Taihe Observation: When NFT meets DeFi

In 2017, a game called CryptoKitties (CryptoKitties) was born and became popular, which made most people pay attention to the non-homogeneous token NFT.

In fact, the prototype of NFT can be traced back to 2012. On December 4, 2012, Meni Rosenfeld, then chairman of the Israel Blockchain Association, proposed in his paper "Overview of Colored Coins" , bitcoins are fungible, and some bitcoins are separated from other bitcoins by injecting "characteristics" (a process called "coloring"). These colored bitcoins will have independent value and can be used to represent real-world assets and have a variety of use cases including: property, coupons, being able to issue their own cryptocurrency, issuing company shares, subscriptions, access tokens, Digital collectibles.

The birth of Colored Coin made many people realize the great potential of issuing assets on the blockchain. Colored Coins opened the door for further experiments in the blockchain, not only laying the foundation for NFT, but also laying the groundwork for the birth of the next programmable blockchain (such as Ethereum), and the large-scale application of the world on the distributed chain It's been on the move since then.

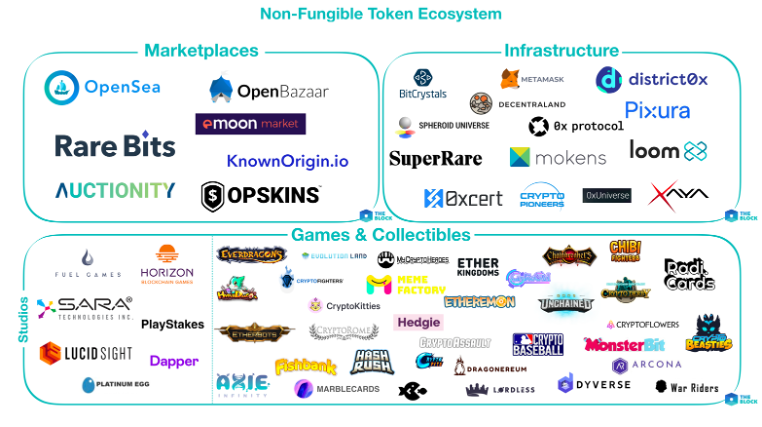

NFT has the characteristics of uniqueness and inseparability, making it suitable for some fields such as artworks, games, electronic certificates, identity authentication, etc. On the one hand, NFT can be used to cryptographically confirm the rights of real and virtual assets to solve the trust problem; on the other hand, after the assets are certified, the liquidity of traditional physical assets has been improved. For example, in the form of NFT, storing calligraphy, painting, sculpture and other artworks on the chain not only meets the anti-counterfeiting needs of collectibles, but also improves the efficiency of physical property confirmation and transaction circulation.

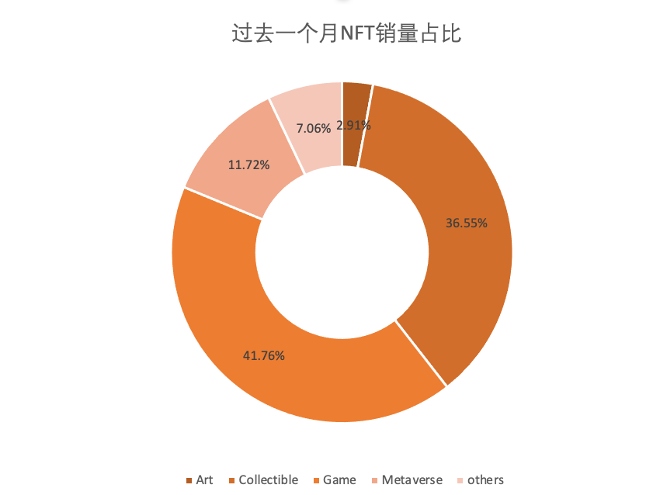

source:

source:www.theblockcrypto.com

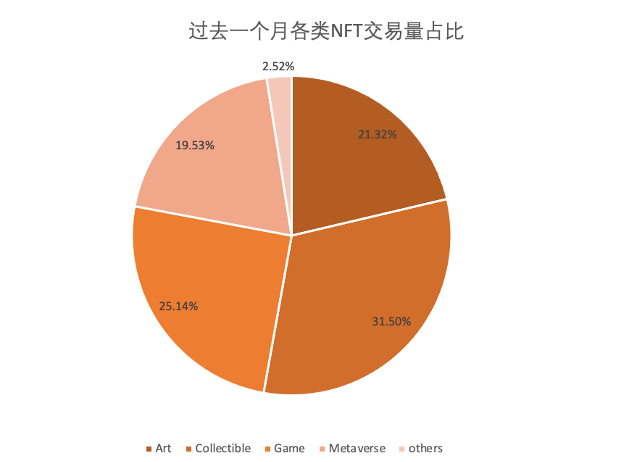

source:

source:https://nonfungible.com/

secondary title

The experiment of NFT in DeFi

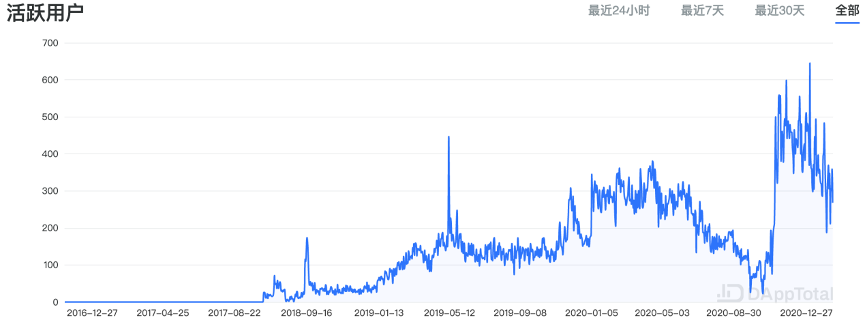

source:

source:https://dapptotal.com/

Below we demonstrate the various possibilities of combining NFT and Defi from the aspects of NFT transaction mining, NFT liquidity mining, NFT mortgage lending, and NFT fragmentation solutions.

NFT transaction mining

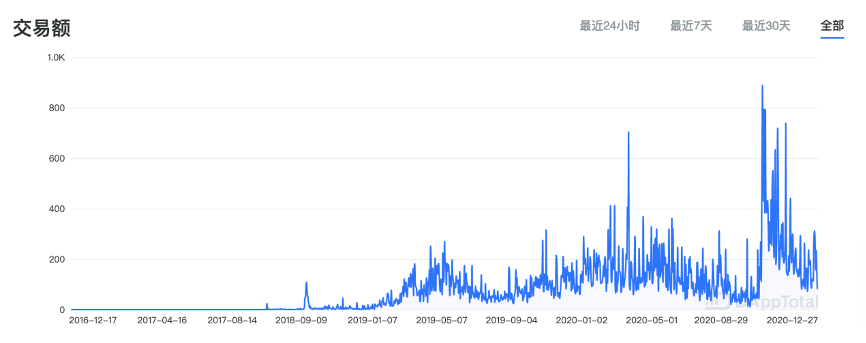

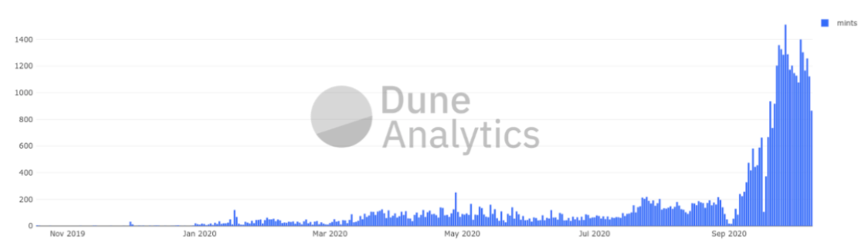

In September this year, the trading volume of the NFT market exceeded 7 million US dollars, of which more than 80% came from the trading platform Rarible, even surpassing OpenSea. Prior to this, the OpenSea trading platform, established in December 2017, had always dominated the NFT market.

Source: Dune Analytics

Source: Dune Analytics

This is the dilemma that NFT is facing: the uniqueness and scarcity of NFT itself make its value more difficult to evaluate. For some NFTs, the cost of shaping them is very low. When the market cannot agree on the value subjectively, there will be problems with liquidity. In the case of transaction distortion, although liquidity has been improved, it does not mean that the market has reached an effective consensus on the value of NFT.

NFT Liquidity Mining

Another part of the platform chose the form of liquidity mining through pledge.

Aave has become a leading Defi product due to its strong innovation. Aavegotchi is a new attempt of Aave ecology to set foot in NFT. Aavegotchi is a DeFi pledged encrypted collectibles platform. Similar to the popular encrypted cat a few years ago, Aavegotchi is actually a pet collection game. But the difference is that the gameplay and functions of CryptoKitties are very simple: each newly born CryptoKitties has random genes and is unique, and the more unique the appearance and the closer to the 0th generation, the higher the value of the cat. Each ERC-721 Aavegotchi manages a custody contract address, which holds the ERC-20 collateral aToken supported by Aave, and the aToken generates income through Aave's Lending Pool. Therefore, as time goes by, the number of aTokens in the NFT hosting address will continue to increase. The rarity of each Aavegotchi elf is dynamically randomly generated, and the valuation of each ERC-721 token comes from the intrinsic value and rarity value-so that the value of NFT is inherently supported, which is compared with traditional collection games Where innovation at Aavegotchi lies.

NFT mortgage

Lending is a core business of DeFi. According to the number of locked positions on DeBank, three of the top five projects are for decentralized lending. The DeFi lending platform supports most ERC-20 standard tokens for mortgage lending. If NFT can also be used as collateral for loans, its liquidity will be further released.

The emergence of NFTfi allows NFT holders to utilize the idle NFT in their wallets. This is a market that specifically supports NFT mortgage loans. Users can mortgage NFT on it to obtain P2P loans, and can also serve as a lender to submit a loan quotation to the other party, including a custom loan amount, required repayment amount, and lending time. The borrower You can choose to accept or not.

Fragmentation Solutions

When the price of a single NFT is too high, resulting in a certain burden to purchase the NFT, the liquidity of the NFT is greatly restricted.

secondary title

More possibilities for NFT

In the second half of this year, market sentiment has been ignited again and again, and everyone is eager to find the next industry explosive point. The application of NFT technology, which has not yet been maturely developed, has huge explosive potential, and many people have set their sights on this track.

In the process of exploring the future application scenarios of NFT, this article reviewed a large number of NFT application projects, and felt that NFT should be more

Treat NFT as a specific technology, rather than restricting its application scenarios-when it comes to NFT, most people think of games, artworks and collectibles. If NFT cannot get rid of such stereotypes, it will never be able to get out of the "niche" confinement.

NFT fills the gap of encrypted assets, and assets with independent value that can be referred to by the blockchain can be included in the encrypted economy. NFT is different from homogeneous tokens, which can refer to the characteristics of independent value asset attributes, such as representing negative assets (liabilities), proof of identity or equity, virtual props, etc.

There is a view that NFT can be divided into two categories: collectibles and services, and the author deeply agrees with this. As the saying goes, without demand, all existence has no real meaning. I personally think that if NFT wants to get out of the ecological dilemma of games, artworks and collectibles, it needs to re-examine its self-positioning: NFT is not so much a commodity, it should be used as a tool and carrier to serve and apply to a wider range of fields , in order to expand the audience, improve universality and demand.

Equity Securities

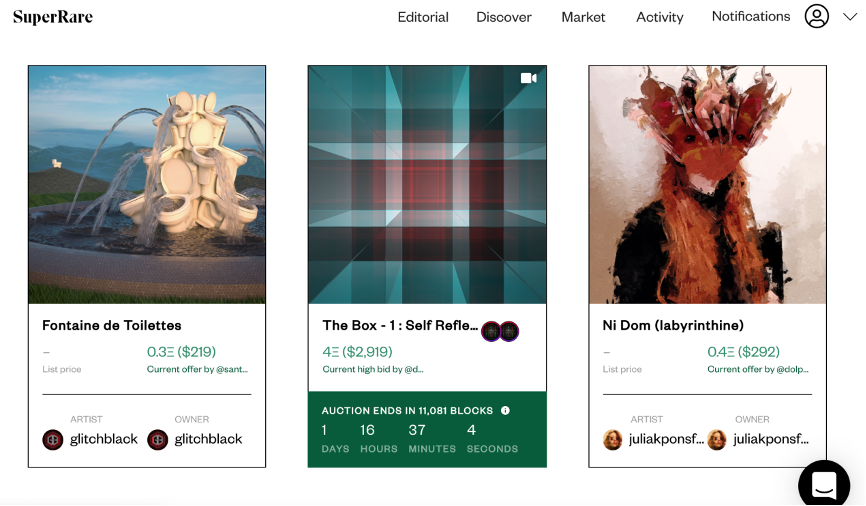

source:

source:https://superrare.co/market

Authentication function

epilogue

epilogue

From any industry perspective, it is impossible to achieve sustainable and substantial development by always putting old wine in new bottles.

quote

quote

1. Overview of Colored Coins by Meni Rosenfeld (December 4, 2012)

2."Panoramic interpretation of the next encryption investment boom NFT"(October 2020)

3. "Are you really going to fry NFT?"by Block Beats (September 2020)