Odaily Frontline | Industry insiders say France will implement mandatory KYC rules for all crypto transactions

This article comes fromThe Block, original author: Yogita Khatri

Odaily Translator | Nian Yin Si Tang

Summary:

This article comes from

, original author: Yogita Khatri

Odaily Translator | Nian Yin Si Tang

secondary title

Summary:

- The Block has learned that France will introduce strict new regulatory measures for the encryption field.

- Simon Polrot, chairman of the French crypto association ADAN, said in an interview with The Block that the French Ministry of Finance is not only preparing to strengthen KYC rules for crypto companies, but will also regulate currency exchanges.

- These sources told The Block that the proposed stringent measures in France are mainly due to the recent terrorist attacks.

France is set to impose strict new measures on the country’s cryptocurrency sector, The Block has learned.

Polrot told The Block in an interview that he had been informed of the proposed measures by the French Ministry of Finance, as ADAN is a “trusted interlocutor” on crypto-related issues.

In general, multiple government departments, including the Ministry of the Interior and the Prime Minister's Cabinet, are involved in crypto-related discussions, Polrot said.

Two other sources — Coinhouse Group CEO Nicolas Louvet and Digital Service Group CTO Pierre Guy Bareges — confirmed the proposed measures to The Block. Coinhouse provides crypto trading and custody services in France and is registered with AMF, the French financial market regulator. Digital Service Group, the operator of French crypto exchange Zebitex, is currently seeking an AMF license.

Both Louvet and Bareges said in their respective interviews that they had been informed of the French government's forthcoming measures.

The French Ministry of Finance had not responded to The Block's request for comment by press time.

secondary titleWhy stricter regulations?The sources told The Block that the main reason for the proposed stricter measures was the recent terrorist attacks in France.

Two weeks before the attack, in September, French police arrested 29 people suspected of using cryptocurrencies to finance Islamic extremists in Syria.

In October this year, French Finance Minister Bruno Le Maire

on national television

, the country will come up with proposals to “strengthen controls over financial funds” because “cryptocurrencies pose a real problem for terrorism financing.”

Polrot described the moves as "political positioning".

"Governments have to respond, take a stand, and do something to explain that they are doing something to fight terrorism," he told The Block.

secondary title

KYC measures

Polrot, Louvet and Baregesall all told The Block that with regard to the first proposed measure, the Treasury Department will issue a decree later this week, possibly on Wednesday or Thursday, requiring all crypto transactions, including crypto-to-crypto transactions ) for full KYC.

Decrees are legal regulations in France and do not require any parliamentary approval process.

Full KYC for all crypto transactions means that all crypto exchanges and other companies must verify their customers, regardless of transaction size.

In other words, all crypto transactions with a value greater than 0 EUR must go through a full KYC process and require two forms of government identification (ID). The current transaction limit that requires KYC is 1000 euros, which is currently only applicable to crypto-to-fiat transactions.

Incorporating crypto-to-crypto transactions into KYC rules is “tougher than other jurisdictions,” Polrot said.

Currently, new user registration costs about 1 euro, which could soar to 5 euros under the proposed measures, Bareges said. "And you're not sure if that user will subsequently make a transaction that exceeds that cost."

Bareges went on to say that this KYC measure has “concern for all parties involved in France” as clients may go to less restrictive foreign exchanges.

What is certain is that under French law, any published rules will apply to crypto companies based in France and those actively focusing on French residents.

Furthermore, full KYC measures would also eliminate the benefits of “occasional” crypto transactions, or one-off transactions worth up to €1,000, which would not otherwise require KYC."It's a shame," Louvet regretted. "From a user experience perspective, without full KYC, we can't provide a good experience for users who make a small transaction or two...but from a business perspective, gamers haven't changed because if I The only customers are people doing 100-euro transactions, and I wouldn't be in that business."secondary title

Mandatory registration required for currency tradingAnother major proposed rule change is the mandatory registration of crypto exchanges, which Louvet, Bareges and Polrot all revealed.。

Currently, in France, mandatory registration rules only apply to fiat exchanges and crypto custodians. According to previous reports, these two types of companies

Permits must be obtained by December 18th

, or face fines and possible imprisonment.

The situation is similar to that of the UK

Polrot and Louvet said that for the proposed measure, crypto exchanges may receive a six-month deadline during which they must achieve compliance.

Polrot added that the scope of the measure is currently unclear, meaning it remains to be seen whether global crypto exchanges operating in France will also be covered by the rule.

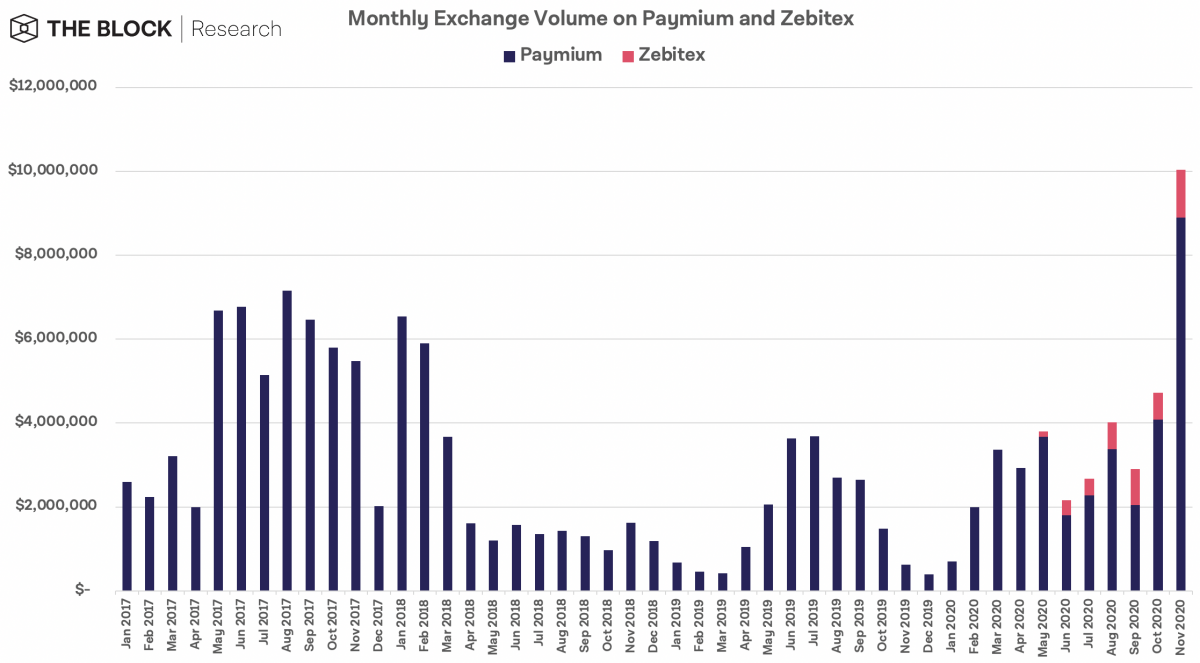

The exact impact is not entirely clear. According to The Block Research, the trading volume of the French crypto exchange ecosystem is relatively small compared to its peers.