Mengyan Finance (ID: Meng-eyes)Mengyan Finance (ID: Meng-eyes), reprinted by Odaily with authorization.Lately, it is common to hear lawsuit calls from mainstream media that “need liquidity to save us”.This ocean of currency energy seems safe for first world fish, but there is still a problem. In fact, it is not an ocean, but a man-made dam. It blocks the leakage of value, allowing the fish to survive. But unfortunately for everyone enjoying the safe first world waters of "2% inflation", a crack has appeared in the dollar dam.Faith-based concrete is starting to show the test of time and bureaucratic incompetence. In all fairness, there has never been a fiat currency in history that has truly stood the test of time. The British pound is the longest-standing legal tender, having survived 325 years. But in the process, it managed to lose 99.99% of its buying power.

Unlike the pound, the dollar still seems to be in its prime, often touted by the financial elite as a reliable store of value due to its "low volatility" and long history. It has a total market capitalization of over $100 trillion, including various layers of currencies and debt instruments, so, it must be safe, right? At first glance, it seems to be safe, and if it's not broken, it shouldn't need to be repaired, right? Wrong, this is not the case with the dam.Once the structure is compromised, it can go from perfectly functioning to completely broken in the blink of an eye. "Functional" doesn't mean flawless, but rather that the black swan moment hasn't come to expose its cracks. And this begs the question. Is there a way to find the cracks before the dam self-destructs? Then try to fix it, or find a bright orange Satoshi's Ark to survive the impending flood!Finding the crack in the dollar damFor ordinary people all over the world, there is no hope of fixing the dollar dam. Fortunately, we have some very skilled engineers around the world that can help us get the currency structure healthy. On this topic, there is a very logical voice with a particularly high signal-to-noise ratio, and he is Preston Pysh. Within the Bitcoin space, Pysh is known for its ability to diagnose financial markets, and coupled with an engineering background, Pysh was the perfect first stop for this structural check. Back in early March 2020, when the financial markets and the world were going wild, Nathaniel Whittmore sat down with Pysh on his weekly podcast "The Breakdown" for an episode called "When Currency What Happens When You Fail" show. In this episode, Pysh lays out the top three factors that have historically signaled the imminent failure of currencies.

While I'm a big believer in the Bitcoiner motto "don't trust, verify," let's take Pysh's advice and point the magnifying glass at each of these potential weaknesses in the dollar dam in turn.secondary title

First, the dollar defaulted on its gold debt in 1971, known as the "Nixon shock." From that day on, there is only the king's decree behind the dollar, which is the definition of money. It should be noted that after the Bretton Woods conference in July 1944, the entire global monetary system was backed by the dollar, which was presumably backed by gold. This means that the Nixon Shock not only threw the United States on the fiat currency standard, but also the entire world. This means that not only is the dollar pegged, but so is the entire global monetary system. And this may be the reason why the whole world is heavily indebted, reaching more than 250 trillion US dollars.When government spending far outpaces tax revenueAs can be seen from the figures above, the U.S. government spends $6.65 trillion a year, of which $3.2 trillion has to be reprinted due to insufficient revenue.If this is the data of a business, then this would be defined as hemorrhaging capital. Fortunately, the US government does not play free market games, only highly manipulated and morally bankrupt ones. Efficient use of capital is not welcome in this playing field, and our future relatives are not allowed to have any debt limits.

To understand whether this was a blip “started with COVID-19” or an ongoing problem, it’s best to look at the long-term trends in the US debt-to-GDP ratio. In addition, there are some liabilities that the U.S. government has accepted but currently has no funds to pay for, commonly known as "unfunded liabilities."The US Debt Clock shows that the debt-to-GDP ratio actually improved from 1960 to 1980. But in the 40 years since then, it has absolutely exploded. 2008 was the black swan that greatly accelerated the problem, and the spontaneous economic suffocation of COVID-19 is the death knell that never recovers the debt-to-GDP ratio. Second, looking at America's unfunded liabilities, can we find some hope that this budget conundrum can be resolved. Turns out, politicians have pledged to pay for roughly $158.9 trillion in welfare for Americans, but they haven't set aside that money because obviously, in American politics, you can always drag problems into the future. It can be argued that the U.S. government will spend more than it takes in for the foreseeable future.The yield on debt denominated in that currency is zeroFinally, it's time to analyze the outlook for the dollar and the broader bond market in 2021.For anyone who is not a bond market expert, some background may be necessary. For this, I will use a simple example. Say your government offers a war bond to help fend off a tribal invasion, and it offers a 5-year bond at 5% interest. So, you decide to drop your last 100 clams into the village to help with reinforcements. So, for the next five years, you go to your local town center every three months to collect 1.25 clam interest. After five years, you'll come to the town center to collect the last 1.25 clams of interest and the original 100 clams of principal. At this point you might be asking, "What the hell is so interesting about that?" Bond math only gets interesting when you sign a long-term bond. And the following simple example will emphasize why I say so.

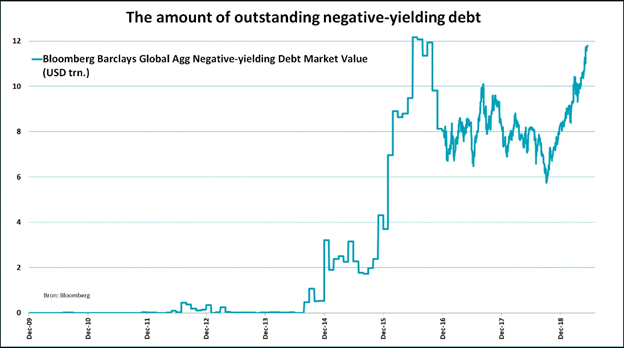

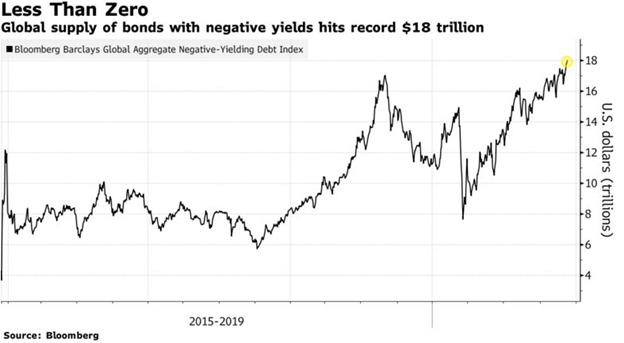

1% interest on a 30-year bond, sounds crappy right? You pay $100 and get only $1 a year for 30 years. Unless, interest rates become negative. If later that year, the market price of the 30-year bond is -1%, then your bad investment becomes a "rock star."Do not believe? Use the Bond Value Calculator to see that your $100 investment is now selling for $170 in the open market. As a result, long-term bonds have become one of the best and easiest money-making trades in the past 50 years. At this point, most reasonable people would say, "Who in their right mind would buy a 30-year bond with a negative yield if negative bond prices were the only way to actually make money and keep the game going? !"Just like the stock market is hyped by Apple, Tesla and GameStops, the bond market is where the biggest whales swim. The size of the global bond market is around $100 trillion (the U.S. is 40% of it), and the total bond market is over $250 trillion. Historically, rates have fluctuated from the low single digits to the high teens or more depending on current financial conditions. Still, 0% interest rates have never been seen since records began, for obvious reasons. Because never in recorded history has an investor lent out money for less, because that would mean that time has no value, or, time is negative.No matter how obvious and simple this may seem, we are at the peak of a 3000 year bull market with negative yielding debt everywhere. At present, the global debt with negative yield has reached more than 18 trillion US dollars. I wasn't able to find a single picture that goes back that far, so these two are needed to show the massive growth over the past 10 years.Now, it's time to zero the dollar. With positive yields across the curve, the dollar is in much better shape than most currency counterparts. Having said that, a 1% rate on a 10-year bond is not great considering that 20 years ago these bonds were yielding 6%. So, the clear trend is that yields will go towards zero/negative.

1% interest on a 30-year bond, sounds crappy right? You pay $100 and get only $1 a year for 30 years. Unless, interest rates become negative. If later that year, the market price of the 30-year bond is -1%, then your bad investment becomes a "rock star."Do not believe? Use the Bond Value Calculator to see that your $100 investment is now selling for $170 in the open market. As a result, long-term bonds have become one of the best and easiest money-making trades in the past 50 years. At this point, most reasonable people would say, "Who in their right mind would buy a 30-year bond with a negative yield if negative bond prices were the only way to actually make money and keep the game going? !"Just like the stock market is hyped by Apple, Tesla and GameStops, the bond market is where the biggest whales swim. The size of the global bond market is around $100 trillion (the U.S. is 40% of it), and the total bond market is over $250 trillion. Historically, rates have fluctuated from the low single digits to the high teens or more depending on current financial conditions. Still, 0% interest rates have never been seen since records began, for obvious reasons. Because never in recorded history has an investor lent out money for less, because that would mean that time has no value, or, time is negative.No matter how obvious and simple this may seem, we are at the peak of a 3000 year bull market with negative yielding debt everywhere. At present, the global debt with negative yield has reached more than 18 trillion US dollars. I wasn't able to find a single picture that goes back that far, so these two are needed to show the massive growth over the past 10 years.Now, it's time to zero the dollar. With positive yields across the curve, the dollar is in much better shape than most currency counterparts. Having said that, a 1% rate on a 10-year bond is not great considering that 20 years ago these bonds were yielding 6%. So, the clear trend is that yields will go towards zero/negative.