The Future of Virtual Assets: Divisible NFTs

We currently live in a world where the most valuable assets are no longer tangible. Although virtual assets have been around for years, it is only recently that these digital commodities have emerged as a new asset class.

Now, with the incorporation of blockchain technology, virtual assets no longer have the opportunity to be limited to traditional use cases such as gaming. In today's sharing economy, as more and more assets, both physical and virtual, are tokenized, a new protocol is essential to ensure security, transparency, ownership, liquidity, and shared use . As a quick recap, tokens are virtual assets on Ethereum that function similarly to cash or existing bearer instruments such as notes, coupons, stock and bond certificates, vouchers, food stamps, and deeds that enable holders to Right to use something different, similar to how we use cash. Organizations operating on Ethereum can issue tokens that entitle holders to use their goods and services, entitle them to dividends from the company, and participate in the governance of their business model.

Here we introduce the next generation token economy:Divisible NFT Tokens (F-NFT)

Don’t worry if you are not familiar with the concept of tokens as we will briefly review the main types of tokens and their role in virtual assets.

Does F-NFT currently exist?Yes, not at all!

There has been some buzz in the Ethereum Improvement Proposal (EIP) community about similar solutions for subdividing NFTs. (Link:https://github.com/ethereum/EIPs/issues/864)

secondary title

Limitations of Non-Fungible Tokens (NFTs) Today

First, let's quickly remember what an NFT (aka "ERC721") is. This is a new class of tokens that have been processed and stored on the blockchain. After security tokens and utility tokens (which are standard "ERC20" tokens), non-fungible tokens are defined by the following characteristics:

One NFT is not interchangeable with another NFT

Each token has characteristics that make it unique

To name a few simple and specific examples, an NFT could be: a piece of land in a virtual world, a unique collectible card, your character in an RPG, a sword your character wields, (whether digital or not) Works of art... the use cases are practically limitless.

Today, most of these NFTs are considered exclusive and exclusive. That is, once the tokens are acquired, you are the sole owner. Again, you are the only one who can benefit from these services.

secondary title

How do we imagine divisible NFTs (F-NFTs)?

Why can't an NFT have multiple co-owners? Fragable Non-Fungible Tokens (F-NFTs) will be various non-fungible tokens that are specifically designed for decentralized ownership and use.

The token will be based on the following foundations:

Co-ownership of NFTs is not enough. The benefits of the functionality and/or services provided by the token must also be shared.

Buying or reselling all or some of the tokens held by other stakeholders should not harm other owners in any way.

secondary title

What is divisible and what is not divisible?

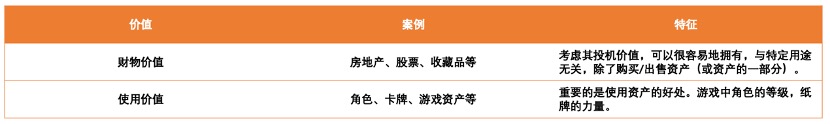

To further define these F-NFTs, we need to examine real use cases and quickly classify assets:

image description

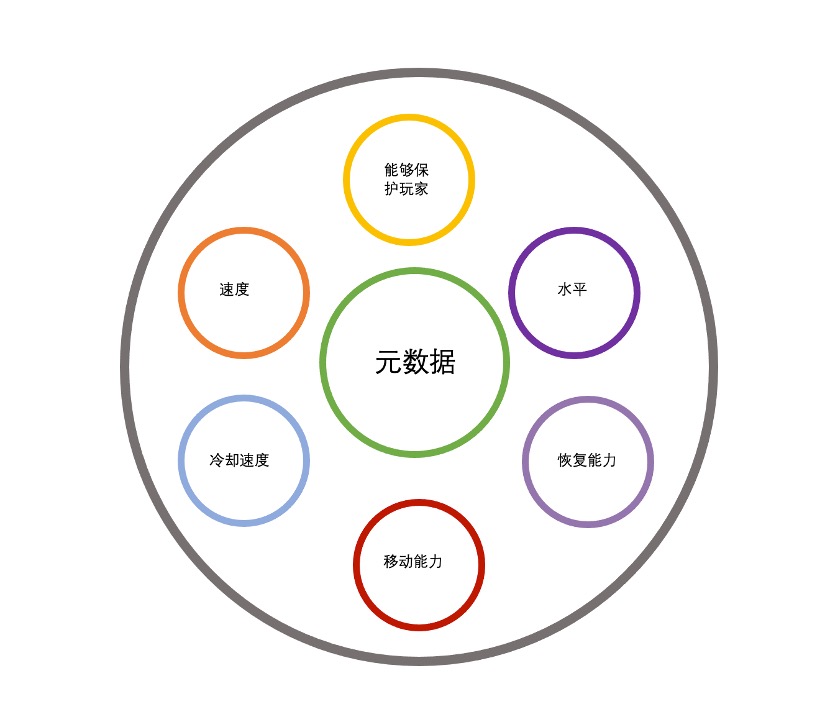

Conceptual representation of video game assets

In this diagram, the financial value of an asset is a gray circle. This value is of course defined by the elements that make it up, that is metadata. From a value perspective, this gray circle can be shared, completely independent of the metadata or the characteristics that make up the metadata. Metadata and features cannot be split in the same way.

Value is divisible.

No skill or character is necessary.

secondary title

How to design F-NFT?

These unruly NFTs require only one thing: thought and designed for shared use. Token design is the key to ICO, similarly, NFT design is also the key to f-NFT.

image description

secondary title

Which industries may be disrupted by F-NFT?

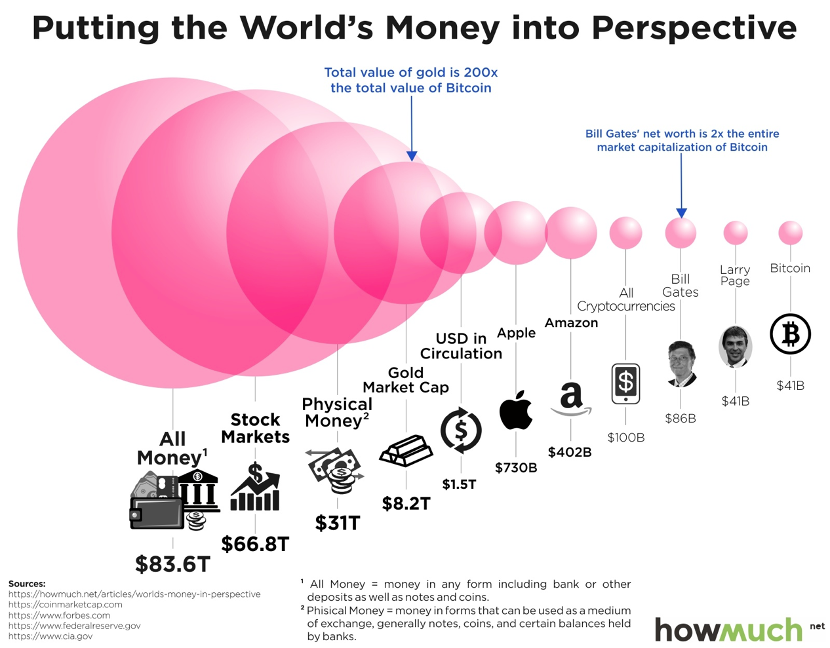

While the initial adoption of F-NFTs will have the most practical and accessible use cases for virtual goods, it will crossover to real-world goods such as artwork, collectibles, and traditional investments. We can imagine that more and more of the world's assets will be tokenized, opening the floodgates for piecemeal use cases.

Art and Collectibles (a & c)

image description

The Star Edgar Degas

Most art and collectibles increase in value over time, and if value is tokenized, it may be an opportunity to benefit from this appreciation in value. If the $1 million Star were subdivided into 100 units, this would allow 1,000 investors to hold one share each. These shares can be traded, and their ownership and authenticity will be verified through smart contracts. This solves the second problem of the art and collectibles industry: liquidity. Individual buyers don’t have to wait weeks or months for high-ticket items, once converted to F-NFTs, it will be available to investors on the secondary market for purchase as a complement to a well-balanced portfolio.

Here, the benefits for each token owner will be value transfer of artwork, portfolio diversification, potential appreciation through a limited number of tokens, and faster liquidity. In this case, even the smallest investor can be the owner of the painting. Of course, the typical authentication and escrow of the original artwork will be required, however, this will be a small price to pay for the benefits of token appreciation and asset liquidity. Of course, unlike digital art, one cannot divide the painting into a thousand, so the value here will be that of asset owners and speculators looking to leverage the art collectible category to help balance their financial portfolios.

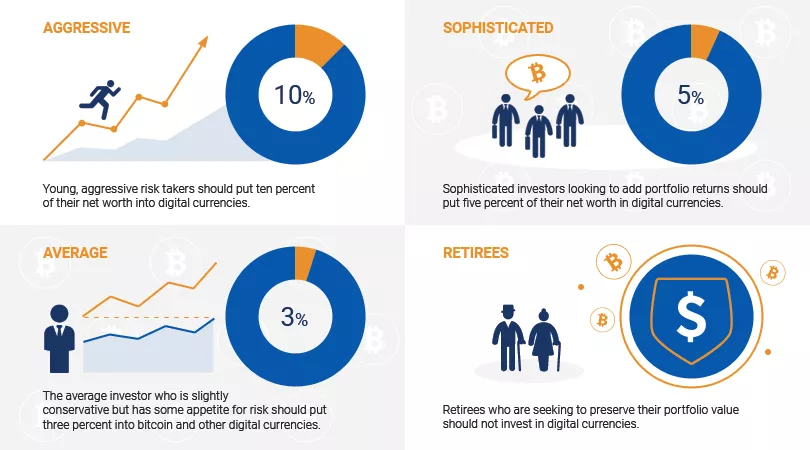

traditional investment

image description

Courtesy of Fred Wilson, CEO of venture capital firm Union Square Ventures

game

game

Today, virtual goods are worth more than $50 billion. While it's probably not worth breaking down a $100 CryptoKitty, you might want to pool your resources for a more expensive product. Just recently, an in-game virtual item became one of the most expensive items ever sold — a $6 million virtual Odaily.

Turning game virtual goods into F-NFTs means you can now pool your resources to crowdfund and co-own this asset. While there may not be too many people with the ability to individually purchase $6 million of global F-NFT shares at a later date, this will enable faster liquidity while allowing democratized access to otherwise prohibitively expensive virtual goods.

The future market of F-NFT?

Today, there are many exchanges that provide liquidity for standard ERC20 and ERC721 (NFT) tokens. F-NFTs will require a new kind of exchange that can provide services to verify non-fungible assets that seek to subdivide. It needs to be able to help create markets for trading these F-NFTs to maximize exposure and access liquidity for this new asset class. Here are some of the features this new type of exchange can offer:

Asset authentication: Every asset, whether it is a physical artwork or a high-value digital asset, requires authenticity verification. Once verified, the record will be placed on-chain for reference by any other party.

Segmentation Smart Contracts: This will allow asset creators and owners to specify attributes or metadata of tokens, including shares to be created and ownership details.

F-NFT Listing: This function will list FNFT on the exchange and provide traditional exchange functions such as order book, matching and token buying and selling. It will also provide full transparency and inform owners of new ownership or reallocation of rights to assets.

in conclusion

in conclusion

Proposing a standard for splittable NFTs could lead to very interesting solutions regarding value and asset liquidity. This new generation of assets may greatly stimulate the entire NFT market. Beyond the financial stakes, the use cases proposed by these sporadic NFTs are also promising.

text

text

Original link:

Original link:https://medium.com/hackernoon/