financing amount of the exchange is the highest, and the amount of DeFi financing is large but the amount is the lowest

From the perspective of the total investment and financing in various fields in the industry, in 2020, cryptocurrency projects are still the most favored by capital. The total investment and financing disclosed throughout the year reached approximately US$1.72 billion, accounting for 48.37% of the total amount for the year. close to half. Secondly, the amount of investment and financing disclosed in the industry application field for the whole year is about 827 million US dollars, ranking second. The total investment and financing disclosed by the underlying technology and other ecology throughout the year does not exceed US$500 million, which is about US$490 million and US$417 million respectively. The amount of investment and financing for other cross-field projects is even smaller, accumulatively not exceeding US$100 million. *Data description: "/" indicates that the project includes two subdivisions, such as "tools/protocols" indicates that the project product includes two subdivisions of tools and protocols, the same below.If you focus your attention on the smaller subdivision tracks, you can find that exchanges, digital asset comprehensive management, and DeFi projects are the three types of projects that disclosed the largest total investment and financing in 2020. Among them, the total amount of investment and financing disclosed by the exchange throughout the year was as high as US$896 million, accounting for 52.09% of the total investment and financing amount in the cryptocurrency field and 25.13% of the total investment and financing amount in the blockchain industry.The closely related digital asset comprehensive management projects have also attracted market attention in recent years. In 2020, the investment and financing amount of 593 million US dollars was disclosed, making it the "gold-absorbing" track second only to exchanges. In contrast to exchanges, DeFi projects will usher in a breakthrough growth in 2020, and the cumulative disclosed investment and financing amount has reached about 278 million US dollars, accounting for about 33.62% of the total investment and financing amount in the industry application field, accounting for 20% of the total investment and financing amount in the blockchain industry. 7.80% of the total investment and financing amount.In addition, tools, protocols, stablecoin issuers, databases, payment, investment, and "investment/incubation" projects have disclosed annual investment and financing totals exceeding US$100 million.Projects in different fields have different financing capabilities. In 2020, industry application projects disclosed the most investment and financing events, with a total of 158 projects disclosing investment and financing events. Among the projects that disclosed the financing amount, the average total financing obtained by each individual project was about 7.01 million US dollars, and the individual financing ability was not high. high. The financing capabilities of the underlying technology projects are also relatively similar. Although 105 related projects disclosed investment and financing events, the average single financing of the projects that disclosed the financing amount was only about 8.16 million US dollars.On the contrary, cryptocurrency projects and "cryptocurrency/industry application" projects have the strongest individual financing capabilities. In 2020, 114 cryptocurrency projects disclosed investment and financing events, and the average single financing of projects disclosing financing amounts was about 20.72 million US dollars , 3 "cryptocurrency/industry application" projects disclosed investment and financing events, and the average financing amount of each project was about 20.57 million US dollars.From the perspective of the financing capabilities of subdivided tracks, the "investment/incubation" projects have the strongest individual financing ability, reaching an average of 38.08 million US dollars. Among them, Pantera Capital completed a fundraising of 165 million US dollars in August, and Bloccelerate Completed a $120 million fundraising round in December.

*Data description: "/" indicates that the project includes two subdivisions, such as "tools/protocols" indicates that the project product includes two subdivisions of tools and protocols, the same below.If you focus your attention on the smaller subdivision tracks, you can find that exchanges, digital asset comprehensive management, and DeFi projects are the three types of projects that disclosed the largest total investment and financing in 2020. Among them, the total amount of investment and financing disclosed by the exchange throughout the year was as high as US$896 million, accounting for 52.09% of the total investment and financing amount in the cryptocurrency field and 25.13% of the total investment and financing amount in the blockchain industry.The closely related digital asset comprehensive management projects have also attracted market attention in recent years. In 2020, the investment and financing amount of 593 million US dollars was disclosed, making it the "gold-absorbing" track second only to exchanges. In contrast to exchanges, DeFi projects will usher in a breakthrough growth in 2020, and the cumulative disclosed investment and financing amount has reached about 278 million US dollars, accounting for about 33.62% of the total investment and financing amount in the industry application field, accounting for 20% of the total investment and financing amount in the blockchain industry. 7.80% of the total investment and financing amount.In addition, tools, protocols, stablecoin issuers, databases, payment, investment, and "investment/incubation" projects have disclosed annual investment and financing totals exceeding US$100 million.Projects in different fields have different financing capabilities. In 2020, industry application projects disclosed the most investment and financing events, with a total of 158 projects disclosing investment and financing events. Among the projects that disclosed the financing amount, the average total financing obtained by each individual project was about 7.01 million US dollars, and the individual financing ability was not high. high. The financing capabilities of the underlying technology projects are also relatively similar. Although 105 related projects disclosed investment and financing events, the average single financing of the projects that disclosed the financing amount was only about 8.16 million US dollars.On the contrary, cryptocurrency projects and "cryptocurrency/industry application" projects have the strongest individual financing capabilities. In 2020, 114 cryptocurrency projects disclosed investment and financing events, and the average single financing of projects disclosing financing amounts was about 20.72 million US dollars , 3 "cryptocurrency/industry application" projects disclosed investment and financing events, and the average financing amount of each project was about 20.57 million US dollars.From the perspective of the financing capabilities of subdivided tracks, the "investment/incubation" projects have the strongest individual financing ability, reaching an average of 38.08 million US dollars. Among them, Pantera Capital completed a fundraising of 165 million US dollars in August, and Bloccelerate Completed a $120 million fundraising round in December.The progress of investment and financing throughout the year is still mainly in the early stage, and 25 DeFi projects have received seed round financing

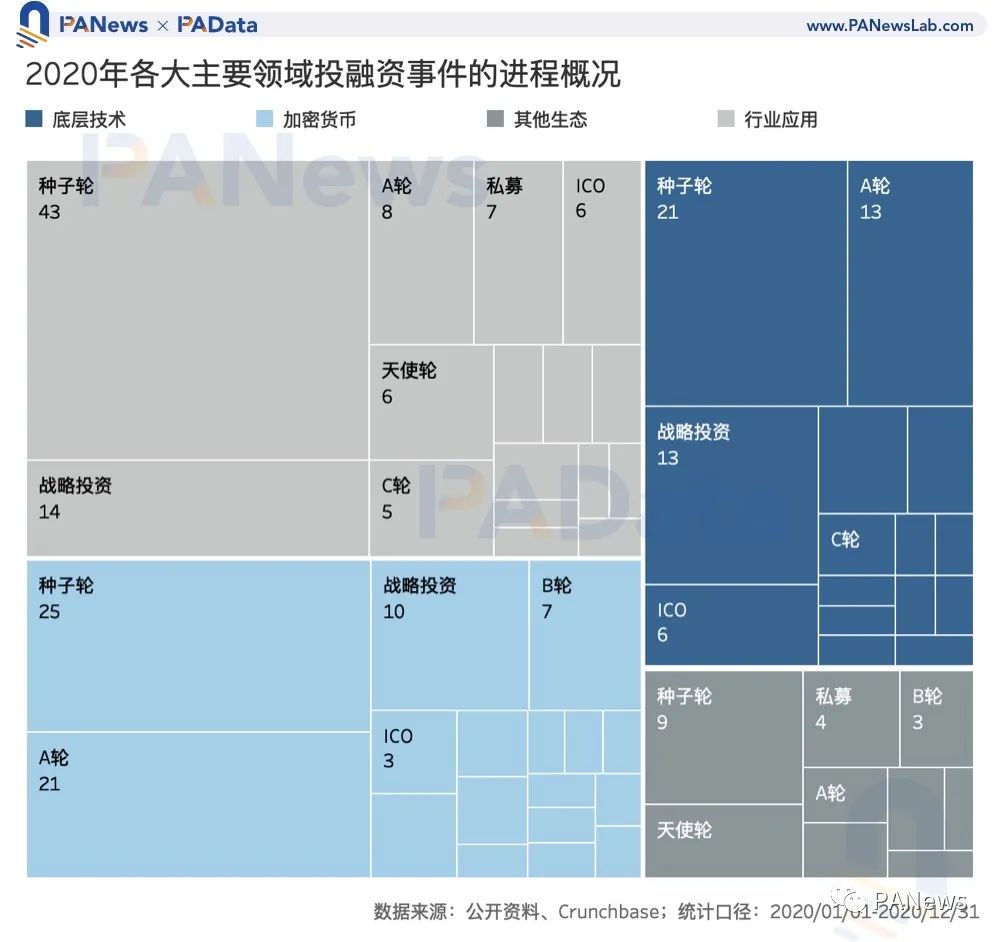

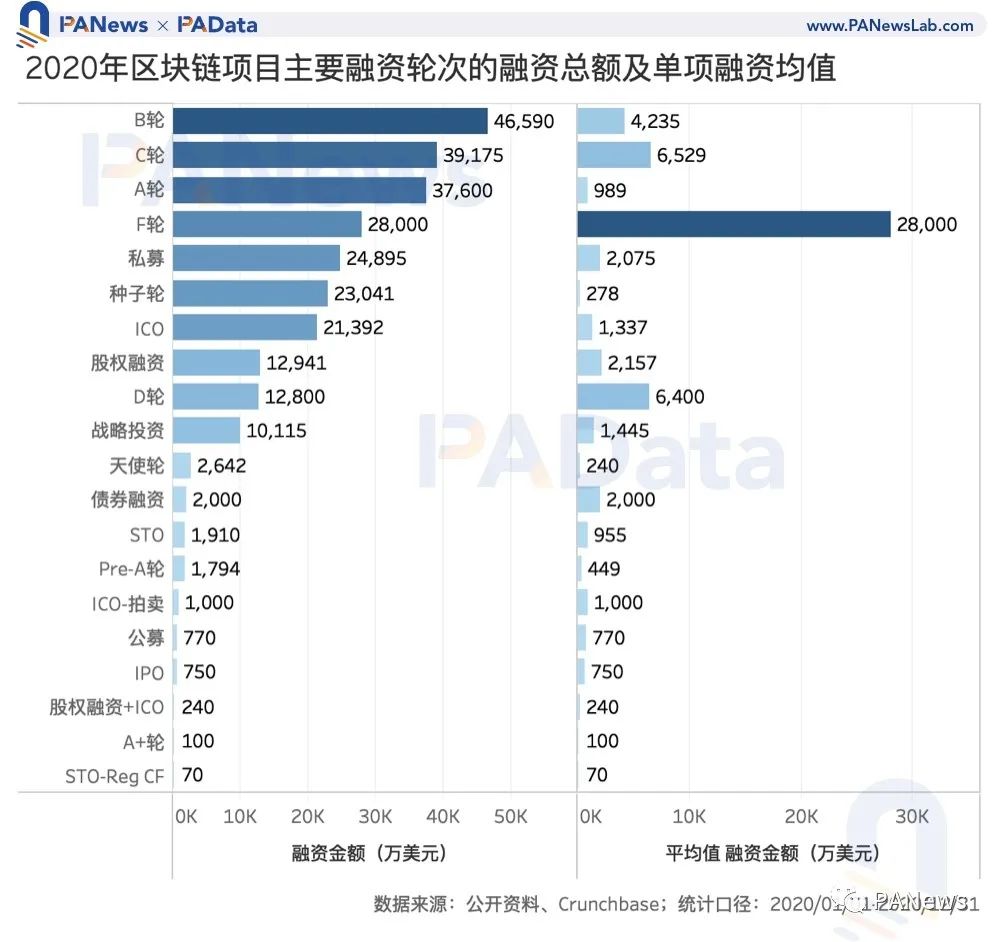

In 2020, the investment in the global pan-blockchain field will still be dominated by early-stage investment. Among the 434 investment and financing events, 296 disclosed the progress of investment and financing, including 98 seed rounds, 44 A rounds, 38 strategic investments, and a total of 180 of the three, accounting for 60.81%.From the perspective of main fields, the investment and financing progress disclosed by industry application projects is mainly seed round and strategic investment, with a total of 57 cases. In addition, there are 5 rounds of financing progress, including data service providers Digital Asset and Chainalysis. The underlying technology and cryptocurrency projects mainly focus on seed rounds, A rounds, and strategic investments. Among them, cryptocurrency projects also have investment and financing events in later rounds such as C rounds, D rounds, and F rounds. One case each, involving stablecoin issuer Paxos, digital bank N26, and exchange Robinhood, all with a financing amount of more than US$100 million. Judging from the amount of financing disclosed in various forms, in the whole of 2020, the total financing of round B, round C and round A is the highest, all exceeding US$350 million, of which the cumulative amount of round B reached about US$466 million. The total amount of financing involved in ICO has also exceeded 225 million US dollars, and ICO is still a very important form of financing in the blockchain industry. In addition, the total amount of financing involved in STO is relatively low, only about 19.8 million US dollars. The only IPO exchange, INX, disclosed a $7.5 million IPO in September, and the mining company Hut8 disclosed a Post-IPO in July.

Judging from the amount of financing disclosed in various forms, in the whole of 2020, the total financing of round B, round C and round A is the highest, all exceeding US$350 million, of which the cumulative amount of round B reached about US$466 million. The total amount of financing involved in ICO has also exceeded 225 million US dollars, and ICO is still a very important form of financing in the blockchain industry. In addition, the total amount of financing involved in STO is relatively low, only about 19.8 million US dollars. The only IPO exchange, INX, disclosed a $7.5 million IPO in September, and the mining company Hut8 disclosed a Post-IPO in July. According to the individual financing capabilities in different rounds, the project financing capabilities of the F, C, D and B rounds are relatively strong, and the individual financing scales have exceeded 40 million US dollars. Among them, the single financing ability of the F round is the strongest, with an average single financing amount of 280 million US dollars, and the average single financing amount of the other three rounds also exceeds 40 million US dollars. In addition, it is worth paying attention to the ICO, whose single financing scale is not small, about 13.37 million US dollars. The single financing scale of STO is relatively small, less than 10 million US dollars.In the DeFi field with the strongest development momentum in 2020, a total of 25 projects disclosed the progress of seed round financing, and another 10 projects disclosed the progress of other rounds of investment and financing, with an average financing amount of about 5.59 million US dollars. Mainly affected by the financing projects in the A round, B round and C round, the average level has been raised. If only the average value of the single financing of the seed round is calculated, it is only about 2.12 million US dollars.

According to the individual financing capabilities in different rounds, the project financing capabilities of the F, C, D and B rounds are relatively strong, and the individual financing scales have exceeded 40 million US dollars. Among them, the single financing ability of the F round is the strongest, with an average single financing amount of 280 million US dollars, and the average single financing amount of the other three rounds also exceeds 40 million US dollars. In addition, it is worth paying attention to the ICO, whose single financing scale is not small, about 13.37 million US dollars. The single financing scale of STO is relatively small, less than 10 million US dollars.In the DeFi field with the strongest development momentum in 2020, a total of 25 projects disclosed the progress of seed round financing, and another 10 projects disclosed the progress of other rounds of investment and financing, with an average financing amount of about 5.59 million US dollars. Mainly affected by the financing projects in the A round, B round and C round, the average level has been raised. If only the average value of the single financing of the seed round is calculated, it is only about 2.12 million US dollars.35 investment institutions "shot" more than 6 times, and the layout of traditional VC investment is more balanced

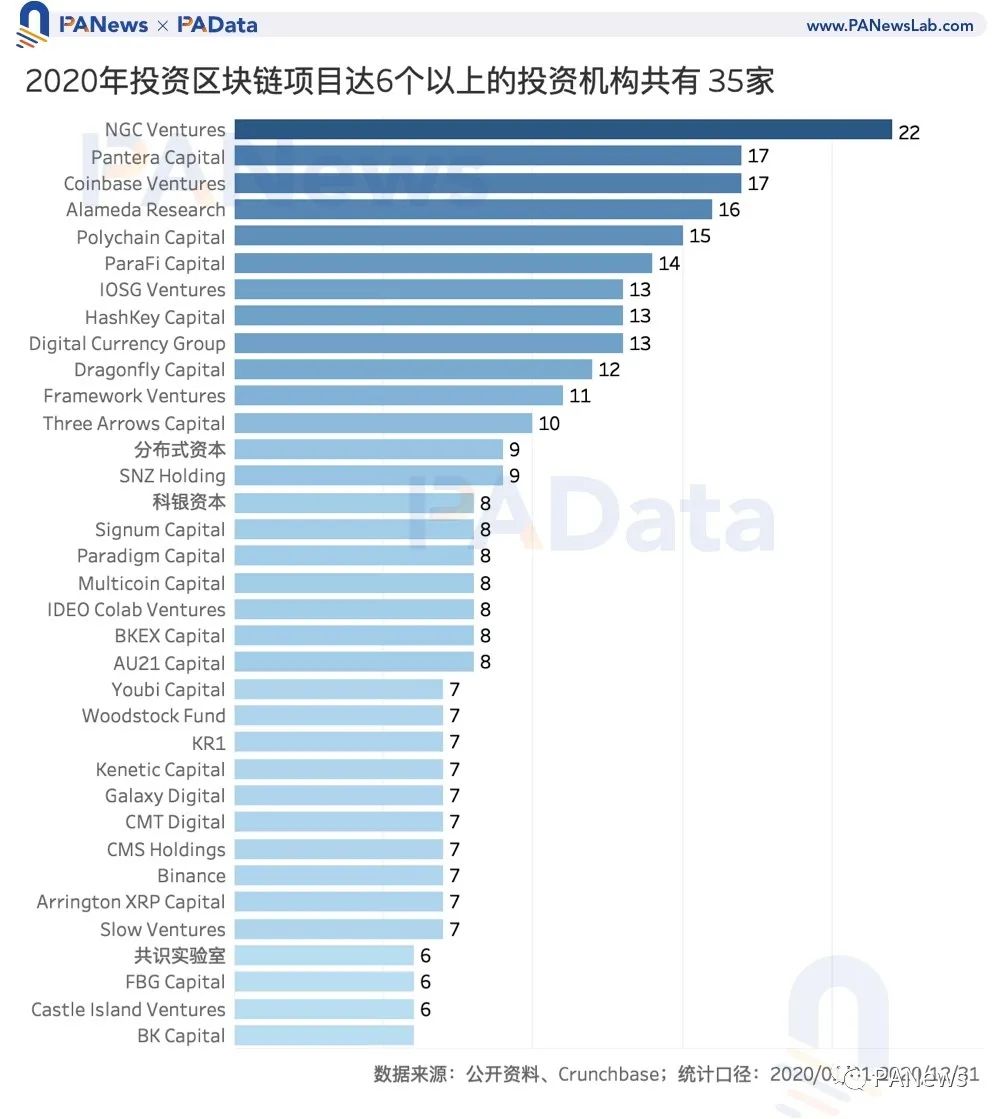

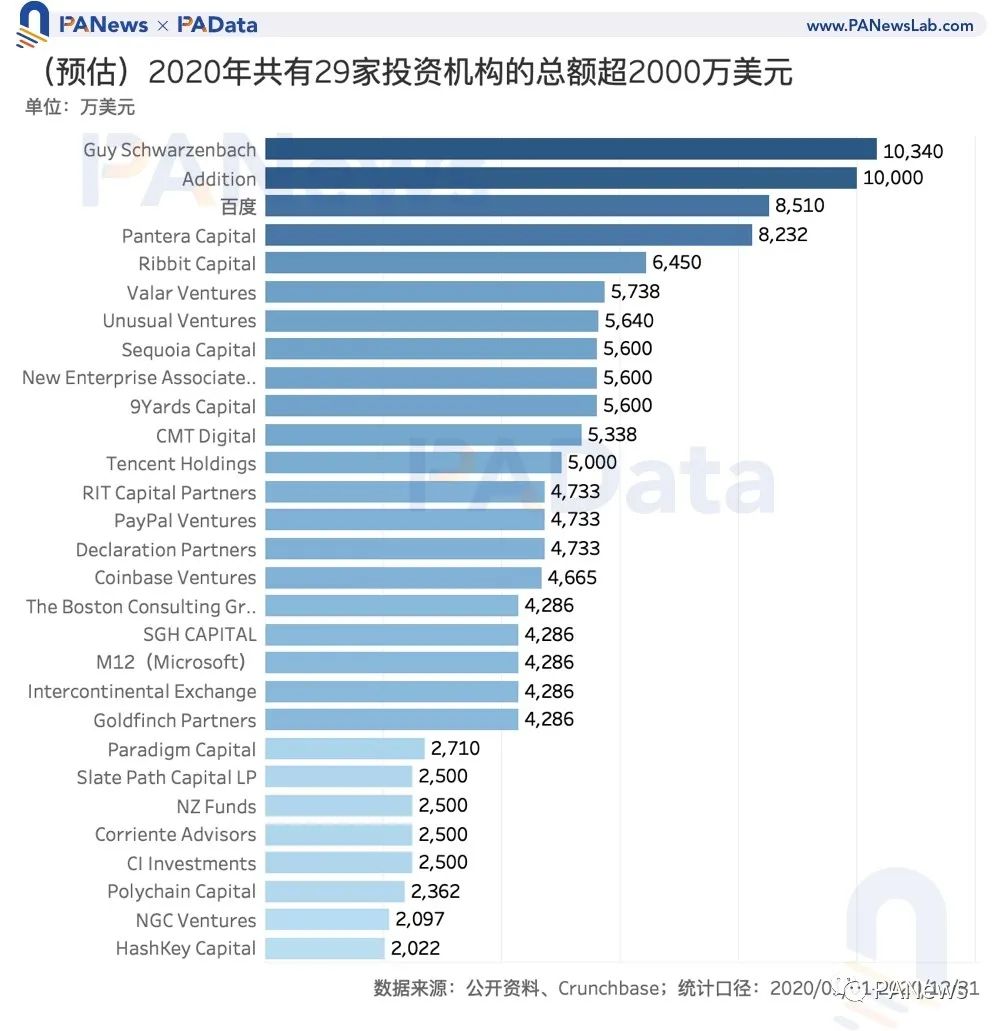

In 2020, a total of 705 institutions (including individuals) participated in blockchain project investment, of which 35 institutions invested in more than 6 projects. NGC Ventures participated in 22 projects in total, including ForTube, Linear Finance, and Math Wallet, among others. In addition, Pantera Capital, Coinbase Ventures, Alameda Research and Polychain Capital have invested in more than 15 blockchain projects. ParaFi Capital, HashKey Capital, IOSG Ventures, Digital Currency Group, Dragonfly Capital, Framework Ventures and Three Arrows Capital have invested in more than 10 projects. These 12 investment institutions are the institutions with the most active investment activities in 2020. Without considering the difference in investment behaviors such as lead investment and follow-up investment, the investment amount of each investor is estimated by estimating the average investment amount of each investor based on the total amount of financing/number of investors. This is only an estimate, and due to ignoring differences, the estimate can only provide limited reference for understanding the investment behavior of investors.According to statistics, in 2020, a total of 29 investment institutions have invested a total of more than 20 million US dollars in the pan-blockchain field, of which Guy Schwarzenbach and Addition have invested a total of more than 100 million US dollars. According to public information, Guy Schwarzenbach invested US$103.4 million in the Swiss encryption bank SEBA in January 2020, while Addition participated in the data service provider Chainalysis in December. According to the average estimate, the investment may be around US$100 million.

Without considering the difference in investment behaviors such as lead investment and follow-up investment, the investment amount of each investor is estimated by estimating the average investment amount of each investor based on the total amount of financing/number of investors. This is only an estimate, and due to ignoring differences, the estimate can only provide limited reference for understanding the investment behavior of investors.According to statistics, in 2020, a total of 29 investment institutions have invested a total of more than 20 million US dollars in the pan-blockchain field, of which Guy Schwarzenbach and Addition have invested a total of more than 100 million US dollars. According to public information, Guy Schwarzenbach invested US$103.4 million in the Swiss encryption bank SEBA in January 2020, while Addition participated in the data service provider Chainalysis in December. According to the average estimate, the investment may be around US$100 million. In addition, the total investment and financing of Baidu, Pantera Capital and Ribbit Capital in 2020 exceeded 60 million US dollars. Among them, Baidu, one of the Internet giants, invested US$85.1 million in Yuxin Technology in January, and Pantera Capital and Ribbit Capital have diversified their investments into more projects. For example, Pantera Capital invested in Acala, Amber Group, Balancer, DODO, Wyre, etc., and Ribbit Capital invested in Chainalysis, Lightning Labs, and Robinhood.Investors with different backgrounds have different investment logics and investment preferences. According to a simple classification of the nature of investors, it can be seen that exchanges have invested more intensively in cryptocurrency projects related to their own businesses. Invested in 13 cryptocurrency projects.Well-known blockchain VCs are particularly inclined to industry application projects, especially DeFi projects. They have invested in 57 related projects throughout the year. In addition, they are also keen to invest in exchanges and protocol projects. They have invested in 24 projects in total throughout the year. and 11 related projects.In contrast, the investment layout of well-known traditional VCs is more balanced, investing in a total of 10 underlying technology projects, 10 industry application projects and 8 cryptocurrency projects throughout the year.Looking at the investment in the DeFi field, NGC Ventures invested in the largest number of projects, with a total of 11, followed by ParaFi Capital and Framework Ventures, which invested in a total of 8 projects. Among investment institutions with a more traditional background, only Winklevoss Capital, a16z, and Galaxy Digital have invested in DeFi projects. Among exchanges, Coinbase, MXC Matcha, and Huobi have all deployed DeFi projects.

In addition, the total investment and financing of Baidu, Pantera Capital and Ribbit Capital in 2020 exceeded 60 million US dollars. Among them, Baidu, one of the Internet giants, invested US$85.1 million in Yuxin Technology in January, and Pantera Capital and Ribbit Capital have diversified their investments into more projects. For example, Pantera Capital invested in Acala, Amber Group, Balancer, DODO, Wyre, etc., and Ribbit Capital invested in Chainalysis, Lightning Labs, and Robinhood.Investors with different backgrounds have different investment logics and investment preferences. According to a simple classification of the nature of investors, it can be seen that exchanges have invested more intensively in cryptocurrency projects related to their own businesses. Invested in 13 cryptocurrency projects.Well-known blockchain VCs are particularly inclined to industry application projects, especially DeFi projects. They have invested in 57 related projects throughout the year. In addition, they are also keen to invest in exchanges and protocol projects. They have invested in 24 projects in total throughout the year. and 11 related projects.In contrast, the investment layout of well-known traditional VCs is more balanced, investing in a total of 10 underlying technology projects, 10 industry application projects and 8 cryptocurrency projects throughout the year.Looking at the investment in the DeFi field, NGC Ventures invested in the largest number of projects, with a total of 11, followed by ParaFi Capital and Framework Ventures, which invested in a total of 8 projects. Among investment institutions with a more traditional background, only Winklevoss Capital, a16z, and Galaxy Digital have invested in DeFi projects. Among exchanges, Coinbase, MXC Matcha, and Huobi have all deployed DeFi projects.