8 sets of data to understand the relationship between stablecoins and BTC

The following content data comes from KingData, please indicate the data source as KingData for reposting and citation. KingData uses data to empower transactions, one step ahead to meet wealth.

The following content data comes from KingData, please indicate the data source as KingData for reposting and citation. KingData uses data to empower transactions, one step ahead to meet wealth.

1. The price of BTC is negatively correlated with the U.S. dollar index

For a long time, the price of DXY (dollar index) and BTC has been negatively correlated. If the U.S. dollar rises, the price of BTC will fall if the value of BTC does not change; Under the premise, the price of BTC will rise.

2. Stablecoins have a crucial impact on the price of BTC

Due to some well-known reasons, the current digital currency transactions will use stable coins as a transfer. At present, there are three main types of stable coins

1. Centralized stablecoins supported by FIAT: such as Tether (USDT), USDCoin (USDC), Gemini USD (GUSD), etc.

3. Decentralized algorithm stable currency: AMPL, etc.

(The total amount of stablecoins in circulation on Ethereum has grown significantly in both type and quantity since 2019)

image description

(The total amount of USDT issued on other chains and the total supply of AMPL)

In the process of this round of bull market, as the price of BTC rises, stablecoins such as USDT are continuously issued.

According to statistics, the circulation of these mainstream stablecoins has reached 35,304,022,770 pieces (35 billion US dollars), accounting for 5.3% of the current BTC market value. Currently, only about 4.2 million bitcoins are in continuous circulation. According to this analysis, the current market value of stablecoins accounts for 23% of the actual market value of BTC, that is to say, as a direct stable currency instead of the US dollar, its price fluctuations have a crucial impact on the price of BTC.

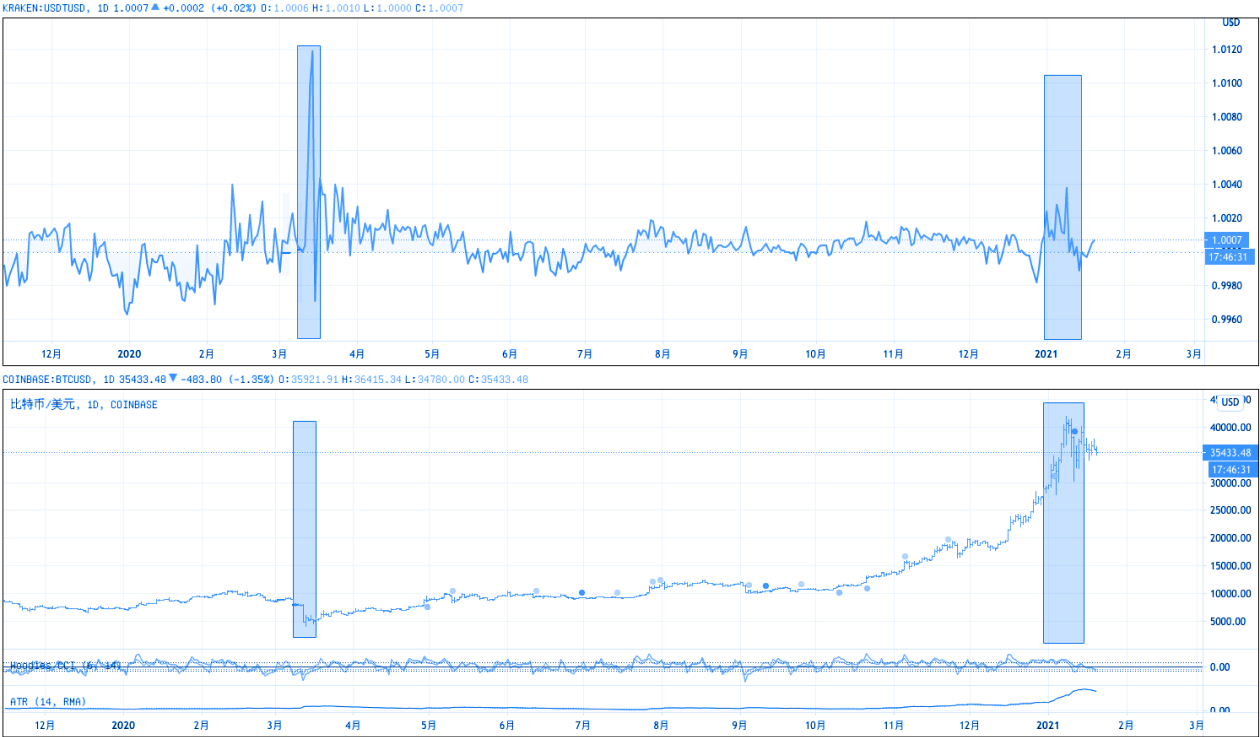

3. The positive premium of USDT is too high or it may become a price turning point

From the comparison chart of this year's OTC price and BTC price, we can see a pattern: whenever it falls, the OTC price of USDT will rise.

4. Conclusion

4. Conclusion

From the above data we can summarize some regularities:

1. The rise of BTC is accompanied by the additional issuance of USDT, and the additional issuance of USDT may not necessarily drive the market to rise.

2. The price of USDT reflects the sentiment of the market to a certain extent, that is, when the price is low or when FOMO is serious, the price of USDT is higher. From the limited data, it can be seen that the premium of USDT explains the market situation to a certain extent. The degree of operation, when USDT has an extreme premium, it often means that the market has come to an end, and there is a risk of market changes.http://ikingdata.com/#/home