On December 18, 2020, the star project The Graph (GRT), which took three years to develop, finally launched its mainnet.

After its mainnet was launched, mainstream exchanges such as Jubi, Coinbase, and Binance launched its governance token GRT one after another. After going online, it stood firm at about 3.5 times the public offering price of 0.11U, and then sang all the way. According to Jubi (ju.com) data, it rushed from 0.11U to 0.78U in 3 days, and now it has fallen back to 0.57U. Compared with the public offering price of 0.03U, the highest increase is 26 times, and even compared with the effective price after the opening, the increase is as high as 7 times.

1. What exactly is The Graph (GRT) and what problems can it solve?

The Graph is an index protocol that many people may not understand. You can understand it as the "Goolge" of the blockchain industry. This protocol can be used to access data in the blockchain and storage network. It can be said that The Graph is a just-needed existence. Currently, to develop a DApp on Ethereum, the developer needs to download the complete ledger of the entire Ethereum network, which will greatly increase the development cost of the Dapp. With The Graph, Dapp developers can quickly obtain relevant raw data and information needed to develop DApps directly from The Graph network, which can greatly reduce costs and allow developers to efficiently access blockchain data.2. What is the distribution of The Graph (GRT) tokens?

According to The Graph's official statement, the total amount of GRT tokens is 10 billion, and additional issuance is made at a rate of 3% per year. When it was launched in the early stage, the circulation was 1,245,666,867. As of press time, the price of GRT on Jubi.com is 0.57U, which means that the current circulation market value of GRT has reached 709 million US dollars. For a project that has just been launched for 4 days, it is rare to have such a high circulation market value. .The number of tokens sold in early private placements accounted for 17%. From April 2018 to June 2020, Graph raised $7.5 million through more than 60 investors. The lock-up period of tokens allocated to investors is from 6 months to 2 years,The number of public tokens for sale accounted for 6%, of which 4% will be publicly sold on The Graph (GRT) on October 23, 2020 (only open to non-US users), at a total price of 0.03U 400 million GRT, raising $12 million. It is reported that a total of more than 10,000 people participated in the registration for this public sale. In just 11 minutes after the sale, all quotas were snapped up by 4,500 people from more than 90 countries around the world.The remaining 2% will be sold by the Graph Foundation to Indexers and strategic community members at a price of US$5.2 million, and these tokens will be locked for 1 year.3. Where is the investment value of GRT? Why is it soaring all the way?

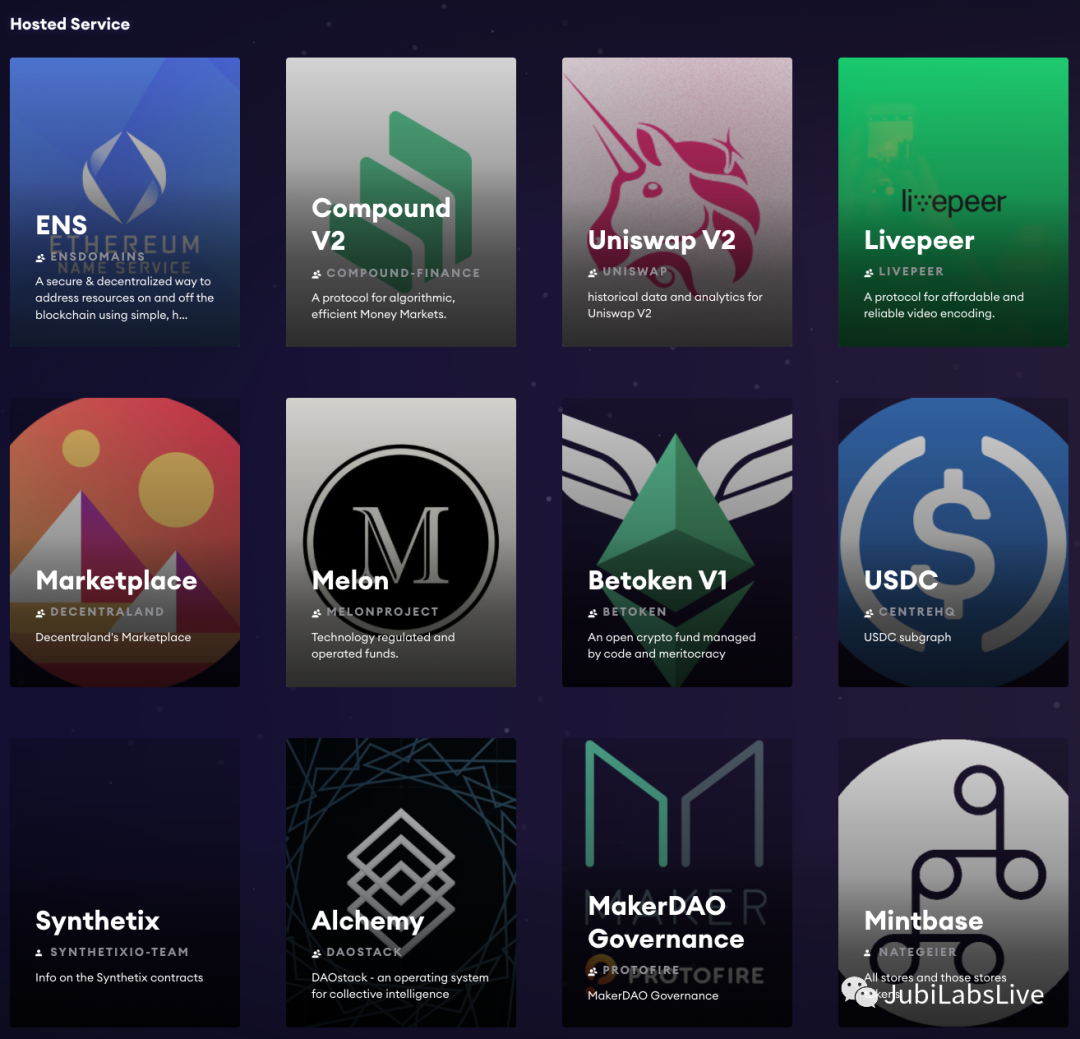

When it comes to investment value, we have to look at it from the perspectives of market prospects, team background, investment background, and ecological needs.Defi has exploded this year, and many Dapps based on Ethereum have developed rapidly. Currently, to develop a DApp on Ethereum, developers need to download the complete ledger of the entire Ethereum network, which will greatly increase the development cost of Dapps. The Graph solves this problem. It allows developers to quickly obtain relevant raw data and information needed to develop DApps directly from The Graph network. In short, it can greatly reduce costs. It allows developers to efficiently access blockchain data. And well-known projects such as Uniswap, Balancer, Synthetix, and Aragon are all using The Graph. In the past six months, the usage of The Graph has increased by 10 times, from 1 billion monthly queries in June to 10 billion monthly queries in November. Query volume, the average daily query volume reached 350 million times. And through the official Twitter, it can be seen that there are a lot of industry leaders who like it on Twitter and express the opinion that "The Graph can greatly improve the efficiency of Dapp development".Judging from the team member information listed on the official website, the background of the entire team members can be considered very luxurious.Team members include: Project Lead is Taniv Tal, who graduated from the University of Southern California with a major in EE, and previously founded the React development environment Workflo, and the catering industry payment app Tapsavvy. He has also worked as a development engineer at companies such as HP and Mulesoft. Tech Lead is Jannis Pohlmann, who graduated from Universität zu Lübeck in Germany with a major in Computer and Human-Computer Interaction, and worked in Workflo, Codethink and other companies before. The Community Lead is Rodrigo Coeldo, who graduated from the Industrial Engineering Department of Arizona State University. He was a serial entrepreneur before and founded a P2P mobile encryption communication platform called cSuite. Project advisors include Decentraland's CTO Esteban Ordano, Tendermint Labs' Zaki Manian, and others.Its team has a healthy diversity of skills, with backgrounds in technology, research, operations, and product. The background of the consultant is also more gorgeous, and there are many veterans in the blockchain circle, which may further make up for the background of the team.3. Investment institutions:Coinbase Ventures, DCG, Framework, ParaFi Capital and many other well-known cryptocurrency funds participated in the early investment, and the lineup of investment institutions can be described as very luxurious.First of all, let's understand what is the role of GRT in The Graph network, and why is it required? Mainly the following points:

And through the official Twitter, it can be seen that there are a lot of industry leaders who like it on Twitter and express the opinion that "The Graph can greatly improve the efficiency of Dapp development".Judging from the team member information listed on the official website, the background of the entire team members can be considered very luxurious.Team members include: Project Lead is Taniv Tal, who graduated from the University of Southern California with a major in EE, and previously founded the React development environment Workflo, and the catering industry payment app Tapsavvy. He has also worked as a development engineer at companies such as HP and Mulesoft. Tech Lead is Jannis Pohlmann, who graduated from Universität zu Lübeck in Germany with a major in Computer and Human-Computer Interaction, and worked in Workflo, Codethink and other companies before. The Community Lead is Rodrigo Coeldo, who graduated from the Industrial Engineering Department of Arizona State University. He was a serial entrepreneur before and founded a P2P mobile encryption communication platform called cSuite. Project advisors include Decentraland's CTO Esteban Ordano, Tendermint Labs' Zaki Manian, and others.Its team has a healthy diversity of skills, with backgrounds in technology, research, operations, and product. The background of the consultant is also more gorgeous, and there are many veterans in the blockchain circle, which may further make up for the background of the team.3. Investment institutions:Coinbase Ventures, DCG, Framework, ParaFi Capital and many other well-known cryptocurrency funds participated in the early investment, and the lineup of investment institutions can be described as very luxurious.First of all, let's understand what is the role of GRT in The Graph network, and why is it required? Mainly the following points:①Consumer (user) needs to purchase GRT tokens to pay the query fee when querying through Indexer (indexer);

②Indexer (indexer) needs to pledge GRT tokens when running the node;

③Curator (curator) uses GRT tokens to indicate which subgraphs are worth indexing

④Delegator (principal) pledges GRT tokens to an Indexer to earn a part of inflation rewards and fees;

⑤ In addition, part of the query fee, withdrawal fee, and unclaimed tokens will be destroyed.It can be seen that in The Graph ecological network, GRT has many application scenarios, and there is also a destruction mechanism, which provides value support for GRT.To sum up, it can be seen that The Graph (GRT) is definitely a very high-quality and hot project at the moment, but whether it still has investment value at the current price remains to be discussed. The current circulating market value has reached 709 million US dollars, entering the top 40 in the global market value, and approaching UNI and YFIl. But there are still billions of tokens that will be gradually released in the next 2 years, so you need to be cautious when chasing high.