Is it possible for Polkadot to surpass DeFi once? | Roast Star Selection

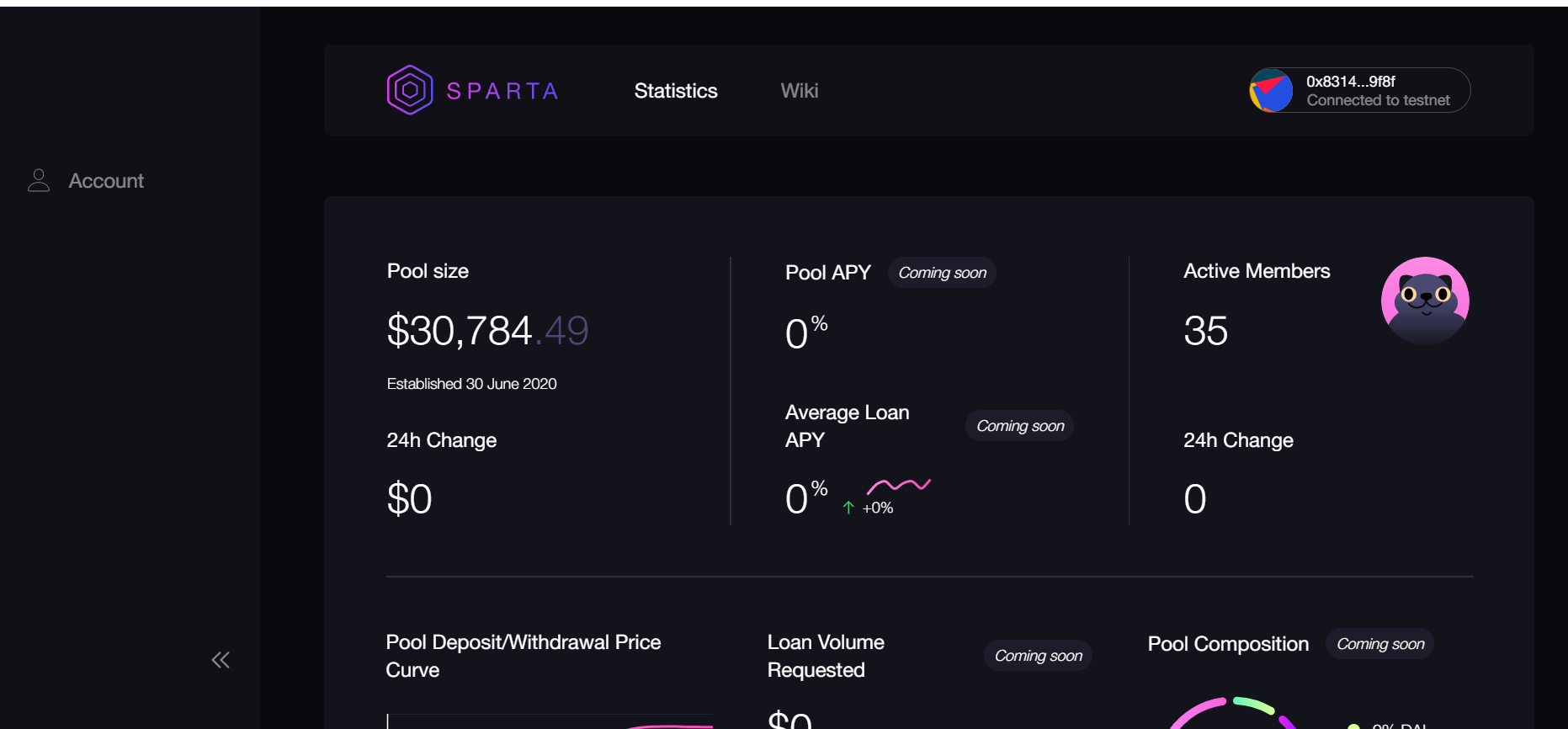

image description

Polkadot monthly line, derived from QKL123

In recent days, Polkadot has surpassed BCH, XRP, LTC, and ADA to rank among the top four in the market capitalization of cryptocurrencies, leading Polkadot holders to become richer and stronger. Also powerful is Polkadot's Defi layout.

Cao Yin, a well-known domestic DEFI player, said when he participated in the event in September: "In the future, more and more Ethereum DeFi projects will migrate to the Polkadot network. The migration of large-scale Ethereum DeFi protocols to Polkadot is a certainty." thing."

With the rise of currency prices, the Defi layout of the Polkadot ecosystem has gradually emerged. Synthetic assets represented by Bifrost, Layer 2 networks represented by Celer Network, stable currency protocols represented by Acala, and Zenlink represented by Zenlink. The representative DEX, the DEFI aggregator represented by Reef Finance, and the lending agreement represented by Akropolis, why should these Defi protocols be built on the Polkadot network? How far have they developed so far? Is it possible to surpass the DEFI ecology on Ethereum in the future? The author of this article will take you into Polkadot's DEFI world.

secondary title

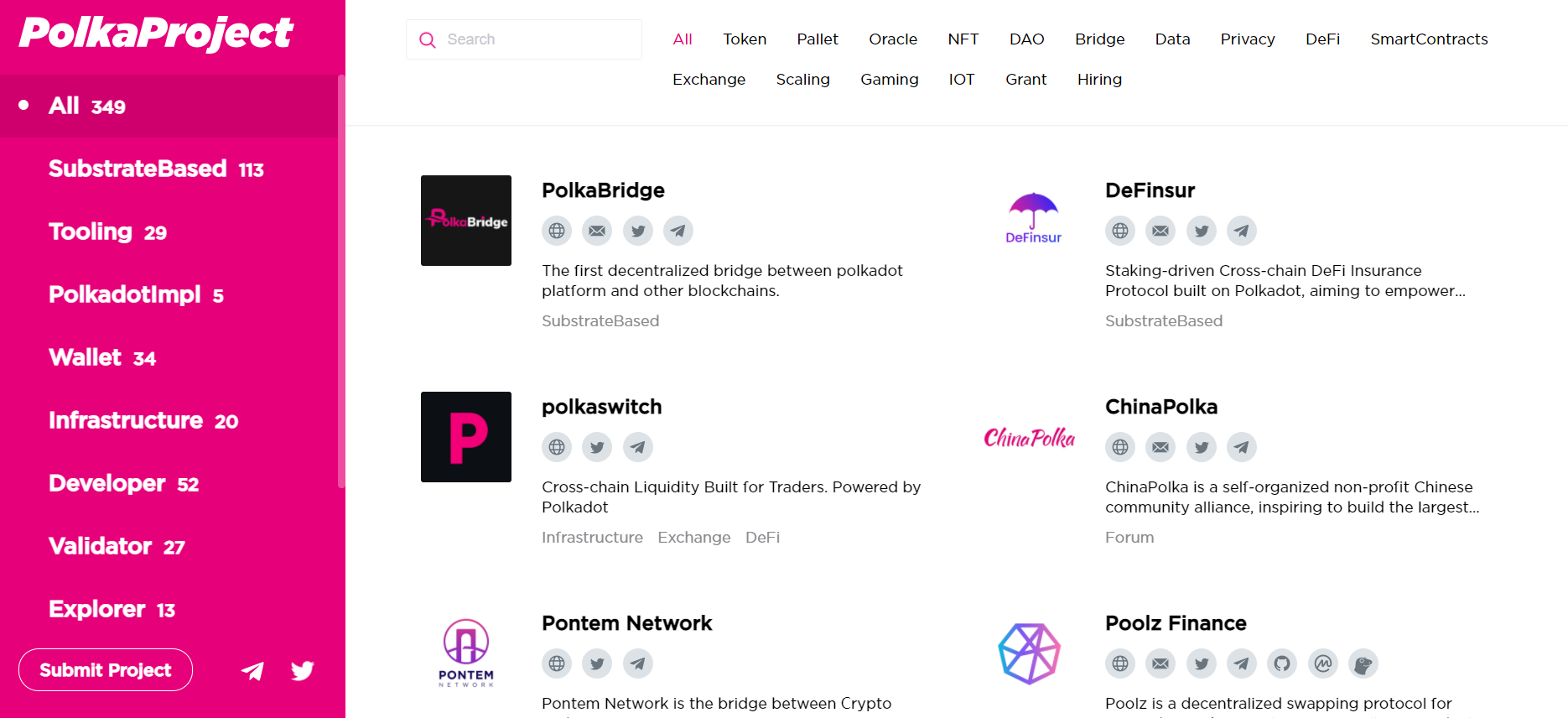

image description

source:https://www.polkaproject.com/

source:

In addition, Polkadot can increase the TPS to 100,000-1 million through the implementation of parallel blockchains, which also completely defeats the processing speed of Ethereum.

secondary title

Polkadot and DEFIhttps://acala.network/)

1. Acala (

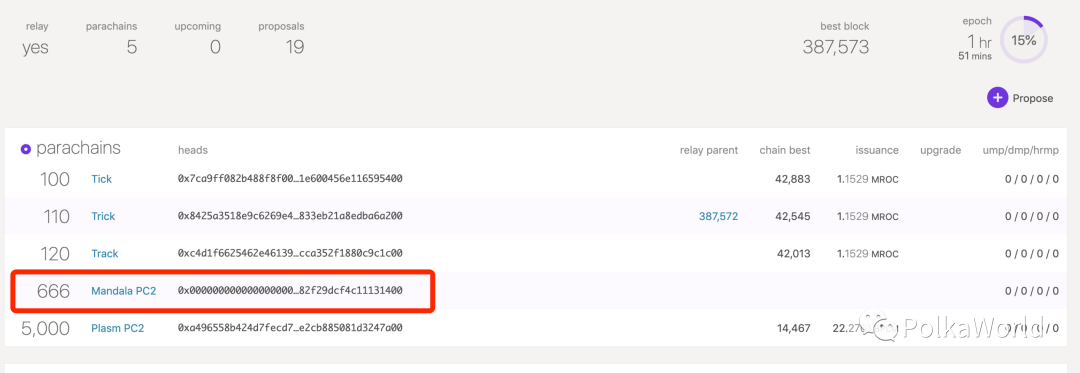

Speaking of Polkadot’s DEFI, Acala is considered to be a more prestigious protocol. According to Polkaworld, Acala has successfully connected to the Rococo V1 slot a week ago, and the next step is to prepare for the slot auction on Kusama.

Acala defines itself as: "a decentralized financial center and stable currency platform that provides support for cross-blockchain liquidity and applications." There are three main parts of business: stable currency generation platform, liquidity release agreement and DEX trading platform, the most important of which is the stable currency generation platform. So some people compare Acala to MakerDAO on Polkadot.

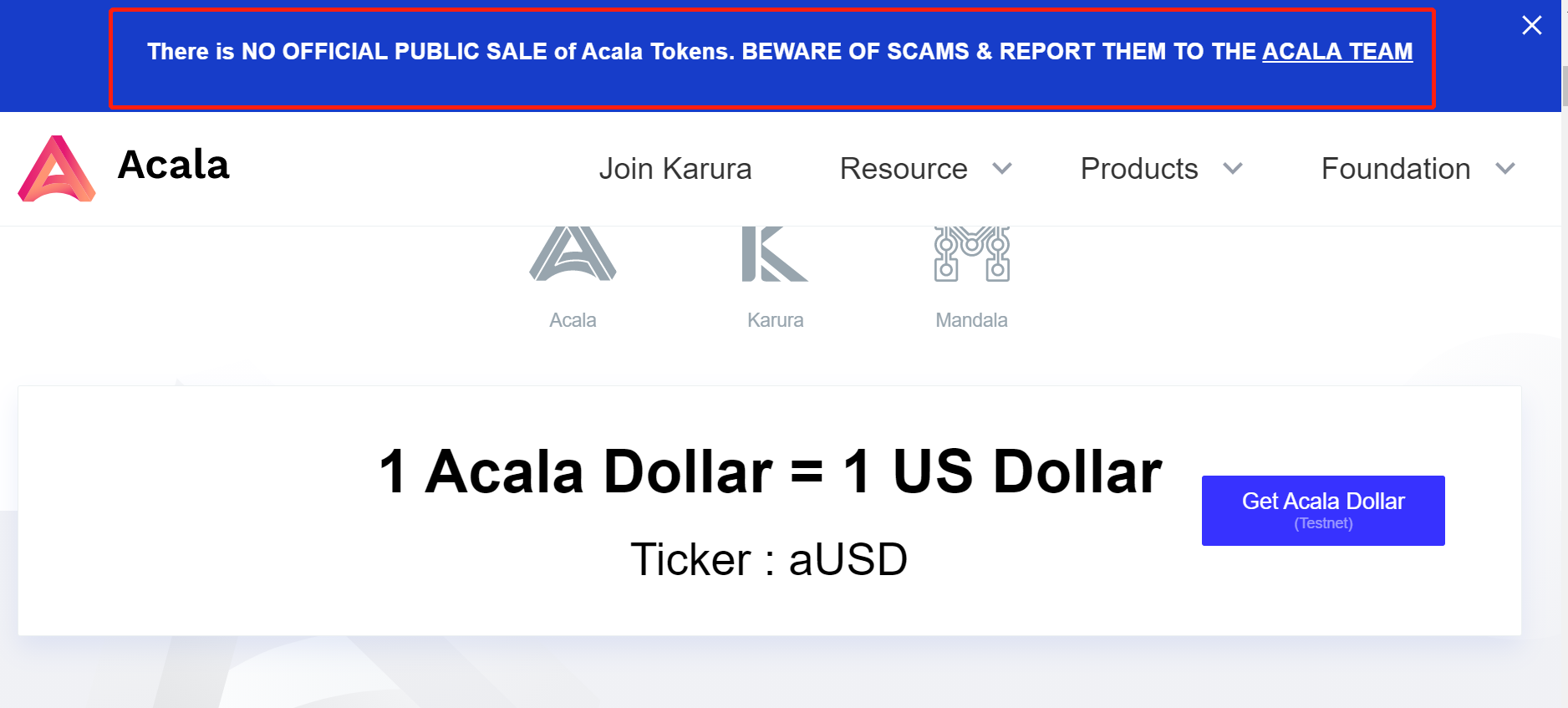

Click on the official website and find that the most conspicuous one is 1 Acala Dollar=1 US Dollar, which shows the focus of the business. It is also worth noting that there is no official token for Acala at present, so be careful of scams on the market.

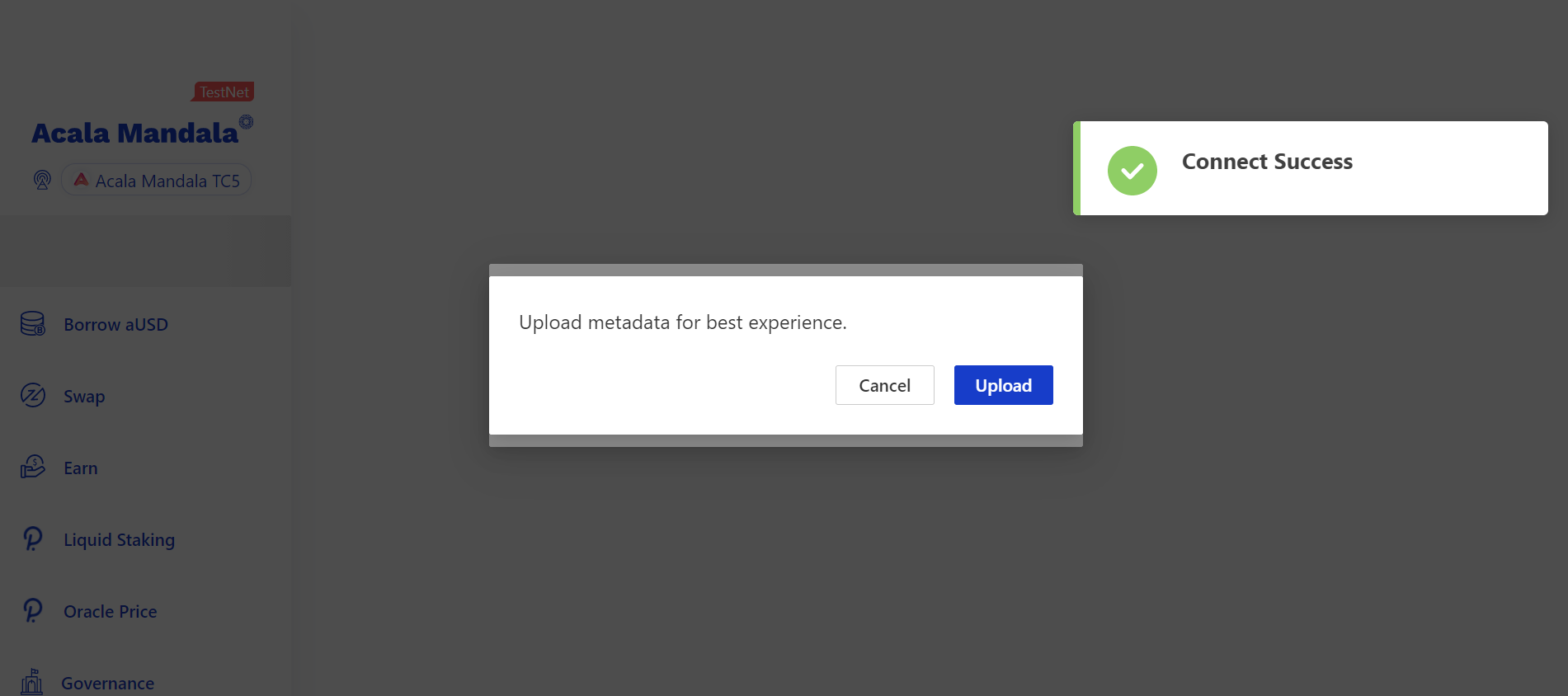

Click "Get Acala Dollar" to enter the test network, you need to connect to the wallet, and find out the main functions of Acala through the page, pledge to borrow stable coins, trade, and provide liquidity, but it is currently unavailable.https://www.celer.network/)

Two, Celer Network (

Celer is an 18-year-old project, Binance IEO, and then the currency price and popularity have been all the way to Waterloo. This year's Layer 2 is hot and re-ignited Celer. At present, Celer has transplanted the state channel to Polkadot's development environment to provide payment transactions and generalized Off-chain smart contracts provide fast, easy and secure off-chain transactions.

However, it seems that the project itself has not developed much. This cooperation with the Web3 Foundation hopes that the project can be truly implemented.https://zenlink.pro/en/)

3. Zenlink (

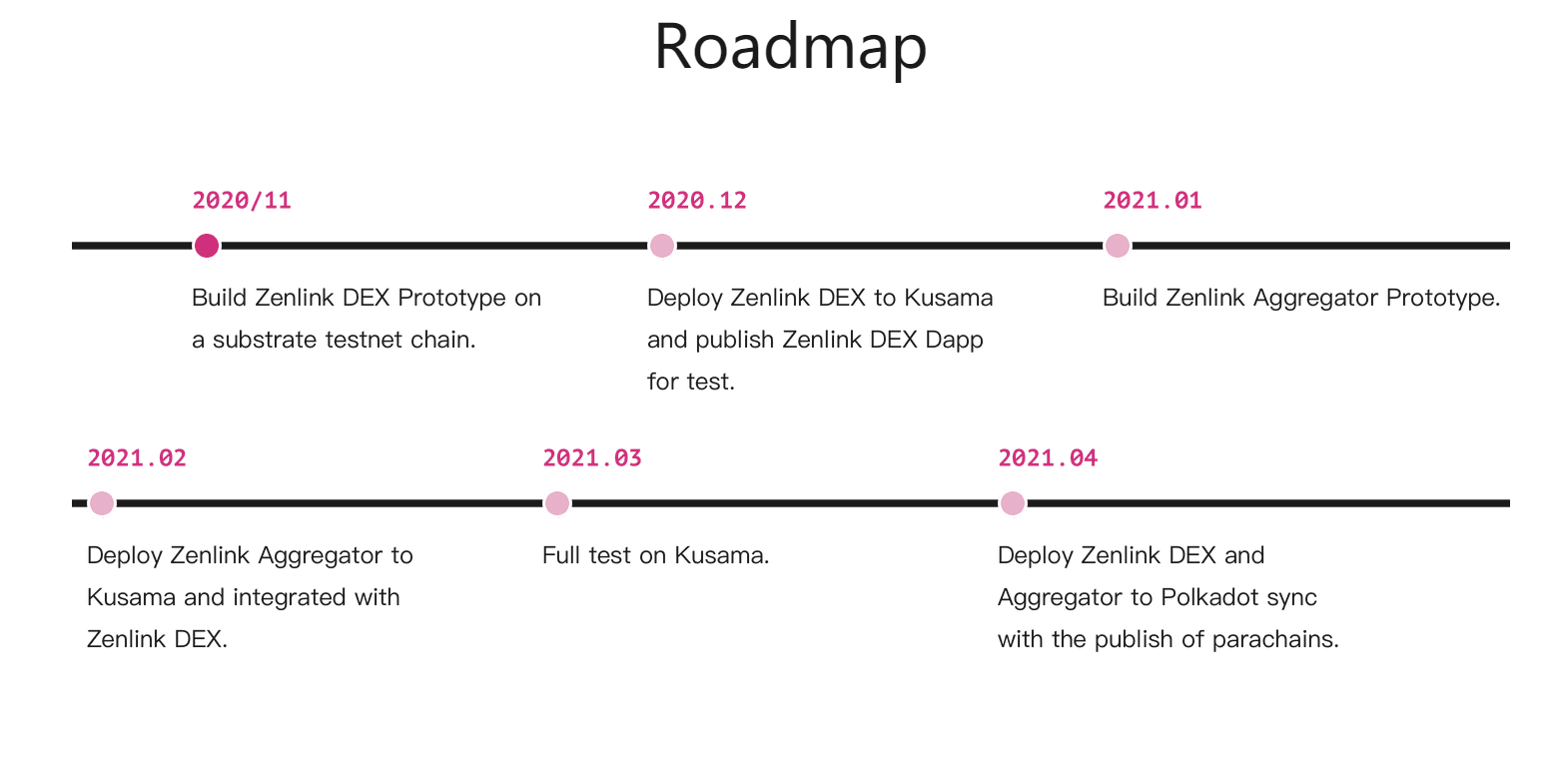

Zenlink (ZLK) Zenlink is a cross-chain decentralized trading network based on Polkadot, dedicated to building a new generation of cross-chain DEX network.

According to the Roadmap on the official website, the testnet will not be launched until March 2021.https://polkaswap.io/)

4. Polkswap (

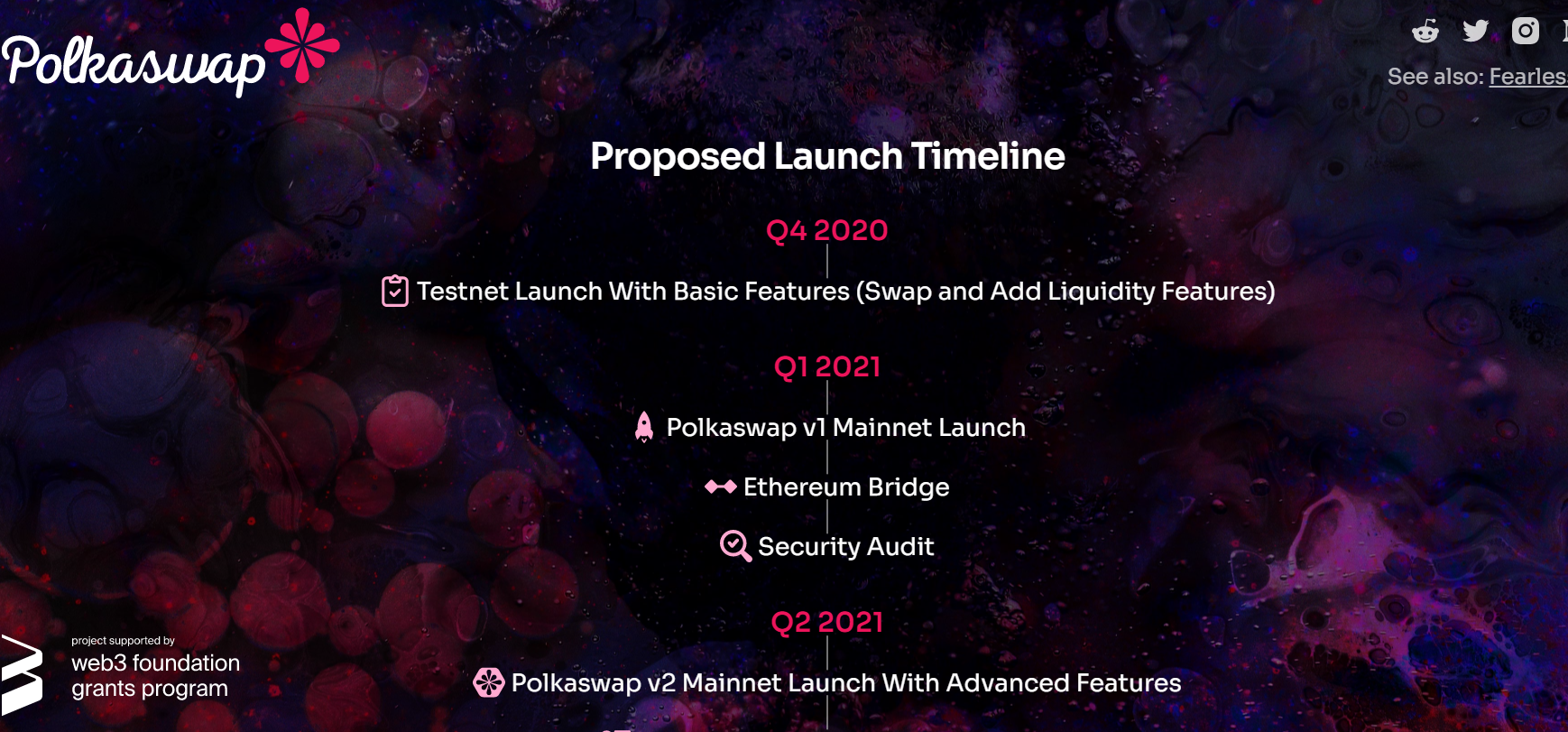

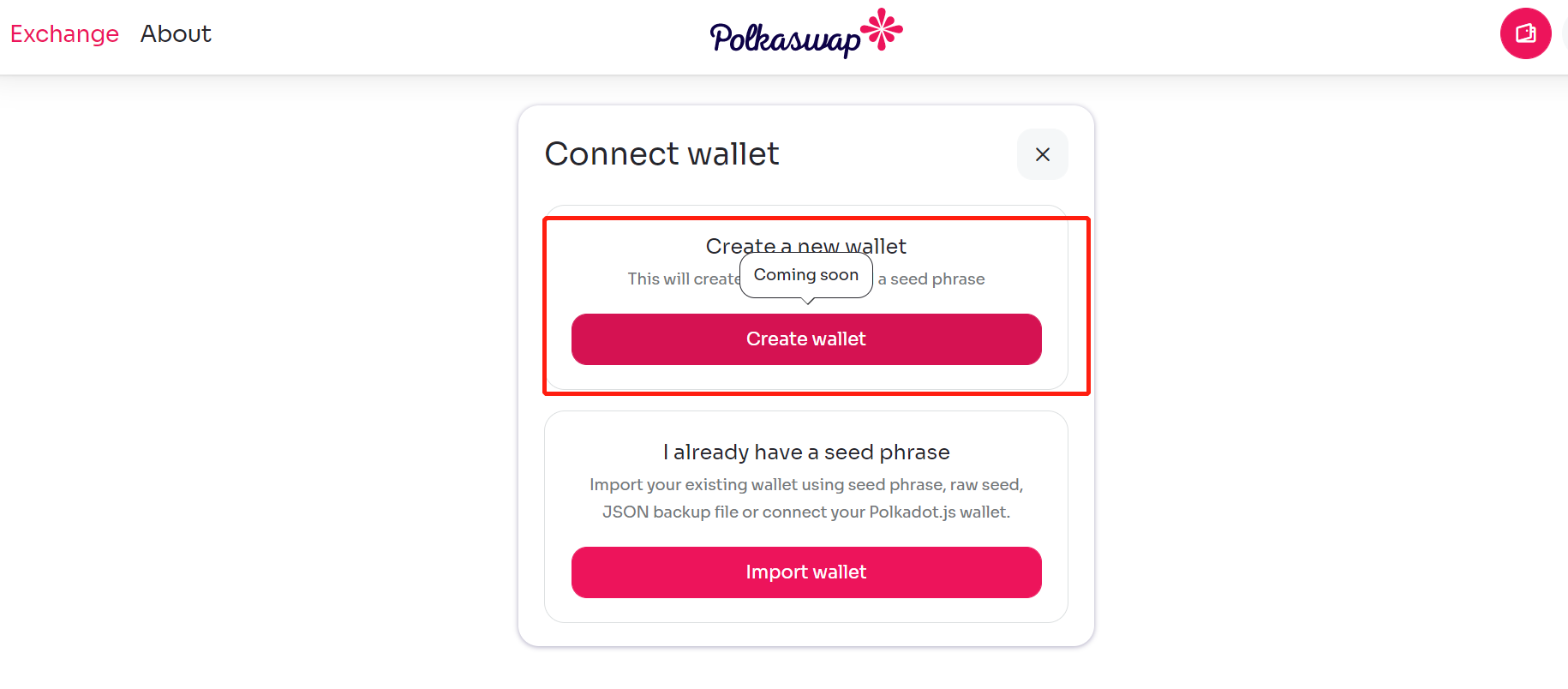

Polkaswap is an uncustodial AMM-based DEX based on SORA (a Polkadot-based chain). As early as 2020, some people said that once Polkaswap goes online, it will be the main competitor of Uniswap.

Click to enter the official website of Polkaswap, see Roadmap, Polkaswap will not go online until V1 in 2021, and it is still in the test network stage.https://supertx.bymov.io/swap)

Click to enter the official website of Polkaswap, see Roadmap, Polkaswap will not go online until V1 in 2021, and it is still in the test network stage.https://supertx.bymov.io/swap)

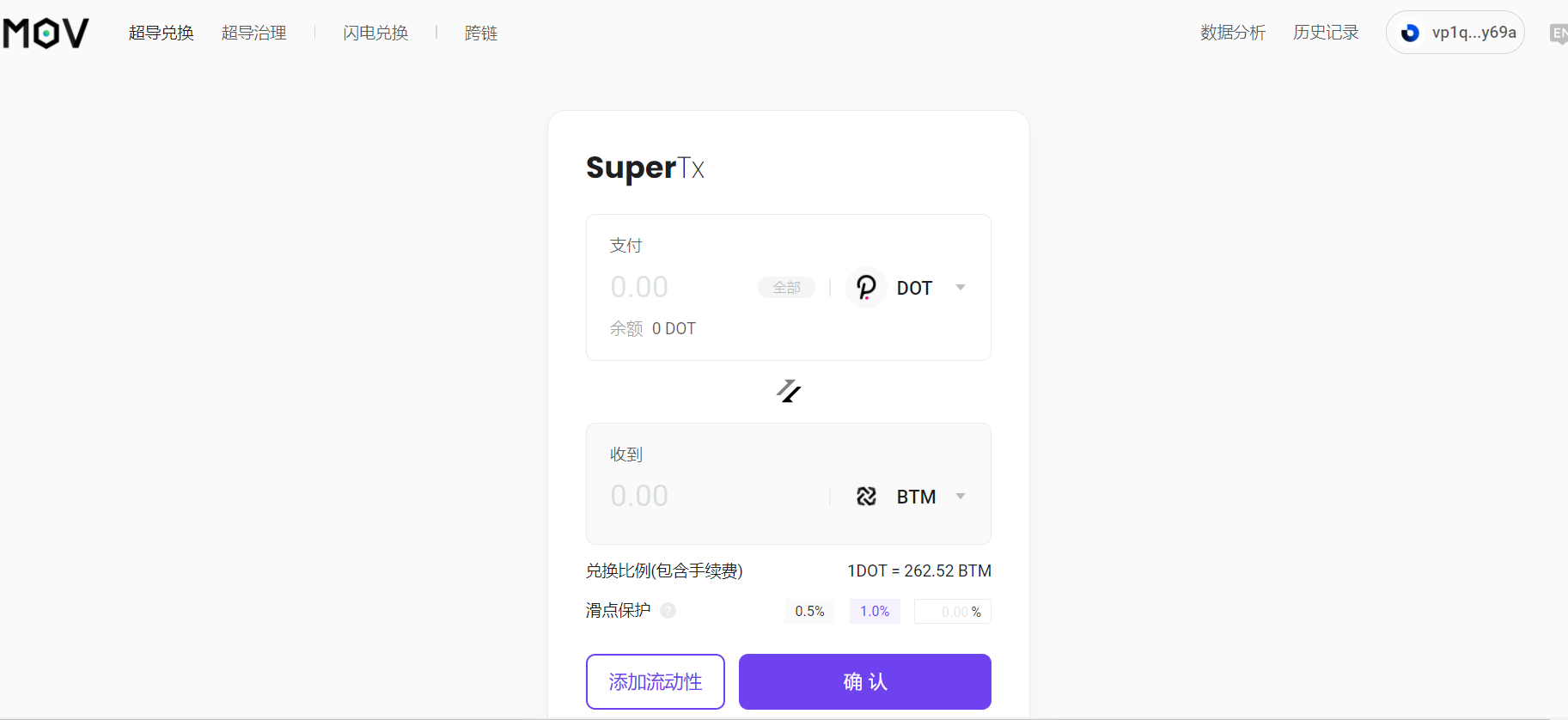

Five, MOV (

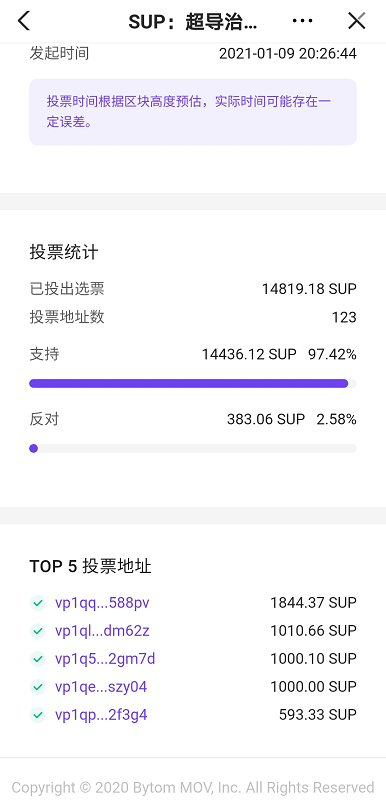

In fact, most of the DEFI projects in the Polkadot ecosystem have not yet been fully implemented, and the author found that MOV has successfully incorporated Polkadot into its own DEFI ecosystem, so I will mention this project.

MOV is a decentralized transaction protocol based on layer 2 of the Bytom chain, and currently supports Polkadot cross-chain and transactions. Based on the AMM-based superconducting exchange protocol to trade Polkadot and BTM, the transaction speed has been tested to be very fast. In addition, MOV has also added the function of Polkadot liquidity mining, which can be invested in the Polkadot trading pool to obtain MAG incentives.https://reef.finance/)

6. Reef Finance (

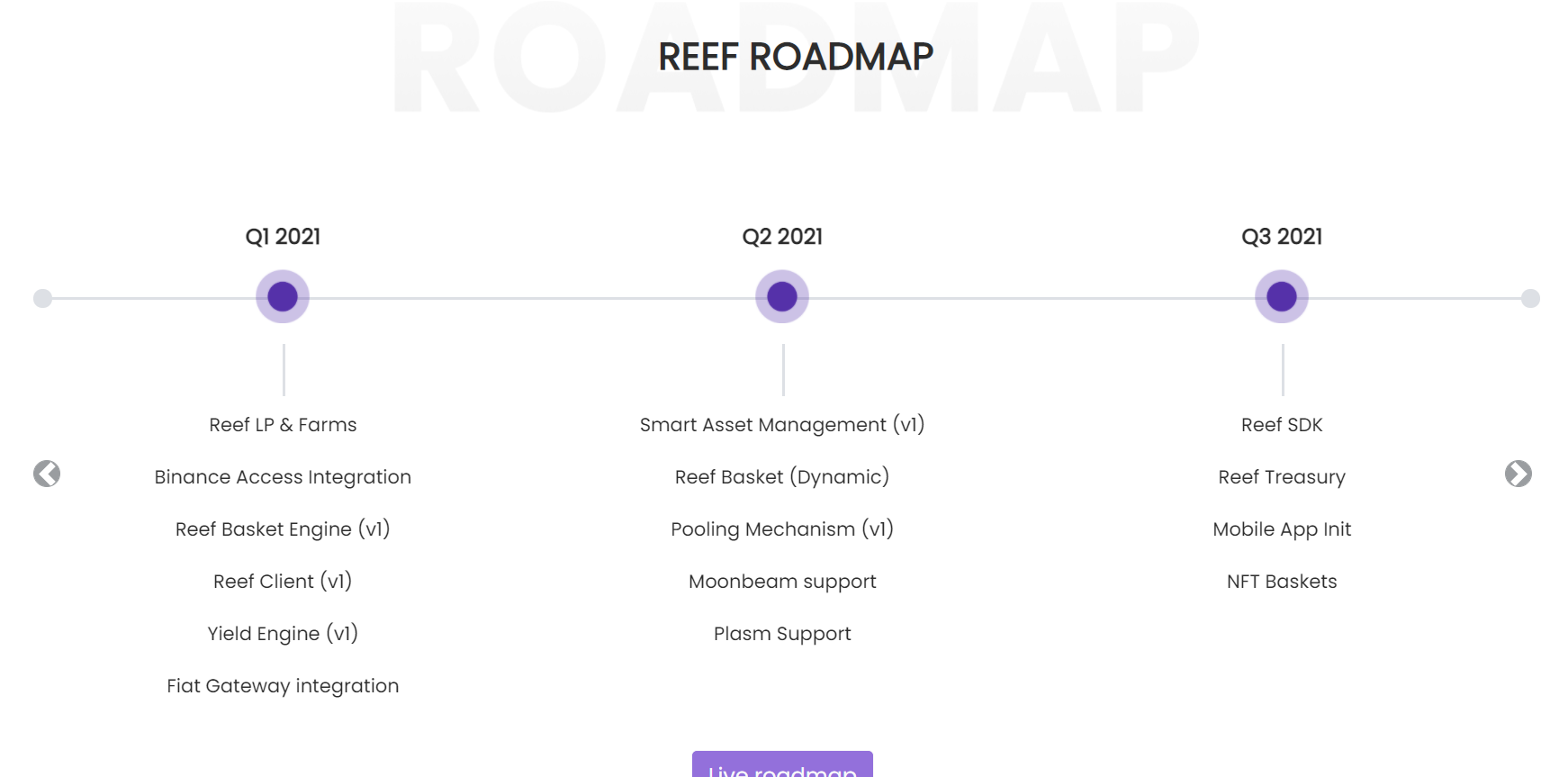

The aggregator is also a key point of the Defi project on Ethereum. It may be possible to achieve routing optimization and execute each transaction with as little slippage as possible. It may be possible to aggregate loan products on the market to find the loan product with the lowest loan interest rate. It may be possible to aggregate Defi mining farms on the market realize their own "maximization of farmers' income". Reef Finance is a Polkadot-based DeFi aggregator that can conduct transactions through CEX and DEX, and can intelligently mine on DEFI to obtain income.

According to Roadmap on the official website, the function of aggregating income is not yet online.https://bifrost.finance/)

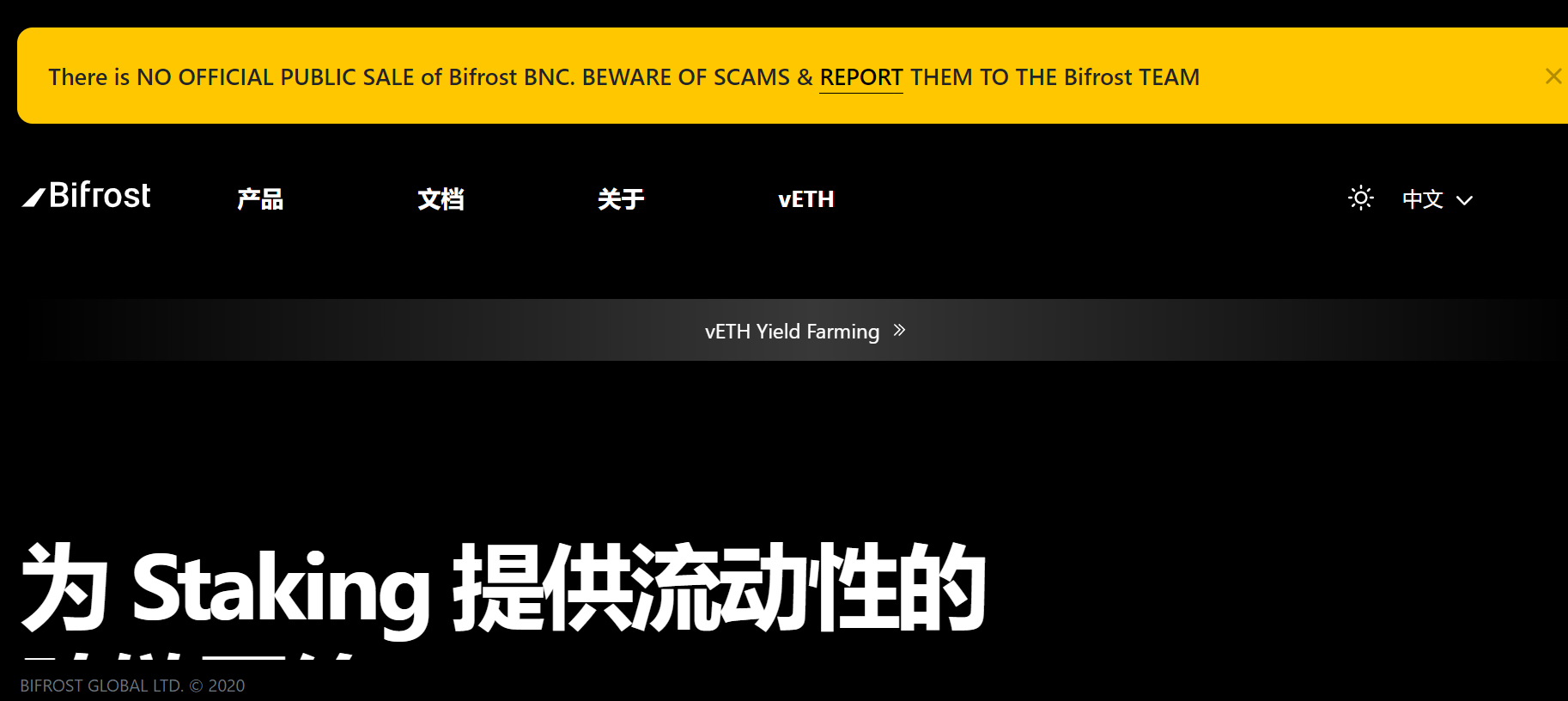

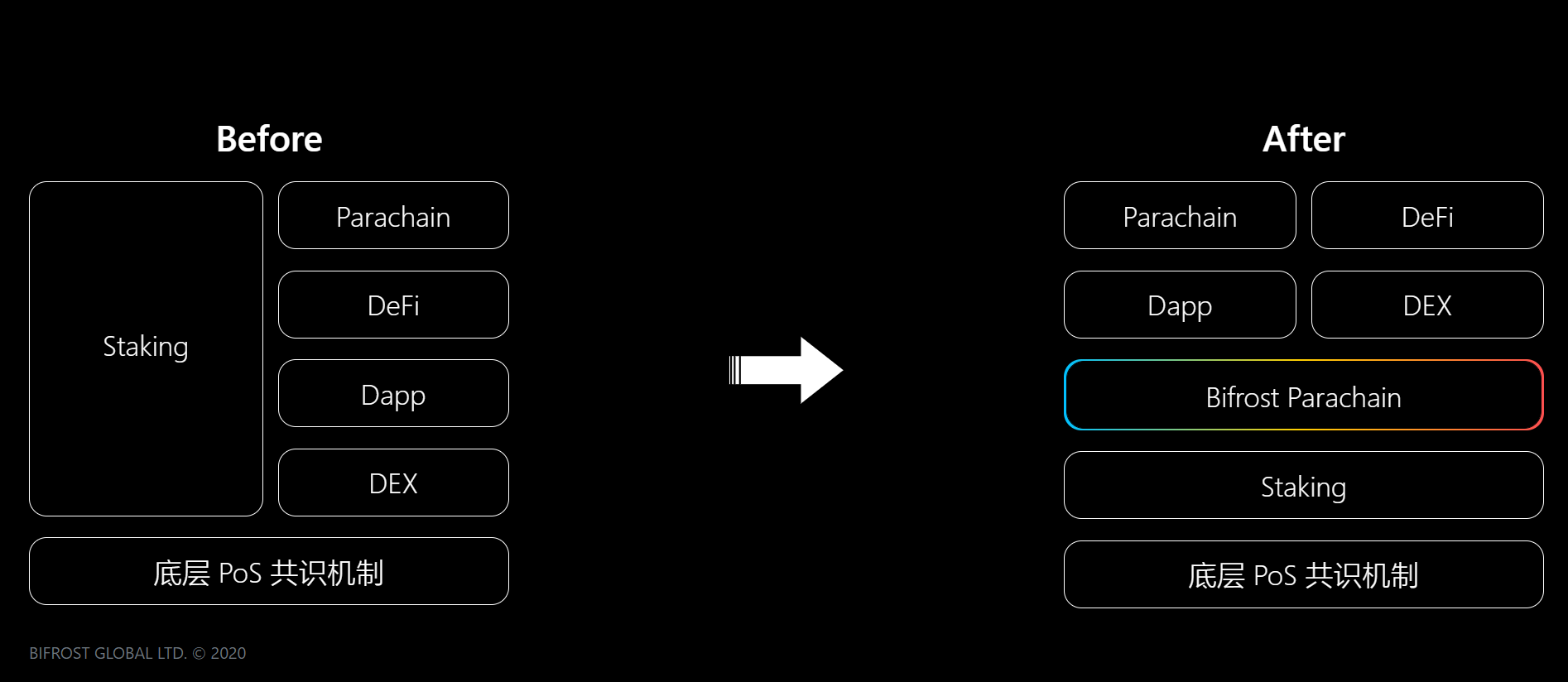

Seven, Bifrost (

According to the official explanation of Bifrost products, the use of Bifrost is to borrow money through vToken to realize the leverage of Staking assets, expand the principal and Staking income to resist inflation, and prevent the depreciation of Staking assets without locking positions.https://akropolis.io/)

Lending is the cornerstone of the DeFi financial system and the earliest mature business model in Ethereum DeFi. At present, there are not many projects in the Polkadot ecosystem that focus on lending, and more have lending functions, such as Acala. Then there is the lending agreement Akropolis. In 2020, Akropolis will earn more attention from insiders than being attacked by hackers and being acquired by AC. The popularity of Akropolis as a lending tool is much lower than that of platforms such as AAVE and Compound.

secondary title

Prospects of the Polkadot Defi Project