The confrontation between traditional finance and retail investors has spread to the currency circle |

Recently, the WSB sub-forum on the Reddit forum became famous because of GameStop GME's battle with Wall Street, and became a new generation of "philosopher". Many of the stocks it focused on have skyrocketed. Some netizens even joked that the recent skyrocketing hot stocks are True FANG.

Shareholders on Reddit will be hit hard, Morgan Stanley CEO said early Thursday. But Alexis Ohanian, co-founder of Reddit, said that the trading frenzy of short-selling stocks by institutions such as GME marked a turning point in the US investment landscape: "I do think this is a groundbreaking moment. I don't think we can go back to the previous world because these Online communities are a by-product of the Internet age, and this is the new normal."

Before the U.S. stock market opened on Thursday, popular Internet brokerages announced restrictions on the trading of related "monster stocks" and increased margin requirements. Robinhood said it "does not support" transactions such as GME, and Interactive Brokers "only allows liquidation" of options such as AMC, GME, Blackberry, Express, and Goss Electronics. TD AmeriTrade has restricted related transactions yesterday, and all three major platforms have increased margins. Futu Securities prohibits GME and AMC from opening new positions, and closing positions will not be affected. The Speaker of the US House of Representatives Pelosi said that he will fully review issues related to GME.

As these popular stocks in the short-squeeze war were unable to open positions one after another, retail investors turned their targets to the popular stocks mentioned in other forums, which pushed up the stock prices of silver, Dogecoin, and American Airlines on Thursday.

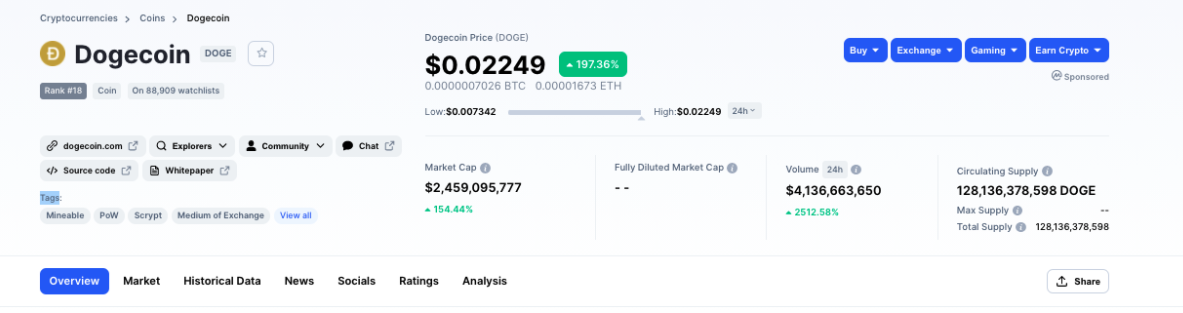

Dogecoin soared 7 times within a day, after the Reddit forum, a gathering place for retail investors in the United States, mentioned this asset. A post titled "Dogecoin is the next GME/Bitcoin" said that getting Dogecoin to $1 a coin (currently about $0.01) would be an incredible achievement, which completely changed the crypto market, sending Dogecoin to Moon.

Subsequently, the news of "450% increase in Dogecoin" rose to the top five on Weibo's hot search list. After the digital currency exchange Huobi issued an announcement to suspend the deposit and withdrawal of Dogecoin on the afternoon of January 29, the sky was full of people. The news that Dogecoin is crazy, this war between retail investors and institutions has also ignited the currency circle.

It has to be said that this is a brand new retail revolution. Even Ray Dalio, co-chairman of Bridgewater Associates, said the firm is watching Bitcoin closely. Dalio wrote in the column: "I wrote this article to clarify my views on Bitcoin. I believe that Bitcoin is an amazing invention. Bitcoin looks like a long-term option, in a highly unknown In the future, I can invest a sum of money, and I don’t mind losing 80% of the money.” In addition, he also said that Bitcoin may become a substitute for gold. Dalio has previously been a long-time critic of Bitcoin, saying he does not think it will become an everyday currency. But he made some concessions last month, saying cryptocurrencies like bitcoin could be a "golden asset."

In addition, Morgan Creek founder Anthony Pompliano said that WSB + Tesla + Bitcoin = Wall Street's nightmare.

Ryan SAdams, founder of Bankless, said that Bitcoin is just the beginning. In DeFi, we have a banking system that will never be closed.