This article was written by Carrie, the managing partner of Chain Hill Capital (Qianfeng Capital). Unauthorized reprinting is strictly prohibited. For reprinting, please refer to the "Reprinting Notice" link of the "Chain Hill Capital" public account. The following is the main text:Volatility weighting is a method of index construction for risk diversification, which can improve the risk-adjusted performance of cryptocurrency portfolios and achieve active returns.

Weighting method and risk diversification

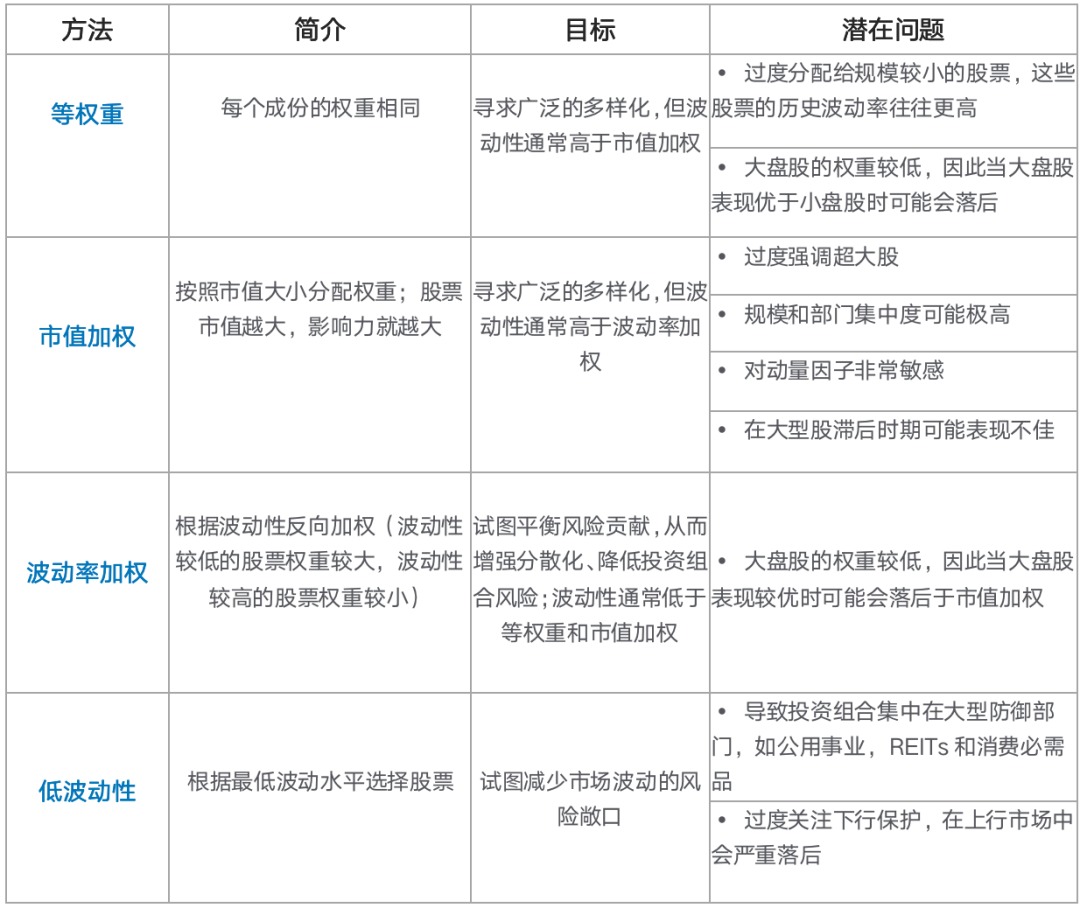

Indexes weighted by market capitalization have always been a barometer for monitoring the stock market, such as the S&P 500 Index and the Shanghai Composite Index.While market capitalization weighting is the most common index construction method, it has also received some skepticism in recent years. For example, while an ETF or mutual fund that tracks a market-cap-weighted index holds hundreds of stocks, it's often only a handful that make the biggest impact. In other words, these funds have not achieved true risk diversification.The reason for this suspicion is that capitalization-weighted indices tend to be heavily skewed towards the largest stocks, underestimating the performance and contribution of smaller constituents. This mega-cap dominance doesn't appear to be a problem in current market conditions, as the largest companies have consistently grown faster than the average stock in recent years. But when these giants run out of steam and fall out of favor with the market, the capitalization-weighted index, which focuses on megacaps, could suffer.To this end, the industry has proposed some different solutions to explore how to better realize risk diversification. Of these, the simplest alternative is equal-weight weighting, ie, assigning weights equally to all components. For example, fixing each company's share in the S&P 500 at 0.20%. This approach appears to be more decentralized, as it resolves the problem of over-concentration of weights in a few industries and large companies in a cap-weighted index. But in reality, the overall risk of the portfolio is elevated because the approach "overweights" smaller companies, which are more volatile over the long run.Another approach is to limit the scope of the index sample to low-volatility stocks, which can achieve low-volatility portfolios, but it is not the best risk diversification strategy. Because low-volatility stocks tend to be concentrated in defensive sectors like consumer staples and utilities, such a portfolio is clearly not an ideal stock allocation.Therefore, the above two alternatives cannot solve the problem of risk diversification well. In contrast, volatility weighting provides a more reasonable solution. It is unique in that it better balances the volatility contribution of each component to the entire portfolio, thereby balancing the risk contribution of the components, making the exposure of each component more reasonable. Research and practice in the stock market has also shown that this approach helps to create a portfolio that consistently performs well through different market cycles.

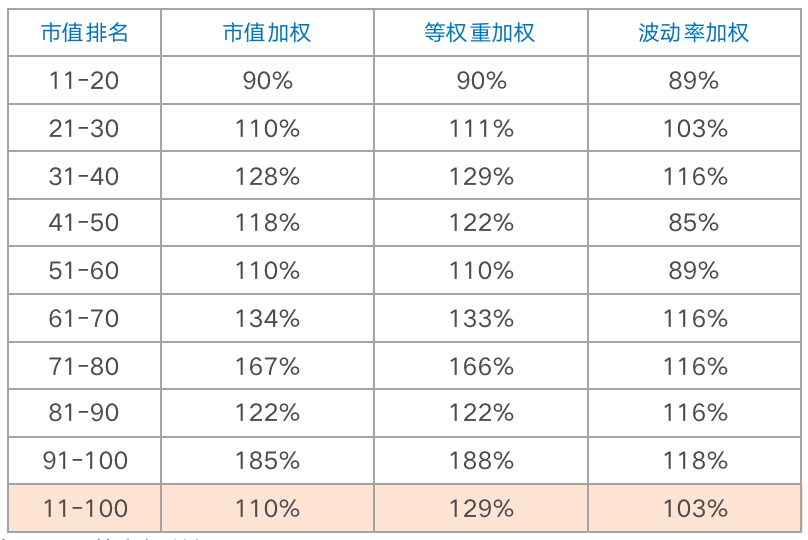

image description

Generally speaking, the volatility corresponding to the weighting method in the table decreases from top to bottom

Understanding Volatility Weighting

1. The relationship between volatility and risk

For stocks, volatility describes the degree to which the stock price fluctuates. Risk refers to factors that can cause a stock to lose value.There are many types of risk that can affect the price behavior of a stock, including macro risk, interest rate risk, company-specific risk, currency risk, geopolitical risk, liquidity risk, and more. The price change of the stock is affected by the comprehensive influence of these risk factors in different proportions and degrees. Because these risks change and interact over time, it is difficult to develop a comprehensive and forward-looking risk calculation that accurately measures the impact of these factors on individual stocks and the broader market.In practice, price volatility is a reliable indicator of a stock's risk. On the one hand, historical price volatility is often persistent: stocks with low historical volatility are more likely to remain relatively low in the short term, while stocks with high historical volatility are more likely to remain highly volatile in the short term. On the other hand, stocks with greater exposure tend to have larger historical price swings than stocks with less exposure. Therefore, it can be considered that volatility is an expression of the relative risk of holding a certain stock, and it is also a comprehensive measure of the risk of the stock. Standard deviation is the metric most commonly used to quantify risk.The above relationship between volatility and risk applies equally to cryptocurrencies.

2. How volatility weighting improves portfolio diversification

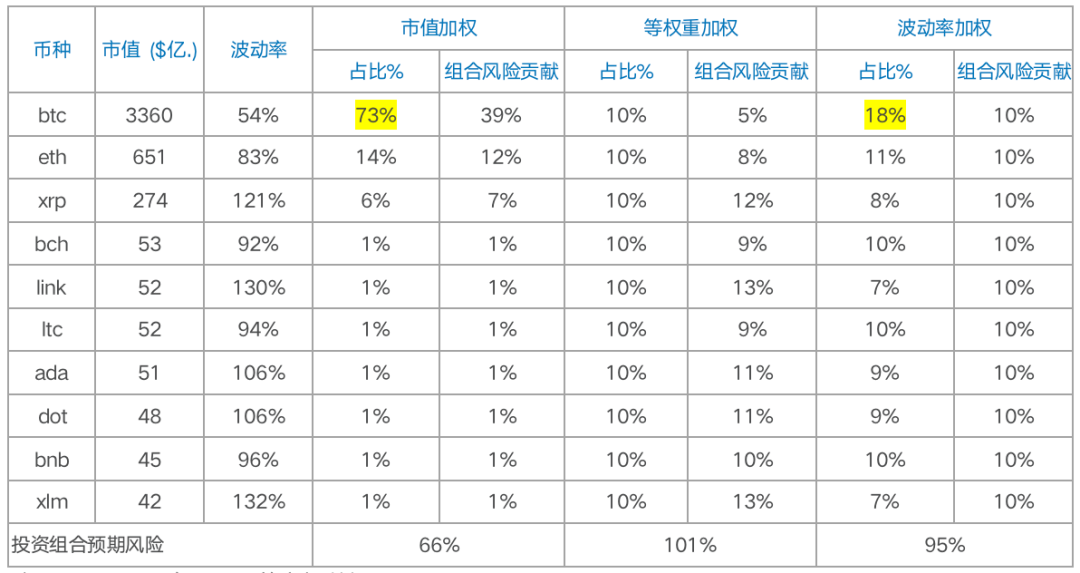

The rationale for volatility weighting is to assign less weight to index components with higher volatility and higher weight to index components with lower volatility, with the goal of having each component contribute an equal amount of expected risk. This risk equalization is an intuitive way to enhance risk diversification, and ideally, it can reduce the overall volatility of the portfolio to a lower level than market-cap weighting.The example in Table 2 compares portfolio risk contributions under three different weighting schemes: market capitalization weighted, equal weighted, and volatility weighted. In this case, the volatility-weighted portfolio is the most risk-diversified of the three weighting methods, and the portfolio's expected risk is the lowest.Table 2: Impact of different weighting methods on portfolio risk

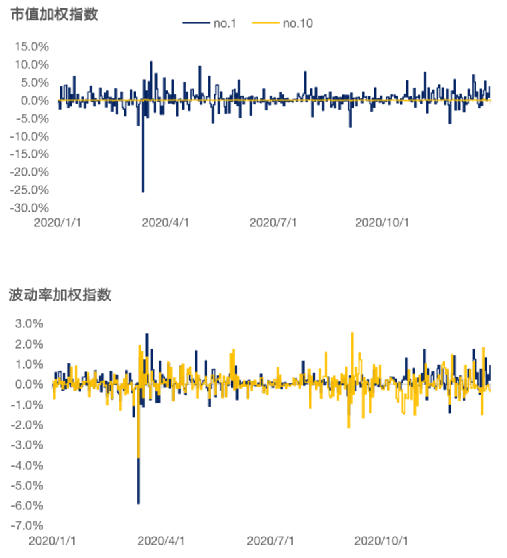

Through this example, it can be seen intuitively that volatility weighting creates a portfolio with a balanced risk distribution.This risk diversification effect is more obvious through the daily rate of return. Figure 1 shows the impact of the largest and smallest constituent currencies in an index composed of the top ten cryptocurrencies by market capitalization on the overall portfolio under different weighting schemes. In a market-cap-weighted index, the coins with the largest market caps have a much greater impact on the portfolio than the coins with the smallest market caps. In contrast, the coins with small market caps have almost negligible impact on the overall. Through volatility weighting, the risk contribution gap of different market capitalization currencies becomes very small.

January 1, 2020 to December 31, 2020

Applying Volatility Weighting in Crypto Markets

The following findings are based on our research on cryptocurrency volatility indices.

1. Volatility weighting cannot reduce the volatility of the portfolio

In the stock market, a volatility-weighted index can usually reduce the overall volatility of the portfolio. However, our study finds that risk equalization through volatility weighting does not reduce the volatility of cryptocurrency portfolios. On the contrary, the volatility of the volatility-weighted index is significantly higher than that of the market capitalization-weighted index.

image description

image description

image description

The data in the table is for the top 10 cryptocurrencies by market capitalization, and this range of cryptocurrencies is the most representative in terms of market capitalization and liquidity.

One of the reasons for this phenomenon lies in the unique structure of the cryptocurrency market itself: the polarization of market capitalization is very serious. As we pointed out in the "Cryptocurrency Index Investment Research Report", "The market value distribution of the current encryption market has obvious head utility. The market value of the top 10 projects accounts for 85% of the market value of the entire market, and the market value of projects ranked 11-30 The ratio is 6%, and the market value of projects ranked 31-100 accounts for 4%. In contrast, the top 10 stocks in the U.S. stock market by market capitalization account for about 20% of the total market.What's more special is that Bitcoin's market value accounted for more than 50% for a long time, especially before 2017, when it accounted for more than 90%. At the same time, the volatility of Bitcoin is significantly lower than that of other currencies. Therefore, when weighting the volatility of a portfolio containing Bitcoin, the weight of Bitcoin will inevitably be greatly reduced, and the weight of currencies with high volatility will be increased, resulting in an increase in the volatility of the portfolio. As can be seen in Table 4, the volatility of Bitcoin is much lower than other components in the portfolio, and volatility weighting reduces the proportion of Bitcoin by about 55%.

Note: Using market data in November 2020

Table 5 shows the portfolios other than the top ten by market capitalization. The use of volatility weighting for these cryptocurrencies can reduce the expected risk of the investment portfolio. The reason may be that the market capitalization and volatility of cryptocurrencies ranked 11 to 100 are not so differentiated.

Note: Using market data in November 2020

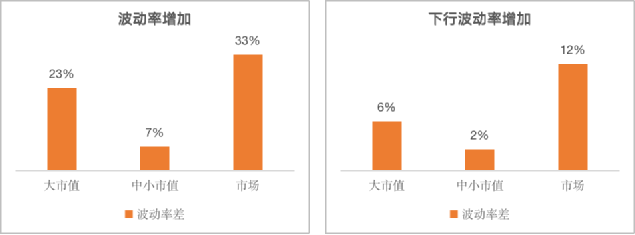

The portfolio expected risk in Tables 4 and 5 is only a static expected value, which will only equal the actual value if the volatility level of the cryptocurrencies in the portfolio remains unchanged between the two weight adjustment dates. volatility. In the backtest from November 31, 2014 to November 31, 2020, the volatility-weighted small-to-medium market capitalization portfolio (cryptocurrencies ranked 11 to 100 by market capitalization) did not achieve the expectation of reducing portfolio risk in Table 5. Volatility is still 7% higher than market capitalization weighted. But in contrast, the increase in volatility is more pronounced for the portfolios that include Bitcoin (large-cap portfolio and market portfolio), for the reasons mentioned above.It should be noted that we should make a distinction between volatility, because the up and down fluctuations of yields are usually asymmetrical, and downward fluctuations have greater risk information than upward fluctuations. In other words, upward volatility is beneficial, and downward volatility is destructive to portfolio value. The increase in the downside volatility of the volatility-weighted portfolio is much smaller than the overall volatility, which shows that the increase in its volatility comes more from the upside volatility. In other words, the positive volatility brought about by volatility weighting is higher than the negative volatility.Figure 2: Volatility Comparison

2. Volatility weighting can improve risk-adjusted performance

It can be seen from Table 3 that the volatility-weighted portfolio with higher frequency and shorter cycle parameters has the most obvious improvement in indicators such as Sharpe ratio and Sortino ratio. This may be due to the rapid changes in the encryption market, so more "Instant" volatility to capture information. Based on our research results, the daily return volatility of the last 90 days is the best parameter setting.Figure 3 illustrates the risk and return profile of three major cryptocurrency portfolios. It can be seen that volatility weighting improves returns more than volatility increases. Consequently, risk-adjusted performance, as measured by the Sharpe ratio, improves in all three portfolios. The increase in the Sortino ratio is more pronounced, suggesting that volatility-weighted portfolios can achieve higher excess returns when bearing the same unit of downside risk.Note: Large market capitalization portfolios refer to the top 10 portfolios by market capitalization; small and medium market capitalization portfolios refer to the portfolios that rank 11 to 100 in market capitalization; market portfolios refer to the top 100 portfolios by market capitalization

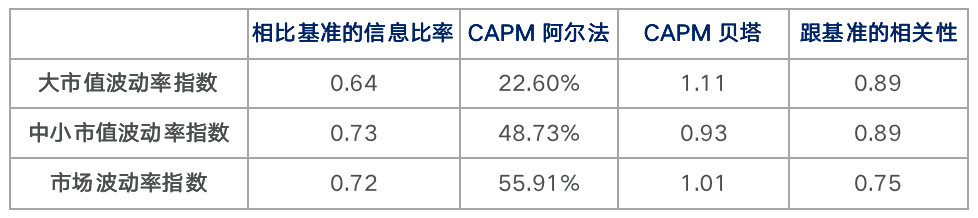

The information ratio describes the risk-adjusted return from the perspective of active management, and measures the excess return brought about by a unit of active risk. The higher the information ratio, the higher the performance of the portfolio continues to outperform the benchmark. From the statistics of the stock and bond markets, only the top 5% of active fund managers can obtain information ratios exceeding 0.5.Taking market capitalization weighted as the benchmark, the volatility-weighted index obtained an information ratio exceeding 0.6, indicating that the performance of the volatility-weighted index is largely better than that of the market capitalization-weighted index. The volatility-weighted index has also seen significant active returns from an alpha return metric. Unsurprisingly, for the reasons mentioned above, the beta coefficients of the large-cap and market volatility indices that include Bitcoin have increased, while the beta coefficients of the small-cap volatility indices have decreased.

3. Performance in different market cycles

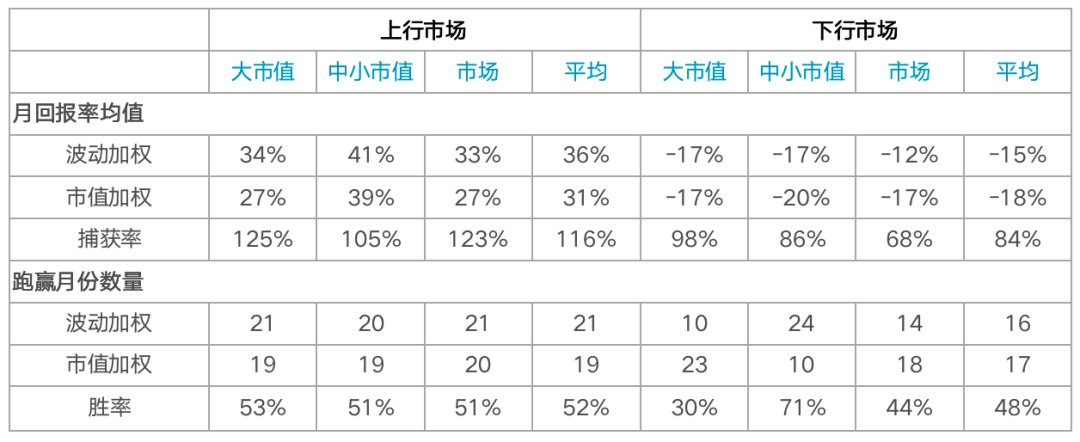

Finally, let's look at how the volatility-weighted index performs in both up and down markets. In Table 7, we use two indicators to measure the performance of the volatility-weighted index under different market conditions, namely the average monthly return capture rate and winning rate. The takeaway from the table is that volatility weighting overcaptures market upside while limiting its downside to some extent. On average, the volatility-weighted index gained 116% of its benchmark in positive months and only lost 84% of its benchmark in negative months. Also, volatility weighted has a slightly higher chance of outperforming the benchmark in up markets, as seen by outperformed odds. On average, the volatility-weighted outperformed the benchmark 52% of the time in up markets but only 48% of the time in down markets. The winning rate of large market capitalization and market indexes in the down market is significantly lower, especially the large market capitalization index. The reason is that Bitcoin has an overwhelming market capitalization ratio and the lowest volatility in the whole market, which distorts the effect of the volatility weighted index. . From this we can also see that the volatility-weighted index can well protect the small and medium-cap index in the down market, and it has the highest probability of outperforming the benchmark index in the down market.

image description

image description

Summarize

Summarize

Research and practice in the stock market show that volatility weighting can provide a more reasonable risk diversification solution, making the risk exposure of the portfolio more balanced.Our research on cryptocurrency volatility-weighted indices concluded the following:1. Due to the unique structure of the cryptocurrency market itself, the volatility of the volatility-weighted index is significantly higher than that of the market capitalization-weighted index. However, the increase in its volatility came more from upside volatility. That is, the positive volatility brought about by volatility weighting is higher than the negative volatility.2. Volatility weighting can significantly improve risk-adjusted performance. Risk-adjusted performance, as measured by the Sharpe and Sortino ratios, has improved across major cryptocurrency indices, especially the Sortino ratio. This suggests that volatility-weighted portfolios can achieve higher excess returns when bearing the same unit of downside risk. Furthermore, information ratios and alpha return metrics, which measure active risk-reward, illustrate that the volatility-weighted approach achieves significant active returns.3. Volatility weighting can overcapture the market's upward returns, while limiting the downward returns to a certain extent. However, the risk management effect of this down market is currently the most effective for the small and medium-sized market capitalization index, and its probability of outperforming the benchmark index in the down market is 71%. However, the volatility-weighted large market capitalization index lags significantly behind in the downward market. The reason is that Bitcoin has an overwhelming market capitalization ratio and the lowest volatility in the entire market, which distorts the effect of the volatility-weighted index. It is expected that as the crypto market matures, the volatility-weighted index can better play the role of risk management.In addition, it should be noted that there may be certain liquidity restrictions on the volatility-weighted index for small and medium market capitalization. This is because volatility weighting increases the weight of small-cap coins compared to market-cap weighting, and small-cap coins in cryptocurrencies are often notoriously illiquid. Therefore, the volatility-weighted index of small and medium-sized market capitalization may not be suitable for large-scale capital allocation at this stage.